Introduction

Navigating the complexities of the Employee Retention Credit (ERC) can feel a bit overwhelming, right? Especially after everything we've faced during the COVID-19 pandemic. This important tax credit not only provides some much-needed financial relief but also comes with its own set of rules about eligibility and compliance. So, how can businesses make the most of it? One big question that pops up is whether they need to amend their income tax returns to properly claim the ERC.

In this article, we’re going to break it down for you. We’ll provide a handy checklist that clarifies the amendment process, highlight the key eligibility criteria, and stress the importance of chatting with tax professionals. After all, getting this right can really help optimize your financial outcomes!

Understand the Employee Retention Credit (ERC)

The Employee Retention Credit (ERC) was designed to help companies keep their employees during the tough times brought on by the COVID-19 pandemic. This refundable tax credit lets eligible employers claim a credit against payroll taxes for wages paid to employees during certain challenging periods.

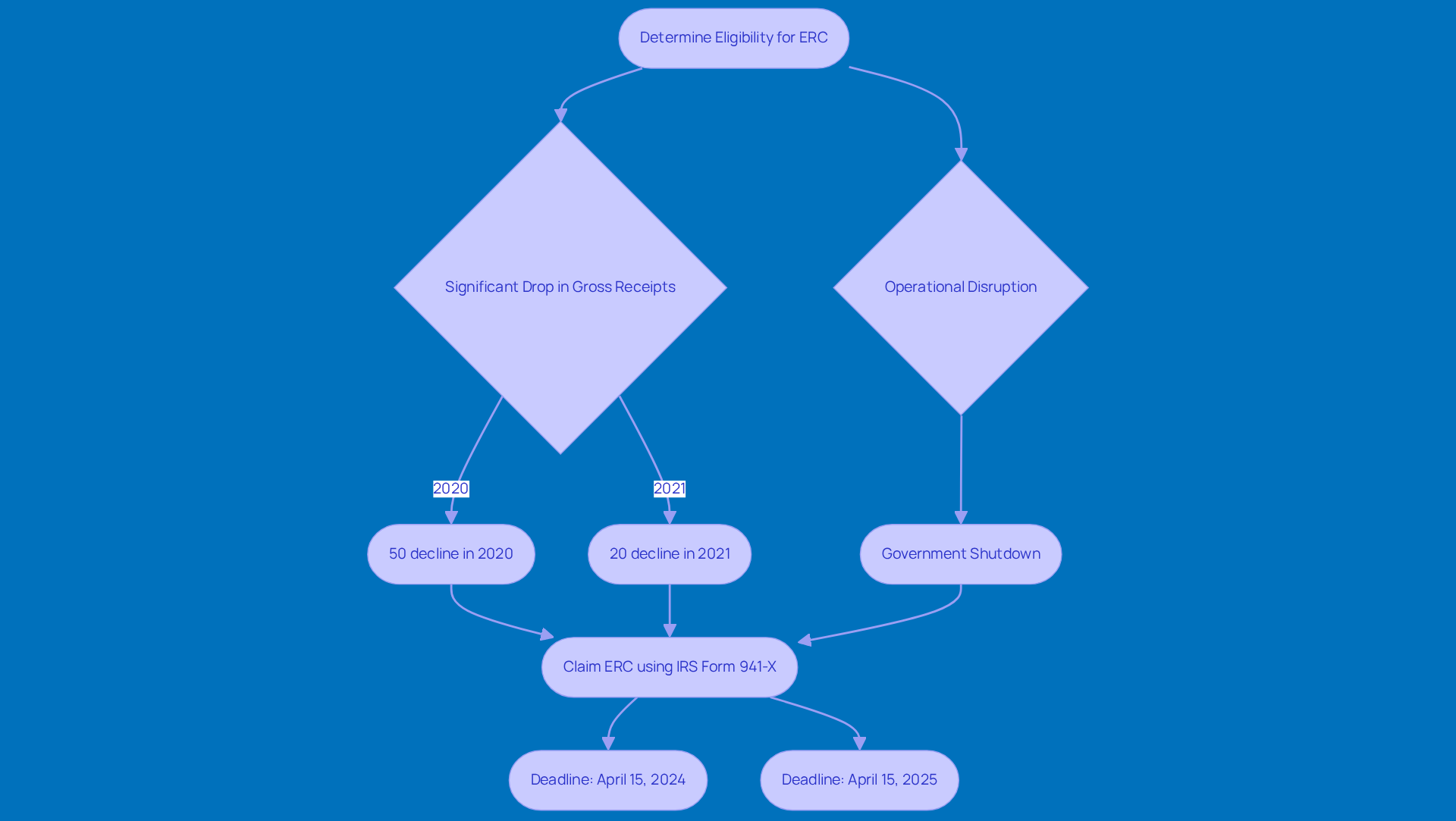

