Introduction

Navigating the world of Form 1040 Box 12 codes can feel like a maze for small business owners, especially during tax season. These codes might seem like just another set of numbers, but they’re actually crucial for accurately reporting income and snagging deductions that could really lighten your tax load.

So, how can you make sure you’re using this info to your advantage and steering clear of any costly blunders? Let’s dive in!

Define Form 1040 Box 12 Codes and Their Importance

When it comes to Form 1040, the designations known as 1040 box 12 codes are those quirky letter symbols you see on your W-2 form. They report different types of compensation and benefits, and they can really shake up your tax liability. For small business owners, understanding these regulations is crucial. They provide important info to the IRS and help you figure out your taxable income.

Take the label 'D', for example. It stands for elective deferrals to a 401(k) plan, which can actually lower your taxable income. Pretty neat, right? But watch out - other labels might indicate additional taxes you owe. Getting a grip on these regulations is key to staying compliant and avoiding costly mistakes come tax season.

Plus, accurate reporting can open the door to potential tax deductions and credits, which can significantly impact your overall tax bill. So, knowing your way around 1040 box 12 codes not only aids in tax prep but also empowers you to make smarter financial decisions. Have you checked your W-2 lately? It might just save you some cash!

Explore Common Box 12 Codes and Their Meanings

Explore Common Box 12 Codes and Their Meanings

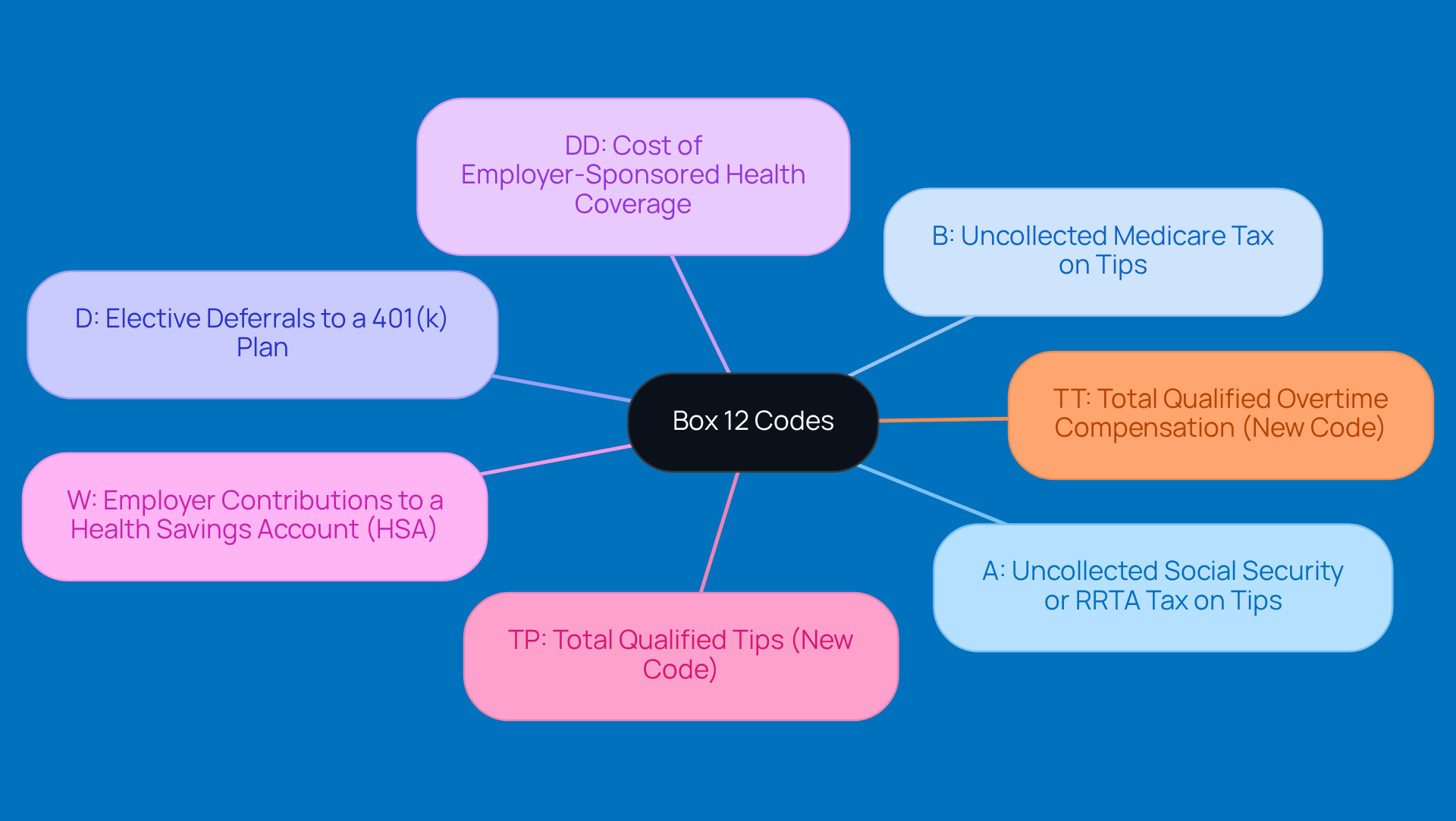

Hey there! If you’re a small business owner, you’ll want to get familiar with the 1040 box 12 codes on the W-2 form. It’s packed with important codes that can help you nail your tax reporting and stay compliant. Let’s break down some of the most common Box 12 codes and what they mean:

