Introduction

Mastering tax deductions can feel a bit overwhelming, right? Especially when you start digging into the details of Section 179 and bonus depreciation. These handy provisions give businesses a fantastic opportunity to cut down on taxable income by letting them deduct the full cost of qualifying equipment and software in the year they buy it. But let’s be real - navigating the rules and requirements can be tricky, leaving many business owners scratching their heads, wondering if they’re really making the most of these savings.

So, how can you tap into these tax benefits to boost your cash flow and streamline operations? It’s all about understanding the ins and outs and making them work for you!

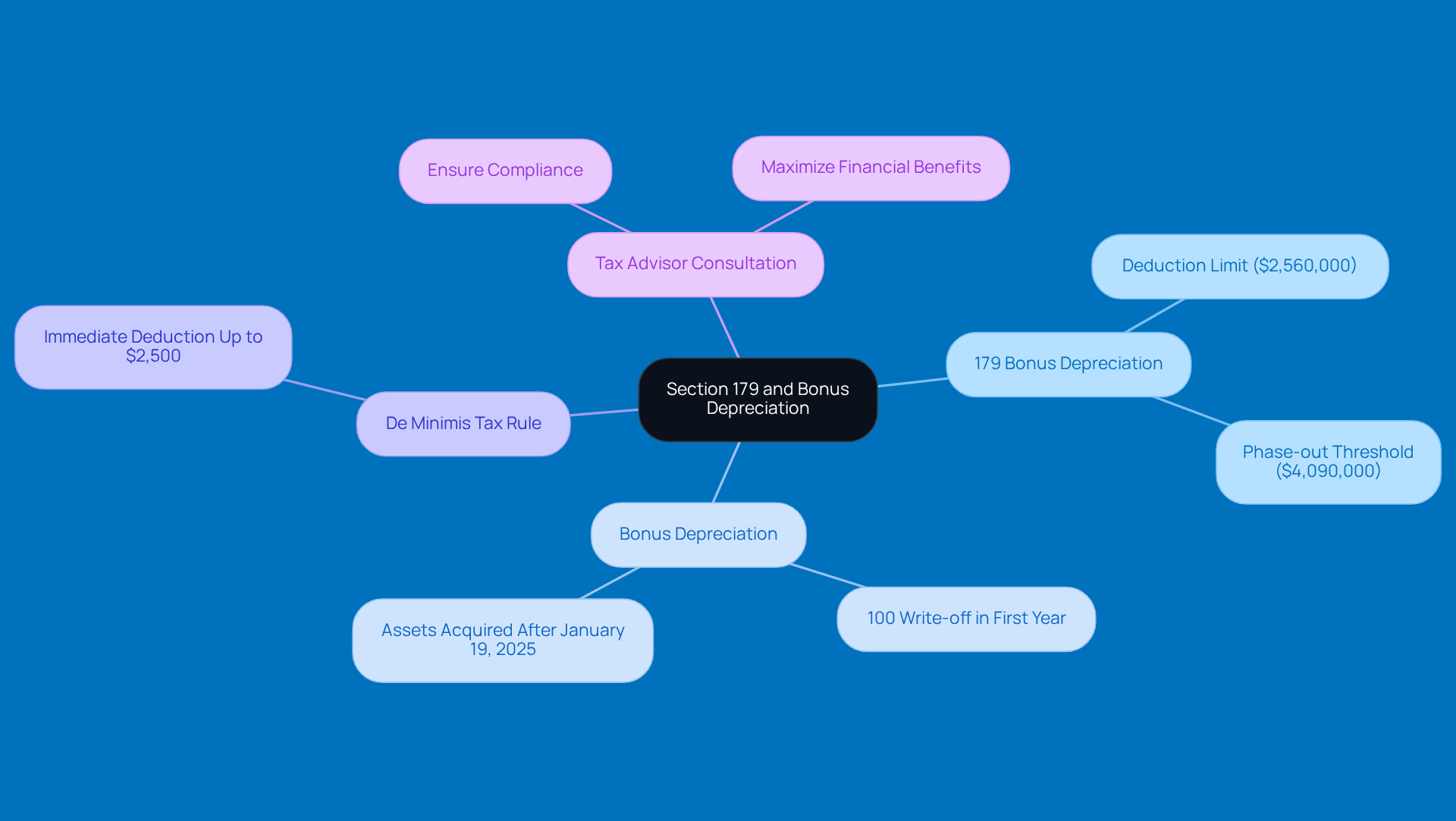

Understand Section 179 and Bonus Depreciation Basics

Hey there! Let’s discuss 179 bonus depreciation as outlined in Section 179. This nifty provision allows companies to take advantage of 179 bonus depreciation to deduct the full cost of qualifying equipment and software they buy or finance during the tax year. For 2026, you can deduct up to $2,560,000, but keep in mind there’s a phase-out threshold at $4,090,000.

Now, what about Bonus Depreciation? This one’s a game-changer! It allows companies to write off 100% of the cost of qualifying assets in the first year they’re put into service, but it only applies to assets acquired after January 19, 2025. This full reinstatement of 179 bonus depreciation is super important for businesses looking to boost their tax savings.

Understanding these provisions can really help you make smart purchasing decisions and maximize your financial benefits. For example, if your organization invests in qualifying equipment, you could significantly lower your taxable income, which means better cash flow and improved operational efficiency.

And don’t forget about the de minimis tax rule! It lets you write off up to $2,500 for tangible property costs right away, giving you even more immediate tax perks. Tax experts often highlight that taking advantage of these benefits can lead to substantial savings, especially for rural businesses that face unique economic challenges.

So, it’s a good idea to chat with a tax advisor to ensure you’re compliant and making the most of these tax provisions. Trust me, it’s worth it!

