Overview

Hey there! If you’re a sole proprietor, you might be wondering about Beneficial Ownership Information (BOI) reports. Good news: you generally don’t need to file these unless you decide to change your business structure—like if you incorporate or form a partnership.

It’s super important to stay in the loop with any regulatory updates from FinCEN. Why? Because these changes can affect your filing obligations and help you stay compliant with the law. Nobody wants to deal with penalties, right? So, keep an eye out for those updates!

Introduction

Navigating the complexities of business ownership can feel pretty overwhelming, right? Especially for sole proprietors who often find themselves juggling a ton of responsibilities. As regulations change, it’s super important to get a handle on the specific filing requirements for Beneficial Ownership Information (BOI). This isn’t just about compliance; it’s about keeping your financial health in check too.

In this article, we’ll break down the essential steps you need to take as a sole proprietor to figure out your BOI obligations. We’ll help you gather the necessary information and steer clear of the pitfalls that come with non-compliance. So, what happens if you miss these reporting requirements? And how can you stay in the loop with all these changing regulations? Let’s dive in!

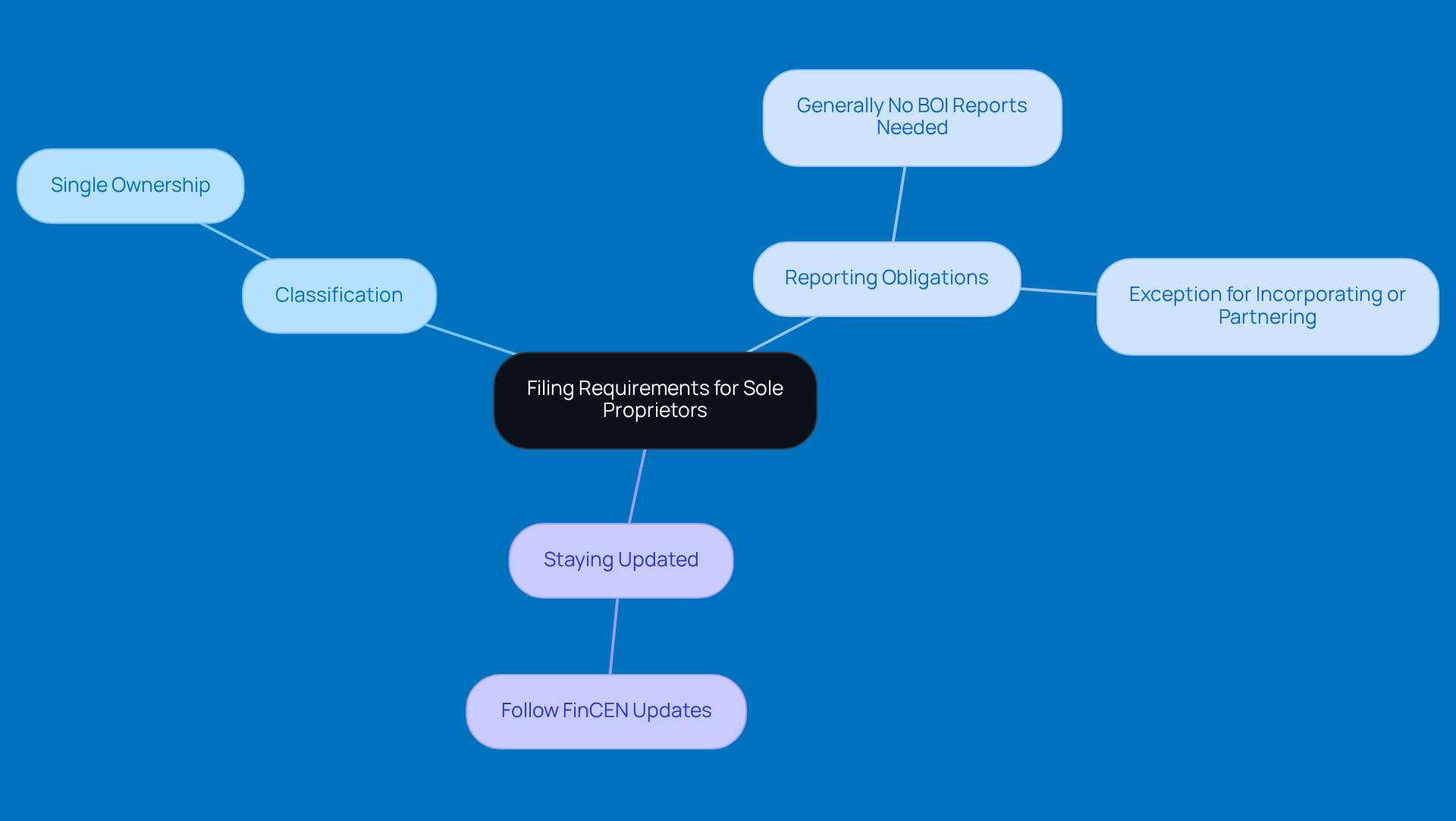

Determine Filing Requirements for Sole Proprietors

Hey there! First things first, let’s make sure you’ve got your enterprise classified correctly as a sole proprietorship. This is usually the case for businesses owned and run by just one person, where there’s no legal separation between you and your business.

