Introduction

Navigating the world of charitable organizations can feel a bit overwhelming, especially when you consider that there are over 1.6 million nonprofits operating in the U.S. alone! While both foundations and nonprofits share the goal of making a positive impact, they actually have some pretty significant differences in their structures, purposes, and how they get funded.

In this article, we’re going to break down the key distinctions between these two types of entities. We’ll explore what exactly defines a foundation and what it takes to achieve nonprofit status. So, how can you make sense of all this and effectively contribute to the philanthropic sector? Let’s dive in!

Define Nonprofits and Foundations

A not-for-profit entity is all about goals that go beyond just making money. These organizations usually focus on social, educational, or charitable aims. Unlike regular businesses, nonprofits take any extra money they make and put it right back into their mission instead of handing it out to owners or shareholders. Did you know that in 2025, there are around 1.6 million charitable organizations in the U.S.? That really shows how important they are in our communities!

Now, let’s talk about a specific type of nonprofit that is a foundation, a nonprofit known as a base. This initiative is a foundation, a nonprofit that mainly focuses on providing financial support to other nonprofits or charitable initiatives. There are two main types of organizations:

- Private entities, which usually get their funding from a single source like a family or corporation.

- Public charities, which rely on a wider public base for support.

Both types enjoy tax-exempt status under IRS rules, but they operate quite differently. For example, private foundations need to give away at least 5% of their assets each year to keep their tax-exempt status, while public charities must get at least one-third of their funding from public sources.

According to the IRS, charitable entities are groups that have been granted tax exemption under Section 501(c)(3). Understanding these differences is super important for anyone involved in the charitable sector. It affects how organizations operate, raise funds, and reach their goals. Plus, bringing in a variety of perspectives during decision-making is key for good governance in both charitable organizations and trusts. So, what do you think? How can we all contribute to making these organizations even better?

Identify Key Differences Between Nonprofits and Foundations

The differences between nonprofits and foundations are pretty important, and here’s a quick rundown:

-

Purpose: Nonprofits are all about getting their hands dirty with charitable activities, providing services and support right to the community. Foundations, on the other hand, mainly focus on grant-making, which means they provide financial support to other nonprofits.

-

Financial Sources: Nonprofits usually gather resources from a mix of sources - think personal contributions, grants, and service fees. In 2024, individual giving hit just over $392 billion, making it the biggest source of charitable contributions at 66%. Foundations, however, often depend on a single or limited source of funding, like an endowment or family wealth, which can really limit their financial flexibility.

-

Public Involvement: Nonprofits tend to connect more with the public and are accountable to their donors and the communities they serve. It’s worth noting that nearly one-third of nonprofits are at risk of survival due to various challenges, highlighting how crucial public support is. Foundations, especially private ones, might operate with less public oversight since they can be run by just a small group of individuals or families.

-

Regulatory Requirements: Nonprofits have to follow specific operational guidelines and reporting requirements, like filing Form 990 with the IRS. Foundations, on the flip side, submit Form 990-PF, which includes detailed info about grants, investments, and expenditures, plus a report on their 5% minimum distribution requirement each year. Foundations face different regulations, especially when it comes to their grant-making activities and financial disclosures.

Understanding these differences is super important for anyone involved in the charitable field. They really shape how these entities operate and interact with their communities. For instance, public charities often get funding from various sources, while private foundations might be limited to the wealth of a single donor or family, which can affect their ability to support a range of initiatives. As the philanthropic landscape changes, staying in the loop about these distinctions will help organizations navigate their roles more effectively.

