Overview

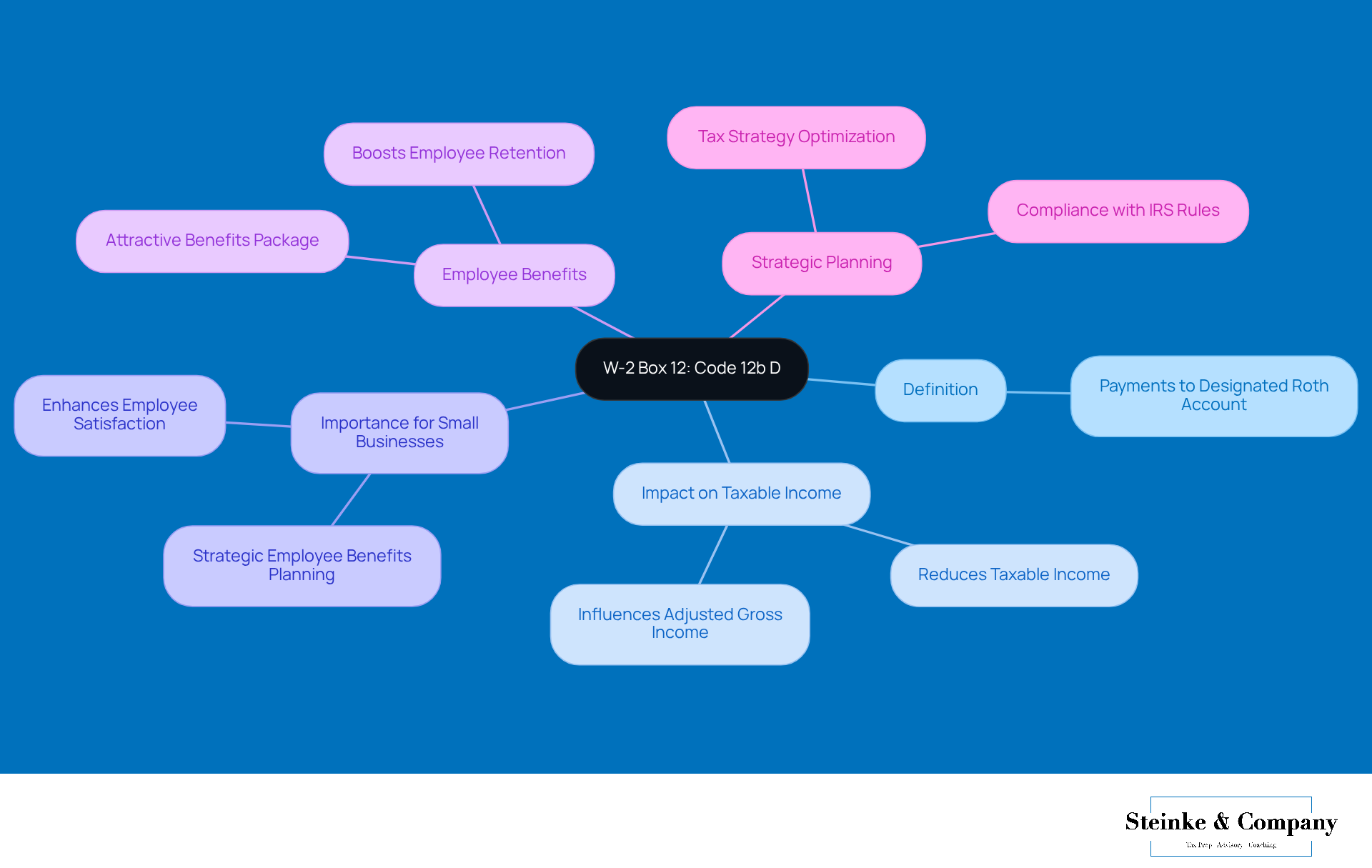

Let’s talk about W-2 Box 12b D and why it matters, especially for small business owners like you. This little box relates to payments made to a designated Roth account within a 401(k) plan. Understanding this code can really level up your payroll and tax reporting game.

But wait, there’s more! Grasping the significance of this code isn’t just about compliance with IRS regulations; it can actually enhance employee benefits and boost job satisfaction. Who wouldn’t want happier employees, right? Plus, it’s a smart move for better financial planning and retention strategies.

So, as you navigate these waters, keep in mind how this knowledge can help you and your team thrive. It’s all about making informed decisions that lead to a more satisfied workforce and a healthier business overall.

Introduction

Understanding the ins and outs of tax reporting can feel like a real challenge for small business owners, right? One area that often flies under the radar is the W-2 Box 12. Among its various codes, 12b D is a key player, representing payments to a designated Roth account within a 401(k) plan. This little code does more than you might think—it affects how taxable income is calculated and plays a big role in shaping employee benefits and satisfaction.

