Overview

Hey there! Did you know that auto repairs can actually be tax deductible for small business owners? If you’re using your vehicle mostly for business, this could really help lower your taxable income. Pretty neat, right?

Now, here’s the kicker: keeping detailed records is super important. You’ll want to understand those IRS guidelines to make sure you’re claiming those deductions correctly. Trust me, it’s worth it to maximize your potential savings! So, have you been keeping track of your auto expenses? It could make a big difference come tax time!

Introduction

Navigating the world of tax deductions can feel like a daunting task for small business owners, right? Especially when it comes to understanding the deductibility of auto repairs. But here’s the good news: with the right knowledge, these vehicle maintenance costs can significantly reduce your taxable income, offering a valuable opportunity for financial relief.

So, what are the specific criteria that determine whether these expenses qualify for deductions? And how can you ensure you're maximizing your savings without falling prey to common pitfalls? Let’s dive in!

Understand Tax Deductibility for Auto Repairs

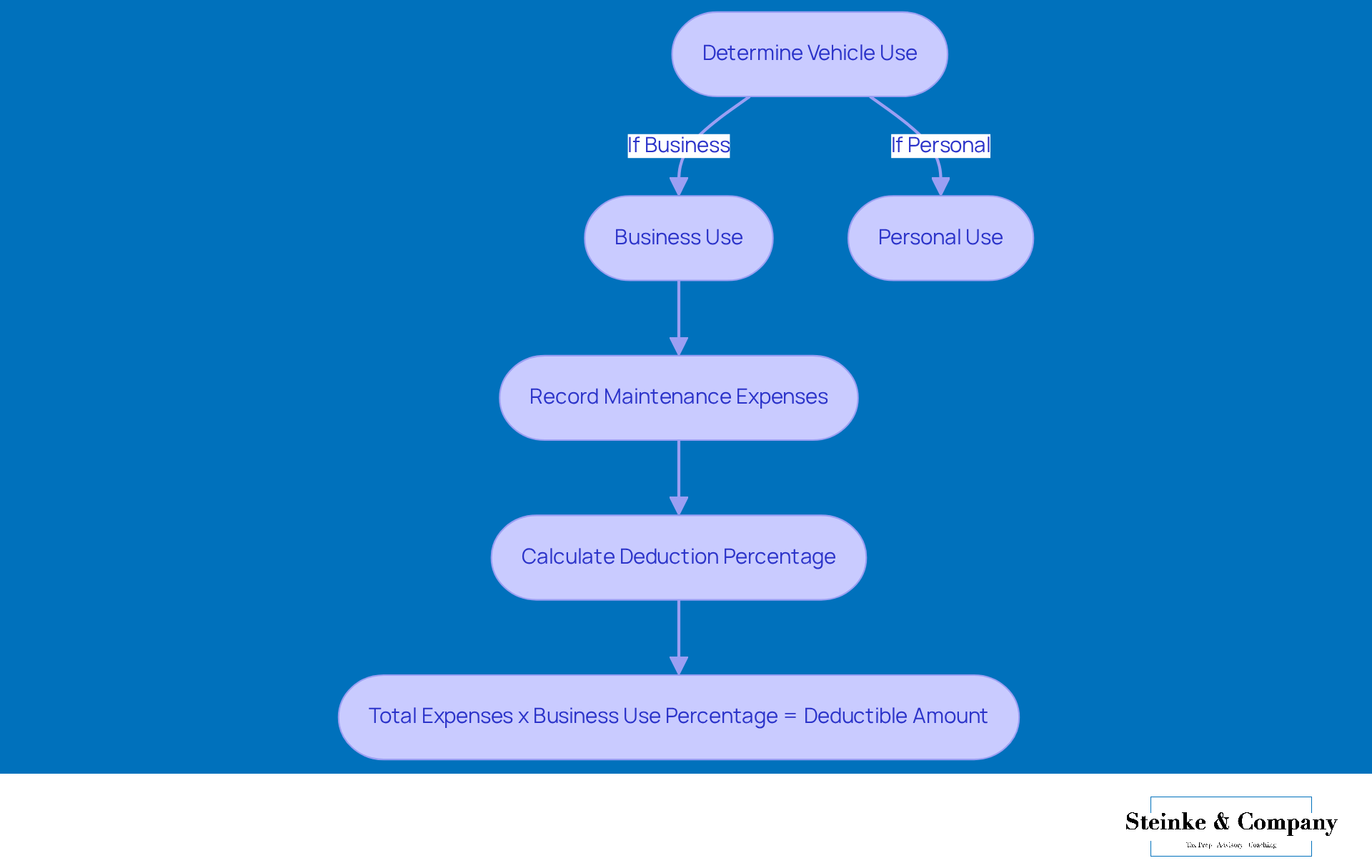

Tax deductibility is a game changer for small enterprise owners, allowing them to lower their taxable income by claiming specific costs, like vehicle maintenance. If you’re using your car for work, it’s crucial to know which maintenance expenses, including whether auto repairs are tax deductible, you can deduct. Generally, expenses like oil changes, tire replacements, and brake repairs are considered auto repairs tax deductible, as long as your vehicle is mainly used for business. In fact, a good number of small business owners are taking advantage of these auto maintenance deductions, highlighting how important these savings can be.

