Introduction

Navigating the ins and outs of a 1031 exchange can feel a bit overwhelming, right? Especially when you start hearing terms like "boot." So, what’s boot? It’s any cash or non-like-kind assets you might receive during the exchange that could hit you with immediate tax liabilities. For small business owners, this can really throw a wrench in your tax strategy.

As the stakes get higher, it’s super important to understand how boot is taxed and the different types of boot that can come into play. This knowledge is key to maximizing those tax deferral benefits. So, how can small business owners like you manage these tax implications and steer clear of any unexpected financial surprises in your 1031 transactions? Let’s dive in!

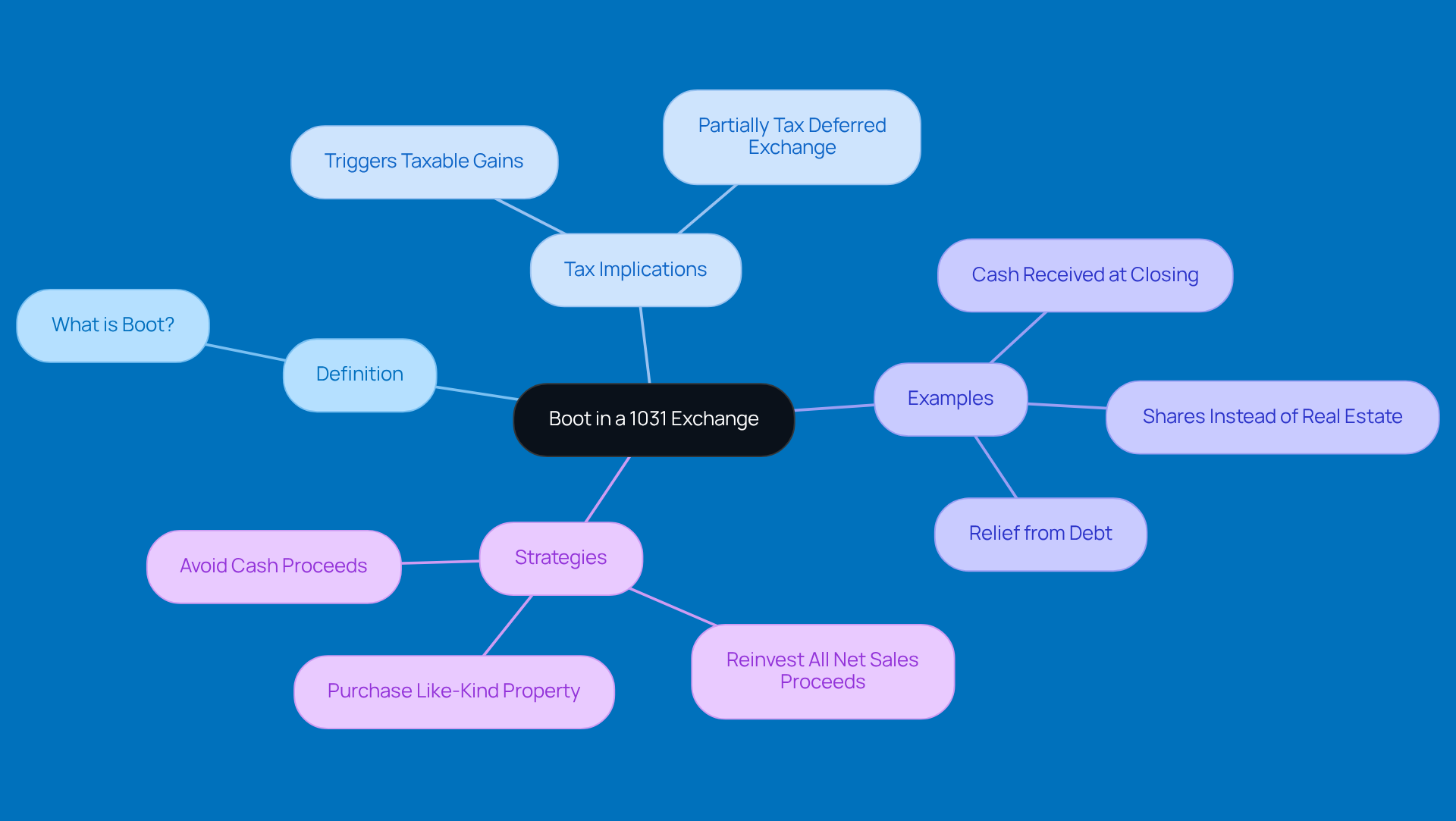

Define Boot in a 1031 Exchange

When discussing how boot is taxed in a 1031 exchange, we refer to any cash or non-similar asset that the taxpayer receives, which doesn’t qualify for tax deferral under Section 1031 of the Internal Revenue Code. This includes cash from selling an asset or anything that isn’t considered like-kind to what was given up. For small business owners, understanding how boot is taxed in a 1031 exchange is super important because it highlights the part of the transaction that might be taxed right away, impacting their overall tax strategy.

For instance, let’s say an investor sells an asset and gets cash at closing. Do you know how boot is taxed in a 1031 exchange? It’s considered additional money and could trigger a taxable gain, which raises the question of how boot is taxed in a 1031 exchange, potentially leading to a partially tax-deferred exchange. Common examples of this compensation also include relief from debt on the asset that was surrendered or getting shares instead of real estate. To dodge those pesky extra tax liabilities, it’s crucial for investors to snag a similar replacement property that’s equal to or greater in value than what they let go of.

By wrapping their heads around the concept of surplus, business owners can navigate their 1031 transactions more effectively and boost their tax deferral benefits. So, what do you think? Are you ready to dive deeper into your 1031 strategies?

