Overview

Choosing the right small business CPA firm is all about taking a systematic approach. First, you’ll want to identify your specific financial needs. Next, it’s crucial to evaluate the firm’s expertise and ensure they align with your business values. This article lays out a step-by-step guide that highlights the importance of understanding your business goals. It encourages you to assess potential CPA qualifications and engage in open communication to find a firm that can truly support your financial health.

So, what are your business goals? Have you thought about how a CPA can help you achieve them? Finding the right fit is essential, and this guide will walk you through the process with ease. Remember, it’s not just about numbers; it’s about building a partnership that works for you!

Introduction

Choosing the right CPA firm for your small business is a big deal—it can really shape your financial success and growth strategy. As you navigate the tricky waters of tax compliance, bookkeeping, and financial planning, it's crucial to understand your unique needs and goals.

But with so many options out there, how do you pick a firm that truly aligns with your values and has the expertise to help you thrive? This guide is here to walk you through a step-by-step approach to finding the perfect small business CPA firm, empowering you to make informed choices that support your long-term financial health.

Identify Your Business Needs and Goals

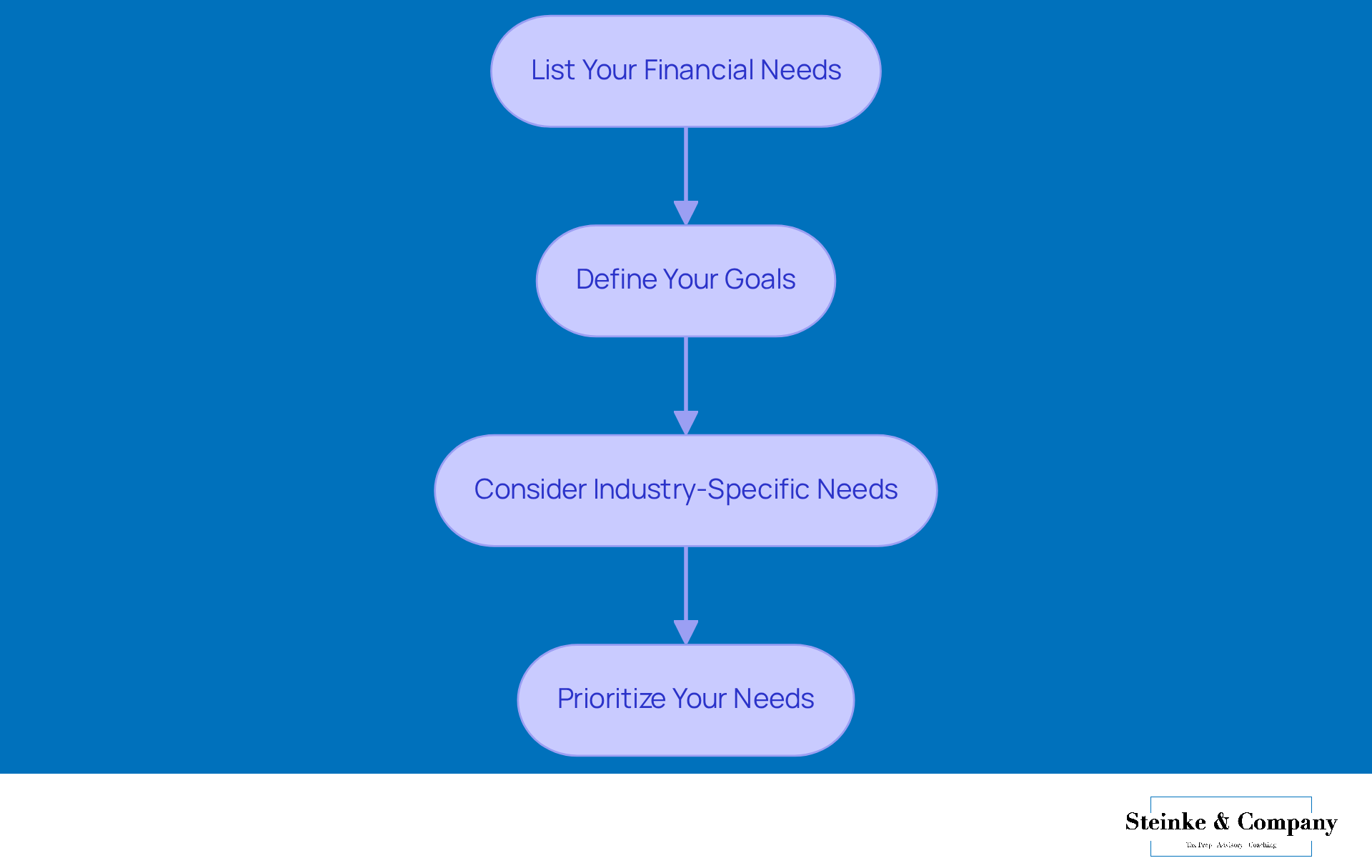

Start by taking a good look at your company's current economic situation and future goals. Here are some steps to help you out:

-