So, how do you qualify for the ERC? Well, businesses need to meet a few criteria. They must show a significant drop in gross receipts - specifically, a 50% decline in 2020 compared to the same quarter in 2019, or a 20% decline in 2021 compared to the same quarter in 2019. Plus, if a company was fully or partially shut down due to government orders during the pandemic, they can also qualify. For 2025, the focus remains on these significant revenue drops and operational disruptions.

You can claim the ERC for wages paid from March 13, 2020, to December 31, 2021. When claiming the credit, do you have to amend income tax returns for ERC by using IRS Form 941-X? Just keep in mind the deadlines:

- For 2020 submissions, it’s April 15, 2024.

- For 2021, it’s April 15, 2025.

Now, understanding how the ERC interacts with other tax credits and deductions is super important for maximizing your financial benefits. For example, while you can claim both the ERC and a Paycheck Protection Program (PPP) loan, you can’t use the same wages for both claims. This distinction is key to staying compliant and optimizing your tax strategies.

Real-world examples really highlight the ERC's impact: many small businesses have successfully claimed substantial credits, with qualifying employers potentially receiving up to $26,000 per worker for the 2020/21 period. This financial support has been a game-changer for companies trying to navigate the pandemic's challenges, showing just how vital the ERC is as a lifeline for small businesses.

