Introduction

Navigating the world of life insurance can feel like a maze, especially for LLC owners trying to wrap their heads around tax implications. This guide is here to help you untangle those complexities and figure out whether life insurance premiums are tax deductible for your LLC. We’ll explore different policy types and their potential benefits, making it easier for you to understand what’s at stake.

But let’s be real - tax regulations can be tricky, and there are common pitfalls that can trip you up. So, how can you make sure you’re making informed decisions that not only maximize your financial advantages but also keep you compliant? Let’s dive in and find out together!

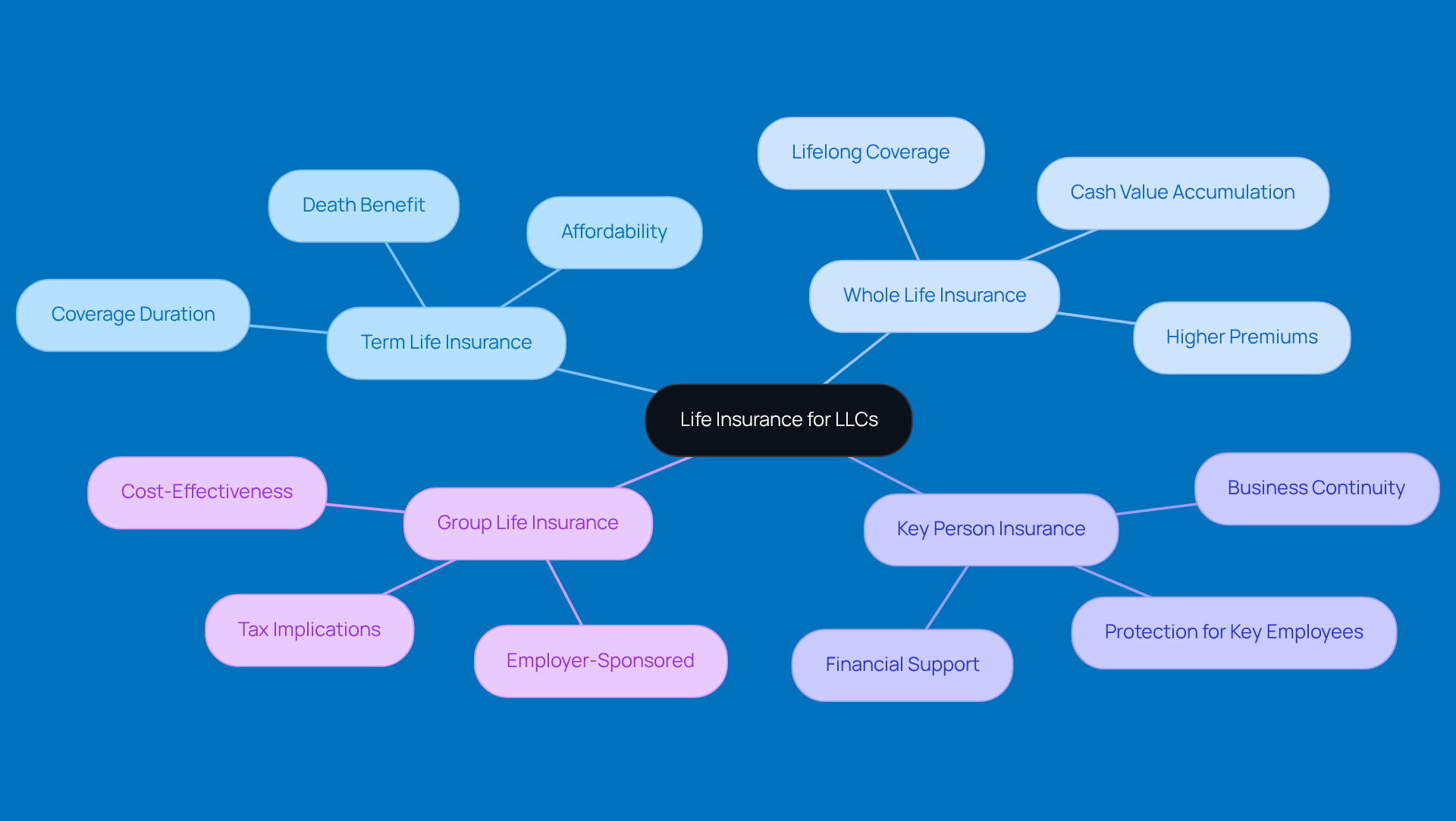

Understand Life Insurance Basics for LLCs

Navigating the tax implications of whether is life insurance tax deductible for LLCs can feel a bit overwhelming, but it doesn’t have to be! Let’s break down the different types of life insurance policies available, so you can find what works best for you.