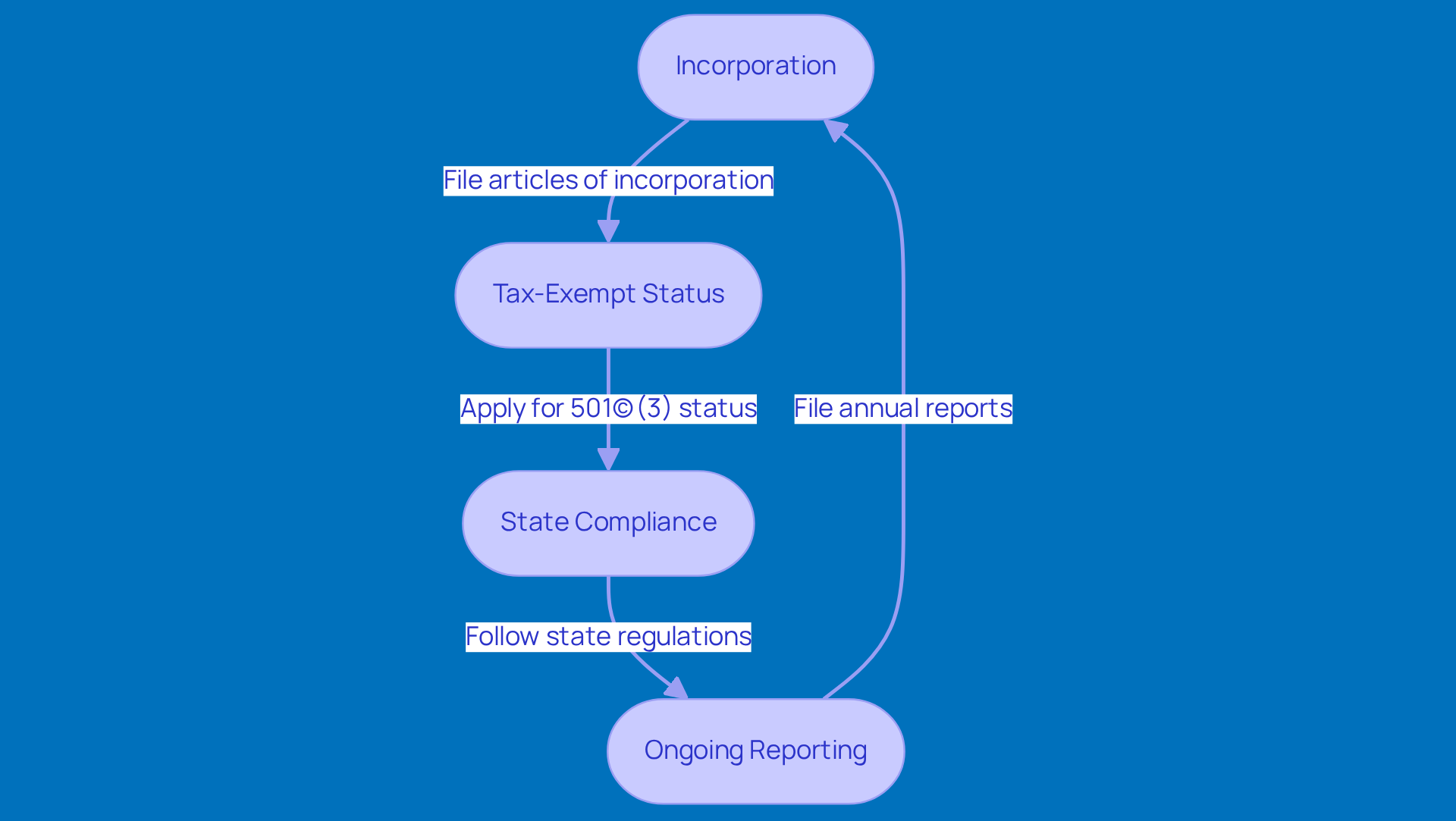

Assess Legal Requirements for Nonprofit Status

Starting a nonprofit? There are a few legal steps you’ll need to tackle first:

-

Incorporation: First things first, you’ve got to get your nonprofit incorporated as a legal entity in your state. This means that filing articles of incorporation, which is a foundation a nonprofit, involves paying any fees that may vary depending on your location.

-

Tax-Exempt Status: If you’re aiming for that coveted federal tax-exempt status under section 501(c)(3), you’ll need to apply to the IRS. This involves filling out Form 1023 or the simpler Form 1023-EZ. You’ll be sharing a lot about your organization’s structure, governance, and what you plan to do, which helps keep everything transparent and accountable.

-

State Compliance: Don’t forget about state rules! Besides the federal requirements, you’ll need to follow your state’s specific regulations. This could mean getting state tax exemptions, registering for charitable solicitation, and adhering to local governance laws, which can really differ from one place to another.

-

Ongoing Reporting: Once you’re up and running, you’ll have to keep filing annual reports with the IRS using Form 990. Plus, staying compliant with state regulations is key to keeping your tax-exempt status. If you don’t, you risk losing it, which can shake donor trust and your organization’s viability. Just so you know, if you fail to file for three years in a row, your tax-exempt status gets revoked automatically.

