Overview

Finding the right accountant for your small business can feel like a daunting task, but it doesn't have to be! Start by thinking about your specific accounting needs, the expertise of the accountant, and how well they communicate. A good tip?

- Take the time to evaluate their credentials and experience.

- See if you vibe with them.

This can really set the stage for a fruitful partnership that boosts your business's financial health and makes operations run smoother. So, are you ready to find that perfect match?

Introduction

Navigating the financial landscape of a small business can feel a bit overwhelming, right? Especially when you consider the vital role an accountant plays. These financial pros do so much more than just crunch numbers; they offer essential services that can really make a difference in your business's success.

As small business owners, the goal is to optimize financial strategies, but finding the right accountant can be tricky. You want someone who not only meets your specific needs but also clicks with your business goals.

So, what should you keep in mind when starting this search? And how can you ensure you pick a partner who will support your long-term growth?

Understand the Role of an Accountant for Small Businesses

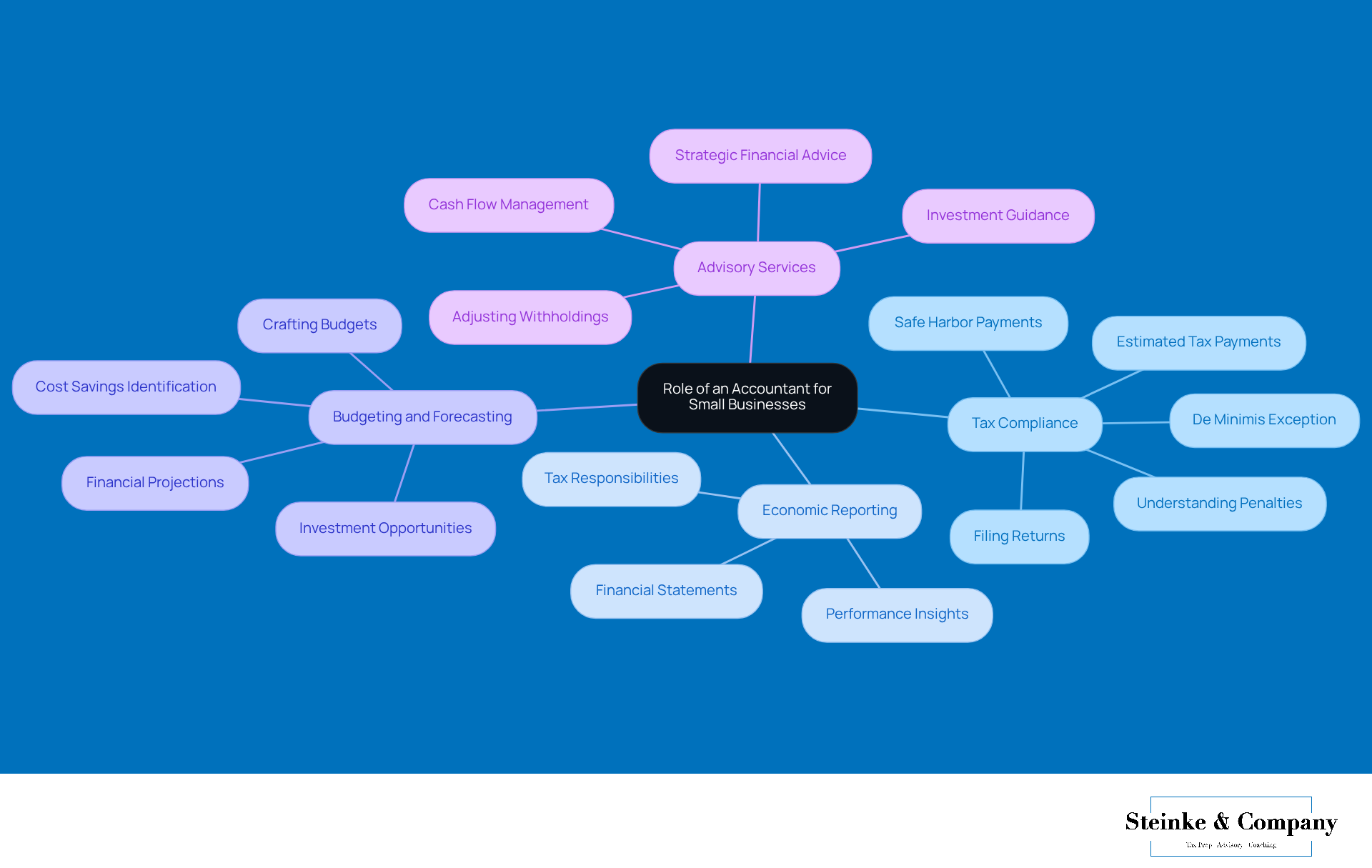

An accountant near me for small business plays a vital role in the economic health of small businesses, and their responsibilities extend far beyond just crunching numbers. Let’s break down what they do:

- Tax Compliance: Accountants make sure all tax obligations are met, filing returns accurately and on time to dodge those pesky penalties. This proactive approach helps businesses navigate the often complicated tax landscape, including understanding underpayment penalties from the IRS that can really impact financial stability. By ensuring estimated tax payments are made correctly and on schedule, accountants help small businesses avoid costly penalties and interest fees. They also offer guidance on strategies like safe harbor payments and the de minimis exception to help minimize risks.

- Economic Reporting: They whip up detailed financial statements that give insights into how the business is performing, allowing owners to make smart decisions based on solid data. This includes looking at tax responsibilities and ensuring reports reflect any potential tax obligations.

- Budgeting and Forecasting: Accountants assist in crafting budgets and financial projections, which are crucial for steering business decisions and planning for future growth. An updated budget can pinpoint areas for cost savings and investment opportunities, especially with all the changes in tax benefits and responsibilities.

- Advisory Services: Beyond just compliance, these financial pros provide strategic advice on financial planning, cash flow management, and investment opportunities, helping businesses optimize their financial strategies. They can guide small business owners on adjusting withholdings and estimated tax contributions to meet IRS safe harbor criteria, reducing the risk of underpayment penalties.

Understanding these roles really highlights the importance of hiring an accountant near me for small business. With 30% of small businesses currently employing a financial expert and 20% outsourcing their accounting to an accountant near me for small business, it's clear that expert financial guidance is crucial. Bringing in a CPA year-round not only helps during tax season but also boosts overall operational efficiency and growth potential. Proactive financial professionals leverage data analytics and business intelligence tools to make informed decisions, further showcasing their strategic importance in small business operations.

Evaluate Your Accounting Needs and Preferences

Before you dive into the search for a financial expert, it’s super important to take a moment to think about your unique accounting needs and preferences. Here are a few things to consider:

- Business Size and Complexity: Do you need just basic bookkeeping, or are your operations a bit more complex? The scale and intricacy of your business will help you figure this out.

- Industry-Specific Needs: It’s worth asking if you need someone with expertise in your specific sector. Different industries come with their own set of financial regulations and challenges, after all.

- Service Preferences: Think about how you like to work. Do you prefer in-person meetings, remote consultations, or maybe a mix of both? This can really shape your relationship with your financial advisor.

- Technology Use: Consider how important it is for you to have a financial pro who knows the accounting software your organization uses. Familiarity with specific tools can really boost efficiency and accuracy.

By clearly defining these needs, you’ll make your search for a financial professional a lot smoother. You want someone who not only ticks all the boxes but also aligns with your organizational goals, setting the stage for a productive partnership.

Research and Compare Local Accountants

Finding the right accountant near me for small business begins with some research into local options. Here are some handy strategies to help you on your search:

- Online Directories: Check out platforms like Yelp, Google, and specialized accounting directories to find accountants nearby. These sites often feature client reviews and ratings, giving you a peek into the quality of service.

- Referrals: Tap into your professional network and ask fellow business owners for recommendations. Personal experiences can guide you to find an accountant near me for small business who has successfully addressed similar financial needs.

- Professional Associations: Explore professional associations such as the CPA (Certified Public Accountant) to find an accountant near me for small business and a list of other qualified financial professionals. Being a member of such associations shows a commitment to high standards and ongoing education.

- Compare Services: Take a moment to assess the range of services offered by different financial professionals, such as tax preparation, bookkeeping, and advisory services. This will help you identify an accountant near me for small business whose expertise aligns with your specific business needs.

- Verify Credentials: It’s super important to check the professional’s credentials to ensure they meet national standards for education, ethics, and experience. This step helps confirm that you’re choosing someone qualified.

- Evaluate Communication and Compatibility: Think about the professional's communication style and how well they fit with your business culture. A good financial professional should communicate clearly and provide proactive guidance throughout the year. As Frédéric Roy-Gobeil puts it, 'A good financial professional is a strategic partner.'

- Trial Engagement: Starting with a trial engagement lets you gauge the professional's responsiveness and accuracy without a long-term commitment. This approach helps you see if they’re the right match for your organization.

- Watch for Red Flags: Stay alert for warning signs like unrealistic promises, poor communication, or lack of transparency about fees. Spotting these red flags can help you avoid hiring financial professionals who might not meet your needs.

