Introduction

Navigating the complexities of tax reporting can feel a bit overwhelming, right? Especially when it comes to figuring out when you need to issue those all-important 1099 forms. These documents are crucial for tracking payments to independent contractors and keeping everything above board with the IRS. But here’s the big question many folks have: when exactly is a 1099 form required?

In this guide, we’re going to break down the ins and outs of 1099 forms. We’ll explore their purpose, the specific situations that call for issuing them, and the steps you need to take to prepare and file them correctly. And hey, staying informed about these requirements can really help you avoid those pesky penalties, don’t you think?

Understand the Purpose of 1099 Forms

When reporting income that doesn’t come from regular jobs, it raises the question of do individuals need to issue 1099s. They help keep track of payments made to independent contractors, freelancers, and other non-employees, making sure everything lines up with IRS rules. To ensure all income is reported and taxed correctly, do individuals need to issue 1099s? Here are the most common types of 1099 forms you might encounter:

- 1099-NEC: This one’s for reporting nonemployee compensation, usually for payments of $600 or more.

- 1099-MISC: This form covers a variety of income, like rents, royalties, and other payments.

You can’t overstate how crucial these documents are; about 70% of small businesses send them out every year. That really shows how vital they are for staying compliant and avoiding penalties. For instance, a small construction company that often hires subcontractors must understand if do individuals need to issue 1099s to report those payments. This way, both the business and the contractors can keep their tax responsibilities in check.

Tax experts emphasize that accurate reporting through these documents is key for compliance, particularly regarding whether do individuals need to issue 1099s. As one expert put it, "The role of tax documents in compliance isn’t just about reporting income; it’s about establishing a clear financial relationship with contractors and making sure everyone meets their tax obligations." By understanding and using these forms correctly, business owners can lower the risks of tax penalties and foster a culture of accountability in their operations.

So, if you’re a business owner, take a moment to reflect: Are you on top of your 1099s? It’s a small step that can make a big difference!

Identify When to Issue a 1099 Form

When you’ve paid an independent contractor or non-employee $600 or more for their services during the tax year, you may wonder do individuals need to issue 1099s for this payment. But that’s not all! You also need to issue a 1099 for:

- Payments for rents, prizes, awards, and other types of income.

- Payments to attorneys, even if they’re incorporated, as long as the amount is $600 or more.

- Transactions that happen in your trade or business, but personal transactions are off the hook.

To keep everything on track, it’s super important to monitor all your transactions throughout the year. This means keeping accurate records and checking out the latest IRS guidelines for any updates on thresholds or requirements. A common pitfall? Forgetting to provide a tax form for qualifying payments or misclassifying contractors, which can lead to penalties. So, by staying organized and informed, you can tackle the ins and outs of tax reporting like a pro!

