Introduction

Navigating the ins and outs of tax deductions can feel like a maze, right? Especially when it comes to bonus depreciation. This handy tax perk lets businesses write off a big chunk of the cost of qualifying assets - think certain land improvements - right from the get-go. But as tax regulations shift, especially with new rates rolling in 2025, you might be wondering: do land improvements really qualify for these sweet write-offs?

Don’t worry! This article’s got your back with a handy checklist to help you figure out eligibility, maximize those deductions, and stay on the right side of IRS guidelines. Plus, we’ll tackle the ticking clock of changing depreciation rates together!

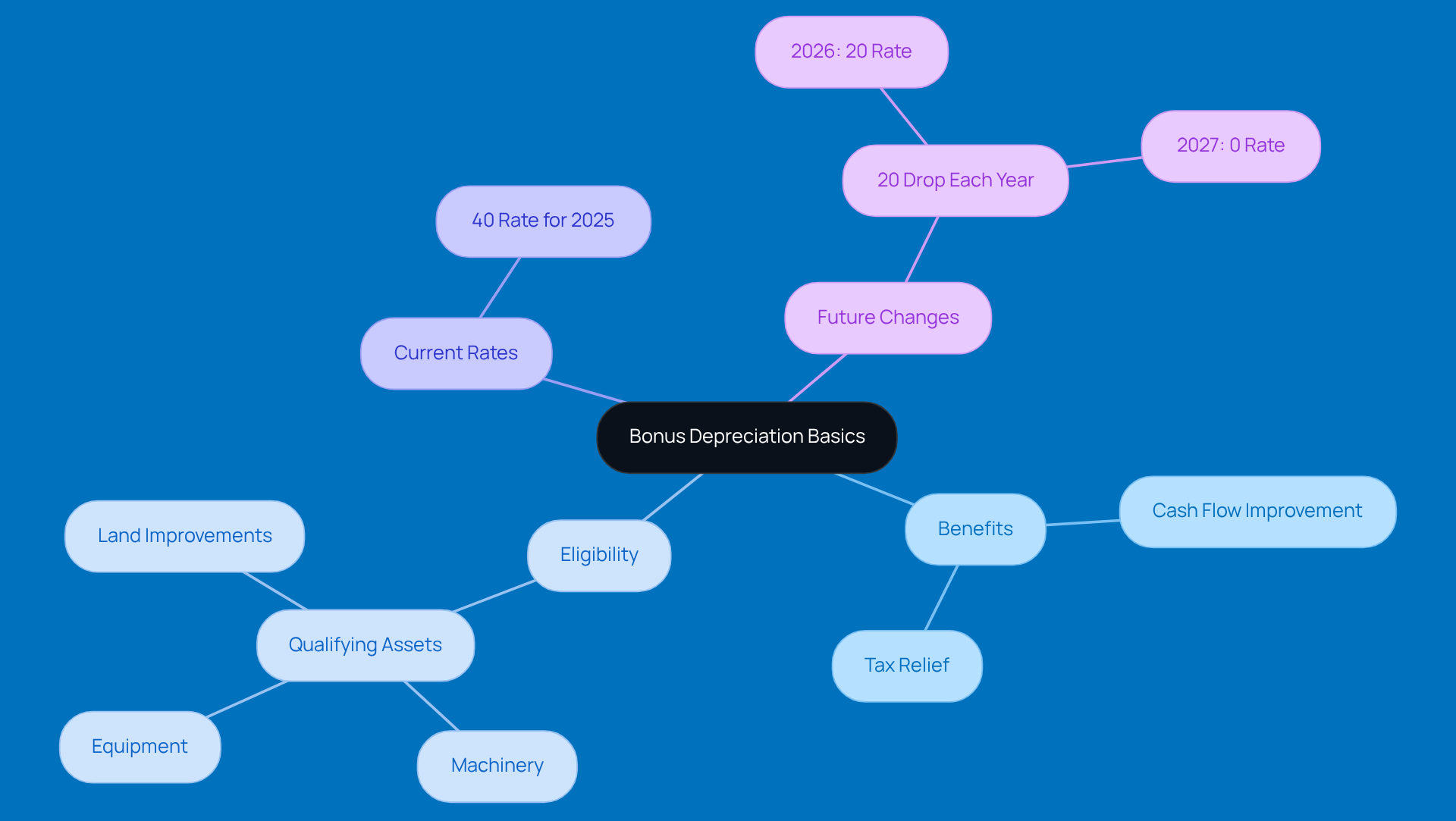

Understand Bonus Depreciation Basics

Hey there! Let’s talk about bonus write-offs. They’re a great way for companies to deduct a big chunk of the cost of qualifying assets right when they start using them. This can really help with cash flow and tax obligations. For the tax year 2025, there’s a new bonus write-off rate set at 40% for eligible assets that are acquired and put to use after January 19, 2025. This is part of the One Big Beautiful Bill (OBBBA), which not only brings back but also boosts these write-off provisions, encouraging businesses to invest in shiny new assets.

