Overview

Finding the right small business accountant can feel a bit daunting, right? Start by taking a moment to think about your specific accounting needs. Consider things like:

- Your business size

- The industry you’re in

- Any growth plans you might have down the line

Once you’ve got a clear picture, you can dive into searching for candidates.

Understanding these factors is key! It helps you evaluate potential accountants based on their expertise and the services they offer. This way, you can ensure they align well with your business goals. So, what do you think? Ready to find someone who can really help your business thrive?

Introduction

Finding the right accountant can be a game-changer for small businesses, but surprisingly, many entrepreneurs don’t give this decision the attention it deserves. A good accountant does more than just keep you compliant with tax regulations; they offer strategic insights that can really help your business grow and improve its financial health.

So, with so many options out there, how do you choose a financial partner who truly gets your unique needs? This guide is here to help! We’ll break down the essential steps to identify, evaluate, and secure the perfect small business accountant. By the end, you’ll feel empowered to make informed choices that will support your financial journey.

Understand the Role of a Business Accountant

A professional bookkeeper is key to keeping your finances in check. They handle important tasks like preparing financial statements, making sure you’re on top of tax regulations, and providing strategic advice to help your business grow. Understanding what they do can really help you figure out what you need from a financial expert. Here are some of their main responsibilities:

-

Tax Preparation and Compliance: They ensure your business meets all tax obligations and deadlines, helping you avoid those pesky underpayment penalties. Did you know the IRS requires you to pay at least 90% of your current year's tax liability or 100% of the previous year's? A proactive accountant can guide you through these requirements with ease.

-

Monetary Reporting: They prepare accurate financial statements that reflect your company’s performance, which is crucial for making informed decisions.

-

Budgeting and Forecasting: They assist in creating budgets and projections to guide your business decisions. Effective budgeting is vital since poor cash flow management is a leading cause of startup failures.

-

Advisory Services: They provide insights on financial strategies, cash flow management, and growth opportunities. This includes understanding safe harbor payments and the de minimis exception to avoid underpayment penalties, ensuring your organization remains compliant and financially healthy.

By recognizing these roles, you can better articulate your needs when searching for a financial professional. Plus, with 53% of accounting firms adopting cloud-based solutions, today’s financial pros can enhance project management and client communication. Small businesses are looking for more flexibility and better service levels—87% of them expect just that from their financial advisors. So, what are you waiting for? It’s time to find the right financial partner for your journey!

