Overview

Did you know that car repairs can actually be deductible? Yep, if you use your vehicle for business more than half the time, those necessary repairs might just save you some money come tax season. Just remember, these repairs should be about keeping your vehicle operational, not sprucing it up to boost its value.

In this article, we’ll dive into the key factors that determine eligibility for these deductions and outline what expenses you can claim. It's super important to keep accurate records and stay in the loop with tax regulations—this way, you can maximize those deductions effectively. So, let's get started on making the most of your business vehicle!

Introduction

Navigating the complexities of tax deductions can feel overwhelming, right? Especially when it comes to figuring out if car repairs are eligible for deductions. For business owners, being able to deduct these expenses could really make a difference in the bottom line, yet many folks are still scratching their heads over what actually qualifies. With tax regulations constantly evolving and various ways to track vehicle expenses, it’s a big question: are car repairs truly deductible?

Don’t worry, though! This article is here to provide you with a handy checklist that breaks down the process, ensuring you account for every eligible expense. By doing so, you’ll be paving the way for smarter financial decisions when tax season rolls around. Let’s dive in!

Understand Eligibility for Car Repair Deductions

- Have you checked that the automobile is used for commercial purposes more than half the time? That's a key factor!

- It's also important to ensure that the maintenance you perform, including whether are car repairs deductible, is crucial for keeping your business running smoothly.

- And remember, the vehicle shouldn't be a luxury type, as those can have different deduction limits that might not work in your favor.

- Make sure that the maintenance isn't seen as enhancements that would increase your vehicle's value, as it raises the question of whether are car repairs deductible since those costs might not be.

- Finally, don’t forget to review any specific state or federal regulations that could impact your eligibility. It’s always good to be informed!

