Introduction

Understanding capital gains tax is super important for anyone dealing with trusts. These financial entities have their own unique tax challenges, and it can get a bit tricky! In this article, we’ll dive into the ins and outs of capital gains tax rates for trusts, and trust me, they’re quite different from what individual taxpayers face.

With the stakes being so high - trusts can end up in the highest tax brackets even with surprisingly low income levels - strategic planning is key. So, how can trustees navigate these complexities to keep tax liabilities low and maximize distributions to beneficiaries? Let’s explore this together!

Define Capital Gains Tax and Its Relevance to Trusts

Capital profits tax hits the earnings you make from selling non-inventory assets like stocks, bonds, and real estate. So, when you sell an asset for more than what you paid for it, that profit is called a capital gain, and yes, it’s taxable. Here’s something interesting: financial entities often find themselves facing the capital gains tax rate for trusts in the highest tax brackets at much lower income levels compared to individual taxpayers. For instance, while single taxpayers don’t hit that top 37% tax rate until they earn over $609,350, the capital gains tax rate for trusts causes estates to enter that bracket with just $14,451 of income.

Looking ahead to 2025, estates will face profits tax rates of 0%, 15%, or 20%, depending on how much profit they realize and their overall income level. This really underscores why it’s crucial for both trustees and beneficiaries to understand the capital gains tax rate for trusts related to asset appreciation. It directly impacts the net income available for distribution and the estate's overall tax responsibility.

Let’s say an arrangement sells an appreciated asset; it might face a capital gains tax rate for trusts on those profits at a maximum rate of 24%. That can really cut down the amount that gets passed on to beneficiaries. So, effective tax planning becomes key to minimizing liabilities and maximizing benefits for everyone involved. As tax experts often point out, navigating the ins and outs of profit taxation is vital for ensuring that financial entities can reach their goals without getting hit with unnecessary tax burdens.