Now, if your company was registered to operate in the U.S. on or after March 26, 2025, you might have some specific reporting obligations to keep in mind. But don’t worry too much—when considering whether do sole proprietors need to file BOI reports, the answer is generally no, unless you decide to change things up, like incorporating or teaming up with a partner.

It’s a good idea to stay in the loop with the latest updates from FinCEN about beneficial ownership reporting requirements. Regulations can change, and you want to be sure you’re on top of your obligations. So, keep an eye out and stay informed!

Gather Necessary Information for BOI Reporting

If you're a small agency owner, it's crucial to know if sole proprietors need to file BOI reporting requirements. Here’s a friendly guide to help you gather the necessary info:

-

First off, make sure to compile personal identification details, like Social Security Numbers. Just a heads up—handle this sensitive data with care, following the Gramm-Leach-Bliley Act (GLBA) Safeguards Rule. This regulation is all about keeping customer information safe, which is key to building trust and avoiding any financial hiccups.

-

Next, jot down any registration details related to your enterprises. This info can be super relevant for understanding whether sole proprietors need to file BOI to meet both BOI and GLBA requirements.

-

Don’t forget to keep track of any changes in your organizational structure. These shifts can impact your filing responsibilities under the GLBA, so it’s good to stay informed.

-

Lastly, maintain a record of all owners and their ownership shares. This info is important for future reporting and compliance. Remember, protecting customer data isn’t just about dodging penalties; it’s about fostering trust that keeps your customers coming back for more.

By following these steps, you’ll be well on your way to ensuring your business stays in good standing while considering whether sole proprietors need to file BOI regulations. So, what do you think? Ready to tackle this together?