- A: This one’s for uncollected Social Security or RRTA tax on tips. It shows that the employee received tips that didn’t get hit with Social Security tax.

- B: Similar to A, this code represents uncollected Medicare tax on tips. It’s all about those tips that skipped the Medicare tax too.

- D: Here we have elective deferrals to a 401(k) plan. This reflects the contributions your employee made to their 401(k), which can help lower their taxable income.

- DD: This code reports the cost of employer-sponsored health coverage. It shows the total cost of health coverage you provide, and while it’s good info, it doesn’t affect taxable income.

- W: Lastly, we’ve got employer contributions to a Health Savings Account (HSA). This indicates what you’ve contributed to your employee’s HSA, which can be tax-deductible.

For small business owners, understanding the 1040 box 12 codes is super important. They can directly impact your tax submissions and how well you stick to IRS guidelines. For instance, the 1040 box 12 codes such as 'D' and 'W' can really influence taxable income and potential deductions, helping you improve your tax situation. Plus, with recent updates like the new TP for total qualified tips and TT for total qualified overtime compensation, it’s clear that tax reporting is always evolving.

So, if you’re a small business owner, make sure you’re using these codes to your advantage. They can help you optimize deductions and cut down on liabilities. And don’t forget-adjusting your estimated tax payments and withholdings throughout the year can help you avoid those pesky underpayment penalties. Stay on top of your IRS requirements, and you’ll steer clear of any costly fees!