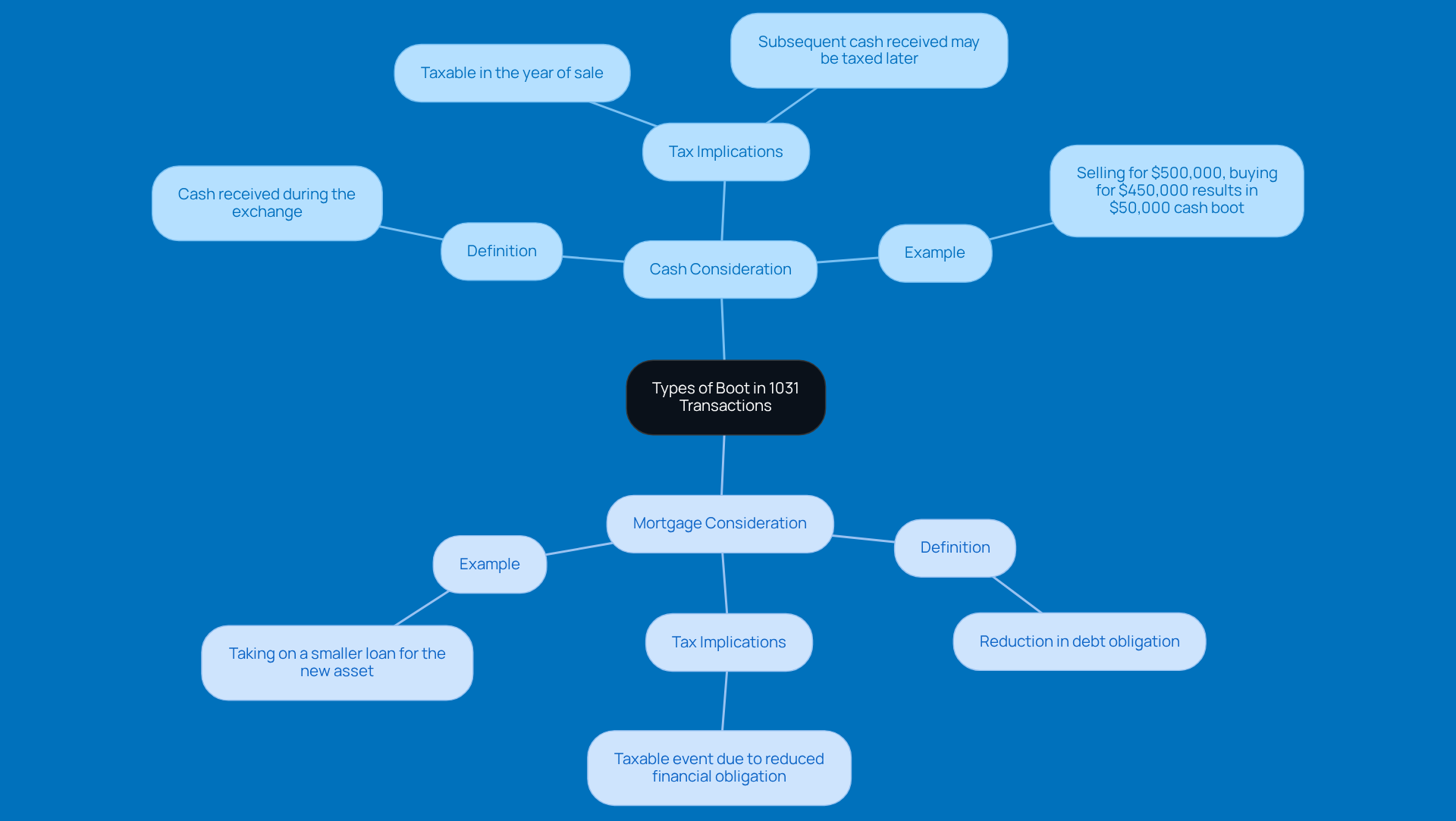

Identify Types of Boot: Cash and Mortgage

When it comes to a 1031 transaction, there are two big players that can impact your tax obligations: cash consideration and mortgage consideration.

So, what’s cash received? It’s any money you snag during the exchange, and guess what? It’s immediately taxable. For instance, if you sell an asset for $500,000 and then grab a substitute asset for $450,000, that $50,000 difference is considered cash and will be taxed in the year you sell. And if you happen to receive cash gain in a later year? Yep, that could be taxed then too.

Now, let’s talk about mortgage gain. This happens when you take on a smaller loan for your new asset compared to what you had for the one you let go. This drop in debt can also stir up tax implications since it’s seen as a taxable event due to your reduced financial obligation.

It’s crucial to understand these differences, especially for small businesses diving into 1031 transactions. They can really shake up your total tax responsibility! So, keep these points in mind as you navigate your options.