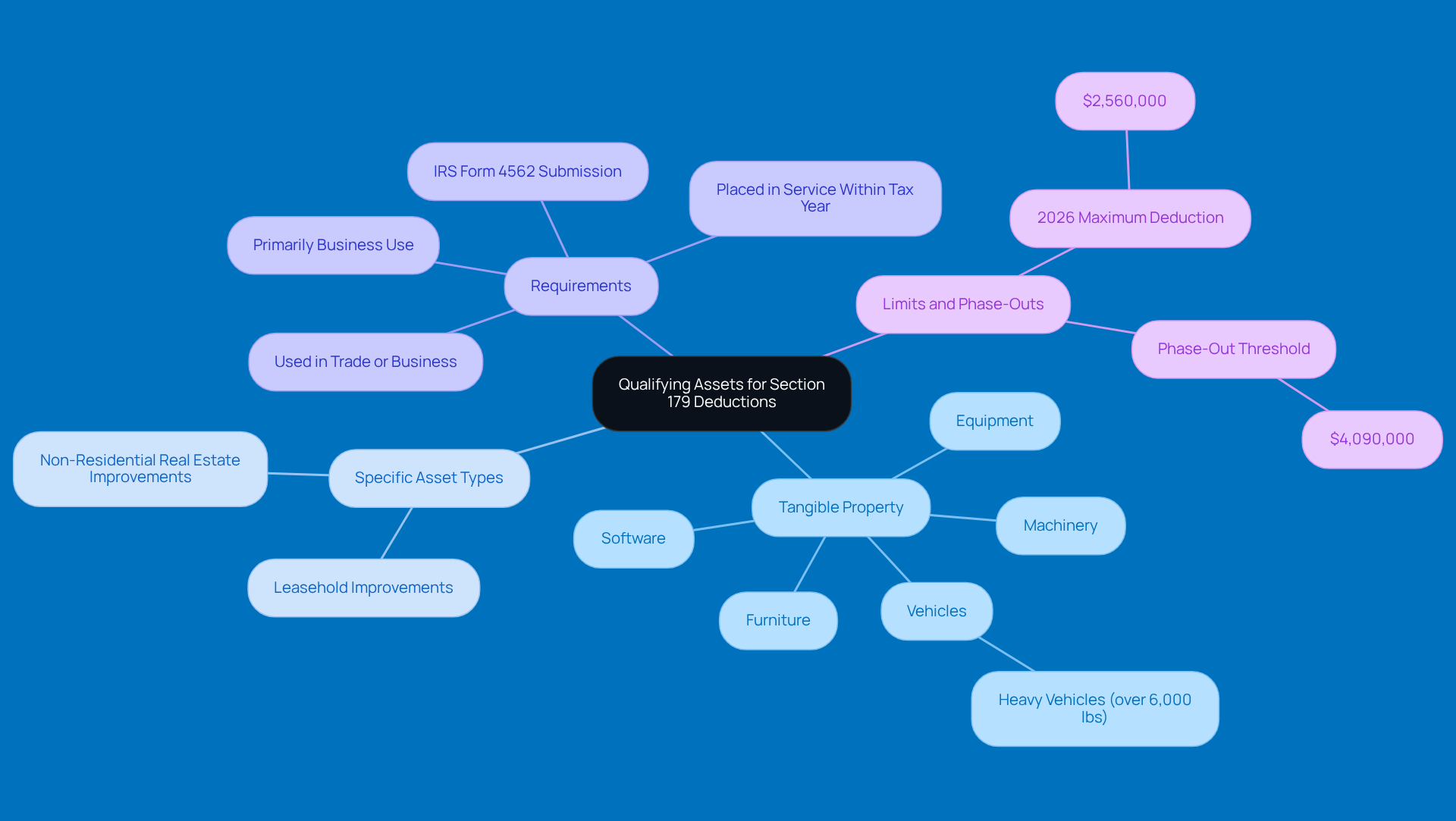

Identify Qualifying Assets for Deductions

To qualify for Section 179 bonus depreciation, it is essential to understand that the assets must be tangible property used in a trade or profession. This includes things like machinery, equipment, and vehicles that weigh over 6,000 pounds, plus some specific improvements to non-residential real estate. For instance, if you buy a new truck for your business, it could qualify for both tax benefits - just make sure it meets the weight requirement and is primarily used for business. Oh, and don’t forget that off-the-shelf software and certain types of furniture can also make the cut!

It’s super important to confirm that the asset is actually used within the tax year to claim the benefit successfully. Plus, businesses need to fill out IRS Form 4562 to officially claim that Section 179 deduction. Tax specialists often emphasize that understanding tangible property qualifications is key to maximizing your tax advantages. Keeping organized records is a must to back up your claims.

With the expert tax prep and planning services from Steinke and Company, small business owners can enjoy a smooth, precise, and stress-free tax season - no surprises here! Just a heads up, in 2026, the highest allowance for 179 bonus depreciation is $2,560,000, with a phase-out threshold of $4,090,000. So, it’s really important for small business owners to be aware of these limits to steer clear of any potential pitfalls.

