Overview

This article dives into the essential codes and reporting tips for Box 12 on the W-2 form—an important topic for small businesses looking to accurately report various types of compensation and benefits. Understanding these codes isn’t just a good idea; it’s vital for tax compliance! Plus, getting it right can have a big impact on an employee's taxable income and future benefits, especially with recent changes like the SECURE 2.0 Act.

So, why should you care about Box 12? Well, these codes can feel a bit like a puzzle, but once you get the hang of them, they can really help you navigate the tax landscape. It’s all about making sure you’re reporting everything correctly, which can save headaches down the road. Remember, staying informed is key, and it’s never too late to brush up on these details!

Introduction

Navigating the complexities of tax reporting can feel like a daunting task for small business owners, especially when it comes to the often-overlooked aa box 12 on the W-2 form. You might think this section is minor, but it actually holds significant implications for accurately documenting various types of compensation and benefits. This can influence both your tax obligations and compliance status. With the IRS scrutinizing these entries more than ever, the stakes are high.

So, how can small businesses leverage aa box 12 effectively to avoid costly errors and maximize deductions? Let’s dive in!

Define Box 12 on the W-2 Form

When it comes to reporting various types of compensation and benefits that go beyond standard wages, aa box 12 on the W-2 form is pretty important. This little box can fit up to four entries, each representing different income types or deductions, from A to HH. You’ll find codes here for things like uncollected Social Security tax, retirement plan contributions, and the cost of employer-sponsored health coverage.

You really can’t underestimate the significance of aa box 12 in tax documentation. It plays a key role in keeping everything compliant with IRS regulations. When this section is documented accurately, it gives the IRS a clear picture of an employee's total compensation package, which is super important for both the employer and the employee. For small businesses, understanding aa box 12 can really make a difference in tax obligations and compliance status.

For example, contributions to retirement plans reported in aa box 12 can impact an employee's taxable income and future benefits. This is especially true with the complexities brought on by the SECURE 2.0 Act, which has implications for how retirement income gets taxed. It could even change how Social Security benefits are treated, impacting future retirement planning. Plus, uncollected Social Security taxes can influence future benefits, so it’s crucial for small agency owners to keep their documentation precise to avoid any underpayment penalties.

And with 44% of employers citing compensation as their top issue in 2025, making sure aa box 12 is documented accurately is more important than ever. As Ted Godbout pointed out, the IRS has been sending reminders that changes under the SECURE 2.0 Act might affect the figures on Forms W-2, highlighting the need for small businesses to stay on top of shifting compliance obligations. By effectively using aa box 12, small businesses can address the complexities of tax documentation, reduce potential liabilities, and enhance overall operational efficiency.