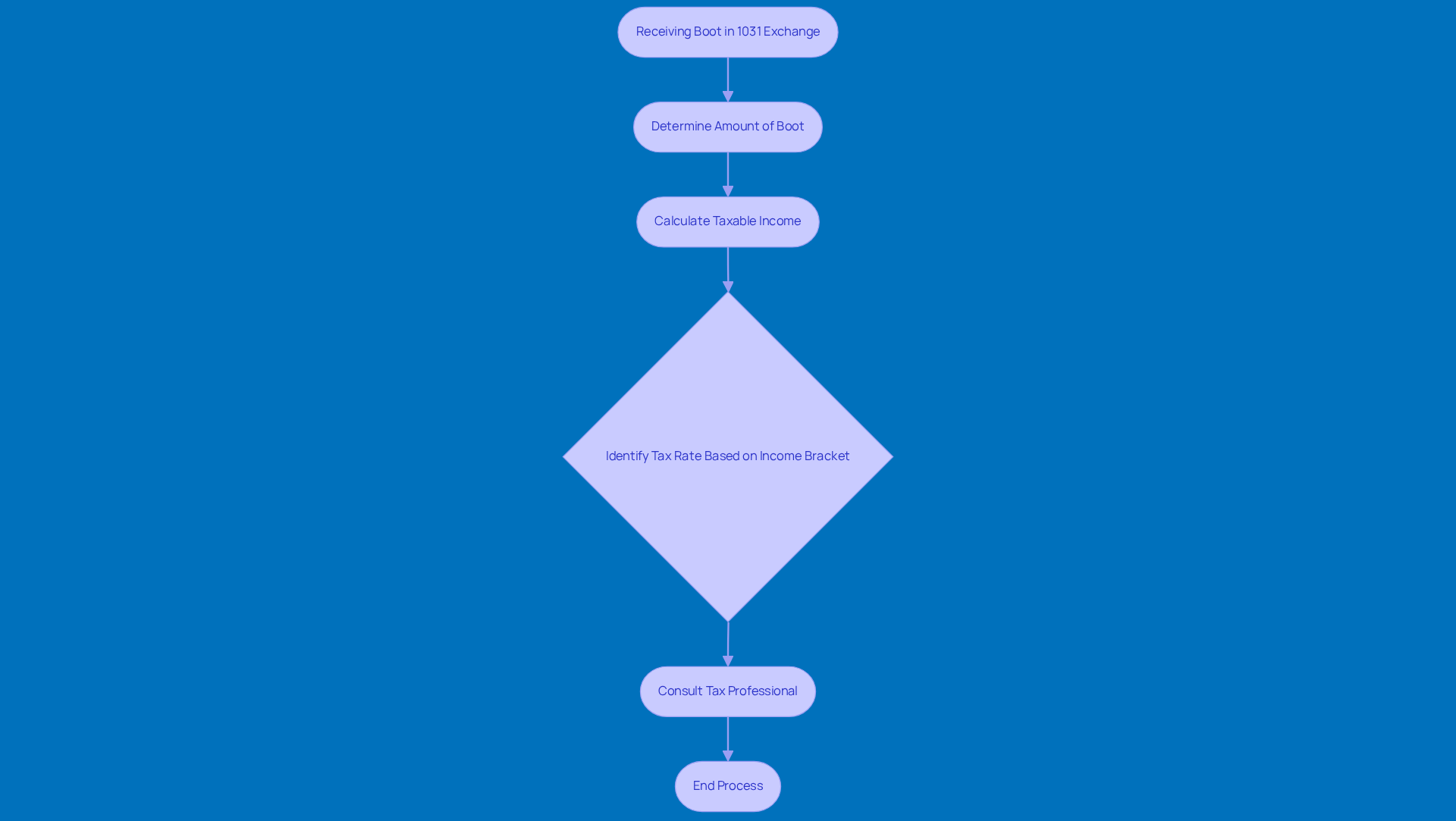

Understand Tax Implications of Receiving Boot

When you receive compensation in a 1031 exchange, it triggers tax responsibilities based on the gain you realized from selling your asset. Let’s say a small business sells an asset for $500,000 and receives $50,000 in cash boot, prompting a discussion on how is boot taxed in a 1031 exchange. That $50,000? Yep, it needs to be reported as taxable income. The tax rate you’ll face can change depending on your total income and how long you owned the asset. So, it’s super important for small business owners to figure out their potential tax liabilities to avoid any nasty surprises down the line.

Now, let’s talk about boot. It can really shake things up when it comes to tax liabilities because it brings taxable gains into the mix. For example, if a business owner puts $450,000 into a new property but takes $50,000 in cash, they’ll owe taxes on that cash, which raises the question of how is boot taxed in a 1031 exchange. Experts stress the importance of understanding these implications-after all, the tax savings from a successful 1031 exchange can often outweigh the complexities involved.

Typically, the tax rate on proceeds from 1031 transactions aligns with your income tax bracket, which can range from 10% to 37%. That’s why it’s a smart move for small businesses to work closely with tax pros. They can help navigate these complexities and ensure you’re following IRS rules, especially when it comes to filling out Form 8824 to report the transaction accurately. So, don’t hesitate to reach out for help!

