Introduction

Navigating the ins and outs of estimated tax payments can feel like a real challenge for small business owners, right? With the financial landscape constantly shifting, it’s super important to get a grip on income thresholds, potential penalties, and the paperwork you need to stay compliant. But don’t worry! We’ve got a handy checklist to help simplify this whole process. It’s all about figuring out your tax obligations and making smart decisions.

Now, as your income changes and your business structure evolves, you might be wondering: how do you know if estimated tax payments are even necessary? And what can you do to dodge those pesky underpayment penalties? Let’s dive in and explore some strategies together!

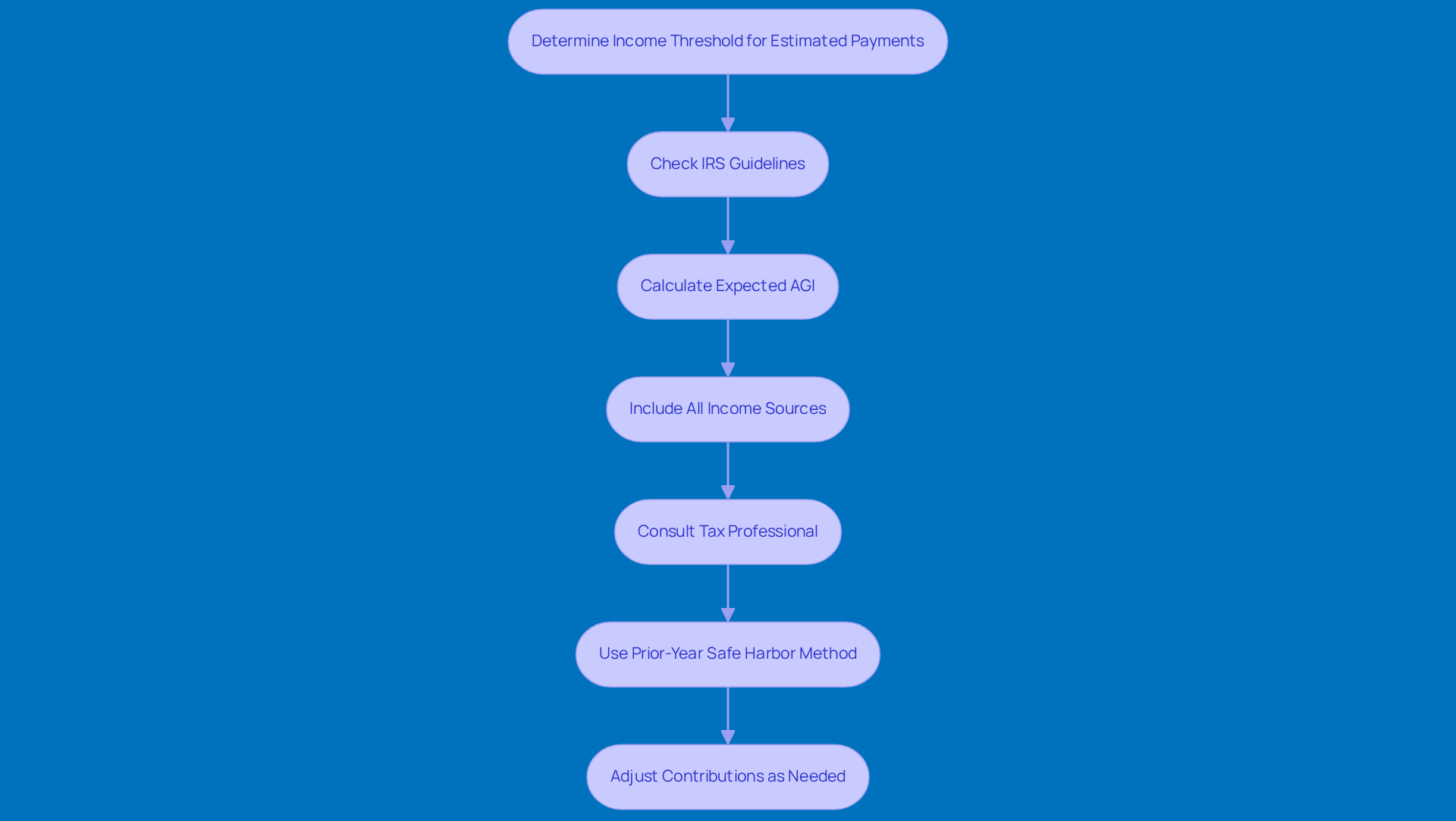

Determine Your Income Threshold for Estimated Payments

Take a moment to check out the IRS guidelines for projected tax contributions. You’ll want to find out the minimum income limit that applies to your business category. For 2026, if you’re a small business owner, you might wonder do you have to make estimated tax payments if you think you’ll owe at least $1,000 in federal tax after credits and withholding.

