Introduction

Navigating the complex world of business interest expense limitations can feel pretty overwhelming for many entrepreneurs. But with the recent changes from the One Big Beautiful Bill Act, there’s a clearer path ahead! This new approach allows businesses to potentially boost their deductions through a revised EBITDA-based calculation.

Now, you might be wondering: how can your company effectively manage its interest expenses to maximize those tax benefits? Understanding the ins and outs of these limitations - like the exceptions for small businesses and specific industries - raises some important questions. Don’t worry, though! This guide is here to break it all down for you, step by step, helping you implement strategies that could lead to some serious financial perks.

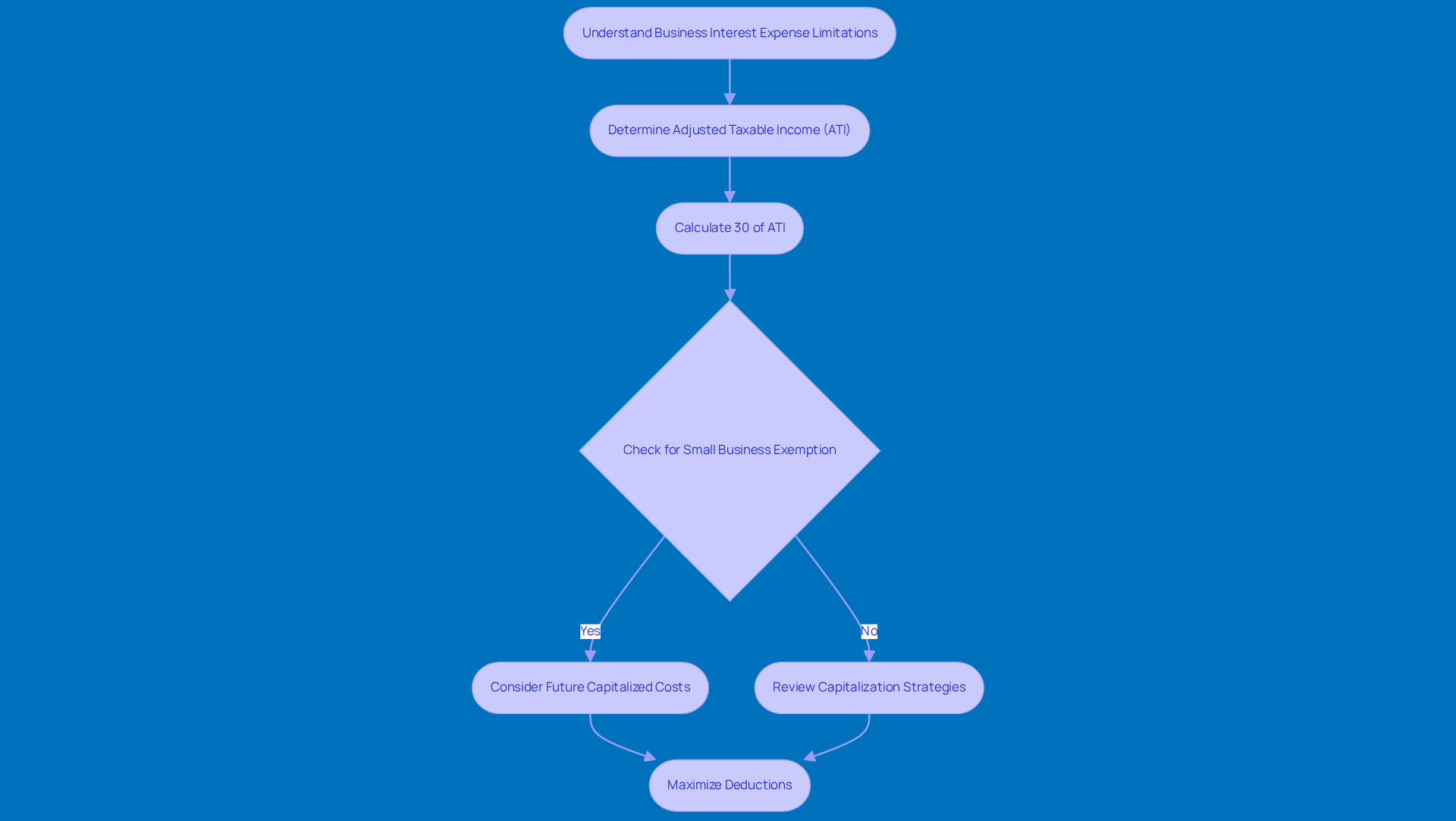

Understand Business Interest Expense Limitations

When it comes to managing financial costs in your operations, the business interest expense limitation defined in Section 163(j) of the Internal Revenue Code has some important rules. The business interest expense limitation typically restricts how much you can deduct for financial charges to just 30% of your adjusted taxable income (ATI). But here’s the good news: the One Big Beautiful Bill Act (OBBBA) has brought back the EBITDA-based calculation for ATI. This means you can add back things like depreciation, amortization, and depletion when figuring out your ATI, which can really boost the amount you can deduct for expenses.

So, if your company incurs borrowing costs, the business interest expense limitation will allow you to deduct only a portion of those based on your income level. For example, let’s say your ATI is $100,000; that means you can only subtract $30,000 of your financing expenses. Keep in mind that the business interest expense limitation can vary based on your business type and specific situations. If your business qualifies as a small business under the gross receipts test, you might even be exempt from the business interest expense limitation.

Getting to know these rules can save you from unexpected tax surprises and help you make the most of your deductions. Starting in 2026, capitalized costs will also fall under the business interest expense limitation as outlined in Section 163(j), so it’s a good idea to rethink your capitalization strategies. Companies should look ahead at future expense deductions and consider refinancing options to maximize what they can deduct.

And hey, if all this sounds a bit overwhelming, don’t worry! Engaging with a qualified tax advisor from Steinke and Company can really help. They can offer tailored strategies, like optimizing your capital structure or exploring alternative financing options, to help you navigate these complexities. With a solid plan in place, you can reduce your tax burden and set the stage for growth!