Evaluate Eligibility Criteria for Amending Returns

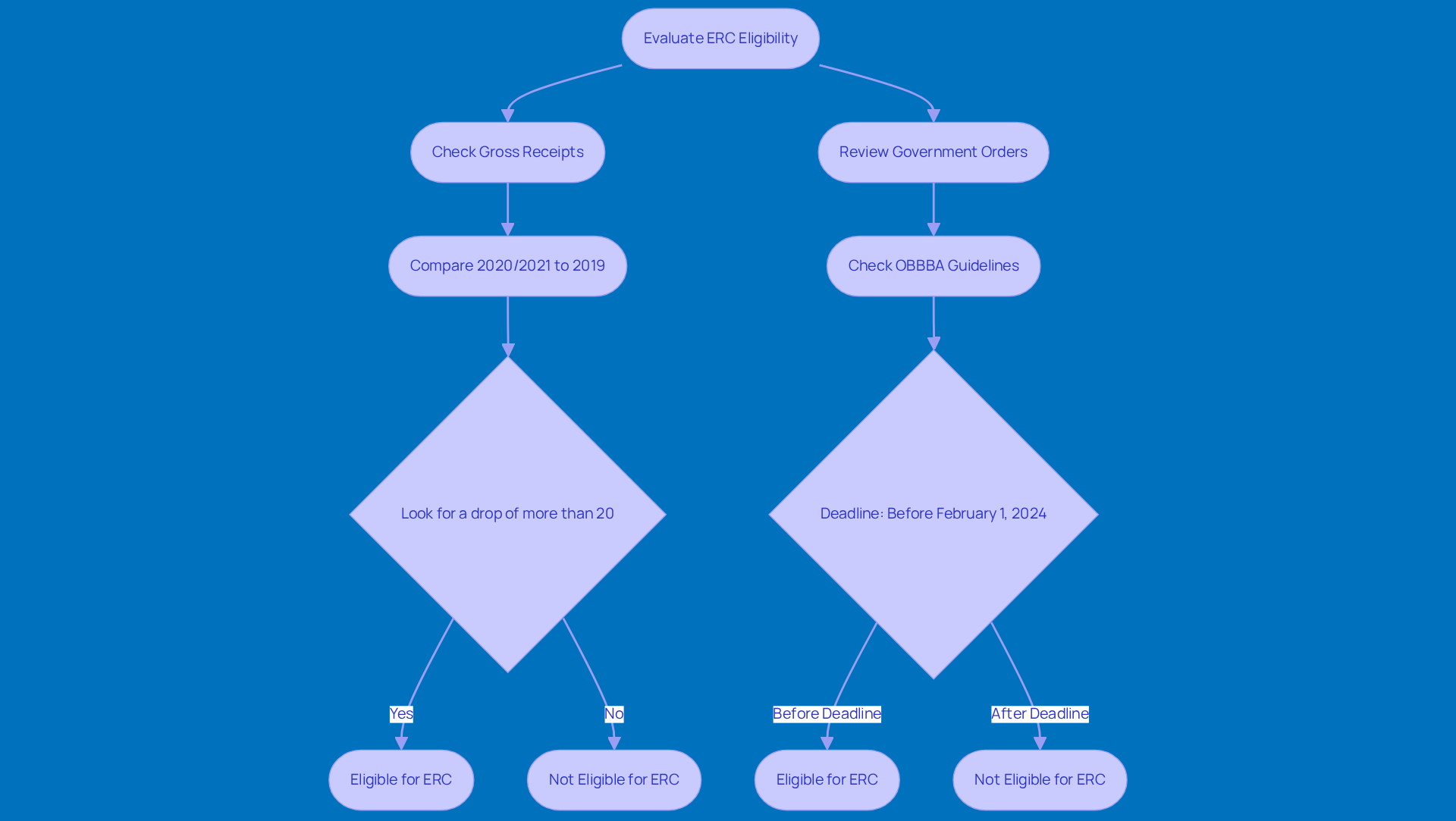

Let's take a closer look at the IRS guidelines for ERC eligibility. To qualify, organizations need to show a significant decline in gross receipts or be under a government order. So, how do you figure out if your business meets that decline? Simply compare your gross receipts from 2020 and 2021 to those from 2019. If you see a drop of more than 20% in any quarter, congratulations - you qualify for the ERC!

Now, it’s important to keep in mind the One Big Beautiful Bill Act (OBBBA). This act has tightened the eligibility criteria and limited new applications to those submitted before February 1, 2024. So, if you’re thinking about applying, make sure you’re on top of those deadlines!

Also, double-check that the wages you’re claiming for the ERC relate to whether you do you have to amend income tax returns for ERC that weren’t already deducted on your tax return. Doing so could lead to some complications and potential penalties down the line, raising the question: do you have to amend income tax returns for ERC? And don’t forget to assess whether the ERC was claimed on the right tax forms, like Form 941-X for payroll taxes. This can help you avoid any issues with the IRS.

Statistics show that by 2025, many companies have struggled to prove their eligibility due to increased scrutiny from the IRS, with numerous claims flagged for review. This is especially true for businesses in the hospitality and retail sectors, which faced significant downturns due to pandemic-related restrictions.

Understanding these criteria is key to ensuring compliance and maximizing your potential benefits from the ERC. And hey, if you’re a small business owner, it’s crucial to know your rights during an IRS audit. If you get a notice of an audit, remember that the IRS will reach out via U.S. mail. You have the right to be represented by a professional, like a CPA or attorney. Keeping your records organized and being honest during the audit can really help ease the stress and make the process smoother.

Lastly, familiarize yourself with the taxpayer bill of rights. This outlines your protections and the IRS's obligations, empowering you in case of an audit. So, stay informed and take charge of your rights!

