Overview

Let’s dive into Code 12a on the W-2 form! This little code is super important for small business owners because it deals with reporting employee contributions to retirement plans and other benefits. It’s crucial to get this right—not just for compliance with IRS regulations but also to steer clear of any potential audits or penalties. Trust me, nobody wants that! Experts have shared some valuable insights on what can go wrong if this code is misreported, so let’s make sure we’re all on the same page. Remember, understanding this code can save you a lot of headaches down the line!

Introduction

Understanding the ins and outs of the W-2 form is crucial for small business owners who want to tackle the tricky waters of employee compensation and tax compliance. One part of this important document that really stands out is Box 12, especially designation 12a, which deals with retirement contributions and other benefits.

But here’s the catch: accurately interpreting these codes can be a bit of a puzzle, and getting it wrong could lead to audits and penalties from the IRS.

So, what happens if these entries are misreported?

And how can small business owners make sure they’re getting the most out of their tax benefits while staying on the right side of the law?

Let’s dive in together!

Understand the W-2 Form and Box 12 Overview

The W-2 form, or Wage and Tax Statement, is super important. It’s a document that employers need to give to their employees and the IRS, summarizing how much an employee earned over the year and the taxes taken out of their paychecks. Now, 12a on W-2 is particularly noteworthy because it contains various symbols that share extra details about an employee’s pay and benefits. Understanding these regulations is key for accurate tax reporting, especially with the IRS's strict rules around underpayment penalties and audits.

For small businesses, Box 12 is a big deal. About 75% of small businesses provide W-2 forms to their employees, so it’s crucial for owners to know what those designations mean. Tax experts often emphasize that having a solid understanding of 12a on W-2 is essential for staying compliant with tax regulations and avoiding potential penalties. As a tax specialist once said, "Understanding Box 12 labels is not just about compliance; it’s about protecting your business from audits and penalties that can arise from misreporting."

Moreover, companies that don’t accurately report these identifiers might face audits or penalties. This really highlights the need for careful attention to detail in payroll processes. By making it a priority to understand Box 12 and the details of 12a on W-2, small business owners can better navigate the complexities of tax compliance, leading to a smoother operational environment. Plus, with the growing challenges of payroll compliance, getting a handle on Box 12 is a vital part of a broader strategy to manage payroll effectively and reduce the risks associated with underpayment penalties and IRS audits.

Explore Box 12 Codes: Focus on Code 12a

In Box 12 of the W-2 form, one of the lines marked is 12a on w2, along with 12b, 12c, and 12d, each intended for specific identifiers that report different types of compensation or benefits. Code 12a is particularly important as it deals with contributions to retirement plans and other benefits that might not be part of an employee's regular wages. For example, contributions to a 401(k) plan are reported under Code 12a, which can offer some nice tax perks for both employees and employers.

Understanding 12a on w2 is crucial for small business owners because it directly affects the employee's tax situation and the employer's reporting responsibilities. Reporting these contributions accurately can help maximize tax savings and ensure you're playing by IRS rules. In fact, many small businesses report contributions to retirement plans in Box 12, highlighting how significant this classification is in overall compensation strategies.

Tax experts point out that misreporting or misunderstanding Code 12a can lead to some real headaches, including potential audits and penalties. For instance, if an employee aged 50 or older contributes to a retirement plan, they might be eligible for extra deferrals, which should be correctly shown in Box 12. This not only impacts the employee's taxable income but also affects the employer's compliance with tax laws.

So, in a nutshell, small business owners really need to understand the implications of 12a on w2 forms to navigate the complexities of employee compensation effectively. By ensuring accurate reporting and grasping the benefits tied to these contributions, businesses can create a more compliant and financially sound environment. And if you’re feeling a bit overwhelmed, Steinke and Company is here to help with expert tax preparation and planning services to assist small agency owners in managing these intricacies and minimizing surprises during tax season.

