Introduction

Navigating the maze of tax preparation can feel overwhelming for small business owners, right? Especially when you're left wondering if you really need to hire a Certified Public Accountant (CPA). Many folks think that only CPAs have the know-how to tackle taxes, but the truth is a bit more complicated. There are both perks and pitfalls to consider.

In this article, we’ll explore:

- What qualifications are necessary for tax prep

- The legal stuff surrounding tax pros

- Why bringing a CPA on board might just be a smart move

With so many myths floating around about whether a CPA is essential, it’s worth asking: is a CPA’s expertise really a must-have, or can non-CPAs handle tax duties just as well? Let’s dive in!

Define CPA: Understanding the Role and Qualifications

A Certified Public Accountant (CPA) is basically a licensed accounting pro who’s passed the CPA exam and met certain educational and experience requirements. To become a CPA, candidates usually need to complete 150 semester hours of college coursework, which often includes a bachelor’s degree in accounting or something similar. Plus, they have to rack up some relevant work experience under the watchful eye of a licensed CPA, making sure they’re well-versed in accounting principles, tax laws, and ethical standards.

This qualification process is no joke! It’s super important because CPAs can offer a whole range of services, including tax preparation, which leads to the question: do you need to be a CPA to do taxes? Their expertise is especially handy for small business owners who often face tricky financial challenges. Did you know that the pass rate for the CPA exam has bounced between 45% and 60% over the years? That really shows how tough it can be and how much commitment it takes to succeed.

Successful CPAs in rural America really showcase what it takes to thrive in this field. They don’t just navigate the complexities of tax laws; they also act as trusted advisors, addressing questions such as do you need to be a CPA to do taxes while helping businesses fine-tune their financial strategies. The role of a CPA goes beyond just compliance; they’re key players in promoting financial health and sustainability for small businesses, making their qualifications and expertise absolutely essential.

Examine Legal Requirements for Tax Preparation

If you're in the U.S. and thinking about preparing tax returns for a fee, you'll need a Preparer Tax Identification Number (PTIN) from the IRS. Now, while there aren't any nationwide educational requirements to become a tax preparer, many states have their own rules that might require you to get licensed or certified. Take California, for instance; they require tax preparers to hold a license. In fact, about 30% of states have similar licensing requirements. This just goes to show how important it is to check the credentials of tax professionals before you work with them.

When it comes to tax pros, Certified Public Accountants (CPAs) and Enrolled Agents (EAs) are at the top of the game. They have the qualifications to represent clients before the IRS, which is a big deal! CPAs need to pass the Uniform CPA Examination and meet strict educational and ethical standards. EAs, on the other hand, are licensed by the IRS after acing a tough three-part Special Enrollment Examination. This distinction is super important for small businesses, especially if they're dealing with audits or complex tax situations. It ensures they have knowledgeable representatives on their side.

Understanding these legal requirements is key for business owners. You want to make sure you're working with qualified professionals who can help you stay compliant with tax laws and manage your tax responsibilities effectively. So, take the time to verify those credentials - it could save you a lot of headaches down the road!

Evaluate Benefits of Hiring a CPA for Tax Services

Hiring a CPA for tax services can be a game-changer for entrepreneurs. They really know their stuff when it comes to tax laws and regulations, helping you stay compliant and cutting down the chances of errors that could lead to audits or penalties. Plus, they’re pros at strategic tax planning, spotting deductions and credits that you might miss, which can save you a pretty penny. For instance, a CPA can help a small business get its operations in order to boost tax efficiency, leading to significant savings over time.

But that’s not all! CPAs also provide fantastic support with financial forecasting and budgeting. They give you insights that help you make informed decisions. Did you know that many small business owners report better compliance after hiring a CPA? It really highlights how important professional guidance is when navigating the tricky tax landscape. They also help you understand and manage underpayment penalties, using strategies like safe harbor payments and the de minimis exception to dodge those pesky fees.

In the end, having a CPA on your side not only takes the stress out of tax issues but also lets you focus on what you do best - growing your business. So, if you’re looking to foster growth and resilience in your venture, consider bringing a CPA into the mix!

Debunk Myths: Do You Really Need a CPA for Taxes?