Follow the Amendment Process for Tax Returns

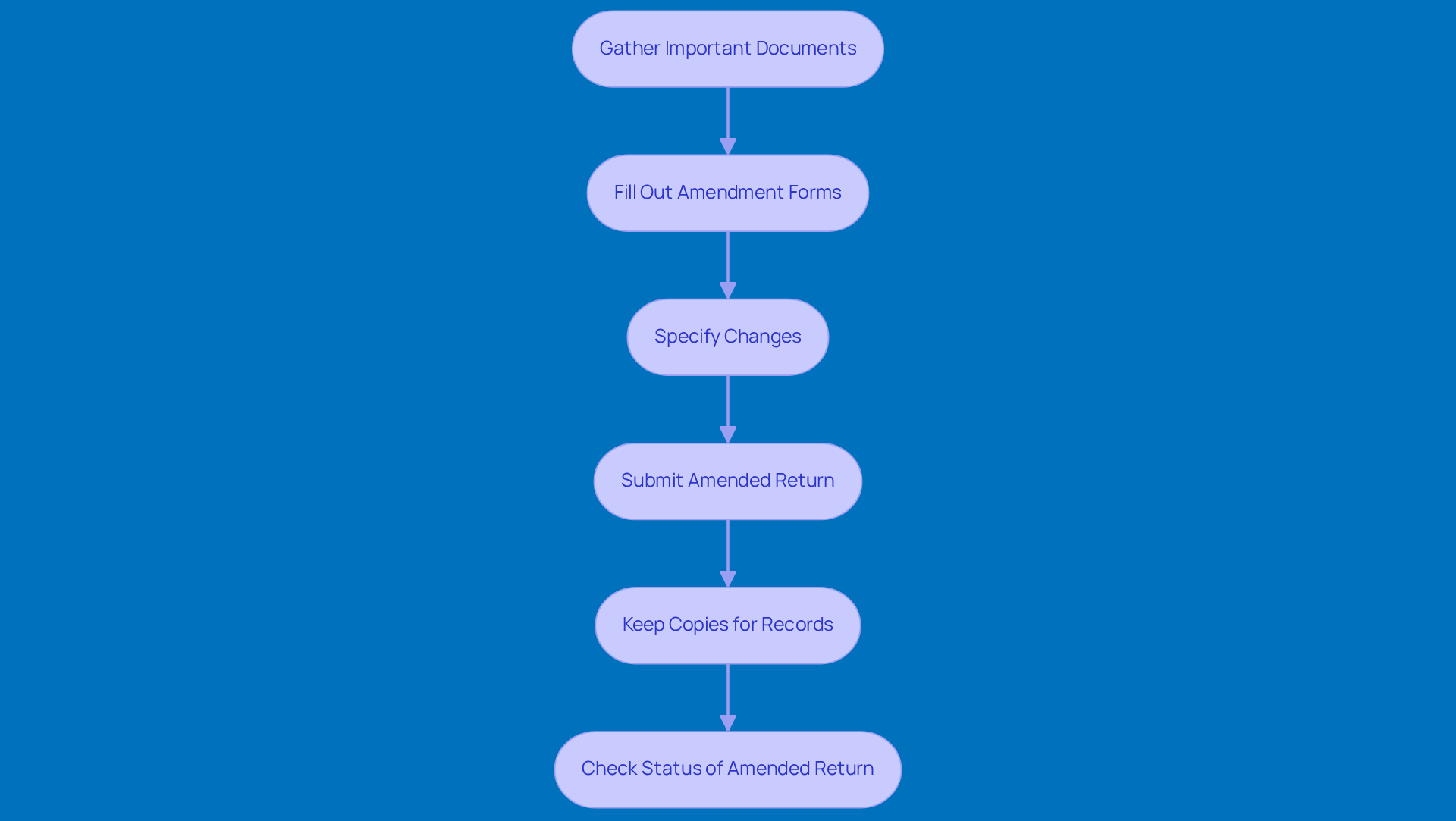

Hey there! Let’s talk about getting your ERC submission sorted out. First things first, gather all the important documents you’ll need. This includes your original tax returns and any supporting materials, like payroll tax returns and employee wage records. Got everything? Great!

Next up, do you have to amend income tax returns for ERC by filling out the necessary amendment forms? If you’re dealing with individual returns, grab Form 1040-X. For corporate returns, it’s Form 1120-X. Make sure to clearly specify the changes you’re making and provide detailed explanations for each amendment, particularly if you are wondering do you have to amend income tax returns for ERC. This helps avoid any confusion down the line.

Once you’ve got your forms ready, submit the amended return to the IRS. Don’t forget to keep copies for your records and future reference-trust me, you’ll thank yourself later!

