Introduction

Understanding the ins and outs of land improvements can really open the door to some sweet tax benefits for property owners, especially with all the recent changes in legislation. These enhancements - think driveways and landscaping - aren't just about making things look nice; they can actually be classified as depreciable assets according to IRS guidelines. This could mean bonus depreciation for you!

But here’s the kicker: figuring out which improvements qualify can be a bit tricky, and navigating the maze of tax regulations isn’t exactly a walk in the park. So, what are the key factors that determine eligibility for these valuable deductions? And how can property owners like you make sure you’re getting the most bang for your buck? Let’s dive in!

Define Your Land Improvements

Let’s talk about what really counts as land improvements. You might be surprised to learn that it includes things like:

- Driveways

- Fences

- Landscaping

- Parking lots

- Sidewalks

These improvements aren’t just for show; they can actually boost the value or utility of your land, making them eligible for bonus depreciation under IRS guidelines. But here’s the kicker: it’s super important to know the difference between land upgrades and other property categories. Misclassifying these can lead to missed tax benefits, and nobody wants that!

According to the IRS, land improvements are depreciable assets with a recovery period of 15 years. This can really impact your tax strategy and overall financial planning. If you’re looking to claim those extra write-offs, you’ll need to file IRS Form 4562. This form details your election to use those additional write-offs, so don’t forget it!

Also, keep in mind that the Tax Cuts and Jobs Act brought about a gradual reduction in additional write-off rates. For instance, the additional write-off rate is set at 40% for 2025. That’s something to consider when planning your finances!

As Gary Massey, CPA, puts it, "By investing in these enhancements, property owners can not only improve the value and functionality of their real estate but also take advantage of immediate tax deductions." So, why not think about how you can enhance your property and enjoy those benefits?