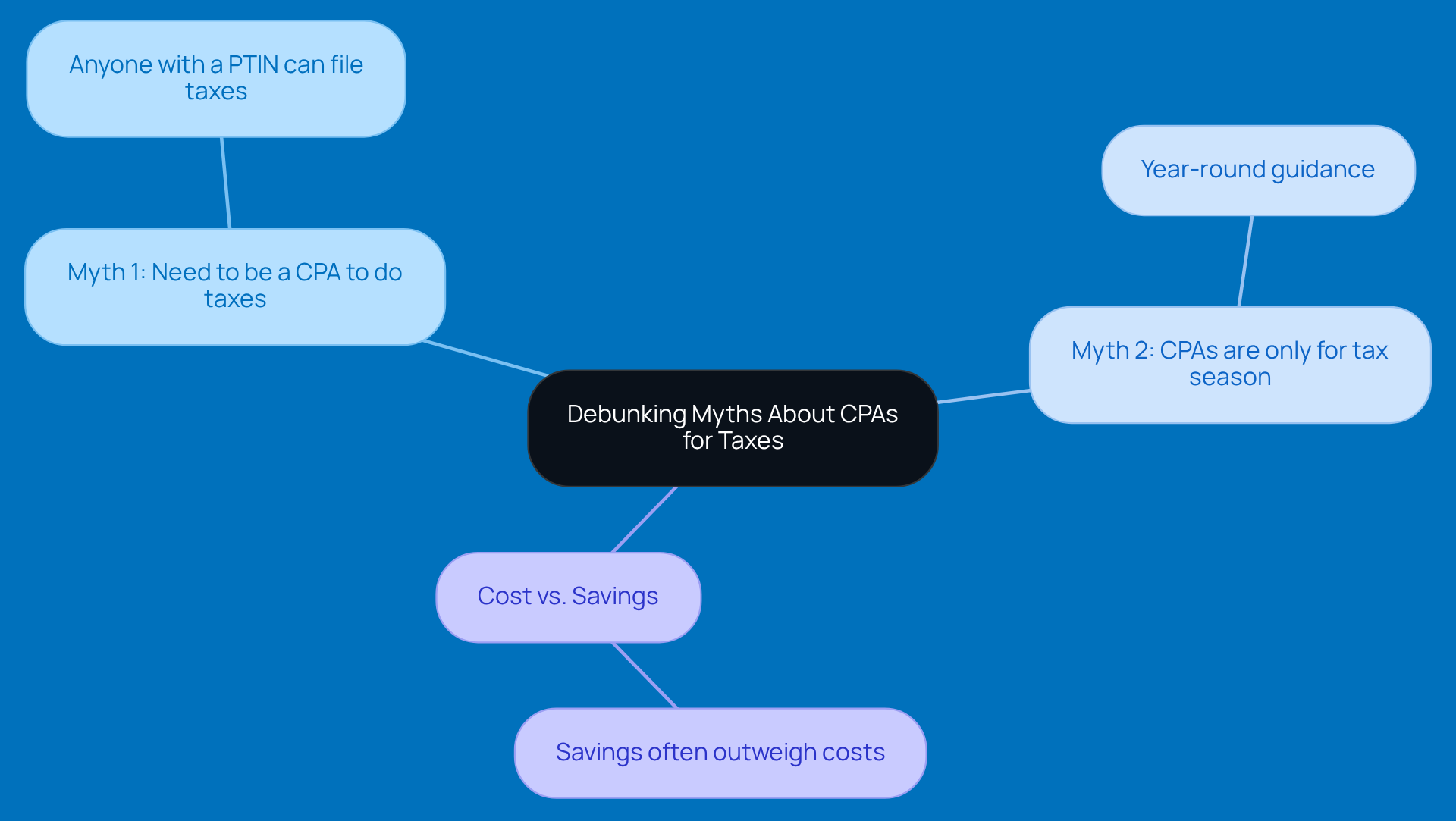

There are quite a few myths out there about why you should hire a CPA for tax prep. One common misconception is related to the question, do you need to be a CPA to do taxes. The truth? Anyone with a Preparer Tax Identification Number (PTIN) can file tax returns. While hiring a CPA isn’t mandatory, many wonder, do you need to be a CPA to do taxes? Their expertise can be a game-changer for businesses dealing with complex financial situations.

Another myth is that CPAs are only needed during tax season. In reality, they offer year-round financial guidance and strategic planning, helping businesses continuously optimize their tax strategies. Now, let’s talk about cost. Some business owners shy away from hiring a CPA because they worry about expenses. But here’s the kicker: the savings from tax deductions and credits often outweigh the cost of professional services. Small businesses that tap into CPA expertise frequently see better tax outcomes and lower liabilities.

By busting these myths, small business owners can better understand their options and truly appreciate the value a CPA brings to the table for tax prep, including the question of do you need to be a CPA to do taxes for their overall financial health. So, why not consider reaching out to a CPA? You might just find they’re worth their weight in gold!

Conclusion

When it comes to tax preparation, hiring a Certified Public Accountant (CPA) is a topic that can really make a difference for small business owners. Sure, you can tackle your taxes without a CPA, but the expertise and range of services they provide can be a game changer, especially when you're dealing with tricky tax laws and trying to maximize those deductions. It’s crucial to understand what qualifications and legal requirements tax preparers need to have so you can make smart choices about your financial management.

Throughout this article, we’ve explored some key insights, like the rigorous qualifications needed to become a CPA and the various legal rules around tax preparation. We also looked at how CPAs differ from other tax preparers, like Enrolled Agents, which really highlights the importance of picking the right professional for your specific needs. Plus, the benefits of hiring a CPA - from strategic tax planning to year-round financial guidance - show just how much you could save and how much easier it can be to stay compliant.

In the end, small business owners should think about the perks of getting professional tax help versus going the DIY route. Bringing a CPA on board can not only take the stress out of tax season but also boost your overall financial health and support your growth strategy. By busting some myths and recognizing the real value that CPAs bring, you can set yourself up for success in a financial landscape that’s always changing. So, what do you think? Are you ready to consider a CPA for your tax needs?

Frequently Asked Questions

What is a Certified Public Accountant (CPA)?

A Certified Public Accountant (CPA) is a licensed accounting professional who has passed the CPA exam and met specific educational and experience requirements.

What are the educational requirements to become a CPA?

To become a CPA, candidates typically need to complete 150 semester hours of college coursework, which often includes a bachelor’s degree in accounting or a related field.

Is work experience required to become a CPA?

Yes, candidates must accumulate relevant work experience under the supervision of a licensed CPA to ensure they are knowledgeable in accounting principles, tax laws, and ethical standards.

What services can CPAs provide?

CPAs can offer a range of services, including tax preparation, financial consulting, and advising small business owners on financial strategies.

Do you need to be a CPA to do taxes?

While CPAs are highly qualified to handle tax preparation and related issues, it is not mandatory to be a CPA to prepare taxes, although having CPA expertise can be very beneficial.

What is the pass rate for the CPA exam?

The pass rate for the CPA exam has varied between 45% and 60% over the years, indicating the exam's difficulty and the level of commitment required to succeed.

How do CPAs contribute to small businesses in rural America?

CPAs in rural America help small businesses navigate complex tax laws, act as trusted advisors, and assist in fine-tuning financial strategies to promote financial health and sustainability.