Introduction

Navigating tax compliance can feel like wandering through a tricky maze, right? This is especially true for small agency owners who juggle unique challenges when it comes to managing their financial responsibilities. A solid tax due diligence checklist isn’t just a handy tool for staying compliant; it also helps spot potential risks and opportunities that could really affect your business’s financial health.

With the tax landscape constantly changing and the deadlines for 2026 creeping up, you might be wondering: how can small agency owners make the most of this checklist? It’s all about protecting your business from unexpected liabilities while also maximizing your financial potential. So, let’s dive in and explore how you can turn this checklist into your best ally!

Define Tax Due Diligence

Tax due diligence is super important! It’s all about taking a good look at an entity’s tax compliance and obligations using a tax due diligence checklist. This means checking out past tax documents, getting a grip on current tax responsibilities, and making sure everything lines up with the relevant tax regulations. For small agency owners, doing tax due diligence is crucial for a bunch of reasons:

- Spotting Risks: By reviewing their tax situation, small agencies can find potential risks that might lead to unexpected liabilities or penalties. For instance, if state income tax forms are left unsubmitted, it could create a hefty tax bill that disrupts business operations.

- Dodging Penalties: Did you know the IRS can assess tax liabilities for up to three years from the due date of a tax return? And penalties for discrepancies can skyrocket to 40% of the difference! Catching tax compliance issues early by utilizing a tax due diligence checklist can really help avoid these headaches.

- Staying Compliant: Regular tax compliance checks included in a tax due diligence checklist help small agencies keep good standing with tax authorities. This is key to steering clear of legal troubles and ensuring everything runs smoothly.

Aiding transactions, tax due diligence can impact 30% to 40% of the total deal finances in mergers and acquisitions. Understanding the tax implications can lead to better negotiations and more favorable deal structures. Expert insights from tax pros emphasize that utilizing a tax due diligence checklist not only safeguards against unforeseen financial burdens but also enhances the value and success of transactions. Getting experienced advisors on board can provide invaluable guidance throughout this process.

Looking ahead to 2026, the importance of tax due diligence for small businesses is huge. As the world of commerce keeps changing, small agency owners need to make tax compliance a priority to navigate complexities and grab opportunities effectively. So, what are you waiting for? Let’s get started on that tax due diligence!

