Introduction

Navigating the ins and outs of the Affordable Care Act (ACA) can feel like a real challenge for small business owners, right? With compliance requirements constantly changing, it’s easy to feel overwhelmed. But don’t worry! This guide is here to help you make sense of ACA principles, figure out what you need to comply with, and explore affordable coverage options that work for both you and your employees.

Now, with the threat of hefty penalties hanging over your head, you might be wondering: how can you meet these requirements without sacrificing your operational efficiency or your employees’ happiness? Let’s dive in and tackle this together!

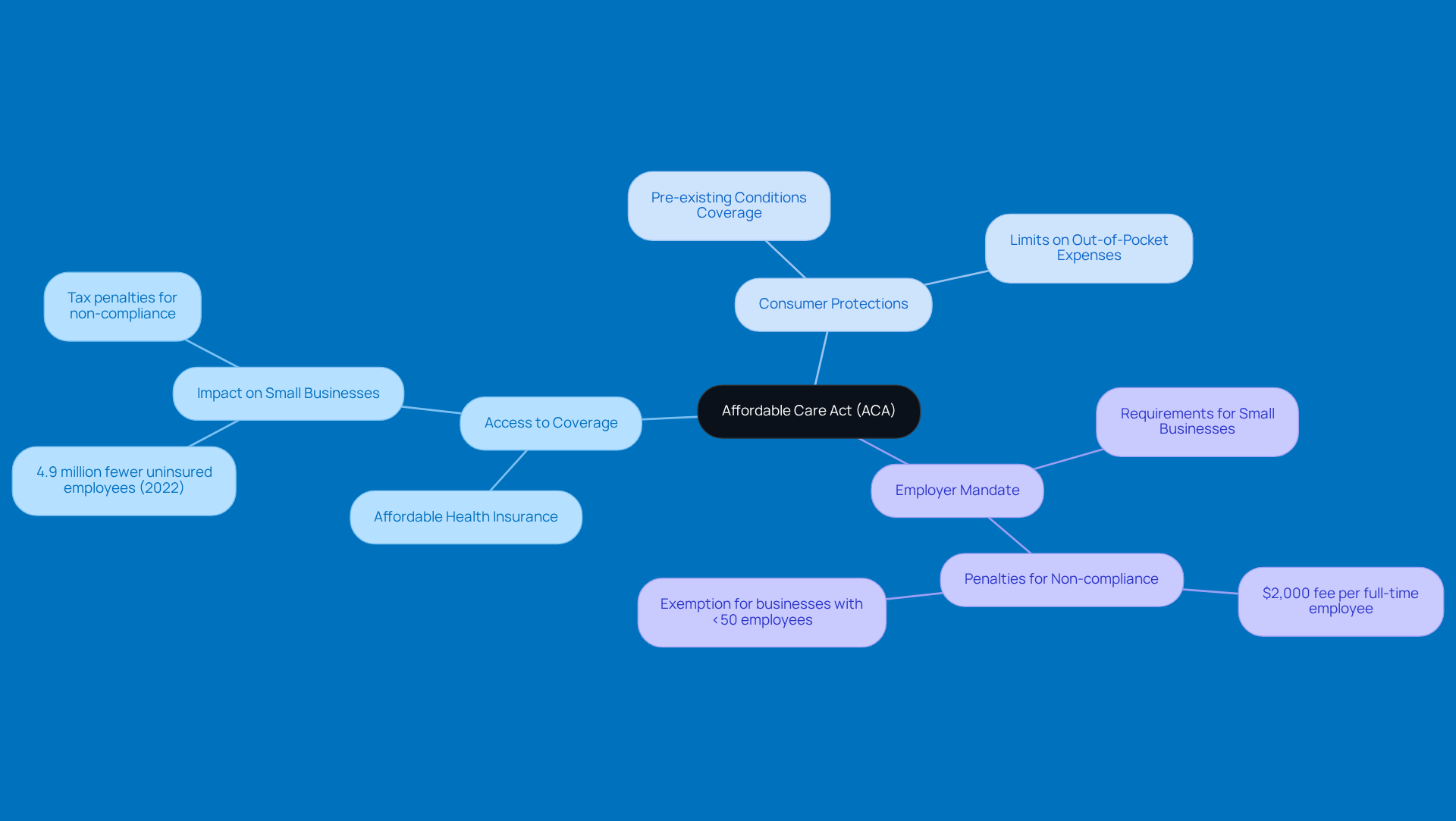

Understand the Affordable Care Act: Key Principles and Objectives

The Affordable Care Act (ACA), which came into play in 2010, is all about making healthcare more accessible, improving quality, and cutting costs. Let’s break down some of its key principles:

- Access to Coverage: The ACA ensures that everyone can get affordable health insurance. This is a big deal, especially for small businesses!