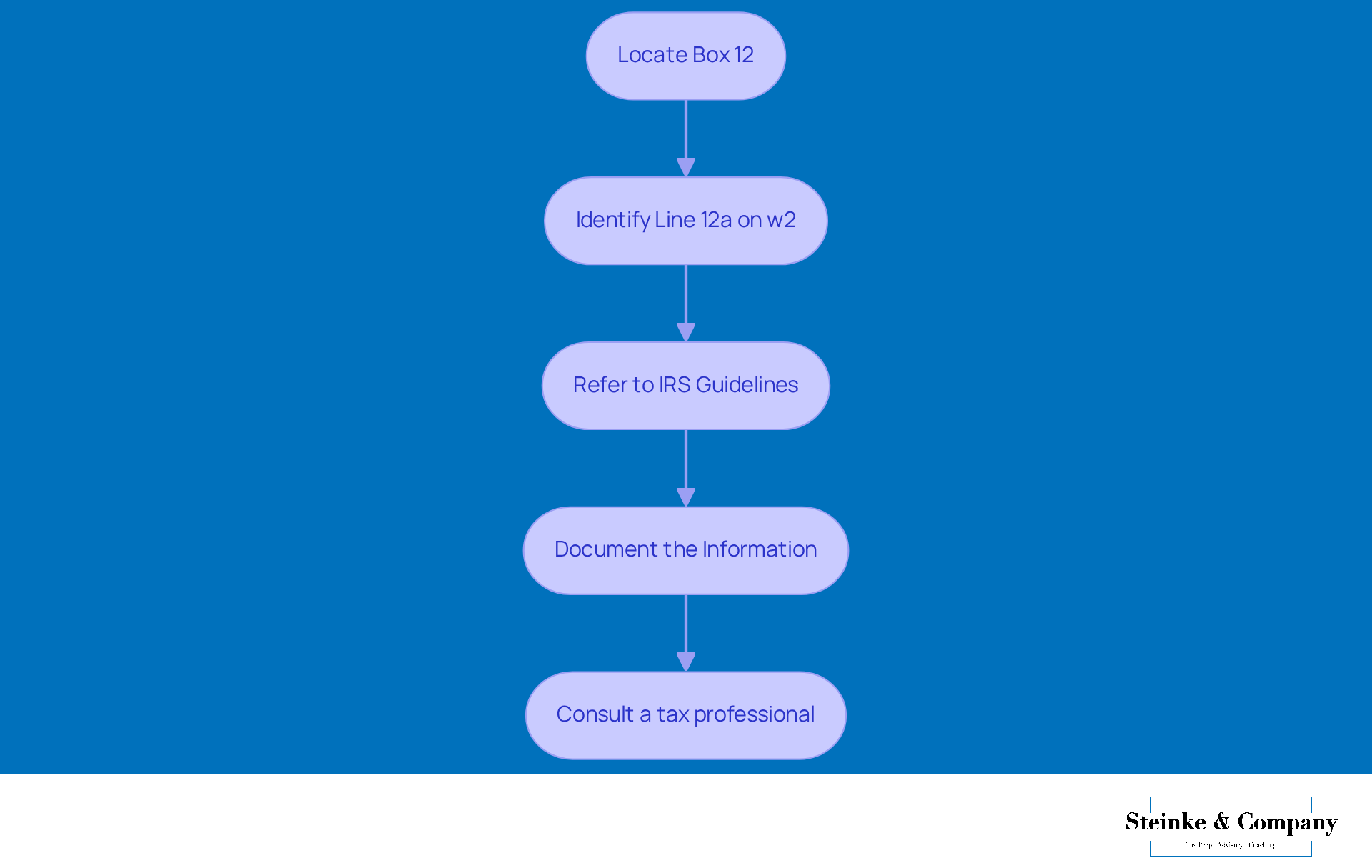

Decode Code 12a: Step-by-Step Instructions

Decoding 12a on w2 of your W-2 form is easier than you might think! Just follow these simple steps:

- Locate Box 12: First things first, find Box 12 on your W-2 form. It’s usually hanging out towards the bottom of the document.