Explore Capital Gains Tax Rates for Trusts

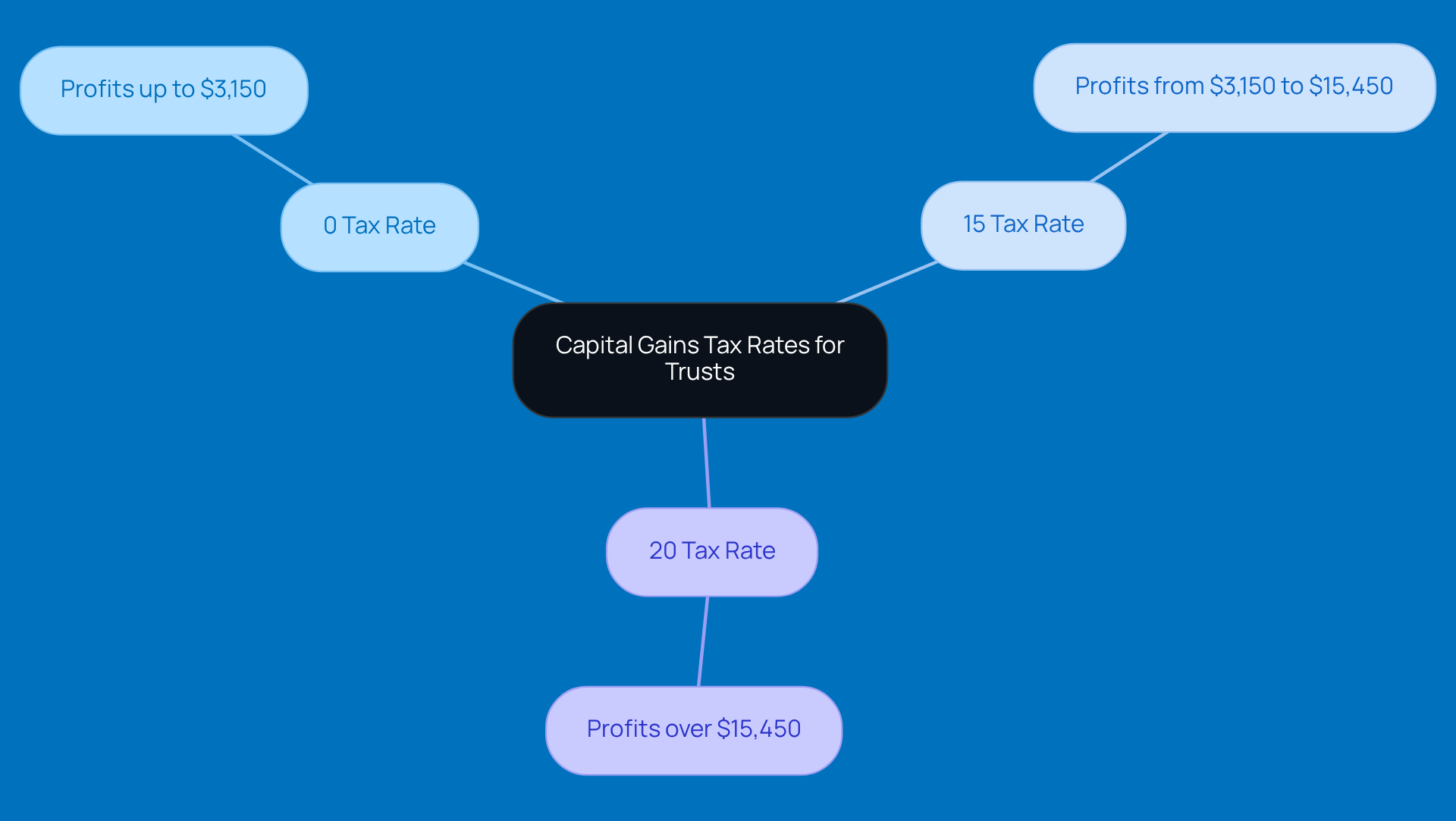

When it comes to the 2026 tax year, the profits tax rates for estates are set up like this: you’ve got 0% on profits up to $3,150, 15% on profits from $3,150 to $15,450, and then 20% on anything over $15,450. Sounds a bit complicated, right? But this tiered structure can really add up, leading to some hefty tax bills even if your profits aren’t sky-high.

Let’s break it down with an example. Imagine an estate pulls in a profit of $20,000. Here’s how it shakes out: the first $3,150? Totally tax-free! The next chunk, $12,300, gets taxed at 15%, and the remaining $4,550 is taxed at 20%. Pretty eye-opening, isn’t it? This is why it’s super important to understand the capital gains tax rate for trusts, as these rates can really influence how trustees decide to handle asset sales and distributions.

Plus, there’s another layer to consider. Entities often want to pass income along to beneficiaries to dodge those higher tax rates. This makes strategic planning a must for keeping tax management efficient. So, what do you think? Have you thought about how these rates might affect your own estate planning?

Calculate Capital Gains for Trusts: Step-by-Step Guide

Calculating capital gains for a trust? Let’s break it down into simple steps:

- Determine the Basis: First off, you’ll want to figure out the original purchase price of the asset. Don’t forget to include any extra costs like commissions or fees.

- Calculate the Sale Price: Next, find out how much you received from selling that asset.

- Subtract the Basis from the Sale Price: Here’s the formula: Sale Price - Basis = Capital Gain. For example, if you sell an asset for $50,000 that you bought for $30,000, your profit is $20,000. Easy, right?

- Consider Holding Period: Now, think about how long you held the asset. Is it short-term (held for a year or less) or long-term (held for more than a year)? This is important because it impacts the capital gains tax rate for trusts.

- Report the Profit: Finally, you’ll need to report that profit using IRS Form 1041 on the estate's tax return. Double-check those calculations to avoid any penalties!

Understanding these steps is super important for a solid tax strategy, especially since estates can accumulate serious capital gains, which are subject to the capital gains tax rate for trusts. Plus, keeping accurate financial records is key-think paystubs and tax documents-to stay compliant and make the most of your tax situation. As Granite Harbor Advisors puts it, "If you’re facing a sale, liquidity event, or portfolio reallocation, now’s the time to get a grip on how your profits are calculated-and how you can tweak your strategy to keep more of your success."

And don’t forget about the Net Investment Income Tax (NIIT)! It could affect high-earning entities, so precise reporting and strategic planning are crucial for optimizing your tax results.

