Introduction

Understanding tax incentives can really change the game for small business owners, especially when it comes to bonus depreciation. This handy tool lets businesses deduct a big chunk of the costs for eligible assets in the year they start using them. That means a nice boost to cash flow and tax savings! But with new legislation on the way, you might be wondering: how can small businesses navigate these changes and make the most of their benefits?

In this guide, we’ll explore the essential steps and strategies to help you tap into the full potential of the bonus depreciation tax bill. We want to make sure you don’t miss out on any valuable opportunities!

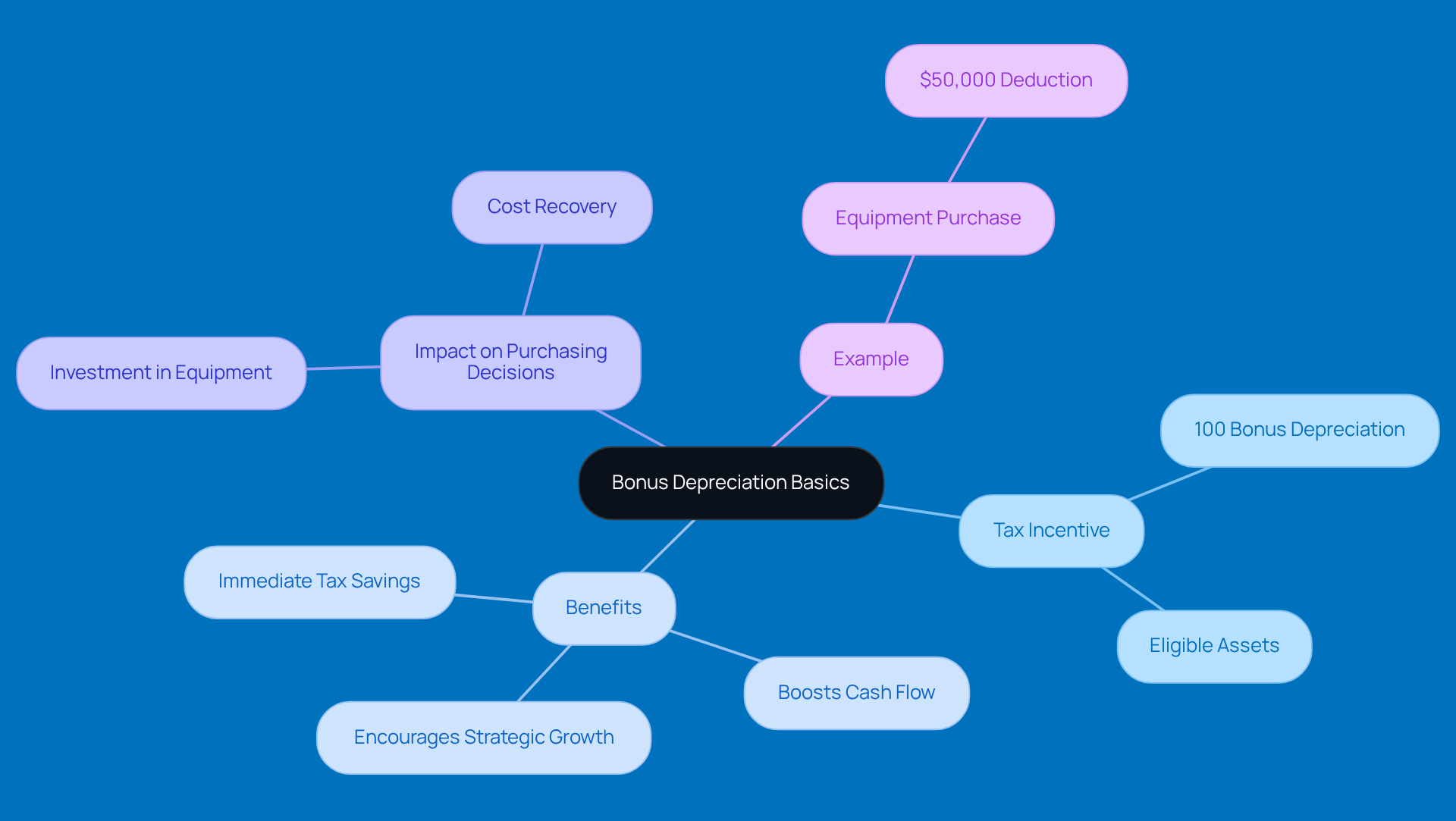

Understand Bonus Depreciation Basics

Bonus write-offs are a fantastic tax incentive! They let companies deduct a big chunk of the cost of eligible assets in the year they start using them. Thanks to the One Big Beautiful Bill Act, businesses can now benefit from a 100% bonus depreciation tax bill for qualifying property purchased and put into use after January 19, 2025. This means companies can write off the entire cost right away instead of spreading the deduction over several years, which can lead to some serious tax savings. For instance, if a company buys equipment for $50,000, it can deduct that whole amount from its taxable income in the year of purchase, which really helps lower its tax bill.

Understanding how the bonus depreciation tax bill works is super important for small business owners. It directly impacts purchasing decisions and cash flow management. This incentive is especially great for companies looking to invest in new equipment or technology, as it allows them to recover costs quickly and reinvest in their operations. Plus, the ability to expense capital investments right away not only boosts cash flow but also encourages strategic growth. So, if you're a small business aiming to improve your financial health, this is definitely something to consider!