List Your Financial Needs: Think about the specific areas where you could use a hand, like tax compliance, bookkeeping, or financial planning. Steinke and Company offers proactive tax planning services that help you spot missed opportunities and craft personalized strategies to reduce your tax burdens while fostering growth. Getting clear on these needs will help you understand which services are essential for your business.

-

Define Your Goals: Write down both your short-term and long-term objectives, such as boosting revenue, expanding your services, or gearing up for a business sale. Having clear goals is crucial because it gives you direction and enhances accountability in your budgeting. The more specific you are, the better your chances of hitting those targets.

-

Consider Industry-Specific Needs: Remember, different industries have unique financial requirements. For instance, service-oriented businesses often need specialized tax strategies to improve their financial performance. Steinke and Company’s expert commercial strategy and advisory services can help you navigate these complexities with ease.

-

Prioritize Your Needs: Rank your needs based on what's most urgent and important. This will help you narrow down the type of services you require from a small business CPA firm, ensuring you focus on what truly matters for your company's growth. Plus, understanding your rights and preparing for potential IRS audits can ease your mind and make sure you're ready for any challenges that come your way.

Steinke and Company connects with clients 1-3 times a year to review their strategies and ensure they’re on track with their goals. By clearly outlining your needs and objectives, you’ll be in a much better position to find a small business CPA firm that can provide tailored assistance, ultimately enhancing your company’s financial health and strategic direction.

