Introduction

Calculating the Unadjusted Basis Immediately After Acquisition (UBIA) of qualified property is super important for tax planning, and it can really affect your business's financial health. By getting a handle on how to calculate this, small business owners can tap into potential tax deductions under the Qualified Business Income Deduction (QBID) and boost their profitability. But with all the different criteria and nuances to think about, how can you make sure your calculations are spot on while navigating the tricky world of tax regulations?

This guide is here to break it down for you! We’ll walk through a clear, step-by-step process to help you understand UBIA calculations better. By the end, you’ll feel empowered to make informed decisions that maximize your tax benefits.

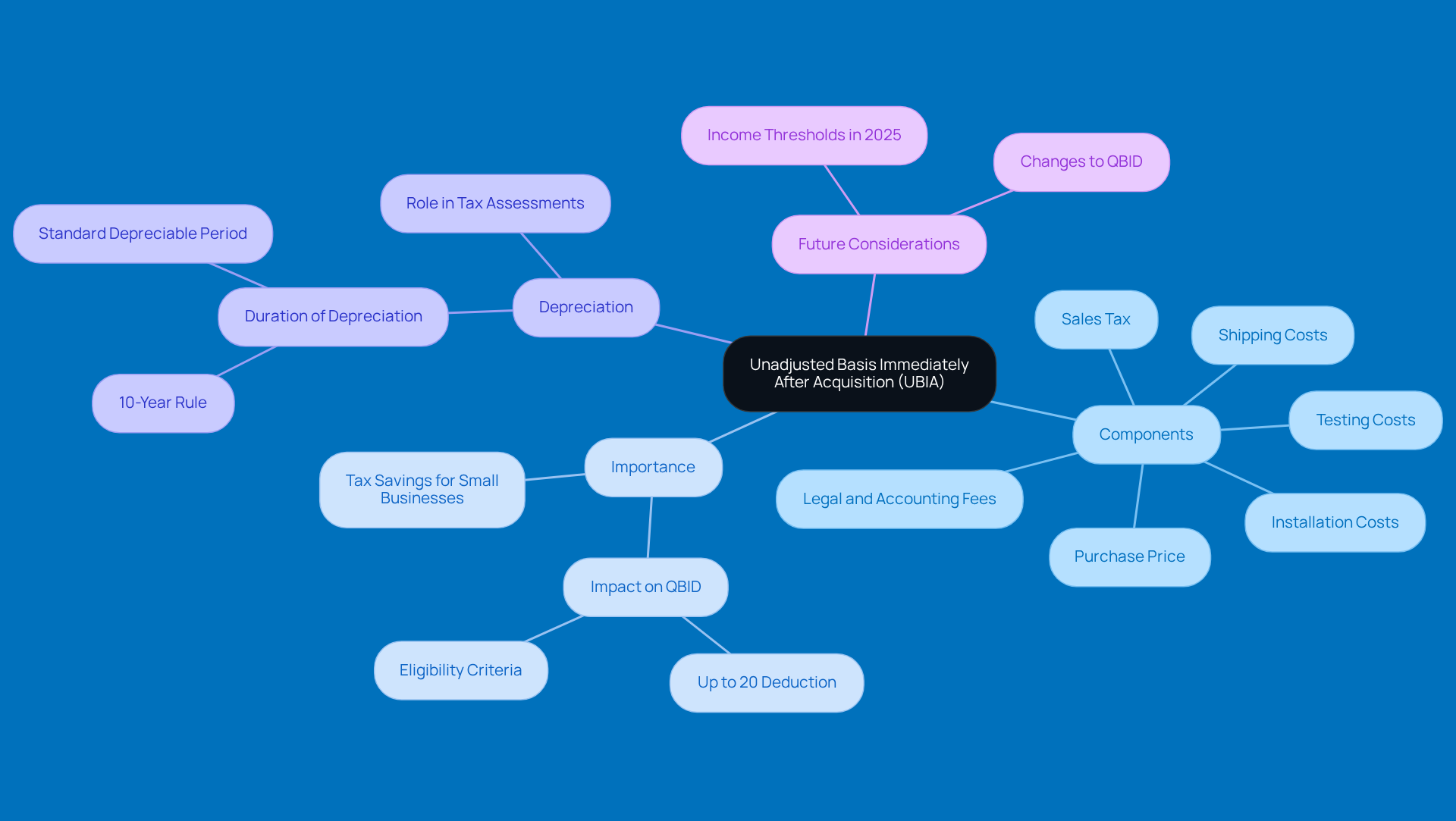

Define UBIA and Its Importance in Tax Calculations

Unadjusted Basis Immediately After Acquisition, or UBIA for short, is all about the initial cost basis of an asset. This includes not just the purchase price but also any extra costs like sales tax, shipping, installation, testing, and even legal and accounting fees when they apply. Understanding how to calculate UBIA of qualified property is super important because it plays a big role in determining the Qualified Business Income Deduction (QBID) under Section 199A of the Internal Revenue Code. This deduction lets qualified taxpayers subtract up to 20% of their eligible business income, so getting the numbers right is key to maximizing those tax benefits.

For small business owners, especially those in rural areas, making the most of this program can lead to significant tax savings, which can really boost their financial stability. Plus, any enhancements made to current assets are treated as separate qualified assets for deduction purposes, allowing business owners to maximize their write-offs.

Now, here’s something to keep in mind: the depreciable duration for certain assets lasts either 10 years after the property is put into use or until the last day of the last complete year of the property's standard depreciable period-whichever comes later. This means that even if an asset is fully depreciated, it can still play a role in tax assessments if it falls within this timeframe.

And don’t forget, the income thresholds for the Qualified Business Income Deduction (QBID) are set to increase in 2025, which will impact eligibility and deduction amounts. Understanding how to calculate UBIA of qualified property not only aids in maximizing the QBID but also assists rural business owners in navigating the complex tax regulations, ultimately contributing to their long-term success and stability. So, how are you planning to leverage this information for your business?