-

Term Life Insurance: Think of this as a safety net for a specific period-like 10 to 30 years. If the insured passes away during that time, a death benefit is paid out. The best part? It’s usually more affordable than permanent insurance.

-

Whole Life Insurance: This one’s a keeper! It covers you for your entire life, as long as you keep up with the premiums. Plus, it builds cash value over time, which you can borrow against for things like operational expenses.

-

Key Person Insurance: This policy is all about protecting your business’s backbone-your key employees or owners. If something happens to them, the company gets the payout, helping to cover any financial losses.

-

Group Life Insurance: Often offered by employers, this policy covers a group of people under one contract. The first $50,000 of coverage is usually tax-exempt for the employer, leading to inquiries about whether is life insurance tax deductible for llc, as those premiums can often be deducted as operational expenses. It’s a cost-effective way to attract and keep top talent, though it can get a bit tricky since it’s tied to employment status.

Understanding whether is life insurance tax deductible for llc can really assist LLC owners in assessing their needs and the potential tax implications. So, why not take a moment to explore and compare life insurance quotes from different companies? You might just find the perfect fit for your unique situation!

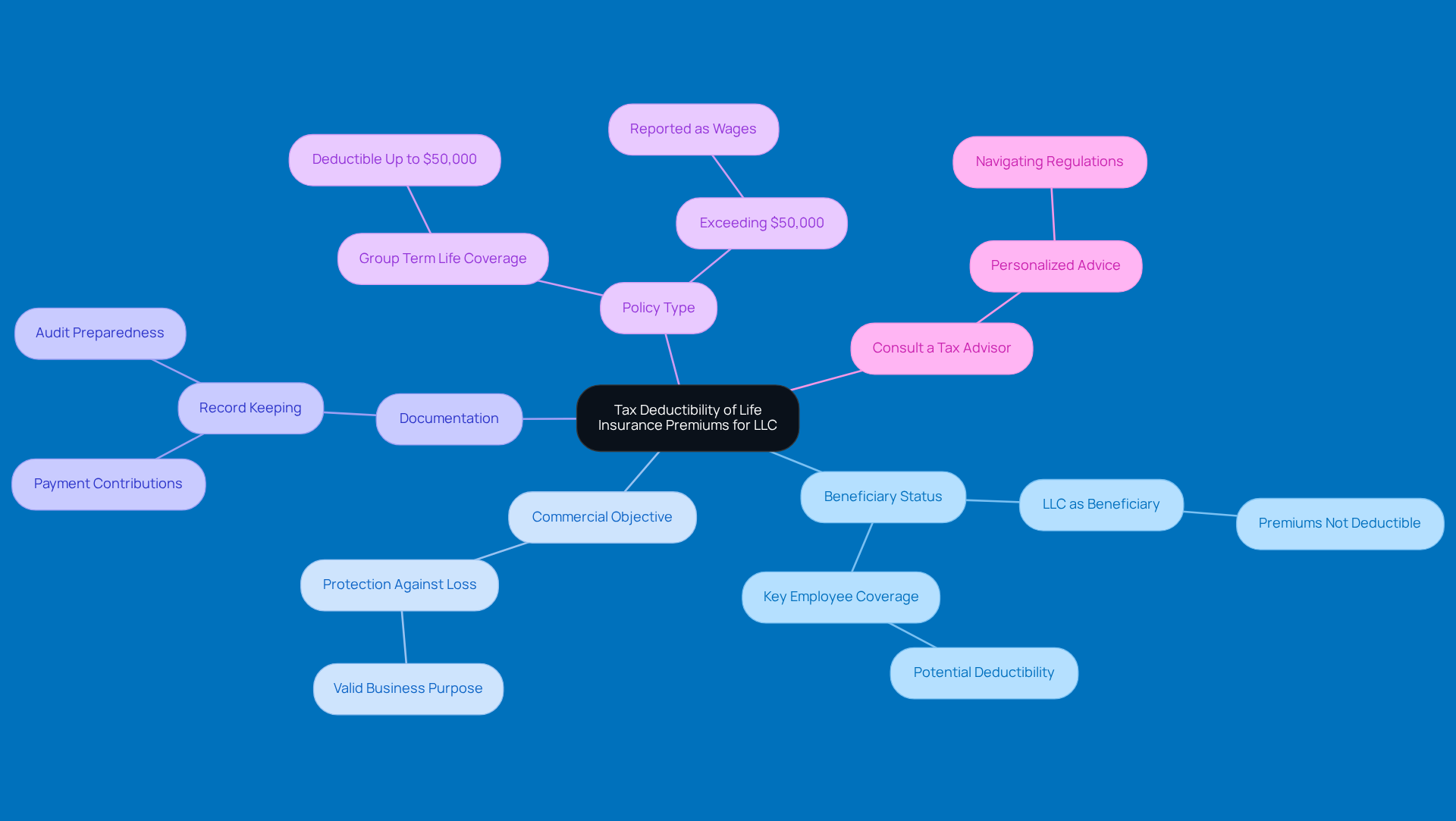

Identify Criteria for Tax Deductibility of Life Insurance Premiums

Wondering if life insurance is tax deductible for LLC when it comes to premiums? Let’s break it down with some key points:

-

Beneficiary Status: Generally, if your LLC is the beneficiary of the policy, those premiums aren’t deductible. But if the policy is for a key employee and your company isn’t the beneficiary, you might be in luck, as this situation raises the question of whether life insurance is tax deductible for LLC!

-

Commercial Objective: The payments need to be tied to your business activities. Think of it as protecting against the loss of a key employee - this fulfills a valid commercial objective.

-

Documentation: Keeping thorough records is a must! Make sure you document payment contributions and the reasons for the policy. This paperwork is crucial if you ever face an audit.

-

Policy Type: If you have group term life coverage, you can deduct costs up to $50,000 of protection per employee, as long as your business isn’t the beneficiary.

-

Consult a Tax Advisor: Tax regulations can be tricky, so it’s a smart move to chat with a tax advisor. They can give you personalized advice on how to navigate the deductibility of life coverage costs.

By keeping these criteria in mind, you can confidently tackle the complexities of understanding if life insurance is tax deductible for LLC. This way, you’ll ensure compliance and maximize any potential tax benefits!