- Consumer Protections: No more worrying about insurers denying you coverage because of pre-existing conditions. Plus, there are limits on out-of-pocket expenses, which is a relief.

- Employer Mandate: If you run a small business with fewer than 50 full-time employees, you’re not required to provide health insurance. But if you do, there are specific standards you need to meet regarding coverage and affordability.

Understanding these principles can really help small business owners grasp their responsibilities and see the benefits of compliance. So, what do you think? How does this impact your business?

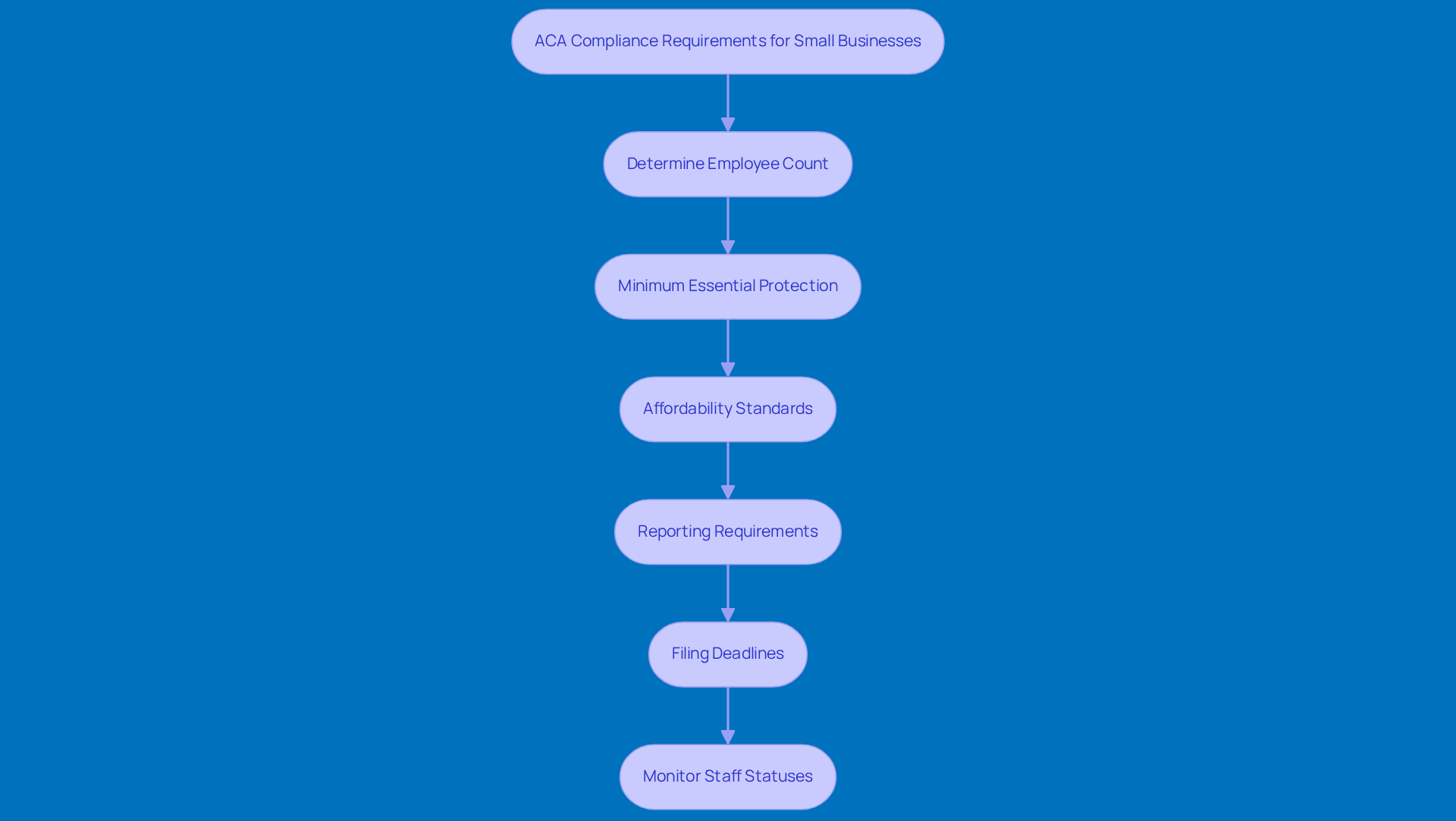

Identify ACA Compliance Requirements for Small Businesses

To comply with the Affordable Care Act (ACA), small businesses have a few key requirements to keep in mind:

- Determine Employee Count: If your business has fewer than 50 full-time equivalent (FTE) employees, you’re off the hook for providing health insurance. But if you choose to offer it, you’ll need to follow some reporting requirements.