In 2025, around 70% of organizations that applied for 501(c)(3) status got it-pretty impressive, right? This really shows how important it is to prepare well and understand the process. Having a legal expert on your side can make things smoother, helping you stay compliant and avoid costly blunders. As one expert puts it, "An attorney ensures compliance, reduces risk, and saves time so leaders can focus on mission-driven work." And let’s not forget, protecting your intellectual property is super important for nonprofits to keep their brand identity and operational integrity intact.

Evaluate Funding Sources and Operational Structures

The unique ways of funding and operating for nonprofits raise the question of whether a foundation is a nonprofit, which significantly shapes how they achieve their missions and effectiveness.

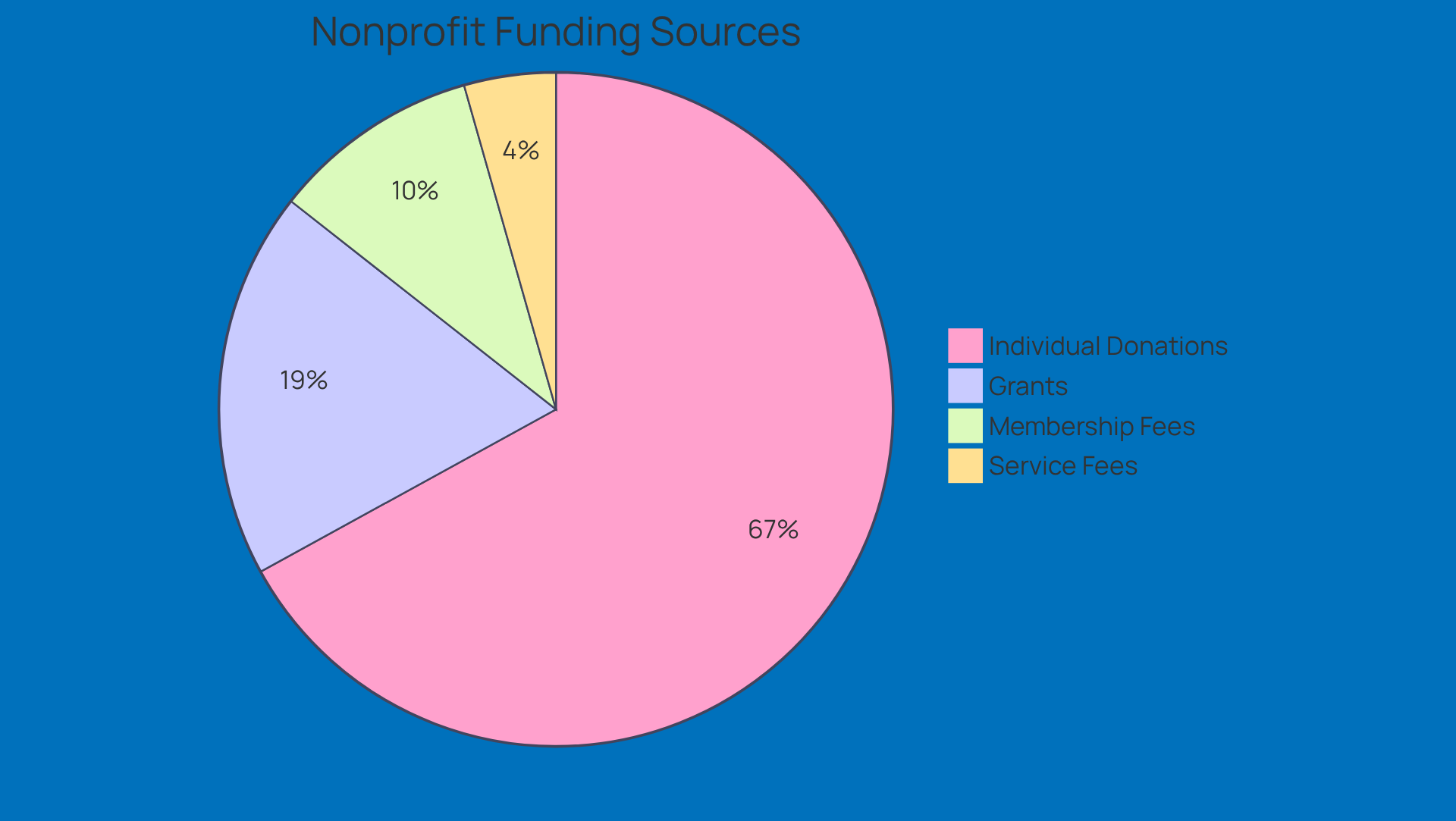

Funding Sources: Nonprofits usually mix things up with their funding, tapping into several channels:

- Individual Donations: These are contributions from private individuals, and they made up about 67% of total charitable giving in 2023. That’s a big deal!