Identify Key Components for Review

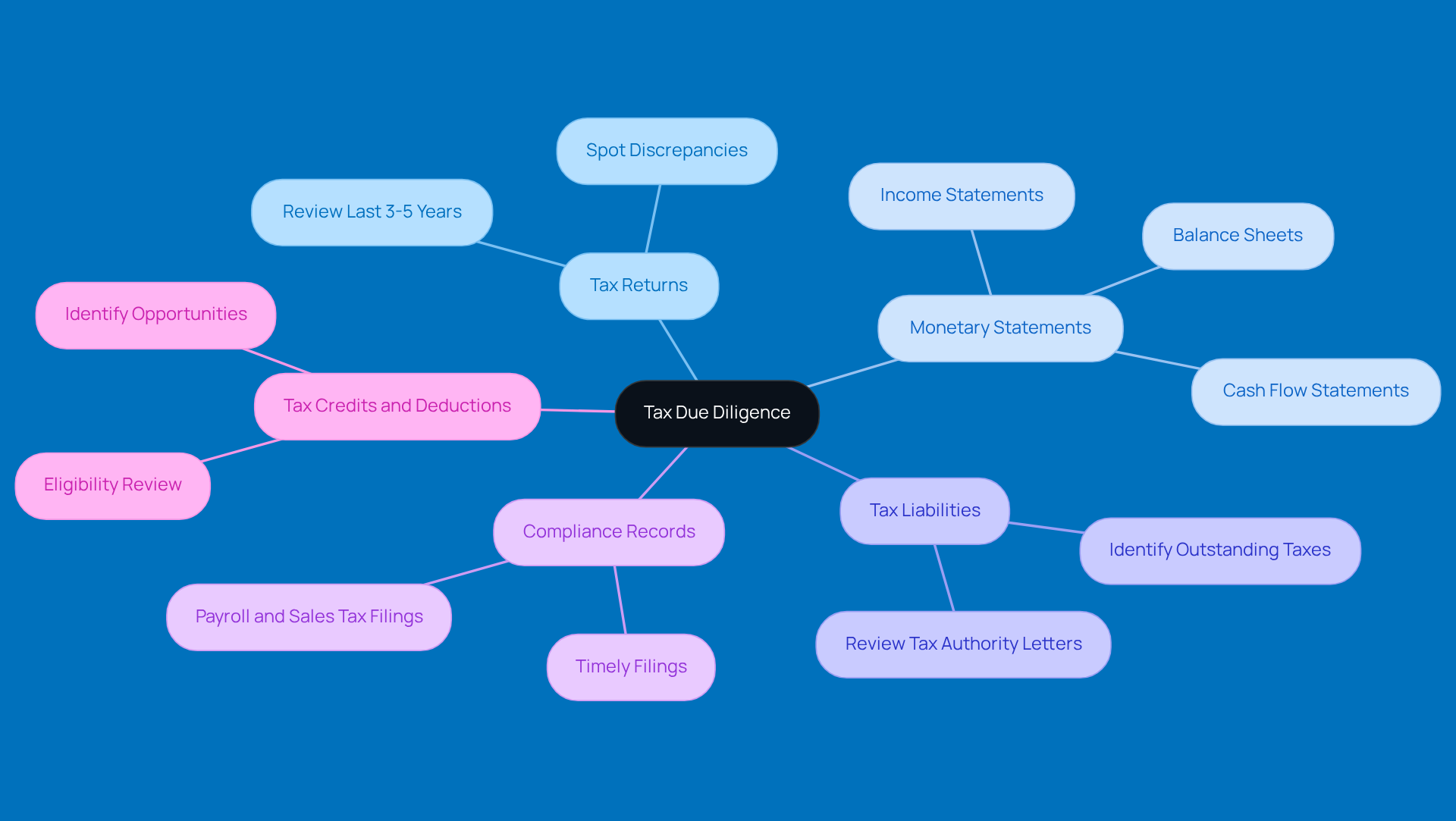

When it comes to tax due diligence, small agency owners should really zero in on a few key components:

- Tax Returns: First off, take a good look at your federal, state, and local tax returns from the last three to five years. This isn’t just busywork; it helps you spot any discrepancies and makes sure you’re on the right side of tax obligations.

- Monetary Statements: Next up, dive into those income statements, balance sheets, and cash flow statements. They’ll give you a clear picture of your business’s financial health. Understanding where you stand economically is crucial, especially when it comes to spotting potential risks.

- Tax Liabilities: Don’t forget about tax liabilities! Identifying any outstanding taxes or potential exposures is a big deal. Make sure to review any letters from tax authorities that might hint at unresolved issues.

- Compliance Records: Keeping all your tax filings complete and timely is vital. This includes payroll and sales tax filings, which often get a closer look during audits.

- Tax Credits and Deductions: Lastly, check out your eligibility for any tax credits or deductions. These can really make a difference in your financial outcome, so be on the lookout for opportunities to lighten your tax load.

Looking ahead to 2026, best practices for tax evaluations stress the importance of keeping thorough records and doing regular check-ups. Typically, small businesses hang onto tax documents for about three to five years, just like the IRS suggests. As industry experts say, "A systematic approach to reviewing tax documents not only ensures compliance but also uncovers potential savings and obligations that could shape your business's future." By focusing on these components, small agency owners can tackle the complexities of the tax due diligence checklist with confidence.