- Identify Line 12a on w2: Now, look for the line labeled '12a'. You’ll see a letter designation followed by a dollar amount—this is what you need to pay attention to.

- Refer to IRS Guidelines: Next, check out the IRS guidelines or a trusted tax resource to get the lowdown on what this code means. For instance, if contributions to a retirement plan are indicated by 12a on w2, it’s important to know how this affects your taxable income.

- Document the Information: Don’t forget to jot down the details from 12a on w2! This info is crucial for making sure your tax return is spot on.

- Consult a tax professional: If you’re scratching your head over the implications of 12a on w2, as it’s a good idea to chat with an expert. With an average of 12 years of experience, these experts can offer personalized insights that help clarify your tax situation and make the most of your deductions.

So, there you have it! Taking these steps can really help you navigate your W-2 form like a pro.

Apply Best Practices for Accurate Interpretation

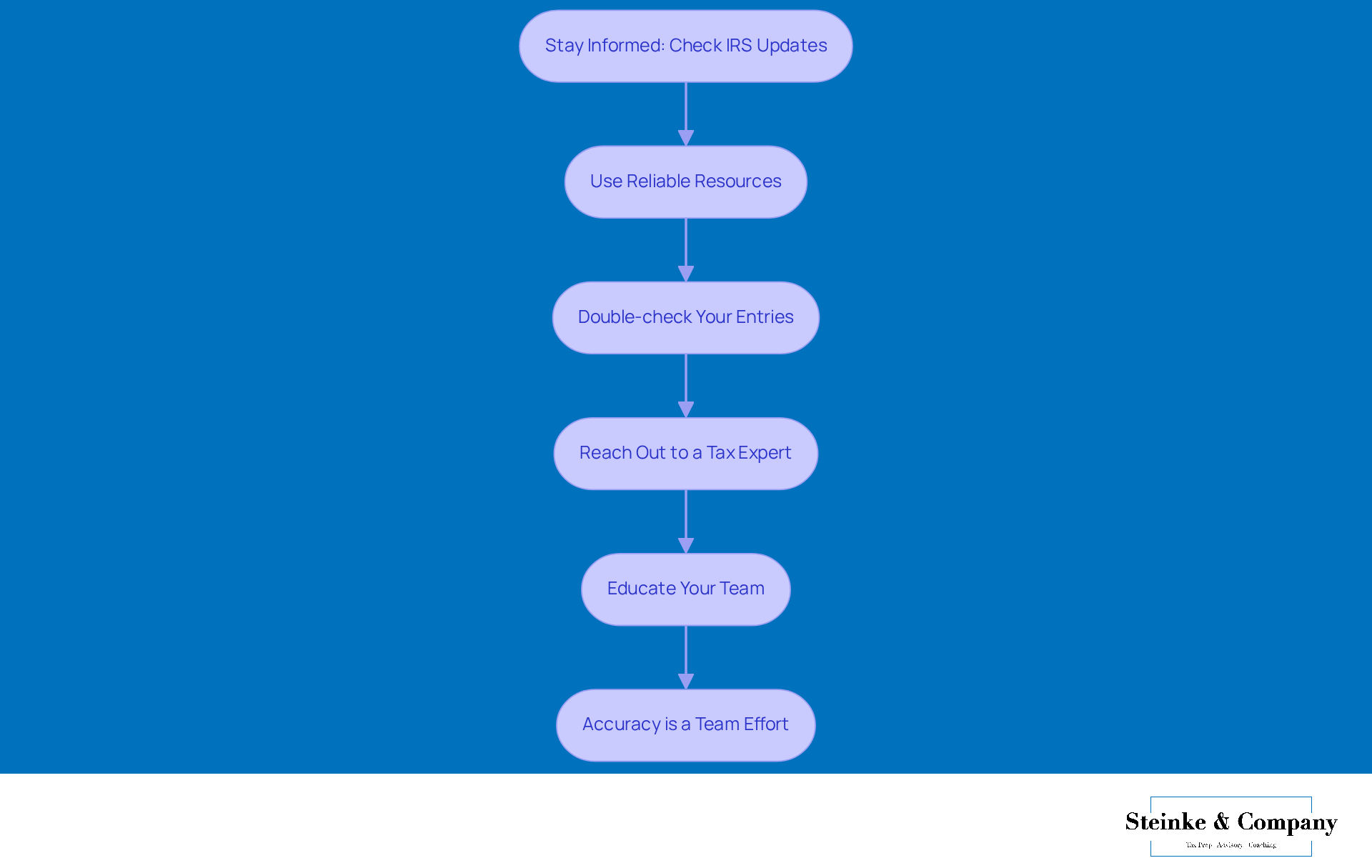

To make sure you interpret Box 12 codes accurately, including Code 12a, here are some friendly best practices to keep in mind:

-

First off, stay in the loop! Regularly check out IRS updates and guidelines about W-2 forms and Box 12 entries, particularly regarding 12a on w2, so you’re always up-to-date with any changes.

-

Next, use reliable resources. Trusted tax materials or software can really help clarify W-2 symbols and what they mean for you.

-

When it’s time to prepare your tax return, double-check those entries! Make sure they match the information on your W-2 form—it's a quick step that can save you a lot of hassle later.

-

And hey, if you stumble upon any unfamiliar terms or have questions about their implications, don’t hesitate to reach out to a tax expert. They’re there to help!

-

Lastly, if you have a team involved in payroll or tax prep, make sure they’re educated about W-2 forms and Box 12 codes. This way, everyone’s on the same page, and accuracy is a team effort across your organization. Remember, staying informed is key!

Conclusion

Understanding the ins and outs of Box 12 on the W-2 form, especially Code 12a, is super important for small business owners trying to navigate the tricky waters of tax compliance. This part of the W-2 not only points out contributions to retirement plans but also plays a key role in making sure everything is reported accurately to the IRS. By taking a moment to decode these codes, business owners can shield themselves from potential audits and penalties, highlighting just how crucial meticulous payroll management really is.

