Introduction

Navigating the complex world of business structures can feel pretty overwhelming for small business owners, right? Especially when you start thinking about the perks of an S Corporation. This unique setup offers pass-through taxation and limited liability, which makes it a tempting option for many. But here’s the big question: can a partnership make the leap to an S Corp? And what are the potential benefits or hurdles that come with it?

Understanding this connection is super important because it could lead to some serious tax savings and boost your business's credibility. Just keep in mind, it also brings along new compliance requirements that you’ll want to think through carefully.

Define S Corporation: Key Characteristics and Structure

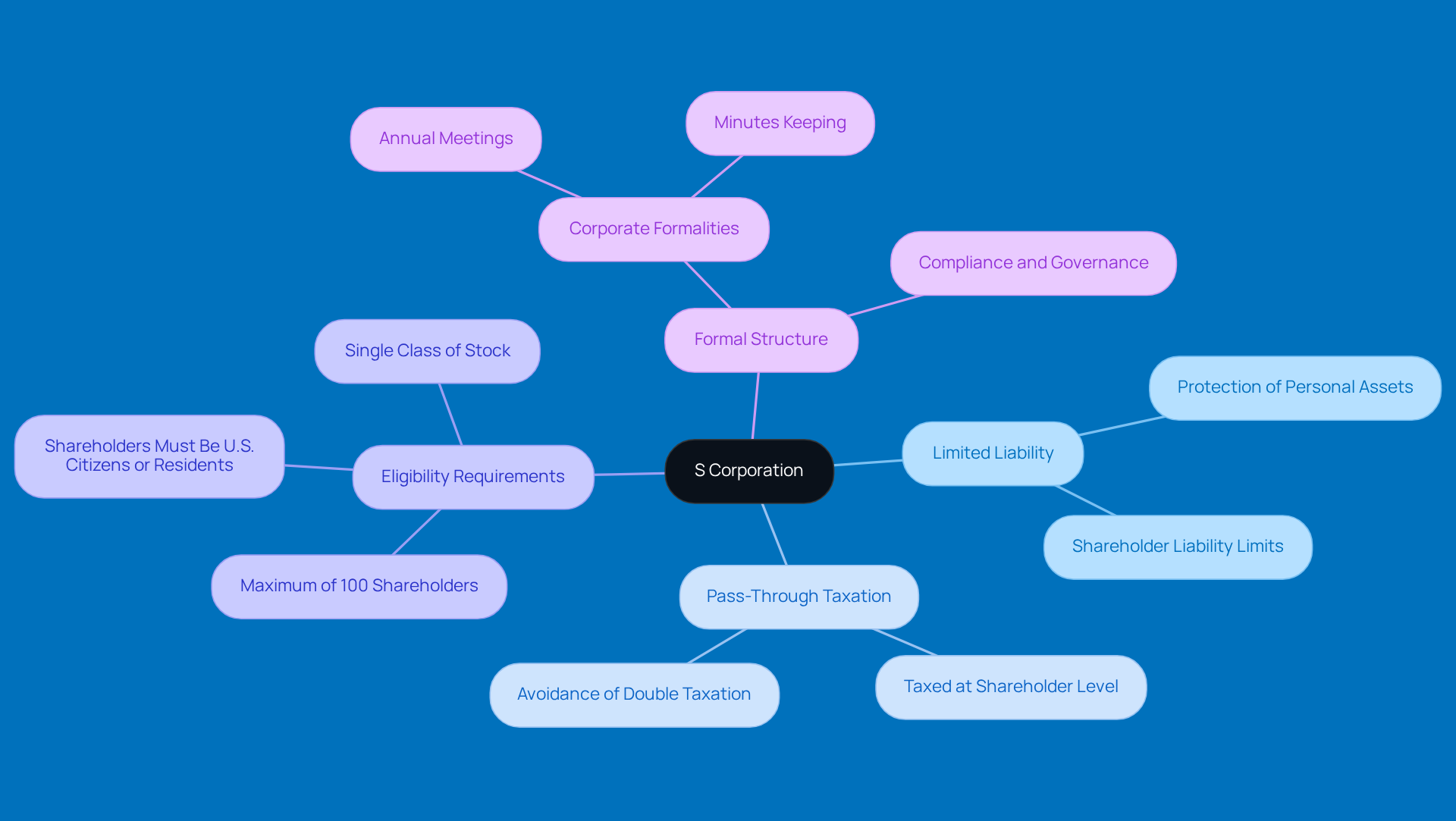

An S Corporation, or S Corp, is a pretty unique business structure. It meets specific requirements set by the Internal Revenue Code, which lets income, losses, deductions, and credits pass through to shareholders for federal tax purposes. This means you can avoid that pesky double taxation on corporate income, making it a popular choice for many small businesses. Let’s break down some key characteristics of an S Corporation:

- Limited Liability: Shareholders usually aren’t personally liable for the corporation's debts and liabilities, which means your personal assets are protected. That’s a big win!