So, how do you figure this out? Start by calculating your expected adjusted gross income (AGI) for the year. This number is super important because it’ll determine your tax obligations. If you think your AGI will be over $1,000 after deductions, then do you have to make estimated tax payments? Don’t forget to include income from all sorts of sources like self-employment, dividends, and capital gains. And keep an eye on any extra income that might push you over that threshold.

To make sure you’re on the right track, consider using tax software or chatting with a tax professional. They can help verify your calculations and ensure you’re following IRS requirements. If you really want to stay ahead of the game, hiring a seasoned CPA can help you sync your projected contributions with your cash flow and adjust those projections as needed throughout the year.

Oh, and here’s a handy tip: you can use the prior-year safe harbor method to dodge underpayment penalties by paying at least 100% of your previous year’s tax liability. Just remember, projected tax contributions are usually due every three months - mark your calendar for April 15, June 15, September 15, and January 15 of the following year.

Lastly, don’t hesitate to tweak your contributions throughout the year based on any changes in your income or expenses. Staying compliant doesn’t have to be a headache!

Evaluate Changes in Income or Business Structure

Take a look at your income statements from last year to spot any trends that might impact your tax obligations. It’s super important to understand these trends, especially since 73% of midsize business owners are gearing up to boost their revenue in 2026. That could definitely affect what you owe in taxes!

Have you made any changes to your business model? Maybe you’ve introduced new services or products? These shifts can really shake up your revenue streams. With 48% of business leaders planning to expand their workforce in 2026, tweaking your business model could lead to higher income - and yes, that means higher taxes too.

Don’t forget about seasonal income variations! If your agency sees ups and downs throughout the year, it’s wise to keep that in mind. For instance, businesses that rely on seasonal contracts might wonder, do you have to make estimated tax payments to adjust their projected expenses and avoid any nasty underpayment fines.

If you’ve switched up your business structure - like moving from a sole proprietorship to an LLC - make sure to chat with a tax professional. Understanding how changes in structure can impact your tax responsibilities raises the question: do you have to make estimated tax payments? As industry experts point out, knowing how to fully deduct R&D expenses and capital investments can seriously shape your tax strategy.

Keep a record of any major changes in your business operations or income. This habit not only helps with tax planning but also allows you to adapt to the ever-changing economic landscape. After all, small businesses are increasingly using technology and innovation to boost productivity!