- Minimum Essential Protection: Any insurance plan you provide must meet minimum essential protection standards. This means it should cover a comprehensive range of medical services. To hit the minimum value requirements, plans need to cover at least 60% of the total cost of medical services.

- Affordability Standards: For the 2025 insurance year, contributions for self-only medical insurance can’t exceed 9.02% of a worker's household income. This reflects the ACA's commitment to affordable care act compliance by making healthcare affordable for everyone.

- Reporting Requirements: If you’re offering medical insurance, you’ll need to file IRS Forms 1095-B or 1095-C, depending on your business size and the type of coverage you provide. Accurate and timely reporting is key to avoiding penalties, which can include hefty fines for affordable care act compliance.

- Filing Deadlines: Don’t forget about deadlines! Forms 1094-C and 1095-C need to be filed with the IRS by February 28 for paper submissions and by March 31 for electronic ones. Plus, you must provide Form 1095-C to your staff by January 31.

- Monitor Staff Statuses: Keeping an eye on staff statuses is super important. It helps you assess eligibility for wellness benefits and ensures you’re sticking to ACA regulations.

Looking ahead to 2025, it’s estimated that around 60% of small businesses will offer medical coverage-up from previous years. This highlights just how crucial it is to understand the obligations of affordable care act compliance. After all, it’s all about keeping your workers happy and avoiding those pesky financial penalties!

Implement Affordable Coverage Options for Employees

To implement affordable coverage options, let’s break it down:

-

Explore the SHOP Marketplace: Small businesses can snag health insurance through the Small Business Health Options Program (SHOP). This program offers a variety of plans tailored just for small employers. Remember, if you’re going this route, you’ll need to provide SHOP insurance to all your full-time or FTE staff-generally those working 30 hours or more each week. It’s all about sticking to the program's requirements!

-

Evaluate Plan Alternatives: Take a good look at different insurance plans based on benefits, costs, and what your workers really need. Make sure the plan you choose meets the minimum value and affordability standards. You want to offer solid protection without breaking the bank.

-

Communicate Benefits: It’s super important to clearly share the benefits with your staff. Break down the coverage details and costs so they really understand their options. When you provide clear information, it helps everyone make informed choices about their medical care.

-

Consider Tax Credits: Did you know that small businesses might qualify for the Small Enterprise Health Care Tax Credit? If you cover at least 50% of your employees' premiums, you could be eligible. This tax credit can make coverage more affordable and encourages you to provide comprehensive medical insurance.

-

Employ Practical Illustrations: Many small businesses have successfully used the SHOP Marketplace to get affordable medical coverage. For instance, a local bakery tapped into SHOP to offer wellness benefits for its staff, which boosted morale and reduced turnover. These real-life examples show just how beneficial engaging with the SHOP Marketplace can be!

By following these steps, small businesses can navigate the complexities of insurance while ensuring their staff have access to benefits that meet affordable care act compliance. So, why not take the plunge and explore these options?