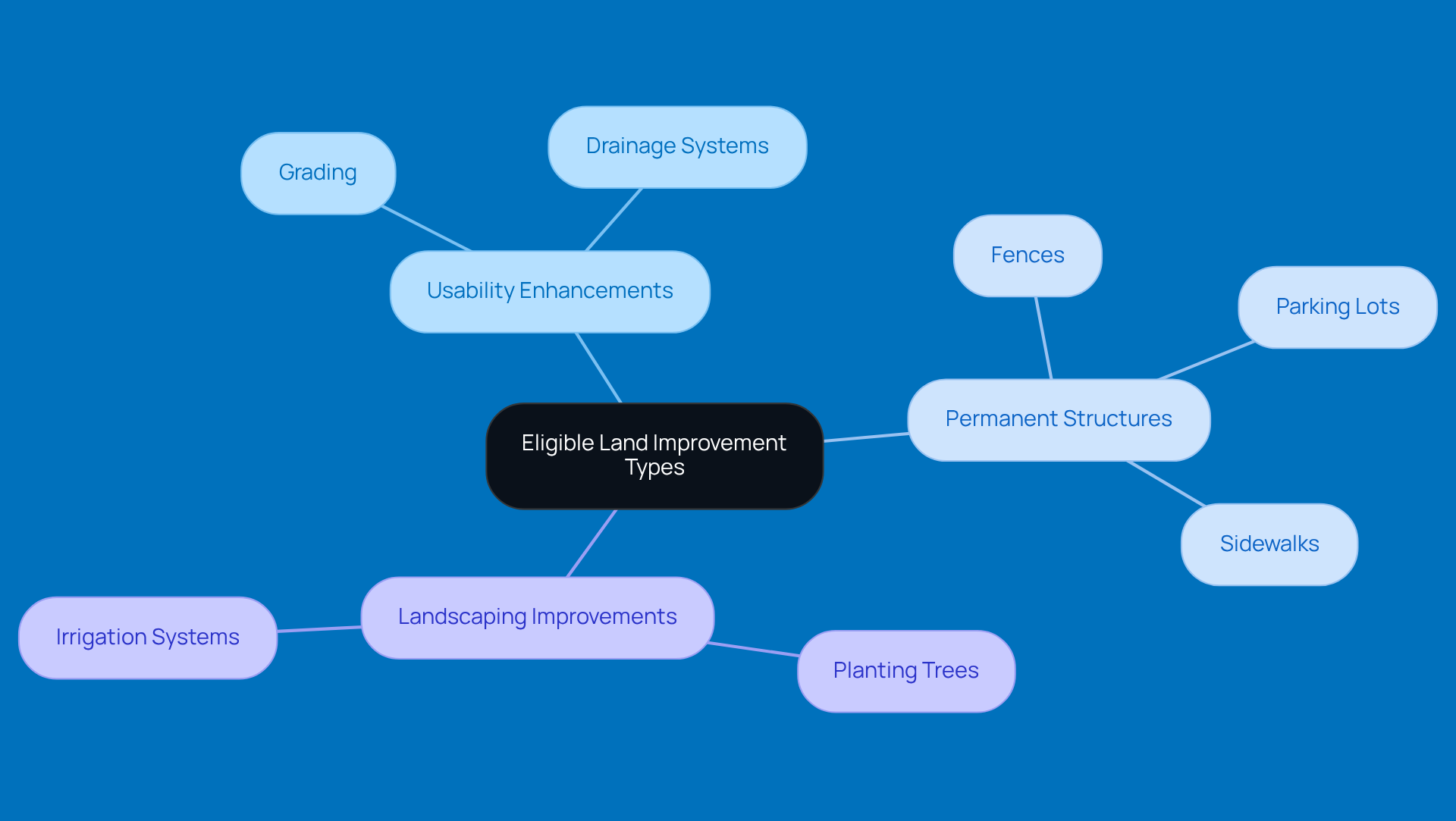

Identify Eligible Improvement Types

Let’s discuss whether land improvements are land improvements eligible for bonus depreciation that can snag you some benefits! First up, we have enhancements that really boost the usability of the land - think grading or drainage systems. Then, there are those permanent structures like fences, parking lots, and sidewalks, which the IRS classifies as 15-year property. And don’t forget about landscaping improvements! Planting trees or installing irrigation systems can really add to your property’s value.

Now, it’s super important to check the IRS guidelines to determine if those enhancements are land improvements eligible for bonus depreciation. You want to stay compliant with the current tax regulations, right? Plus, keep an eye out for any changes in tax legislation that might affect which improvements qualify for those extra write-offs, especially as we move closer to 2027. It’s always good to stay informed!

