Introduction

Navigating the world of not-for-profit bookkeeping can be quite a ride, right? It’s filled with unique challenges that might feel a bit overwhelming at times. These organizations have to stick to specific accounting standards while juggling various funding sources, each with its own set of reporting requirements. But here’s the good news: by adopting some solid bookkeeping practices, nonprofits can boost transparency, build trust with donors, and stay compliant with all those pesky regulations.

So, how can these organizations set up strong financial systems and develop the skills their teams need to thrive in this complex landscape? It’s a great question, and one that many are asking. Let’s dive in and explore how to tackle these challenges together!

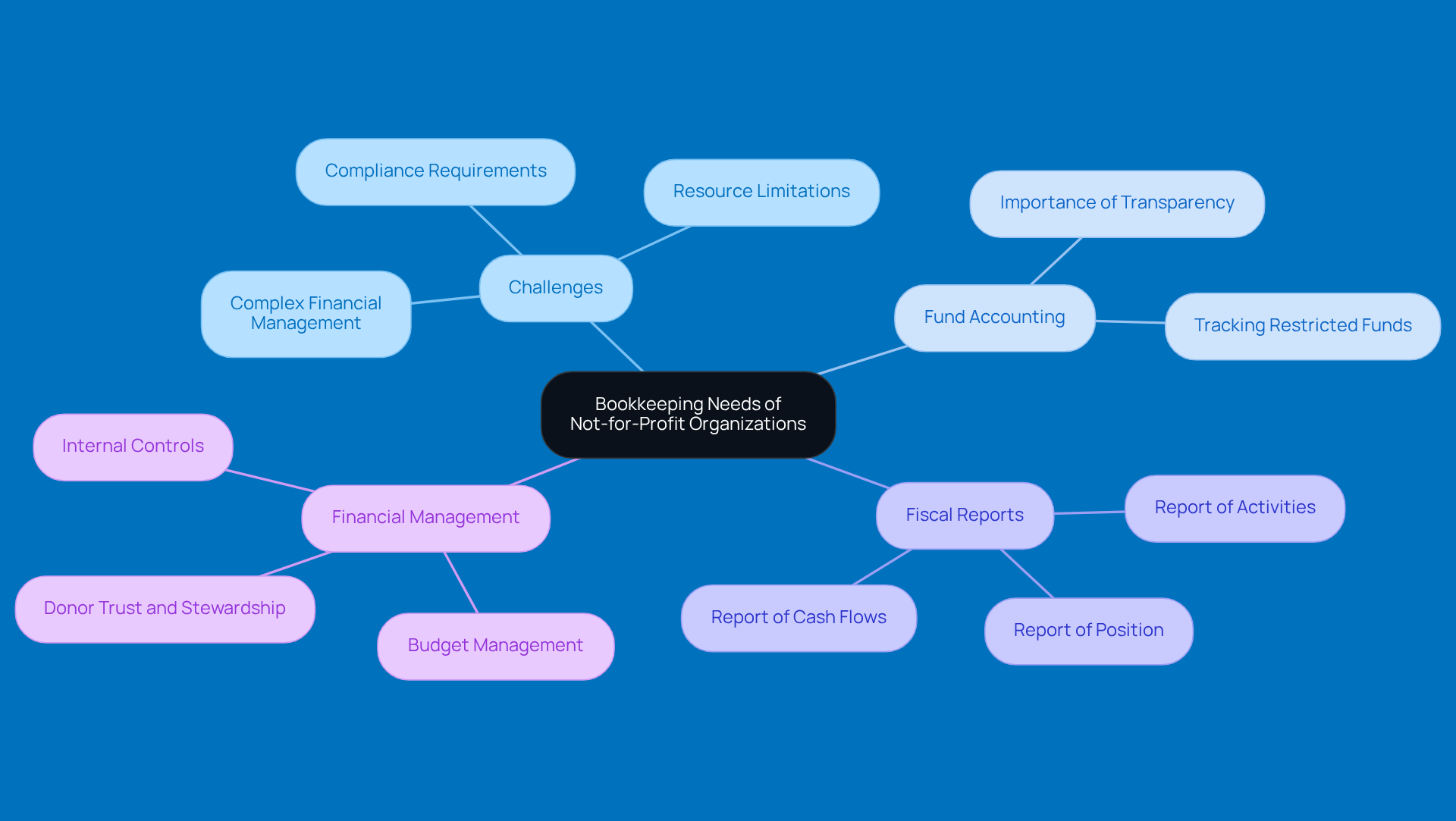

Understand Unique Bookkeeping Needs of Not-for-Profit Organizations

Not-for-profit entities encounter unique challenges in bookkeeping for not-for-profit organizations, mainly due to their mission-driven nature and the need to comply with strict regulations. Unlike for-profit organizations, these nonprofits must follow specific accounting standards, which necessitate proper bookkeeping for not-for-profit organizations, especially in terms of fund accounting. This method categorizes resources based on how they’re meant to be used, which is super important for keeping things transparent and accountable to donors and stakeholders.

Since these organizations often rely on a mix of funding sources - like grants, contributions, and government assistance - each with its own reporting requirements, it’s crucial to understand these details for effective budget management and compliance. Plus, keeping accurate records of restricted funds is key; if things go awry here, it can lead to compliance headaches and damage donor trust.

By adopting solid bookkeeping for not-for-profit organization practices, nonprofits can improve their oversight and ensure resources are allocated in line with their mission. And let’s not forget, nonprofits need to whip up three main fiscal reports each year:

- The report of activities

- The report of position

- The report of cash flows

These statements are vital for staying audit-ready and proving compliance with donor and regulatory requirements.

As noted by Martus Solutions, managing money in the nonprofit world can be quite tricky, especially with limited resources and complex compliance rules. On top of that, organizations might have to deal with unrelated business income tax (UBIT) on net income, which adds another layer of complexity to managing their resources. By following these practices and understanding their financial responsibilities, nonprofits can build trust with their donors and stakeholders.