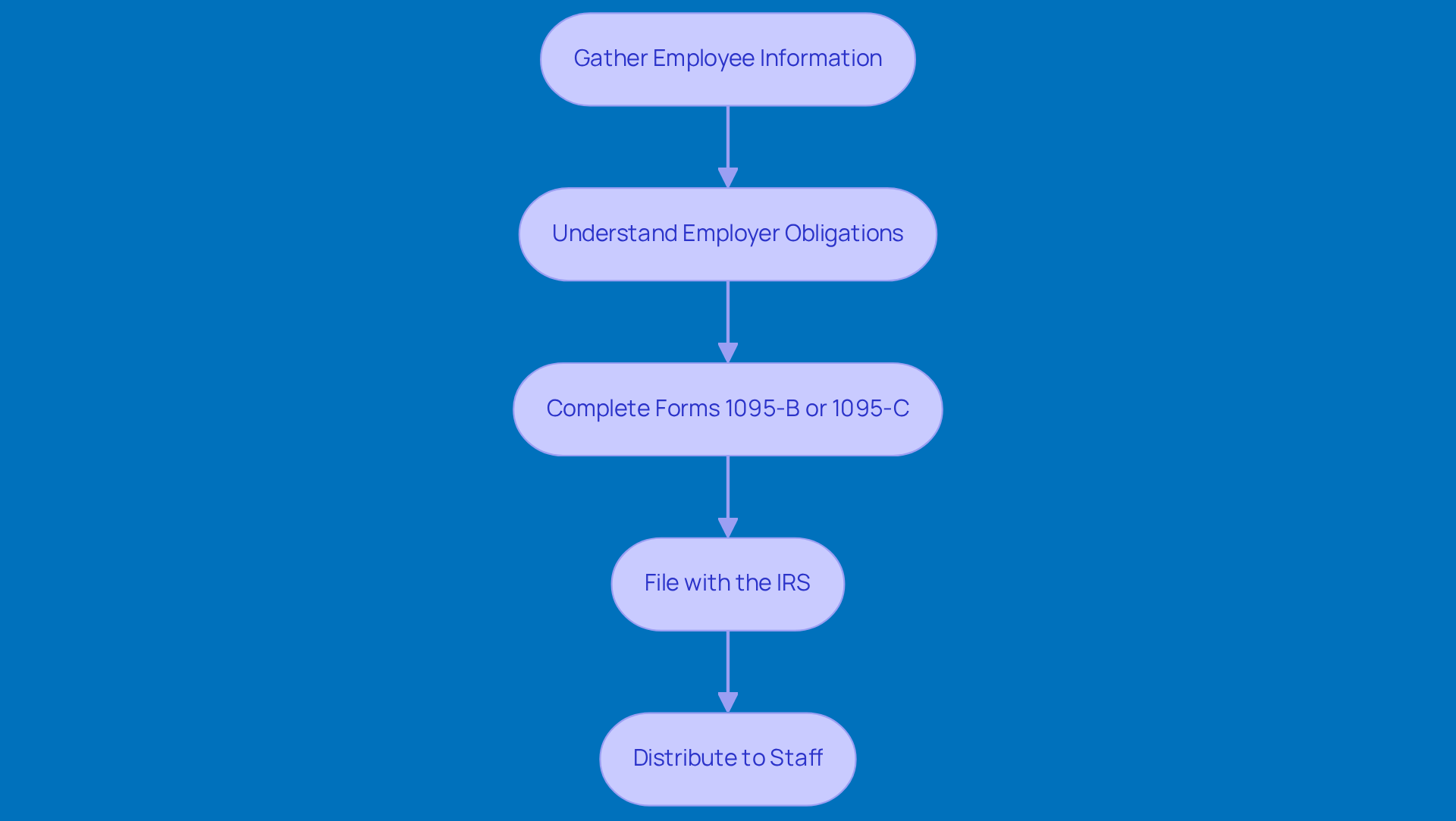

Complete Required ACA Reporting to the IRS

To successfully tackle ACA reporting, let’s break it down into some essential steps:

- Gather Employee Information: First things first, you’ll want to collect all the necessary data on your employees. This includes their full-time status and any details about their health coverage. Trust me, having this info is key for accurate reporting and staying compliant.

- Understand Employer Obligations: Now, if you’re running a small business with 1-50 staff members, you’re not required to offer medical insurance. However, if you do provide coverage, you’ll need to stick to Form 1095-B reporting. On the flip side, Applicable Large Employers (ALEs) must offer affordable medical insurance to at least 95% of their full-time staff to dodge any penalties.

- Complete Forms 1095-B or 1095-C: Depending on your business size, make sure to fill out the right forms accurately. ALEs should use Form 1095-C to report the medical benefits they offer to full-time staff, while smaller employers can go with Form 1095-B if they provide benefits.

- File with the IRS: Don’t forget to submit those completed forms to the IRS by the deadlines-February 28 for paper filings and March 31 for electronic submissions. In 2025, sticking to these timelines is crucial to avoid penalties, which can hit up to $270 per return for failures.

- Distribute to Staff: Lastly, make sure to give each full-time staff member a copy of Form 1095-C by January 31. This way, they’ll have all the info they need for their tax filings, ensuring they can accurately report their health coverage.