To make the most of your auto repair deductions, keeping meticulous records is a must. It’s a smart move to maintain a detailed logbook that separates your professional and personal use of the vehicle. This log should include:

- Total kilometers driven

- Work-related kilometers

- Personal kilometers

- Odometer readings

For instance, if you use your car 40% for business, you can deduct 40% of your total maintenance expenses, which can significantly lower your taxable income.

Experts agree that, under Canadian tax law, auto repairs are tax deductible as long as you meet certain criteria regarding maintenance and upkeep costs. Let’s say you rack up $1,000 in maintenance expenses and can prove that half of the car’s use is for business. In that case, you can deduct $500 from your taxable income. This not only keeps you in line with tax regulations but also helps you maximize your savings.

Many small businesses have successfully tackled the ins and outs of auto maintenance deductions. Take, for example, a local delivery service that managed to save a bundle by accurately tracking their vehicle costs, resulting in a lower tax bill and better cash flow. By understanding the ins and outs of deductible vehicle maintenance costs, small enterprises can seize these opportunities to boost their financial health.

Identify Criteria for Deducting Auto Repairs

If you're looking to determine whether auto repairs are tax deductible, there are a few key things you need to keep in mind. First up, let’s talk about Commercial Use. Your vehicle needs to be mainly used for business activities. If it serves dual purposes, you can only deduct the expenses tied to its commercial use. Got it?

Next, we have Essential and Typical Expenses. The repairs should be necessary and ordinary in your field, meaning they should be common among similar businesses. For instance, auto maintenance companies often allocate around 34% of their income to parts. This really highlights the importance of knowing what typical expenses look like in your industry.

And don’t forget about Documentation! Keeping detailed records is crucial. Make sure to save all your receipts for maintenance and track your work-related mileage. This will be super helpful if you ever need to validate your claims during an audit.

By following these simple guidelines, you’ll be well on your way to navigating the complexities of tax deductions for vehicle maintenance like a pro!