- Pass-Through Taxation: Instead of being taxed at the corporate level, income is taxed at the shareholder level. This can lead to some significant tax savings.

- Eligibility Requirements: To qualify, an S Corp can’t have more than 100 shareholders, and all of them need to be U.S. citizens or residents. Plus, it can only issue one class of stock.

- Formal Structure: S Corporations have to stick to corporate formalities, like holding annual meetings and keeping minutes. This helps ensure compliance and good governance.

Understanding these traits is super important for small business owners as they weigh the pros and cons of choosing S status. Interestingly, recent trends show that more small businesses are opting for S Corporation status in 2026. Why? Well, the permanent 20% Qualified Income deduction and other favorable tax reforms are definitely driving this shift.

As small business owners navigate the tricky waters of tax compliance, it’s crucial to be aware of underpayment penalties that can pop up from not making enough estimated tax payments. Did you know the IRS's interest rate for underpayments is currently at 8% per year, compounded daily? That’s why effective tax planning is key to avoiding unnecessary financial stress.

By taking advantage of the benefits of S Corporations and implementing strategies like adjusting withholdings and making timely estimated tax payments, you can optimize your tax compliance and lower the risk of penalties. And as regulations change - especially with some major shifts expected in 2026 - staying informed about the perks and requirements of S Corporations can really empower you to make smart decisions that align with your long-term goals. So, what do you think? Are you ready to dive into the world of S Corps?