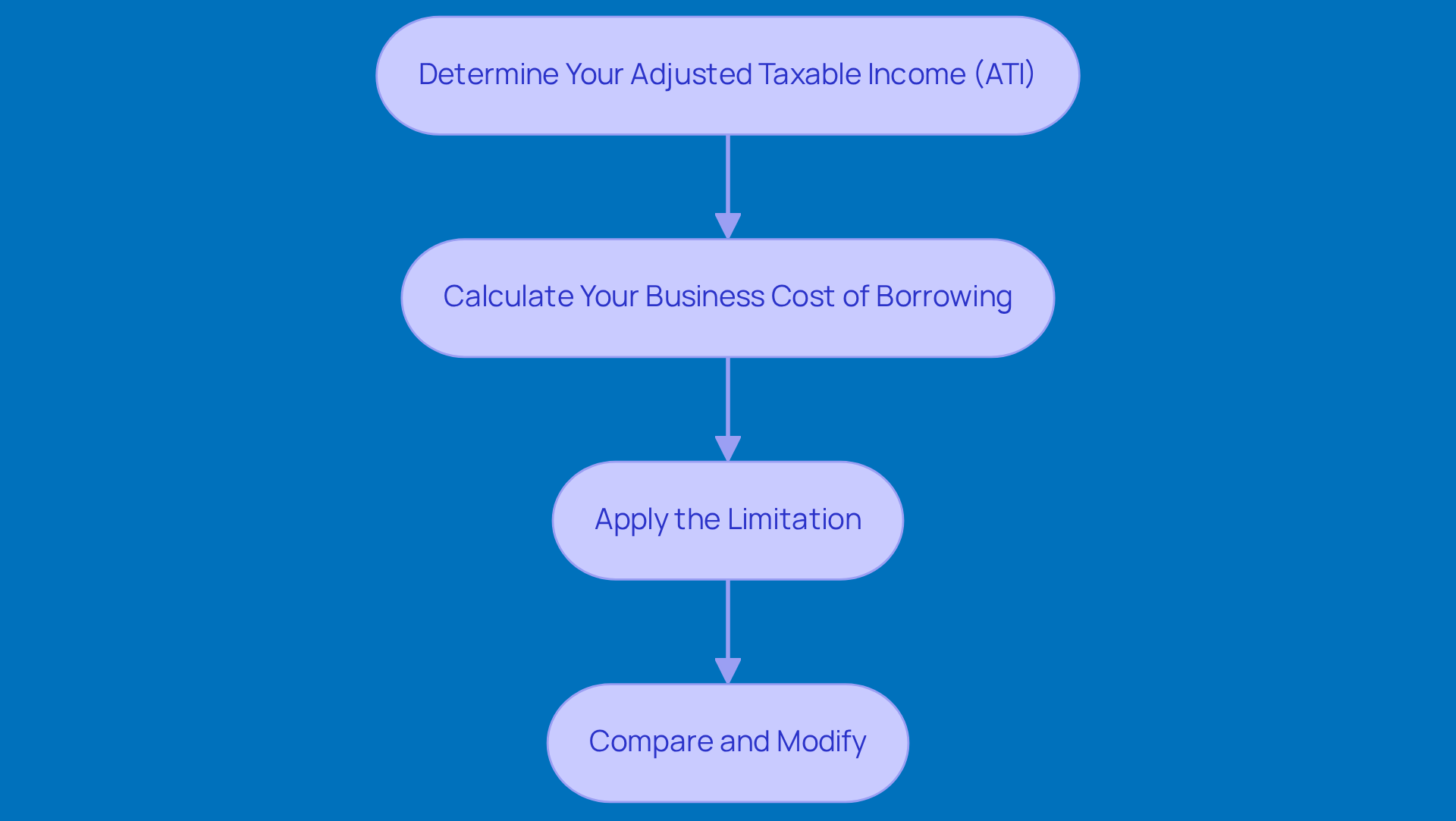

Calculate Your Business Interest Expense Limitation

Calculating the business interest expense limitation might sound a bit daunting, but it’s really not that complicated! Just follow these simple steps:

-

Determine Your Adjusted Taxable Income (ATI): First things first, figure out your taxable income as if Section 163(j) doesn’t even exist. Then, make a few adjustments-like adding back any non-deductible costs. Easy, right?

-

Calculate Your Business Cost of Borrowing: Next up, add up all the costs you racked up during the tax year. This includes everything from loan charges to credit line fees and any other business-related debt. It’s all about getting the full picture here!

-

Apply the Limitation: Now, take your ATI and multiply it by 30%. This number is your golden ticket-it tells you the maximum amount of costs you can deduct. For example, if your ATI is $150,000, then your deduction limit would be $45,000 (which is 30% of $150,000). Not too shabby!

-

Compare and Modify: If your total operational costs go over this limit, don’t sweat it! You can carry forward the excess to future tax years, just keep in mind the same rules apply. And hey, make sure to keep detailed records to back up your calculations and stay in line with IRS regulations.

So, there you have it! With these steps, you’re well on your way to managing your business interest expense limitation like a pro.