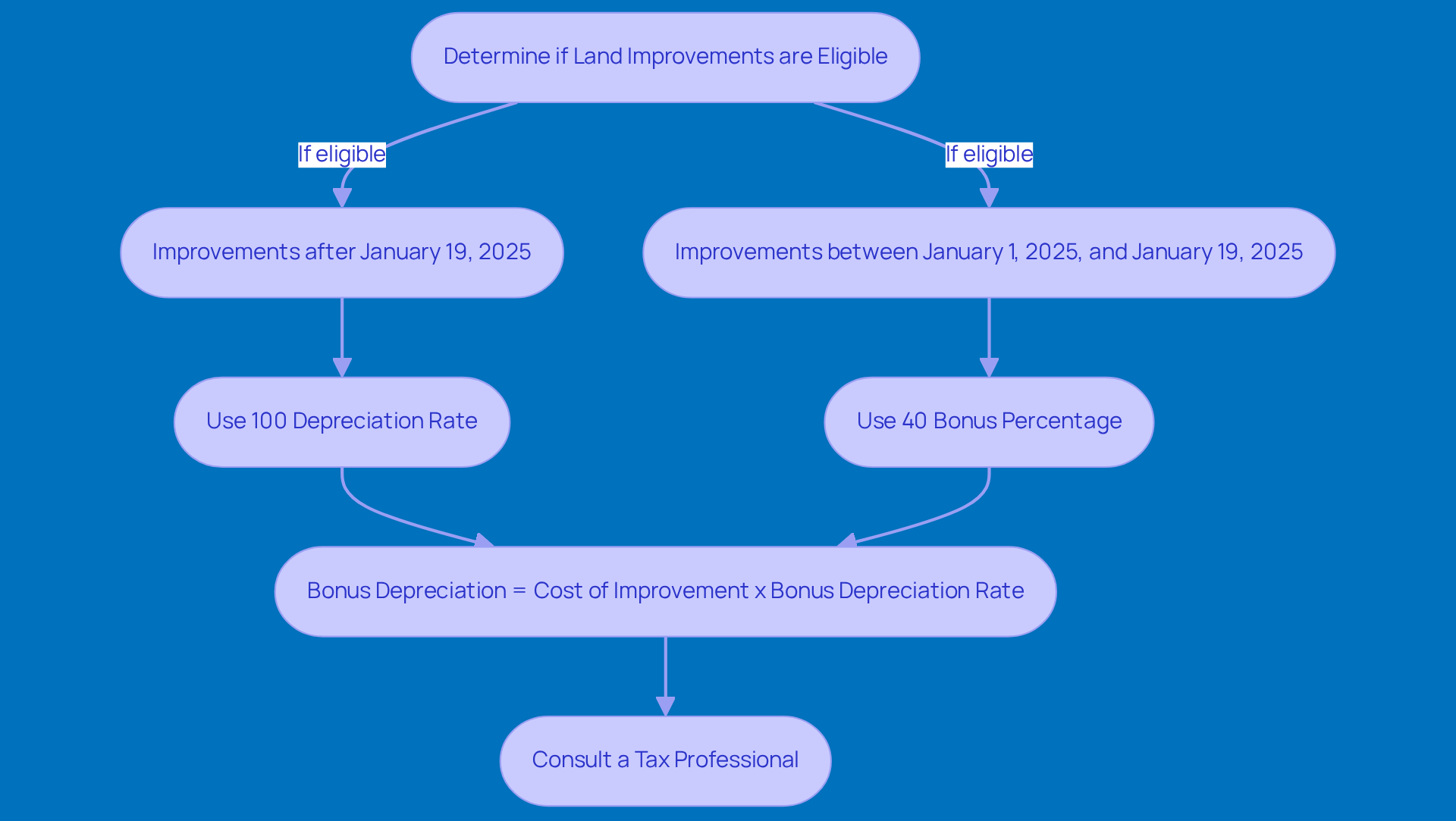

Calculate Your Bonus Depreciation

Alright, let’s talk about how to figure out if land improvements are land improvements eligible for bonus depreciation. This means you’ll want to include all the expenses that are related to property improvements that are land improvements eligible for bonus depreciation. It’s all about keeping track of what you spend!

Now, if you’re looking at enhancements that you’re putting into operation after January 19, 2025, you can use a depreciation rate of 100%. For any qualified property that you place in service between January 1, 2025, and January 19, 2025, there’s a bonus percentage of 40%. This is super important for businesses planning their asset purchases for 2025-don’t miss out on that!

Here’s a quick formula to keep in mind:

- Bonus Depreciation = Cost of Improvement x Bonus Depreciation Rate

Make sure to document your calculations carefully. This is key for accurate tax reporting and compliance. You don’t want any surprises come tax time!

Given how complex all this can get, it might be a good idea to chat with a tax professional. They can help you navigate those tricky calculations and ensure you’re getting the most out of your benefits. Tax advisory services are really helpful for optimizing your tax position and understanding how the OBBBA affects your capital investments and tax strategies moving forward. So, why not reach out and get some expert advice?