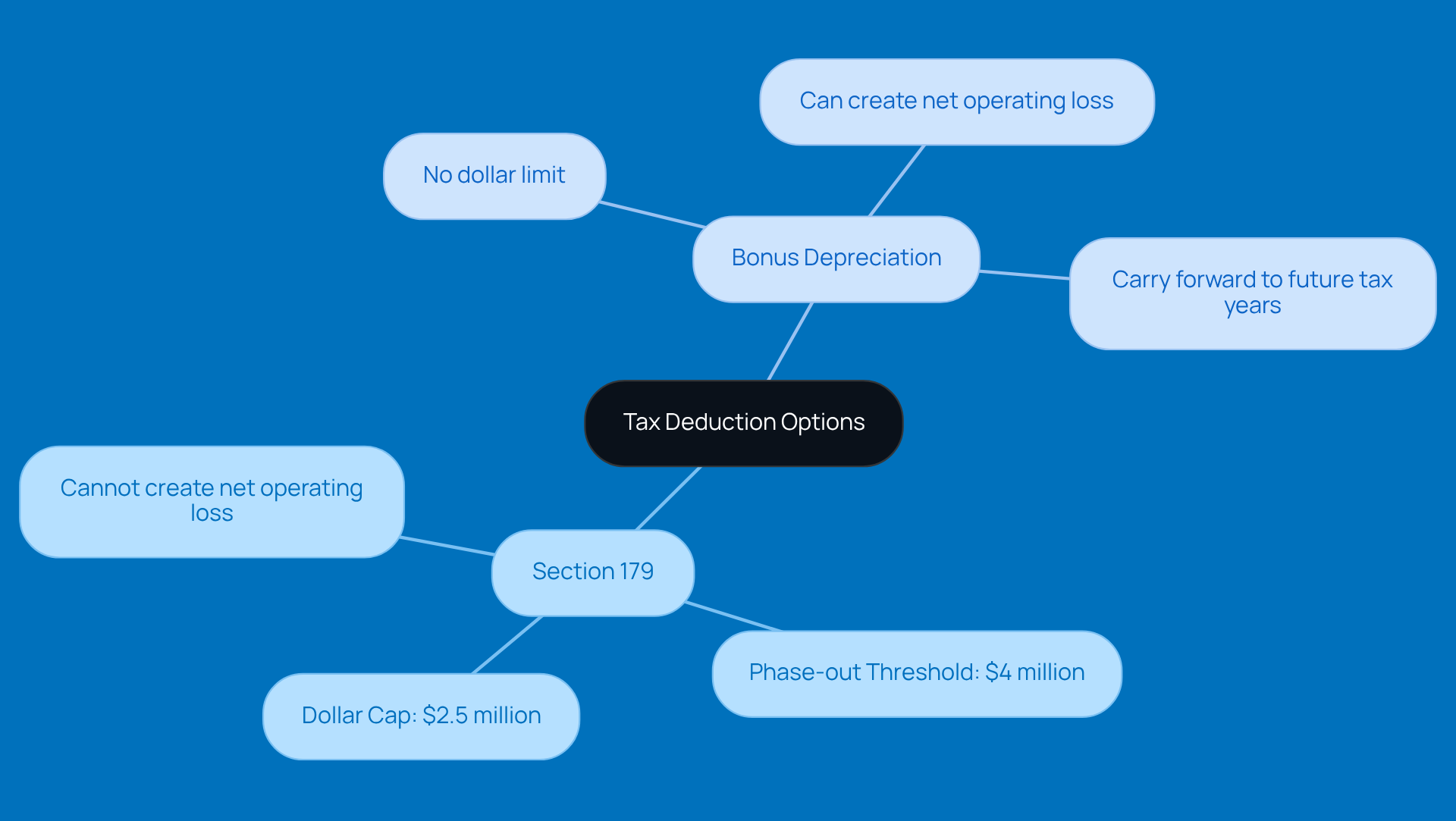

Compare Section 179 and Bonus Depreciation Options

Both Section 179 bonus depreciation and bonus depreciation offer significant tax deductions, but they work in different ways. For instance, Section 179 has a dollar cap of $2.5 million for 2025 and kicks in a phase-out threshold starting at $4 million. This means you can’t use it to create a net operating loss. On the flip side, 179 bonus depreciation doesn’t have a limit and can actually generate a net operating loss, which you can carry forward to future tax years.

Let’s say your company buys $3 million in equipment. You can deduct up to $2.5 million under Section 179 bonus depreciation, and then you can apply bonus depreciation to the remaining $500,000. This combo really highlights why it’s crucial to understand these differences to maximize your tax benefits.