Once you’ve compiled a list of potential candidates, the next important step is to verify their credentials to ensure you’re selecting someone qualified.

Verify Credentials and Experience of Candidates

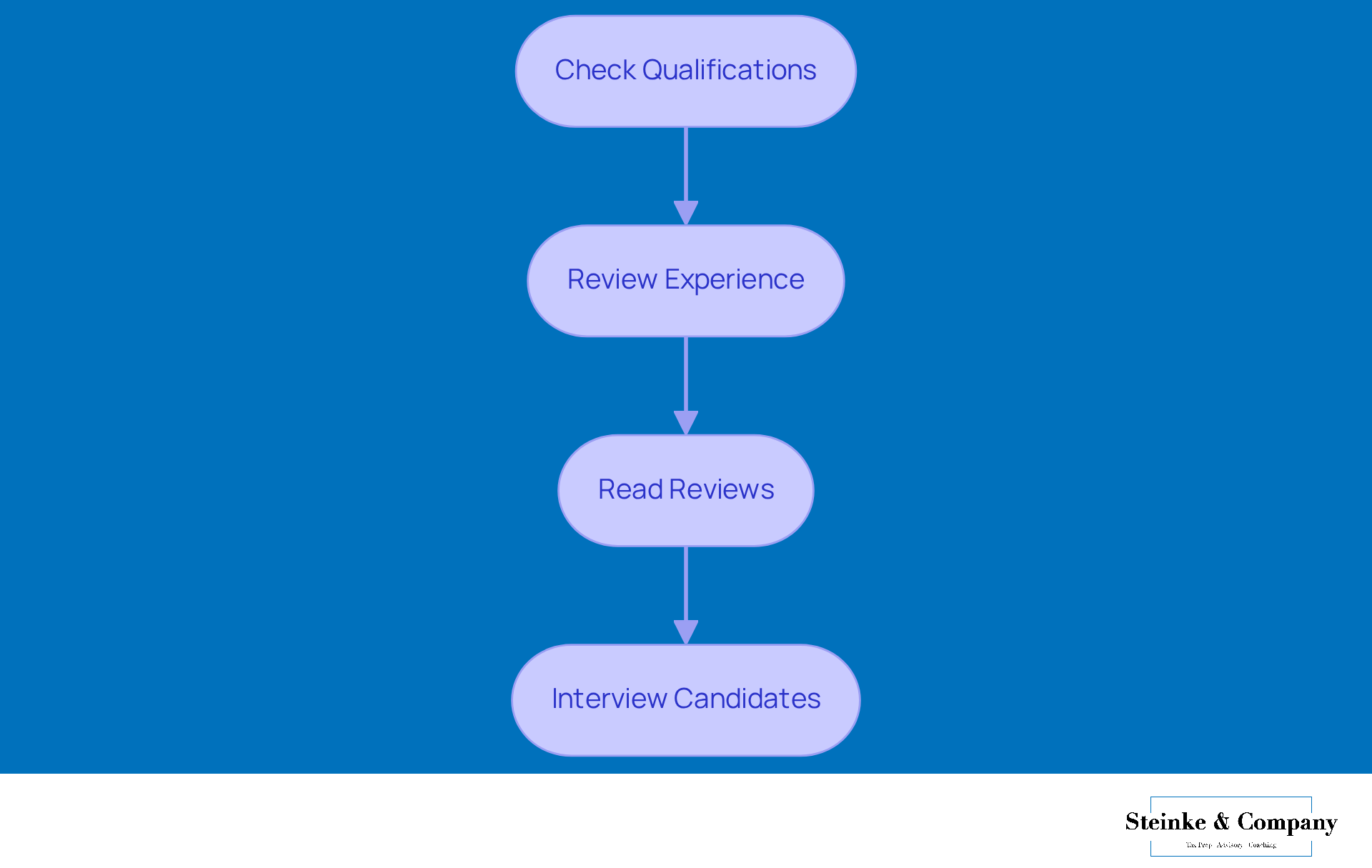

Are you looking for an accountant near me for small business? It’s super important to dig a little deeper into their credentials and experience.

First off, check their qualifications. Make sure they have the right certifications, like CPA (Certified Public Accountant) or CA (Chartered Accountant). These badges of honor show they know their stuff and play by the rules of the profession.

Next, review their experience. You’ll want an accountant near me for small business who has a solid track record working with small businesses, especially in your industry. Their understanding of the unique challenges and opportunities you face can make a significant difference in your financial health, particularly if you seek an accountant near me for small business.