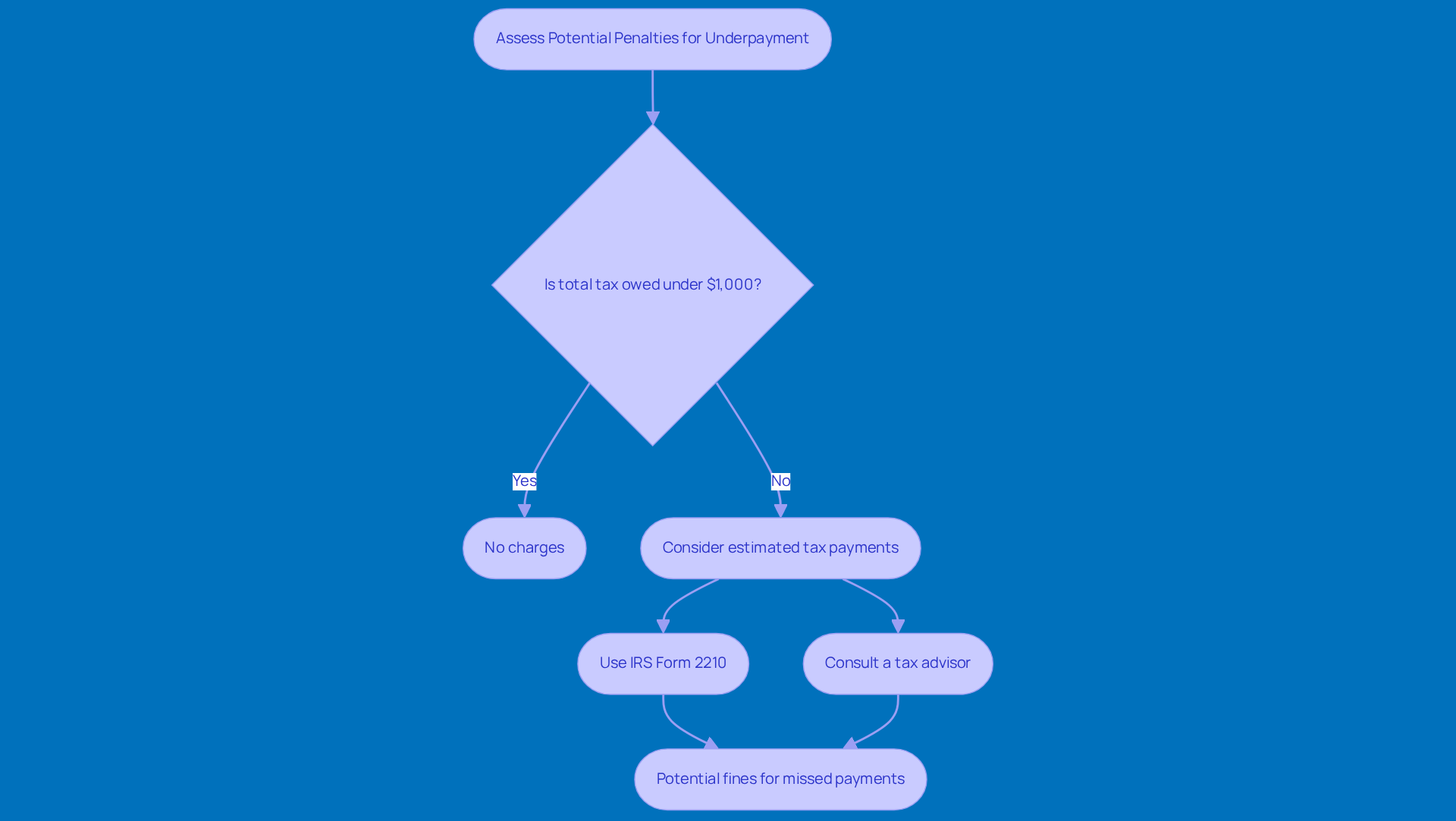

Assess Potential Penalties for Underpayment

It is super important for business owners to understand the IRS consequences for underpayment of estimated taxes, particularly regarding do you have to make estimated tax payments. These fees can pile up quickly, including both interest and fines, if you don’t address them. To figure out if you might owe any charges from last year, you can use IRS Form 2210 - it’s a handy tool for this.

Now, if your total tax owed, after deducting withholding and refundable credits, is under $1,000, you’re in the clear - you won’t face any charges. But if you think you might be underpaying, you may want to ask yourself, do you have to make estimated tax payments to help reduce any potential fines?

For example, let’s say you’re a contractor pulling in $150,000. The question arises, do you have to make estimated tax payments, as failing to do so could result in owing around $25,000 to $30,000 in estimated taxes for 2026. Missing just one quarterly payment can lead to fines ranging from $50 to $100, and those can really add up over four quarters!

That’s why chatting with a tax advisor is key. They can help you navigate your specific situation and understand the potential repercussions you might face. With some proactive planning and accurate projected contributions, you can significantly lower the risk of penalties and stay on the right side of federal tax regulations.