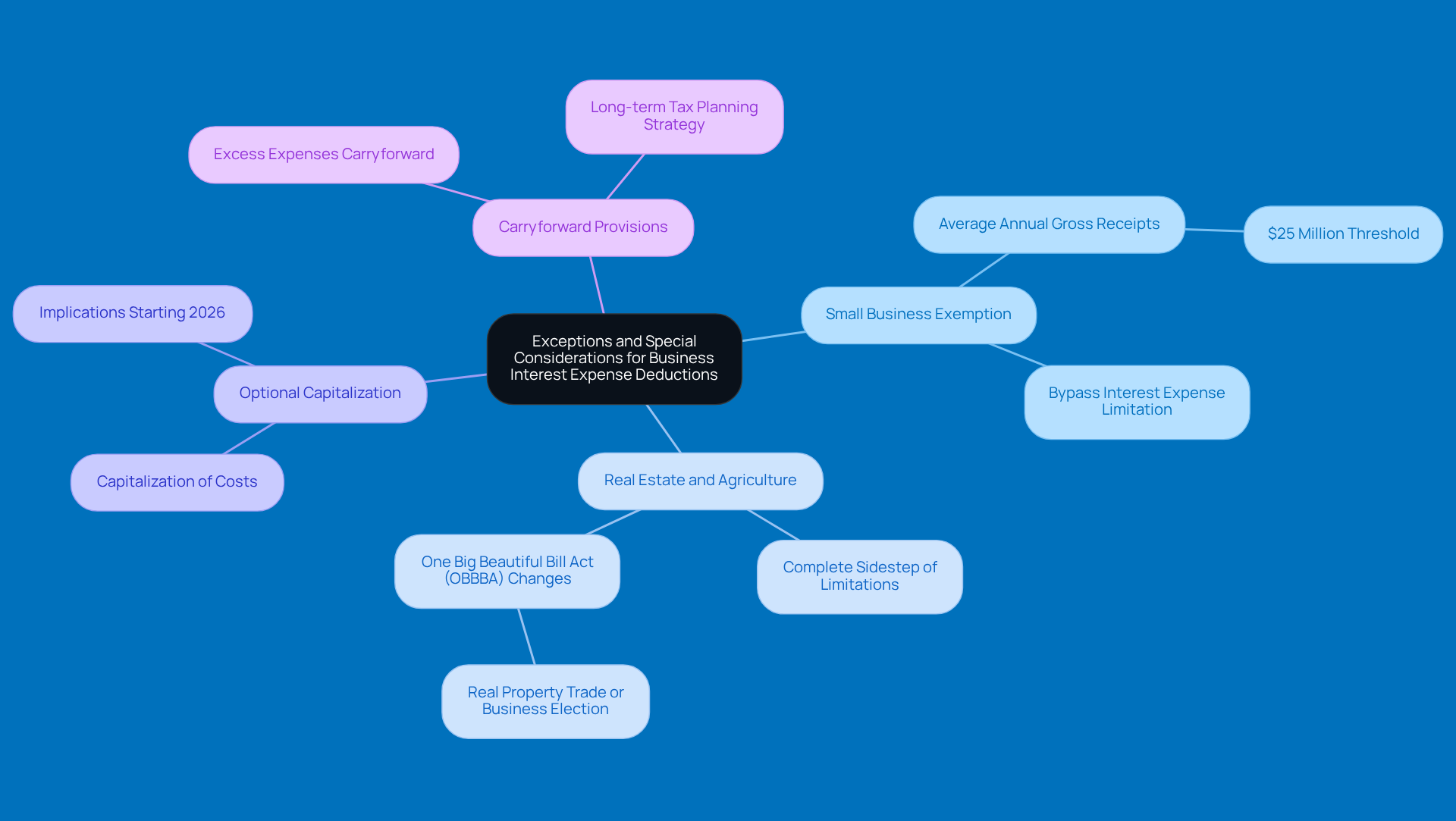

Identify Exceptions and Special Considerations

While the general rule limits business interest expense deductions to 30% of adjusted taxable income (ATI), there are some exceptions and special considerations that can really shake up your tax strategy:

-

If your business has average yearly gross earnings of $25 million or less over the last three years, you might qualify for a waiver from the business interest expense limitation on borrowing costs. This means you can deduct all your borrowing expenses! It’s a fantastic perk for small businesses, giving you a bit more financial wiggle room. As Richard Weiner, CPA, MST, puts it, 'The small enterprise exemption under Section 163(j) enables taxpayers with average annual gross receipts of $25 million or less to bypass the business interest expense limitation on operational borrowing, fostering growth and investment.'

-

Real Estate and Agriculture Enterprises: If you’re in real estate or agriculture, you might have the option to completely sidestep limitations on borrowing costs. This can lead to some serious tax savings, especially since these sectors often deal with hefty capital expenditures and financing needs. Just keep in mind that the One Big Beautiful Bill Act (OBBBA) has made some changes that could affect the benefits of choosing the Real Property Trade or Business (RPTB) election, especially in relation to the business interest expense limitation, as more borrowing costs are expected to be allowable.

-

Optional Capitalization: Starting after December 31, 2025, companies will have the option to capitalize costs related to property. This change allows businesses to keep the nature of these costs intact, which could lead to better tax handling. And here’s the kicker: beginning in 2026, certain capitalized expenses will be treated as operational costs subject to limits. So, it’s crucial to understand what this means for your tax situation.