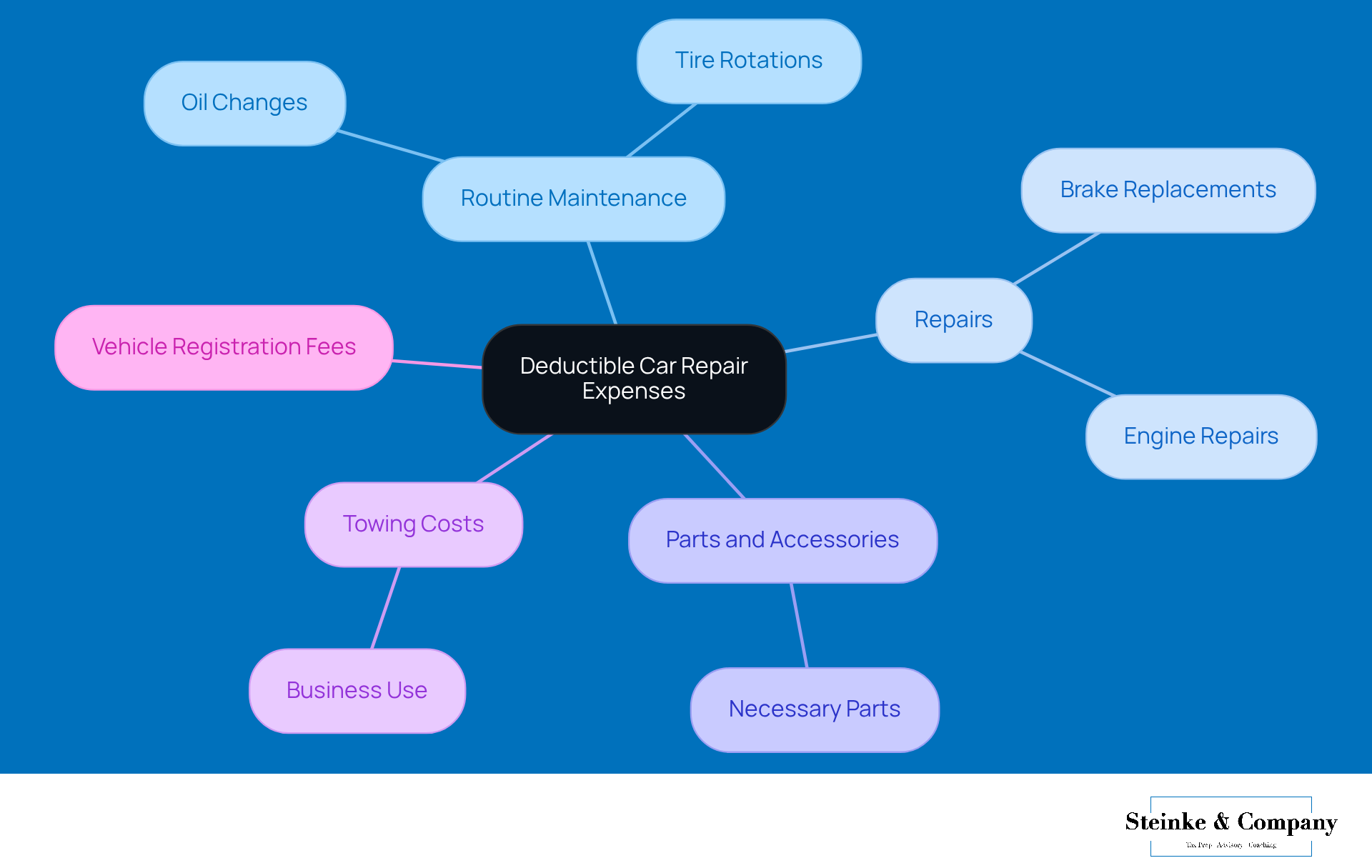

Identify Deductible Car Repair Expenses

Here are some common deductible expenses you might want to keep in mind:

- Routine maintenance, like those oil changes and tire rotations that keep your vehicle running smoothly.

- Repairs, such as brake replacements or engine repairs, raise the question of whether car repairs are deductible when things go a bit sideways.

- Parts and accessories that are necessary for those repairs—because sometimes you just need that new part to get back on the road.

- Towing costs, especially if you’re using your vehicle for business purposes.

- Vehicle registration fees, if they apply to your situation.

Just remember, it’s important that all these expenses, including whether car repairs are deductible, are directly related to your business operations. So, keep track of what you’re spending, and you’ll be in good shape come tax time!