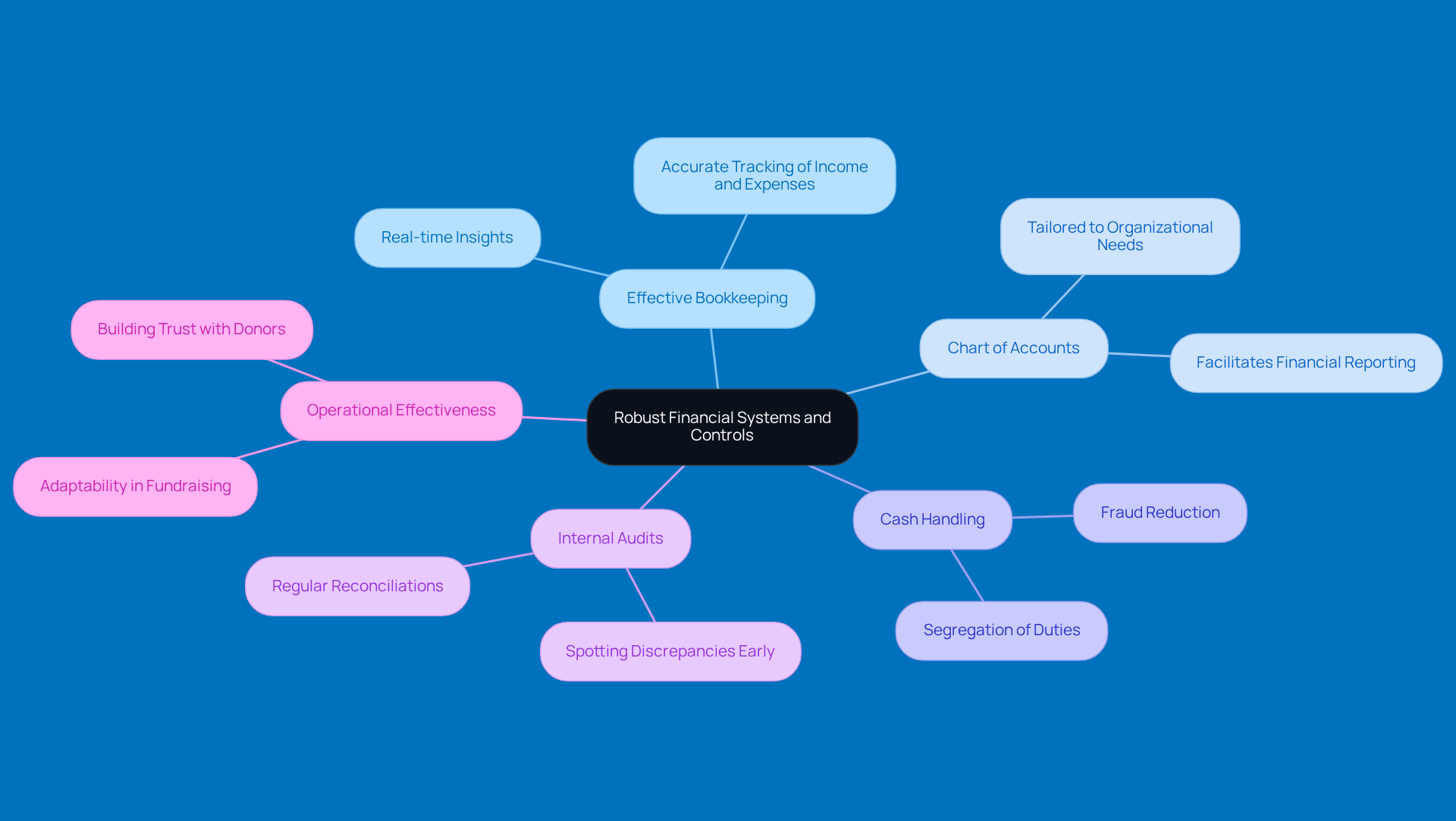

Implement Robust Financial Systems and Controls

To keep things financially sound, not-for-profit organizations really need to implement effective bookkeeping for not for profit organization and establish solid financial systems and controls. This means crafting a clear chart of accounts that fits the unique needs of the organization, allowing for accurate tracking of income and expenses. Plus, it’s super important to have different people handling cash receipts, disbursements, and reconciliations. This way, you can reduce the risk of fraud. Regular internal audits and reconciliations are also key to spotting discrepancies early and keeping those accounting records on point. And hey, bookkeeping for not for profit organization can really make life easier by providing you with real-time insights into your financial health and compliance.

Nonprofit leaders often juggle a ton of responsibilities, so having effective bookkeeping for not for profit organization systems in place is crucial. As Sean Kosofsky points out, asking for contributions is a big part of fundraising, and having a strong financial foundation can really build trust with potential donors. Also, looking at case studies can show how important representation is in decision-making and how smart resource management can help achieve broader organizational goals. By steering clear of common traps - like skipping regular audits or not adjusting budget strategies - nonprofits can boost their operational effectiveness and better serve their communities.

So, what do you think? Are your financial systems up to snuff? Let's make sure you're set up for success!

Establish Regular Financial Oversight and Reporting

Regular fiscal supervision and reporting are crucial for bookkeeping for not for profit organization to maintain transparency and accountability. It’s a good idea for these groups to establish a routine for bookkeeping for not for profit organization by reviewing their financial statements, including the statement of activities and the statement of position, at least every three months. Did you know that nonprofits that utilize bookkeeping for not for profit organization and adhere to regular fiscal reporting often see better transparency and governance? In fact, about 75% of them report that it boosts trust among stakeholders! This practice aids boards and management in evaluating their performance against budgets and making informed decisions about bookkeeping for not for profit organization.

And let’s not forget about the annual report! It’s a great way to summarize financial activities and showcase the impact of the organization’s work. Sharing this with stakeholders and donors can really strengthen those relationships. As nonprofit leader Sean Kosofsky puts it, "Nonprofit leaders must have the courage to take risks and try new approaches, even in the face of uncertainty and challenges."