Explore Methods for Claiming Auto Repair Deductions

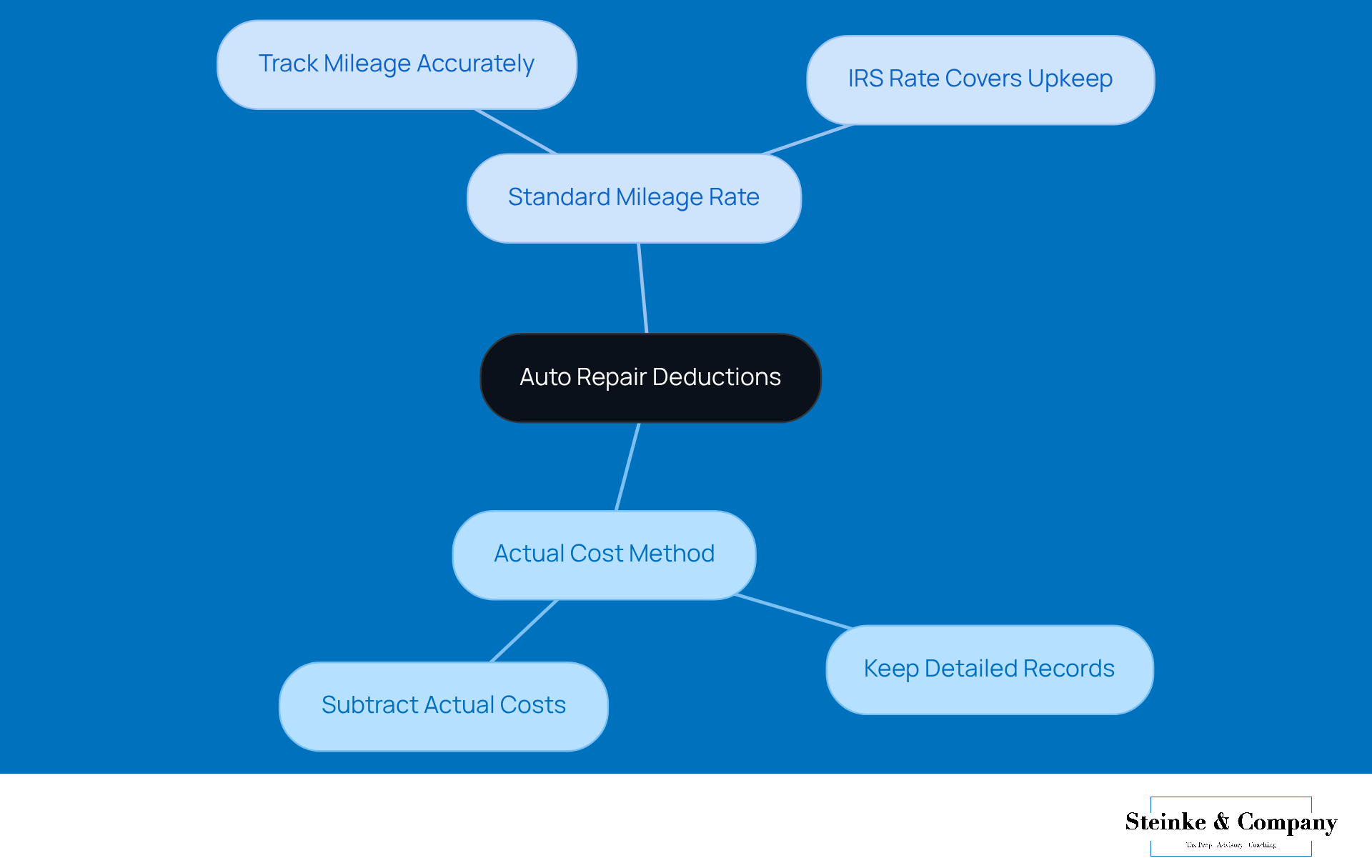

When it comes to claiming deductions, you may wonder if auto repairs are tax deductible, and you've got two main methods to choose from!

-

Actual Cost Method: This one lets you subtract the actual costs of maintenance and other vehicle-related expenses. Just remember, you’ll need to keep detailed records of all those costs to assess whether auto repairs are tax deductible.

-

Standard Mileage Rate: On the flip side, you can go with the standard mileage rate set by the IRS, which includes a bit for upkeep and maintenance. If you choose this route, make sure you track your mileage accurately.

So, which method should you pick? It really depends on what gives you the biggest deduction! Just be sure to have all the necessary documentation to back up your claim. Happy deducting!

Avoid Common Mistakes in Auto Repair Deductions

To avoid common mistakes when claiming auto repair deductions, let’s go over some helpful tips together:

-

Mixing Personal and Professional Use: It’s super important to accurately separate personal and professional use of your vehicle. If you don’t, you might end up with incorrect deductions, and nobody wants that!

-

Inadequate Documentation: Always keep those receipts handy and maintain a detailed log of your business mileage. Incomplete records can really jeopardize your deductions during an audit, since the IRS wants thorough documentation to back up your claims.

-

Disregarding IRS Guidelines: Familiarize yourself with IRS regulations regarding vehicle costs. Ignoring these rules can lead to denied deductions, especially if your claims are questioned during an audit.

-

Claiming Non-Deductible Expenses: Be careful not to claim expenses that aren’t deductible, like repairs on a personal vehicle or improvements that boost the vehicle's value.

Also, understanding the different types of audits—like correspondence, office, and field—and preparing for them can really help you navigate any potential audits, especially when considering which expenses, such as whether are auto repairs tax deductible, may be applicable. This way, you’ll feel prepared and informed if the IRS asks for more information!

Conclusion

Understanding the tax deductibility of auto repairs is super important for small business owners looking to optimize their financial strategies. By figuring out which vehicle maintenance expenses can be claimed, you can really lower your taxable income and boost your cash flow. This knowledge gives you the power to leverage tax deductions effectively, ultimately benefiting your bottom line.

So, what should you keep in mind? First off, maintaining accurate records of your vehicle use is crucial. You’ll want to clearly distinguish between personal and business-related expenses and stick to those IRS guidelines. Also, there are two main ways to claim deductions:

- Actual Cost Method

- Standard Mileage Rate

Each has its quirks, and picking the right one can lead to some serious savings. Just be careful—common pitfalls like not having enough documentation or mixing personal with business use can put your deductions at risk. Diligence is key!

In a nutshell, navigating the complexities of auto repair tax deductions isn’t just about compliance; it’s a savvy financial move that can lead to substantial savings. So, stay informed about the criteria for deducting auto repairs, regularly track your expenses, and don’t hesitate to consult with tax pros if needed. By taking these proactive steps, you can make the most of your vehicle-related expenses while staying compliant with tax regulations. Happy saving!

Frequently Asked Questions

What is tax deductibility for auto repairs?

Tax deductibility for auto repairs allows small enterprise owners to lower their taxable income by claiming specific costs related to vehicle maintenance, such as oil changes, tire replacements, and brake repairs, as long as the vehicle is mainly used for business.

Which auto repair expenses are generally tax deductible?

Generally, expenses like oil changes, tire replacements, and brake repairs are considered tax deductible if the vehicle is primarily used for business purposes.

How can I maximize my auto repair deductions?

To maximize auto repair deductions, it is essential to keep meticulous records, including a detailed logbook that separates professional and personal use of the vehicle, noting total kilometers driven, work-related kilometers, personal kilometers, and odometer readings.

How is the deductible amount calculated?

If you use your car for both business and personal purposes, the deductible amount is calculated based on the percentage of business use. For example, if you use your car 40% for business, you can deduct 40% of your total maintenance expenses.

What criteria must be met for auto repairs to be tax deductible under Canadian tax law?

Under Canadian tax law, auto repairs are tax deductible as long as you can prove the vehicle's use for business and meet specific criteria regarding maintenance and upkeep costs.

Can you provide an example of how a business benefited from auto repair deductions?

A local delivery service successfully saved money by accurately tracking their vehicle costs, which resulted in a lower tax bill and improved cash flow due to utilizing auto maintenance deductions effectively.