Introduction

Running a small business in a rural area? You’re not alone in facing some pretty unique challenges that can make managing your finances a bit tricky. That’s why effective tax planning is crucial for your success. By tapping into tailored CPA strategies, you can navigate those complex regulations, keep your cash flow healthy, and boost your profits.

But let’s be real - tax laws are always changing, and the last thing you want is to get hit with penalties. So, how can you make sure you’re not just compliant but also maximizing your financial health? In this article, we’ll dive into some essential tax planning strategies specifically designed for rural small businesses. Get ready for insights that can help you thrive in today’s competitive landscape!

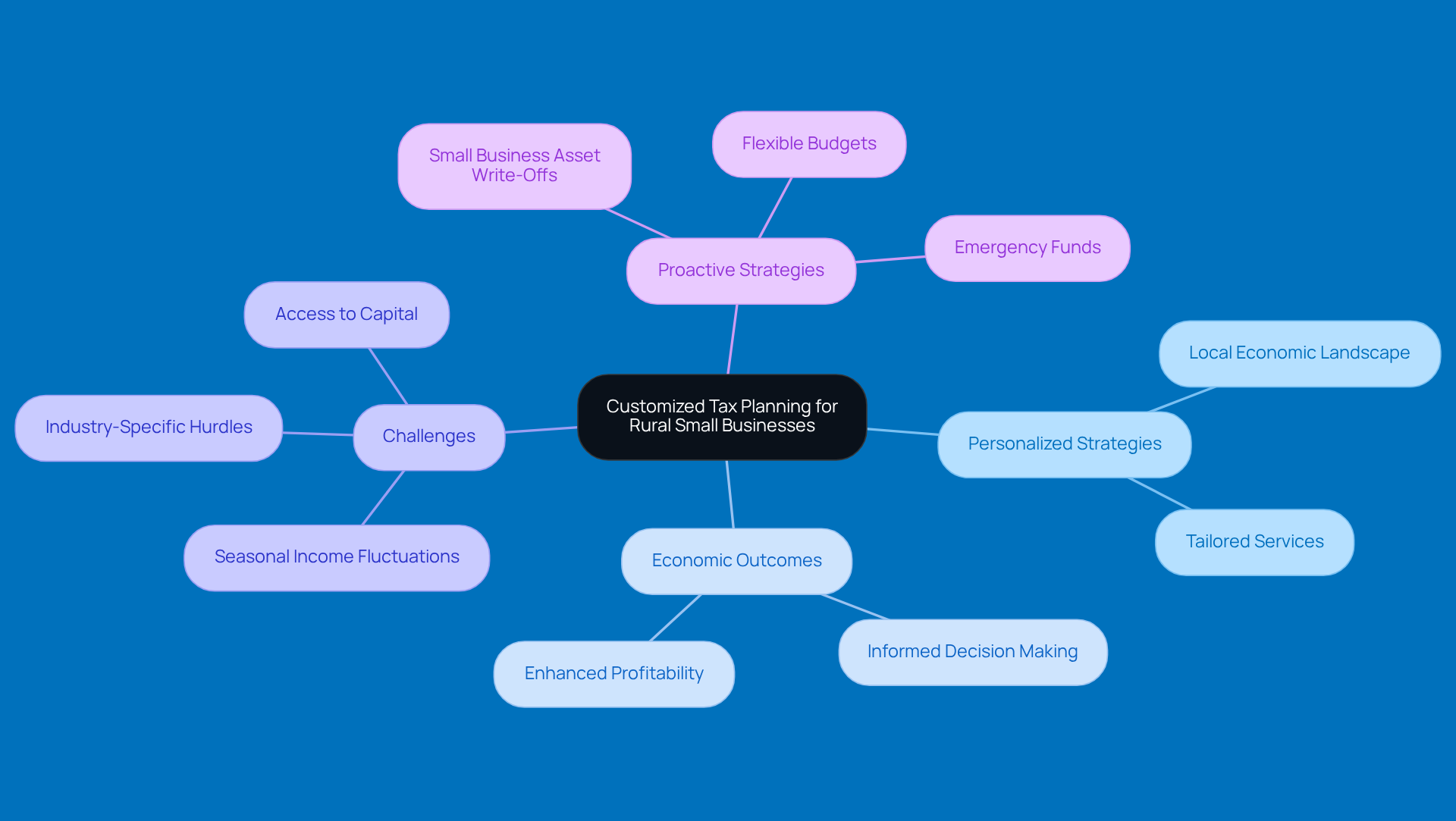

Steinke and Company: Customized Tax Planning for Rural Small Businesses

Steinke and Company really shines when it comes to crafting personalized tax planning CPA strategies that tackle the unique challenges faced by rural small businesses. They get the local economic landscape and understand what their clients truly need. This means they offer tailored services that help entrepreneurs navigate the complexities of tax regulations without losing sight of their core values.