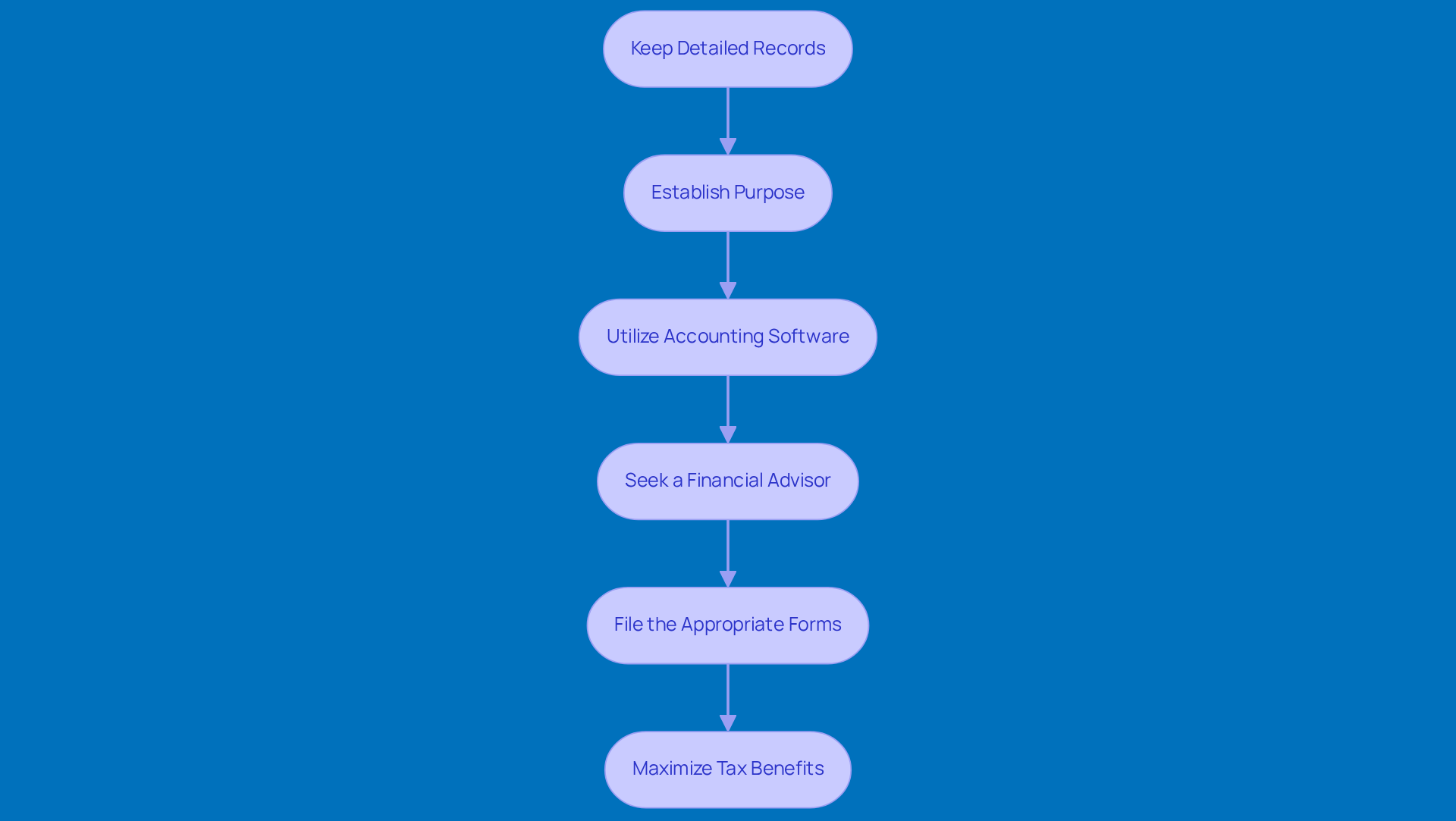

Document and Claim Life Insurance Premiums as Business Expenses

If you're an LLC owner looking to document and claim life insurance premiums as business expenses, here’s a friendly guide to help you out:

-

Keep Detailed Records: First things first, make sure you’re keeping thorough records of all your premium payments. This means holding onto invoices and bank statements that clearly show when you made payments and how much they were. Trust me, it’ll save you a headache later!

-

Establish Purpose: Next, it’s important to document why you have that life coverage policy. Jot down notes on how this policy protects your business or your key employees. It’s all about showing the value it brings to your organization.

-

Utilize Accounting Software: Now, let’s talk tech! Using accounting software can really help you classify and track those insurance costs as operational expenses. This makes tax season a breeze and boosts accuracy. Did you know that while 18.71% of small business owners use accounting software, a whopping 71% still rely on old-school methods like pen and paper? That can lead to some pretty avoidable mistakes!

-

Seek a Financial Advisor: Before you hit that submit button on your tax returns, it’s a smart move to chat with a financial advisor. They can help ensure you’re claiming your contributions accurately and sticking to all those IRS regulations. Just a heads up: while determining if life insurance is tax deductible for LLC, it's important to note that life coverage costs usually aren’t tax-deductible if your company is the policy’s beneficiary.

-

File the Appropriate Forms: Finally, when tax time rolls around, make sure you’re including those costs on the right forms. For sole proprietors, that’s Schedule C, and for partnerships, it’s Form 1065. If you’re running a sole proprietorship or a single-member LLC, you’ll want to list those business coverage costs on Schedule C, line 15 under 'Expenses'.

By following these steps, you can efficiently record and claim your life coverage costs, especially to understand if life insurance is tax deductible for LLC, maximizing those potential tax benefits. And remember, using accounting software can really boost your efficiency when managing those insurance-related financial records!