Identify Eligibility Criteria for Bonus Depreciation

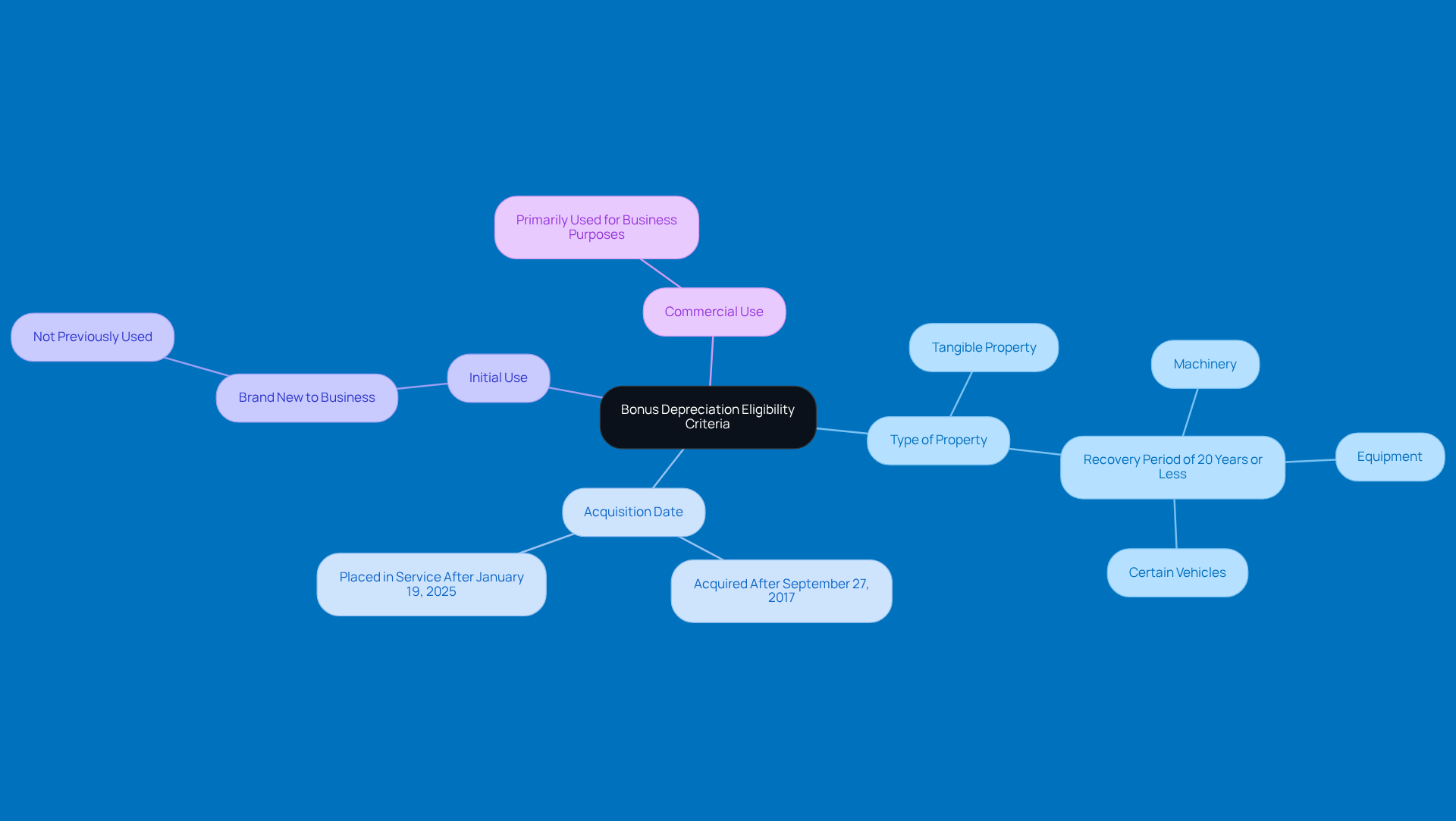

If you're looking to take advantage of bonus depreciation, there are a few key criteria your business needs to meet:

- Type of Property: First off, the property has to be tangible and have a recovery period of 20 years or less. Think machinery, equipment, and certain vehicles.

- Acquisition Date: You’ll want to make sure the property is acquired after September 27, 2017, and put into service after January 19, 2025, to snag that 100% deduction.

- Initial Use: The property must be brand new to your business, meaning it hasn’t been used by anyone else before you.

- And don’t forget, the asset should primarily be used for commercial purposes.

For instance, let’s say a small business buys a new delivery truck for $30,000 and starts using it in 2025. If it meets all the criteria, that business can claim the full $30,000 as an extra deduction! This is a fantastic opportunity, especially since the reinstated 100% bonus depreciation tax bill allows companies to fully expense qualifying assets in the year they start using them. This can really boost cash flow and help lower tax obligations.

So, if you’re considering making a purchase, keep these points in mind! It could make a big difference for your bottom line.

