Introduction

Health Savings Accounts (HSAs) are becoming quite the financial gem, especially for small business owners trying to make sense of healthcare costs and tax perks. They let you stash away money for qualified medical expenses while reaping some pretty sweet tax benefits. Sounds good, right? But here’s the kicker: the tax rules around HSAs can be a bit tricky. So, how can small business owners make the most of these accounts without stumbling into common traps?

To really get the hang of HSAs, it’s crucial to understand the eligibility criteria, contribution limits, and reporting requirements. This knowledge is key to maximizing the benefits of HSAs while keeping everything above board with tax regulations. So, let’s dive in and explore how you can turn HSAs into a smart part of your financial strategy!

Define Health Savings Accounts and Their Tax Benefits

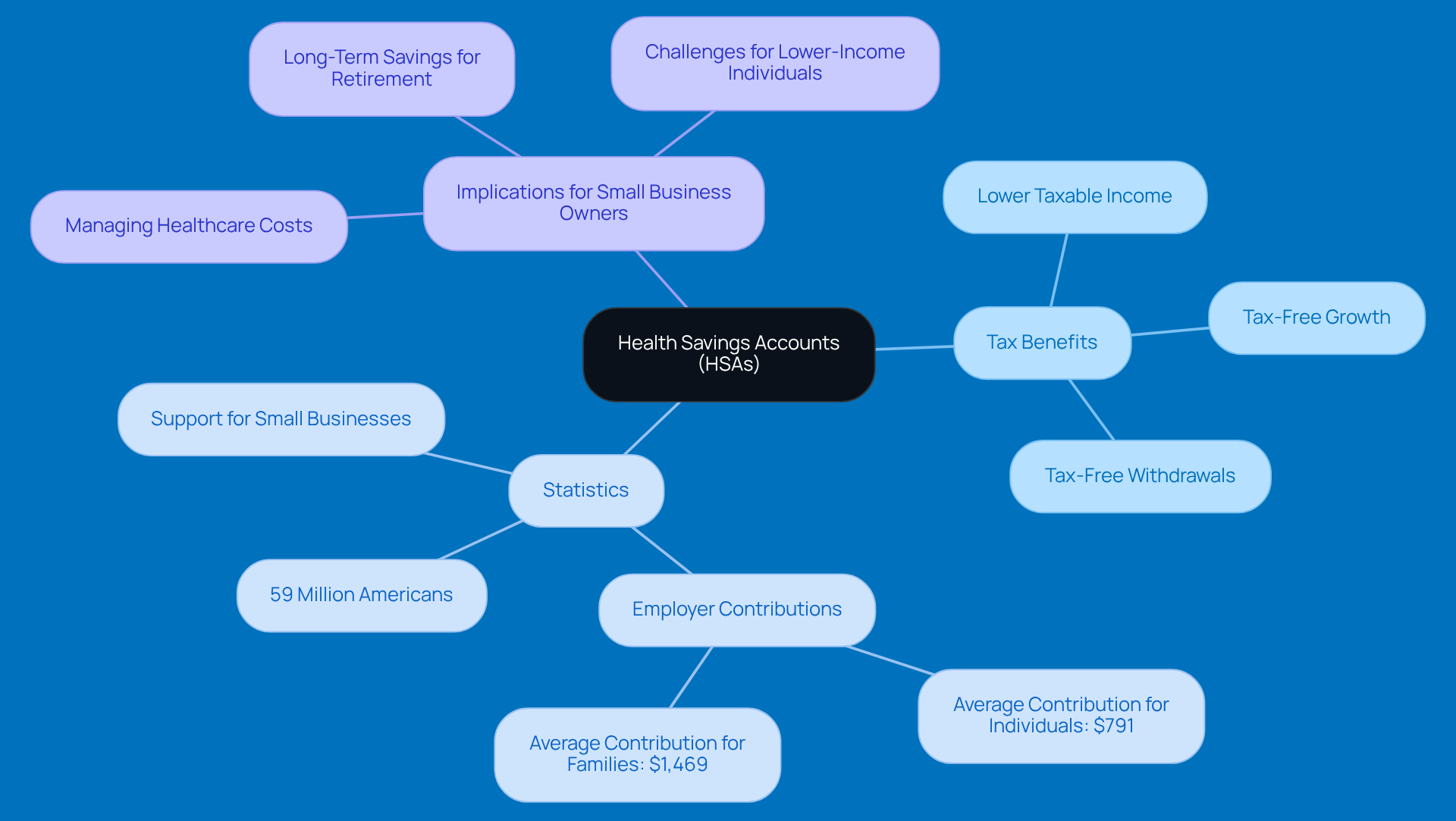

Health Savings Accounts (HSAs) are pretty neat little tools designed to help you save for qualified medical expenses, and they can even double as a smart way to save for retirement. When you contribute to an HSA, the funds you use are HSA taxable, which means you get to lower your taxable income. Plus, the money in your HSA grows tax-free, and when you withdraw it for qualified medical expenses, you won’t pay taxes on that either. That’s a triple tax benefit! It’s no wonder small business owners are keen on HSAs to manage healthcare costs effectively. For instance, if an entrepreneur puts $3,000 into their HSA, that amount gets deducted from their taxable income, but it's important to note that contributions to HSAs are HSA taxable, which could lead to a lower tax bill.

As of 2024, around 59 million Americans have HSAs, and a good chunk of small business owners are taking advantage of these accounts for their tax perks. Recent stats show that over 80% of HSA holders get contributions from their employers, with the average employer kicking in about $791 for individuals and $1,469 for families. This kind of support really highlights how HSAs are being recognized as a smart financial tool.

But wait, there’s more! Small business owners can really use HSAs to tackle rising healthcare costs. They not only help with immediate medical expenses but also allow for long-term savings since you can stash away money for retirement. However, it’s worth noting that HSAs mainly benefit those in higher tax brackets, leaving lower-income folks with less support when it comes to affording healthcare. As the healthcare landscape continues to change, HSAs remain a vital resource for small businesses looking to enhance their financial health while meeting their employees’ medical needs. So, if you’re a small business owner, have you thought about how an HSA could work for you?