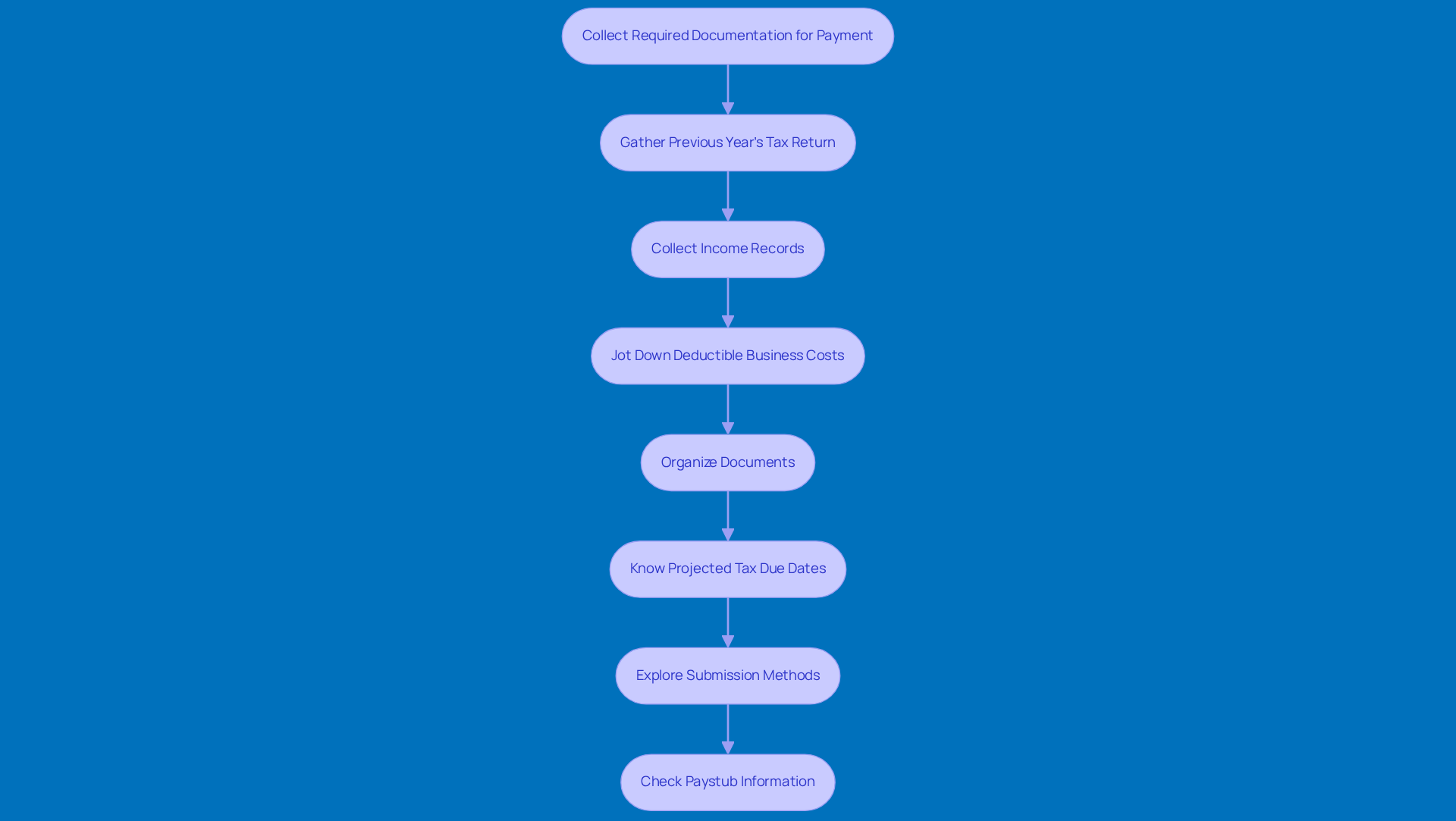

Collect Required Documentation for Payment

Gather your previous year’s tax return - it’s a handy reference for your income and deductions, and it really helps in estimating what you owe this year. Don’t forget to collect records of all your income sources, like those 1099 forms and other income statements. This way, you can report your earnings comprehensively.

Also, jot down any business costs that might be deductible. These can significantly lower your taxable income and reduce what you owe. Keep an eye on any changes in your financial situation, like shifts in income or new revenue streams, as these may influence whether you do you have to make estimated tax payments.

Organize these documents in a specific folder. This makes it easier to access everything when it’s time to prepare your projected tax contributions, simplifying the process and cutting down on stress. If you’re in a rural business, think about farmers who keep detailed records of crop sales and expenses, or contractors who track project income and costs. These practices can really help with accurate tax prep.

And hey, don’t forget about those projected tax due dates, which raise the question: do you have to make estimated tax payments by April 15, June 15, September 15, and January 15? Timely submissions are key to avoiding fines! You might want to familiarize yourself with the safe harbor rule, especially if you're wondering do you have to make estimated tax payments to avoid underpayment fees. Just make sure you pay at least 90% of your current year’s tax obligation or 100% of last year’s total tax.

It’s also good to know the potential consequences of missing your projected tax contributions. They can start at 0.5% of the amount due and climb monthly up to a maximum of 25%. Understanding this can save you from unnecessary financial stress and penalties.