Implement Strategies to Maximize Bonus Depreciation

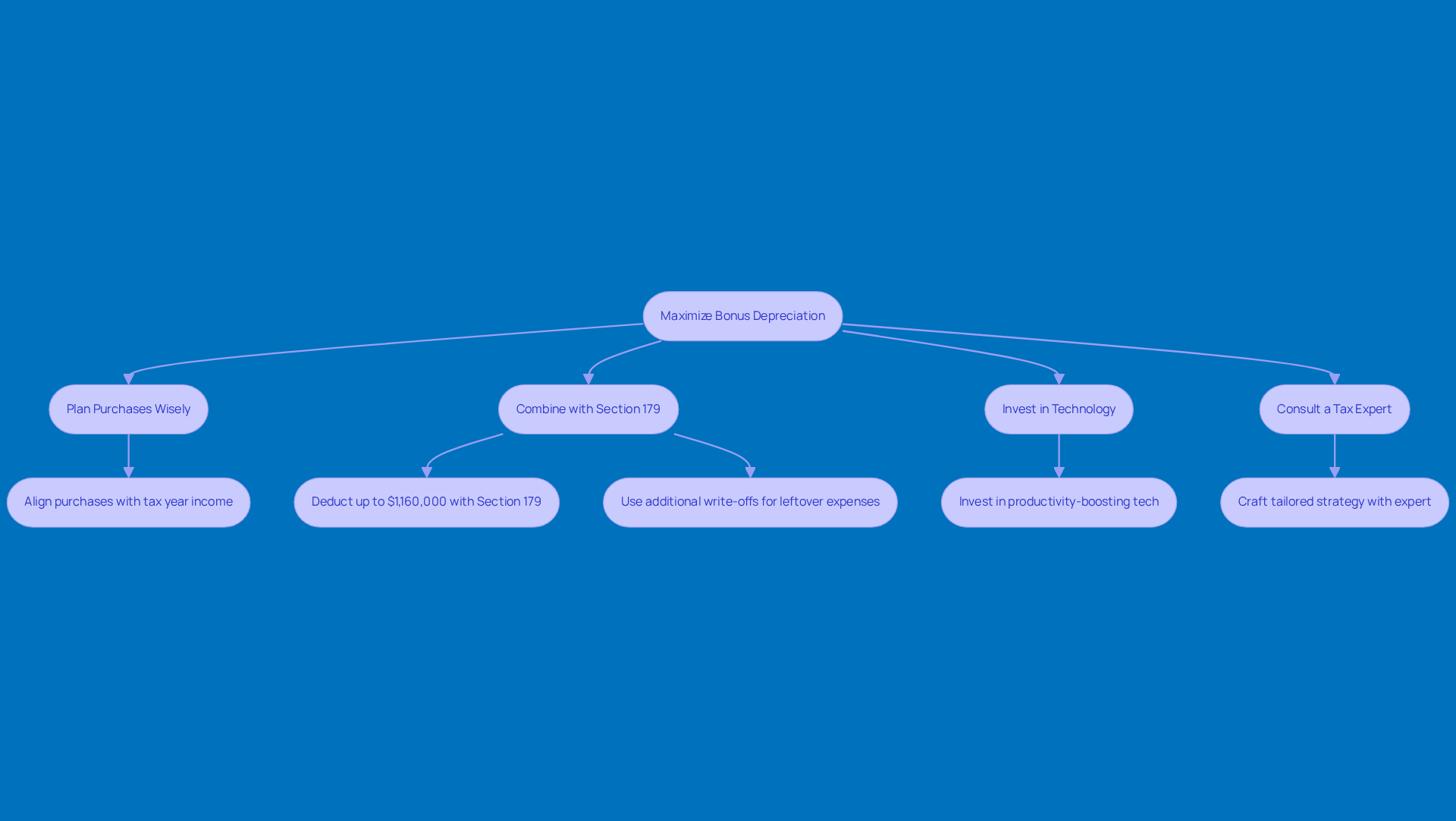

If you're a small business owner looking to maximize your bonus depreciation, here are some friendly strategies to consider:

-

Plan Purchases Wisely: Think about timing when you acquire qualifying assets. Align those purchases with the tax year when you expect to rake in the most income. This little tweak can really amp up the impact of your deductions!

-

Combine with Section 179: Why not take advantage of Section 179 expensing along with additional write-offs? For 2025, you can deduct up to $1,160,000 of qualifying property costs with Section 179, and then use those extra write-offs for any leftover expenses. That’s some serious tax savings!

-

Invest in Technology: Consider investing in tech and equipment that can boost your productivity. Not only do these assets qualify for additional write-offs, but they also help streamline your operations, setting you up for long-term growth.

-

Consult a Tax Expert: Teaming up with a tax consultant who knows the ins and outs of additional write-offs can be a game changer. Their expertise can help you craft a tailored strategy that aligns with your goals and maximizes your tax benefits.

For example, let’s say your company is eyeing $100,000 worth of new equipment. You could kick things off by using Section 179 to deduct the whole amount, and then apply accelerated write-offs for any extra qualifying costs. This strategic approach is key as you prepare for the upcoming tax year, especially with the bonus depreciation tax bill reinstating the 100% additional write-off on January 20, 2025.

