Introduction

Rising education costs have many families on the hunt for smart ways to save, and guess what? 529 plans are stepping up as a popular choice! These tax-advantaged accounts not only help parents and grandparents stash away funds for future educational expenses, but they also come with some pretty sweet tax benefits that can really make a difference in your overall financial planning.

But here’s a question that might be on your mind: Are 529 plans included in a taxable estate? Understanding this can be a game-changer for families looking to maximize their savings while navigating the sometimes tricky waters of estate planning. So, let’s dive in and explore!

Define 529 Plans: Overview and Purpose

A 529 account is a great way to save for future education costs, and it comes with some nice tax benefits! These accounts were created under Section 529 of the Internal Revenue Code, allowing folks to save for qualified expenses like:

- Tuition

- Fees

- Books

- Room and board

The main idea behind a 529 plan is to help families save for their kids' education by offering some pretty sweet tax perks, like tax-free growth on your contributions and tax-free withdrawals for eligible expenses.

This makes 529 plans a popular choice for parents and grandparents who want to invest in their loved ones' educational futures while keeping tax bills in check. Did you know that as of 2026, about 3.2 million households are using 529 accounts? That’s a clear sign of their growing popularity as a smart financial tool!

Plus, with the recent updates from the One Big Beautiful Bill Act, these plans are even more flexible. They now allow for larger annual withdrawals for K-12 expenses and cover a wider range of educational costs. This really strengthens their role in helping families achieve their educational goals. So, if you’re thinking about saving for education, a 529 account might just be the way to go!

Contextualize 529 Plans: Importance in Education and Tax Strategy

529 accounts are a game-changer when it comes to financing education! With the average cost of higher education in the U.S. expected to soar past $36,000 a year by 2026, these accounts offer a smart way to save. They let families build up funds over time, all while enjoying tax-free growth on earnings.

Here’s a fun fact: contributions to a 529 account are treated as completed gifts. This can really help reduce the contributor's taxable estate, especially when assessing if 529 plans are included in taxable estate. For example, a wealthy couple can toss in up to $190,000 for each grandchild's 529 account. That’s a hefty chunk taken off their taxable estate, raising the question of whether 529 plans are included in taxable estate, while they still get to keep control over the funds! It’s a win-win situation that not only supports education but also brings some nice tax perks.

Plus, the flexibility of 529 accounts is fantastic! You can withdraw money for all sorts of educational expenses, from K-12 tuition to vocational training, and even student loan repayments. This makes them a valuable tool in your overall financial planning. As families face rising education costs, understanding and using 529 accounts can lead to some serious long-term financial benefits. So, why not take a closer look at how these accounts can work for you?