Throughout the article, we shared some key insights, like:

- Why accurately reporting Code 12a matters

- What retirement contributions mean for both employees and employers

- The best practices for interpreting W-2 forms

We laid out steps for decoding Code 12a, stressing the importance of knowing IRS guidelines and the benefits of consulting tax pros when things get a bit murky. These practices are essential for building a compliant and financially sound business environment.

In the end, grasping the significance of W-2 Box 12 codes goes beyond just ticking boxes for compliance; it’s about embracing a proactive approach to tax management that could lead to real savings and lower risks. Small business owners should really make it a priority to understand these codes and seek help whenever they need it. This way, they’re not just protecting their businesses—they’re also setting themselves up for a brighter financial future.

Frequently Asked Questions

What is the W-2 form?

The W-2 form, or Wage and Tax Statement, is a document that employers must provide to their employees and the IRS, summarizing how much an employee earned over the year and the taxes deducted from their paychecks.

What is significant about Box 12 on the W-2 form?

Box 12 on the W-2 form contains various symbols that provide additional details about an employee’s pay and benefits, which are important for accurate tax reporting.

Why is understanding Box 12 important for small businesses?

Understanding Box 12 is crucial for small businesses because about 75% of them provide W-2 forms to their employees. Knowing what the designations mean helps ensure compliance with tax regulations and avoids potential penalties.

What are the consequences of not accurately reporting Box 12 identifiers?

Companies that fail to accurately report Box 12 identifiers may face audits or penalties, highlighting the importance of attention to detail in payroll processes.

How can small business owners benefit from understanding Box 12 and 12a on the W-2?

By prioritizing the understanding of Box 12 and the details of 12a, small business owners can navigate tax compliance complexities more effectively, leading to a smoother operational environment and reduced risks associated with underpayment penalties and IRS audits.