So, what do you think? Ready to make the most of these strategies?

Troubleshoot Common Bonus Depreciation Issues

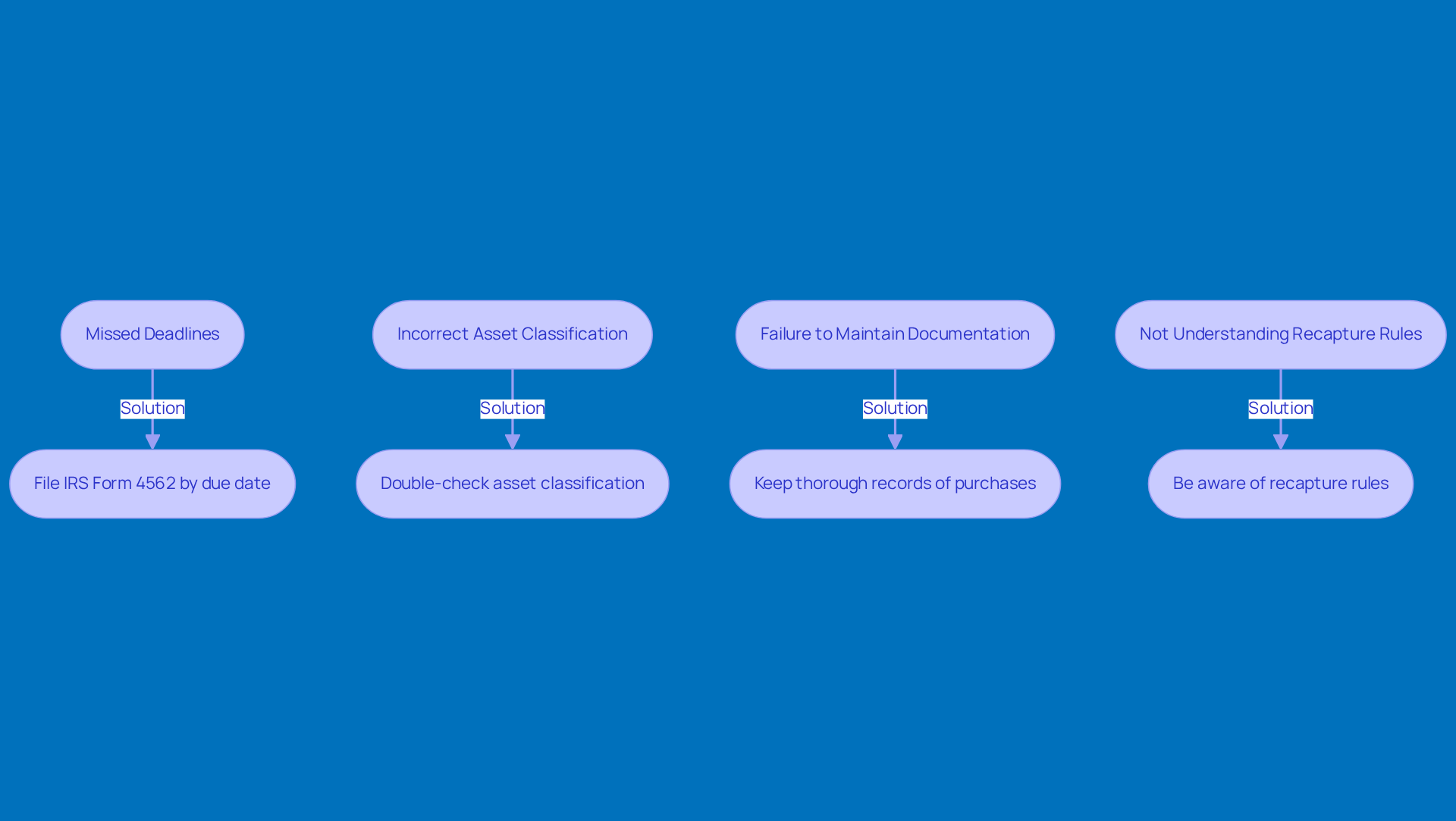

When it comes to the bonus depreciation tax bill, small business owners often run into a few common hiccups. Let’s break them down:

-

Missed Deadlines: First off, make sure you file all your forms, like IRS Form 4562, by the due date. If you’re late, you might just lose out on that deduction, and nobody wants that!