Creating a dashboard to track key performance indicators (KPIs) can also provide real-time insights into financial health and operational efficiency. Additionally, adhering to Generally Accepted Accounting Principles (GAAP) is essential for bookkeeping for not for profit organization, as it helps maintain compliance and credibility in reporting. So, how does your organization handle fiscal supervision? It might be time to take a closer look!

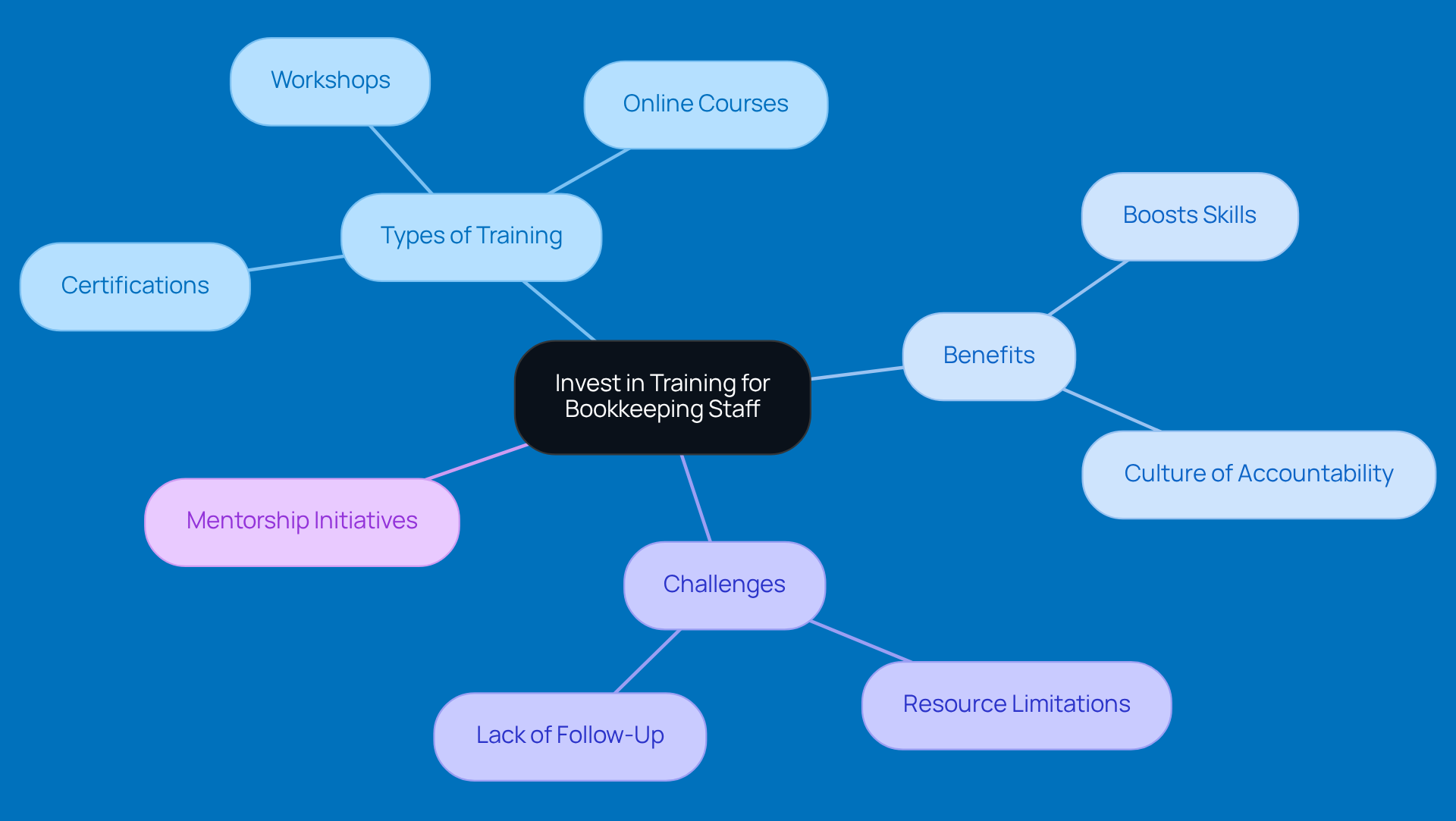

Invest in Training and Capacity Building for Bookkeeping Staff

Investing in training and capacity building for bookkeeping personnel is crucial for effective bookkeeping for not for profit organizations. It’s really important for these entities to prioritize professional development opportunities - think workshops, online courses, and certifications in charity accounting and financial management. Not only does this boost staff skills, but it also helps create a culture of accountability and excellence within the organization.

Did you know that a recent study found 55% of nonprofit leaders cite competitive compensation as a major staffing challenge? This highlights just how essential it is for organizations to invest in their staff’s development to keep talent around. Plus, mentorship initiatives can be a game-changer, where seasoned pros guide junior staff. But let’s not forget, there are common pitfalls when rolling out training programs, like not having enough resources or failing to follow up, which can really undermine their effectiveness.

By equipping bookkeeping personnel with the right tools and knowledge for bookkeeping for not for profit organizations, organizations can enhance their financial practices, adapt to regulatory changes, and ultimately boost their mission-driven efforts. As Sean Kosofsky, The Nonprofit Fixer, puts it, "Fundraising is a partnership. You are not asking a donor for a favor when you ask for money. You are doing them a favor by inviting them to fund the world they want to see." This perspective applies to investing in staff development too, as it fosters a collaborative environment that benefits both the organization and its employees. So, what steps can you take today to invest in your team?

Conclusion

Mastering bookkeeping for not-for-profit organizations is super important for keeping things transparent, accountable, and managing resources effectively. When nonprofits understand their unique bookkeeping needs, set up solid financial systems, and have regular oversight, they can confidently navigate their financial landscapes with integrity.