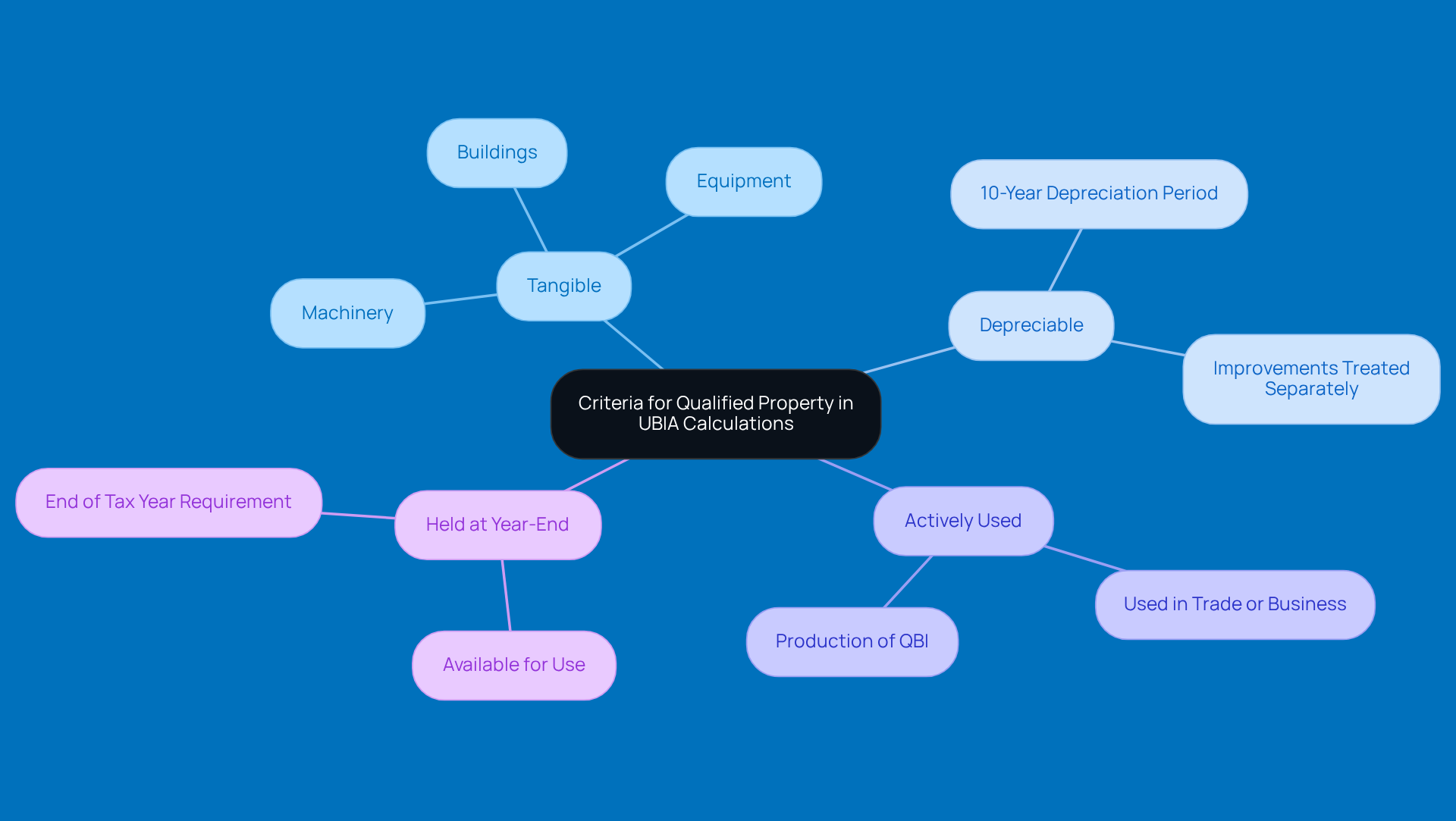

Identify Criteria for Qualified Property in UBIA Calculations

If you want to understand how to calculate UBIA of qualified property, there are a few key criteria to keep in mind. First off, these items need to be tangible, depreciable, and actively used in producing Qualified Business Income (QBI) during the tax year. Plus, the asset should be held by you and ready for use at the end of the tax year. Common examples? Think machinery, equipment, and buildings.

Now, here’s something important: the property must stay within its depreciation period, which usually lasts ten years from when it was first put into service. Once that decade is up, the asset gets kicked out of the calculations, even if you’re still using it. By ensuring your assets meet these criteria, you can accurately learn how to calculate UBIA of qualified property and truly maximize your Qualified Business Income Deduction (QBID).

It’s a good idea to chat with a business tax accountant, like the folks at Steinke and Company. They can help you navigate the ins and outs of qualifying for the QBID deduction, ensuring you stay compliant and avoid any surprises. Steinke and Company offers tailored tax prep and planning services, helping small businesses like yours understand these criteria for effective tax planning - especially in rural areas where tangible assets are often the name of the game.