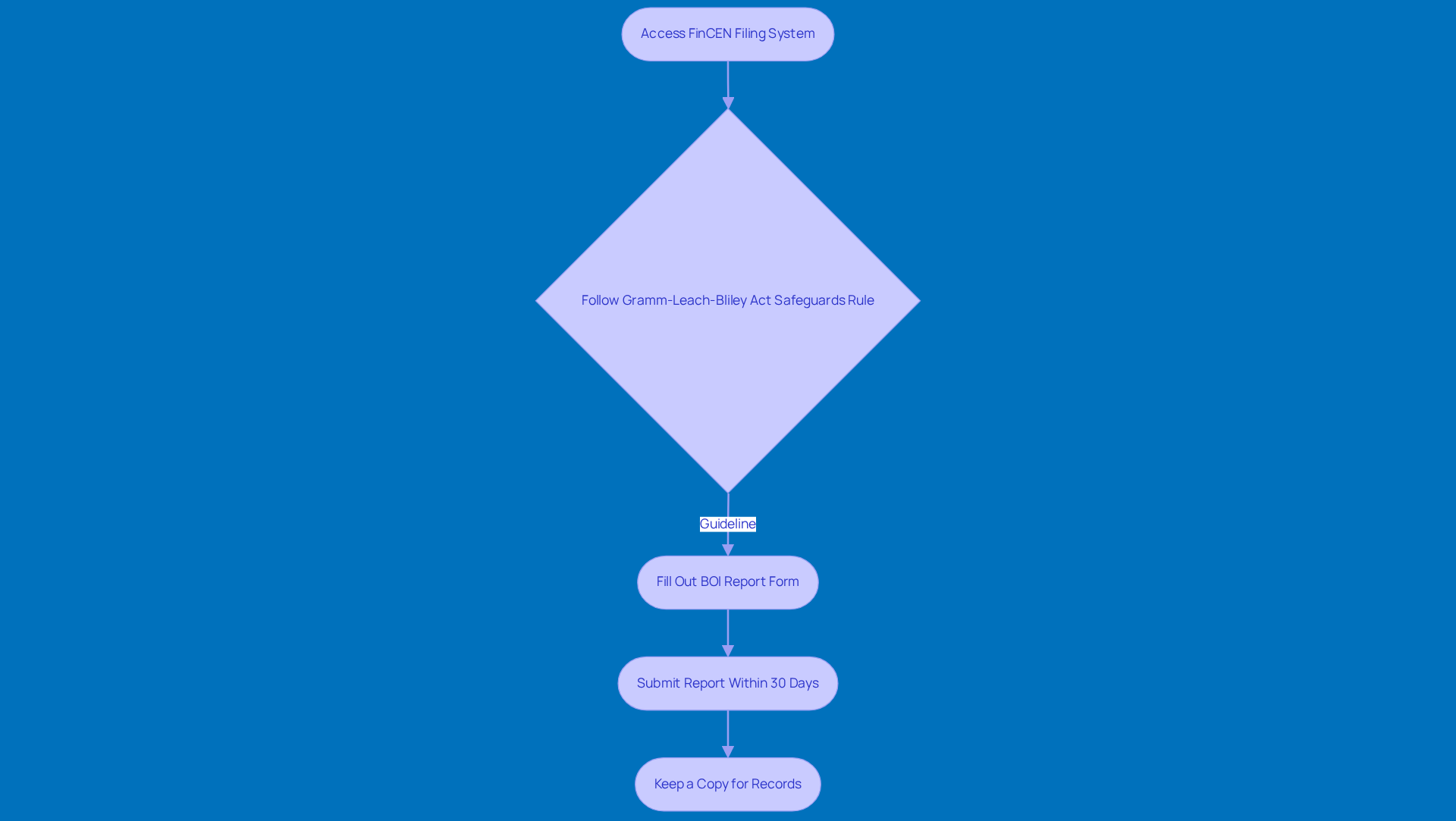

Follow the Filing Process for BOI Reports

If you need to file, hop onto the FinCEN online filing system. Just remember to stick to the Gramm-Leach-Bliley Act Safeguards Rule, which is all about keeping your customers' sensitive info safe with the right security measures. When you fill out the BOI report form, make sure you provide accurate details and follow best practices for data security. This helps build trust with your customers, which is super important.

Don’t forget to submit your report within the required timeframe—30 days for new registrations—to steer clear of any penalties. And hey, keep a copy of that submitted report for your records! It’s essential to have documentation on hand to show you’re responsible and compliant.