Explore HSA Tax Rules: Contributions, Withdrawals, and Qualified Expenses

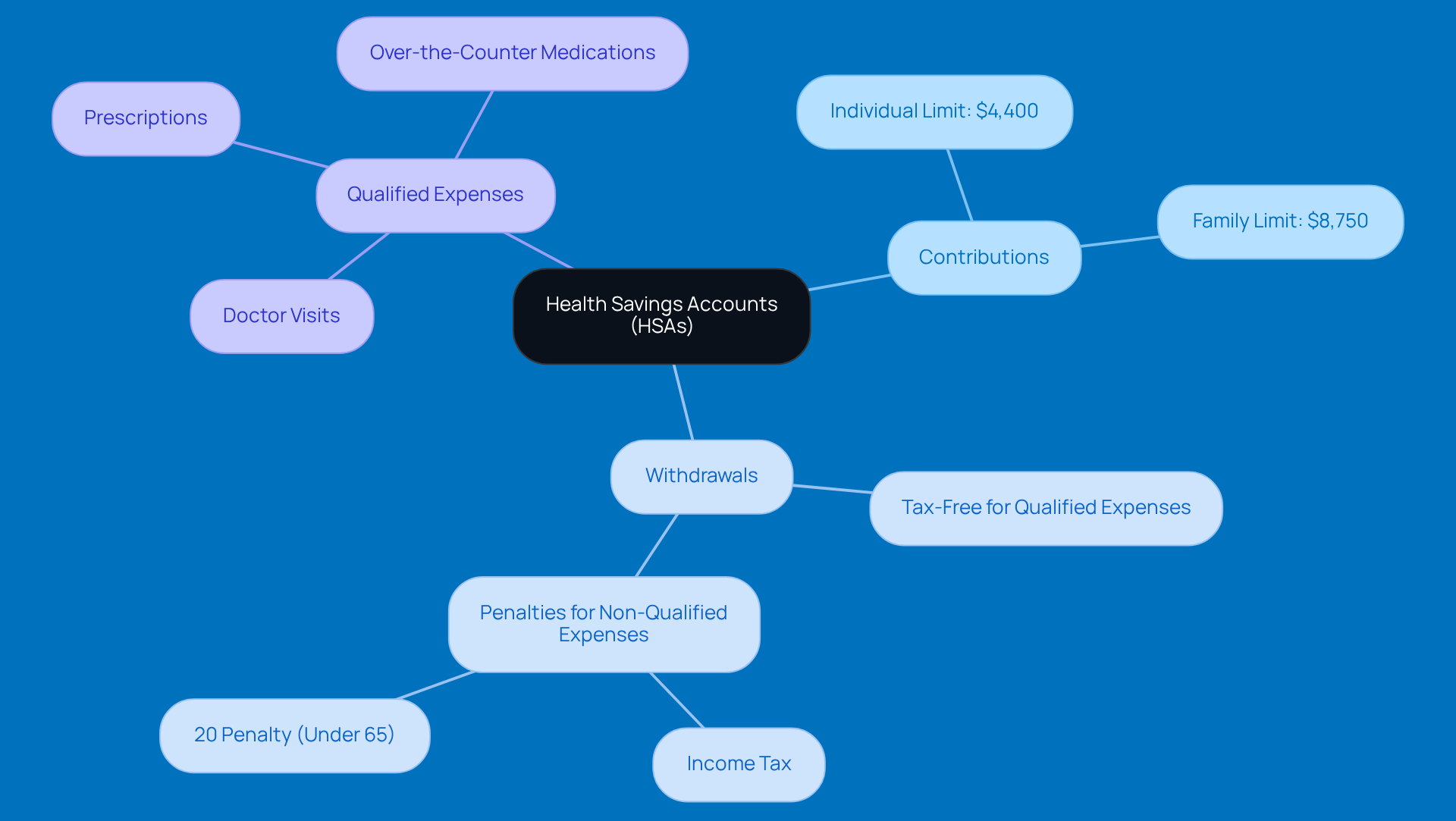

It is important for small business leaders to understand that Health Savings Accounts (HSAs) are HSA taxable and have tax implications. Did you know both the account holder and their employer can contribute? For 2026, the IRS has set the contribution limits at $4,400 for individuals and $8,750 for families.

Now, here’s the good part: withdrawals from an HSA are tax-free when you use them for qualified medical expenses. This includes a wide range of healthcare costs, like doctor visits, prescriptions, and even some over-the-counter medications. But watch out! If you take money out for non-qualified expenses, you’ll face income tax and a hefty 20% penalty if you’re under 65. So, keeping a close eye on those qualified expenses is key to avoiding any surprise tax bills, as some of them are HSA taxable.

Plus, small businesses can really benefit from employer contributions to HSAs. Not only does this boost employee satisfaction, but it also comes with tax perks. By making the most of HSAs, entrepreneurs can sharpen their tax strategies while supporting their employees' healthcare needs. So, why not explore how HSAs can work for you and your team?

