Overview

This article dives into some smart strategies for small business owners looking to tackle the tricky world of 401(k) withdrawal income tax. It’s all about understanding the different types of withdrawals, the potential penalties that could sneak up on you, and the tax implications that come along with them. Plus, we’ve got some practical tips to help you minimize those tax burdens through careful planning and a little advice from tax professionals.

So, why is this important? Well, knowing the ins and outs can save you a pretty penny down the road. Imagine being able to keep more of your hard-earned money! By understanding the nuances of your withdrawals, you can make informed decisions that benefit you in the long run. And remember, a chat with a tax pro can really help clear things up.

In the end, it’s all about being proactive and informed. Take the time to plan ahead, and you’ll find that managing your 401(k) withdrawals doesn’t have to be a headache. So, are you ready to take control of your financial future? Let’s get started!

Introduction

Navigating the ins and outs of 401(k) withdrawals can feel overwhelming for small business owners, especially when you start thinking about the tax implications that come with these financial choices. It’s super important to get a grip on the different types of withdrawals, any potential penalties, and how to keep those pesky tax liabilities to a minimum—after all, we want to maximize our retirement savings, right?

But with the complexities of tax brackets and the risk of making costly mistakes, how can you ensure that your withdrawal strategy is both effective and efficient? This guide is here to help you explore essential strategies and insights that will empower you to master the art of 401(k) withdrawal income tax, so you can make informed decisions for your financial future.