But it’s not just about compliance; this personalized approach also boosts economic outcomes. Clients can make informed decisions that enhance their profitability. For rural enterprises, working with a tax planning CPA is crucial, especially since they often deal with seasonal income fluctuations and specific industry hurdles.

By adopting proactive strategies - like taking advantage of small business asset write-offs and creating flexible budgets - rural entrepreneurs can really improve their financial health and sustainability. In a competitive environment, customized tax planning CPA services are essential for these entrepreneurs, enabling them to focus on what they do best while confidently managing their tax obligations.

So, if you’re a rural entrepreneur, consider how a tax planning CPA can make a difference for you. It’s all about keeping your business thriving while you handle the numbers!

Cash Flow Optimization: Leveraging Tax Deductions and Credits

Enhancing cash flow is super important for rural small businesses, and a tax planning CPA can really help by tapping into available tax deductions and credits. Have you heard about the Qualified Income (QBI) deduction? It lets eligible taxpayers deduct up to 20% of their qualified earnings! Plus, understanding and using available tax credits through a tax planning CPA can give your cash flow a nice boost, offering some much-needed financial relief.

At Steinke and Company, we’re all about making tax season smooth, accurate, and stress-free. We prepare and file your commercial and personal returns, ensuring compliance and minimizing surprises. Our proactive tax planning CPA means you won’t have to panic at the deadline, allowing you to focus on growing your business instead.

Also, getting a grip on the different accounting methods - cash, accrual, and hybrid - can help you choose the best approach for your needs. This way, you can keep your finances healthy while improving your tax planning CPA. So, why not take a moment to think about how these tips could work for you?