So, how can small business owners like you navigate the complexities of this code to boost your tax strategies while staying compliant? Let's dive in!

Explore W-2 Box 12: The Role of Code 12b D

W-2 Box 12 is a key part of the W-2 form, outlining different types of compensation and benefits. So, what’s the deal with 12b d on w2? It specifically refers to payments made to a designated Roth account within a 401(k) plan. This code is super important for small business owners because it directly impacts how staff input affects taxable income and retirement savings.

Keeping track of these inputs not only helps you stay on the right side of IRS rules but also gives your team the info they need for their tax filings. Plus, getting a good grasp on 12b d on w2 can really help you plan your employee benefits strategically. This ultimately boosts employee satisfaction and retention! For instance, small businesses that manage Roth deposits well in their 401(k) plans can create a more attractive benefits package, which helps cultivate a loyal workforce while also improving their tax strategies.

Have you thought about how this might apply to your business? It’s all about making those benefits work for you and your employees!

Decode the 12b D Code: Implications for Tax Reporting

Did you know that the 12b d on w2 code tells us that payments to a Roth account are made with after-tax dollars? That means while employees won’t get a tax deduction for these payments, they can enjoy tax-free withdrawals during retirement—if they meet certain conditions, of course. For small business owners, understanding what the 12b d on w2 code means is crucial since it directly affects payroll calculations and tax reporting.

Employers need to accurately reflect these payments in their payroll systems to avoid any hiccups come tax-filing time. Plus, sharing the perks of Roth deposits with your staff not only helps them with their retirement plans but also boosts overall job satisfaction. Who wouldn’t want to work in a place where people feel engaged and informed about their financial futures?