And here’s a friendly tip: by tapping into expert tax preparation and planning services from Steinke and Company, you can ensure that your business and personal returns are prepared and filed smoothly and accurately. This way, small agency owners can stay compliant, dodge surprises, and ultimately boost their financial strategies while avoiding those pesky budgeting pitfalls.

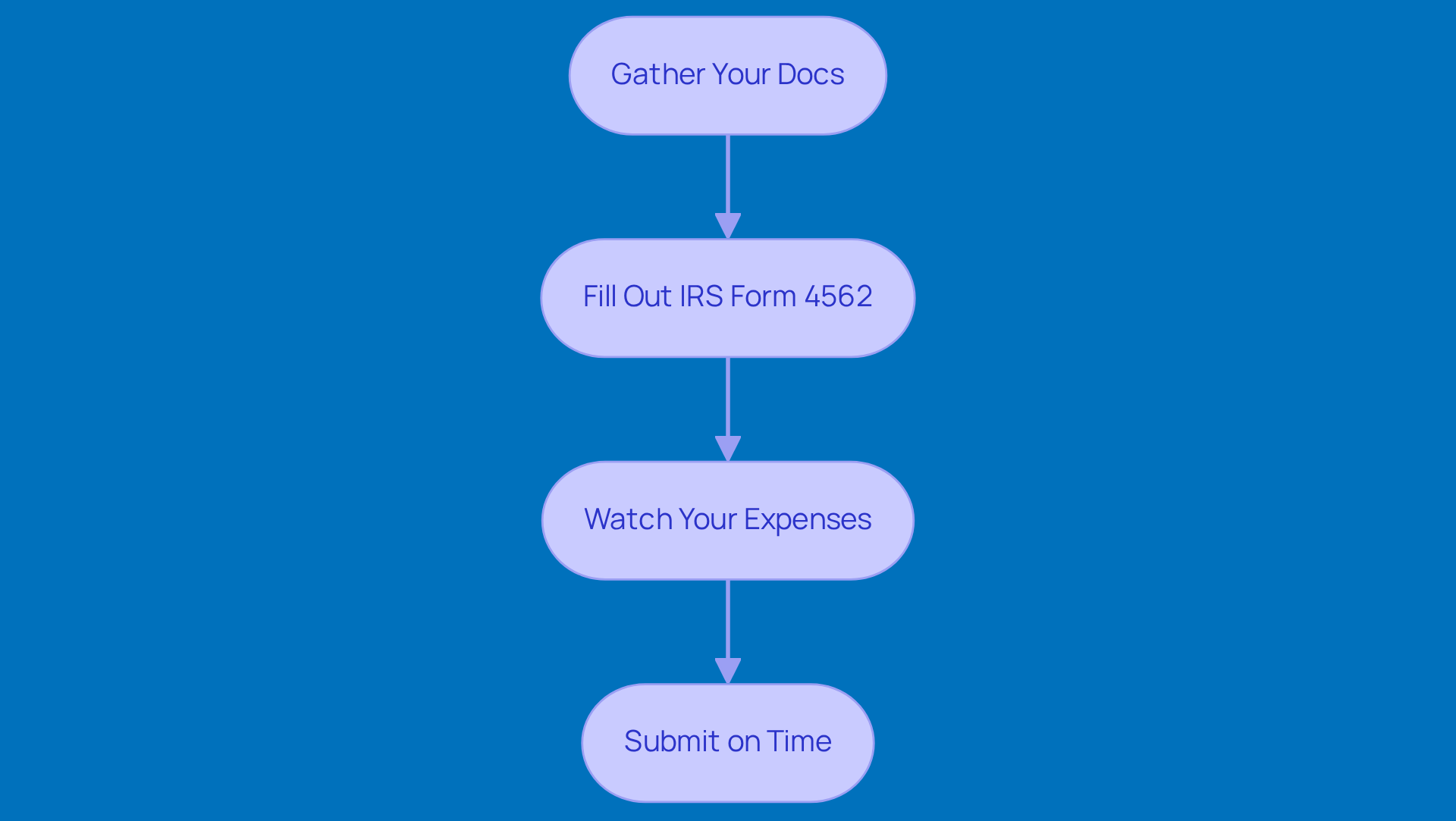

Claim Your Deductions: A Step-by-Step Process

Want to make the most of your tax benefits? Here’s a friendly guide to help you through the process:

-

Gather Your Docs: Start by collecting all the necessary paperwork for your qualifying assets. This means grabbing those purchase invoices and financing agreements. Don’t forget to check your paystub details - they show your income and tax withholdings, which are super important for accurate reporting.

-

Fill Out IRS Form 4562: Next up, you’ll want to accurately complete IRS Form 4562, which is all about reporting depreciation and amortization. Make sure you specify the right amounts for both Section 179 bonus depreciation and other deductions. And here’s a little nugget of info: the allowable IRC 179 write-off has jumped from $510,000 to a whopping $1 million! That’s a big opportunity for tax savings.

-

Watch Your Expenses: If you’re using Section 179, double-check that your total expenses don’t go over your taxable income. A common pitfall is exceeding this limit, which can lead to some headaches down the road.

-

Submit on Time: Don’t forget to file your tax return, including Form 4562, by the due date. With 179 bonus depreciation decreasing by 20% each year until the end of 2026, timely filing is key. Plus, keep your tax documents for at least three years - this is crucial for compliance and may be needed to confirm your expenses.

If you have any questions or need a hand, reaching out to a tax professional can really help you stay on track and maximize your deductions. As CPA John J. Rainone puts it, "You do not want to miss an opportunity to expense 100% of certain assets and improvements, especially if you are in the real estate or construction industry." So, let’s make sure you’re not leaving any money on the table!

Conclusion

Understanding and leveraging Section 179 and bonus depreciation can really boost your business's financial strategy. These provisions let you take some hefty deductions on qualifying assets, which means you can lower your taxable income and improve your cash flow. By getting a handle on these tax benefits, you can make smart purchasing decisions that align with your financial goals.

This article has covered the key points about Section 179 and bonus depreciation, like what assets qualify, how the two options differ, and a step-by-step guide on claiming those deductions. From the requirements for tangible property to the importance of filing on time, each point highlights how you can maximize your tax savings. Plus, chatting with a tax professional can help ensure you're compliant and making the most of these benefits.

In the end, mastering 179 bonus depreciation and its details is super important. It’s a fantastic tool for businesses looking to boost their financial health. As tax laws change, staying in the loop and being proactive about using these provisions can lead to significant savings and better operational efficiency. So, why not take the initiative to explore these options? You’ll not only save some cash but also set the stage for your future growth!

Frequently Asked Questions

What is Section 179 bonus depreciation?

Section 179 bonus depreciation allows companies to deduct the full cost of qualifying equipment and software purchased or financed during the tax year.

What is the deduction limit for Section 179 in 2026?

In 2026, you can deduct up to $2,560,000 under Section 179, but there is a phase-out threshold at $4,090,000.

What is Bonus Depreciation and when does it apply?

Bonus Depreciation allows companies to write off 100% of the cost of qualifying assets in the first year they are put into service, but it only applies to assets acquired after January 19, 2025.

How can understanding Section 179 and Bonus Depreciation benefit businesses?

Understanding these provisions can help businesses make smart purchasing decisions, significantly lower taxable income, improve cash flow, and enhance operational efficiency.

What is the de minimis tax rule?

The de minimis tax rule allows businesses to write off up to $2,500 for tangible property costs immediately, providing additional tax benefits.

Why is it advisable to consult with a tax advisor regarding these provisions?

Consulting with a tax advisor ensures compliance and helps businesses maximize their benefits from Section 179 and Bonus Depreciation.