Don’t forget to read reviews! Take a peek at online testimonials to see how past clients feel about their services. Feedback from similar businesses can give you valuable insights into how reliable and effective they are.

Finally, interview your candidates. Chat with them about their experience, their approach to accounting, and how they can tailor their services to fit your needs. This is a great chance to see how they communicate and whether they’re genuinely invested in supporting your business.

Going through this thorough vetting process is key to finding a qualified professional who can provide the strategic guidance your business needs to thrive.

Discuss Fees and Payment Structures

When you're on the hunt for an accountant, it’s super important to chat about their fees and payment structures to make sure they fit your budget and needs.

-

Get to Know Fee Structures: Accountants usually have different billing methods up their sleeves, like hourly rates, flat fees for specific services, and monthly retainers. Hourly rates can swing anywhere from $150 to $450, depending on how complex the services are. If you’re looking at flat fees for things like tax preparation, those can range from $500 to $3,000, which can really help you plan your budget better.

-

Ask for Estimates: Want a clearer picture of what you might be spending? Don’t hesitate to ask for estimates that are tailored to your specific accounting needs. This way, you can easily compare different accountants and what they offer.

-

Negotiate Terms: Remember, it’s totally okay to negotiate terms that work for your financial situation, especially if you’re a small business needing an accountant near me for small business with a tight budget. Bringing up your budget right from the start can lead to more affordable options while still getting the essential services you need.

-

Check for Additional Costs: Be proactive and ask about any extra costs that might pop up, like fees for additional services or consultations. This will help you avoid any surprise expenses and ensure you know exactly what you’re committing to financially.

By getting a solid grasp on fees and payment structures, you’ll be in a great position to make informed decisions that keep your business’s financial health in check.