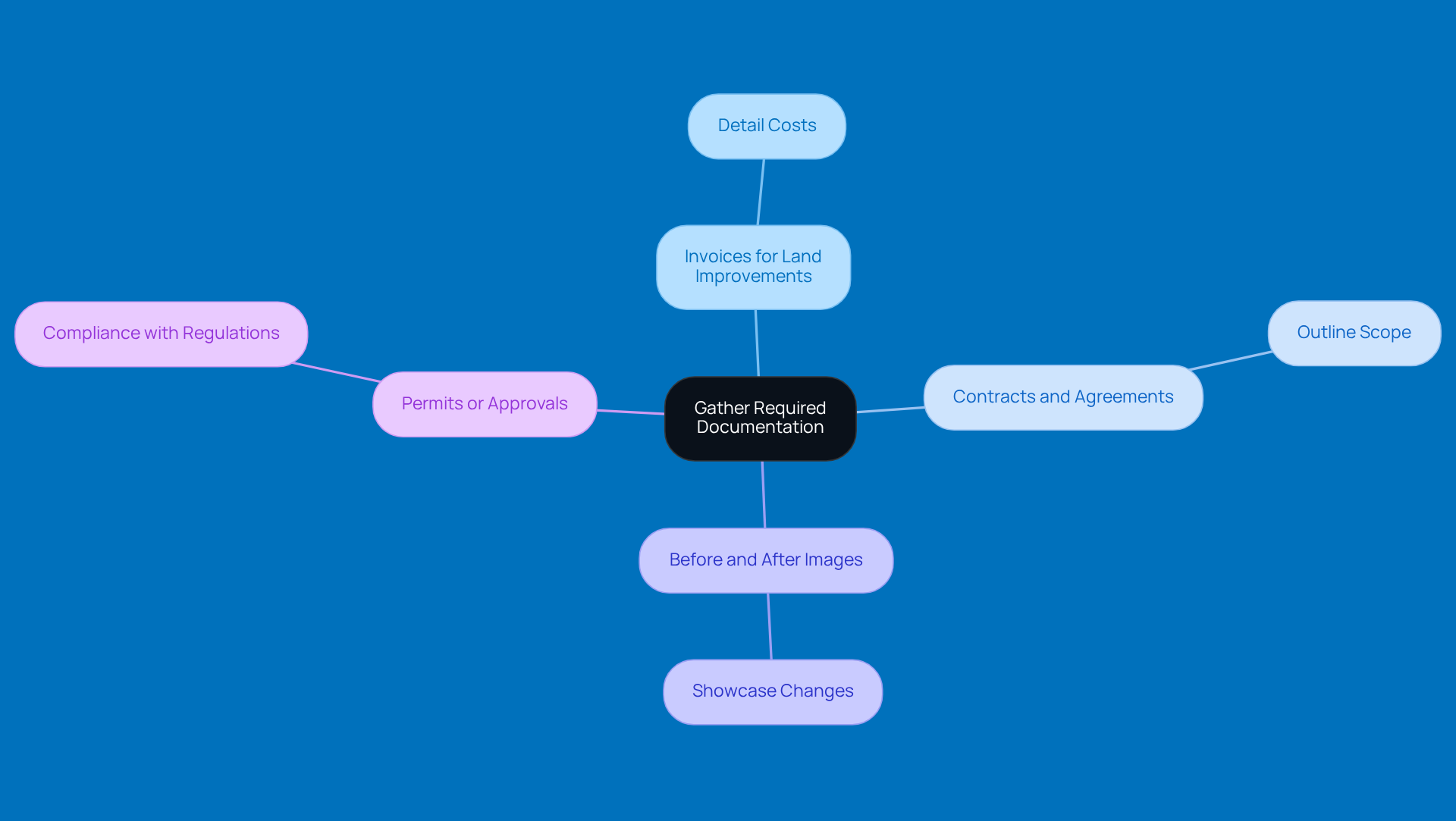

Gather Required Documentation

Hey there! Let’s talk about getting your documents in order for tax season. Here’s what you’ll want to gather:

- Invoices for land improvements: These detail the costs you’ve incurred, so keep them handy.