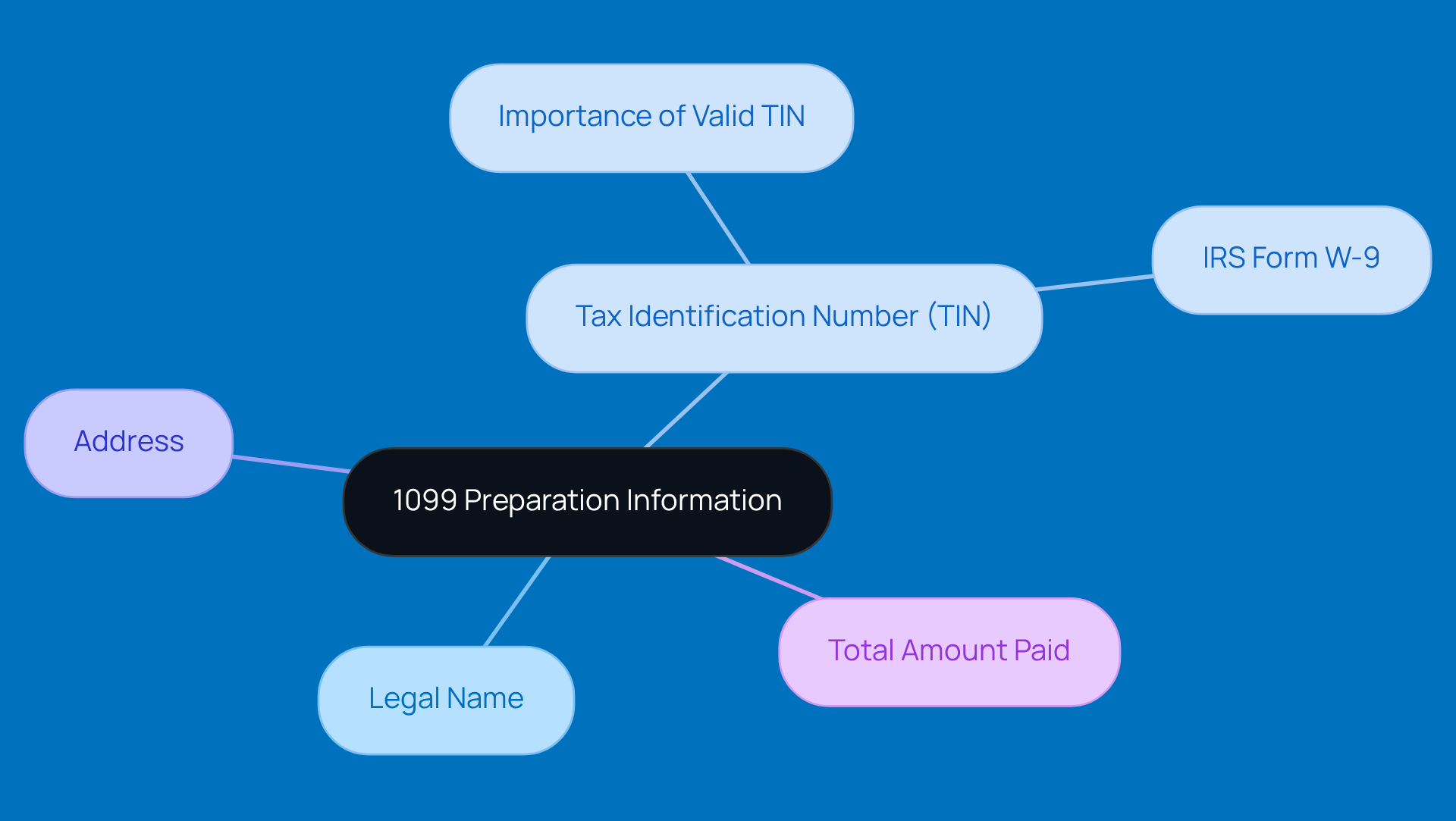

Gather Required Information for 1099 Preparation

To get your 1099 forms ready without a hitch, you’ll want to gather some key info for each recipient:

- Legal Name: Make sure you have the full name of the individual or business.

- Tax Identification Number (TIN): This could be a Social Security Number (SSN) or an Employer Identification Number (EIN). Getting the TIN right is super important - it helps you dodge penalties and stay in line with IRS rules. Tax advisors often stress that it’s a good idea to snag a valid TIN before you e-file to avoid any headaches down the road.

- Address: Don’t forget to collect the current mailing address of the recipient. You want to ensure that the 1099 document lands in the right hands.

- Total Amount Paid: Keep track of the total payments made to the recipient throughout the tax year.

Now, how do you get that TIN? Just ask the recipient to fill out IRS Form W-9. This handy form not only gives you the info you need for tax reporting but is also a go-to for businesses when collecting TINs. In fact, a lot of companies rely on Form W-9 to make sure they have accurate info for tax reporting. By following these steps, you can make your tax prep smoother and stay compliant with tax regulations. So, are you ready to tackle those forms?