So, what qualifies for these additional write-offs? Well, it includes tangible items that have a useful life of 20 years or less, like machinery, equipment, and raises the question of whether land improvements qualify for bonus depreciation. This is all about getting businesses to invest right away, giving them some tax relief that can really help their financial health.

Tax pros are buzzing about how important it is to understand these benefits. Steven A. Barnes put it nicely: "100% additional cost recovery is a recently reinstated provision of the tax code that permits property owners and real estate investors to claim a tax deduction equivalent to 100% of the expense of a qualified business property." This change is a game-changer for businesses looking to optimize their tax strategies. It’s super important for owners to stay in the loop about current rates and eligibility.

And here’s something to keep in mind: those extra write-offs are set to drop by 20% each year from 2023 to 2026, hitting 0% in 2027. So, it’s a good idea to take advantage of these benefits while they last!

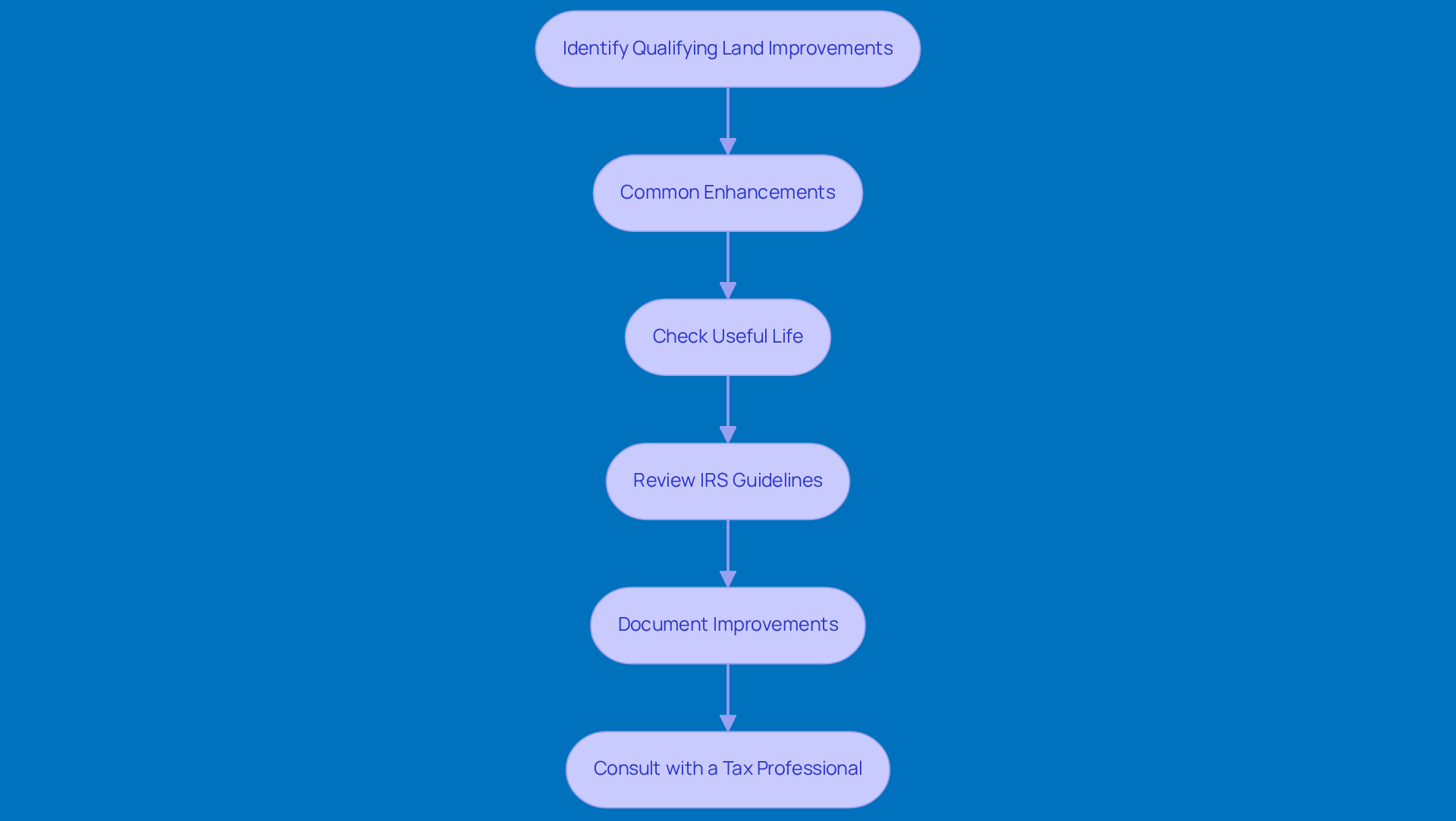

Identify Qualifying Land Improvements

-

Common Enhancements: So, do land improvements qualify for bonus depreciation to snag you some extra deductions? Think parking lots, landscaping, fences, drainage systems, sidewalks, and driveways. These are your go-tos!

-

Check Useful Life: Now, here’s a tip: to find out whether do land improvements qualify for bonus depreciation, make sure your enhancements have a useful life of 15 years or less. That’s straight from the IRS playbook!

-

Review IRS Guidelines: It’s a good idea to get cozy with IRS publications that explain do land improvements qualify for bonus depreciation and which land enhancements are eligible for those sweet write-offs. Staying in the loop with current regulations is key!

-

Document Improvements: Don’t forget to keep a detailed record of all your improvements! Jot down the costs and service dates to back up your claims when tax season rolls around.

-

Consult with a Tax Professional: Lastly, why not chat with a tax advisor? They can help you confirm that your improvements meet the criteria for those additional write-offs, helping you maximize your tax benefits!