In this article, we’ve highlighted some key practices like fund accounting, keeping accurate records of restricted funds, and sticking to Generally Accepted Accounting Principles (GAAP). We also talked about the importance of regular fiscal reporting and investing in staff training. These elements are crucial for building trust with donors and stakeholders while boosting overall operational effectiveness.

But here’s the thing: adopting these best practices isn’t just about ticking boxes for compliance. It’s really about empowering not-for-profit organizations to fulfill their missions more effectively. By prioritizing financial management and investing in their teams, nonprofits can stay accountable to their communities and keep making a meaningful impact. So, why not take some proactive steps today? It could set the stage for a stronger, more resilient future in the nonprofit sector!

Frequently Asked Questions

What are the unique bookkeeping needs of not-for-profit organizations?

Not-for-profit organizations face unique challenges in bookkeeping due to their mission-driven nature and the need to comply with strict regulations. They must follow specific accounting standards and utilize fund accounting to categorize resources based on their intended use, ensuring transparency and accountability to donors and stakeholders.

Why is fund accounting important for not-for-profit organizations?

Fund accounting is crucial for not-for-profit organizations because it helps categorize resources based on how they are meant to be used, which is essential for maintaining transparency and accountability, particularly to donors and stakeholders.

What types of funding sources do not-for-profit organizations typically rely on?

Not-for-profit organizations often rely on a mix of funding sources, including grants, contributions, and government assistance, each with its own reporting requirements.

What are the main fiscal reports that not-for-profit organizations need to prepare annually?

Not-for-profit organizations need to prepare three main fiscal reports each year: the report of activities, the report of position, and the report of cash flows. These statements are vital for staying audit-ready and demonstrating compliance with donor and regulatory requirements.

What challenges do not-for-profit organizations face in managing their finances?

Managing finances in the nonprofit sector can be challenging due to limited resources, complex compliance rules, and the potential for unrelated business income tax (UBIT) on net income, which adds complexity to resource management.

How can proper bookkeeping practices benefit not-for-profit organizations?

By adopting solid bookkeeping practices, not-for-profit organizations can improve their oversight, ensure resources are allocated in line with their mission, and build trust with their donors and stakeholders.