Avoid Common Errors: Navigating Box 12b D Misunderstandings

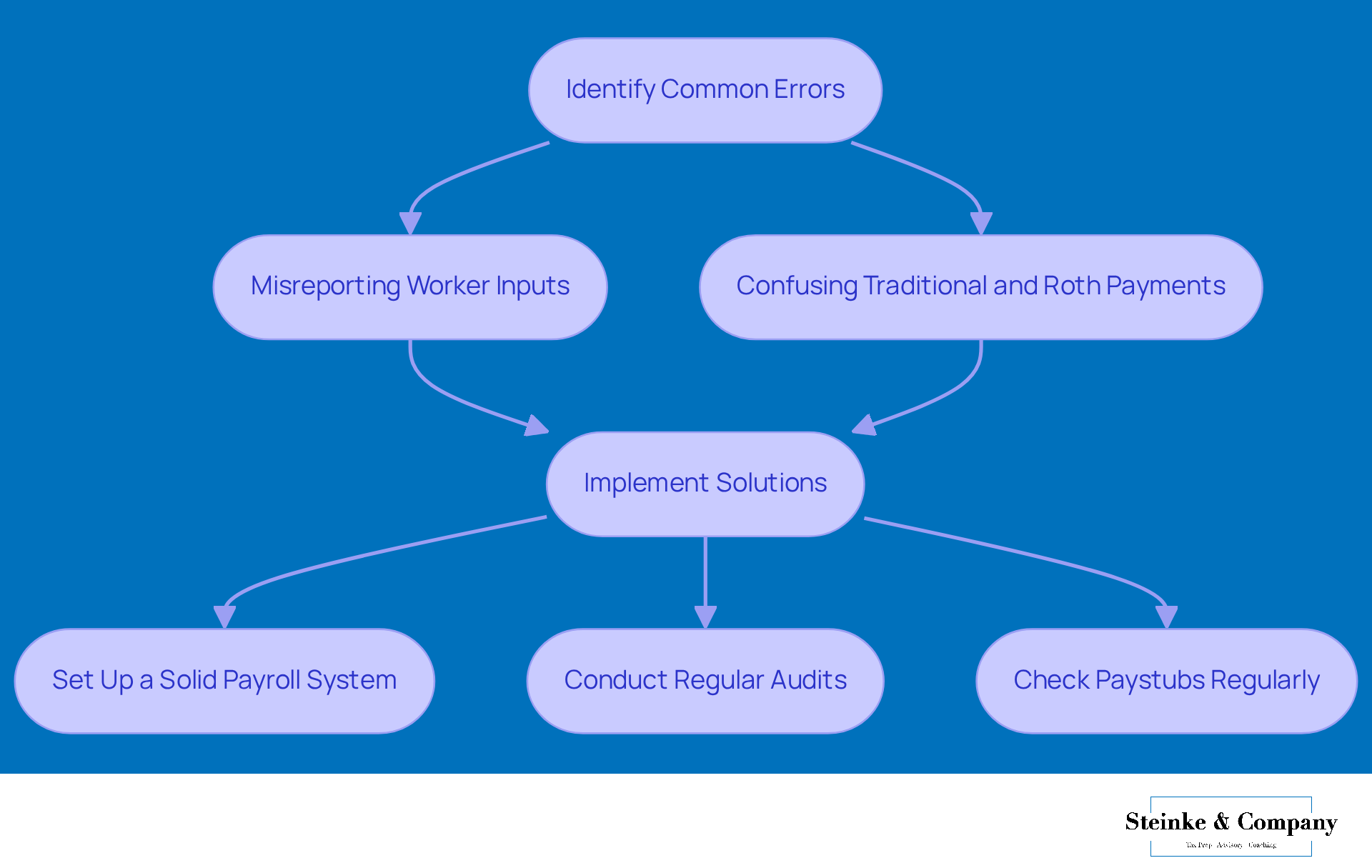

Mistakes related to 12b d on w2 can occur more frequently than you'd expect, often due to misreporting worker inputs or a misunderstanding of Roth investments. One common slip-up is failing to distinguish between traditional and Roth payments, which can throw off tax calculations. For example, if someone opts for a pre-tax deferral but it gets mistakenly recorded as a Roth payment, that mix-up could lead to penalties when tax time rolls around.

So, how can small business owners avoid these pitfalls? First off, setting up a solid payroll system is key. This system should accurately track employee inputs and provide regular training for anyone involved in payroll processing. Plus, conducting regular audits of payroll records can help catch any discrepancies before they escalate into bigger issues. Understanding these inputs is crucial for financial health and compliance since they directly affect tax reporting and potential liabilities.

Also, checking paystubs often ensures that employees are clear on their inputs and deductions, which is vital for keeping accurate records. By taking these proactive measures, small businesses can effectively navigate the complexities of 12b d on w2 regarding Roth contributions. This approach not only helps maintain compliance with tax regulations but also optimizes tax strategies and avoids those pesky penalties.

Seek Expert Guidance: Understanding Box 12 Codes for Small Business Owners

Navigating the maze of tax regulations, especially the 12b d on w2, can feel pretty overwhelming for small business owners. That’s why reaching out to tax compliance pros is a smart move for service-oriented enterprises. These experts provide tailored advice that fits the unique needs of each business, helping clarify the implications of various regulations and assisting with accurate reporting. By developing effective strategies to minimize tax liabilities and avoid costly underpayment penalties, they allow entrepreneurs to focus on what they do best while staying compliant with tax laws.

Regular chats with tax experts not only keep business owners updated on the latest changes in tax regulations but also boost compliance rates. As we look ahead to 2025 and the evolving tax landscape, the value of professional tax advice becomes even more crucial. Engaging with seasoned advisors can lead to significant improvements in compliance, creating a safer financial environment for small businesses. This proactive approach to tax compliance not only eases stress but also sets up businesses for long-term success. So, why not take that step and connect with a tax professional today?

Conclusion

Understanding the implications of Code 12b D on the W-2 form is crucial for small business owners looking to optimize payroll processes and enhance employee benefits. This code represents payments made to a designated Roth account within a 401(k) plan, which can really influence tax reporting and retirement savings strategies. By managing these contributions effectively, business owners can ensure compliance with IRS regulations and create a benefits package that boosts employee satisfaction and loyalty.

Throughout this article, we’ve shared some key insights on the importance of accurately reporting these contributions, steering clear of common errors, and the value of seeking expert guidance. Small business owners are encouraged to implement solid payroll systems, conduct regular audits, and keep the lines of communication open with employees regarding their contributions. These proactive steps can help mitigate potential tax liabilities and enhance overall financial health.

Ultimately, mastering the intricacies of W-2 Box 12, especially Code 12b D, goes beyond just compliance; it’s about empowering employees and fostering a robust workplace culture. By prioritizing accurate reporting and understanding the benefits of Roth contributions, small business owners can lay the groundwork for long-term success and create a thriving environment for both their business and their team. And hey, engaging with tax professionals can further streamline this process, ensuring that businesses stay informed and compliant in an ever-evolving tax landscape.

Frequently Asked Questions

What does W-2 Box 12 represent?

W-2 Box 12 outlines different types of compensation and benefits, including specific codes that indicate various payments or contributions.

What is the significance of Code 12b D in W-2 Box 12?

Code 12b D refers to payments made to a designated Roth account within a 401(k) plan, which is important for understanding taxable income and retirement savings.

Why is it important for small business owners to track Code 12b D?

Tracking Code 12b D helps small business owners comply with IRS rules and provides necessary information for employee tax filings, as well as aids in strategic planning of employee benefits.

How can managing Roth deposits in 401(k) plans benefit small businesses?

Proper management of Roth deposits can enhance the attractiveness of the benefits package, leading to increased employee satisfaction and retention, while also improving tax strategies.

How does understanding Code 12b D impact employee benefits planning?

A good grasp of Code 12b D allows businesses to strategically plan employee benefits, which can foster a loyal workforce and contribute to overall business success.