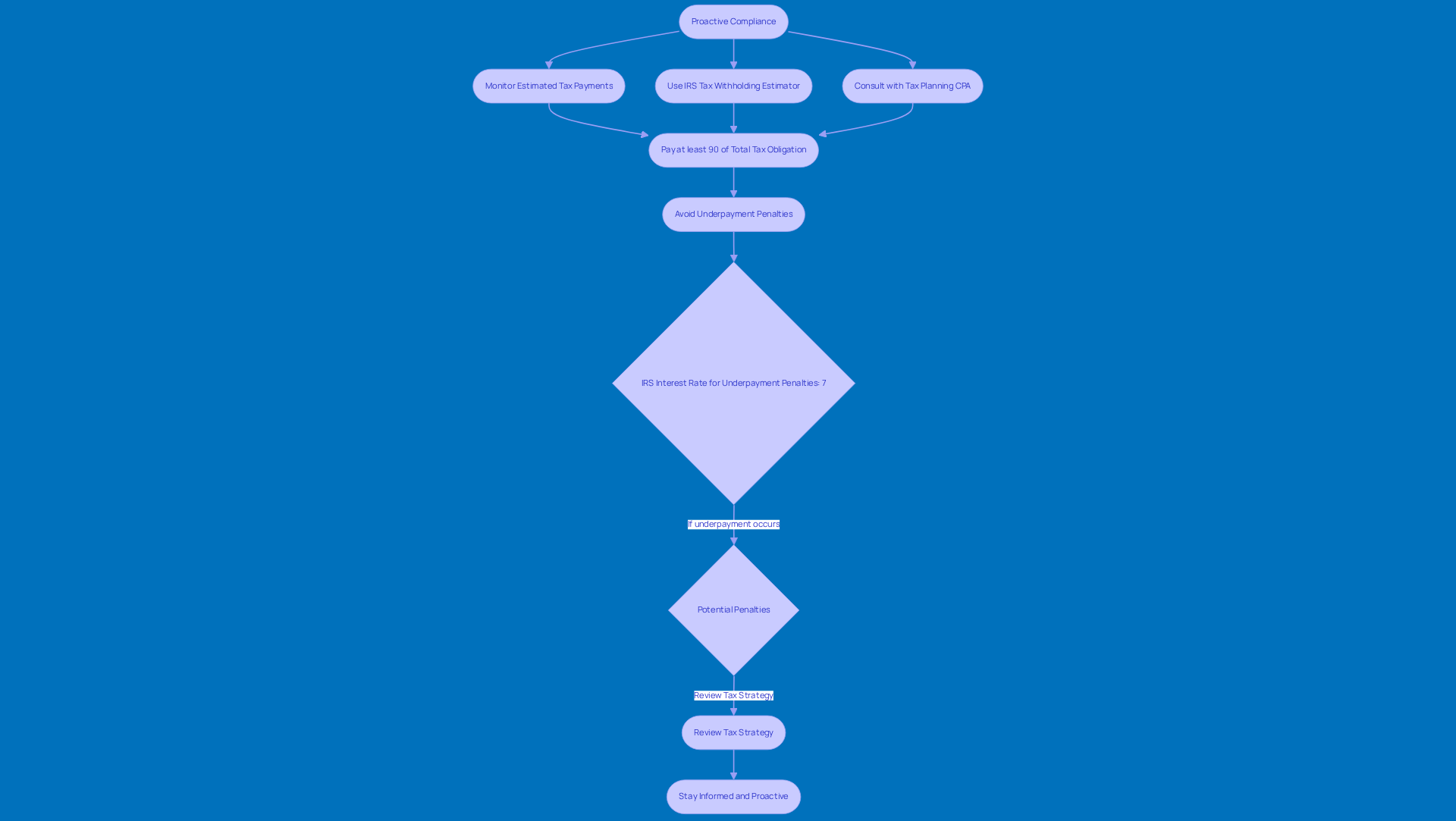

Proactive Compliance: Avoiding Underpayment Penalties and IRS Fees

Hey there! If you’re running a small business in a rural area, staying on top of your tax game is super important. Proactive compliance can save you from those pesky underpayment penalties and IRS charges that can really hit your wallet hard. So, what’s the deal? Well, it’s all about keeping an eye on those estimated tax payments. Aim to pay at least 90% of your total tax obligation for the year to dodge any penalties.

Now, let’s talk tools! The IRS Tax Withholding Estimator is a handy resource that can help you figure out your withholding amounts and make any necessary tweaks. Plus, don’t underestimate the power of chatting with a tax planning CPA. Regular consultations with a tax planning CPA can provide you with valuable insights into compliance strategies, making it easier to navigate the sometimes tricky world of tax obligations.

And here’s a little nugget of info: in 2025, the IRS interest rate for underpayment penalties is set at 7%. That’s a pretty clear reminder of how costly non-compliance can be! By staying informed and proactive, you can significantly cut down on the risk of penalties and keep your financial operations running smoothly. So, why not take a moment to review your tax strategy today?

Retirement Income Strategies: Maximizing After-Tax Income for Business Owners

For rural small business owners, maximizing after-tax income is key when gearing up for retirement, and consulting a tax planning CPA can help achieve this. Contributing to a Simplified Employee Pension (SEP) IRA or a Solo 401(k) can bring some serious tax perks while also building up those retirement savings.

With a SEP IRA, you can contribute up to 25% of your earnings, capped at $66,000 for 2023. That makes it a pretty attractive option for small businesses looking to boost their tax efficiency through a tax planning CPA. On the flip side, the Solo 401(k) offers even higher contribution limits, letting you contribute as both an employee and an employer. If you’re over 50, you could potentially reach up to $73,500! This dual contribution feature can really ramp up your retirement savings while trimming down your taxable income.

Now, let’s talk about why these contributions matter for rural entrepreneurs. They often face unique financial challenges, so understanding how to time withdrawals and the tax implications of different retirement accounts can really help optimize income during retirement. For example, using a SEP IRA might lower your taxable income in those high-earning years, while a Solo 401(k) gives you flexibility in managing distributions, making tax-efficient withdrawals a breeze.

When it comes to investments, small business owners should definitely consider mutual funds to diversify their portfolios, but keep an eye on those tax implications. Good recordkeeping is crucial; keeping accurate transaction records can save you from tax surprises down the line. Timing your withdrawals and understanding the tax consequences of various retirement accounts can further enhance your income during retirement with guidance from a tax planning CPA. For instance, selling mutual fund shares after holding them for over a year can help you dodge short-term capital gains taxes, boosting your after-tax income.

Real-life examples really bring these strategies to life. Picture a rural contractor who contributes the max to a SEP IRA - this could significantly lower their taxable income, leading to higher after-tax income that can be reinvested into the business or saved for retirement. Similarly, a farmer using a Solo 401(k) can take advantage of both employee and employer contributions to maximize retirement savings while keeping their tax burden in check.

In conclusion, understanding the tax benefits of SEP IRAs and Solo 401(k)s, along with smart mutual fund strategies, is super important for rural entrepreneurs seeking guidance from a tax planning CPA to enhance their financial stability and secure a comfortable retirement. These retirement accounts not only provide immediate tax benefits but also support long-term financial health, allowing you to focus on your business and community.