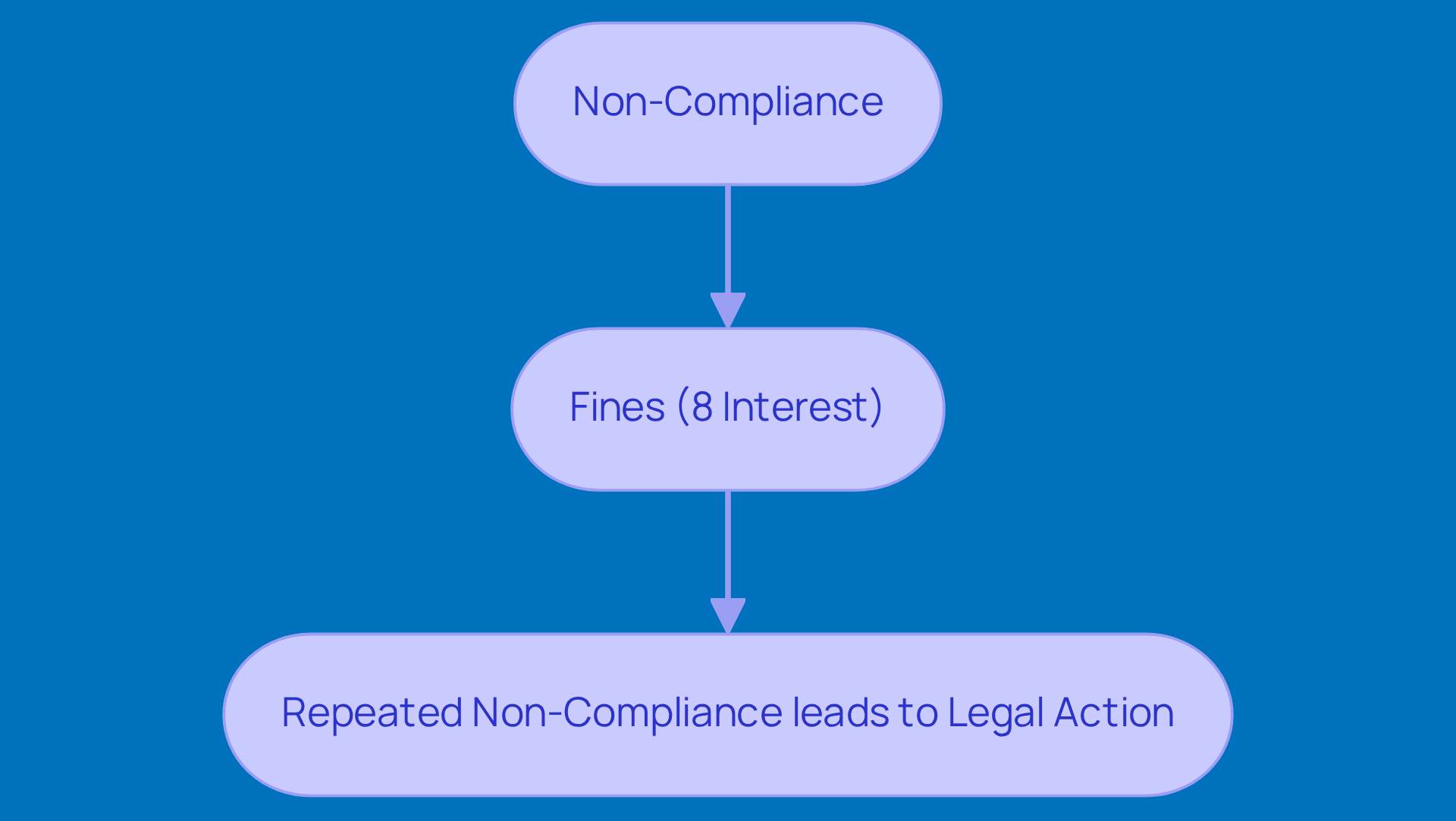

Understand Consequences of Non-Compliance

Hey there! Let’s talk about the potential penalties for not filing a BOI report. You might be surprised to learn that these can include fines similar to the underpayment penalties the IRS dishes out for insufficient tax payments, which currently sit at an interest rate of 8% per year. Yikes, right? Staying on top of timely and accurate reporting can really help you dodge that financial stress.

Now, if you keep missing the mark, things could get a bit more serious. Repeated non-compliance might lead to some hefty consequences, including legal action tied to those pesky underpayment penalties. So, it’s super important to stay informed about any changes in regulations that could affect your filing obligations down the line. After all, these changes can have a big impact on your overall tax adherence and financial health.

So, what do you think? Are you keeping an eye on those updates? It’s always a good idea to stay in the loop!