And hey, it’s a good idea to regularly check the status of your amended return. This way, you can confirm it’s being processed correctly and tackle any potential issues right away. Stay on top of it, and you’ll be just fine!

Consult a Tax Professional for Guidance

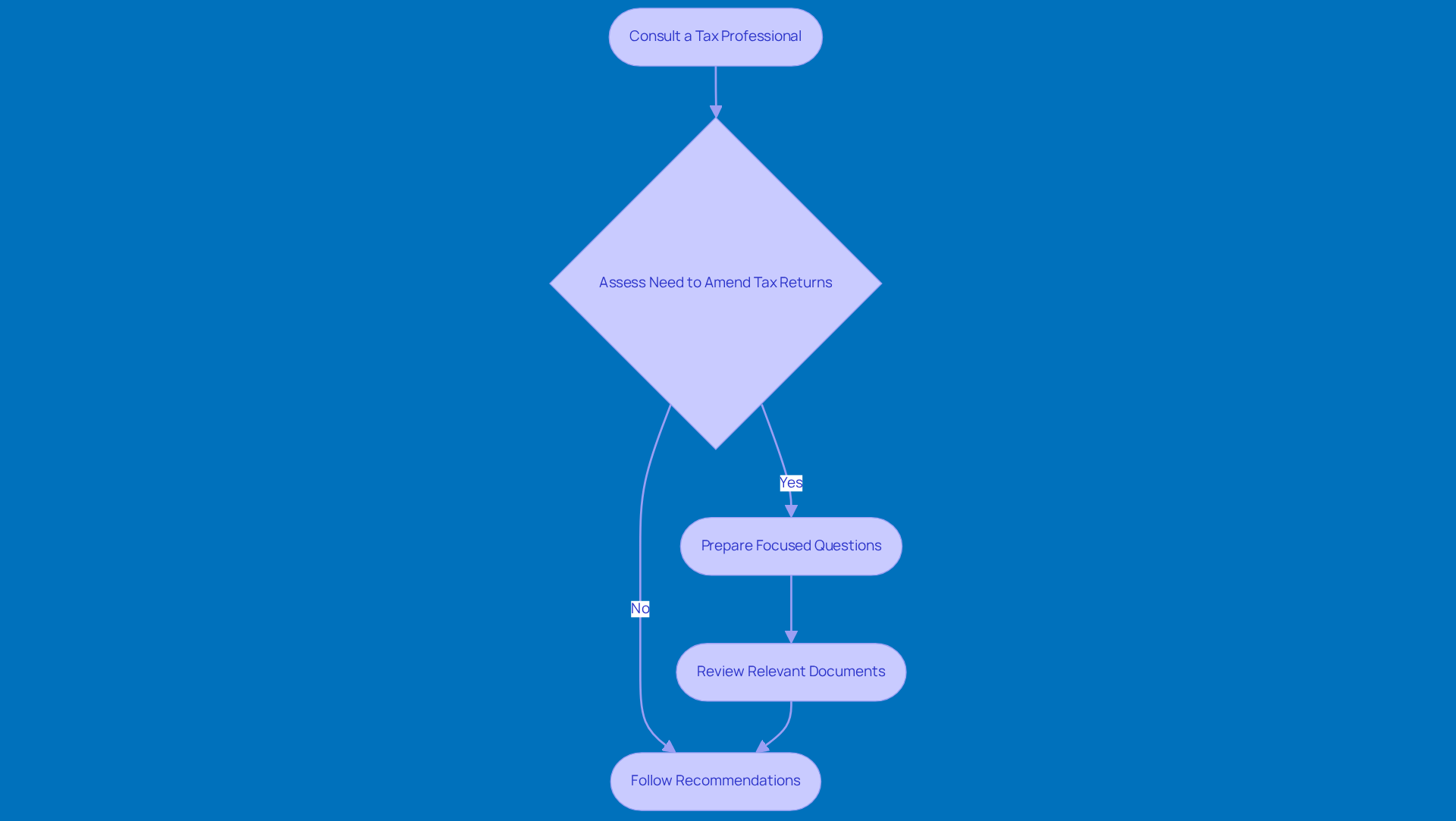

Finding a qualified tax expert is key, especially if you need to know do you have to amend income tax returns for ERC submissions. You want someone with a solid track record, especially with all the IRS warnings about ERC mills and the risks of working with consultants who charge contingency fees. At Steinke and Company, we really stress the importance of planning and compliance. It’s all about setting your business up right from the get-go. So, why not schedule a consultation? We can dive into your specific situation, particularly to determine do you have to amend income tax returns for ERC. This personalized approach makes sure we consider all the unique factors, highlighting how important it is for taxpayers to be responsible for accurate reporting.

Got questions about how the ERC might impact your tax returns? It’s a good idea to prepare some focused ones! Think about the consequences of claiming it and the possible penalties for any incorrect assertions. Understanding the ins and outs of the credit can really help clarify your eligibility and what’s at stake. And don’t forget, it’s crucial for your tax professional to do a thorough review of all relevant documents to determine if you have to amend income tax returns for ERC before filing any amendments. This step is vital to back up your claims and avoid future compliance headaches, especially with the IRS ramping up their scrutiny of ERC submissions.

Make sure to follow their recommendations closely to minimize risks related to ERC submissions. Sticking to professional advice can significantly boost your chances of a successful request and help you steer clear of audits or penalties. Just a heads up: employers have until April 15, 2024, to claim the ERC for quarters in 2020, and until April 15, 2025, for quarters in 2021. Plus, it’s a good idea to familiarize yourself with the taxpayer bill of rights so you know your protections and rights during the audit process.

Conclusion

Understanding the ins and outs of the Employee Retention Credit (ERC) is super important for businesses trying to tackle tax returns and get the most out of their financial benefits. Think of the ERC as a lifeline for many organizations, helping them keep their employees on board during tough times while also offering potential tax credits that can really make a difference to their bottom line.