Evaluate CPA Firm Expertise and Services

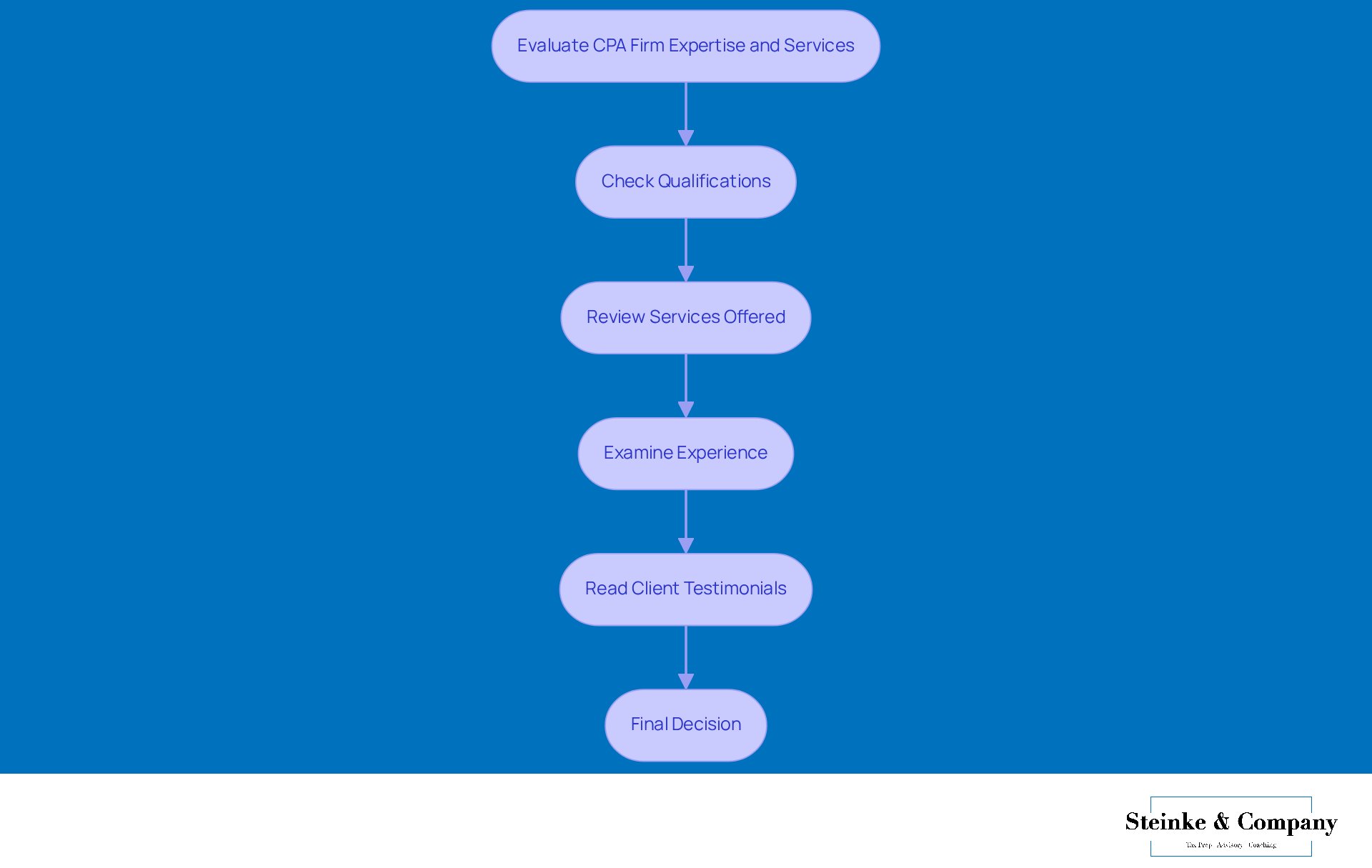

When it comes to picking the right CPA organization for your business needs, doing a little homework on potential candidates is key. Here are some steps to help you out:

-

Check Qualifications: Start by looking for CPAs who have recognized certifications like CPA (Certified Public Accountant) or EA (Enrolled Agent). If they have specialized designations that relate to your industry, that’s a good sign they understand the specific economic challenges you might face.

-

Review Services Offered: Make sure the firm offers a solid range of services that fit what you need. This could include tax preparation, consulting, and tailored planning for service-oriented businesses like yours.

-

Examine Experience: Look into the company’s history with businesses similar to yours, especially regarding size and industry. A CPA who has relevant experience can provide valuable insights that are essential for navigating your unique financial situation.

-

Read Client Testimonials: Check out reviews or case studies that highlight the firm’s success in helping clients with similar needs. Positive feedback can really reassure you that they have what it takes to support your business effectively.

By carefully considering these factors, you can find a CPA practice that not only has the right expertise but also understands the unique challenges faced by small agency owners, ultimately helping you achieve financial success.