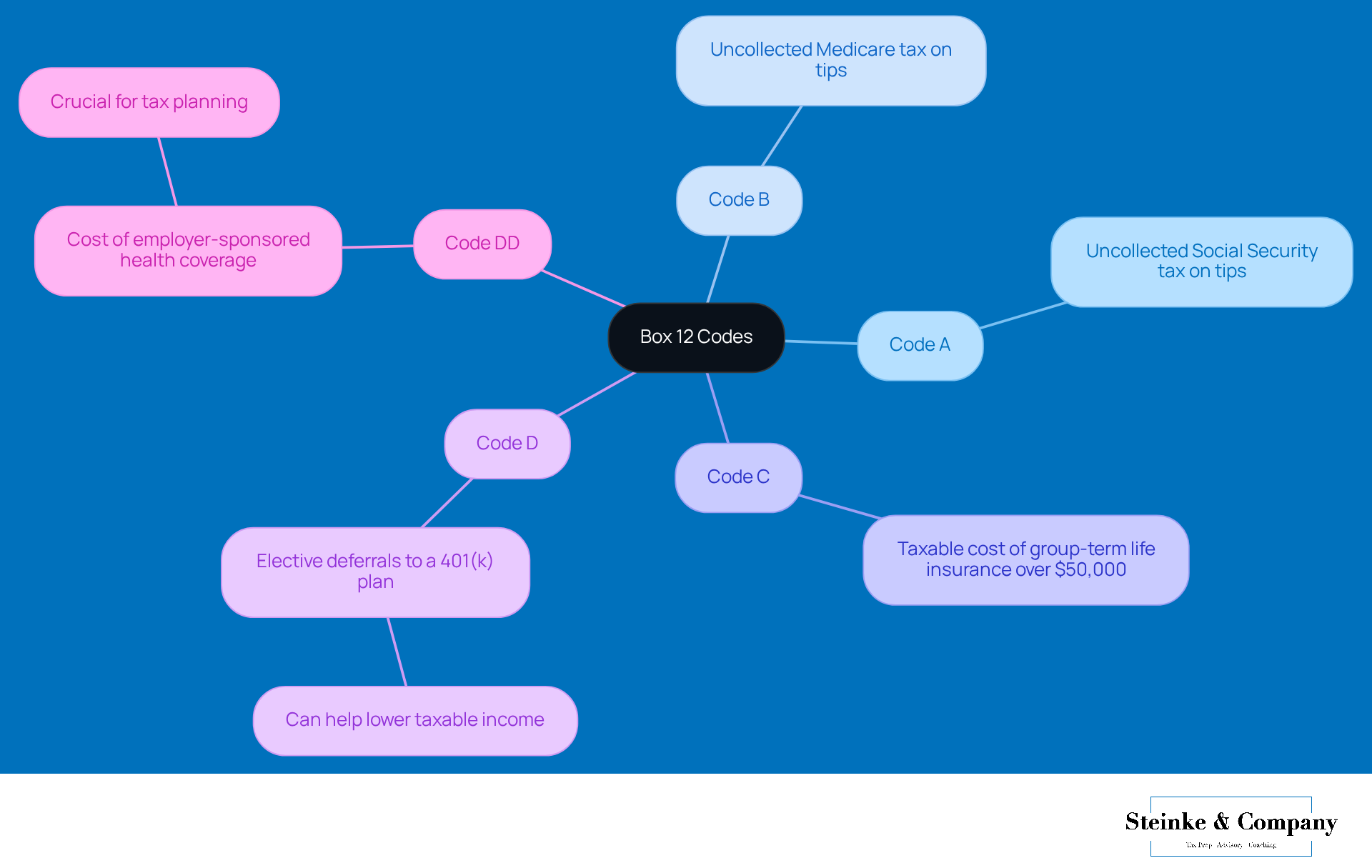

Explore Box 12 Codes and Their Meanings

Understanding aa box 12 of the W-2 form, which is filled with various symbols representing specific types of compensation and benefits, can really impact your taxable income. Getting a handle on these regulations is key for accurate tax reporting and making the most of your deductions. Let’s break down some important codes:

- Code A: Uncollected Social Security tax on tips.

- Code B: Uncollected Medicare tax on tips.

- Code C: Taxable cost of group-term life insurance over $50,000.

- Code D: Elective deferrals to a 401(k) plan, which can help lower your taxable income.

- Code DD: Cost of employer-sponsored health coverage, crucial for tax planning.

The impact of these regulations on your taxable income can be pretty significant. For instance, contributions reported under Code D can actually reduce your taxable income, while amounts under Code C might increase it. It's a bit of a balancing act! Misunderstanding these symbols has led to tax adjustments that have cut refunds by hundreds of dollars—yikes! Almost half of employers (44%) say compensation is their biggest HR headache for 2025, so it’s clear that managing these regulations accurately is super important.

Employers really need to pay attention when submitting these identifiers to dodge penalties and stick to IRS regulations. Take, for example, mistakes in documenting elective deferrals (Code D)—those can have serious financial consequences for employees. It’s a good idea to consult with tax experts to navigate the complexities of aa box 12 entries and achieve the best possible tax results. So, what’s your experience with these codes? Have you ever found them confusing?