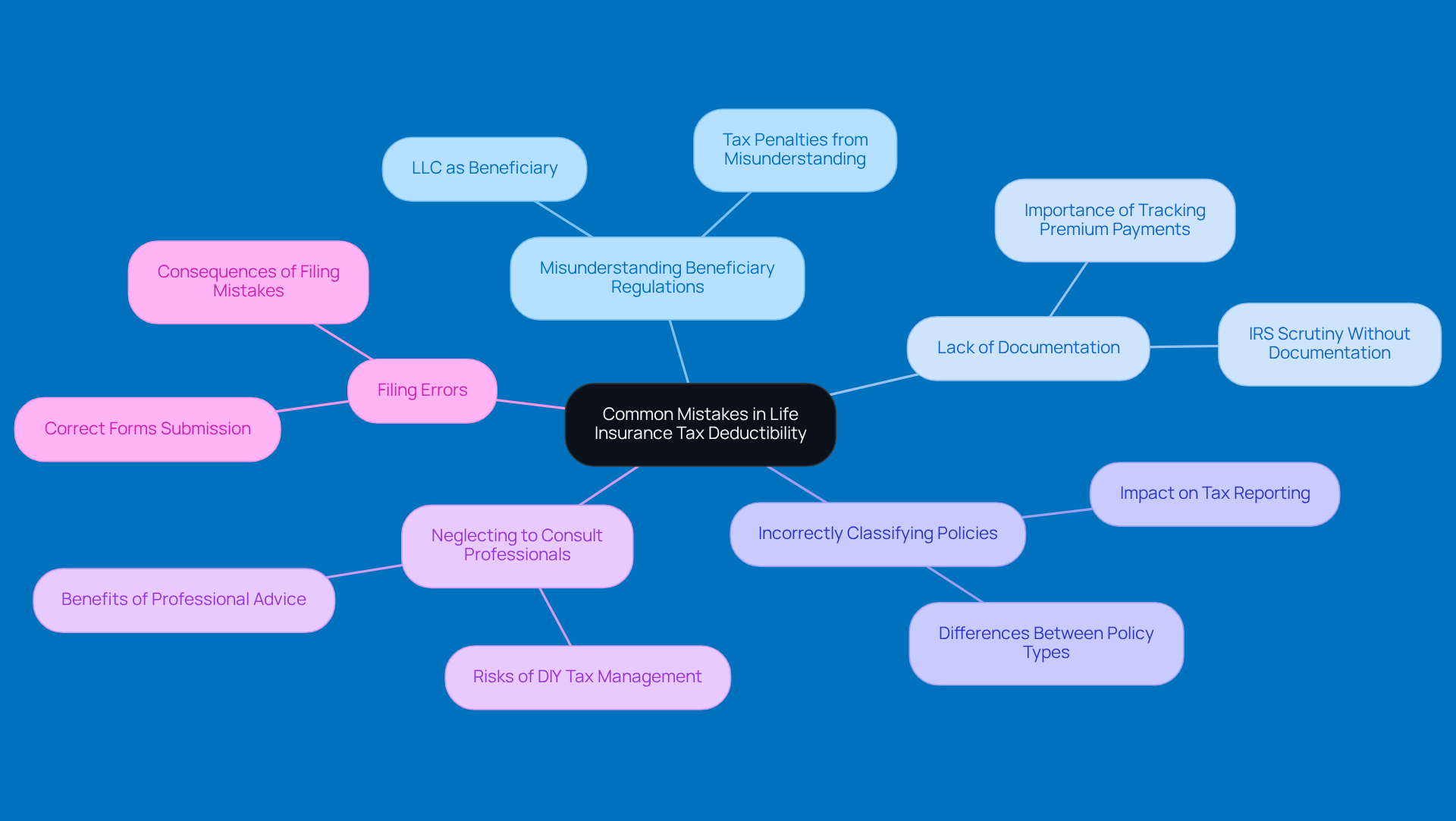

Avoid Common Mistakes in Life Insurance Tax Deductibility

Hey there, LLC owners! Let’s chat about some common pitfalls regarding whether life insurance is tax deductible for LLC. Avoiding these mistakes can save you a lot of headaches down the road.