File the 1099 Form Correctly and Timely

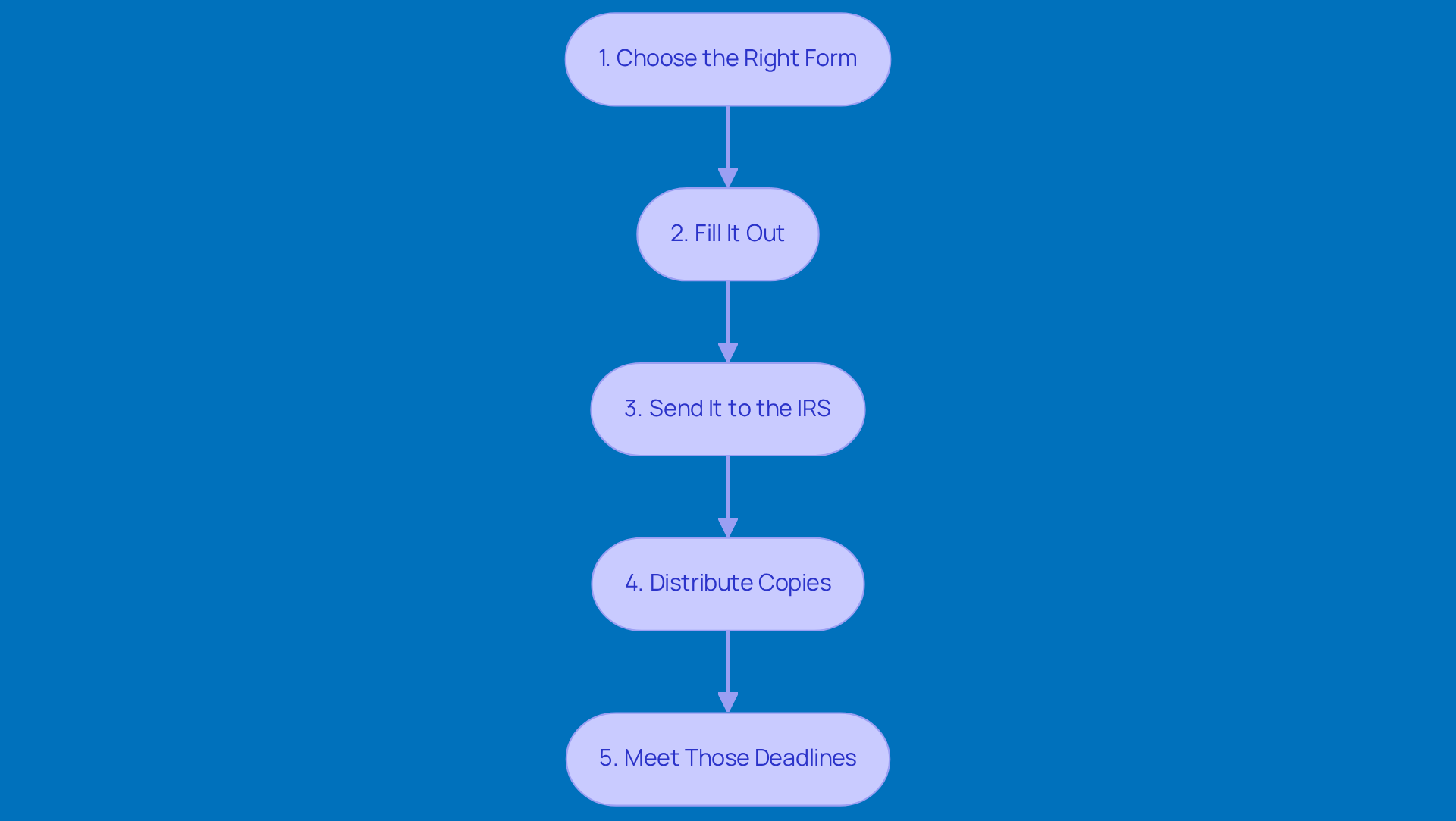

Understanding whether individuals need to issue 1099s can help ensure that filing your 1099 forms correctly and on time doesn’t have to be a headache! Just follow these essential steps:

- Choose the Right Form: Depending on what you’re paying for, you’ll want to use Form 1099-NEC for non-employee compensation or Form 1099-MISC for other reportable payments. It’s all about picking the right tool for the job!

- Fill It Out: Make sure to accurately enter the payer's info, the recipient's details, and the total amount paid. Double-check everything - getting it right helps you avoid any pesky penalties.

- Send It to the IRS: If you’re filing electronically, the IRS FIRE system is your best friend for smooth processing. For paper submissions, just send your documents to the right IRS address.

- Distribute Copies: Don’t forget to give Copy B of the 1099 to the recipient by January 31 of the following year. They’ll need it for their tax filings, so it’s important to keep them in the loop!

- Meet Those Deadlines: Keep an eye on those deadlines: January 31 for 1099-NEC forms and February 28 for 1099-MISC if you’re going the paper route. Missing these can lead to fines of up to $660 for each late submission - yikes!

Did you know that more and more folks are opting for electronic filing? It’s true! It cuts down on errors and late submissions. Businesses that file electronically often find it’s a smoother ride than those sticking with paper forms. By following these steps, do individuals need to issue 1099s to stay compliant and avoid penalties for late or incorrect filings? You’ve got this!

Conclusion

Understanding why 1099 forms are important is key for both individuals and businesses. These forms are essential for reporting payments to independent contractors and other non-employees, helping everyone stay on the right side of IRS regulations. When you get the hang of 1099s, it makes managing your tax responsibilities a lot easier and keeps your financial relationships clear with those you pay.

In this article, we’ve highlighted some important points, like the different types of 1099 forms, when you need to issue them, and the info you need for accurate preparation. We also stressed the importance of filing on time and sticking to IRS guidelines - because let’s face it, nobody wants to deal with penalties! Staying organized and informed about these requirements can really smooth out your tax processes and cut down on mistakes.

So, don’t overlook the responsibility of issuing 1099 forms. By taking some proactive steps to understand and follow the necessary procedures, you can create a culture of accountability and compliance in your financial dealings. Embracing these practices not only helps you out but also supports the integrity of the entire tax system. Ready to tackle those 1099s? You’ve got this!

Frequently Asked Questions

What is the purpose of 1099 forms?

1099 forms are used to report income that doesn’t come from regular jobs, helping to keep track of payments made to independent contractors, freelancers, and other non-employees, ensuring compliance with IRS rules.

What are the most common types of 1099 forms?

The most common types of 1099 forms are 1099-NEC, which is for reporting nonemployee compensation (usually for payments of $600 or more), and 1099-MISC, which covers a variety of income such as rents, royalties, and other payments.

How important are 1099 forms for small businesses?

About 70% of small businesses send out 1099 forms every year, highlighting their importance for staying compliant with tax regulations and avoiding penalties.

Why is accurate reporting through 1099 forms crucial?

Accurate reporting through 1099 forms is key for compliance, as it helps establish a clear financial relationship with contractors and ensures that everyone meets their tax obligations, reducing the risk of tax penalties.

Should business owners be concerned about their 1099 forms?

Yes, business owners should ensure they are on top of their 1099s, as it is a small step that can significantly impact their compliance and financial accountability.