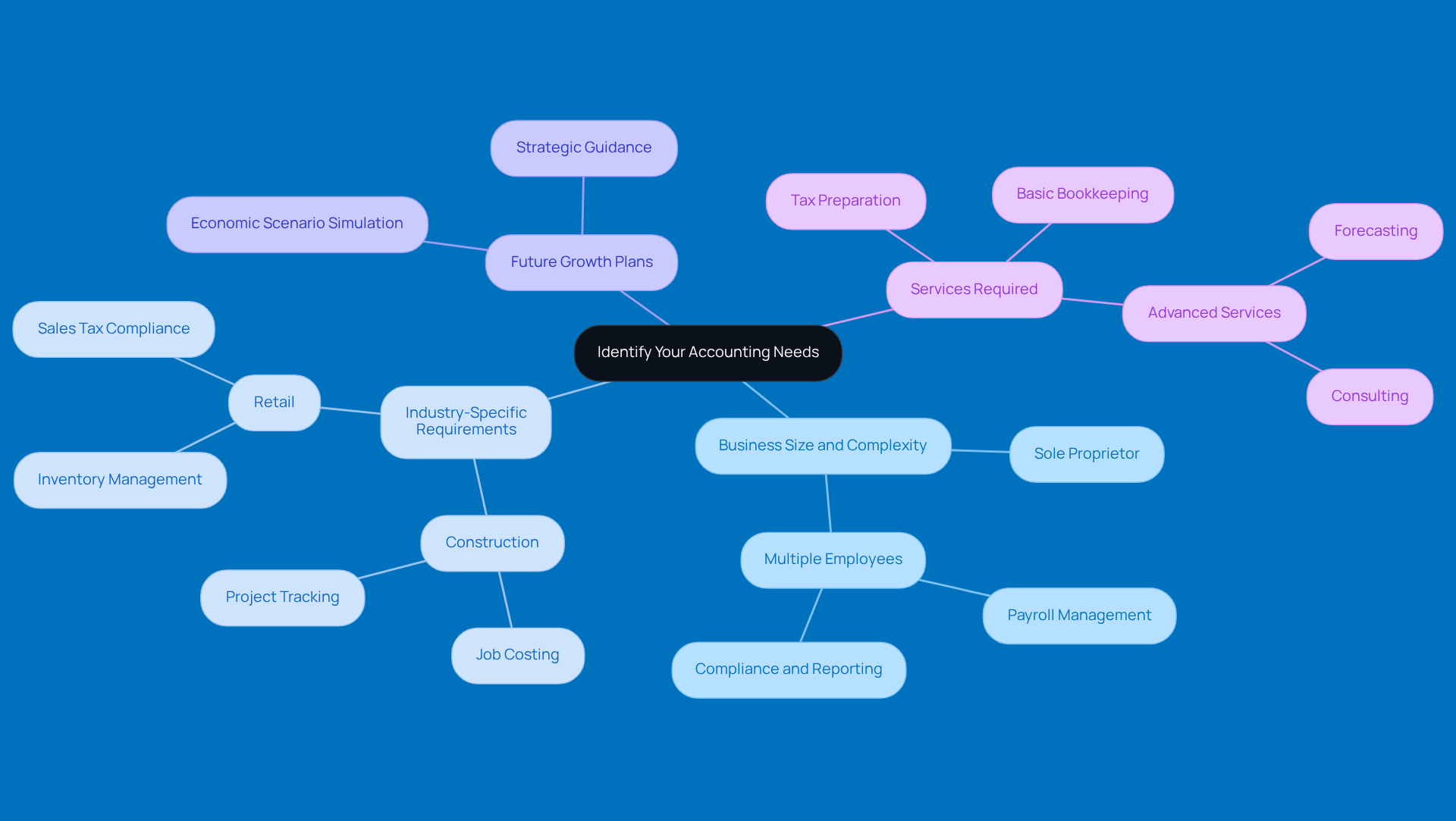

Identify Your Accounting Needs

Before you dive into finding a financial professional, it’s super important to take a moment and think about your specific accounting needs. Let’s break it down:

- Business Size and Complexity: Are you flying solo as a sole proprietor, or do you have a whole team behind you? If you’ve got multiple employees, you’ll likely need more comprehensive accounting services to tackle payroll, compliance, and reporting.

- Industry-Specific Requirements: Different industries come with their own unique accounting needs. For example, if you’re in construction, you might need job costing and project tracking. Retail businesses, on the other hand, often focus on inventory management and sales tax compliance. Understanding these nuances can help you find a pro who really knows their stuff.

- Future Growth Plans: Got big dreams for expansion? Look for a financial advisor who can offer strategic guidance and support as you scale up. An accountant who can simulate different economic scenarios will be a game-changer as your business grows.

- Services Required: Be clear about what you need—whether it’s basic bookkeeping, tax prep, or more advanced services like forecasting and consulting. Many small businesses find that a hybrid approach, blending tech with professional services, really boosts their resource management.

By laying out your financial needs, you’ll make your search for the right professional a whole lot easier. You want to find someone who not only aligns with your goals but can also help you navigate the complexities of financial oversight. So, what are you waiting for? Start thinking about what you need!