Utilize a Comprehensive Tax Due Diligence Checklist

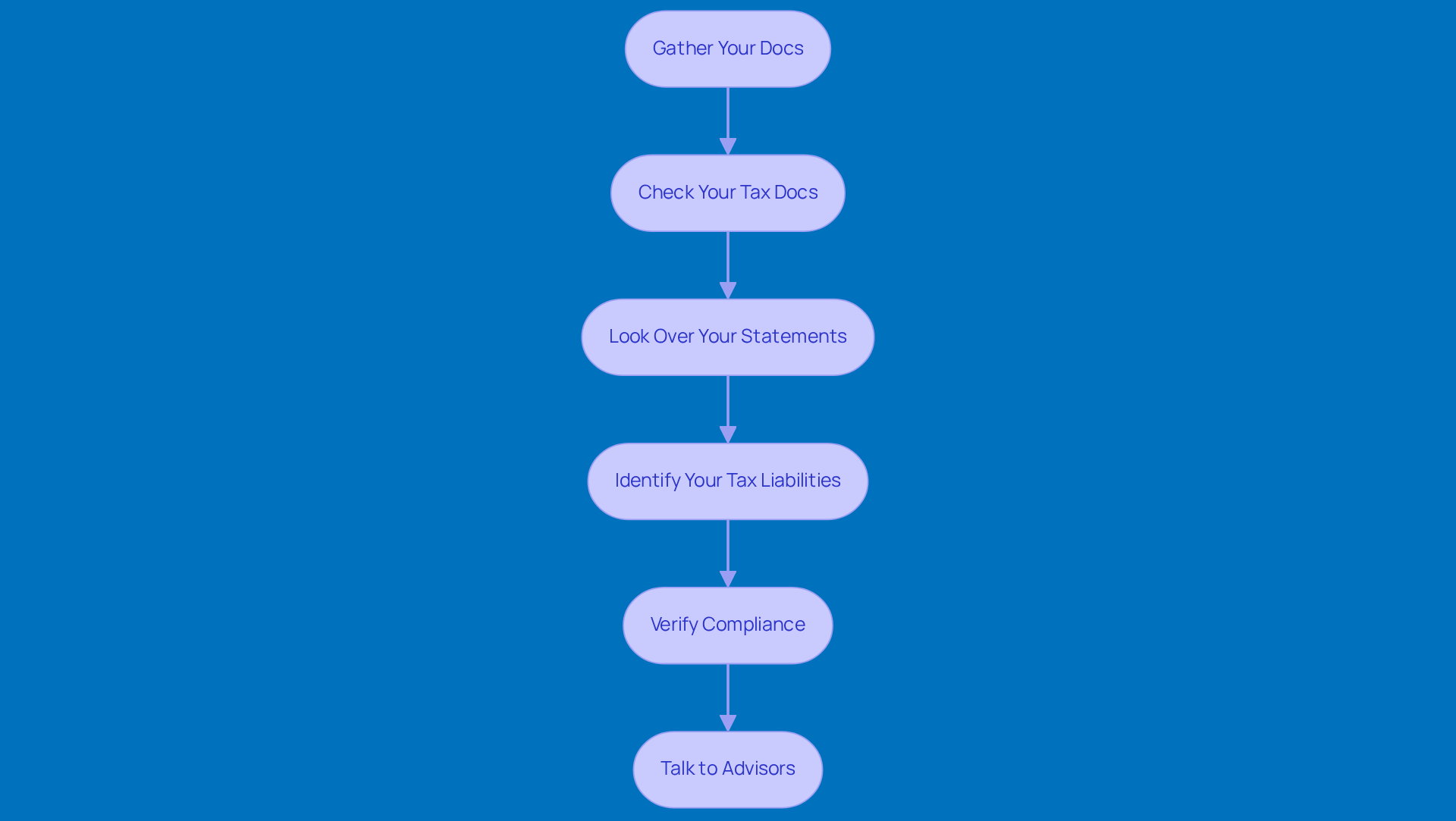

If you're a small agency owner looking to tackle tax due diligence, here's a handy checklist to guide you through the process:

-

Gather Your Docs: Start by collecting all your important tax papers - think submissions, account statements, and compliance records. Keeping everything organized is key; it can really help lower your chances of an audit.