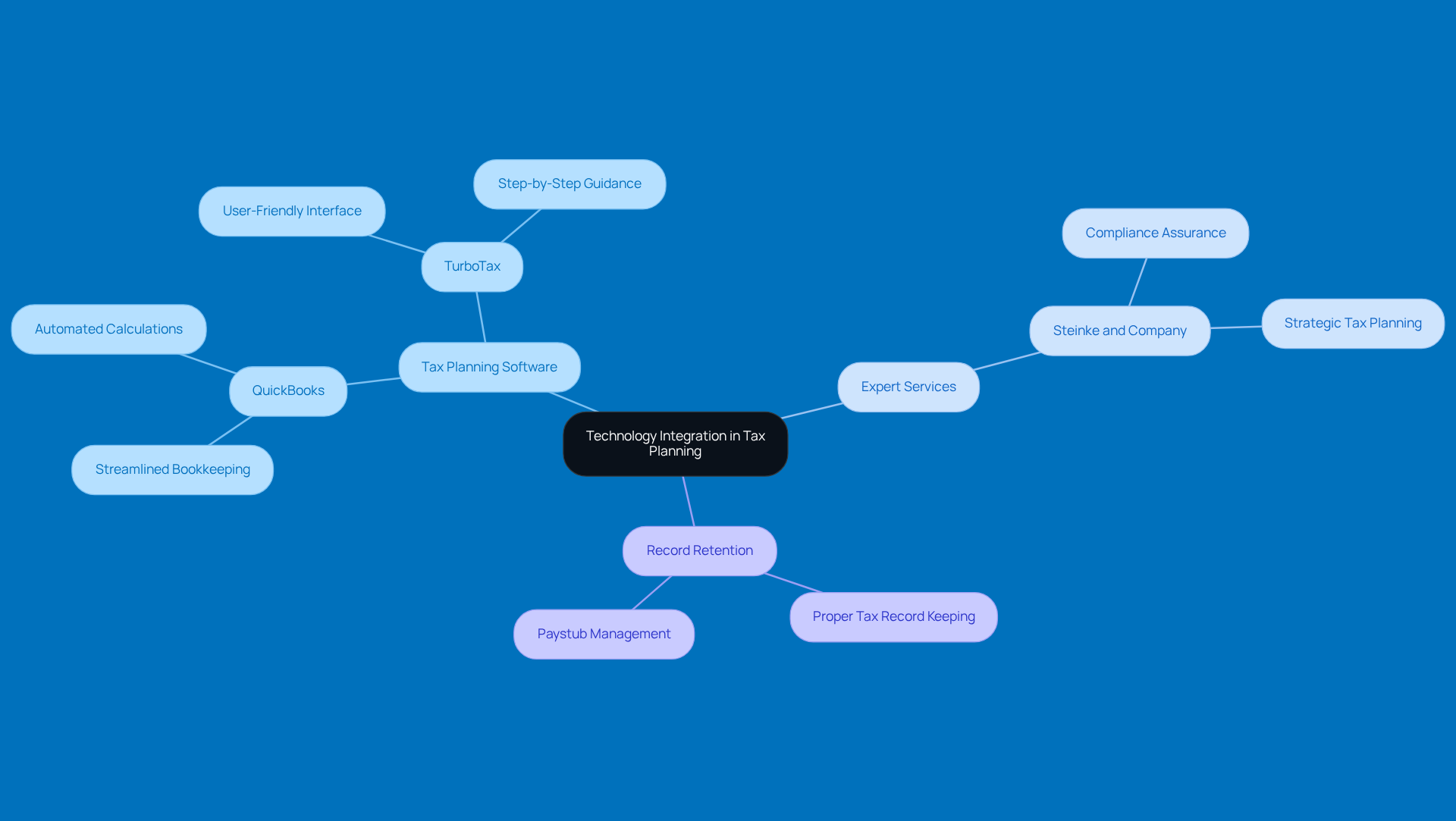

Technology Integration: Utilizing Tax Planning Software for Efficiency

Integrating tax planning CPA software can really boost how efficiently rural small businesses handle their taxes. Tools like QuickBooks and TurboTax make bookkeeping and tax filing a breeze. By automating those pesky calculations and keeping everything organized, entrepreneurs can save time and reduce the risk of mistakes. This means they can focus more on growing their business instead of getting bogged down in paperwork.

And let’s not forget about expert tax preparation services, like those offered by Steinke and Company. They help ensure compliance and keep those tax season surprises at bay. With a focus on strategy, Steinke and Company helps clients dodge budgeting pitfalls and achieve success. It’s crucial for small agency owners to understand just how important fiscal and tax planning CPA really is.

Plus, getting a grip on paystubs and maintaining proper tax record retention is key for economic stability and compliance. This just underscores why incorporating these strategies into their operations is so vital. So, have you thought about how a tax planning CPA could change the game for your business?

