Introduction

Understanding the ins and outs of Beneficial Ownership Information (BOI) reporting is super important for anyone running a business, especially if you’re a sole proprietor. As regulations change, the consequences of filing - or not filing - a BOI report can really affect your transparency and compliance. With recent court rulings and deadlines looming, you might be wondering: do sole proprietors really need to deal with the complexities of BOI reporting, or can they relax a bit? In this article, we’ll explore the details of BOI requirements and what’s at stake for sole proprietors in this ever-evolving regulatory landscape.

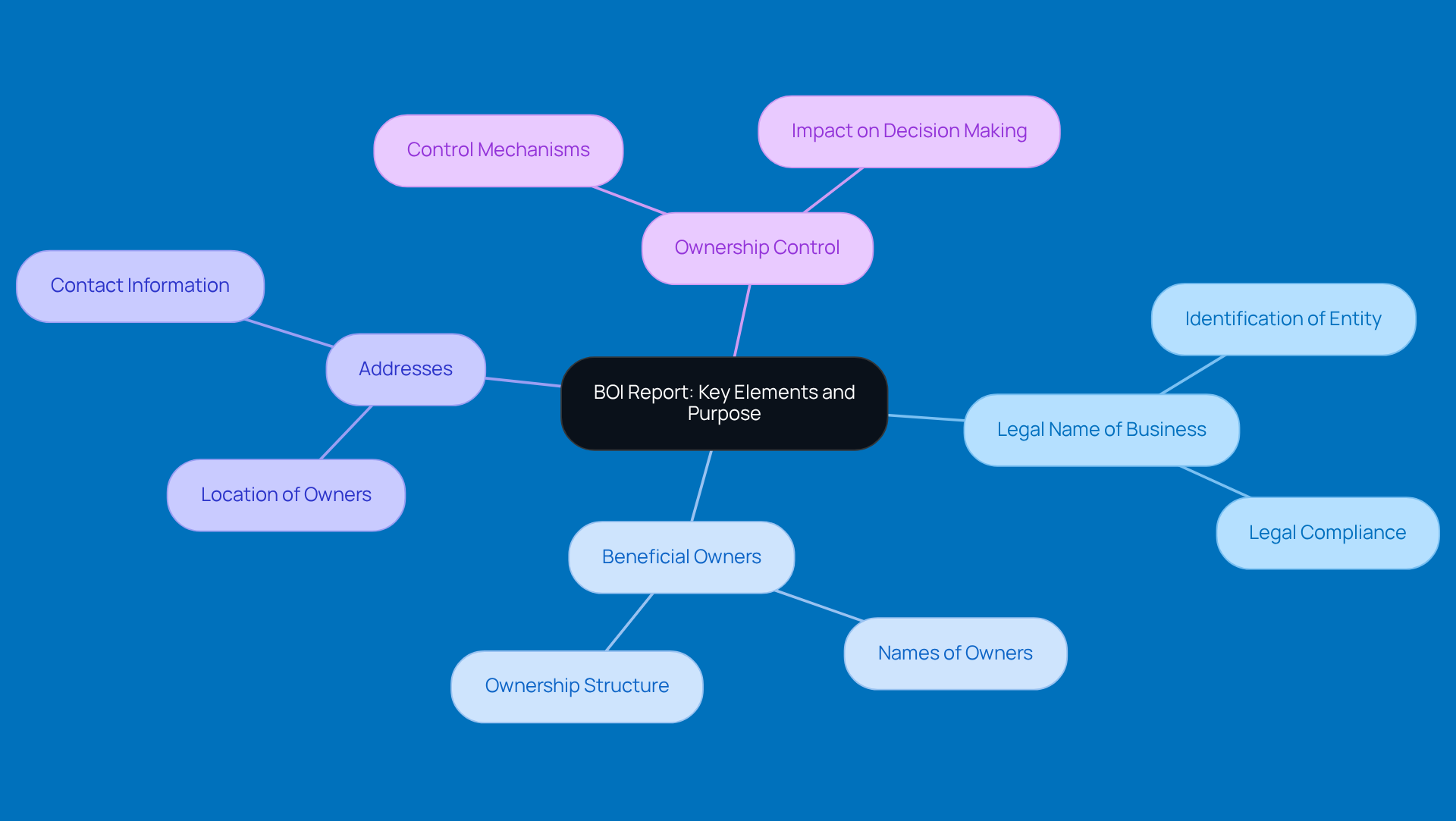

Define BOI Report: Key Elements and Purpose

If you're running a business, it's important to understand whether a sole proprietor needs to file a BOI report concerning the Beneficial Ownership Information (BOI) document. It's a requirement from the Financial Crimes Enforcement Network (FinCEN) that shows who really owns or controls a company. So, what’s in a BOI document? Well, it includes:

- The legal name of the business

- The names of the beneficial owners

- Their addresses

- How they own or control the enterprise

The main idea behind this document is to boost transparency in ownership, which helps in preventing financial crimes like money laundering and fraud.