Understand 401(k) Withdrawal Basics

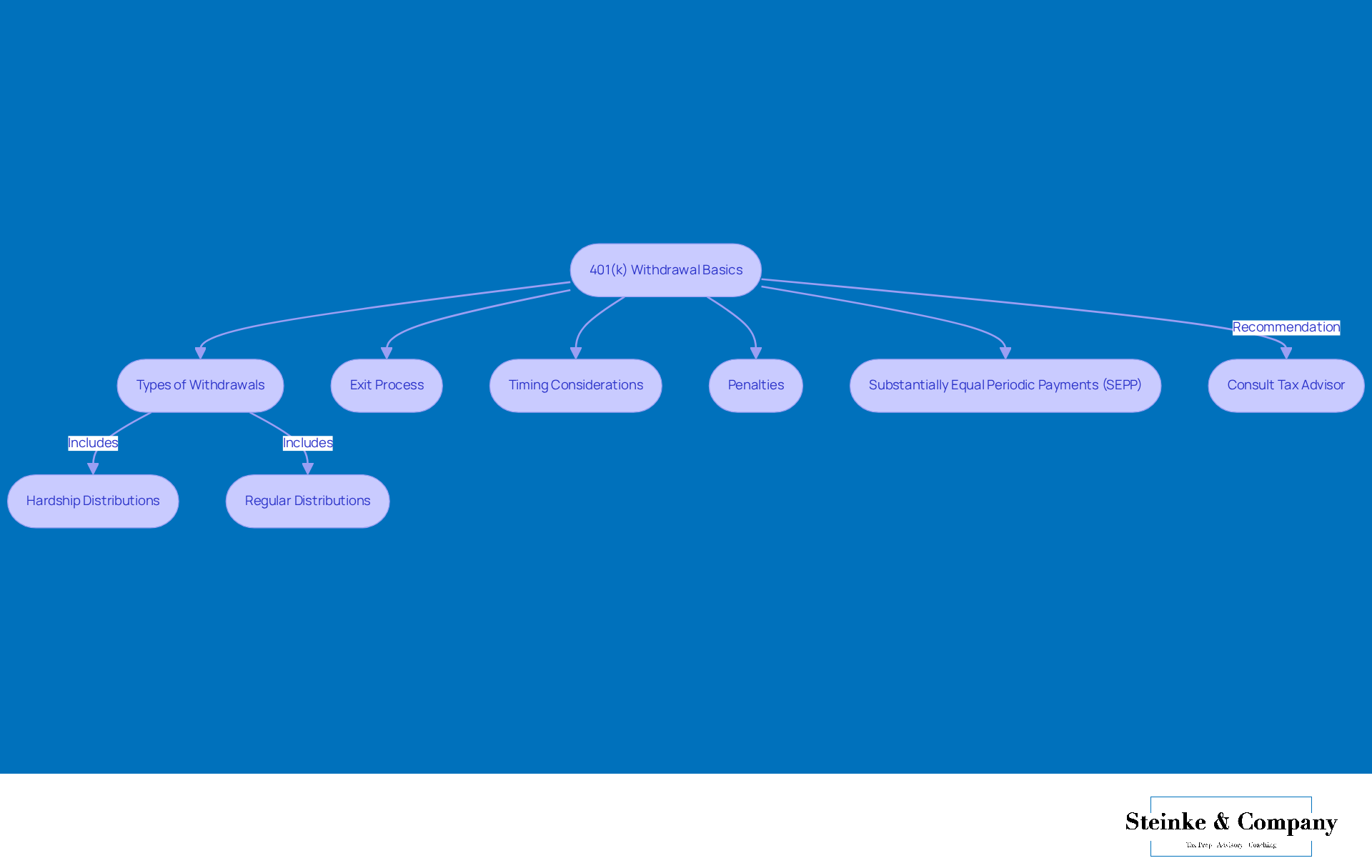

Understanding 401(k) withdrawals is super important for effective financial planning. A 401(k) is a retirement savings plan that lets employees put aside a chunk of their paycheck before taxes get taken out. However, when you withdraw those funds, they are typically subject to 401k withdrawal income tax. Let’s break down the key aspects you should consider:

-

Types of Withdrawals: There are two main types of withdrawals: hardship removals and regular distributions. Hardship distributions can be accessed in certain situations, like covering medical expenses or preventing eviction, while you can take standard payments once you hit age 59½. Plus, if you were born between 1951 and 1959, you’ll need to start taking required minimum distributions (RMDs) from your 401(k) at age 73. If you were born in 1960 or later, that age jumps to 75.

-

Exit Process: Ready to make a move? Start by reaching out to your plan administrator to get the lowdown on their specific procedures. This usually means filling out some forms and providing the necessary documentation to support your exit.

-

The timing of your withdrawal can greatly influence your 401k withdrawal income tax. It’s a good idea to take a look at your current earnings and tax bracket to make the most of your withdrawal. For instance, pulling out $25,000 from your retirement account could lead to 401k withdrawal income tax, a 10% penalty of $2,500, and possibly state taxes too. So, careful planning is key!

-

Penalties: If you take money out before age 59½, be prepared for a 10% early withdrawal penalty, as well as regular income tax and 401k withdrawal income tax. That said, there are some situations where you might be able to access your funds without penalties, like those hardship distributions allowed by the IRS.

-

Substantially Equal Periodic Payments (SEPP): If you’re under 59½, you can withdraw from your 401(k) without penalties through SEPP. This involves taking a series of equal payments based on your life expectancy.

By grasping these essential concepts, small business owners can make smart choices about their 401(k) withdrawals and navigate the tax implications effectively. As Miguel Burgos, a CPA, puts it, "When it comes to withdrawing funds from your 401(k), information is your friend. Consult your tax advisor as soon as possible so you can make an informed decision on whether you want to distribute the funds or roll them over into a new retirement account.

Explore Tax Implications of 401(k) Withdrawals

Withdrawing from your 401(k) can feel a bit daunting, especially when you consider the 401k withdrawal income tax that comes along with it. But don't worry; we’ll break it down together! Here are the key points you need to keep in mind:

-

First up, let’s talk about Taxable Earnings. Any amount you take out of your 401(k) will be subject to 401k withdrawal income tax and added to your taxable earnings for the year. This could bump you into a higher tax bracket, resulting in increased overall payments due to 401k withdrawal income tax. For example, if your total income exceeds certain thresholds, you could find yourself facing that 22% federal tax rate or even higher, depending on how you file.

-

Next, there’s the Early Withdrawal Penalty. If you decide to withdraw funds from your 401k before you hit 59½, you’ll face a 10% penalty on the amount you take out, along with the 401k withdrawal income tax. This penalty is really meant to make you think twice about taking money out too soon, so it’s important to plan your distributions wisely.

-

Now, let’s not forget about State Taxes. These can vary quite a bit! For instance, California has a hefty marginal tax rate of 13.3%, while states like Florida and Texas don’t charge any state income tax at all. Understanding your state’s rules is crucial because those extra charges can really cut into what you actually get to keep.

-

Lastly, there are Reporting Requirements. You’ll need to report all distributions on your tax return, usually using IRS Form 1099-R, which your plan administrator will send you. This form lays out the amount you withdrew and any taxes that were withheld, helping you stay on the right side of federal tax laws.

By understanding the 401k withdrawal income tax implications, you can make smarter choices about your distributions. So take a moment to think about your options and plan accordingly—you’ve got this!