Understand HSA Eligibility and Impact of High-Deductible Health Plans

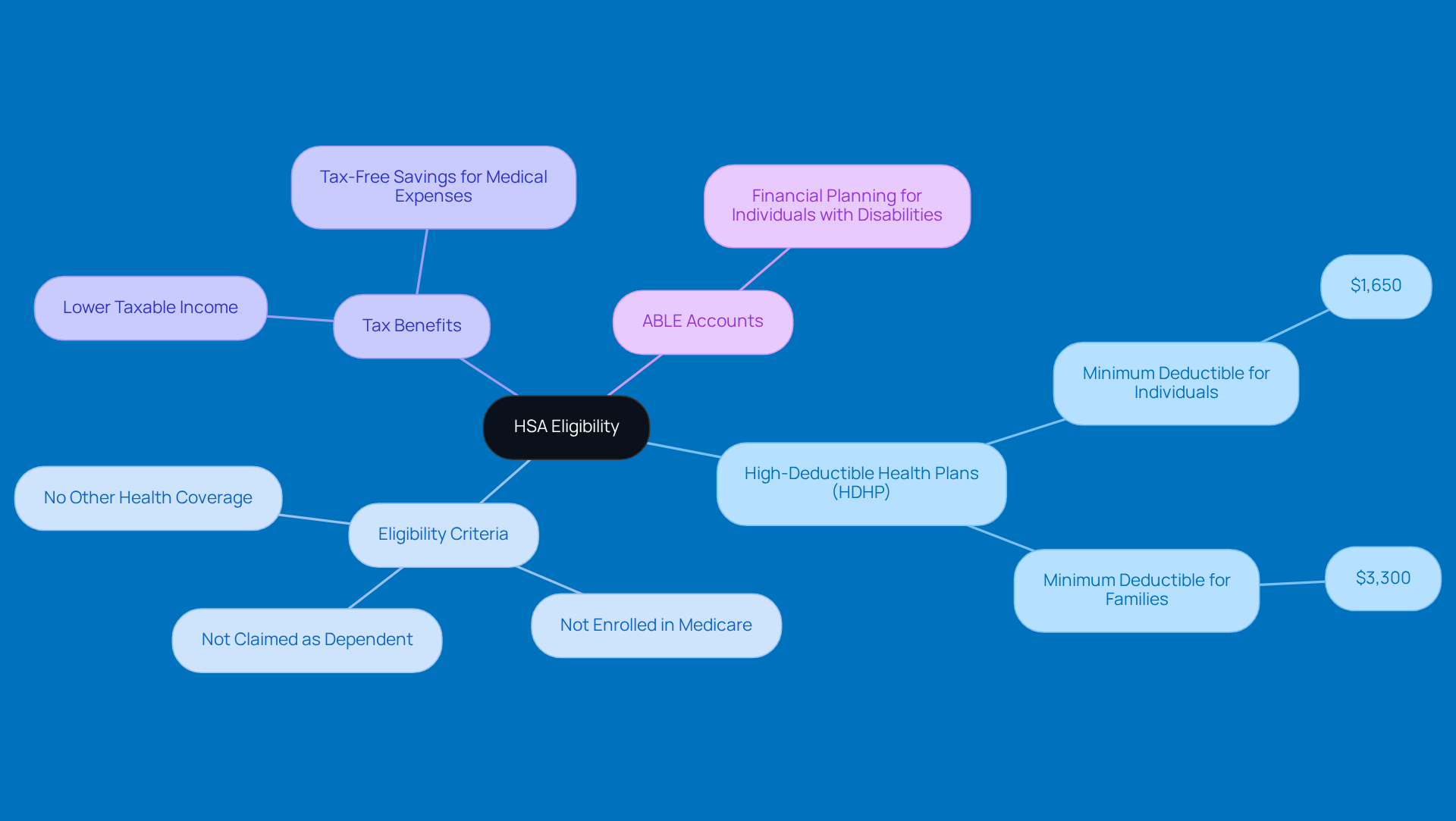

If you’re looking to qualify for a Health Savings Account (HSA), you’ll need to be enrolled in a high-deductible health plan (HDHP). For 2025, the minimum deductible for an HDHP is $1,650 for individual coverage and $3,300 for family coverage. Just a heads up: you can’t have any other health coverage that isn’t an HDHP, and you also can’t be enrolled in Medicare or be claimed as a dependent on someone else’s tax return. Understanding these eligibility criteria is super important for small business owners, as it directly impacts their ability to set up an HSA and whether the funds within those HSAs are HSA taxable, allowing them to take advantage of its tax benefits.