Assess Compatibility with Your Business Values

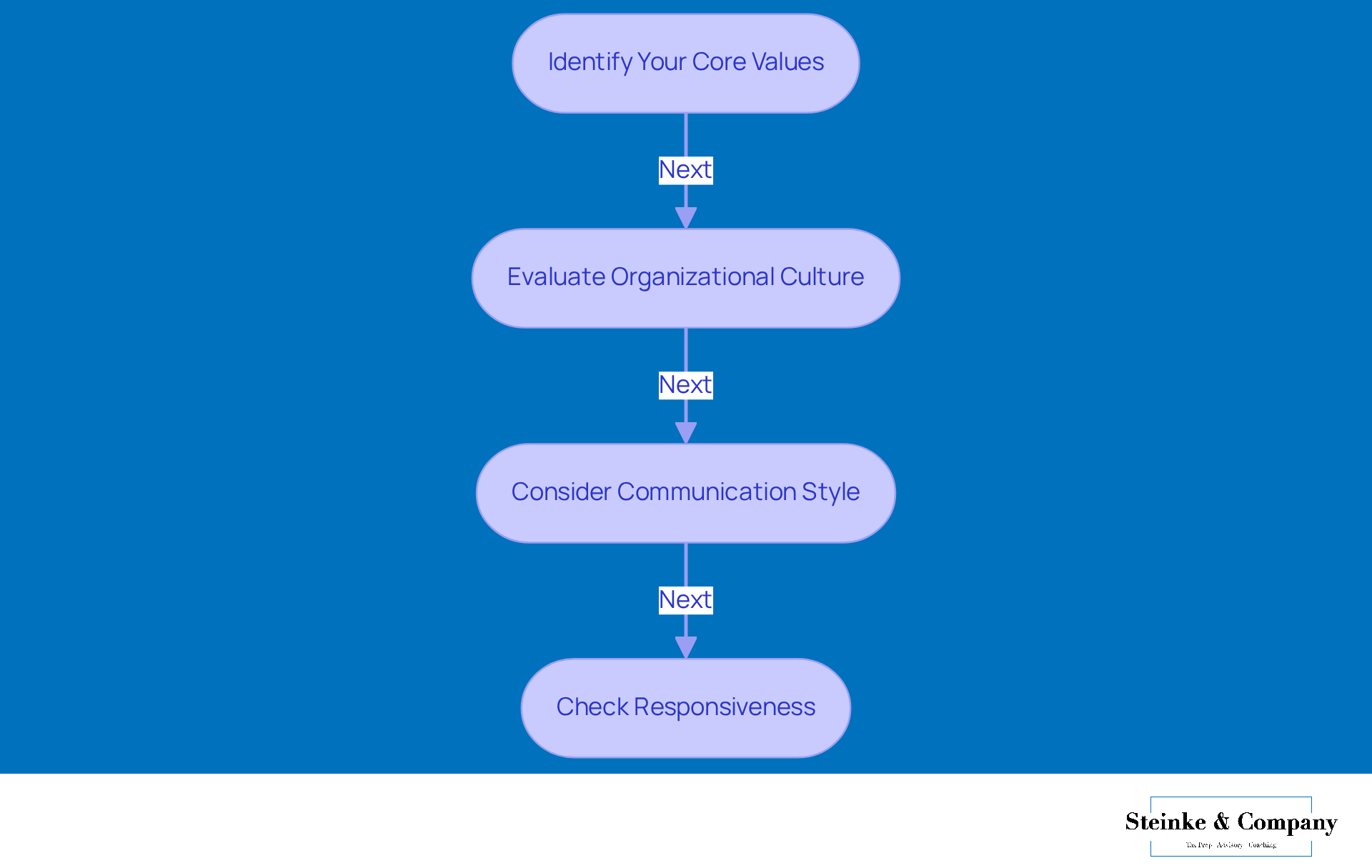

To kick off a successful partnership, it’s super important to see how well a small business CPA firm meshes with your business values.

First up, Identify Your Core Values. Think about what principles steer your business decisions—like integrity, transparency, and innovation. What really matters to you?

Next, let’s Evaluate Organizational Culture. Take a peek at the company’s culture and values through their website, social media, and how they interact with clients. This will help you get a feel for how aligned they are with what you stand for.

Don’t forget to Consider Communication Style. Does their way of communicating jive with your preferences? Whether you like things formal or a bit more laid-back, effective communication is key to building trust, especially for a small business CPA firm.