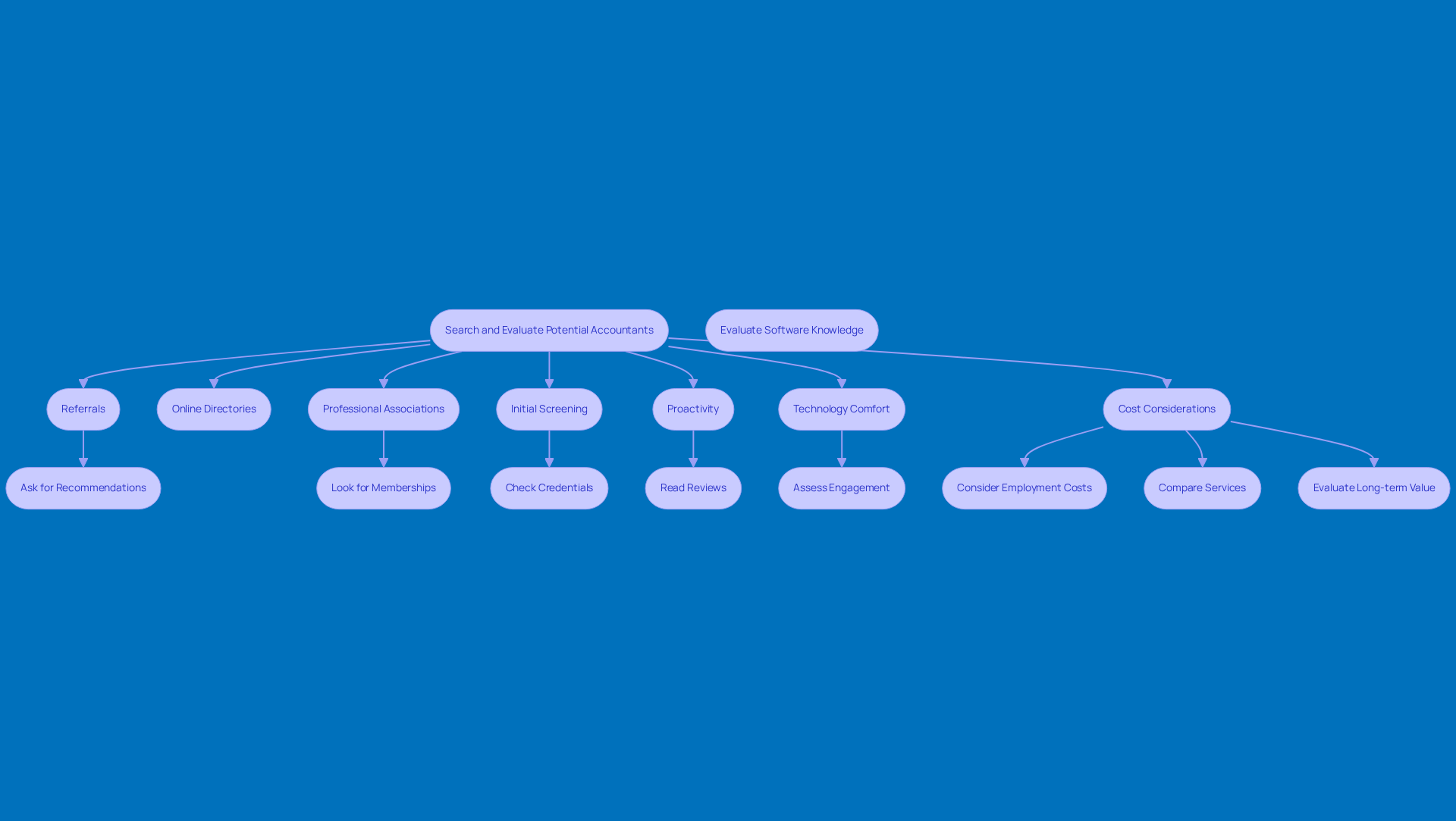

Search and Evaluate Potential Accountants

Once you’ve figured out your accounting needs, it’s time to start hunting for the right accountant. Here are some effective strategies to help you out:

- Referrals: Start by asking fellow business owners or local business associations for recommendations. Personal referrals often lead you to reliable experts who really get the unique challenges small businesses face, like managing underpayment penalties and boosting tax compliance.

- Online Directories: Check out platforms like the American Institute of CPAs (AICPA) or local business directories to find financial pros in your area. These resources can help you discover qualified candidates who have the right expertise in tax strategies and financial management.

- Professional Associations: Look for accountants who are members of professional organizations. Membership usually shows a commitment to ongoing learning and sticking to ethical standards, which is super important for your business, especially when navigating the complexities of tax submissions and potential refunds.

- Initial Screening: Once you’ve got a shortlist, take the time to check their credentials, experience, and specialties. Look for reviews or testimonials from past clients to get a sense of their reliability and effectiveness in providing tailored financial advice.

- Proactivity: During your chats, see if the potential accountant asks questions about your business. A proactive financial professional will engage with your needs and offer customized guidance, including strategies to dodge those costly IRS penalties.

- Technology Comfort: Make sure the financial professional is tech-savvy and can recommend suitable software for your business. In today’s digital world, being comfortable with technology is key to managing tax compliance and avoiding penalties by streamlining processes and ensuring timely submissions.

- Cost Considerations: Keep an eye on the costs that come with hiring an accountant, including employment taxes and benefits if you’re thinking about an in-house option. Hiring a fractional CFO can be a budget-friendly choice, giving you essential financial management and personalized support without the full-time commitment.

As Bill Gerber wisely points out, doing your homework and researching your options can mean the difference between a dream experience and a financial nightmare. By thoroughly assessing potential financial professionals, you’ll be better equipped to find someone who truly aligns with your needs and can help your business thrive.