The Corporate Transparency Act (CTA) outlines requirements, leading to the question of whether a sole proprietor needs to file a BOI report to give the government a clearer picture of who’s behind the scenes in U.S. operations. But here’s the twist: a federal district court recently ruled the CTA unconstitutional, which could shake things up for BOI disclosure requirements. On top of that, if you’re in New York, the New York LLC Transparency Act kicks in on January 1, 2026, leading to the question of whether a sole proprietor needs to file a BOI report with the New York Department of State.

Looking ahead to 2025, it’s estimated that over 25,000 U.S. accounting firms are gearing up to help clients with BOI reporting. That’s a big step toward greater accountability in corporate practices! By submitting BOI documents, companies aren’t just ticking a box; they’re also fostering a more transparent economic environment, which builds trust and integrity in the marketplace.

According to the National Small Business Association, which boasts over 65,000 members, these changes are super important for small agency owners trying to navigate the tricky waters of compliance. So, how are you preparing for these shifts in ownership transparency?

Contextualize the BOI Report: Regulatory Importance for Sole Proprietors

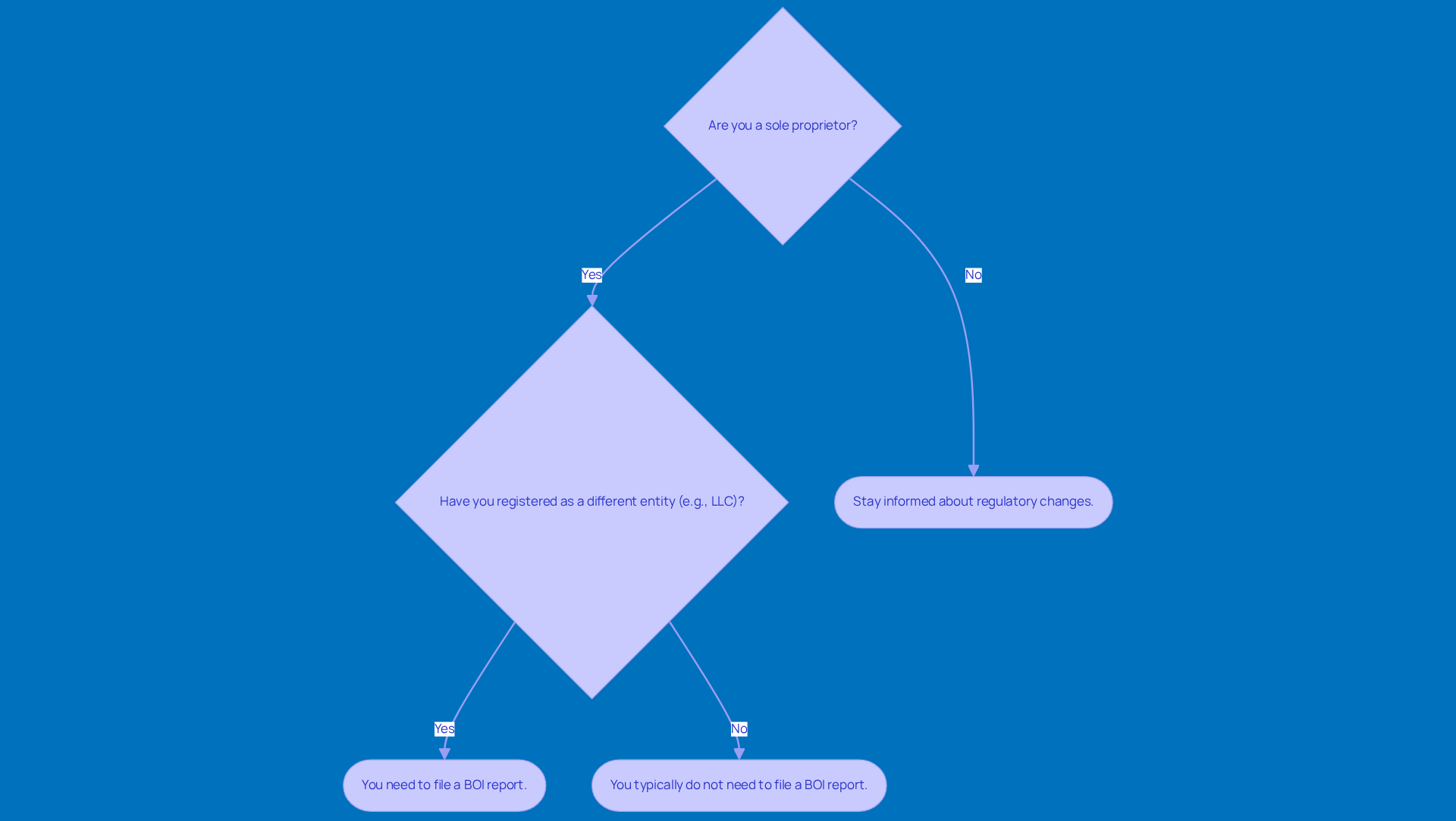

The BOI document plays a key role in a broader effort to boost accountability and transparency in ownership. Now, if you're a sole proprietor, you may ask yourself, does a sole proprietor need to file a BOI report, as the whole filing requirement can feel a bit tricky. Typically, sole proprietorships don’t fall under the Corporate Transparency Act (CTA), which leads to the question of whether does a sole proprietor need to file a BOI report unless they’ve registered their business as a different entity, like an LLC. This is super important for sole proprietors because it lightens the compliance load while highlighting the need to grasp ownership structures and what they mean for you.