Also, check out their Responsiveness. How fast and thorough are they when replying to your inquiries? This can really show their commitment to client service. For example, Steinke and Company has gone fully remote, which means they can respond quickly and provide support without the usual office constraints. Their remote team is all about making sure you get the help you need, which really boosts the overall service quality.

By making sure they align with your core values—especially when it comes to accessibility and communication—you can build a collaborative relationship that significantly enhances your organization’s financial well-being.

Engage and Communicate with Potential CPA Firms

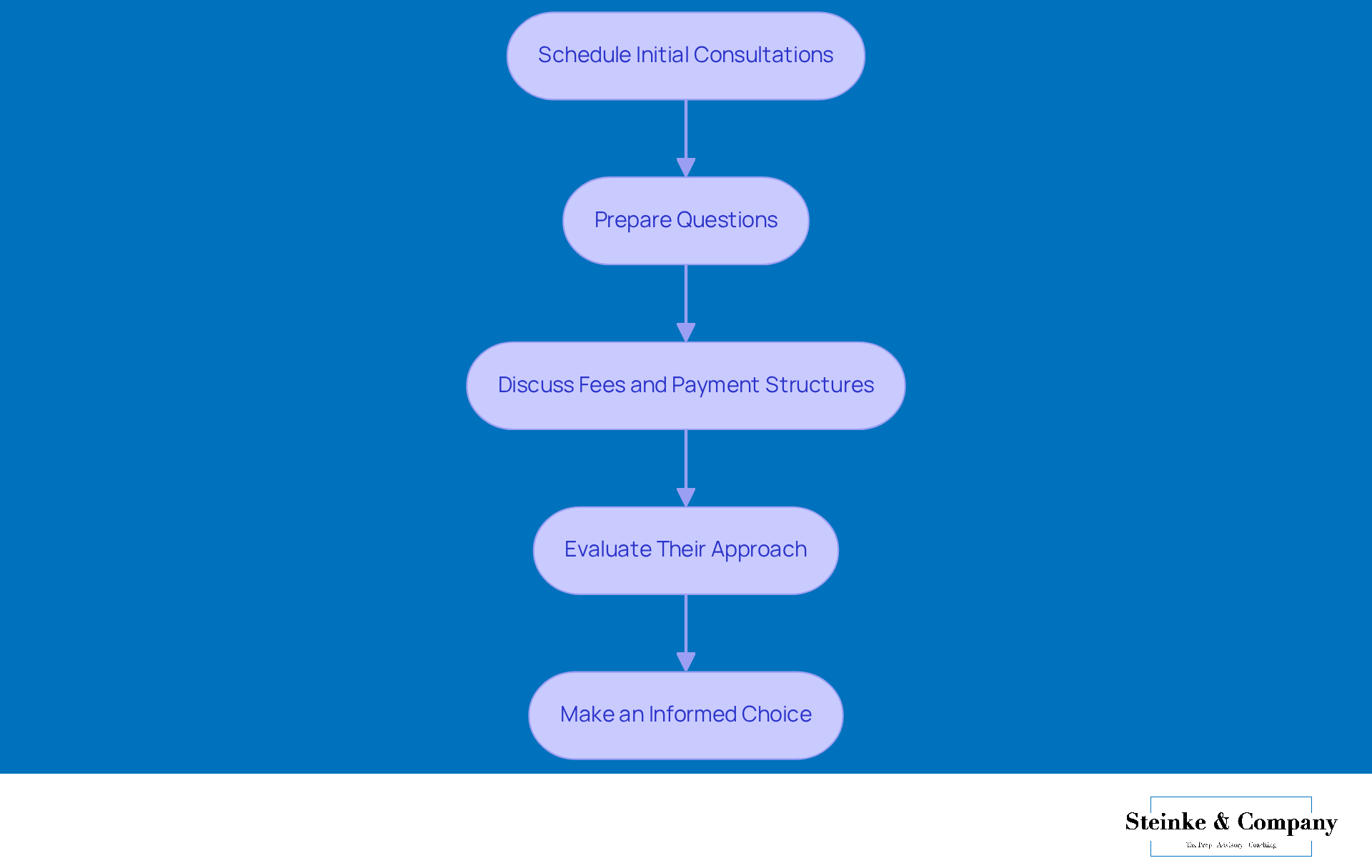

Finding the right small business CPA firm can feel a bit daunting, but it doesn't have to be! Here’s a friendly guide to help you navigate this process:

- Schedule Initial Consultations: Start by setting up meetings with your top CPA choices. This is your chance to chat about what you need and see how well they understand your operations, especially when it comes to tax compliance and avoiding those pesky underpayment penalties.