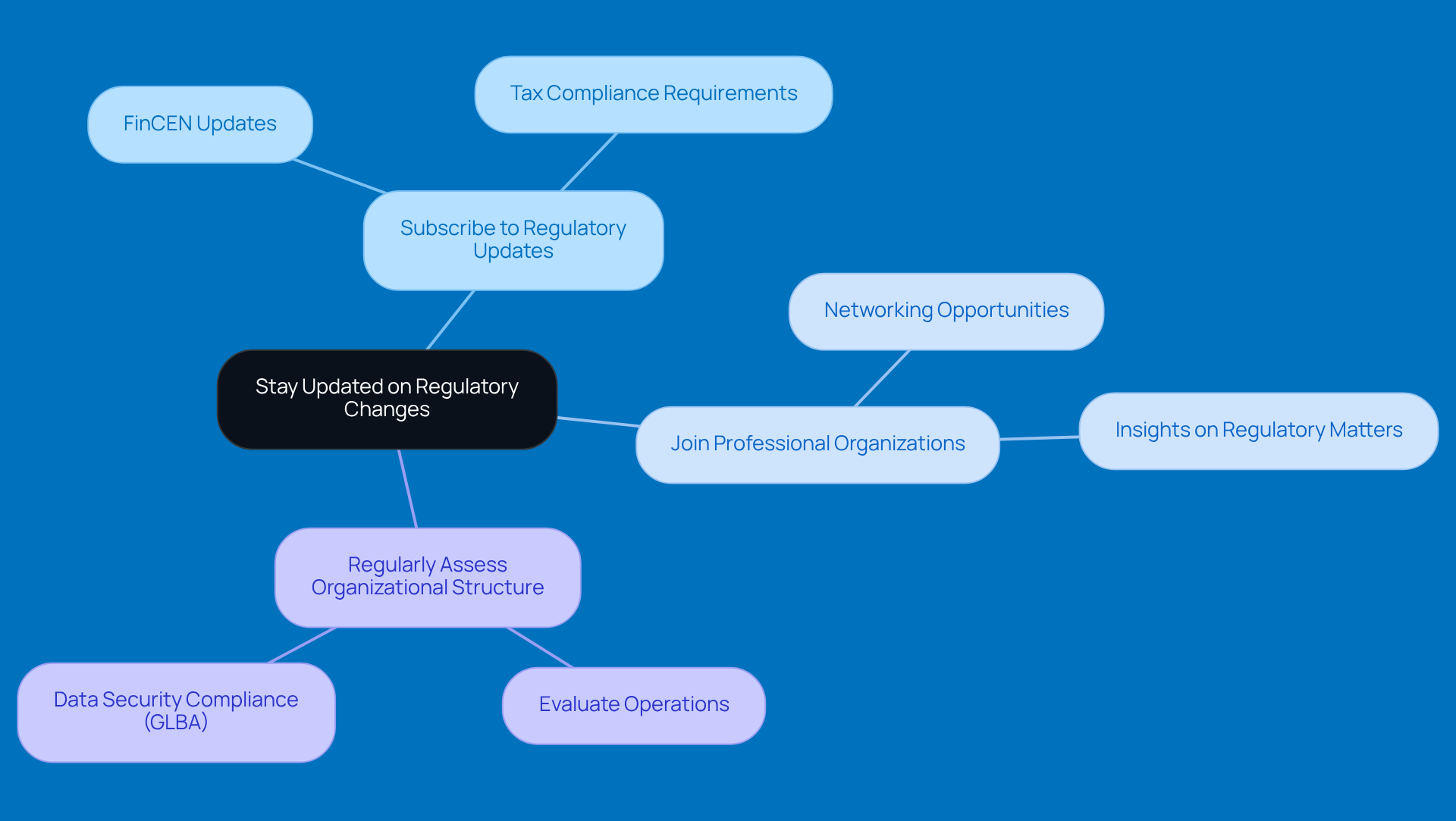

Stay Updated on Regulatory Changes

To keep your business compliant and protected, here are some friendly tips to consider:

-

First off, why not subscribe to updates from FinCEN and other regulatory bodies? Staying in the loop about changes in beneficial ownership information (BOI) reporting and tax compliance requirements can really help you out.

-

Also, think about joining professional organizations or networks. They often share valuable insights on regulatory matters, including tax planning strategies that can lighten your tax load and boost your growth.

-

Lastly, make it a habit to regularly assess your organizational structure and operations. This way, you can ensure you’re keeping up with any new regulations, especially those related to data security under the GLBA. Protecting customer information is key to avoiding potential breaches and ensuring your business thrives in the long run.

Conclusion

Understanding the filing requirements for beneficial ownership information (BOI) is super important for sole proprietors. Sure, many of you might think you don’t need to file these reports unless you change your business structure, but staying in the loop about potential obligations is key for compliance. The regulatory landscape can shift unexpectedly, and being proactive helps keep your business in good standing.

So, what are the key steps?

- Figure out if your business qualifies as a sole proprietorship.

- Gather the necessary info for any potential BOI reporting.

- If you find you do need to file, follow the process carefully.

- Understand the consequences of non-compliance!

Each of these elements is crucial for ensuring your business adheres to regulations and protects sensitive customer information, which in turn fosters trust and financial stability.

Let’s not underestimate the importance of staying updated on regulatory changes. By subscribing to updates from regulatory bodies, engaging with professional networks, and regularly reviewing your business practices, you can confidently navigate the complexities of BOI compliance. Taking these proactive measures not only shields your business from potential penalties but also sets you up for long-term success in an ever-evolving regulatory environment.

So, what are you waiting for? Stay informed, stay compliant, and keep your business thriving!

Frequently Asked Questions

What is a sole proprietorship?

A sole proprietorship is a business owned and run by one person, with no legal separation between the owner and the business.

Do sole proprietors need to file BOI reports?

Generally, sole proprietors do not need to file BOI reports unless they change their business structure, such as incorporating or partnering with someone.

What should sole proprietors do to stay informed about reporting obligations?

Sole proprietors should keep up with updates from FinCEN regarding beneficial ownership reporting requirements, as regulations can change.

What personal information is necessary for BOI reporting?

Sole proprietors should compile personal identification details, such as Social Security Numbers, while handling this sensitive data carefully according to the Gramm-Leach-Bliley Act (GLBA) Safeguards Rule.

What registration details should sole proprietors keep track of?

Sole proprietors should note any registration details related to their enterprises, as this information is relevant for understanding BOI filing requirements.

Why is it important to track changes in organizational structure?

Changes in organizational structure can impact filing responsibilities under the GLBA, so staying informed about these changes is crucial.

What ownership information should be maintained by sole proprietors?

Sole proprietors should keep a record of all owners and their ownership shares, which is important for future reporting and compliance.