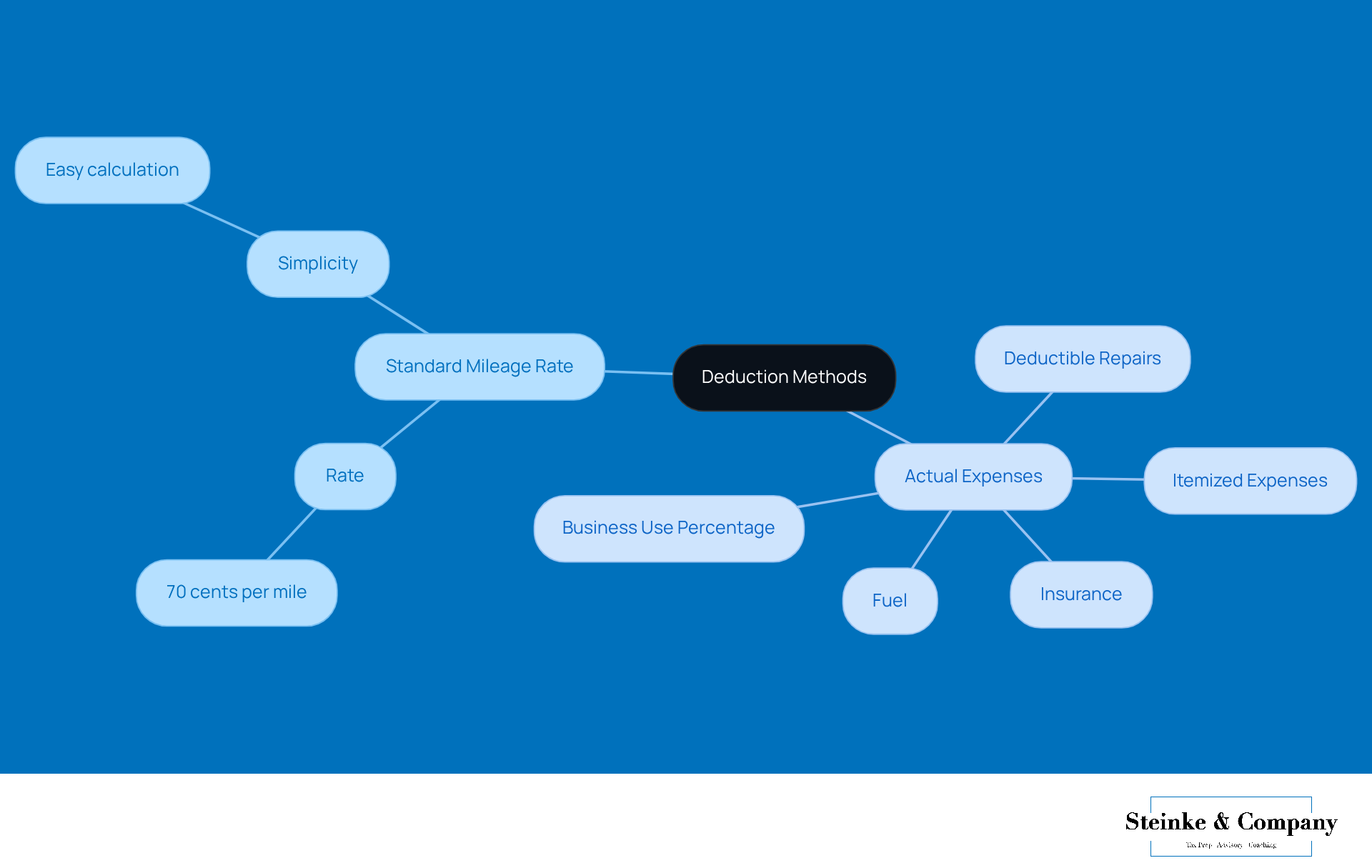

Choose Your Deduction Method: Standard Mileage vs. Actual Expenses

Let's take a moment to evaluate two methods for tracking your vehicle expenses:

-

Standard Mileage Rate:

For 2025, this rate is set at 70 cents per mile. It's super simple to calculate—just multiply the business miles you drive by this standard rate. Easy peasy, right? -

Actual Expenses:

This one requires a bit more effort. You'll need to itemize all your vehicle-related expenses, including whether car repairs are deductible, along with fuel and insurance. Then, calculate the percentage of business use to figure out how much you can deduct.

When choosing a method, consider factors like your total mileage, the condition of your car, and what feels right for you. Which method do you think fits your situation best?

