Introduction

Navigating the ins and outs of capital gains tax can feel pretty overwhelming, right? Especially when you’re thinking about selling your primary residence. But here’s the good news: homeowners often discover there are ways to minimize or even dodge this tax burden altogether! By getting a grip on the nuances of exemptions and using some smart planning techniques, you could save yourself thousands of dollars.

So, what are the key steps you need to take to make sure you snag these benefits while steering clear of common pitfalls? Let’s dive in!

Understand Capital Gains Tax on Primary Residences

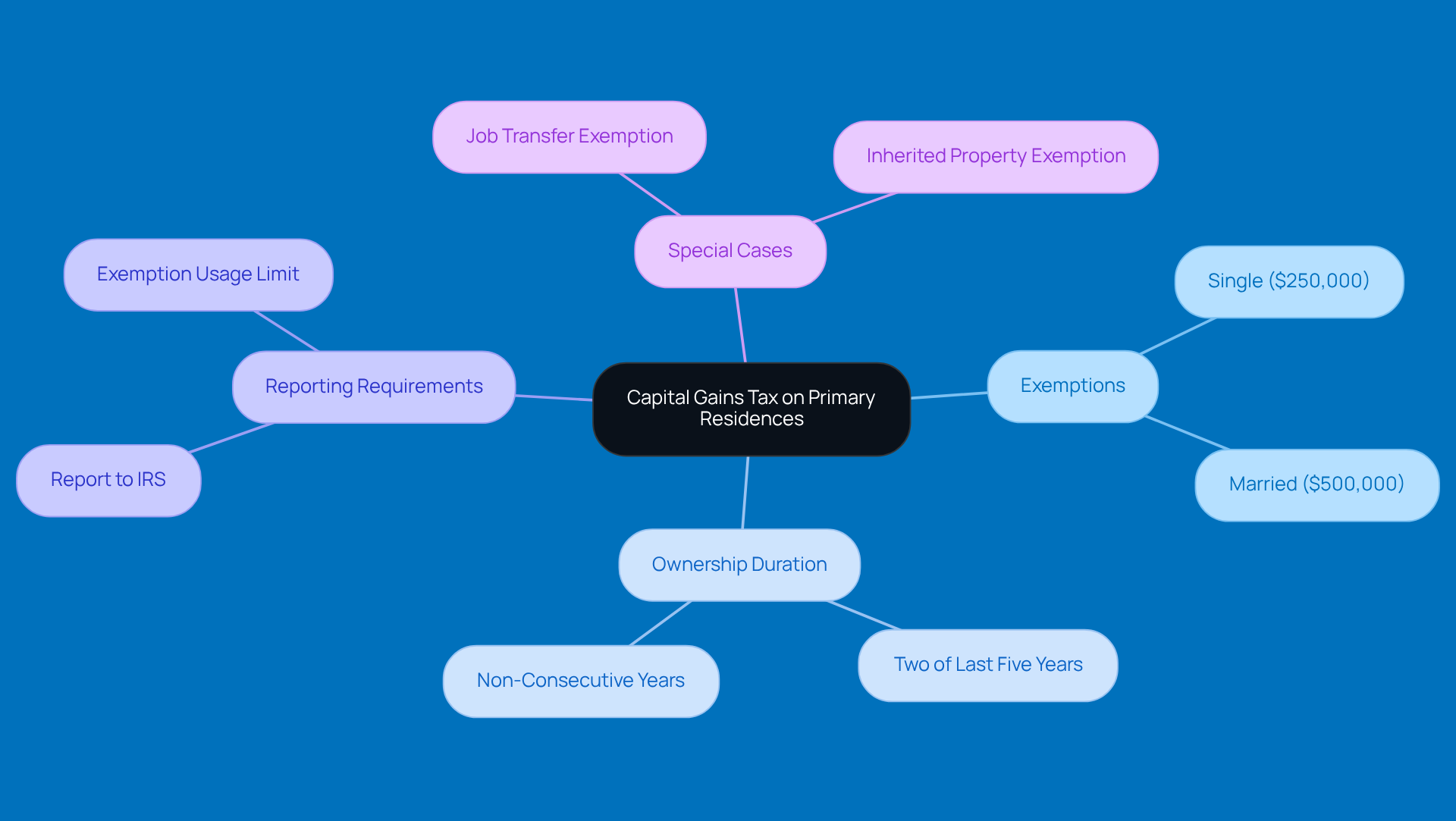

Capital profits tax is basically a tax on the money you make when you sell something like your home. If you sell your primary residence, you might be in for a nice surprise as you could discover how to avoid capital gains tax on primary residence! This means you can exclude up to $250,000 of profit if you’re single, or up to $500,000 if you’re married and filing jointly. Pretty sweet, right?