In this article, we’ve highlighted some key points, like:

- Who’s eligible to claim the ERC

- Why it’s crucial to amend tax returns accurately

- The need to consult tax pros for guidance

To qualify, businesses need to show a significant drop in gross receipts or be under government orders. Plus, we can’t forget about the importance of sticking to IRS regulations and deadlines, especially when it comes to amending returns with the right forms.

At the end of the day, the ERC isn’t just a financial opportunity; it’s a vital support system for small businesses working hard to bounce back from the pandemic’s impact. By taking proactive steps to ensure eligibility, getting a grip on the amendment process, and seeking professional advice, businesses can really boost their chances of a successful claim. So, don’t wait too long! Act quickly to secure those credits before the deadlines hit, and make sure you’re making the most of this valuable resource.

Frequently Asked Questions

What is the Employee Retention Credit (ERC)?

The Employee Retention Credit (ERC) is a refundable tax credit designed to help companies retain their employees during the COVID-19 pandemic by allowing eligible employers to claim a credit against payroll taxes for wages paid to employees during certain challenging periods.

What are the eligibility criteria for the ERC?

To qualify for the ERC, businesses must demonstrate a significant drop in gross receipts, specifically a 50% decline in 2020 compared to the same quarter in 2019, or a 20% decline in 2021 compared to the same quarter in 2019. Additionally, companies that were fully or partially shut down due to government orders during the pandemic can also qualify.

What is the time frame for claiming the ERC?

Employers can claim the ERC for wages paid from March 13, 2020, to December 31, 2021.

Do I need to amend my income tax returns to claim the ERC?

Yes, to claim the ERC, you must amend income tax returns using IRS Form 941-X.

What are the deadlines for submitting the ERC claims?

The deadline for submitting claims for the 2020 ERC is April 15, 2024, and for the 2021 ERC, it is April 15, 2025.

How does the ERC interact with other tax credits and deductions?

While you can claim both the ERC and a Paycheck Protection Program (PPP) loan, you cannot use the same wages for both claims. This distinction is important for compliance and optimizing tax strategies.

How much financial support can businesses potentially receive from the ERC?

Qualifying employers can potentially receive up to $26,000 per worker for the 2020/21 period, providing substantial financial support to help navigate the challenges posed by the pandemic.