- Prepare Questions: Make a list of questions to ask during these consultations. Think about their experience with businesses like yours, the services they provide, and how they build relationships with their clients. Don’t forget to ask about their strategies for helping clients dodge costly IRS penalties related to underpayment—like safe harbor payments and the de minimis exception.

- Discuss Fees and Payment Structures: It’s super important to get clear on their fee structures, including any hidden costs. Knowing whether they charge hourly or have flat rates will help you steer clear of any surprise expenses down the line.

- Evaluate Their Approach: Pay attention to how each firm plans to meet your needs. Their responsiveness and willingness to customize their services to fit your expectations are key signs of a good match. A proactive CPA won’t just answer your questions; they’ll also share insights into common industry challenges, like dealing with underpayment penalties and optimizing tax compliance.

Recent studies show that 90% of small firms are turning to technology for a smoother tax season, so selecting a small business CPA firm that is tech-savvy is more important than ever. This conversation will empower you to make an informed choice that aligns with your business goals. Remember, "A great CPA won’t just do your taxes—they’ll help you pay less and navigate the complexities of tax obligations effectively, ultimately saving you from potential financial penalties.

Conclusion

Choosing the right small business CPA firm is a big deal—it can really shape your company’s financial health and strategic direction. By figuring out what your business specifically needs and matching that with the right CPA services, you can build a partnership that not only ticks the compliance boxes but also boosts growth and efficiency.

This article walks you through a solid approach to picking a CPA firm. It starts with a good look at your business’s financial needs and goals. You’ll want to:

- Evaluate the CPA's expertise

- Check out the services they offer

- Make sure their values and communication style vibe with yours

Don’t forget to engage in those initial consultations and ask targeted questions; this empowers you to make informed decisions that fit your unique situation.

In the end, choosing a small business CPA firm should feel like a strategic investment in your business’s future. By taking the time to carefully weigh your options and build a strong working relationship, you can tackle the complexities of financial management with confidence. This proactive approach not only helps you hit your immediate financial targets but also lays the groundwork for long-term success and resilience in today’s ever-changing business landscape.

Frequently Asked Questions

How should I start identifying my business needs and goals?

Begin by assessing your company's current economic situation and future goals. This includes listing your financial needs, defining your objectives, considering industry-specific requirements, and prioritizing those needs.

What types of financial needs should I consider for my business?

Consider specific areas such as tax compliance, bookkeeping, and financial planning. Identifying these needs will help you understand which services are essential for your business.

Why is it important to define both short-term and long-term goals?

Defining clear short-term and long-term objectives is crucial as it provides direction and enhances accountability in your budgeting process. The more specific your goals, the better your chances of achieving them.

How do industry-specific needs affect my business?

Different industries have unique financial requirements. For example, service-oriented businesses may need specialized tax strategies. Understanding these needs can help you improve your financial performance.

How can I prioritize my business needs effectively?

Rank your needs based on urgency and importance. This prioritization will help you focus on the services you require from a CPA firm, ensuring you address what truly matters for your company's growth.

How often does Steinke and Company connect with clients to review strategies?

Steinke and Company connects with clients 1-3 times a year to review their strategies and ensure they’re on track with their goals.

What is the benefit of outlining my needs and objectives?

Clearly outlining your needs and objectives positions you better to find a small business CPA firm that can provide tailored assistance, ultimately enhancing your company’s financial health and strategic direction.