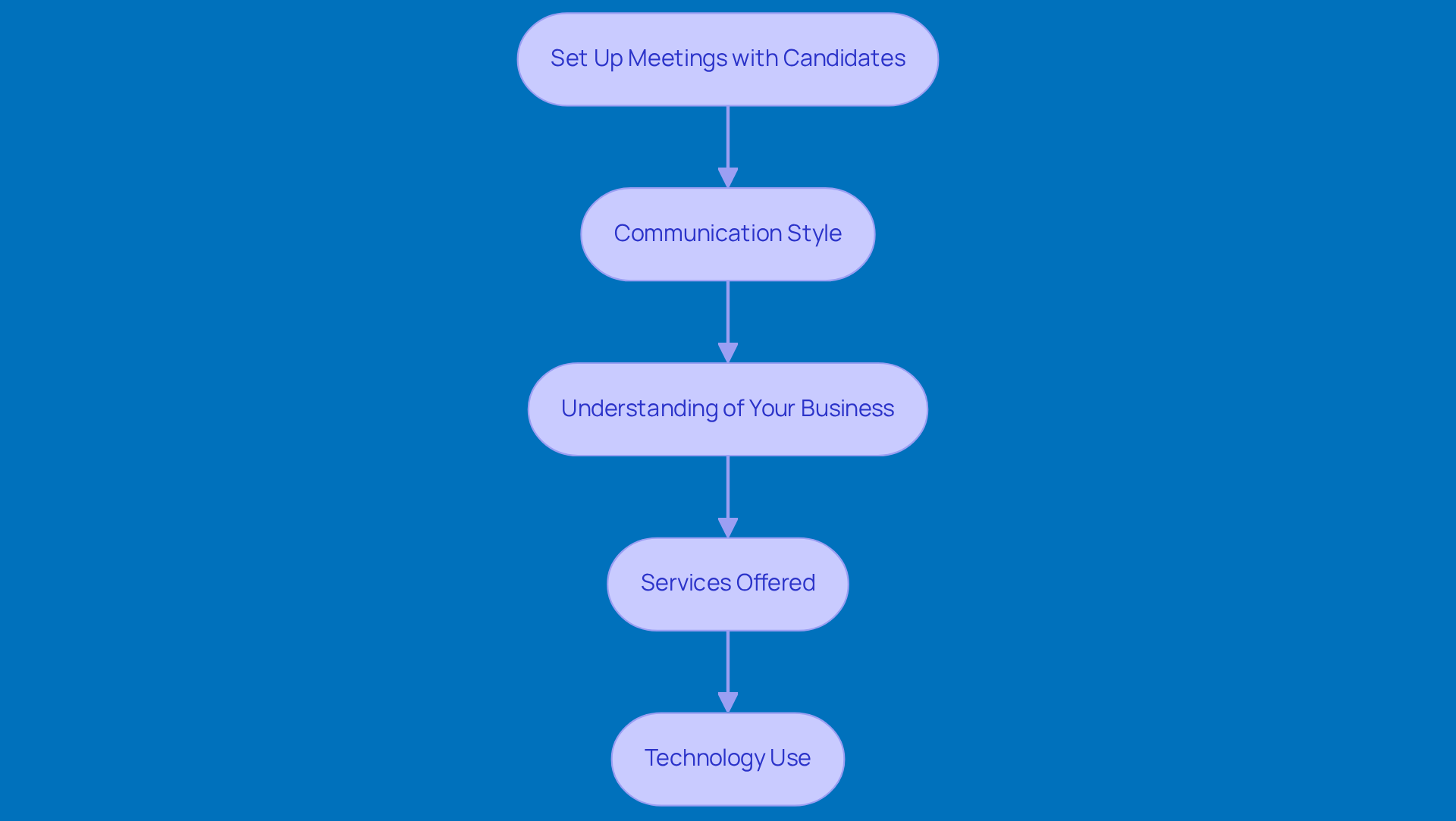

Meet and Assess Your Accountant Candidates

Once you’ve narrowed down your list of potential professionals, it’s time to set up some meetings with your top candidates. During these chats, keep an eye on a few key areas:

- Communication Style: How well do they explain complex financial concepts? You want someone who can break down intricate details in a way that feels clear and approachable, making it easy for you to engage in a comfortable dialogue.

- Understanding of Your Business: Do they know your industry and the unique challenges it brings? A good small business accountant should have a solid grasp of your operational context, which is crucial for providing personalized guidance.