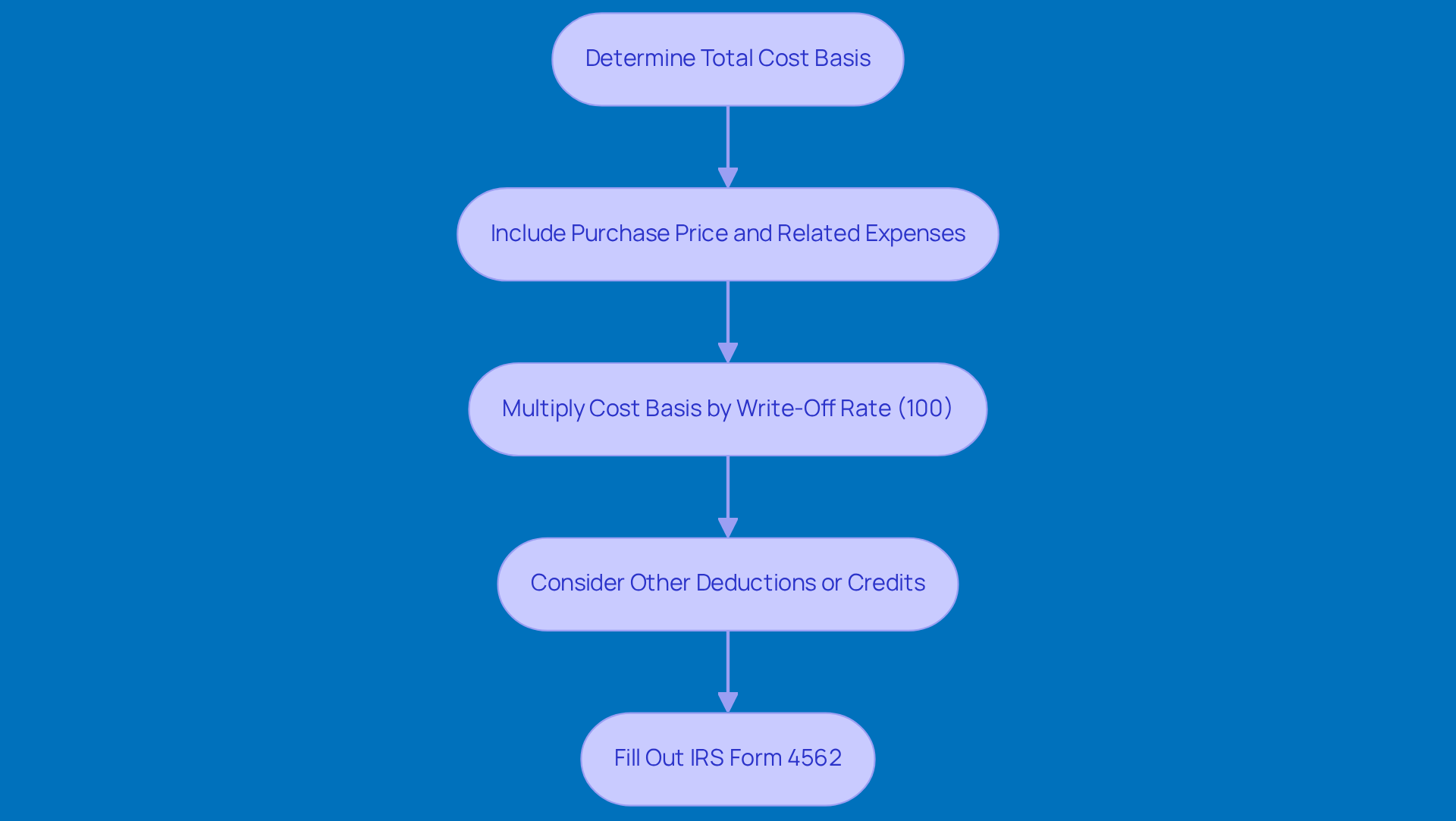

Calculate Your Bonus Depreciation

First things first, let’s figure out the total cost basis of your qualifying asset. This includes the purchase price and any related expenses, like installation. It’s super important to get this right! Understanding your financial documents - think paystubs and tax records - will help you accurately report your income and deductions.

Now, take that cost basis and multiply it by the current additional write-off rate. For qualifying assets put into use after January 19, 2025, that’s a whopping 100%! If you have any other deductions or credits that might affect your overall tax liability, don’t forget to factor those in too.

Filling out IRS Form 4562 is a must to report that additional deduction on your tax return. And hey, double-check all your calculations for accuracy! Make sure you’ve included all qualifying assets. Remember, keeping accurate records not only helps you maximize your tax efficiency but also supports your compliance and financial stability. So, how are you planning to keep track of everything?