Explore the Relationship: Partnerships and S Corporations

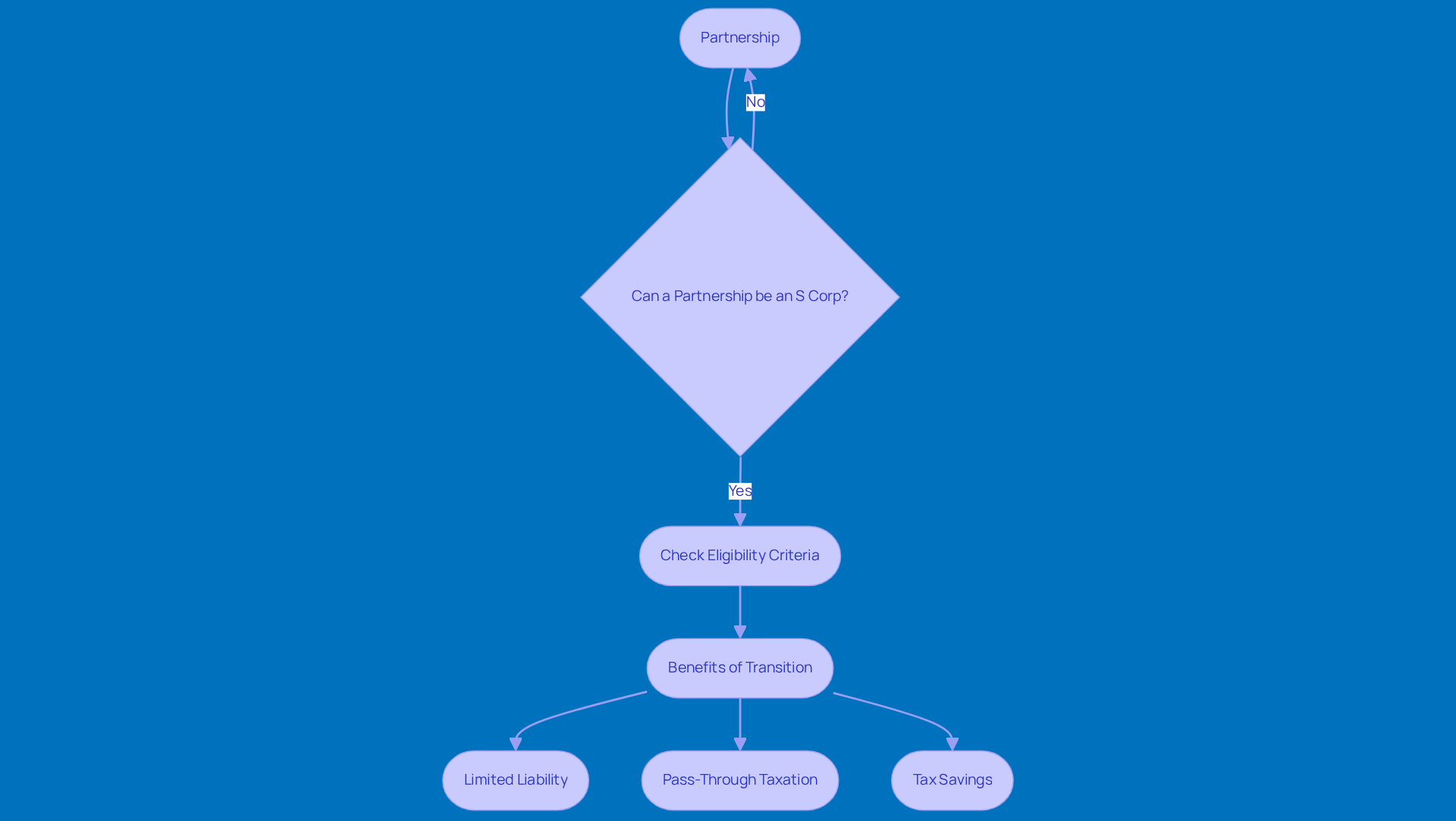

Partnerships and S Corporations are both popular ways to organize a business, but they each have their own unique purposes. A partnership is basically a business setup where two or more people share ownership and profits. On the flip side, an S Corporation is a formal business that opts to be taxed under Subchapter S of the Internal Revenue Code.

So, how do these two connect? Well, sometimes a partnership might consider the question of can a partnership be an S Corp. This change can bring some great perks, like limited liability and pass-through taxation. What’s that? It means the income can be reported on individual tax returns, which helps avoid double taxation. But, it’s not all smooth sailing; it takes careful planning and sticking to IRS rules. For instance, a partnership needs to determine if it can a partnership be an S Corp by checking that it meets the eligibility criteria, such as having no more than 100 shareholders and only one class of stock. Plus, there are new rules that let small businesses, including joint ventures and S Corporations, skip submitting Forms K-2 and K-3 if they meet certain criteria about total receipts and assets. That’s a nice way to lighten the compliance load!

Understanding this relationship is super important for small business owners who are thinking about changing their structure to get better tax benefits and liability protection. Real-life examples really show how beneficial this transition can be. Take ABC Consulting, for example. They made the switch from a joint venture to an S Corporation and saved over $40,000 on self-employment taxes in their first year! Not to mention, they gained more credibility and limited liability. Similarly, XYZ Manufacturing’s conversion helped them cut down on tax burdens, attract new investors, and maximize their business expense deductions. And let’s not forget the Fifth Circuit Court of Appeals’ ruling about self-employment tax for passive owners in joint ventures and LLCs - it adds even more context to the tax implications that matter to you. By optimizing tax advantages and boosting liability protection, moving from a joint venture to an S Corporation can be a smart move for long-term growth and stability.

Evaluate Benefits and Drawbacks of S Corporation Status for Partnerships

Choosing S Corporation status raises the question of how can a partnership be an S Corp, which can really bring some perks. Let’s break it down:

-

Tax Savings: With pass-through taxation, you might find yourself with lower overall tax bills compared to traditional corporations. This is especially great for active owners raking in over $60,000 to $80,000. S-Corps often save on self-employment tax for these folks. And guess what? Steinke and Company’s expert tax prep services are here to help you snag those savings while keeping everything above board with tax regulations.

-

Limited Liability Protection: One of the big wins here is that shareholders usually don’t have to worry about personal liability for the company’s debts. That’s a nice change from general partnerships, right?

-

Credibility: Running your business as an S Entity can boost your credibility with customers and suppliers. It’s a smart move, and Steinke and Company can help you plan this strategically.

But hold on, there are a few downsides to think about:

-

Increased Complexity: S Corporations have to follow more rules and formalities than partnerships, which can pile on the administrative work. No worries, though! Steinke and Company can help make this process smoother, so tax season doesn’t feel like a mountain to climb.

-

Eligibility Restrictions: Not every partnership can snag S entity status. There are limits on shareholders (only 100 allowed) and specific stock class requirements that can cramp your ownership style. But don’t fret! Our planning services can guide you through these hurdles.

-

Potential for Higher Taxes on Certain Income: Some income types might still face self-employment taxes, which could eat into those tax benefits. With Steinke and Company focused on minimizing surprises, you’ll be better prepared for any tax implications that might pop up.