By following these steps, small businesses can navigate the maze of affordable care act compliance with ease, reducing the risk of penalties and meeting their reporting obligations. As Jesse Hansen, a Senior Employee Benefits Attorney, puts it, "Knowing how and when to comply with ACA reporting is both critical and complex." So, let’s get started!

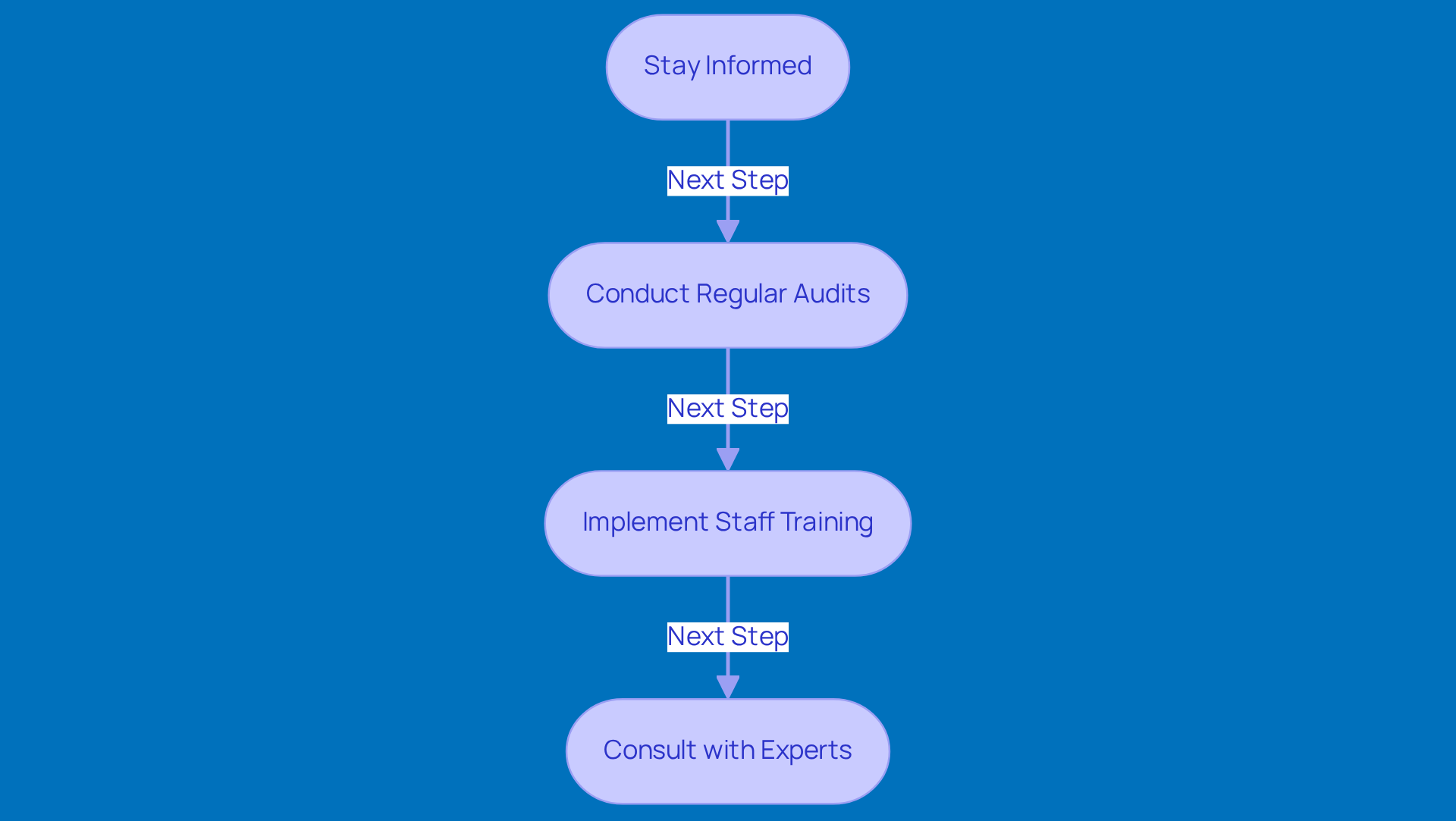

Manage and Mitigate ACA Compliance Penalties

To effectively manage and mitigate penalties associated with ACA compliance, small businesses should really consider a proactive approach.