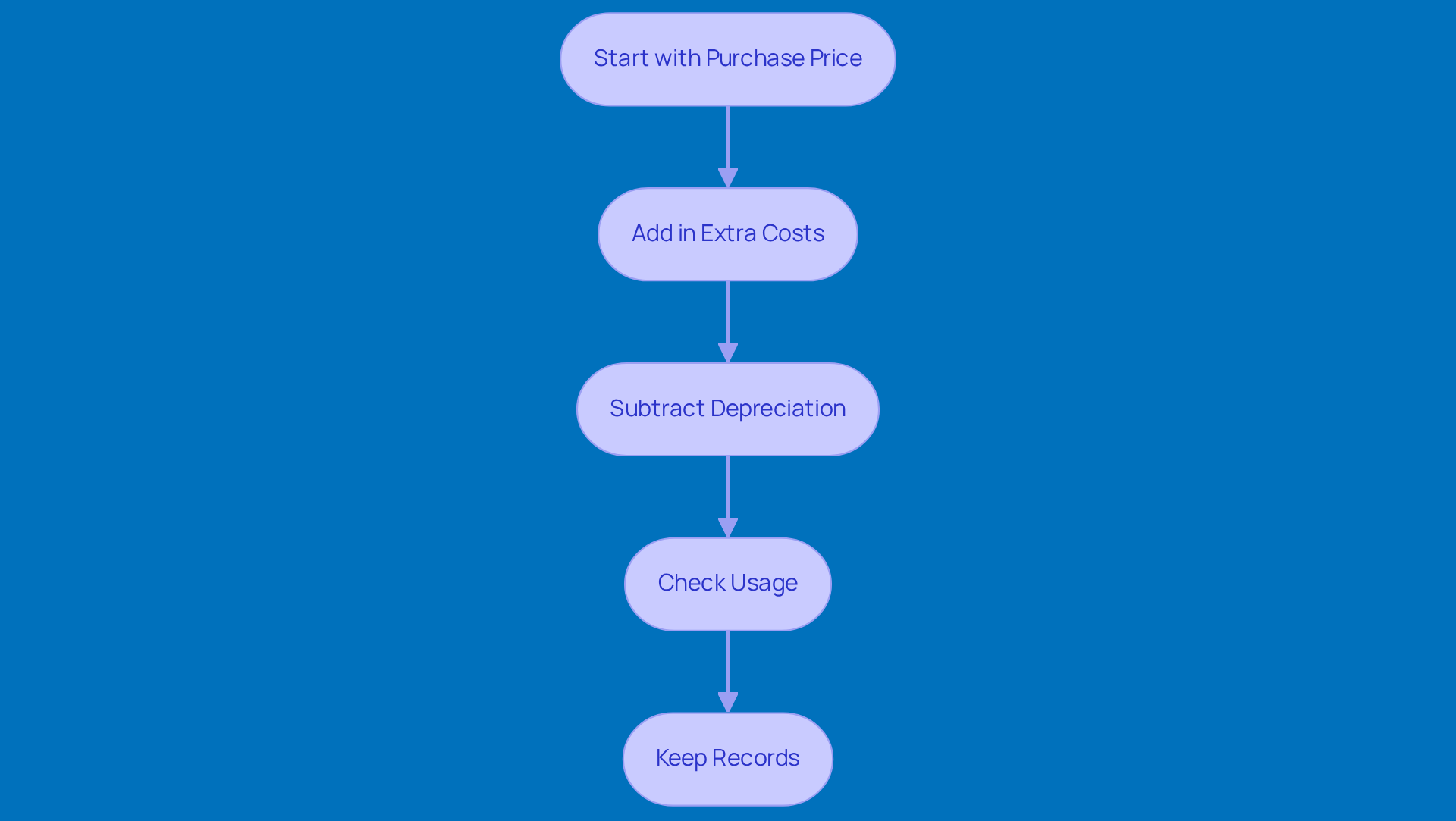

Calculate UBIA: Step-by-Step Process for Qualified Property

Understanding how to calculate ubia of qualified property doesn’t have to be a headache! Just follow these simple steps:

- Start with the Purchase Price: Kick things off with the original cost of your asset. Don’t forget to add in any sales tax and shipping fees - those can sneak up on you!

- Add in Extra Costs: Think about any additional expenses you incurred while getting the asset, like installation or upgrades that boost its value. Every little bit counts!

- Subtract Depreciation: If your asset has been depreciated, make sure to deduct that total from your overall cost. This will help you find the unadjusted basis.

- Check Usage: It’s crucial to confirm that the property was actively used in your business during the tax year and is still within its depreciation period. This step is key for eligibility!

- Keep Records: Don’t skimp on documentation! Make sure to maintain thorough records of all your calculations and supporting documents. You might need them for tax reporting or audits down the line.