Understanding these factors is key for partnerships that are considering if can a partnership be an S corp. They can really impact your financial health and how well your business runs. Steinke and Company is ready to provide the expertise you need in tax prep and planning, ensuring your business not only survives but thrives!

Understand the Election Process: How Partnerships Become S Corporations

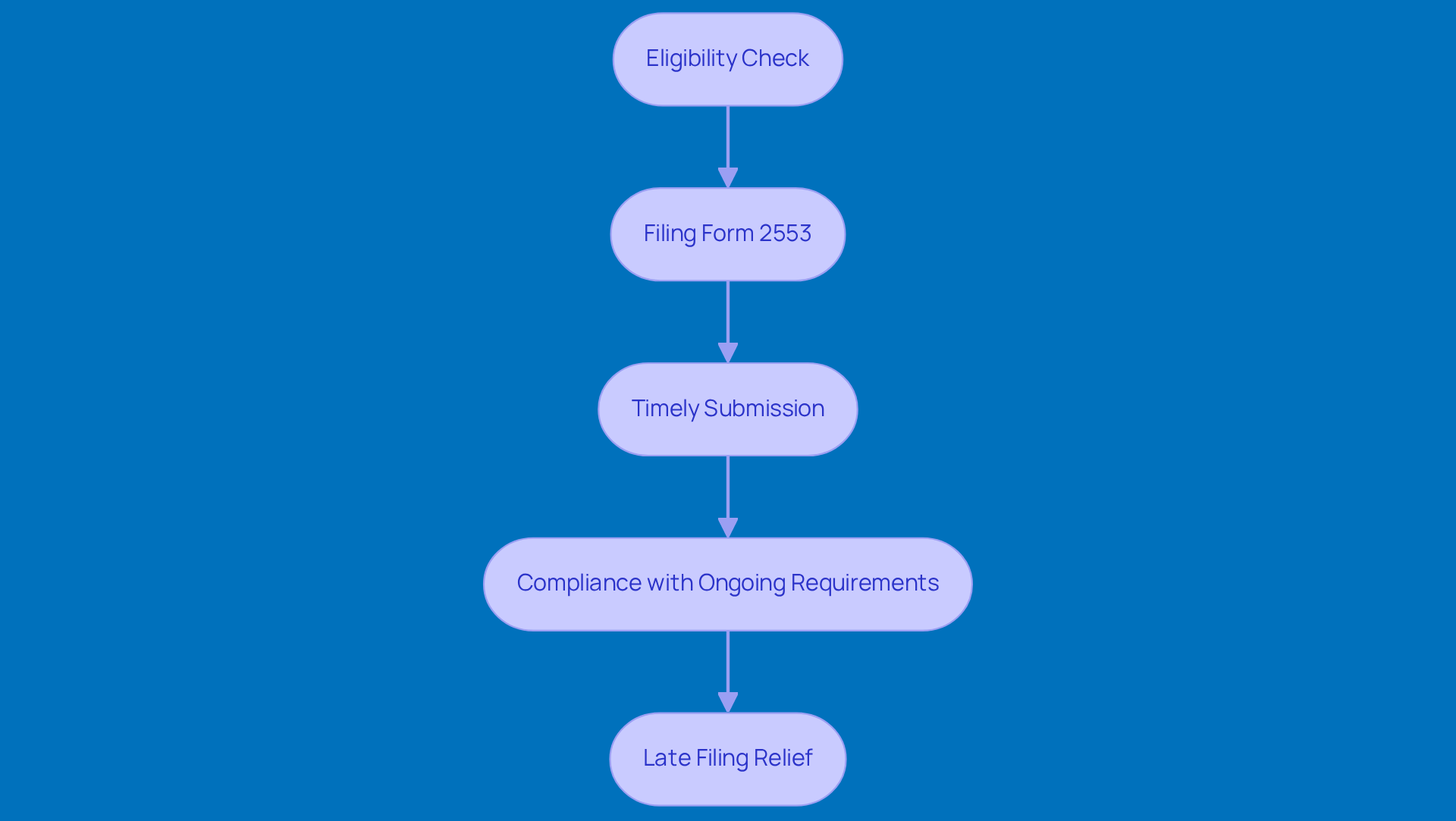

Are you navigating the process to understand how can a partnership be an S Corp? Let’s break it down into some essential steps that’ll make it a breeze:

-

Eligibility Check: First things first, you’ll want to make sure your partnership meets the S Corporation eligibility criteria. This means having no more than 100 shareholders, sticking to a single class of stock, and ensuring your shareholders are of the right types.