Apply Box 12 Codes in Your Tax Filing Process

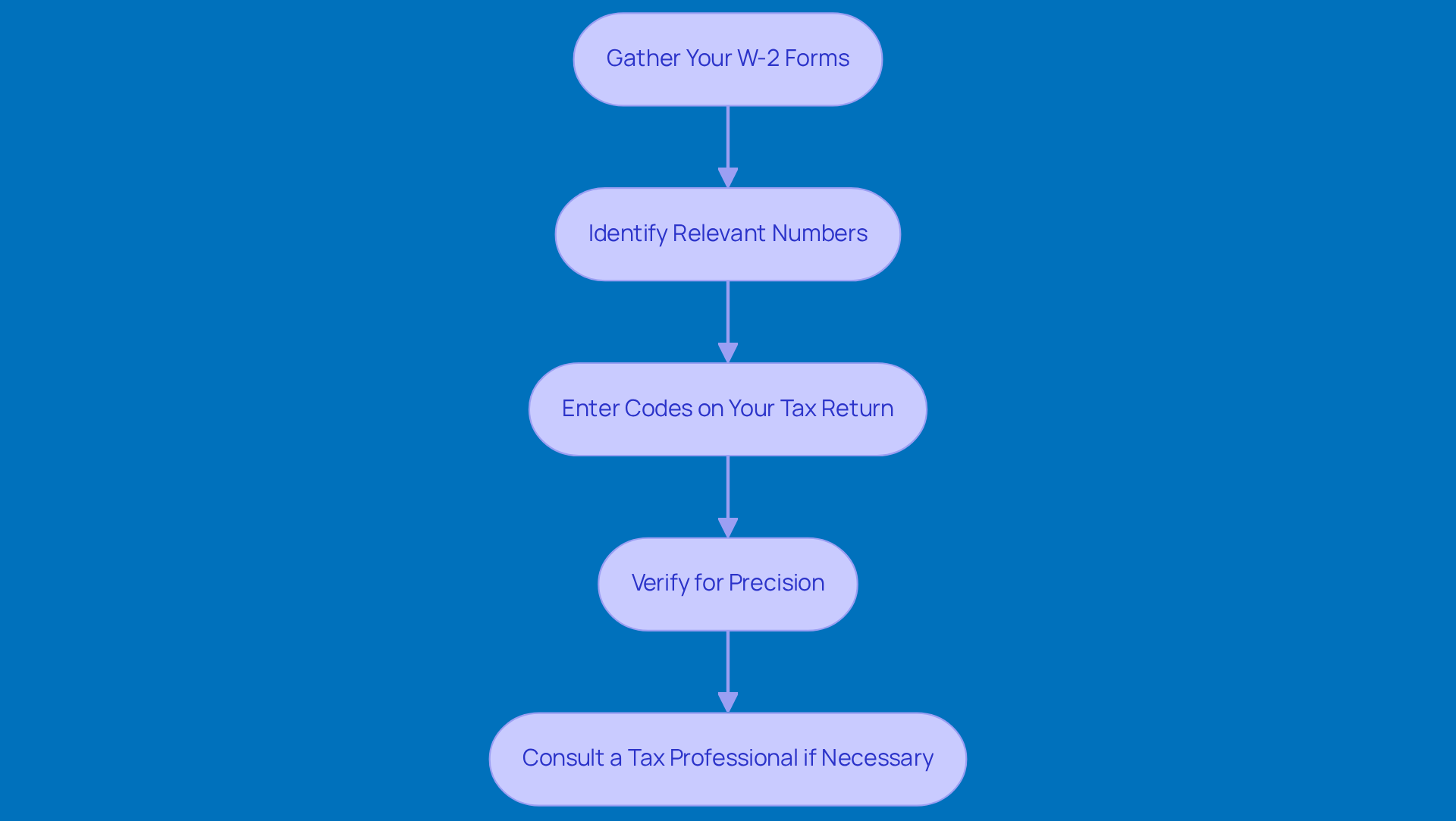

To effectively apply Box 12 codes in your tax filing process, just follow these simple steps:

-

Gather Your W-2 Forms: First things first, collect all your W-2 forms from your employers. Each form will list the 1040 box 12 codes that are relevant to your income and benefits.

-

Identify Relevant Numbers: Next, take a look at the Box 12 section on each W-2 form and figure out which 1040 box 12 codes apply to you. Jot down the identifiers along with their corresponding amounts so you don’t miss anything important.

-

Enter Codes on Your Tax Return: When you’re filling out your Form 1040, find the section for reporting W-2 income. Enter the amounts from the 1040 box 12 codes next to the respective identifiers, ensuring you follow the IRS instructions for where to place them.

-

Verify for Precision: After you’ve inputted everything, double-check your entries for accuracy. It’s crucial to confirm that the amounts match those on your W-2 forms to avoid any discrepancies. Remember, inaccuracies in tax filings can lead to significant penalties and delays, and nobody wants that!