Implement Strategies to Minimize Withdrawal Taxes

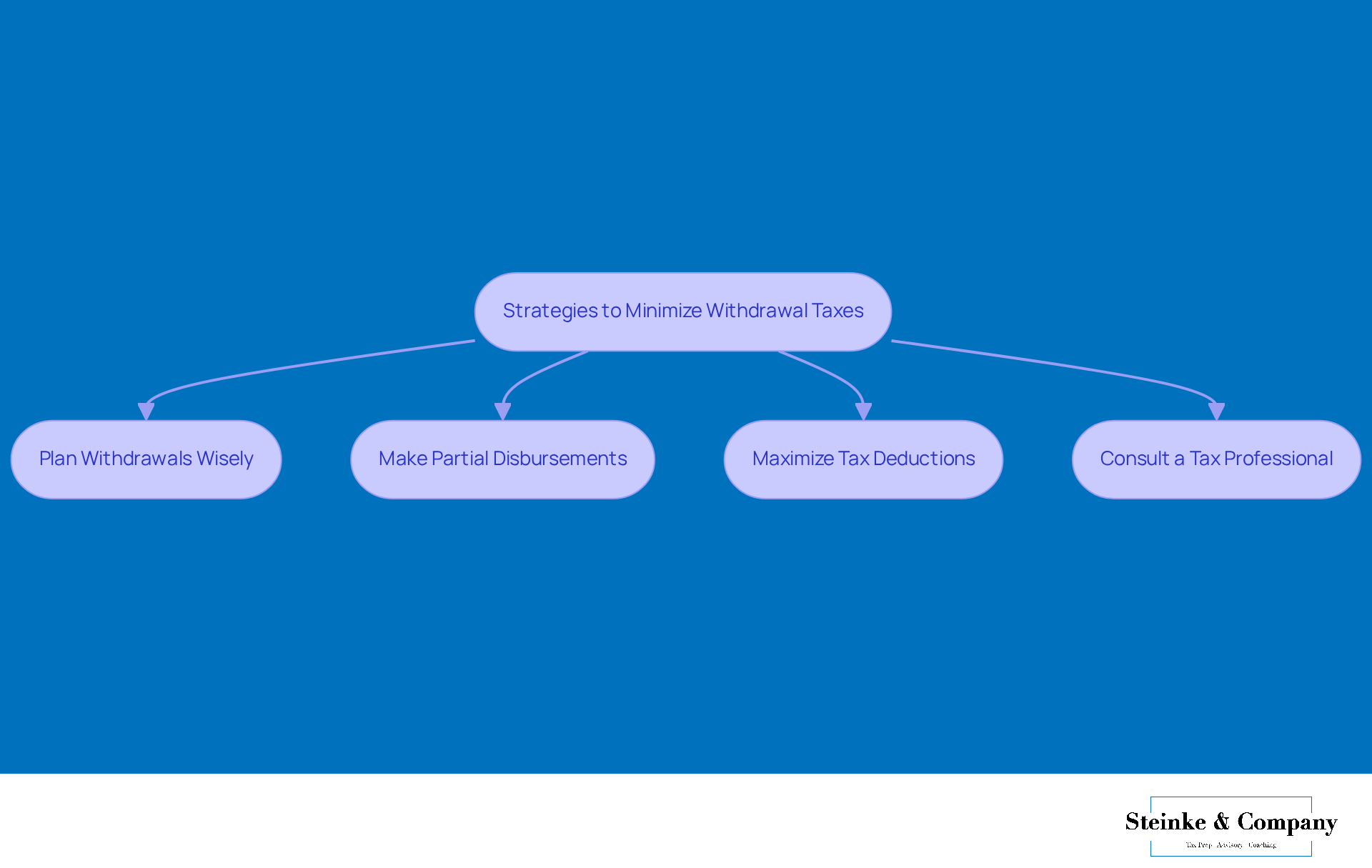

If you want to minimize the tax impact of your 401(k) withdrawals, here are some friendly tips to consider:

-

First off, think about planning your withdrawals wisely. It's a good idea to pull funds during years when your income is lower. This way, you can dodge those higher tax brackets and keep more of your hard-earned retirement savings.

-

Next, have you thought about making partial disbursements? Instead of taking a lump sum all at once, consider smaller, partial withdrawals spread over several years. This can help ease the tax burden related to 401k withdrawal income tax and might significantly lower your overall tax bill.