-

Carryforward Provisions: If your business expenses exceed the limit, don’t worry! You can carry forward the excess to future tax years. This is a great strategy for long-term tax planning, as it lets you use those disallowed interest deductions down the line.

Understanding these exceptions and provisions is key to making smart choices about financing and tax strategies, especially in relation to the business interest expense limitation and the changes happening in regulations and opportunities for tax relief. Plus, if you’re a small business in Massachusetts, keep an eye on the corporate nexus threshold of $500,000-it could impact your tax obligations!

Implement Strategies to Manage Business Interest Expenses

Managing your business interest expense limitation and maximizing deductions doesn’t have to be a headache! Here are some friendly strategies to consider:

-

Refinance Existing Debt: Have you thought about refinancing those high-interest loans? Finding lower rates can really lighten your borrowing costs and help you manage cash flow better.

-

Utilize Capitalization: If it fits your situation, consider capitalizing costs tied to property. This could lead to different tax treatment and possibly higher deductions down the line, which is always a win for your finances!

-

Enhance Equity Funding: Relying less on debt can help lower those pesky borrowing costs. Why not explore ways to boost equity financing? Attracting investors or reinvesting profits back into your business could be the way to go.

-

Monitor Interest Income: If your business is raking in some interest income, keep an eye on it! It can offset your deductions under the business interest expense limitation, so tracking this income is key to understanding its impact on your taxes and ensuring you’re getting the most out of your deductions.

-

Consult a Tax Professional: Let’s be real-tax regulations can be tricky. Teaming up with a tax professional can give you tailored strategies that fit your business goals. Their expertise will help you stay compliant while optimizing your tax position.

So, what do you think? These strategies could really make a difference in your financial game!

Conclusion

Wrapping up, navigating the ins and outs of business interest expense limitations is key to fine-tuning your financial strategy. By getting a grip on the rules in Section 163(j) of the Internal Revenue Code - especially with the recent tweaks from the One Big Beautiful Bill Act - you can really make a difference in the deductions your business can claim. With these insights in your back pocket, you’ll be better positioned to manage borrowing costs and snag those tax benefits.

So, what should you take away from this guide? First off, it’s all about accurately calculating your adjusted taxable income (ATI). Don’t forget to spot any exceptions that might apply to your situation, and think about strategic moves like refinancing or boosting your equity funding. Each of these steps is crucial for not just staying compliant with IRS regulations but also for maximizing your deductions.

In the end, staying in the loop and being proactive about these limitations can lead to some serious savings and a healthier cash flow for your business. And hey, teaming up with a savvy tax advisor can help you craft strategies that fit your unique needs, making sure you’re ready to tackle any changes in tax laws and grab every chance for financial growth.

Frequently Asked Questions

What is the business interest expense limitation according to Section 163(j) of the Internal Revenue Code?

The business interest expense limitation restricts the amount you can deduct for financial charges to just 30% of your adjusted taxable income (ATI).

How does the One Big Beautiful Bill Act (OBBBA) affect the calculation of ATI?

The OBBBA has reinstated the EBITDA-based calculation for ATI, allowing businesses to add back depreciation, amortization, and depletion when calculating their ATI, which can increase the amount they can deduct for expenses.

How does the business interest expense limitation work with borrowing costs?

The limitation allows you to deduct only a portion of your borrowing costs based on your income level. For instance, if your ATI is $100,000, you can only deduct $30,000 of your financing expenses.

Are there any exemptions from the business interest expense limitation?

Yes, if your business qualifies as a small business under the gross receipts test, you might be exempt from the business interest expense limitation.

What changes are expected regarding capitalized costs starting in 2026?

Starting in 2026, capitalized costs will also fall under the business interest expense limitation as outlined in Section 163(j), which may require businesses to rethink their capitalization strategies.

How can businesses prepare for future expense deductions and maximize what they can deduct?

Businesses should consider refinancing options and look ahead at future expense deductions to maximize their allowable deductions.

How can a tax advisor assist businesses in navigating these complexities?

A qualified tax advisor, such as those from Steinke and Company, can provide tailored strategies to optimize capital structure and explore alternative financing options, helping businesses reduce their tax burden and plan for growth.