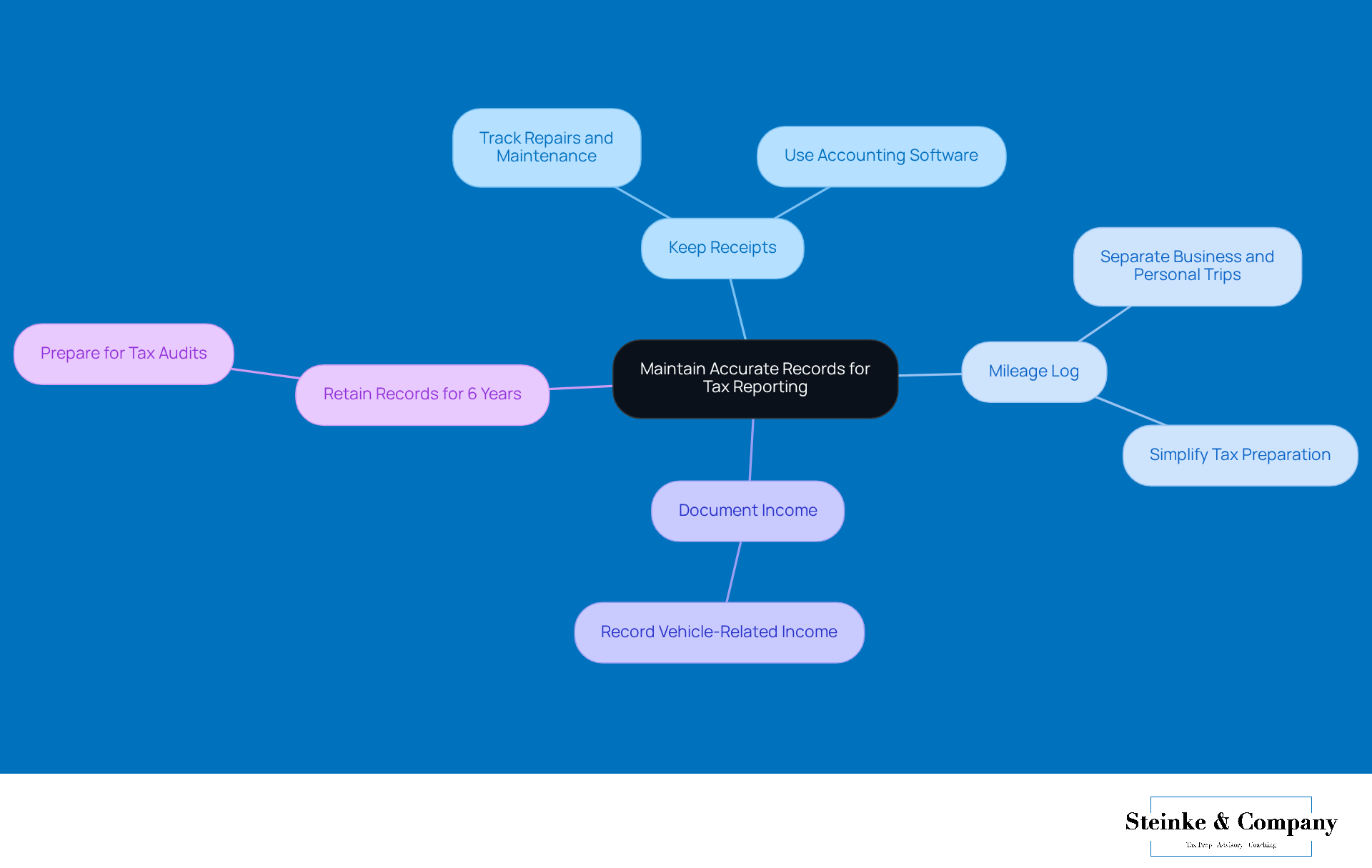

Maintain Accurate Records for Tax Reporting

Keeping track of your vehicle-related expenses is super important! Here’s a handy checklist to help you out:

- Hang on to those receipts for repairs and maintenance—every little bit counts!

- Keep a mileage log to separate your business trips from personal ones. Trust me, it’ll make things a lot easier come tax time.

- If you've got any vehicle-related income, jot that down too (if it applies to you).

Now, a little tip: hold onto these documents for at least six years just in case the tax folks come knocking. And don’t forget, using accounting software or apps can really streamline tracking those expenses and mileage. It’s like having a personal assistant in your pocket! So, are you ready to get organized?

Review Changes in Tax Laws and Deduction Limits

Staying informed about yearly changes to tax regulations is crucial, particularly regarding whether car repairs are deductible. Have you checked if car repairs are deductible under the latest deduction limits for vehicle maintenance and related expenses this tax year? It's worth a look!

For the most accurate and official updates, make sure to visit the IRS or CRA websites. They have all the guidelines you need to stay on top of things.

And hey, if you notice any significant changes, don’t hesitate to reach out for professional advice. It can really pay off to have someone in your corner!

Consult a Tax Professional for Personalized Advice

Thinking about scheduling a chat with a tax pro? Here are a few things to discuss:

- Your unique situation regarding vehicle use and repairs. It’s super important to get this right, especially since underpayment penalties can sneak up on you if tax obligations aren’t managed well.

- Tips for maximizing your deductions based on what your personal enterprise needs. Don’t forget, the impact of those diminished COVID-19 tax advantages on your overall tax situation and refunds is something worth exploring.

- Consider whether the decisions related to your vehicle may have tax implications, especially regarding if car repairs are deductible. You want to make sure you’re compliant with small business tax regulations while also optimizing your tax strategy for long-term success.

Make sure the professional you choose knows their stuff about small business tax rules. You want someone who can guide you through these complexities with ease!

Conclusion

Understanding the nuances of car repair deductions can really make a difference for your business's bottom line. By getting a grip on the eligibility criteria, deductible expenses, and the importance of keeping accurate records, you can navigate the complexities of tax deductions more easily. This knowledge puts you in the driver’s seat, helping you make informed decisions that align with IRS guidelines and maximize your potential deductions.

Let’s break it down a bit. First off, using your vehicle for commercial purposes is a must. Then, there’s the difference between routine maintenance and enhancements—knowing this can save you money! Plus, you’ve got two main deduction methods to choose from:

- Standard mileage

- Actual expenses

And don’t forget: keeping thorough records and staying updated on tax law changes are crucial steps to ensure compliance and optimize those deductions. If you're ever unsure, consulting a tax professional can help clarify your specific situation and give you tailored advice.

So, why is all this important? Being proactive about understanding and managing your car repair deductions can lead to some serious savings. As tax regulations change, staying informed and organized will not only make tax filing easier but also boost your financial health. Why not take charge of your tax strategy today? Make sure every deductible expense is accounted for, paving the way for a more prosperous business future!

Frequently Asked Questions

What is a key factor in determining eligibility for car repair deductions?

A key factor is that the automobile must be used for commercial purposes more than half the time.

Are luxury vehicles eligible for car repair deductions?

No, luxury vehicles can have different deduction limits that may not work in your favor.

What types of maintenance are considered deductible car repair expenses?

Deductible expenses include routine maintenance like oil changes and tire rotations, as well as repairs such as brake replacements or engine repairs.

Are parts and accessories for repairs deductible?

Yes, parts and accessories that are necessary for repairs are deductible expenses.

Can towing costs be deducted?

Yes, towing costs are deductible if the vehicle is used for business purposes.

Are vehicle registration fees deductible?

Yes, vehicle registration fees can be deductible if they apply to your situation.

What should be considered when determining if car repairs are deductible?

It is important that all expenses are directly related to business operations and not enhancements that increase the vehicle's value.

Should I check for specific regulations regarding car repair deductions?

Yes, it's advisable to review any specific state or federal regulations that could impact your eligibility for deductions.