-

Stay Informed: It’s crucial to keep up with updates to ACA regulations and compliance requirements. The IRS is stepping up its game with better systems for handling ACA submissions and catching non-compliance. So, staying in the loop is essential for companies.

-

Conduct Regular Audits: How often do you check your health insurance offerings and reporting processes? Periodic audits can make a big difference! Small businesses that regularly assess their compliance status can spot gaps early, which helps reduce the risk of penalties. Did you know that organizations not complying with ACA requirements could face hefty financial consequences? For example, the 4980H(a) penalty could hit $2,900 each year per employee in 2025. Ouch!

-

Implement Staff Training: It’s all about education! Make sure your staff knows their health coverage options and why compliance matters. By fostering a culture of accountability, you ensure that everyone understands their role in keeping things compliant, which can really help mitigate risks.

-

Consult with Experts: Sometimes, it’s best to call in the pros. Engaging with tax compliance experts or legal advisors can help you navigate those tricky regulations. Working with experts can provide tailored strategies that fit your needs, ensuring you stay compliant and avoid those costly penalties. As industry experts say, staying informed about ACA regulations is more important than ever, especially with the recent updates for 2025.

By taking these steps, small businesses can not only dodge penalties but also boost their overall operational efficiency and employee satisfaction. So, why not start today?

Conclusion

Navigating the ins and outs of Affordable Care Act (ACA) compliance can feel like a maze for small businesses, but it’s crucial if you want to offer quality healthcare options without running into penalties. By getting a handle on the key principles of the ACA - like access to coverage, consumer protections, and employer mandates - you’re setting the stage for responsible business practices. When small business owners understand these foundational concepts, they can truly appreciate their obligations and the potential perks that come with compliance.

So, what are the steps to achieve ACA compliance? First off, you’ll want to:

- Determine your employee counts.

- Meet those minimum essential coverage standards.

- Stick to reporting requirements.

Don’t forget to explore affordable coverage options through the SHOP Marketplace and communicate these benefits effectively to your employees. Plus, timely reporting to the IRS is a must! Taking proactive measures, like conducting regular audits and consulting with compliance experts, can really help you dodge those pesky penalties.

At the end of the day, complying with the ACA isn’t just about avoiding financial headaches; it’s also about boosting employee satisfaction and retention. Small businesses should actively engage with ACA requirements, ensuring they provide valuable health insurance options while fostering a culture of compliance. By taking these steps, you’re not just protecting your business - you’re also contributing to the bigger picture of improving healthcare access and affordability for everyone. So, let’s get started on this journey together!

Frequently Asked Questions

What is the Affordable Care Act (ACA)?

The Affordable Care Act (ACA), implemented in 2010, aims to make healthcare more accessible, improve quality, and reduce costs.

What are the key principles of the ACA?

The key principles of the ACA include ensuring access to affordable health insurance, providing consumer protections against denial of coverage due to pre-existing conditions, and establishing an employer mandate for small businesses.

Do small businesses have to provide health insurance under the ACA?

Small businesses with fewer than 50 full-time employees are not required to provide health insurance. However, if they choose to offer it, they must meet specific standards regarding coverage and affordability.

What are the compliance requirements for small businesses under the ACA?

Small businesses must determine their employee count, ensure any insurance plan meets minimum essential protection standards, adhere to affordability standards, fulfill reporting requirements, and monitor staff statuses.

What is the minimum essential protection standard?

Any insurance plan provided must cover a comprehensive range of medical services and meet minimum value requirements, meaning it should cover at least 60% of the total cost of medical services.

What are the affordability standards for health insurance contributions?

For the 2025 insurance year, contributions for self-only medical insurance cannot exceed 9.02% of a worker's household income.

What reporting requirements must small businesses follow if they offer medical insurance?

Small businesses must file IRS Forms 1095-B or 1095-C based on their size and the type of coverage provided. Accurate reporting is essential to avoid penalties.

What are the filing deadlines for ACA-related forms?

Forms 1094-C and 1095-C must be filed with the IRS by February 28 for paper submissions and by March 31 for electronic submissions. Additionally, Form 1095-C must be provided to employees by January 31.

Why is it important for small businesses to monitor staff statuses?

Monitoring staff statuses is crucial for assessing eligibility for wellness benefits and ensuring compliance with ACA regulations.

What is the projected trend for small businesses offering medical coverage by 2025?

It is estimated that around 60% of small businesses will offer medical coverage by 2025, indicating a growing commitment to employee health and compliance with the ACA.