To snag this exemption, you need to have owned and lived in your home for at least two of the last five years before selling. And don’t worry, those two years don’t have to be consecutive! Even if you took a short break, it won’t mess with your eligibility. Just a heads up, though: if you’ve already used this exemption in the last two years, you won’t be able to use it again right away.

Understanding these rules is super important to determine how to avoid capital gains tax on primary residence and see if you can benefit from this tax break in your situation. For example, if you sold your home because of a job transfer, you might still qualify for a reduced exemption, even if you didn’t quite hit that two-year mark. And remember, you still need to report the sale on your income tax return, even if the exemption wipes out your profit. This helps you avoid any potential headaches with the IRS later on.

For more detailed info, check out the IRS guidelines on tax benefits for primary residences. It’s always good to be informed!

Implement Strategies to Avoid Capital Gains Tax

If you want to sidestep capital gains tax on your primary residence, here are some friendly tips to consider:

-

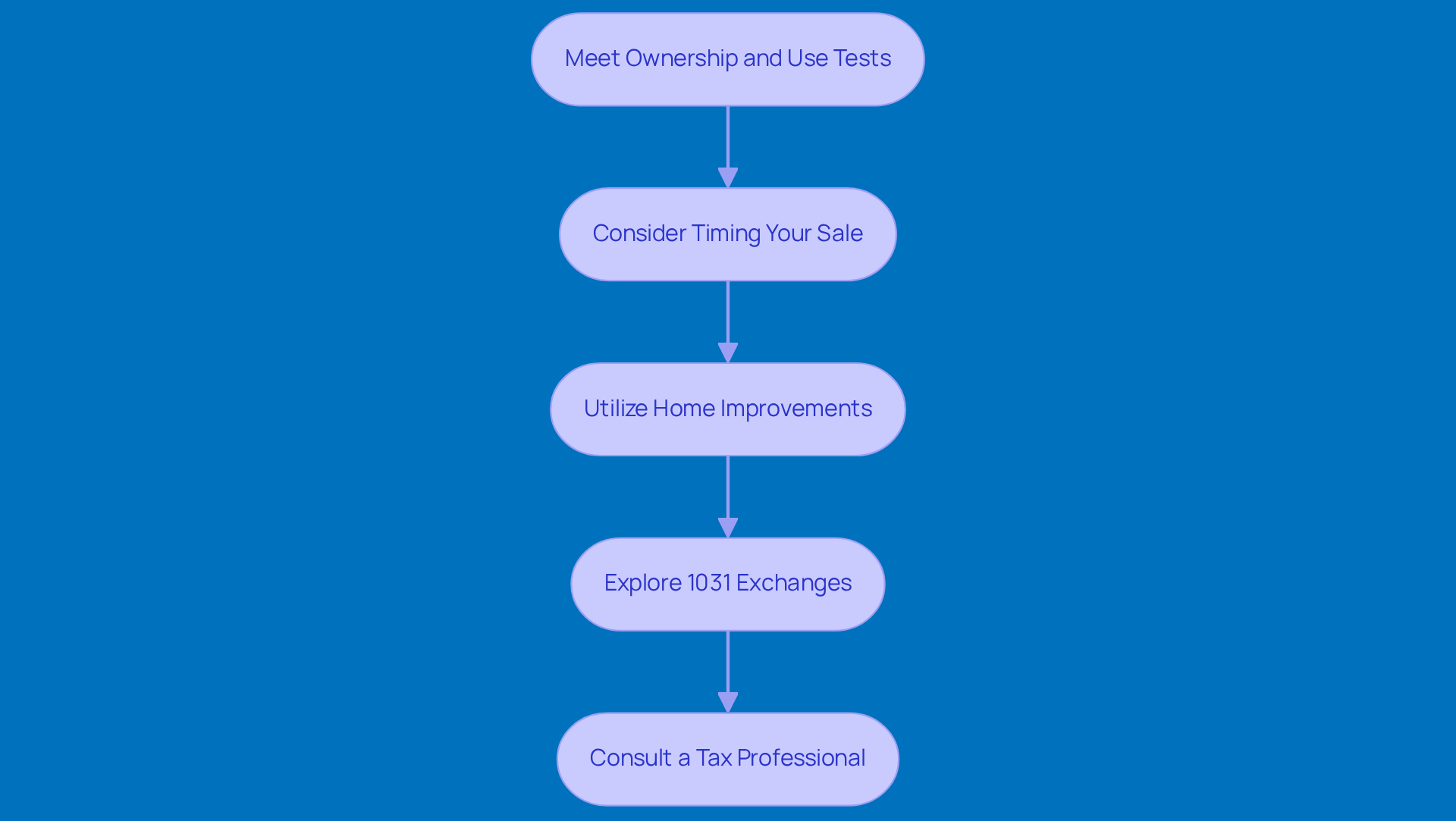

Meet the Ownership and Use Tests: First things first, make sure you’ve lived in your home for at least two of the last five years. This is super important for learning how to avoid capital gains tax on primary residence. If you do, single filers can skip up to $250,000 in profits, and married couples can leave out up to $500,000, according to the IRS. Pretty neat, right?