For example, if you’re a business owner with an HDHP, you can contribute to an HSA. This not only helps lower your taxable income but also allows you to save for future medical expenses, which are HSA taxable. It’s a smart way to enhance your financial planning while promoting long-term health management. Plus, Steinke and Company offers tailored advisory services to help clients manage their health savings accounts and improve their tax strategies.

And don’t forget about ABLE accounts! They provide additional financial planning options for individuals with disabilities, making health savings accounts even more beneficial. So, why not explore these options and see how they can work for you?

Clarify Tax Reporting Requirements for Health Savings Accounts

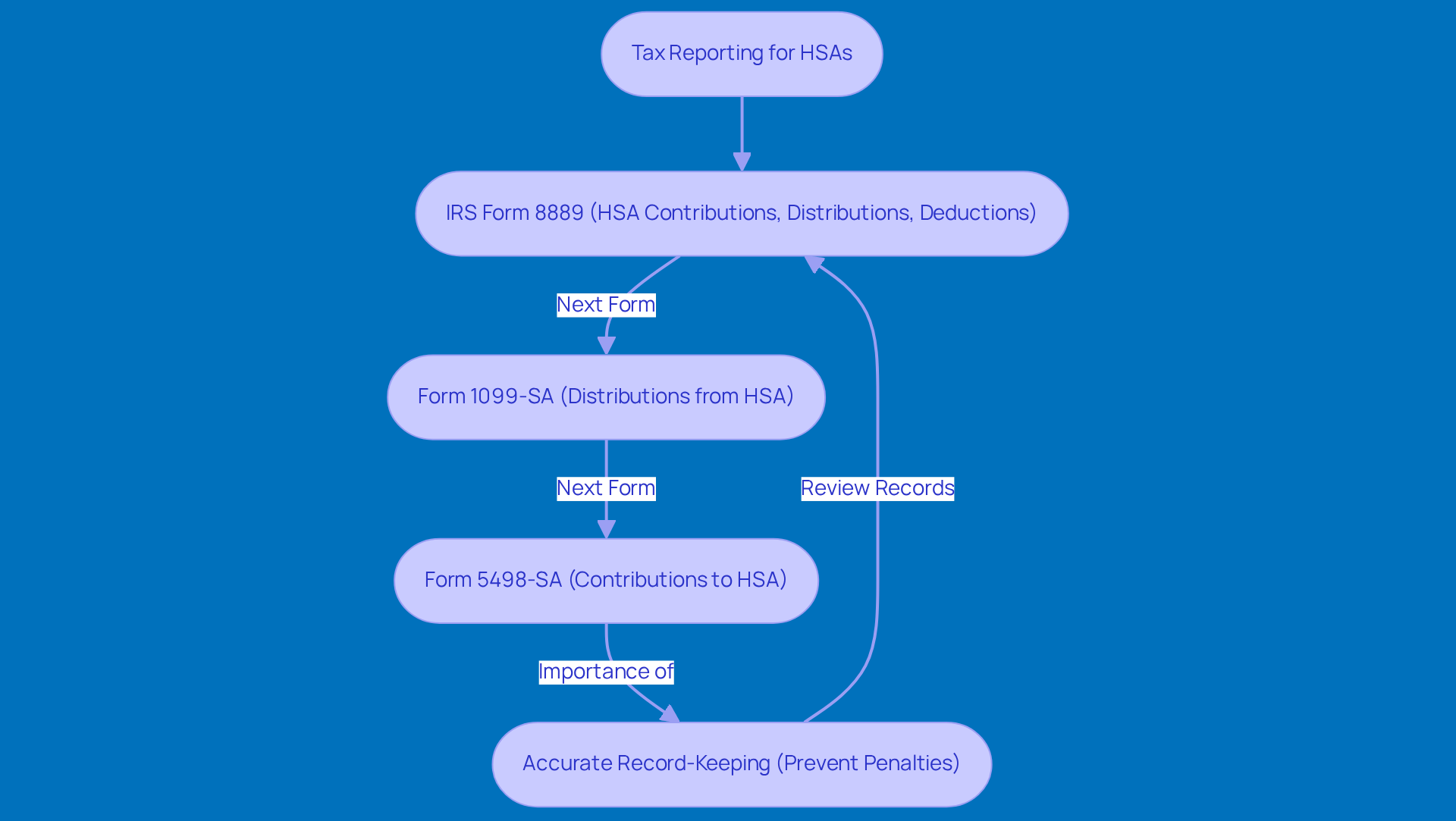

When it comes to tax reporting for Health Savings Accounts (HSAs), it’s important to pay close attention to which forms are HSA taxable. The main one you’ll need is IRS Form 8889, which should go along with your tax return (that’s Form 1040, by the way). This form is where you’ll jot down your HSA contributions, distributions, and any tax deductions you might be eligible for.

But wait, there’s more! You’ll also receive:

- Form 1099-SA, which details any distributions from your HSA

- Form 5498-SA, reporting the contributions you made throughout the year

Keeping accurate records of all your contributions and withdrawals is crucial - not just for compliance, but to avoid any pesky penalties.

For example, if you’re an entrepreneur and you forget to declare an HSA distribution used for non-qualified expenses, those distributions are HSA taxable, potentially resulting in extra taxes and penalties. Yikes! So, if you’re a small business owner, it’s really important to stay on top of your reporting. This way, you can make the most of your HSA benefits while sticking to IRS regulations. Remember, a little diligence now can save you a lot of headaches later!

Conclusion

Health Savings Accounts (HSAs) are a fantastic way for small business owners to get a handle on their tax strategies while keeping healthcare costs in check. By grasping the ins and outs of HSAs - like tax implications, contribution limits, and who’s eligible - business owners can not only lower their taxable income but also provide essential support for their employees’ medical needs.