- Grants: This is where financial support from government entities, foundations, and corporations comes in. They’re crucial for funding projects and keeping the lights on. In fact, foundations alone contributed around $103.53 billion, which is about 18.6% of overall charitable giving. Talk about making an impact!

- Membership Fees: Some nonprofits charge fees for individuals who want to be part of the organization. This not only brings in revenue but also helps build a sense of community.

- Service Fees: This is income from programs or services offered, allowing organizations to keep running while providing value to their communities.

On the flip side, when discussing charitable organizations, it is important to recognize that a foundation as a nonprofit mainly relies on its endowment funds, often focusing on specific causes or projects. This approach lets them zero in on long-term impact and strategic initiatives.

Operational Structures: Nonprofits typically have a board of directors that oversees governance and ensures they’re following the rules. They often have staff managing daily activities like program delivery, fundraising, and community outreach. Foundations might have a similar governance setup but usually operate with a smaller team focused on grant-making and compliance with financial regulations. Understanding these structures is key to effective governance and reaching organizational goals.

Plus, the charitable sector is growing! All nine major charitable areas showed growth in current dollars during 2024, which opens up strategic opportunities for financial support and operational efficiency. And let’s not forget about the power of partnerships - when nonprofits team up with businesses, it can really boost funding sources and operational strategies, creating even more paths to sustainability.

So, what do you think? How can we all contribute to this growing sector?

Conclusion

Understanding the differences between nonprofits and foundations is super important for anyone wanting to navigate the charitable sector effectively. Sure, both types of organizations fall under the nonprofit umbrella, but they each have their own unique roles and ways of operating. Nonprofits are all about engaging directly with communities through charitable activities, while foundations mainly focus on providing financial support to other nonprofits. It’s fascinating how they shape the philanthropic landscape in their own distinct ways!

Let’s break it down a bit. Nonprofits often rely on a mix of funding sources - think individual donations, grants, and service fees. This variety helps them stay nimble and responsive to their missions. On the flip side, foundations usually depend on endowment funds and have a narrower focus. This can limit their financial flexibility, but it also allows them to make a significant long-term impact. Plus, both types of organizations need to keep an eye on legal requirements and compliance to maintain their tax-exempt status and ensure accountability.

Recognizing these differences isn’t just about organizational success; it’s also key to boosting community engagement and support. As the charitable sector keeps growing, there’s plenty of room for individuals and organizations to contribute to its evolution. By fostering partnerships and exploring innovative funding strategies, we can all play a part in this journey. So, let’s engage with these entities thoughtfully - who knows what kind of impactful collaborations we can create together to strengthen the communities we care about?

Frequently Asked Questions

What is a nonprofit organization?

A nonprofit organization is an entity focused on social, educational, or charitable goals rather than making a profit. Any extra money they make is reinvested into their mission instead of being distributed to owners or shareholders.

How many charitable organizations are there in the U.S.?

In 2025, there are approximately 1.6 million charitable organizations in the U.S., highlighting their importance in communities.

What is a foundation in the context of nonprofits?

A foundation is a specific type of nonprofit that primarily provides financial support to other nonprofits or charitable initiatives.

What are the two main types of foundations?

The two main types of foundations are private entities, which typically receive funding from a single source like a family or corporation, and public charities, which rely on support from a broader public base.

What tax benefits do nonprofits and foundations receive?

Both private foundations and public charities enjoy tax-exempt status under IRS rules, but they operate differently regarding funding and distribution requirements.

What are the funding requirements for private foundations and public charities?

Private foundations must give away at least 5% of their assets each year to maintain their tax-exempt status, while public charities must obtain at least one-third of their funding from public sources.

What is the significance of Section 501(c)(3) in relation to charitable organizations?

Section 501(c)(3) is the IRS designation that grants tax exemption to charitable organizations, allowing them to operate as nonprofits.

Why is understanding the differences between types of nonprofits important?

Understanding these differences is crucial for anyone involved in the charitable sector as it impacts how organizations operate, raise funds, and achieve their goals.

How can good governance be achieved in charitable organizations?

Good governance in charitable organizations and trusts is supported by incorporating a variety of perspectives during decision-making processes.