By following these steps, you can ensure an accurate assessment of how to calculate ubia of qualified property, which is super important for maximizing your eligibility for the Qualified Business Income Deduction (QBID). Remember, keeping good records and understanding depreciation rates can really impact your tax obligations and benefits. So, get started and make sure you’re on top of it!

Utilize Tools and Resources for Accurate UBIA Calculations

To get those UBIA calculations just right, let’s chat about some handy tools and resources you might want to consider:

- Tax Software: Programs like TurboTax or H&R Block can really take the stress out of calculations and help you stay on the right side of current tax laws.

- Online Calculators: There are plenty of tax websites that offer calculators for qualified business income. These can simplify things by walking you through the necessary inputs.

- IRS Publications: Don’t forget to check out IRS publications, like the instructions for Form 8995-A. They provide detailed guidance on calculating unadjusted basis right after acquisition and the QBID.

- Consult a Tax Professional: It’s always a good idea to chat with a tax advisor or accountant-like those folks at Steinke and Company-who specialize in small business tax compliance. They can offer personalized help and make sure your calculations are spot on. Their expertise can really help you avoid surprises and set you up for long-term success.

- Record-Keeping Tools: Using accounting software to keep track of your assets, including purchase dates, costs, and depreciation schedules, can make a world of difference.

By tapping into these tools and resources, small business owners can improve their understanding of how to calculate ubia of qualified property, leading to better tax outcomes. So, why not give them a try?

Conclusion

Understanding how to calculate the Unadjusted Basis Immediately After Acquisition (UBIA) of qualified property is super important for getting the most out of your tax benefits under the Qualified Business Income Deduction (QBID). When small business owners nail down their UBIA, they can really boost their financial health and stay on the right side of tax regulations. This knowledge gives them the power to make smart choices that can lead to some serious tax savings.

So, what’s the scoop on calculating UBIA? The article lays out some key steps, stressing the need to include all relevant costs, keep proper documentation, and stick to depreciation periods. Plus, it highlights what qualifies as property and the perks of using tools like tax software or professional help to make the calculation process smoother. Each of these pieces is crucial for navigating the sometimes tricky world of tax law.

In the end, using this info can really improve financial outcomes for small business owners, especially those in rural areas. By staying in the loop and being proactive about UBIA calculations, businesses can set themselves up for long-term success and stability. Embracing these strategies not only helps with tax compliance but also encourages growth and resilience in our ever-changing economy. So, why not take a moment to reflect on how you can apply these insights to your own business? It could make a world of difference!

Frequently Asked Questions

What does UBIA stand for and what does it represent?

UBIA stands for Unadjusted Basis Immediately After Acquisition. It represents the initial cost basis of an asset, including the purchase price and additional costs such as sales tax, shipping, installation, testing, and applicable legal and accounting fees.

Why is understanding UBIA important for tax calculations?

Understanding UBIA is crucial because it plays a significant role in determining the Qualified Business Income Deduction (QBID) under Section 199A of the Internal Revenue Code, which allows qualified taxpayers to subtract up to 20% of their eligible business income.

How can small business owners benefit from understanding UBIA?

Small business owners, particularly in rural areas, can achieve significant tax savings by accurately calculating UBIA, which can enhance their financial stability and maximize tax benefits through the QBID.

What happens to enhancements made to current assets regarding UBIA?

Enhancements made to current assets are treated as separate qualified assets for deduction purposes, allowing business owners to maximize their write-offs.

What is the depreciable duration for certain assets?

The depreciable duration for certain assets lasts either 10 years after the property is put into use or until the last day of the last complete year of the property's standard depreciable period, whichever comes later.

How does the depreciation status of an asset affect tax assessments?

Even if an asset is fully depreciated, it can still impact tax assessments if it falls within the specified depreciable timeframe.

What changes are expected regarding the Qualified Business Income Deduction (QBID) in 2025?

The income thresholds for the Qualified Business Income Deduction (QBID) are set to increase in 2025, which will affect eligibility and deduction amounts for taxpayers.