-

Check Your Tax Docs: Make sure all your tax documents are accurate and submitted on time. Did you know that less than 1% of tax returns get examined each year? Still, any discrepancies can raise eyebrows, especially for small businesses like yours.

-

Look Over Your Statements: Take a close look at your statements for any odd transactions or discrepancies. Spotting inconsistencies early on can save you a lot of headaches down the road during audits.

-

Identify Your Tax Liabilities: Make a list of any outstanding tax obligations and think about how they might impact your business. Knowing what you owe is crucial for making smart decisions and managing risks.

-

Verify Compliance: Double-check that you’re meeting all your tax obligations, including payroll and sales tax. Falling behind can lead to hefty penalties, so it’s super important to stay on top of your responsibilities.

-

Talk to Advisors: Don’t hesitate to reach out to tax professionals to go over your findings. Getting expert advice can help you refine your tax strategies and lower your audit risks, which is a win for your overall compliance and financial health.

So, how does your tax prep stack up? Remember, using a tax due diligence checklist will help you stay organized and informed for a smooth tax season!

Recognize Common Red Flags

Hey there, small agency owners! Let’s chat about some common red flags to keep an eye out for while using the tax due diligence checklist. Trust me, staying alert can save you a lot of headaches down the road.

First up, we have Unfiled Tax Returns. If you’re missing or late on your tax returns, it might signal some deeper issues within your business. Late filings and payments can raise red flags, hinting at noncompliance or cash flow problems. Plus, if you consistently fail to file, the IRS might start taking a closer look at your finances. And let’s not forget about those underpayment penalties - they can really add up if you don’t pay enough of your tax liability throughout the year.

Next, let’s talk about Discrepancies in Income Reporting. If there are significant differences between what you report and what third parties, like W-2s and 1099s, show, you could be inviting an audit. The IRS gets copies of all those forms, so make sure you’re reporting everything accurately. They cross-check these figures, and any mismatches could lead to automatic notices or bills. Yikes! Addressing these issues promptly is key to avoiding underpayment penalties outlined in the tax due diligence checklist.

Now, onto High Deductions. If your deductions seem excessive compared to your income, tax authorities might start raising their eyebrows. For example, claiming huge charitable contributions or home office expenses that don’t match your reported income can lead to increased scrutiny. It’s especially true if those deductions are way above industry norms. Just think about it - wouldn’t you want to avoid the IRS knocking on your door?

Another thing to watch out for is Frequent Amendments. If you find yourself regularly modifying tax documents, it might indicate past inaccuracies or attempts to fix mistakes. This pattern can catch the IRS’s attention, suggesting you might not have a solid grasp on your record-keeping or tax obligations. Understanding the IRS’s audit process can help ease your stress during these situations.

Lastly, let’s discuss Inconsistent Monetary Records. If there are mismatches between your monetary statements and tax filings, it could signal potential problems. For instance, if you report substantial income on your tax documents but show losses in your statements, that’s a red flag. Keeping accurate and consistent records is crucial to avoid complications during audits. Remember, contemporaneous records hold much more weight than reconstructed ones. And hey, knowing your rights during an audit can really help you navigate the process more smoothly.

So, keep these red flags in mind, and you’ll be better prepared to tackle tax season with confidence!