Implement Strategies to Minimize Capital Gains Tax for Trusts

If you're looking to minimize capital gains tax for trusts, here are some strategies that might just do the trick:

-

Tax-Loss Harvesting: Ever thought about selling off those underperforming assets? This strategy helps balance out the capital gains you’ve made from other investments. Lincoln Fleming, a senior tax economist, puts it simply: "Tax-loss harvesting is a popular investment strategy that seeks to obtain a tax benefit from the sale of securities that have declined in value." By recognizing those losses, estates can really cut down on their taxable gains, which means better after-tax returns.

-

Distributing Income to Beneficiaries: Here’s a thought - what if you allocate some income to beneficiaries? This can lower the estate's taxable income since beneficiaries might fall into lower tax brackets. Not only does this lighten the tax load on the fund, but it also lets beneficiaries enjoy some of that income.

-

Holding Assets Longer: Consider keeping those assets for over a year. Why? Because long-term profits are taxed at friendlier rates compared to short-term ones. This could lead to some serious tax savings down the line. Tiffany Lam-Balfour suggests, "Hiring a seasoned financial advisor can help you navigate these waters, particularly if they are or can work hand in hand with a tax advisor."

-

Charitable Contributions: Thinking about donating? Giving appreciated assets to charity can wipe out capital gains tax on those assets and score you a charitable deduction. It’s a win-win that can really boost your financial strategy while supporting a good cause.

-

Timing Your Sales: Timing is everything! Strategically selling assets can help manage those pesky tax liabilities, especially in years when your income might dip. For instance, selling during a low-income year can really help reduce taxes on those profits. Efficient management of a profit tax fund can make a big difference in lowering tax obligations and protecting your assets.

By using these strategies, trusts can tackle the complexities associated with the capital gains tax rate for trusts with confidence, paving the way for a solid financial future for beneficiaries.

Conclusion

Understanding the capital gains tax rate for trusts is super important for managing your estate and planning your finances effectively. This tax can really affect how much income beneficiaries get and the overall tax burden on the estate. Trusts face much steeper capital gains tax rates compared to individual taxpayers, so it’s crucial for both trustees and beneficiaries to get a handle on these implications to make the most of their financial outcomes.

In this article, we’ve explored how capital gains tax works, highlighting the tiered tax rates that apply to trusts. We’ve also provided a step-by-step guide to calculating capital gains. Plus, we discussed some smart strategies like tax-loss harvesting, distributing income to beneficiaries, and timing asset sales. These methods can help lighten the tax load, enhancing the trust's financial health and helping beneficiaries maximize their inheritances.

Navigating the ins and outs of capital gains tax can feel overwhelming, but with careful planning and informed decision-making, it doesn’t have to be. By using the insights and strategies we’ve shared, trustees can take proactive steps to minimize tax exposure. This way, trusts can truly fulfill their purpose of benefiting beneficiaries while staying compliant with tax regulations. Embracing these practices isn’t just about ticking boxes; it’s about empowering financial growth and preserving wealth for generations to come. So, why not start thinking about how you can apply these strategies today?

Frequently Asked Questions

What is capital gains tax?

Capital gains tax is a tax on the earnings made from selling non-inventory assets, such as stocks, bonds, and real estate, when those assets are sold for more than their purchase price.

How does capital gains tax apply to trusts?

Trusts can face capital gains tax rates at much lower income levels compared to individual taxpayers, often entering the highest tax brackets with significantly less income.

What are the income thresholds for capital gains tax rates for trusts?

Trusts enter the top 37% tax rate with just $14,451 of income, while single taxpayers do not reach that rate until earning over $609,350.

What will the capital gains tax rates be for estates in 2025?

In 2025, estates will face capital gains tax rates of 0%, 15%, or 20%, depending on the amount of profit realized and the overall income level.

Why is understanding capital gains tax important for trustees and beneficiaries?

Understanding capital gains tax is crucial because it directly affects the net income available for distribution and the overall tax responsibility of the estate.

What is the maximum capital gains tax rate for trusts when selling appreciated assets?

The maximum capital gains tax rate for trusts when selling appreciated assets can be as high as 24%.

How does capital gains tax impact the distribution to beneficiaries?

Capital gains tax can significantly reduce the amount passed on to beneficiaries, highlighting the importance of effective tax planning to minimize liabilities and maximize benefits.