Explore different ways to submit your projected taxes, whether it’s online transactions, mailing checks, or using the Electronic Federal Tax Payment System (EFTPS). Stay in the loop about any tax law changes that might affect your responsibilities for the 2026 tax year, as these can influence your projected contributions.

Lastly, take a look at your paystub information to ensure the right amounts are being withheld. This little check can go a long way in keeping you compliant with your taxes!

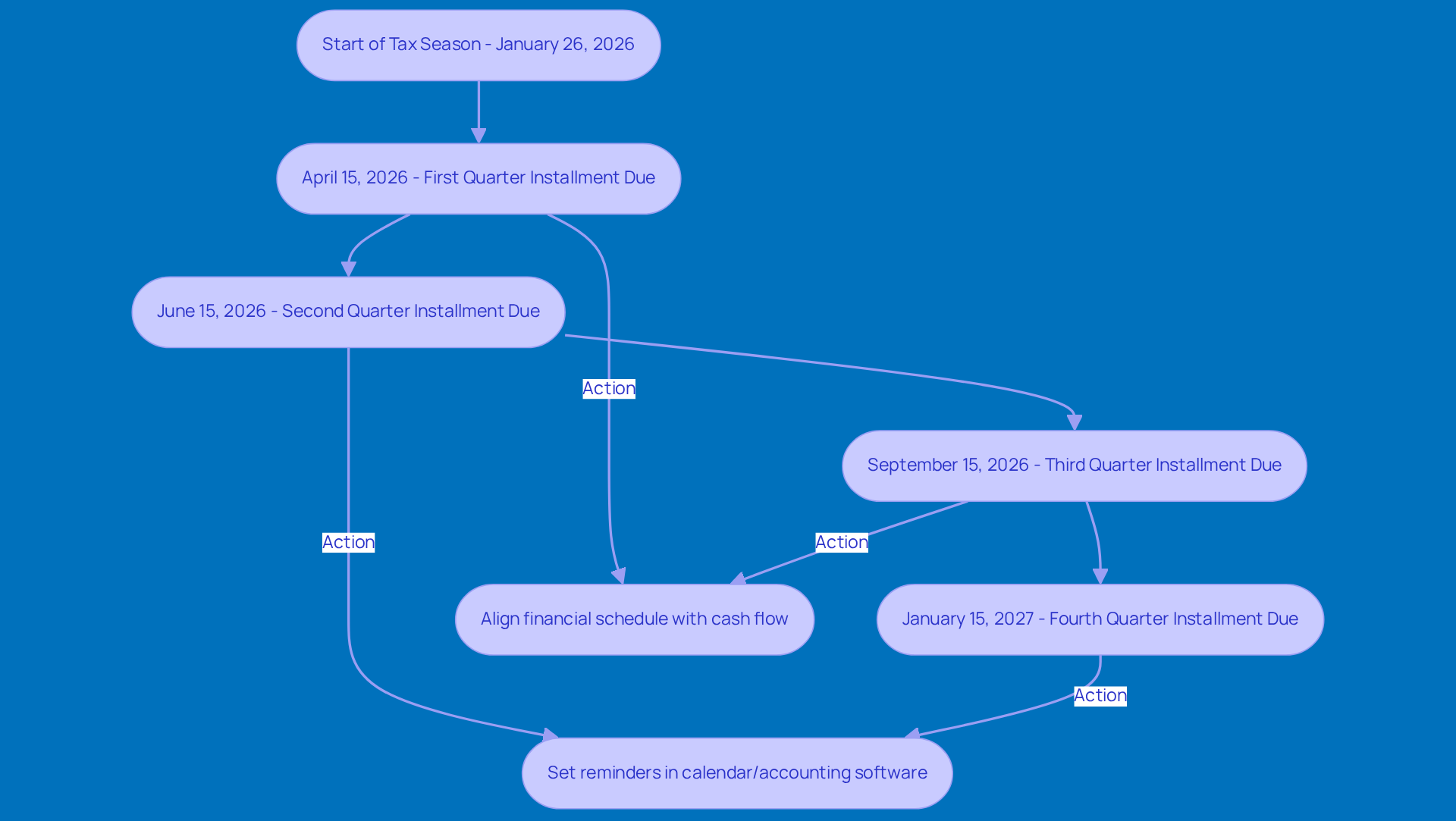

Establish a Payment Schedule for Estimated Taxes

Let’s discuss the due dates related to when do you have to make estimated tax payments! You’ll usually find them on April 15, June 15, September 15, and January 15 of the following year. For 2026, mark your calendar because the first quarter installment is due on April 15, 2026.