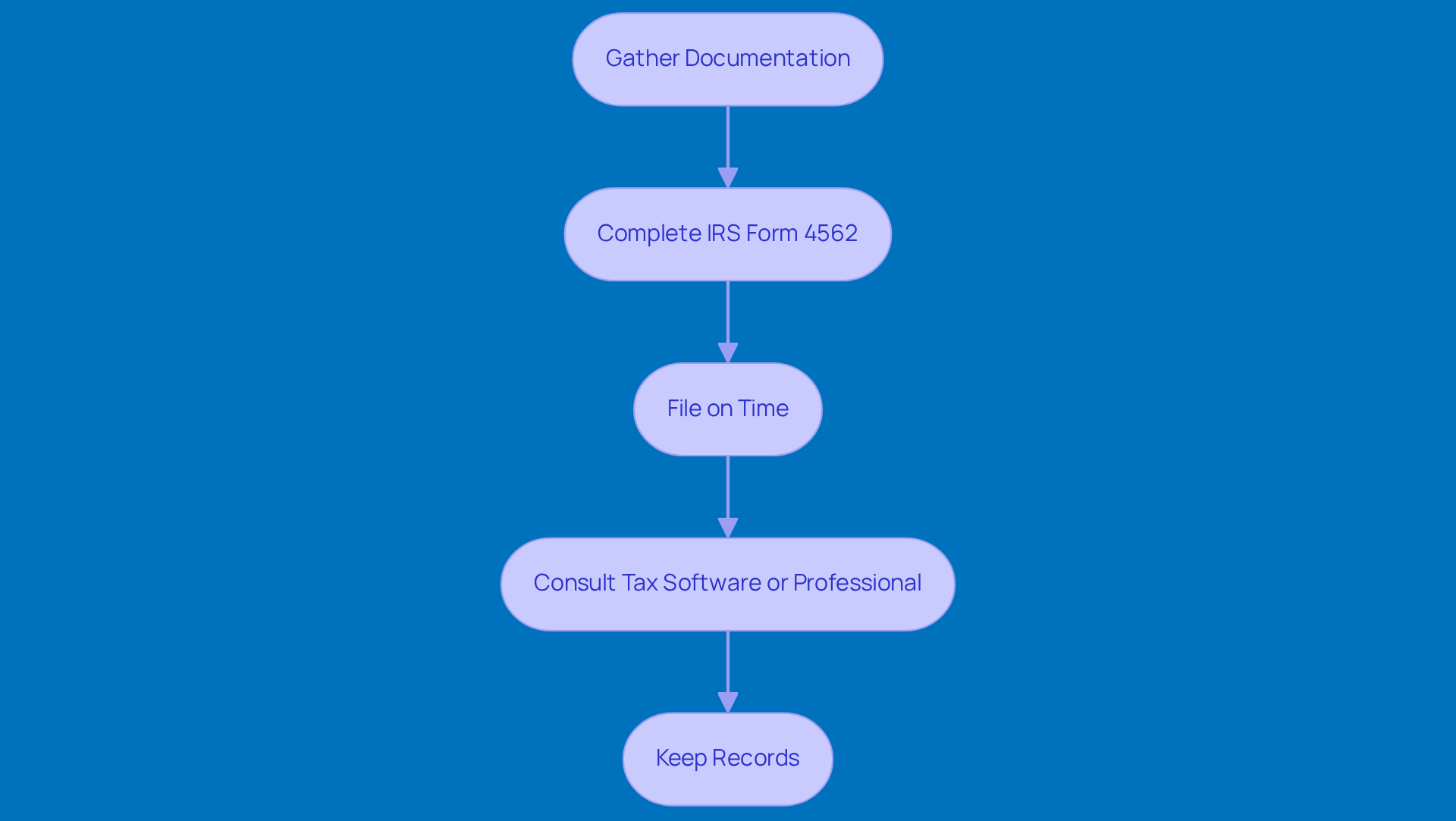

Claim Bonus Depreciation on Your Tax Return

Gather Documentation: First things first, gather all the necessary paperwork-think invoices, receipts, and detailed records of any improvements you’ve made to your property. This stuff will really help back up your claims for those extra write-offs related to whether do land improvements qualify for bonus depreciation!

-

Complete IRS Form 4562: Next up, you’ll want to tackle Form 4562. Make sure you fill it out accurately, reporting all qualifying assets and their corresponding reduction values. Don’t forget to pay special attention to the sections about additional write-offs; it could mean more money in your pocket!

-

File on Time: Now, let’s talk deadlines. Be sure to submit your tax return by the due date, even if you’re filing for an extension. Timely filing is super important if you want to determine if do land improvements qualify for bonus depreciation benefits and avoid any pesky penalties.

-

Consult Tax Software or Professional: If tax forms make your head spin, don’t hesitate to use tax software or consult a tax pro. Their expertise can really help you navigate those tricky tax regulations and make sure you’re claiming all the deductions you’re entitled to.

-

Keep Records: Lastly, keep copies of everything you submit, along with any supporting documents. This is crucial for future reference and in case of audits. Good record-keeping is your best friend when it comes to substantiating your claims and staying compliant!

Conclusion

Understanding bonus depreciation can really help businesses fine-tune their tax strategies, especially when it comes to those valuable land improvements. By tapping into the current bonus depreciation rules, companies can boost their cash flow and lower their tax bills, which is definitely something to think about for financial planning.

This article has laid out a handy checklist for spotting and claiming bonus depreciation on land improvements. Key takeaways include:

- Figuring out which enhancements qualify

- Making sure they have a useful life of 15 years or less