First up, Misunderstanding Beneficiary Regulations. It’s a common misconception that if your LLC is the beneficiary, you can deduct those payments. Unfortunately, that’s not the case! If the LLC is the beneficiary, it raises the issue of whether life insurance is tax deductible for LLC, as those costs usually aren’t deductible, which can lead to some nasty surprises come tax time. Trust me, many LLCs have found themselves in hot water during audits because of this misunderstanding, racking up hefty tax penalties.

Next, let’s talk about Lack of Documentation. If you’re not keeping track of your premium payments and the business purpose behind your policy, you might run into trouble during an audit. It’s super important to document why you’re keeping that policy to show it’s relevant to your business. Did you know that businesses without proper documentation are more likely to catch the IRS’s eye? It’s true!

Now, onto Incorrectly Classifying Policies. Not all life insurance policies are treated the same when it comes to taxes. You really need to know the differences between term, whole, and key person insurance for accurate tax reporting. Misclassifying these can lead to wrong deductions and, you guessed it, potential audits.

Don’t forget about Neglecting to Consult Professionals. Many business owners try to tackle complex tax laws on their own, but that can be risky. A tax advisor can offer valuable insights and help you stay on the right side of IRS regulations, saving you from costly mistakes. As tax advisor Pam Olson puts it, "Consulting a professional can clarify the complexities of tax laws and help prevent missteps."

Lastly, let’s not overlook Filing Errors. Getting your filing right is crucial! Make sure you submit the correct forms and report premiums in the right sections of your tax return. Filing mistakes can lead to audits and penalties. Plus, with the recent proposed regulations from the Treasury Department and IRS aimed at modernizing tax treatment rules for life coverage, accurate reporting is more important than ever.

By keeping these common mistakes in mind, you can navigate the tricky waters of whether life insurance is tax deductible for LLC and stay compliant with tax regulations. So, what do you think? Have you encountered any of these issues before?

Conclusion

Understanding the tax implications of life insurance for LLCs is super important for business owners who want to protect their assets and employees while also maximizing potential tax benefits. Life insurance can do a lot - like safeguard key personnel or provide financial support during tough times. But let’s be real, the tax deductibility can get a bit tricky. That’s why it’s essential for LLC owners to know the criteria and documentation needed to navigate these waters effectively.

So, what’s on the table? We’re talking about different types of life insurance policies - think term, whole, key person, and group life insurance - and their specific tax implications. Plus, understanding beneficiary status, commercial objectives, and keeping diligent records can really help ensure you’re in line with IRS regulations. And hey, don’t forget to consult with tax and financial advisors! It’s a smart move to avoid those common pitfalls that could lead to costly mistakes come tax season.

Ultimately, taking the time to understand and properly document life insurance premiums can lead to some serious financial advantages for LLCs. By being informed and prepared, business owners can confidently use life insurance as a strategic tool for both protection and tax efficiency. Embracing this knowledge not only safeguards your business but also sets it up for growth and stability in the long run. So, why not take that step today? Your future self will thank you!

Frequently Asked Questions

What are the different types of life insurance policies available for LLCs?

The main types of life insurance policies available for LLCs are Term Life Insurance, Whole Life Insurance, Key Person Insurance, and Group Life Insurance.

What is Term Life Insurance?

Term Life Insurance provides coverage for a specific period, typically between 10 to 30 years. If the insured passes away during this time, a death benefit is paid out, and it is generally more affordable than permanent insurance.

How does Whole Life Insurance work?

Whole Life Insurance covers the insured for their entire life as long as premiums are paid. It also builds cash value over time, which can be borrowed against for operational expenses.

What is Key Person Insurance?

Key Person Insurance protects a business's key employees or owners. If something happens to them, the company receives a payout to help cover any financial losses.

What is Group Life Insurance and how does it benefit LLCs?

Group Life Insurance is often offered by employers and covers a group of people under one contract. The first $50,000 of coverage is usually tax-exempt for the employer, and premiums can often be deducted as operational expenses, making it a cost-effective way to attract and retain talent.

Are life insurance premiums tax deductible for LLCs?

Yes, understanding whether life insurance is tax deductible for LLCs can help owners assess their needs and the potential tax implications, particularly for Group Life Insurance premiums.