-

Filing Form 2553: Next up, you’ll need to file IRS Form 2553, which is the official way to elect S Corporation status. Don’t forget, this form needs signatures from all shareholders-everyone has to be on board! As Billie Anne Grigg points out, "Yes, the IRS requires unanimous written consent from all shareholders."

-

Timely Submission: Timing is everything! You’ve got to file your election within a specific window-usually within 75 days from the start of the tax year you want it to kick in. For existing partnerships, that means getting it in by March 15 to be effective for the current tax year. If you’re starting fresh, you’ve got 75 days from your launch date. So, mark those calendars!

-

Compliance with Ongoing Requirements: Once you’ve made the election, there are some ongoing IRS requirements to keep in mind. You’ll need to maintain corporate formalities, keep accurate records, and file annual tax returns like Form 1120-S. Skipping out on these could lead to penalties that might wipe out the tax benefits you were hoping for.

Understanding these steps is super important for partnerships looking to enhance their business structure and explore if a partnership can be an S Corp to optimize tax strategies. The S election can bring some serious tax perks, like avoiding double taxation on corporate profits. Plus, if you happen to miss the initial deadline, you might wonder, can a partnership be an S Corp? There’s late filing relief under Revenue Procedure 2013-30 that allows for retroactive S Corporation elections, which can be a lifesaver for partnerships.

Conclusion

Transitioning from a partnership to an S Corporation can be a smart move for small business owners who want to boost their financial health and protect their personal assets. By getting to know the unique perks of S Corporations - like limited liability and pass-through taxation - partnerships can really make the most of these benefits to fine-tune their tax strategies and enhance their business credibility.

So, what are the key steps for partnerships thinking about this transition? First off, you’ll want to:

- Check your eligibility

- File Form 2553

- Stay on top of ongoing compliance requirements

There’s a lot to gain here, including potential tax savings and less personal liability. But, it’s also important to keep in mind the complexities and restrictions that come with S Corporation status. Real-world examples show just how much businesses have benefited from making this switch, highlighting the need for careful planning and informed decision-making.

In the end, choosing to elect S Corporation status can bring some serious advantages for partnerships, especially when it comes to tax efficiency and liability protection. If you’re a small business owner, it’s definitely worth exploring this option further. With the tax landscape always changing, there’s a real opportunity for long-term growth and stability. Taking proactive steps now can help you navigate your financial future with confidence and clarity. So, why not dive in and see what this could mean for your business?

Frequently Asked Questions

What is an S Corporation?

An S Corporation, or S Corp, is a unique business structure that allows income, losses, deductions, and credits to pass through to shareholders for federal tax purposes, avoiding double taxation on corporate income.

What are the key characteristics of an S Corporation?

Key characteristics include limited liability for shareholders, pass-through taxation, specific eligibility requirements (no more than 100 shareholders, all must be U.S. citizens or residents, and only one class of stock), and a formal structure that requires adherence to corporate formalities.

What is limited liability in the context of an S Corporation?

Limited liability means that shareholders are generally not personally liable for the corporation's debts and liabilities, protecting their personal assets.

How does pass-through taxation work for S Corporations?

In pass-through taxation, the income of the S Corporation is not taxed at the corporate level; instead, it is taxed at the individual shareholder level, which can lead to tax savings.

What are the eligibility requirements for an S Corporation?

To qualify as an S Corporation, there cannot be more than 100 shareholders, all shareholders must be U.S. citizens or residents, and it can only issue one class of stock.

What formalities must S Corporations adhere to?

S Corporations must follow corporate formalities, such as holding annual meetings and keeping minutes, to ensure compliance and good governance.

Why are more small businesses opting for S Corporation status in 2026?

The trend towards S Corporation status is driven by favorable tax reforms, including the permanent 20% Qualified Income deduction.

What should small business owners be aware of regarding tax compliance?

Small business owners should be aware of potential underpayment penalties for insufficient estimated tax payments, as the IRS's interest rate for underpayments is currently 8% per year, compounded daily.

How can S Corporations optimize tax compliance?

S Corporations can optimize tax compliance by adjusting withholdings and making timely estimated tax payments to lower the risk of penalties.

Why is it important for business owners to stay informed about S Corporations?

Staying informed about the benefits and requirements of S Corporations is crucial for making smart decisions that align with long-term goals, especially with anticipated regulatory changes in 2026.