But here’s the thing: the rules around BOI documentation are changing fast. Sole proprietors need to keep an eye on their registration status and any changes in structure to determine if does a sole proprietor need to file a BOI report. The CTA is all about closing those pesky loopholes that let people hide ownership behind shell companies, so keeping up with BOI reporting is becoming more crucial than ever. Ignoring these requirements could lead to hefty penalties, including fines and even legal trouble. So, staying in the loop about the current regulatory landscape is key for effective compliance and smart planning.

Explore Implications: Benefits and Consequences of Filing a BOI Report

To enhance credibility and trustworthiness with clients and partners, one might wonder, does a sole proprietor need to file a BOI report? It shows a commitment to transparency and compliance, which is super important! If you’re required to file, sticking to these regulations is key to avoiding some serious penalties - think fines up to $10,000 and even potential jail time for willful violations. Non-compliance can lead to legal headaches that might put your operations at risk, including civil penalties that just complicate things further.

Now, if you’re a sole proprietor thinking about changing your business structure, you may wonder does a sole proprietor need to file a BOI report to meet documentation requirements, and it’s worth weighing the benefits against the extra administrative work and costs that might come up. The regulatory landscape is always shifting, so it’s crucial to stay on top of any changes that could impact your compliance responsibilities. For instance, if you set up your entity after January 1, 2024, you’ll need to report your BOI within 30 days of creation. And if you’re already established, mark your calendar - reports are due by January 1, 2025.

Industry leaders are all about stressing that keeping up with BOI documentation not only lowers risks but also enhances your company’s reputation. Did you know that a survey found one-third of small business owners mistakenly think the Corporate Transparency Act (CTA) doesn’t apply to them? That’s a big gap in understanding that could lead to non-compliance! By proactively tackling these requirements, sole proprietors can determine if a sole proprietor needs to file a BOI report, which will set them up for success in the marketplace and help build trust and reliability with stakeholders.

So, in a nutshell, getting a grip on BOI reporting is essential for making smart strategic decisions that align with compliance needs and your long-term business goals. What steps are you taking to ensure you’re on the right track?

Conclusion

Understanding the ins and outs of the BOI report is super important for sole proprietors trying to navigate the tricky waters of business ownership and compliance. Even though sole proprietorships might not usually be under the Corporate Transparency Act, the rules are changing all the time, so it’s essential to stay on your toes. Keeping up with your obligations helps ensure transparency and steer clear of any nasty penalties.

This article really shines a light on why the BOI report matters. It’s all about promoting accountability and keeping financial crimes at bay. We’ve covered the key elements of the report, what the Corporate Transparency Act means for you, and the potential fallout from not complying - think hefty fines or even legal trouble. Plus, being proactive about filing those BOI reports can boost your business’s credibility and build trust with clients and partners.

So, what’s the takeaway? It’s crucial for sole proprietors to take a good look at their business structures and stay in the loop with any regulatory changes. Embracing transparency not only helps reduce risks but also sets your business up for long-term success in a marketplace that’s getting more complex by the day. Taking those proactive steps today can really pave the way for a more secure and reputable business tomorrow. What are you waiting for?

Frequently Asked Questions

What is a BOI report?

A BOI report is a document that provides information about the beneficial ownership of a company, including the legal name of the business, the names of the beneficial owners, their addresses, and how they own or control the enterprise.

Why is the BOI report important?

The BOI report is important for boosting transparency in ownership, which helps prevent financial crimes such as money laundering and fraud.

Who is required to file a BOI report?

The requirement to file a BOI report primarily applies to businesses under the Corporate Transparency Act (CTA). It is essential for sole proprietors to understand their obligations regarding BOI reporting.

What recent legal change has affected BOI reporting requirements?

A federal district court recently ruled the Corporate Transparency Act unconstitutional, which could impact the BOI disclosure requirements.

What is the New York LLC Transparency Act?

The New York LLC Transparency Act is a law that will come into effect on January 1, 2026, requiring additional transparency in ownership for businesses in New York.

How many accounting firms are preparing for BOI reporting?

It is estimated that over 25,000 U.S. accounting firms are preparing to assist clients with BOI reporting by 2025.

What is the overall goal of submitting BOI documents?

The goal of submitting BOI documents is to foster a more transparent economic environment, which builds trust and integrity in the marketplace.