-

Don't forget about tax deductions! Maximize those deductions in the year you take a distribution. By offsetting some of that taxable income with deductions, you can effectively shrink your tax bill.

-

And hey, consulting a tax professional can be a game changer. They can provide personalized strategies that fit your unique financial situation and goals. Their expertise can really help you navigate the complexities of tax planning for your distributions.

By implementing these strategies, you can more effectively tackle the 401k withdrawal income tax responsibilities tied to your distributions. Remember, it’s all about making your money work for you!

Troubleshoot Common Withdrawal Issues

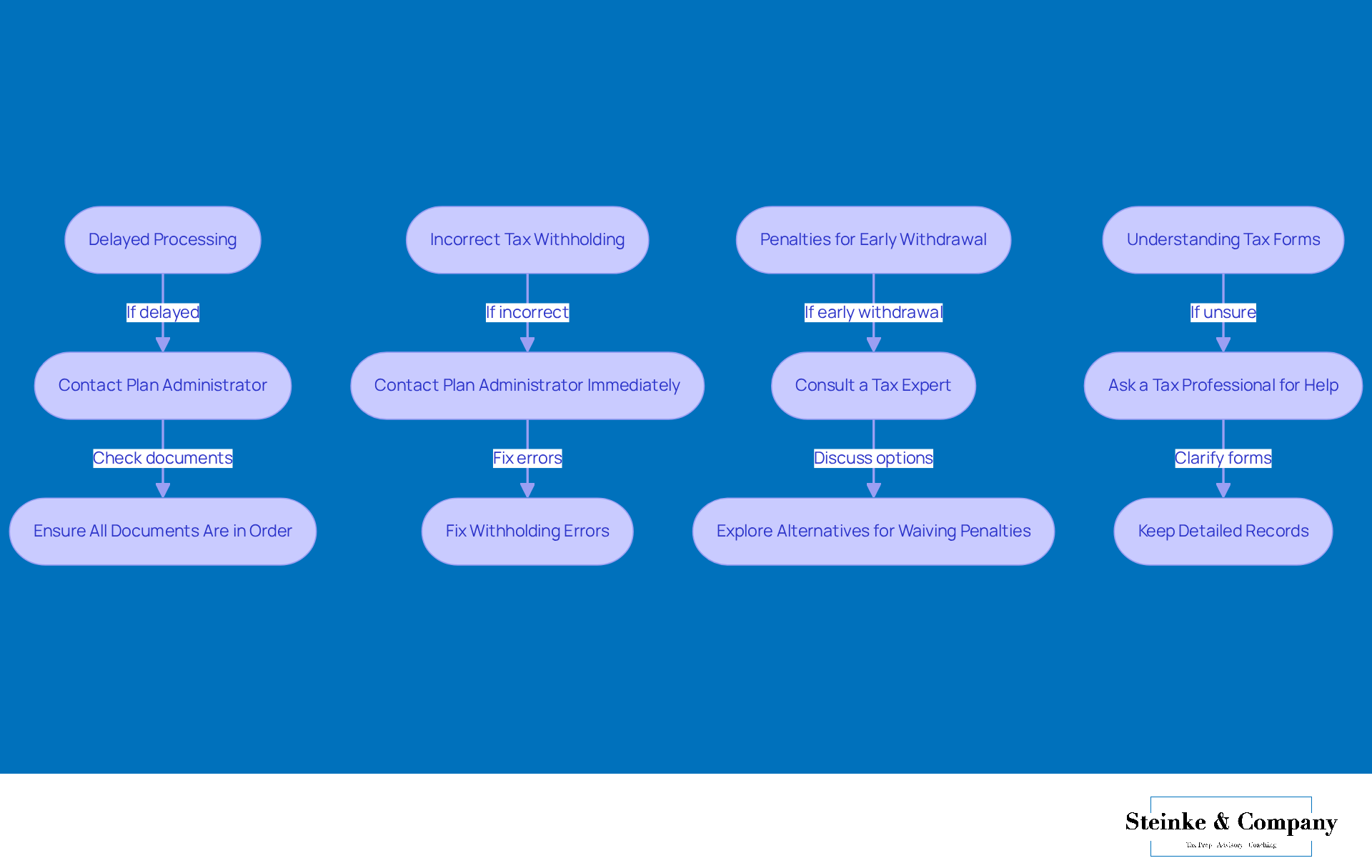

Even with the best planning, challenges can pop up during the process of managing 401k withdrawal income tax. Let’s take a look at some common issues and how you can tackle them effectively:

-

Delayed Processing: Is your request for funds taking longer than you thought? Don’t hesitate to reach out to your plan administrator for updates. Make sure all your required documents are in order, as missing paperwork can cause delays. Generally, processing times can vary, but being proactive can really help speed things along.