- Services Offered: What services do they provide, and can they tailor them to fit your specific needs? This is important to ensure you get the support necessary for your company’s growth and compliance.

- Technology Use: Ask about the accounting software they use and how they integrate technology into their services. Familiarity with modern accounting tools is key for efficiency and accuracy in managing your finances.

These meetings are super important for figuring out if a small business accountant is the right fit for your business. They can be a valuable partner in your financial journey, so make the most of them!

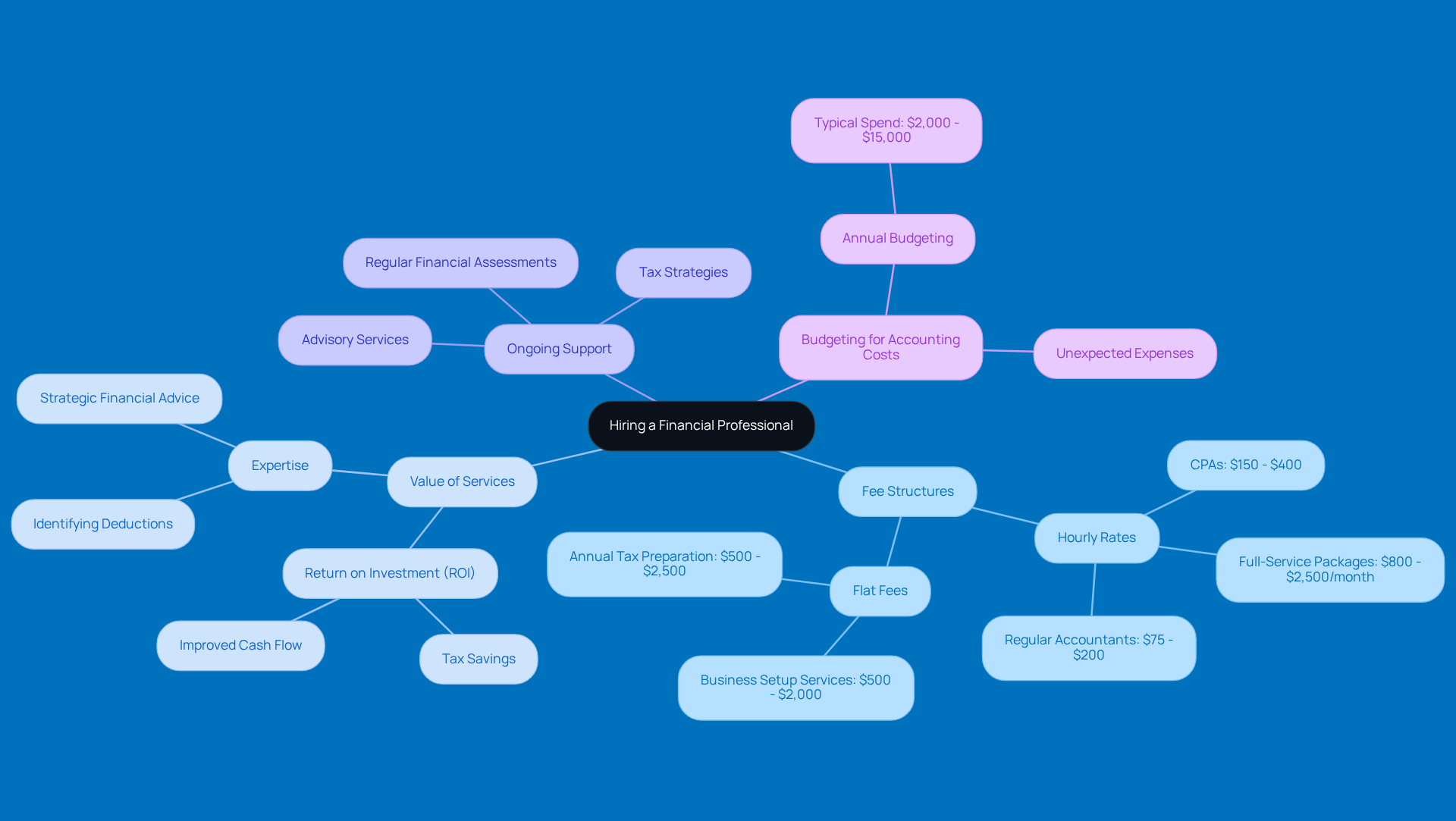

Consider Costs and Ongoing Services

When you're on the hunt for a financial professional, it’s super important to get a grip on the costs involved and the range of services they provide. Let’s break down some key points to consider:

-

Fee Structures: Accountants have their own ways of billing, whether it’s hourly rates, flat fees for specific tasks, or monthly retainers. It’s a good idea to familiarize yourself with their pricing models to keep things transparent. For example, hourly rates can vary quite a bit, ranging from $75 to $400. If you’re looking at full-service monthly packages, expect to pay anywhere from $800 to $2,500, depending on how complex your needs are.