-

Consult a Tax Professional if Necessary: If you’re feeling a bit lost about any regulations or how to report them, don’t hesitate to reach out to a tax expert. Their insights can help you navigate the complexities of tax reporting and ensure you’re compliant with the latest regulations.

By following these steps, you can accurately apply the 1040 box 12 codes in your tax filing process. This will significantly reduce the risk of mistakes and enhance your overall tax compliance. So, let’s get started!

Identify and Avoid Common Mistakes with Box 12 Codes

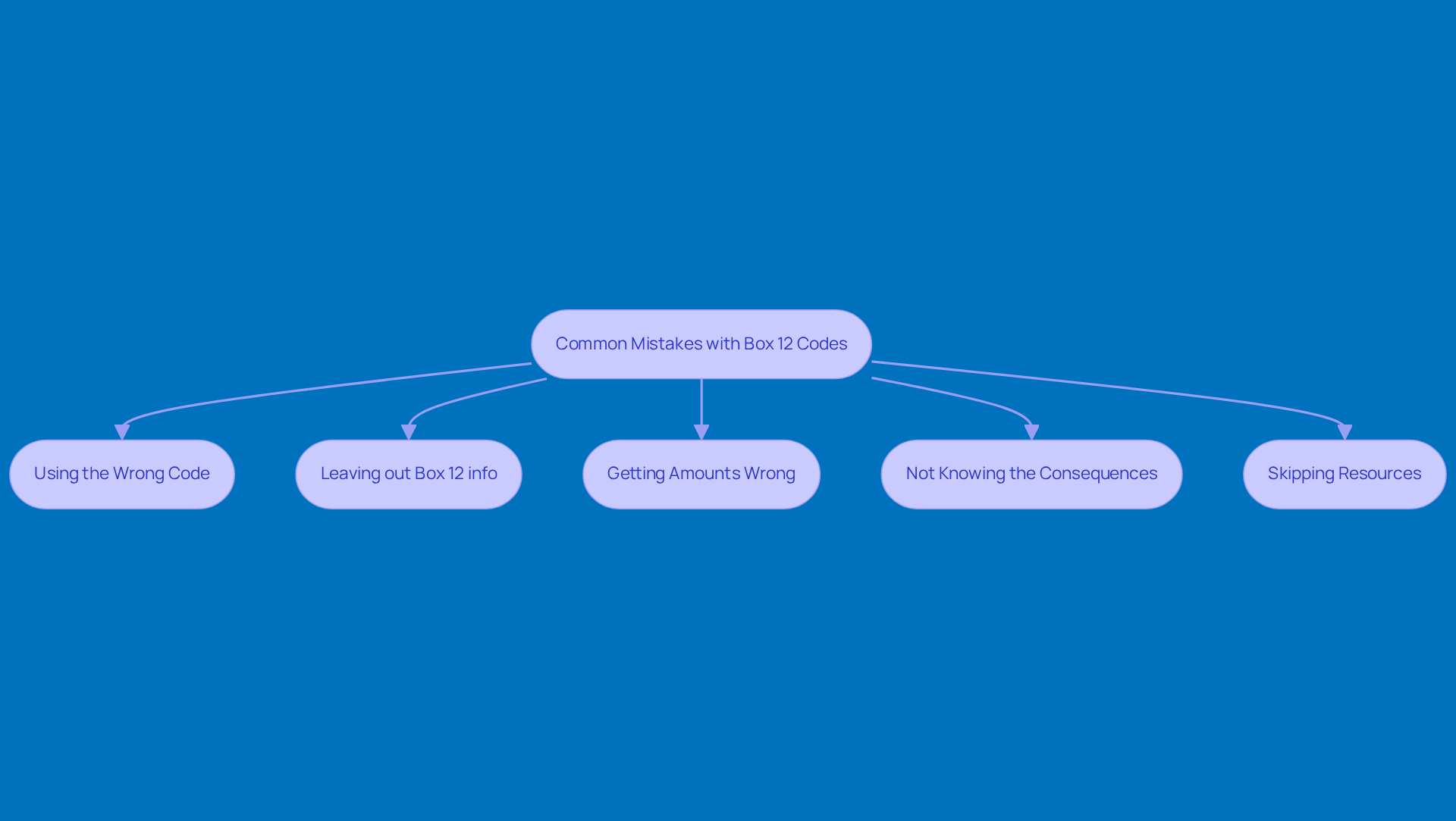

When it comes to Box 12 codes, small business owners need to keep their eyes peeled to dodge some common pitfalls that could lead to tax headaches:

- Using the Wrong Code: It’s super important to stick to IRS guidelines. Using the wrong identifier in the 1040 box 12 codes can throw off your tax calculations and might lead to some serious financial trouble down the line.

- Leaving out Box 12 info: Forgetting to report 1040 box 12 codes can leave your tax filings incomplete. Make sure to include all the relevant details to give a full picture of your income and benefits.

- Getting Amounts Wrong: Always double-check the amounts tied to each identifier. Mistakes in reporting can create discrepancies that might catch the IRS's attention, leading to an audit and more scrutiny.

- Not Knowing the Consequences: Each entry has its own tax implications. For instance, contributions to retirement accounts can lower your taxable income, while other entries might mean you owe more taxes. Understanding these implications is key for smart tax planning.

- Skipping Resources: If you’re unsure about 1040 box 12 codes, don’t hesitate to check out IRS resources or seek professional advice. Taking this proactive step can save you from costly mistakes and help you stay compliant.

By being aware of these common mistakes and taking steps to avoid them, small business owners can make their tax filing process smoother and stay on the right side of IRS regulations, ultimately protecting their financial well-being.

Conclusion