-

Consider Timing Your Sale: Are you getting close to that two-year mark? If so, it might be worth your while to wait a bit longer. Timing your sale just right can really boost your exclusion potential and teach you how to avoid capital gains tax on primary residence to maximize those tax benefits.

-

Utilize Home Improvements: Don’t forget to keep track of any major improvements you’ve made to your home! These can actually bump up your cost basis. For instance, if you bought your house for $300,000 and spent $50,000 on renovations, your adjusted basis would be $350,000. This means you’ll lower your taxable profit when it’s time to sell. Win-win!

-

Explore 1031 Exchanges: If you’re selling an investment property, you might want to look into a 1031 exchange. This nifty option lets you postpone profit taxes by reinvesting the proceeds into a similar property. Just remember to follow the rules, like identifying replacement properties within 45 days and finalizing the exchange within 180 days, as the IRS outlines.

-

Consult a Tax Professional: Finally, chatting with a tax advisor can really help you out. They can offer personalized strategies based on your unique financial situation. Their expertise can guide you through the sometimes tricky tax regulations, helping you make smart decisions about timing and improvements.

So, what do you think? Have you tried any of these strategies before? Let’s make sure you’re set up for success!

Maintain Proper Documentation and Reporting

Selling your home can be easy, especially if you understand how to avoid capital gains tax on primary residence! Just follow these simple documentation and reporting guidelines to keep things running smoothly:

-

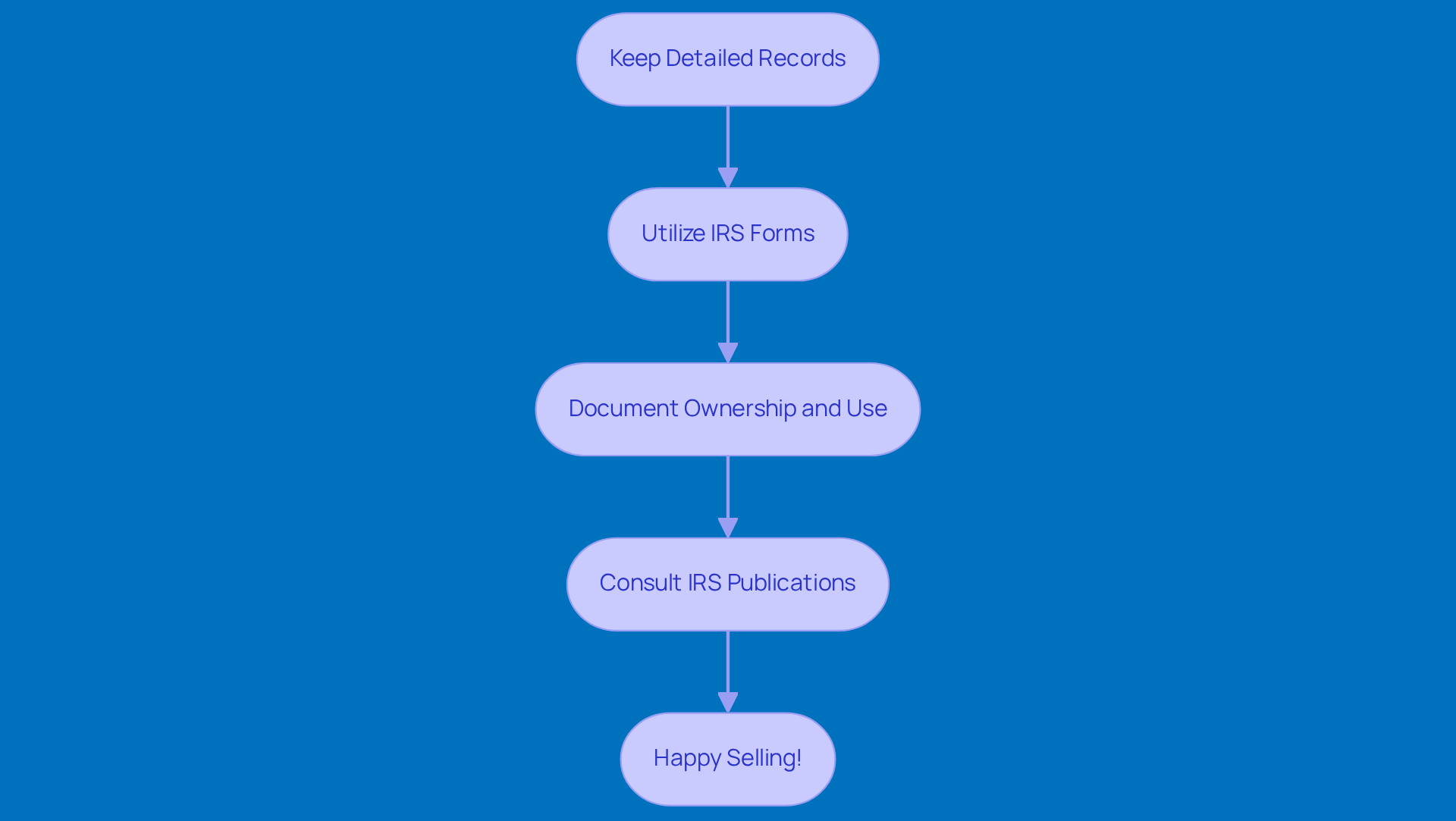

Keep Detailed Records: It’s super important to hang onto records of your purchase price, any improvements you made, and the sale price. This info is key for figuring out your profit from the sale.

-

Utilize IRS Forms: When it’s time to declare the sale, you’ll likely need to fill out IRS Form 8949 and Schedule D to report your profits and losses. Make sure you fill these out accurately to reflect your situation - trust me, it’ll save you some headaches later!

-

Document Ownership and Use: Don’t forget to keep records that show you lived in the home for the required period. Things like utility bills, tax returns, or bank statements can come in handy here.

-

Consult IRS Publications: For more detailed guidance, check out IRS Publication 523. It’s packed with info on selling your home and includes guidance on how to avoid capital gains tax on primary residence. You’ll find everything you need about exclusions and reporting requirements there.

So, there you have it! Keeping these tips in mind can make the process a lot easier. Happy selling!

Utilize Resources and Tools for Tax Planning

Looking to optimize your tax planning and manage capital gains tax effectively? Here are some handy resources and tools to consider:

-

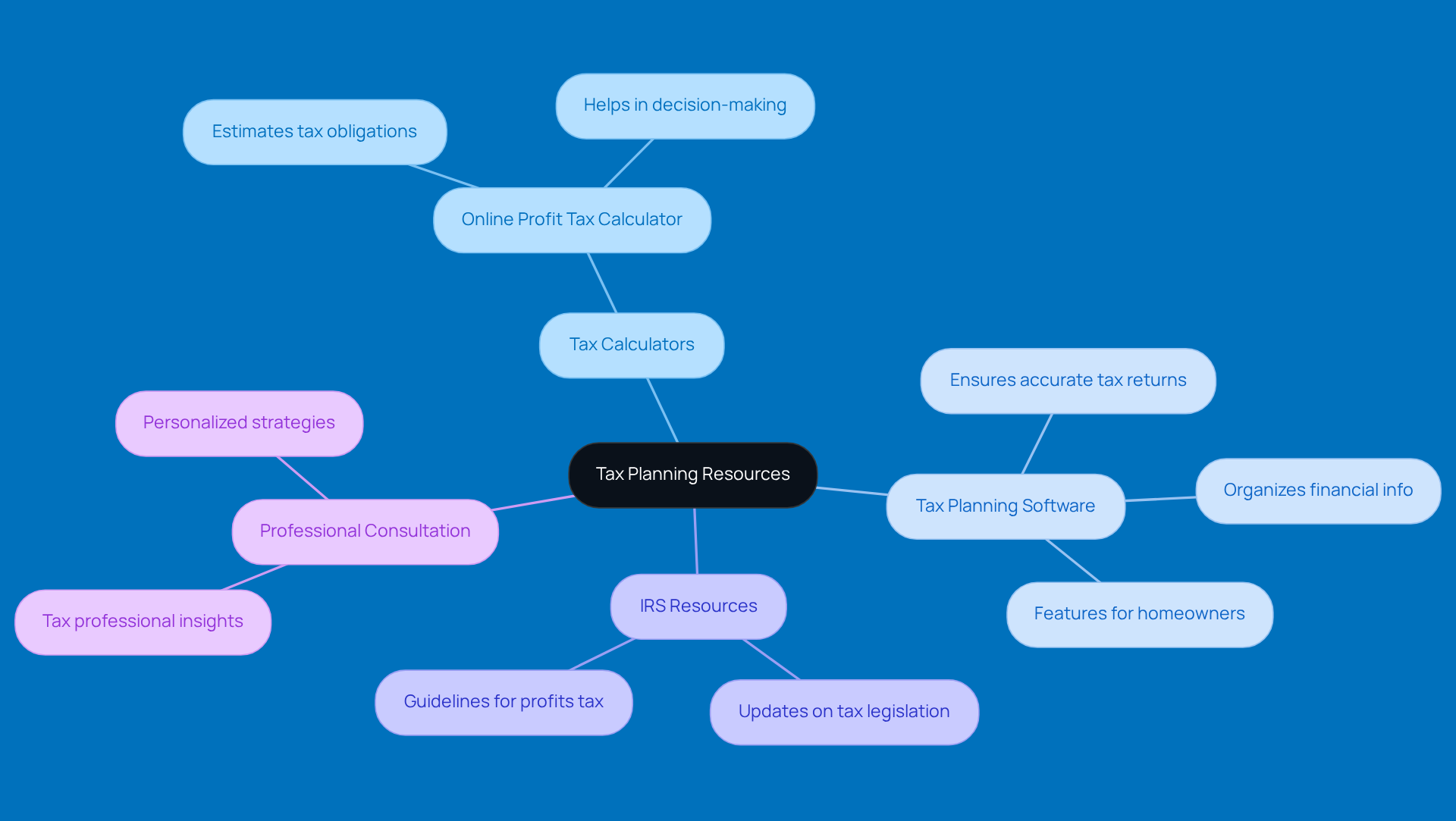

Tax Calculators: Have you ever tried using an online profit tax calculator? These tools are fantastic for estimating your potential tax obligation based on your unique situation. They help you understand the financial implications of selling your home, making it easier to make informed decisions.

-

Tax Planning Software: Investing in tax planning software can really simplify organizing your financial info and ensure your tax returns are spot on. Many of these programs come with features specifically designed for homeowners, which can really help you navigate those tricky tax scenarios.

-

IRS Resources: Don’t forget to check the IRS website regularly for updates on tax legislation and guidelines related to profits tax. Staying in the loop about changes can empower you to make smarter financial decisions and seize any new opportunities that come your way.

-

Professional Consultation: Ever thought about chatting with a tax professional or financial advisor who specializes in real estate? They can offer personalized strategies and insights tailored just for you. Their expertise can help you navigate the ins and outs of how to avoid capital gains tax on primary residence and optimize your overall tax strategy.

Conclusion

So, if you’re a homeowner looking to sell, knowing how to dodge capital gains tax on your primary residence is key to maximizing your profits. By getting a grip on the exemptions and strategies available, you can save a good chunk of change, letting you keep more of that hard-earned cash in your pocket.

Here’s the scoop: there are several steps you can take to navigate capital gains tax effectively.

- Make sure you meet the ownership and use tests.

- Timing your sale wisely is also crucial.

- Don’t forget to document any home improvements you’ve made!

- If you’re dealing with investment properties, consider 1031 exchanges.

- Consulting with a tax professional can really help you minimize those tax liabilities while keeping you in line with IRS regulations.

In the end, being proactive about your tax planning can lead to some serious financial perks. I encourage you to tap into resources like tax calculators, planning software, and professional advice to boost your understanding and execution of these strategies. By taking informed steps today, you can set yourself up for a more profitable and stress-free home selling experience down the road.

Frequently Asked Questions

What is capital gains tax on primary residences?

Capital gains tax is a tax on the profit you make when you sell your home.

How can I avoid capital gains tax when selling my primary residence?

You can exclude up to $250,000 of profit if you’re single or up to $500,000 if you’re married and filing jointly, provided you meet certain criteria.

What are the eligibility requirements to qualify for the capital gains tax exclusion?

To qualify, you must have owned and lived in your home for at least two of the last five years before selling. The two years do not have to be consecutive.

Can I use the capital gains tax exclusion more than once?

No, if you have already used this exemption in the last two years, you cannot use it again right away.

What if I sell my home due to a job transfer?

You may still qualify for a reduced exemption even if you didn’t meet the two-year residency requirement.

Do I need to report the sale of my home on my income tax return?

Yes, you must report the sale on your income tax return, even if the exemption eliminates your profit.

Where can I find more detailed information about capital gains tax and primary residences?

You can check the IRS guidelines on tax benefits for primary residences for more detailed information.