Engage External Advisors for Expertise

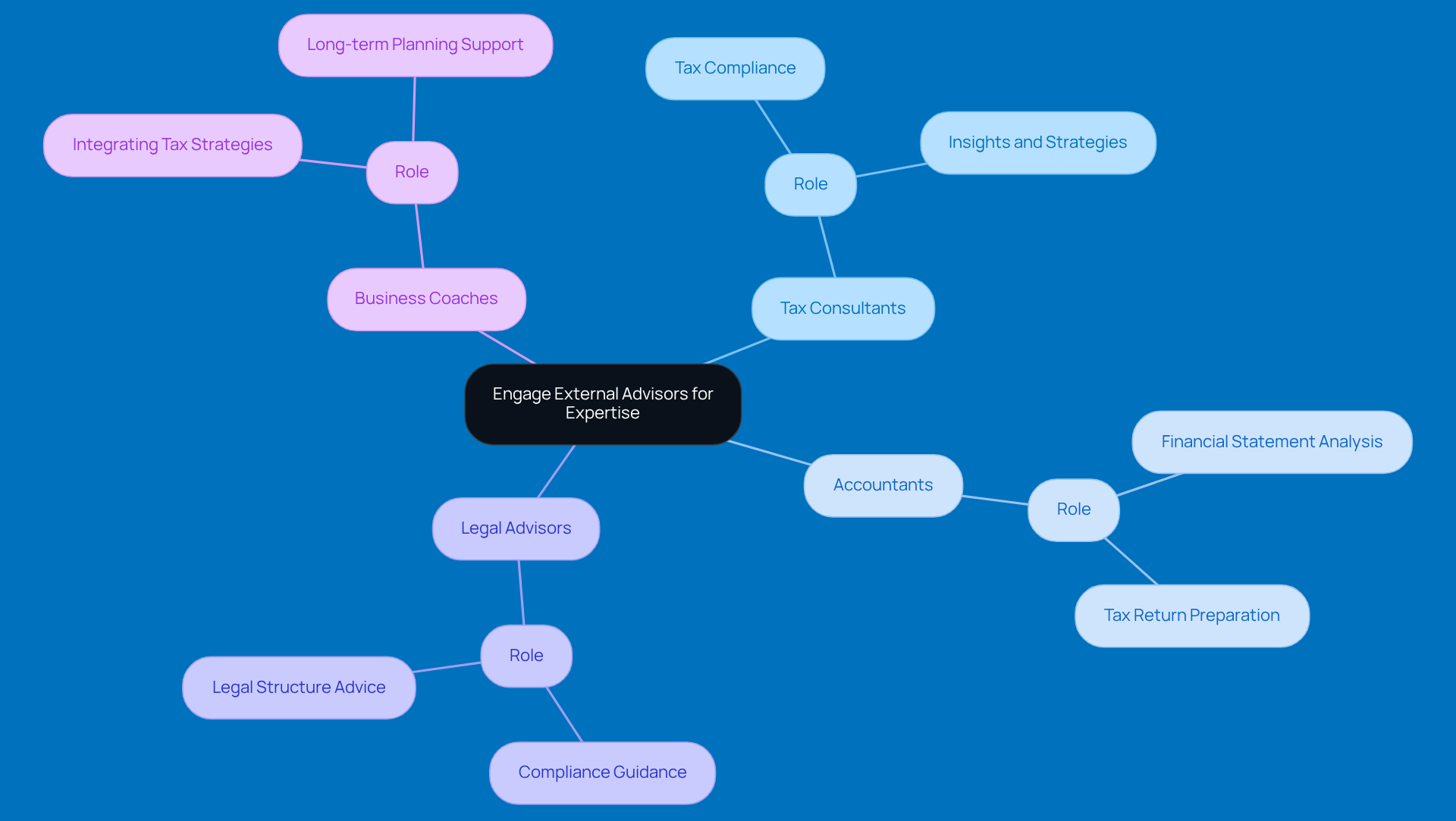

If you're a small agency owner looking to enhance your tax due diligence checklist, it might be time to consider bringing in some external advisors. Here are a few you might want to consider:

- Tax Consultants: These folks are all about tax compliance. They can provide insights and strategies that really fit your business's needs. Their expertise is key when it comes to navigating the tricky world of tax regulations and making the most of your deductions.