- Contracts and agreements: These should outline the scope and terms of the work done on your property.

- Before and after images: Snap some pics of the enhancements to visually showcase the changes you’ve made.

- Permits or approvals: These are crucial for showing you’ve complied with local regulations.

Now, it’s super important to organize these documents by project. This way, when tax prep rolls around, you can easily access everything you need. Make sure each set of documents is clearly labeled and stored together.

Also, don’t forget to check that all your documentation regarding land improvements eligible for bonus depreciation meets IRS requirements for substantiation. This means keeping accurate records that reflect the nature and cost of your improvements. Think of it as maintaining a neat filing system with invoices and contracts sorted by year and expense category. Proper documentation is key for claiming those extra tax deductions efficiently!

So, are you ready to tackle this? Let’s make tax season a breeze!

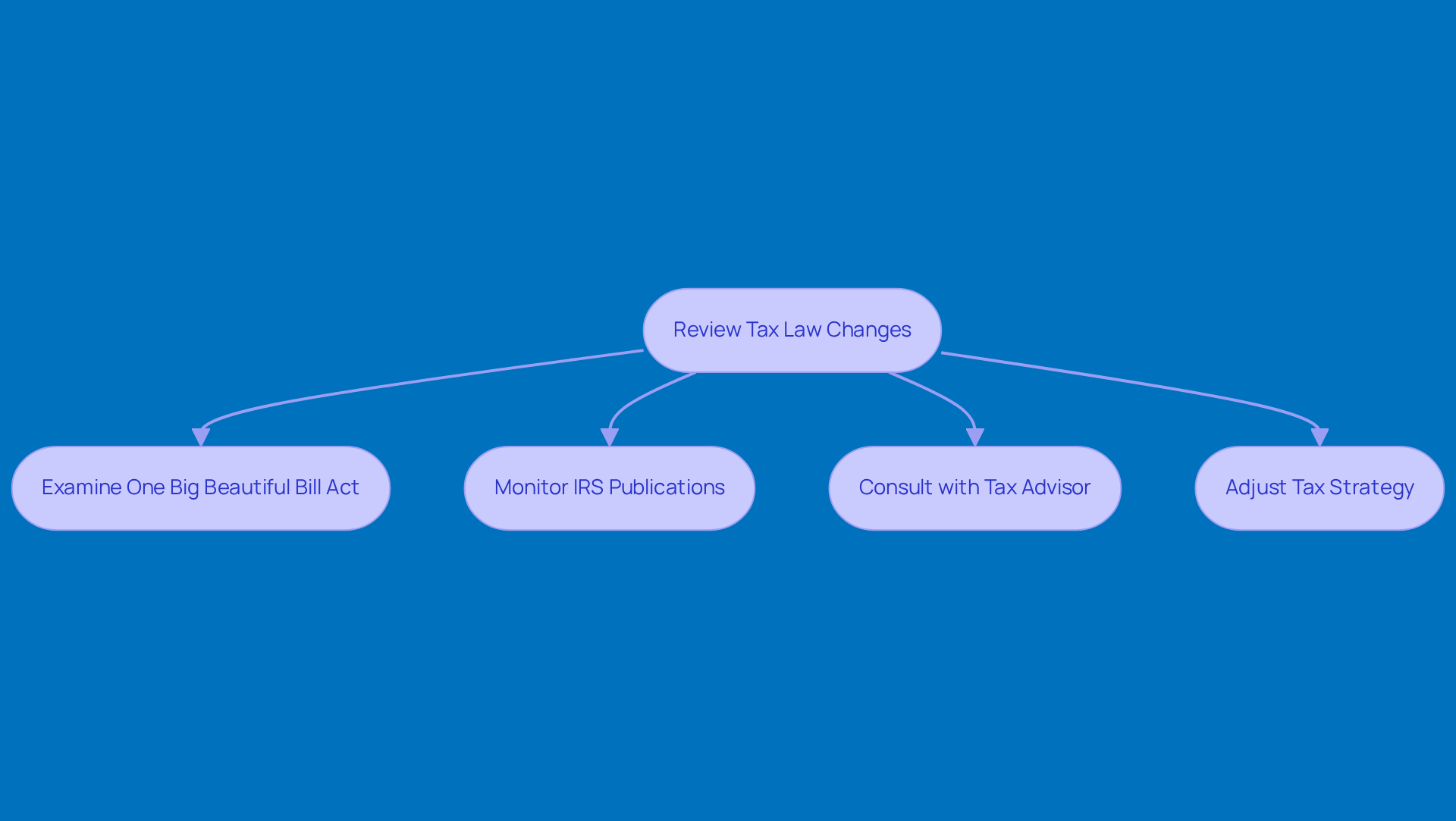

Review Tax Law Changes

Stay in the loop about the latest tax law changes that could impact bonus depreciation!

First up, take a good look at the One Big Beautiful Bill Act. This legislation shakes things up starting in 2025, allowing for a whopping 100% bonus depreciation on eligible property acquired after January 19, 2025. This is a fantastic opportunity for businesses to invest in production assets, as experts like Christian Wood and Ryan Corcoran have pointed out.

Don’t forget to keep an eye on IRS publications and announcements. They often provide updates and clarifications about the 10-year recapture rule and other specific provisions of the OBBBA that might influence your tax strategies.

And hey, it’s a smart move to chat with a tax advisor. They can help you understand how these changes specifically impact your business and help you strategize effectively. This is especially important when it comes to assessing property qualifications, particularly for mixed-use buildings.

Now’s the time to adjust your tax strategy to make the most of these new provisions. Make sure your capital investments align with the updated regulations, and you’ll be in a great position!

Conclusion

Understanding the ins and outs of land improvements and how they qualify for bonus depreciation is super important for property owners looking to boost the value and functionality of their investments. By knowing what counts as a land improvement - think driveways, fences, and landscaping - property owners can smartly use these upgrades to snag some tax benefits under IRS rules.