-

Incorrect Asset Classification: Next, double-check how you classify your assets. Misclassifying can lead to missing out on some valuable tax deductions. It’s worth taking a moment to get it right.

-

Failure to Maintain Documentation: Keeping thorough records of all your purchases and how you use those assets is crucial. If your documentation isn’t up to snuff, you could face challenges during audits. And hey, understanding your paystub and ensuring the right amounts are withheld can help you keep those financial records accurate. This is key for backing up your claims when the taxman comes knocking.

-

Not Understanding Recapture Rules: Lastly, be aware of the recapture rules. If you sell or dispose of an asset before its useful life is up, you might have to pay back some of those tax benefits you enjoyed. Yikes!

For instance, if you forget to file Form 4562 on time, you could miss out on claiming the bonus depreciation tax bill for that tax year. To dodge this bullet, set reminders for those filing deadlines and consider chatting with a tax pro to stay compliant. Plus, keeping copies of your tax returns and supporting documents for at least three years can act as a safety net in case of an audit. This way, you can verify your claims and know your rights throughout the process.

Conclusion

Taking advantage of the bonus depreciation tax bill can really change the game for small business owners. By getting a grip on how this tax incentive works - like who qualifies and how to implement it strategically - businesses can boost their deductions and improve cash flow. And let’s not forget, the reinstatement of 100% bonus depreciation for qualifying assets bought after January 19, 2025, is a golden opportunity for companies eager to invest in growth and efficiency.

So, what’s the takeaway here? Planning and execution are key. From figuring out which property types are eligible to keeping your documentation in check and steering clear of common pitfalls, small business owners need to approach this with care. Timing your purchases, combining benefits with Section 179, and chatting with tax pros can really amp up the effectiveness of these deductions.

In the end, the bonus depreciation tax bill isn’t just another tax incentive; it’s a powerful tool for driving business growth and stability. Small business owners should definitely explore these opportunities, implement smart strategies, and stay in the loop about any potential challenges. By doing this, they can set their businesses up for success while enjoying the perks of this valuable tax legislation. So, why not dive in and see how you can make the most of it?

Frequently Asked Questions

What is bonus depreciation?

Bonus depreciation allows companies to deduct a significant portion of the cost of eligible assets in the year they are put into use, rather than spreading the deduction over several years.

What is the impact of the One Big Beautiful Bill Act on bonus depreciation?

The One Big Beautiful Bill Act enables businesses to benefit from a 100% bonus depreciation tax bill for qualifying property purchased and used after January 19, 2025, allowing them to write off the entire cost immediately.

How does bonus depreciation affect a company's tax bill?

Bonus depreciation can lead to substantial tax savings, as companies can deduct the full cost of assets from their taxable income in the year of purchase, significantly lowering their tax bill.

Why is understanding bonus depreciation important for small business owners?

Understanding bonus depreciation is crucial for small business owners because it influences purchasing decisions and cash flow management, helping them recover costs quickly and reinvest in their operations.

What types of investments benefit from bonus depreciation?

Bonus depreciation is particularly beneficial for companies looking to invest in new equipment or technology, as it allows for immediate expensing of capital investments.

How does bonus depreciation encourage strategic growth for businesses?

By allowing businesses to expense capital investments right away, bonus depreciation boosts cash flow, enabling companies to reinvest in their operations and pursue strategic growth opportunities.