Throughout this article, we’ve highlighted some key insights, such as:

- The triple tax benefit of HSAs

- The importance of qualified expenses

- The potential penalties for not playing by the rules

We’ve also connected HSAs with high-deductible health plans (HDHPs), showing how they can really boost financial planning and long-term health management. Plus, we can’t forget about the need for accurate tax reporting, including using specific IRS forms, to stay compliant and avoid any nasty surprises down the road.

So, what’s the takeaway? HSAs are more than just a financial tool; they’re a strategic asset for small business owners looking to navigate the tricky waters of healthcare costs and tax obligations. By taking proactive steps to understand and use HSAs effectively, business owners can not only improve their bottom line but also create a healthier workforce. Exploring the full potential of HSAs could lead to some serious savings and happier employees, making it crucial for small business leaders to think about how these accounts can fit into their financial game plan.

Frequently Asked Questions

What are Health Savings Accounts (HSAs)?

Health Savings Accounts (HSAs) are financial tools designed to help individuals save for qualified medical expenses, and they can also serve as a means to save for retirement.

What are the tax benefits of HSAs?

HSAs offer a triple tax benefit: contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are also tax-free.

How do HSAs benefit small business owners?

Small business owners can use HSAs to manage healthcare costs effectively, as they help cover immediate medical expenses and allow for long-term savings for retirement.

How many Americans have HSAs as of 2024?

As of 2024, around 59 million Americans have Health Savings Accounts.

Do employers contribute to HSAs?

Yes, over 80% of HSA holders receive contributions from their employers, with the average employer contributing about $791 for individuals and $1,469 for families.

Who benefits the most from HSAs?

HSAs mainly benefit individuals in higher tax brackets, while lower-income individuals may receive less support in affording healthcare.

Why are HSAs considered a vital resource for small businesses?

HSAs are considered vital for small businesses as they help enhance financial health while addressing employees' medical needs amidst rising healthcare costs.