- Keeping detailed records

- Chatting with tax pros to maximize those deductions

Plus, don’t forget how crucial it is to accurately calculate the cost basis and fill out IRS Form 4562 - these steps are key to reaping the rewards of bonus depreciation.

So, businesses, now’s the time to grab the opportunity that the current bonus depreciation rates offer while they’re still around. With rates set to drop in the coming years, being proactive about documenting improvements and understanding eligibility can lead to some serious tax relief. Engaging with tax experts and staying updated on IRS guidelines will help you navigate these regulations smoothly and make the most of your investments.

Frequently Asked Questions

What is bonus depreciation?

Bonus depreciation allows companies to deduct a significant portion of the cost of qualifying assets when they start using them, which can improve cash flow and reduce tax obligations.

What is the bonus depreciation rate for the tax year 2025?

For the tax year 2025, the bonus write-off rate is set at 40% for eligible assets that are acquired and put to use after January 19, 2025.

What types of assets qualify for bonus depreciation?

Qualifying assets include tangible items with a useful life of 20 years or less, such as machinery and equipment. There is also consideration for whether land improvements qualify.

Why is understanding bonus depreciation important for businesses?

Understanding bonus depreciation is crucial for businesses as it provides tax relief and encourages investment in new assets, which can significantly impact their financial health.

How does the bonus depreciation rate change over the years?

The bonus depreciation rate is set to decrease by 20% each year from 2023 to 2026, ultimately reaching 0% in 2027.

Who highlighted the importance of bonus depreciation for tax strategies?

Tax professional Steven A. Barnes emphasized the significance of bonus depreciation, stating that it allows property owners and real estate investors to claim a tax deduction equivalent to 100% of the expense of qualified business property.