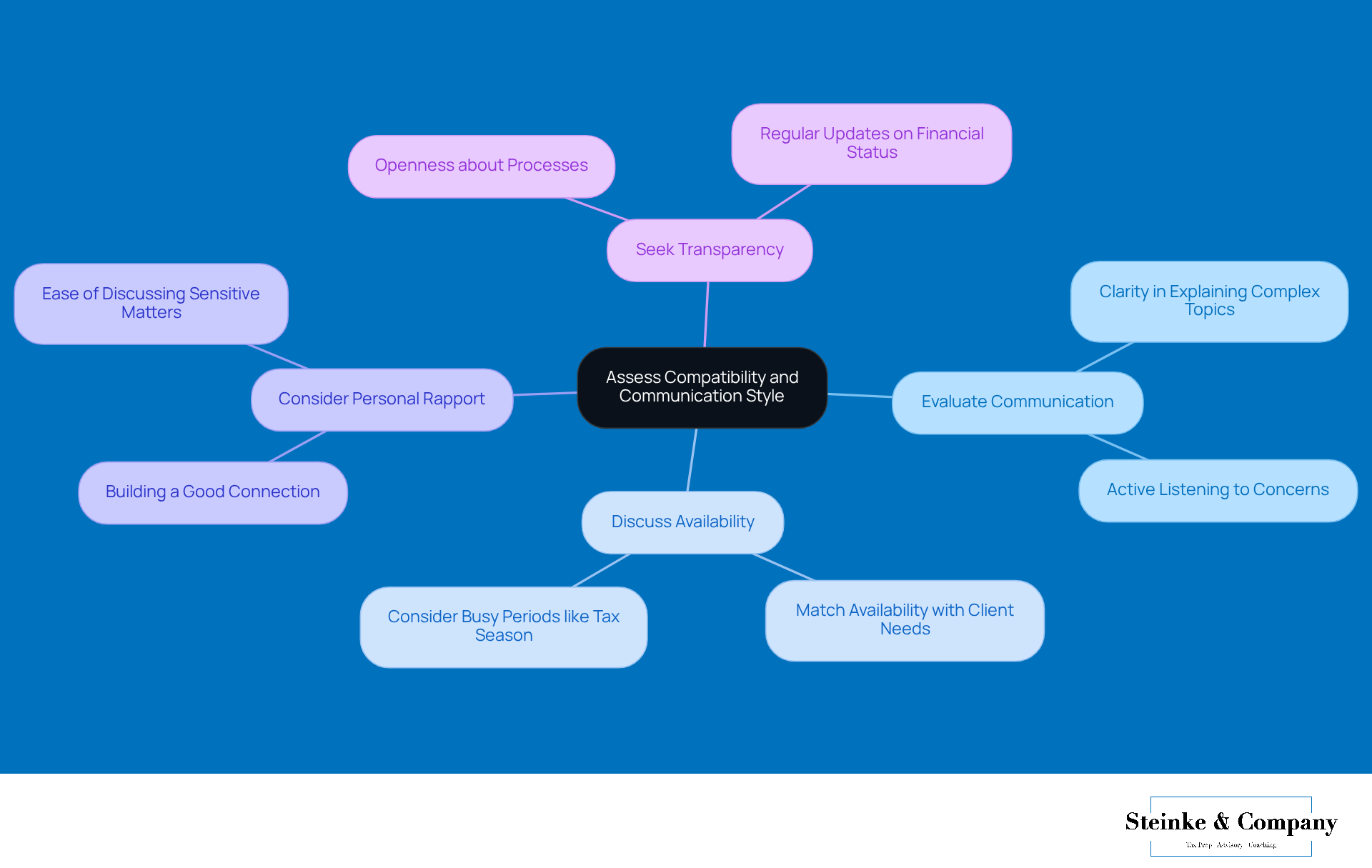

Assess Compatibility and Communication Style

Finally, let’s talk about how well your potential accountant communicates and connects with you:

- Evaluate Communication: When you’re interviewing them, notice how they explain complex topics. Do they break things down in a way that makes sense? And are they really listening to your concerns?

- Discuss Availability: It’s super important to make sure their availability matches your needs, especially during those hectic times like tax season.

- Consider Personal Rapport: Building a good personal connection can really boost your collaboration. It makes it easier to chat about those sensitive money matters, doesn’t it?

- Seek Transparency: Look for someone who’s open about their processes and is willing to keep you in the loop with regular updates on your financial status.

Finding an accountant who communicates well and shares your business values will definitely lead to a more productive partnership. So, take your time and choose wisely!

Conclusion

Finding the right accountant for your small business is a vital step in achieving financial stability and growth. An accountant does so much more than just crunch numbers; they offer essential services like tax compliance, economic reporting, budgeting, and strategic advice. When you understand these responsibilities, it becomes clear just how valuable a skilled accountant can be to your operations.

Throughout this article, we’ve shared some key insights on how to:

- Evaluate your accounting needs

- Research local accountants

- Verify their credentials

- Discuss fees

- Assess compatibility

It’s super important to recognize what’s unique about your business—whether that’s industry-specific expertise or your preferred way of communicating. Using online directories, referrals, and professional associations can really help you find an accountant who aligns with your goals and values.

In the ever-changing world of small business finance, having a reliable accountant is more important than ever. Taking the time to find the right professional can lead to smarter financial decisions, increased efficiency, and ultimately, greater success. So, small business owners, consider investing in this crucial partnership. It’s all about ensuring you have the financial guidance you need to tackle challenges and grab those growth opportunities!

Frequently Asked Questions

What role does an accountant play for small businesses?

An accountant for small businesses is crucial for tax compliance, economic reporting, budgeting and forecasting, and providing advisory services. They ensure tax obligations are met, create financial statements for informed decision-making, assist in budgeting for future growth, and offer strategic advice on financial planning.

How do accountants help with tax compliance?

Accountants ensure that all tax obligations are met by filing returns accurately and on time, helping businesses avoid penalties. They guide on estimated tax payments and strategies to minimize risks, such as safe harbor payments and the de minimis exception.

What is the importance of economic reporting by accountants?

Accountants produce detailed financial statements that provide insights into business performance, allowing owners to make informed decisions. This includes assessing tax responsibilities and ensuring reports reflect any potential tax obligations.

How do accountants assist in budgeting and forecasting?

Accountants help create budgets and financial projections that guide business decisions and planning for growth. An updated budget can identify areas for cost savings and investment opportunities.

What kind of advisory services do accountants provide?

Accountants offer strategic advice on financial planning, cash flow management, and investment opportunities. They assist small business owners in adjusting withholdings and estimated tax contributions to meet IRS safe harbor criteria.

Why is it important for small businesses to hire an accountant?

Hiring an accountant is vital for navigating complex tax landscapes, improving operational efficiency, and supporting growth potential. They provide year-round assistance, not just during tax season, and leverage data analytics for informed decision-making.

What should small businesses consider when evaluating their accounting needs?

Small businesses should consider their size and complexity, any industry-specific needs, service preferences (in-person or remote), and the importance of familiarity with specific accounting software when evaluating their accounting needs.

How can defining accounting needs help in finding a financial professional?

Clearly defining accounting needs helps streamline the search for a financial professional, ensuring that the chosen expert aligns with the business's goals and can effectively meet its unique requirements.