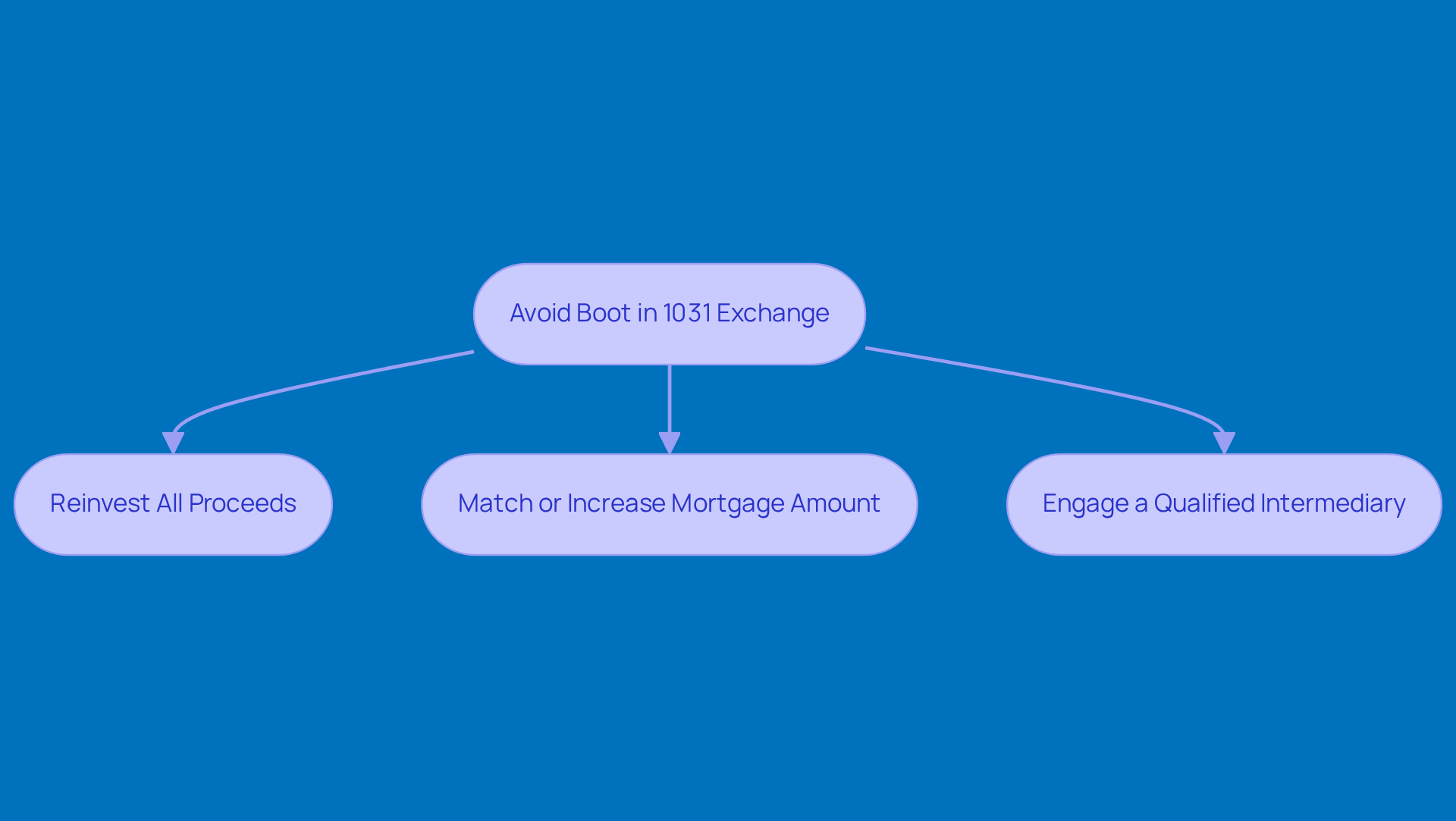

Implement Strategies to Avoid Boot

If you're a small business owner looking to dodge boot in a 1031 exchange, here are some friendly tips to keep in mind:

-

Reinvest All Proceeds: First off, make sure to reinvest every penny from the sale of your relinquished property into the new one. This is super important because it helps you avoid any cash surplus that might pop up from uninvested cash proceeds. Industry pros agree that reinvesting all your net equity is key to steering clear of taxable gains and maximizing those sweet tax deferral benefits.