-

Value of Services: Think about the potential return on investment (ROI) when hiring a financial pro. A savvy accountant can help you spot tax deductions and implement smart money strategies, which can save you a pretty penny. Many small businesses find that investing in a small business accountant leads to significant tax savings and better cash flow, making it a worthwhile expense.

-

Ongoing Support: Don’t forget to ask about the ongoing services that come with your agreement. Regular financial assessments, tax strategies, and advisory services are crucial for boosting your financial health. Knowing what support you’ll receive can really help you assess the overall value of the accountant’s services.

-

Budgeting for Accounting Costs: It’s essential to factor these accounting costs into your overall business budget to steer clear of any surprise expenses. Small businesses typically set aside between $2,000 and $15,000 each year for a small business accountant, depending on their specific needs and complexity.

By taking the time to evaluate these factors, you can find an accountant who fits your budget and brings the expertise you need to help your business thrive!

Conclusion

Finding the right small business accountant is a big step toward achieving financial stability and growth. When small business owners understand the essential role of an accountant, they can express their needs and expectations more clearly. This clarity not only makes the search easier but also sets the stage for a partnership that can really boost the business's success.

In this article, we’ve laid out a straightforward approach to picking an accountant. It’s all about identifying your specific accounting needs, evaluating potential candidates, and getting a grip on the costs involved. Key points to consider include:

- The accountant's communication style

- Their industry knowledge

- How comfortable they are with technology

- The importance of ongoing support

- Proactive financial strategies

Each of these factors is crucial in making sure your accountant fits the unique demands of your business.

Ultimately, putting in the time and effort to find the right financial partner can lead to better financial management, compliance, and strategic growth. Seriously, small business owners should take these steps to heart! The right accountant can help you navigate the complexities of financial oversight and even open up new opportunities for success. By using the insights shared in this guide, you can make informed decisions that pave the way for a prosperous future. So, what are you waiting for? Start your search today!

Frequently Asked Questions

What is the role of a business accountant?

A business accountant, or professional bookkeeper, is responsible for managing finances, preparing financial statements, ensuring compliance with tax regulations, and providing strategic advice to support business growth.

What are the main responsibilities of a business accountant?

The main responsibilities include tax preparation and compliance, monetary reporting, budgeting and forecasting, and providing advisory services on financial strategies and cash flow management.

How does a business accountant assist with tax obligations?

A business accountant ensures that the business meets all tax obligations and deadlines, helping to avoid penalties. They guide clients on requirements such as paying at least 90% of the current year's tax liability or 100% of the previous year's.

Why is monetary reporting important?

Monetary reporting is crucial because it provides accurate financial statements that reflect the company's performance, which aids in making informed business decisions.

How can a business accountant help with budgeting and forecasting?

A business accountant assists in creating budgets and financial projections to guide business decisions, which is essential for effective cash flow management and avoiding startup failures.

What kind of advisory services do business accountants provide?

Business accountants offer insights on financial strategies, cash flow management, growth opportunities, and compliance with regulations like safe harbor payments and the de minimis exception.

What should I consider when identifying my accounting needs?

Consider your business size and complexity, industry-specific requirements, future growth plans, and the specific services you require, such as bookkeeping, tax preparation, or advanced forecasting and consulting.

How does the size and complexity of a business affect accounting needs?

Sole proprietors may need basic services, while businesses with multiple employees require more comprehensive accounting services to handle payroll, compliance, and reporting.

Why are industry-specific requirements important in accounting?

Different industries have unique accounting needs, such as job costing in construction or inventory management in retail. Understanding these nuances helps in finding an accountant with relevant expertise.

What benefits can come from having a financial advisor who supports future growth?

A financial advisor can provide strategic guidance and support for expansion, including simulating different economic scenarios, which is valuable as the business grows.

What is a hybrid approach in accounting services?

A hybrid approach combines technology with professional accounting services, allowing small businesses to enhance their resource management and efficiency.