Understanding the 1040 Box 12 codes is super important for small business owners who want to tackle tax filing without a hitch. These codes show up on W-2 forms and give you crucial info that can affect your taxable income and help you spot potential deductions. Getting a handle on these codes not only keeps you in line with IRS rules but also helps you make smart financial choices that could save you a chunk of change come tax time.

Throughout this article, we’ve highlighted key points about various Box 12 codes, like 'D' for 401(k) contributions and 'W' for HSA contributions. We really stressed the importance of reporting these codes accurately to dodge common mistakes - like using the wrong identifiers or misreporting amounts. Plus, we provided a handy step-by-step guide on how to use these codes when filing your taxes, so you can tackle your tax obligations with confidence.

In closing, mastering those 1040 Box 12 codes isn’t just about checking a box for compliance; it’s a smart move that can lead to better financial outcomes. We encourage small business owners to stay in the loop about these codes and what they mean, and to seek out resources or professional advice when needed. By doing this, you can boost your tax filing accuracy, steer clear of costly blunders, and ultimately pave the way for a brighter financial future.

Frequently Asked Questions

What are Form 1040 box 12 codes?

Form 1040 box 12 codes are letter symbols found on your W-2 form that report different types of compensation and benefits, impacting your tax liability.

Why are box 12 codes important for small business owners?

Understanding box 12 codes is crucial for small business owners as they provide important information to the IRS and help determine taxable income.

Can box 12 codes affect my taxable income?

Yes, certain box 12 codes, like 'D' for elective deferrals to a 401(k) plan, can lower your taxable income.

What risks are associated with misunderstanding box 12 codes?

Misunderstanding box 12 codes can lead to costly mistakes, including owing additional taxes or missing out on potential tax deductions and credits.

How can accurate reporting of box 12 codes benefit me?

Accurate reporting can open the door to potential tax deductions and credits, which can significantly reduce your overall tax bill.

Should I check my W-2 for box 12 codes?

Yes, checking your W-2 for box 12 codes is advisable as it may help you save money on your taxes.