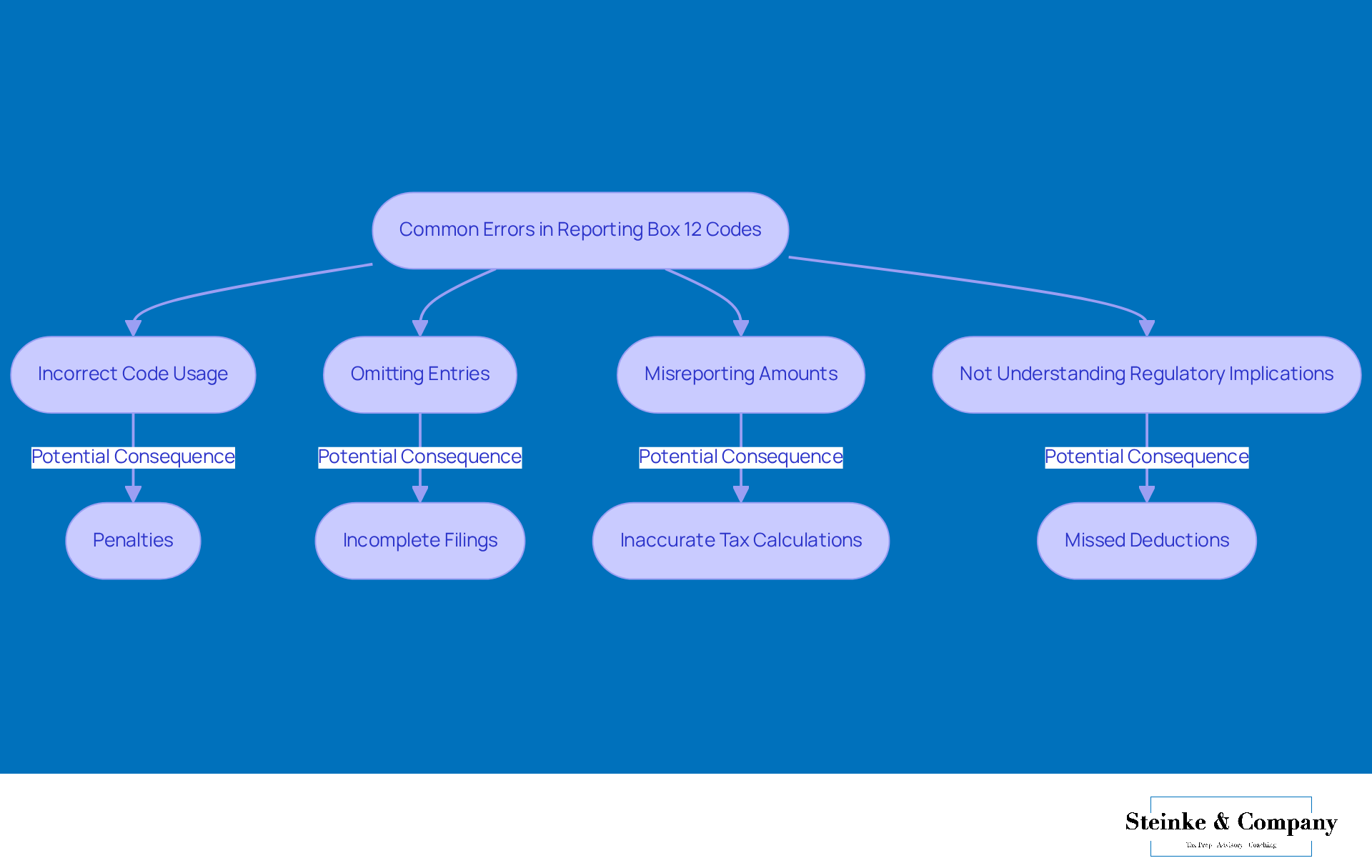

Identify Common Errors in Reporting Box 12 Codes

Frequent mistakes in reporting aa box 12 entries can really mess with your tax submissions and lead to some not-so-great outcomes. Let’s chat about a few key blunders you might want to watch out for:

- Incorrect Code Usage: Using the wrong code can totally misrepresent your income or deductions. For example, if you accidentally use Code A instead of Code B for uncollected taxes, you might end up facing some penalties.

- Omitting Entries: Forgetting to report important entries can leave your tax filings incomplete, which could increase your chances of audits or penalties. Yikes!

- Misreporting Amounts: If you enter the wrong dollar amounts, it can skew your taxable income calculations, leading to inaccurate tax obligations. Nobody wants that!