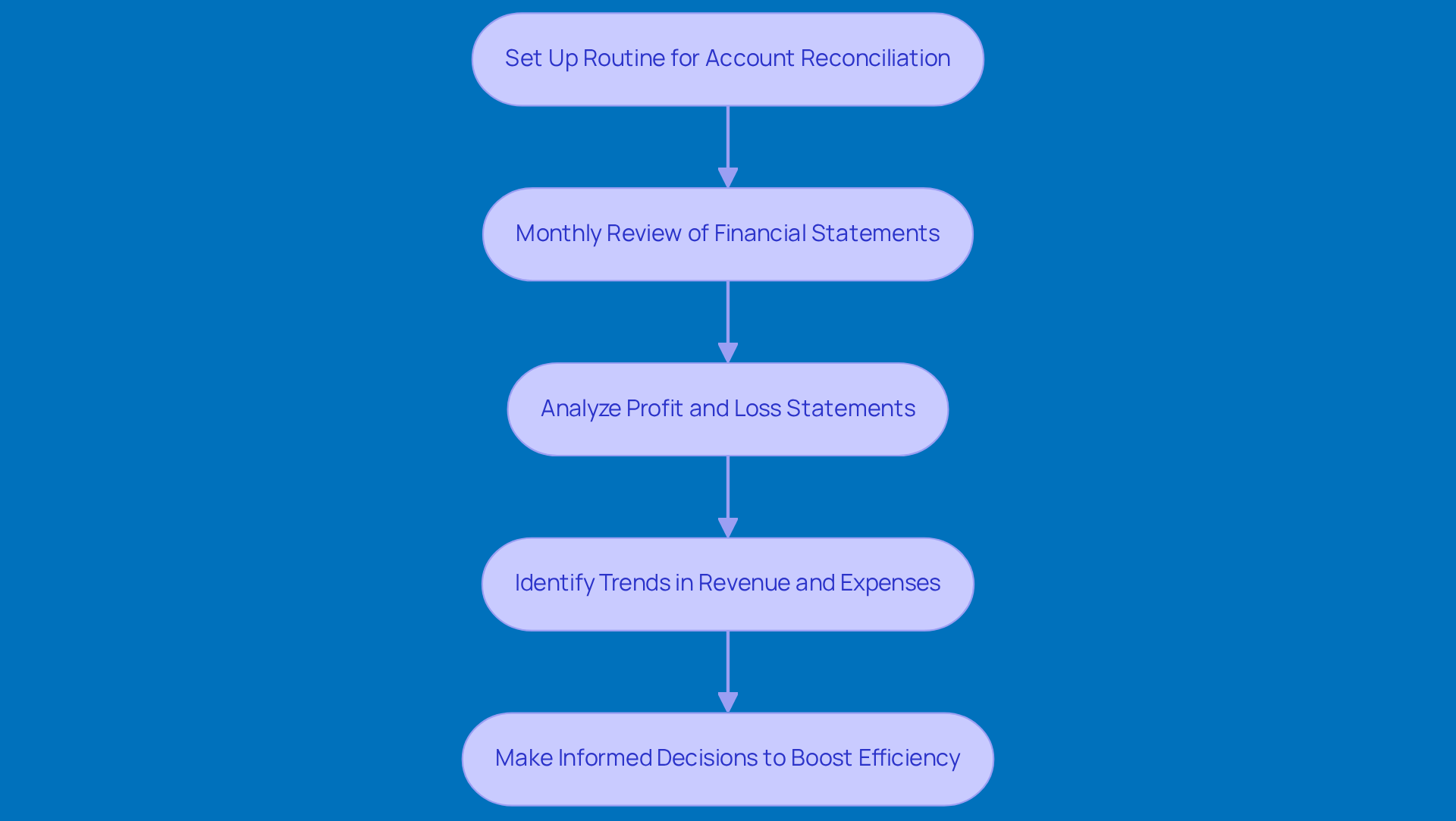

Regular Financial Oversight: Keeping Books Clean and Current

Regular fiscal supervision is super important for rural small businesses to keep their records accurate and up-to-date. Setting up a routine for reconciling accounts and reviewing statements every month not only helps with compliance but also gives you valuable insights into cash flow and profitability. This proactive approach lets entrepreneurs make informed decisions, which can really boost their operational efficiency and overall financial health.

For instance, businesses that regularly analyze their Profit and Loss (P&L) statements can spot trends in revenue and expenses, helping them tweak their strategies effectively. Plus, with the IRS changing tax brackets and deductions each year based on inflation, having a tax planning CPA to keep track of your records is even more crucial for maximizing those tax savings. By focusing on monthly financial assessments, small business leaders can get a clearer picture of their financial status, keep an eye on key performance metrics, and make necessary adjustments to encourage growth.