Now, it’s super important to align your financial schedule with your cash flow. This way, you’ll have enough funds available when those due dates roll around. If you’re running a small agency, take a good look at your revenue cycles and plan your expenses during those peak cash flow times. This proactive approach can really help you avoid any financial strain and keep you in good standing with the IRS.

Don’t forget to set reminders in your calendar or accounting software! A little nudge before those due dates can keep you organized and help you dodge late fees. Speaking of fees, if you submit a partnership or S-Corp return late, it’ll cost you about $220 for each partner or shareholder, each month. That’s a hefty reminder of why timely payments are so crucial! And let’s not overlook underpayment penalties; if you don’t meet your projected tax obligations, do you have to make estimated tax payments to avoid being hit with those by the IRS?

Have you considered if you do you have to make estimated tax payments by breaking your contributions into quarterly payments? This can help spread your tax responsibility evenly throughout the year, making it easier to manage instead of facing a big bill all at once during tax season. Plus, you can use vouchers from Form 1040-ES for your projected tax contributions. This strategy can really help you avoid the financial strain that comes with underpayment charges, which can pile up if you’re not careful.

It’s a good idea to regularly check your billing schedule to adjust for any changes in your income or expenses. You want to make sure your projected contributions match your current financial situation. Financial advisors often stress that syncing your cash flow with your tax obligations is key to maintaining your financial health and determining if you do have to make estimated tax payments to steer clear of underpayment penalties. As Mark Milton puts it, 'If you suspect you will owe taxes for 2025 or if you didn’t have enough withholding throughout the year, you must submit an amount by this date.' And remember, the IRS kicks off tax season on January 26, 2026, so it’s time to start gearing up for those estimated payments!

Conclusion

So, let’s wrap this up! Figuring out if you need to make estimated tax payments is super important for small business owners and self-employed folks. It’s all about knowing those income thresholds, keeping an eye on any changes in your business setup, and understanding the potential penalties for underpayment. Staying informed and proactive means you can tackle your tax obligations with confidence.

Here’s the deal: you’ll want to calculate your expected adjusted gross income (AGI) and keep tabs on any shifts in your income or business operations that could affect your tax responsibilities. Plus, don’t forget to maintain proper documentation and set up a payment schedule. These steps are key to staying compliant and steering clear of penalties. And hey, regularly chatting with a tax professional can really help clarify things and guide you in managing these obligations effectively.

In the end, being proactive about estimated tax payments not only helps you dodge those pesky financial penalties but also supports solid financial planning. By getting a grip on the requirements and taking a strategic approach, you can focus on growing your business and sparking innovation, all while knowing you’re on top of your tax responsibilities. So, why not take action today? It’ll make for a smoother tax season tomorrow!

Frequently Asked Questions

What is the income threshold for making estimated tax payments in 2026?

For 2026, if you are a small business owner and expect to owe at least $1,000 in federal tax after credits and withholding, you will need to consider making estimated tax payments.

How can I determine my expected adjusted gross income (AGI) for the year?

You can calculate your expected AGI by considering all sources of income, including self-employment, dividends, and capital gains, as well as any deductions that may apply.

What should I do if I am unsure about my tax calculations?

It is advisable to use tax software or consult with a tax professional to verify your calculations and ensure compliance with IRS requirements.

What is the prior-year safe harbor method?

The prior-year safe harbor method allows you to avoid underpayment penalties by paying at least 100% of your previous year’s tax liability.

When are projected tax contributions due?

Projected tax contributions are typically due every three months on April 15, June 15, September 15, and January 15 of the following year.

How should I adjust my estimated tax payments throughout the year?

You should adjust your contributions based on any changes in your income or expenses to stay compliant with tax obligations.

Why is it important to evaluate changes in income or business structure?

Evaluating changes is crucial because trends in revenue, new services or products, and changes in business structure can significantly impact your tax obligations.

What should I consider if my business has seasonal income variations?

If your business experiences seasonal income fluctuations, you may need to adjust your estimated tax payments to avoid underpayment fines.

How can changing my business structure affect my tax responsibilities?

Changing your business structure, such as moving from a sole proprietorship to an LLC, can impact your tax responsibilities, so it's important to discuss these changes with a tax professional.

What record-keeping practices should I follow for tax planning?

Keep a record of any major changes in your business operations or income to help with tax planning and to adapt to changes in the economic landscape.