Trace the Origins of 529 Plans: Historical Development and Changes

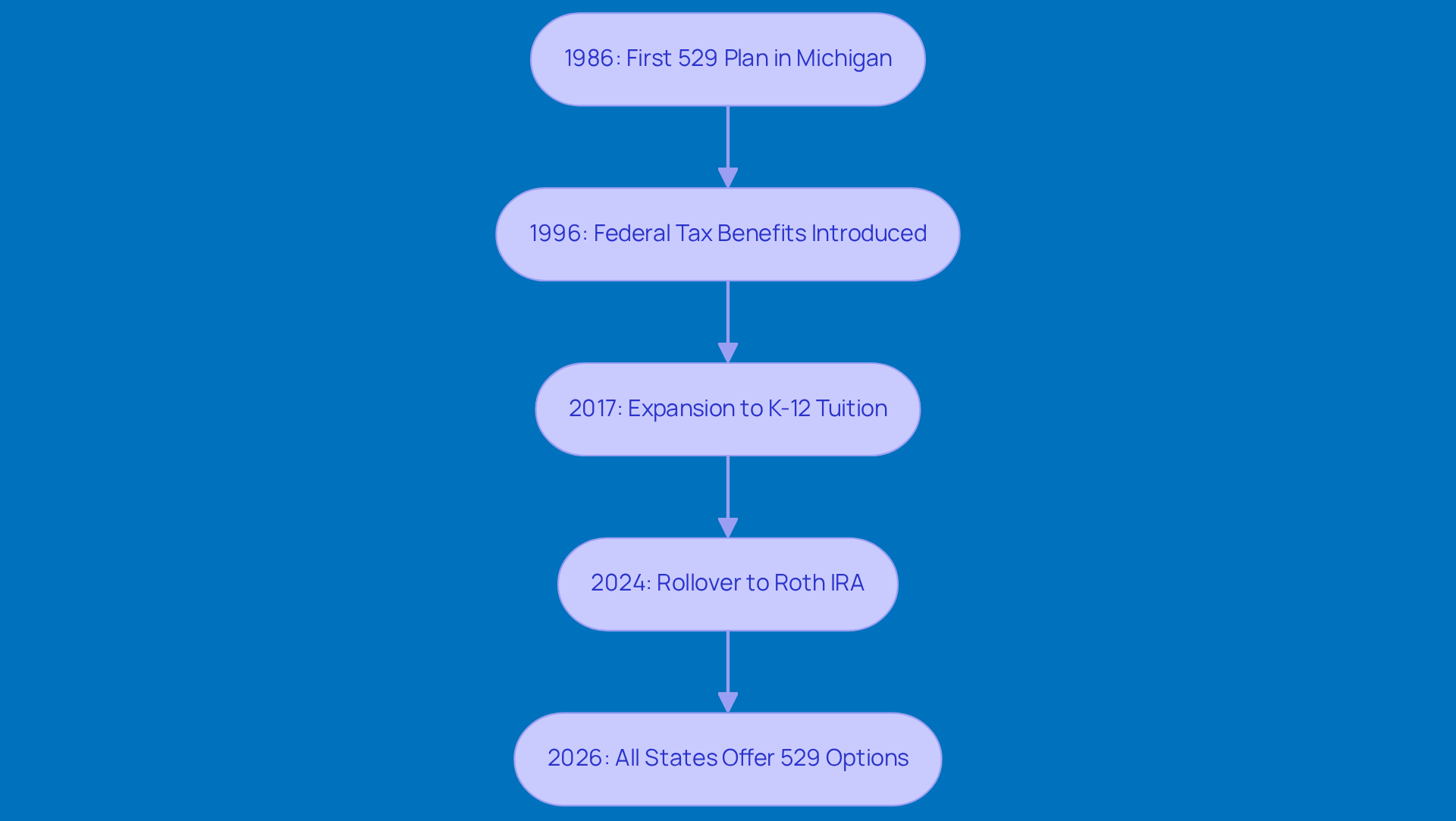

Did you know that 529 programs have been around since the late 1980s? The very first one popped up in Michigan back in 1986. Initially, these programs were all about prepaid tuition, helping families lock in tuition rates for future college costs. But things took a big turn in 1996 when the federal government stepped in with some tax perks under Section 529 of the Internal Revenue Code. This change allowed for tax-free growth and withdrawals for eligible education expenses, making 529 accounts a lot more attractive for families.

Over the years, these accounts have evolved quite a bit. For instance, the Tax Cuts and Jobs Act of 2017 expanded their use to cover K-12 tuition costs and broadened what counts as qualified expenses. And guess what? Starting in 2024, the SECURE 2.0 Act will let you roll over any unused 529 funds into a Roth IRA for the same beneficiary. How cool is that? As of 2026, all 50 states offer 529 options, showing just how popular and important these programs are for saving for education.

On average, folks have about $30,960 saved in their 529 accounts, which really highlights how these programs help families tackle educational expenses. Plus, households earning between $100,000 and $150,000 are chipping in an average of $3,832, covering about 11% of overall college costs. It’s clear that families are making significant financial contributions toward education, and 529 plans are a big part of that picture.

Identify Key Characteristics of 529 Plans: Features and Benefits

529 accounts come with some pretty great features that make them a top choice for education savings. For starters, they offer tax-exempt growth and tax-free withdrawals for eligible expenses, which means families can really maximize their savings potential. When you contribute to a 529 account, your money grows tax-deferred, so any earnings are off the hook from federal income tax as long as they’re used for qualified educational expenses. Plus, by 2026, about 30% of states are expected to offer tax deductions or credits for contributions to their own state's 529 program, which just sweetens the deal for families.

As new parents step into the financial world, kicking things off with a realistic budget is key. Let’s face it, the costs of raising a child can feel like a tidal wave, and knowing what to expect can help parents manage their funds better. And don’t forget about those tax breaks! Taking advantage of things like the child tax credit and the child and dependent care credit can really lighten the financial load.

Another big perk of 529 plans is the flexibility they offer when it comes to changing beneficiaries without any tax penalties. Say your child decides not to pursue higher education; no worries! Parents can easily transfer the account to another eligible family member, like a sibling, without any tax headaches. This kind of adaptability means the funds can still be put to good use within the family.

The tax-exempt growth and withdrawals tied to 529 accounts are a game changer, especially with tuition costs on the rise. Families can save more effectively since the funds can grow over time without the tax burden, ultimately providing greater financial support for educational goals.

Experts are all on the same page about the tax benefits of 529 accounts. They point out that these accounts not only help with saving for education but also serve as smart financial tools that can help families navigate the complexities of funding education while keeping tax obligations in check. All in all, with tax-free growth, flexible beneficiary options, and potential state tax perks, 529 plans stand out as a fantastic resource for families looking to invest in their kids' educational futures.

Conclusion

Understanding 529 plans is like discovering a hidden gem for your family's future. These accounts do double duty as both a way to save for education and a smart financial move. Not only do they help you stash away funds for school expenses, but they also come with some pretty sweet tax perks. With education costs on the rise, it’s clear that tapping into 529 plans is a smart choice for families wanting to invest in their kids' futures.

As we wrap up, let’s highlight some key points about 529 accounts:

- They’re flexible

- They grow tax-free

- They can adapt to your family's changing needs

From how these plans have evolved over time to the recent changes in legislation that make them even more useful, it’s clear that 529 plans are built to keep up with what families need. Plus, the ability to transfer funds between beneficiaries and snag some significant tax deductions really shows how valuable they can be in your financial planning.

But here’s the kicker: 529 plans aren’t just about funding education; they’re a crucial part of a solid financial strategy. So, why not take a moment to explore what 529 accounts can do for you? Think about how these plans can fit into your long-term financial goals. By taking proactive steps to use 529 plans, you’re not just supporting your loved ones’ educational dreams; you’re also optimizing your tax situation. That’s a win-win for a brighter financial future for generations to come!

Frequently Asked Questions

What is a 529 plan?

A 529 plan is a savings account designed to help families save for future education costs, offering tax benefits for qualified expenses such as tuition, fees, books, and room and board.

What are the tax benefits of a 529 plan?

A 529 plan provides tax-free growth on contributions and tax-free withdrawals for eligible education expenses, making it a tax-efficient way to save for education.

Who typically uses 529 plans?

529 plans are commonly used by parents and grandparents who want to invest in their loved ones' educational futures while minimizing tax liabilities.

How many households are using 529 accounts?

As of 2026, approximately 3.2 million households are utilizing 529 accounts, indicating their growing popularity as a financial tool for education savings.

What recent changes have been made to 529 plans?

Recent updates from the One Big Beautiful Bill Act have made 529 plans more flexible by allowing larger annual withdrawals for K-12 expenses and covering a broader range of educational costs.