Business Coaching: Bridging the Gap Between Numbers and Growth

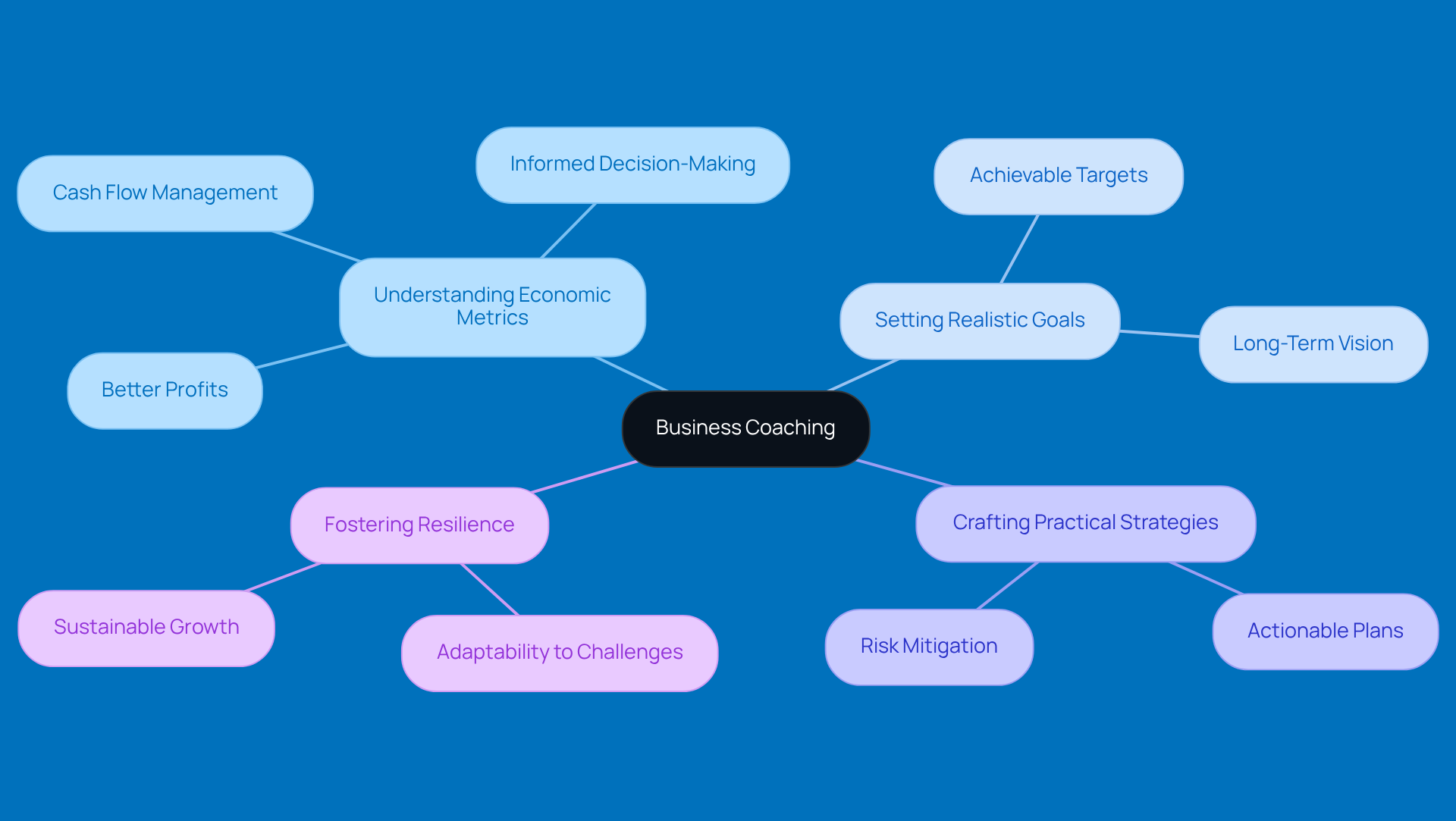

Coaching in commerce is like a bridge connecting economic data to business growth, especially for rural entrepreneurs. Coaches help these entrepreneurs get a grip on economic metrics, making it easier for them to set realistic goals and craft practical strategies to achieve them. This deeper understanding of economic performance not only aids in making informed decisions but also encourages sustainable growth.

For instance, with tailored coaching programs, rural entrepreneurs have skillfully navigated complex economic landscapes, leading to better profits and smoother operations. By blending economic insights with strategic planning, coaching turns those numbers into a clear roadmap for success. This approach fosters resilience and adaptability in their businesses, making them better equipped to face challenges.

So, if you're a rural entrepreneur looking to thrive, consider how coaching could help you make sense of your economic data and turn it into actionable steps for your business!

Strategic Partnerships: Collaborating with CPAs for Effective Tax Strategies

Teaming up with a tax planning CPA can significantly enhance the effectiveness of tax strategies for rural small businesses. When entrepreneurs form a strategic alliance with a tax planning CPA, they tap into expert advice on compliance and financial management. Plus, keeping the lines of communication open with a tax planning CPA means entrepreneurs stay in the loop about any changes in tax laws and can adjust their strategies as needed.