- Not Understanding Regulatory Implications: Some business owners might overlook the tax implications of specific regulations, which can mean missed deductions or higher tax bills.

To cut down on these errors, be sure to carefully check all your entries in aa box 12. And if you’re ever unsure about specific regulations, don’t hesitate to reach out to a tax expert. This proactive approach not only helps you stay compliant but also optimizes your tax outcomes. So, let’s keep those tax worries at bay!

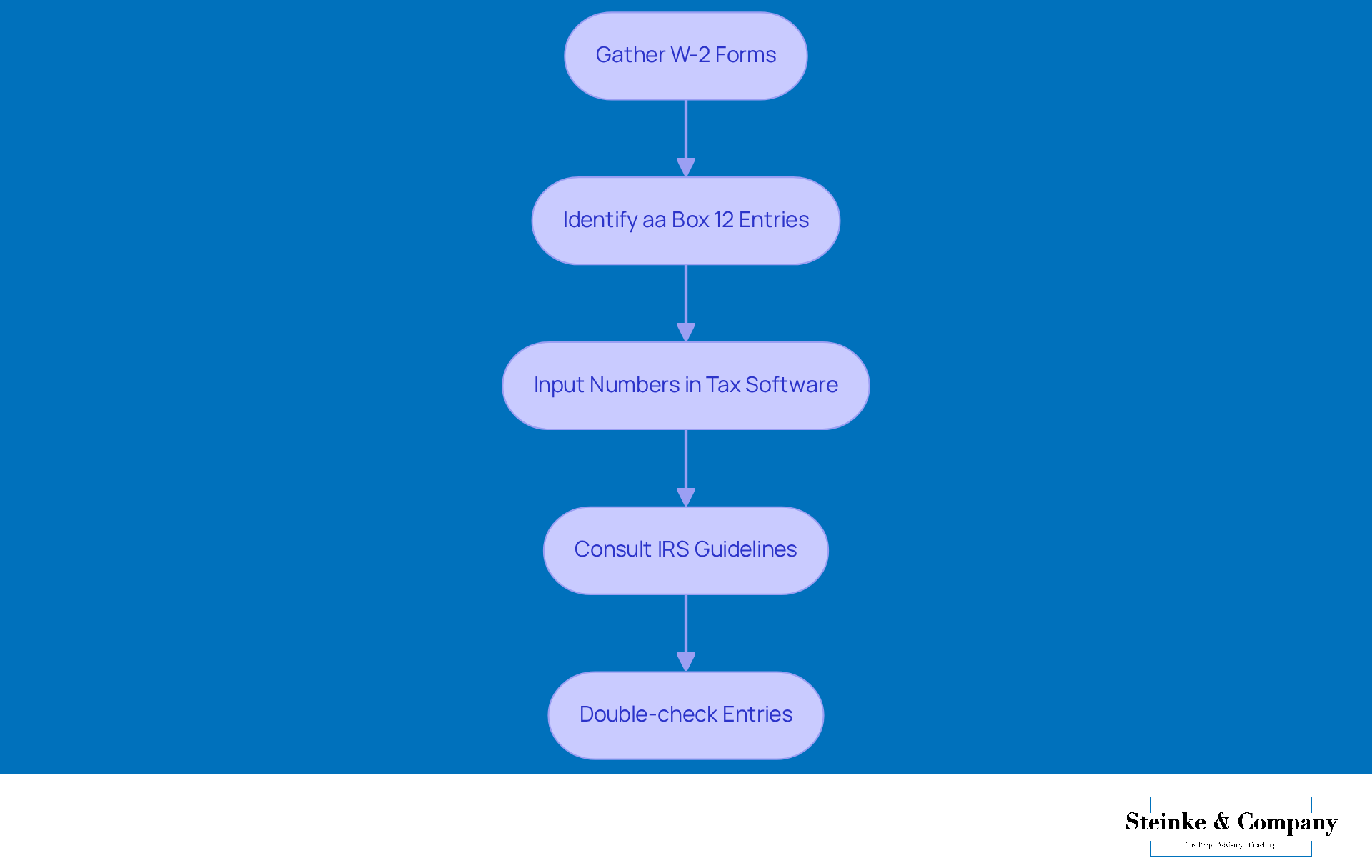

Apply Box 12 Codes in Tax Preparation

Are you ready to tackle the aa box 12 codes during tax season? Here’s a friendly guide to help you navigate through it:

- Gather W-2 Forms: Start by collecting all W-2 forms from your employees. This way, you’ll have all the necessary info at your fingertips.