The article shares some key insights about the need to:

- Correctly spot eligible improvements

- Figure out the right bonus depreciation

- Keep solid documentation

With the chance for a whopping 100% bonus depreciation on eligible property acquired after January 19, 2025, thanks to the One Big Beautiful Bill Act, it’s the perfect time for property owners to take a fresh look at their tax strategies and make sure they’re in line with the latest regulations.

In the end, staying up-to-date on tax law changes and chatting with tax pros can really help property owners make smart financial choices. By getting involved in land improvements and understanding the tax implications, property owners can not only boost their real estate assets but also grab some significant tax deductions that can lead to overall financial success. So, why not take that step today?

Frequently Asked Questions

What qualifies as land improvements?

Land improvements include driveways, fences, landscaping, parking lots, and sidewalks. These enhancements can increase the value or utility of your land.

Why are land improvements important for tax purposes?

Land improvements are considered depreciable assets with a recovery period of 15 years according to IRS guidelines. They can make you eligible for bonus depreciation, impacting your tax strategy and financial planning.

How can I claim bonus depreciation for land improvements?

To claim bonus depreciation, you need to file IRS Form 4562, which details your election to use additional write-offs for land improvements.

What is the additional write-off rate for land improvements under the Tax Cuts and Jobs Act?

The additional write-off rate is set at 40% for the year 2025. It’s important to consider this when planning your finances.

What types of enhancements boost the usability of land?

Enhancements that boost usability include grading, drainage systems, and permanent structures like fences, parking lots, and sidewalks.

Are landscaping improvements eligible for bonus depreciation?

Yes, landscaping improvements such as planting trees or installing irrigation systems can add value to your property and may be eligible for bonus depreciation.

How can I ensure compliance with IRS guidelines for land improvements?

It’s important to check the IRS guidelines to determine if your enhancements qualify as land improvements eligible for bonus depreciation and to stay informed about any changes in tax legislation.