Have you ever thought about how much easier tax season could be with a little help? Imagine having someone in your corner who knows the ins and outs of tax regulations. It’s like having a trusted guide on a tricky journey! So, why not consider reaching out to a CPA? They can help you navigate the complexities of your tax situation with the expertise of a tax planning CPA to ensure you're making the most of it.

Tax Law Awareness: Staying Updated on Changes Affecting Small Businesses

Staying in the loop about tax law changes is super important for rural small businesses. It helps them stay compliant and fine-tune their tax strategies. So, what can entrepreneurs do? Well, subscribing to industry newsletters, attending workshops, and chatting with tax experts regularly can keep them updated on new regulations and opportunities.

Understanding changes like the One Big Beautiful Bill provisions can really help entrepreneurs make smart adjustments to their tax planning CPA. Plus, with the recent drop of the 1099-K reporting threshold to just $600, it’s crucial for small business owners and gig economy folks to keep detailed records of their transactions and expenses. This not only helps with compliance but also gets them ready for any potential IRS audits.

And let’s be honest, when it comes to an audit, having organized documentation can take a load off your shoulders and make the whole process smoother. Engaging with a tax planning CPA can also provide valuable guidance on navigating these complexities and ensuring that all tax obligations are met efficiently. So, why not take that step? It could save you a lot of hassle down the road!