- Identify the entries in aa box 12: Take a moment to review each W-2 for those aa box 12 entries and their amounts. Jot down a list of these identifiers for easy reference.

- When you’re using tax prep software, ensure that you input the numbers and amounts exactly as they are shown in aa box 12. Double-check that you’re putting them in the right fields.

- Consult IRS Guidelines: Don’t forget to peek at the IRS instructions for Form W-2. This will help you confirm that you’re applying the designations correctly and understanding what they mean for your taxes.

- Before hitting send on your tax return, take a moment to double-check all your entries in aa box 12 for accuracy. It’s worth it to ensure everything is accurate and compliant.

Understanding aa box 12 codes is crucial for small business owners, as they have a direct impact on tax reporting and compliance. Plus, don’t forget that Steinke and Company is here to help! We offer expert tax compliance and preparation services to keep your business legally sound and minimize any surprises come tax season. With our tailored tax planning and advisory services, you can craft strategies that not only reduce your tax burden but also support your growth—ultimately leading to better financial stability. So, why not reach out and see how we can assist you today?

Conclusion

Getting a handle on the ins and outs of box 12 on the W-2 form is crucial for small businesses trying to tackle the complexities of tax reporting. This box isn’t just a minor detail; it holds important codes that represent different types of compensation and benefits, which can really affect compliance and tax obligations. Reporting accurately in this section is key to painting a clear picture of an employee's total compensation, something that can influence future financial planning and tax liabilities.

Throughout this article, we’ve highlighted some key points, like the significance of specific codes for retirement plan contributions and uncollected Social Security taxes. It’s easy to make common mistakes in reporting—like using the wrong code or leaving entries out—which can lead to serious financial consequences. By staying alert and checking out IRS guidelines, small business owners can avoid these pitfalls and ensure they’re compliant with the ever-changing regulations, especially with the updates brought about by the SECURE 2.0 Act.

Ultimately, mastering the box 12 codes isn’t just about dodging penalties; it’s a smart move that can boost financial stability and operational efficiency for small businesses. Taking proactive steps to understand and apply these codes can lead to better tax outcomes and a more secure financial future. So, small business owners, don’t hesitate to seek expert advice and tap into available resources to navigate this vital part of tax preparation effectively.

Frequently Asked Questions

What is the purpose of Box 12 on the W-2 form?

Box 12 on the W-2 form is used to report various types of compensation and benefits beyond standard wages, including uncollected Social Security tax, retirement plan contributions, and the cost of employer-sponsored health coverage.

How many entries can Box 12 accommodate?

Box 12 can fit up to four entries, each representing different income types or deductions, identified by codes from A to HH.

Why is Box 12 significant for tax documentation?

Box 12 is significant because it helps ensure compliance with IRS regulations by providing a clear picture of an employee's total compensation package, which is important for both employers and employees.

How can contributions reported in Box 12 affect an employee?

Contributions to retirement plans reported in Box 12 can impact an employee's taxable income and future benefits, especially considering the complexities introduced by the SECURE 2.0 Act.

What implications does the SECURE 2.0 Act have for Box 12?

The SECURE 2.0 Act may affect how retirement income is taxed and how Social Security benefits are treated, which can influence future retirement planning.

What should small business owners be cautious about regarding Box 12?

Small business owners should ensure precise documentation for Box 12 to avoid underpayment penalties related to uncollected Social Security taxes and to maintain compliance with changing tax obligations.

Why is accurate documentation in Box 12 increasingly important for employers?

Accurate documentation in Box 12 is increasingly important because 44% of employers cited compensation as their top issue in 2025, and the IRS has emphasized the need for compliance with changes under the SECURE 2.0 Act.