-

Incorrect Tax Withholding: Noticed something off with the tax withholding on your distribution? It’s super important to get in touch with your plan administrator right away. By fixing any withholding errors before the funds are sent out, you can save yourself from unexpected 401k withdrawal income tax bills and ensure compliance with IRS regulations. Keep in mind that the IRS allows a maximum of 20% withholding on early distributions, but that might not cover your total tax bill, especially if you’re in a higher tax bracket.

-

Penalties for Early Withdrawal: If you happen to withdraw funds before reaching 59½, you could face a 10% penalty on top of your regular taxes. In these cases, chatting with a tax expert is a smart move to explore potential alternatives for waiving penalties or making corrections. This is especially true if your withdrawal was due to qualifying reasons like unreimbursed medical expenses exceeding 7.5% of your adjusted gross income or job loss. Understanding the implications of 401k withdrawal income tax can help you make informed choices about your retirement savings.

-

Understanding Tax Forms: Tax documents related to your exit can be a bit tricky to navigate. If you’re feeling unsure about how to report your exit correctly, don’t hesitate to ask a tax professional for help. They can clarify the necessary forms and ensure your tax return accurately reflects your withdrawal. Plus, keeping detailed records of your transactions and understanding how they impact your overall tax situation is key for your financial health.

By being aware of these common issues and knowing how to tackle them, small business owners can navigate the withdrawal process related to 401k withdrawal income tax more smoothly, reducing stress and boosting their financial outcomes.

Conclusion

Understanding the ins and outs of 401(k) withdrawals and their tax implications is crucial for small business owners looking to secure their financial future. This guide has shed light on various strategies and considerations to help navigate the sometimes tricky withdrawal processes. With the right information, you can make informed decisions that minimize tax liabilities and boost your retirement savings.

We’ve touched on key points like:

- The timing of withdrawals

- The types you can take

- The potential penalties for accessing funds early

Plus, it’s important to grasp both federal and state tax implications. By planning your withdrawals during lower-income years, considering partial disbursements, and consulting with tax pros, you can effectively manage your 401(k) withdrawals while keeping those tax burdens in check.

Ultimately, the importance of proactive planning and informed decision-making is huge! Small business owners are encouraged to take the reins of their financial strategies by leveraging the insights shared here. Doing so can help ensure that your retirement funds truly serve their purpose—providing you with financial security and peace of mind for the years ahead.

Frequently Asked Questions

What is a 401(k) and how does it work?

A 401(k) is a retirement savings plan that allows employees to save a portion of their paycheck before taxes are deducted.

What are the main types of 401(k) withdrawals?

The two main types of withdrawals are hardship distributions and regular distributions. Hardship distributions can be accessed in specific situations, such as medical expenses or preventing eviction, while regular distributions can be taken once you reach age 59½.

At what age must I start taking required minimum distributions (RMDs) from my 401(k)?

If you were born between 1951 and 1959, you must start taking RMDs at age 73. If you were born in 1960 or later, the age increases to 75.

What is the process for withdrawing funds from a 401(k)?

To withdraw funds, you should contact your plan administrator to understand their specific procedures, which typically involve filling out forms and providing necessary documentation.

How does the timing of my withdrawal affect my taxes?

The timing of your withdrawal can significantly impact your 401(k) withdrawal income tax. It's important to consider your current earnings and tax bracket, as withdrawing funds may incur taxes and penalties.

What penalties apply if I withdraw from my 401(k) before age 59½?

If you withdraw funds before age 59½, you may face a 10% early withdrawal penalty, in addition to regular income tax and 401(k) withdrawal income tax.

Are there any exceptions to the early withdrawal penalty?

Yes, certain situations, such as hardship distributions permitted by the IRS, may allow you to access your funds without incurring penalties.

What are Substantially Equal Periodic Payments (SEPP)?

SEPP allows individuals under age 59½ to withdraw from their 401(k) without penalties by taking a series of equal payments based on their life expectancy.

Why is it important to consult a tax advisor before making a withdrawal?

Consulting a tax advisor is crucial for understanding the tax implications of your withdrawal and making informed decisions about whether to distribute the funds or roll them over into a new retirement account.