Personalized Tax Planning: Tailoring Strategies to Individual Business Needs

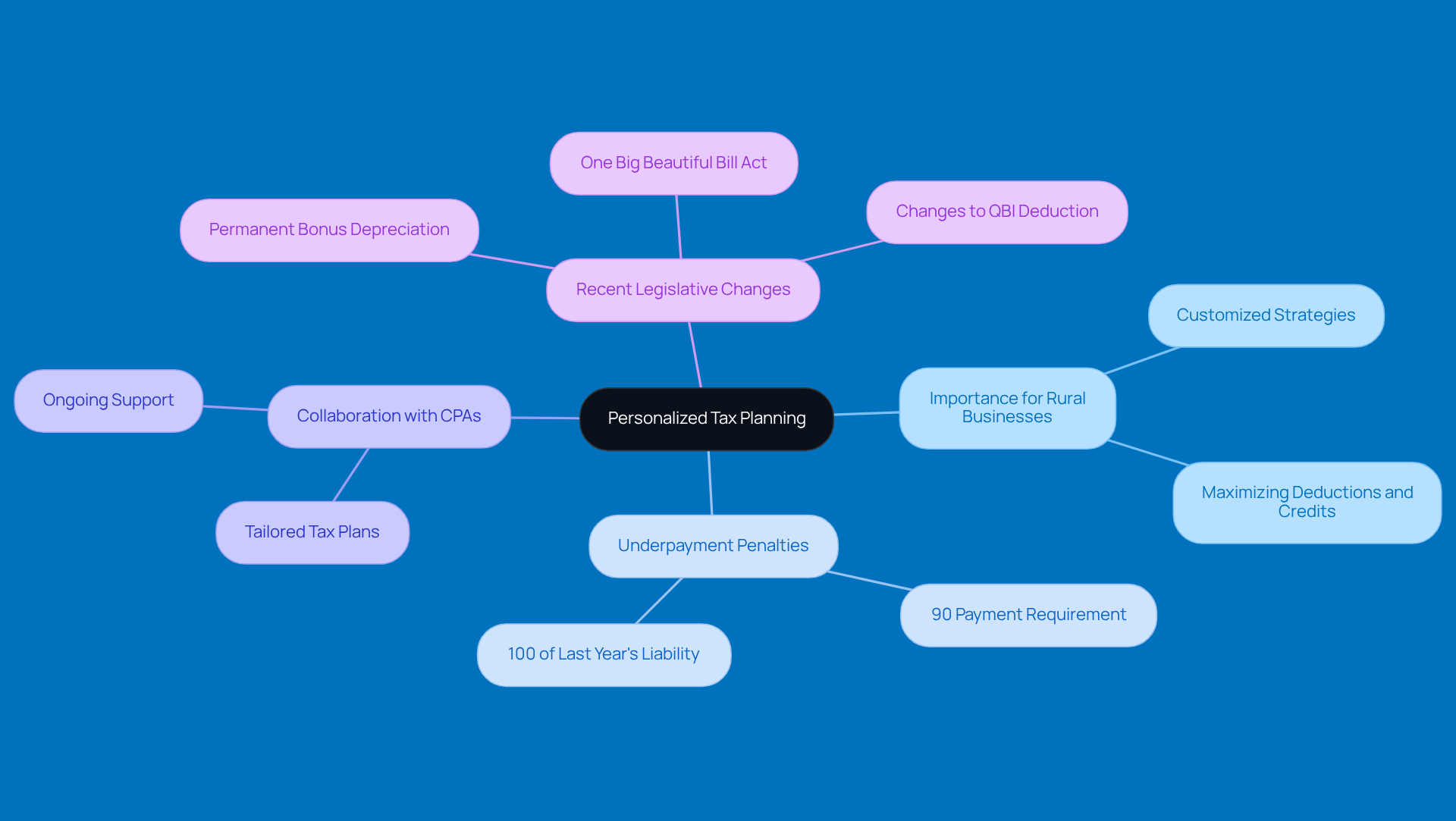

Tailored tax planning CPA is super important for rural small businesses to manage their tax responsibilities effectively, especially when it comes to those pesky underpayment penalties. Every business is unique, so it’s crucial to customize strategies to fit individual circumstances. Entrepreneurs should collaborate with a tax planning CPA to create plans that take into account their specific financial situations, goals, and industry trends.

Now, let’s talk about underpayment penalties. Did you know that the IRS expects taxpayers to pay at least 90% of their current year’s tax liability or 100% of what they owed last year to dodge those penalties? This tailored approach helps entrepreneurs maximize deductions and credits while collaborating with a tax planning CPA to stay on the right side of tax regulations.

A recent study found that 82% of managed account sponsors see improving tax management as a top priority. That really highlights how vital tailored strategies are! As Aaron Borden, a partner in Private Wealth Services, points out, finding solutions to complex tax issues is key for entrepreneurs and business leaders.

With the recent changes from the One Big Beautiful Bill Act, rural businesses need to adjust their tax planning CPA strategies to keep up with the shifting landscape. By honing in on specific needs and understanding the ins and outs of underpayment penalties - like safe harbor payments and the de minimis exception - rural business owners can use customized tax strategies to boost their financial health and support long-term growth. So, what’s your plan for tackling your tax strategy this year?

Conclusion

Steinke and Company really gets how crucial customized tax planning CPA strategies are for rural small businesses. This personalized touch not only helps entrepreneurs tackle those tricky tax regulations but also boosts their financial health and sustainability. When rural business owners team up with a tax planning CPA, they can zero in on what they do best while keeping their tax obligations in check.

So, what are some key takeaways from the article? Well, there are several strategies that can make a real difference for rural entrepreneurs. Think about:

- Optimizing cash flow through tax deductions and credits

- Staying ahead of compliance to dodge penalties

- Using retirement income strategies to make the most of after-tax income

- Integrating technology and having regular financial check-ins to streamline operations and sharpen decision-making

With all this in mind, rural small business owners should definitely consider taking proactive steps in their tax planning. Partnering with a tax planning CPA can bring in the expertise needed to navigate the ever-changing tax landscape, ensuring compliance and maximizing financial opportunities. By embracing these essential strategies, rural enterprises can secure their financial future and truly thrive in their communities.

Frequently Asked Questions

What services does Steinke and Company offer for rural small businesses?

Steinke and Company provides customized tax planning CPA strategies specifically tailored to the unique challenges faced by rural small businesses, helping them navigate tax regulations while enhancing profitability.

Why is tax planning important for rural entrepreneurs?

Tax planning is crucial for rural entrepreneurs due to seasonal income fluctuations and specific industry challenges. It allows them to make informed decisions that improve their financial health and sustainability.

How can rural small businesses improve their financial health through tax planning?

By adopting proactive strategies such as taking advantage of small business asset write-offs and creating flexible budgets, rural entrepreneurs can enhance their financial health and sustainability.

What is the Qualified Income (QBI) deduction?

The Qualified Income (QBI) deduction allows eligible taxpayers to deduct up to 20% of their qualified earnings, which can significantly boost cash flow for rural small businesses.

How does Steinke and Company assist during tax season?

Steinke and Company prepares and files both commercial and personal tax returns, ensuring compliance and minimizing surprises, making tax season smoother and less stressful for clients.

What accounting methods should rural businesses consider for effective tax planning?

Rural businesses should consider different accounting methods such as cash, accrual, and hybrid, to choose the best approach for their financial needs and improve their tax planning.

What are the benefits of proactive compliance for small businesses?

Proactive compliance helps small businesses avoid underpayment penalties and IRS fees by ensuring that they pay at least 90% of their total tax obligation for the year.

What tools can help small businesses manage their tax obligations?

The IRS Tax Withholding Estimator is a useful tool for determining withholding amounts, and regular consultations with a tax planning CPA can provide valuable insights into compliance strategies.

What is the IRS interest rate for underpayment penalties in 2025?

The IRS interest rate for underpayment penalties is set to be 7% in 2025, highlighting the potential costs of non-compliance.

How can rural entrepreneurs stay informed about their tax strategy?

By staying informed and proactive, including regular reviews of their tax strategy and consultations with a tax planning CPA, rural entrepreneurs can reduce the risk of penalties and maintain smooth financial operations.