- Accountants: Certified public accountants (CPAs) are your go-to for analyzing financial statements and preparing tax returns. With their deep understanding of tax laws, they ensure your filings are spot on and can help you uncover potential savings.

- Legal Advisors: If you’re dealing with complex regulations, having an attorney who specializes in tax law is a must. They can guide you through compliance issues and help you choose the right legal structures to minimize risks related to tax liabilities.

- Business Coaches: Coaches can help weave tax strategies into your overall business planning. This way, your financial decisions can align with your long-term goals. Plus, their support can keep you focused on growth while you manage your tax obligations.

Bringing these external advisors on board not only boosts your compliance game but also helps you develop a tax due diligence checklist for long-term financial success. As the tax landscape keeps changing, having a team of experts can give you the strategic insights you need to thrive in a competitive market. So, why not consider reaching out to some of these professionals? It could make all the difference!

Conclusion

Tax due diligence is super important for small agency owners. It’s all about taking a good look at your tax compliance and obligations. By using a structured tax due diligence checklist, you can stay on top of your tax responsibilities, spot potential risks, and make sure you’re following the rules. This proactive approach not only helps you dodge penalties and legal headaches but also boosts your business's financial health.

In this article, we’ve highlighted some key components to review, like:

- Tax returns

- Financial statements

- Tax liabilities

- Compliance records

- Eligibility for tax credits

Each of these elements is crucial for keeping you compliant and finding potential savings. Plus, being aware of common red flags - like unfiled returns, income reporting discrepancies, and excessive deductions - can help you steer clear of unwanted scrutiny and penalties.

Let’s be real: the importance of tax due diligence can’t be stressed enough. As tax regulations change, it’s essential for small agency owners to prioritize their tax compliance efforts. This way, you can navigate the complexities effectively and grab opportunities for growth. Engaging with external advisors, like tax consultants and accountants, can really enhance your due diligence process. They provide valuable insights and strategies tailored to your specific business needs. By taking these steps, you’re not just ensuring compliance; you’re setting your agency up for long-term success in a competitive market. So, what are you waiting for? Let’s get started on that checklist!

Frequently Asked Questions

What is tax due diligence?

Tax due diligence involves examining an entity's tax compliance and obligations using a checklist. This process includes reviewing past tax documents, understanding current tax responsibilities, and ensuring alignment with relevant tax regulations.

Why is tax due diligence important for small agency owners?

Tax due diligence is crucial for small agency owners as it helps in spotting risks, dodging penalties, and staying compliant with tax authorities. It can prevent unexpected liabilities and ensure smooth business operations.

What potential risks can tax due diligence help identify?

Tax due diligence can uncover risks such as unsubmitted state income tax forms, which could lead to hefty tax bills and disrupt business operations.

How can tax due diligence help avoid penalties?

By catching tax compliance issues early using a checklist, small agencies can avoid penalties that may arise from discrepancies, which can be as high as 40% of the difference in tax owed.

What impact does tax due diligence have on mergers and acquisitions?

Tax due diligence can affect 30% to 40% of the total deal finances in mergers and acquisitions, leading to better negotiations and more favorable deal structures.

What key components should small agency owners review during tax due diligence?

Small agency owners should focus on tax returns, monetary statements, tax liabilities, compliance records, and tax credits and deductions.

How far back should small agency owners review their tax returns?

Owners should review their federal, state, and local tax returns from the last three to five years to identify discrepancies and ensure compliance.

Why is it important to review monetary statements during tax due diligence?

Reviewing income statements, balance sheets, and cash flow statements provides a clear picture of the business's financial health and helps in spotting potential risks.

What should be done regarding tax liabilities during tax due diligence?

It is essential to identify any outstanding taxes or potential exposures and review any correspondence from tax authorities regarding unresolved issues.

What is the recommended record-keeping duration for tax documents?

Small businesses should typically retain tax documents for about three to five years, in line with IRS recommendations.