-

Match or Increase Mortgage Amount: Next, when you're getting that replacement asset, aim for a mortgage amount that's equal to or even greater than the one on the property you sold. This little trick helps you avoid mortgage headaches, which can happen if the debt on your new property is less than what you had before. As Inland points out, it is crucial for a smooth, tax-deferred transaction to understand how is boot taxed in a 1031 exchange while keeping those debt levels in check.

-

Engage a Qualified Intermediary: Don’t forget to team up with a qualified intermediary! They’re essential for structuring your transaction the right way. They’ll help you stay on the right side of IRS regulations and minimize the risk of receiving boot, particularly regarding how boot is taxed in a 1031 exchange, which can really mess with your tax deferral benefits. Edward E. Fernandez emphasizes that working with a qualified intermediary can make the whole process a lot smoother.

And hey, remember the timelines for 1031 transactions: you’ve got to identify replacement properties within 45 days and wrap up the deal within 180 days. By following these strategies, you can boost your chances of a successful 1031 transaction, keeping your capital safe for future investments and ensuring your financial health stays intact.

For instance, many small business owners have navigated these transactions successfully by sticking to these guidelines, leading to optimized tax deferral advantages and lower tax bills. Take a look at a case study about a delayed exchange for market diversification: an investor sold a property in a pricey urban area and reinvested in several properties in a more affordable market. This savvy move helped reduce risk and enhance their portfolio.

So, what do you think? Are you ready to dive into your own 1031 exchange adventure?

Conclusion

Understanding how boot is taxed in a 1031 exchange is super important for small business owners who want to make the most of their tax strategies. This article has covered the key points about boot, like what it is, the different types, and the tax implications that come into play when you receive cash or mortgage boot. By getting a handle on these concepts, business owners can navigate their 1031 transactions more effectively and make smart decisions that boost their financial outcomes.

We talked about some crucial aspects, such as the difference between cash and mortgage boot, why it’s essential to reinvest all proceeds, and the perks of working with a qualified intermediary. Each of these factors is vital in figuring out tax liabilities and keeping transactions in line with IRS regulations. By using effective strategies, small businesses can lower the chances of running into boot and maximize their tax deferral benefits.

In the end, the insights shared here serve as a handy guide for small business owners looking to take advantage of 1031 exchanges. Taking proactive steps to understand and manage boot can lead to significant tax savings and better financial health. As tax regulations keep changing, staying informed and seeking professional advice will help business owners make the most of their investment opportunities. So, why not take that next step and dive deeper into your 1031 exchange journey?

Frequently Asked Questions

What is boot in a 1031 exchange?

Boot in a 1031 exchange refers to any cash or non-similar asset that the taxpayer receives, which does not qualify for tax deferral under Section 1031 of the Internal Revenue Code.

How is boot taxed in a 1031 exchange?

Boot is considered additional money received in a transaction, which can trigger a taxable gain. This means that the portion of the transaction involving boot may not be tax-deferred, potentially leading to a partially taxable exchange.

What are common examples of boot in a 1031 exchange?

Common examples of boot include cash received from selling an asset, relief from debt on the surrendered asset, or receiving shares instead of real estate.

Why is understanding boot important for small business owners?

Understanding how boot is taxed in a 1031 exchange is crucial for small business owners as it highlights the part of the transaction that might be taxed immediately, impacting their overall tax strategy.

How can investors avoid extra tax liabilities related to boot?

To avoid extra tax liabilities, investors should acquire a replacement property that is equal to or greater in value than the property they relinquished in the exchange.