Introduction

Mastering fund due diligence is super important for small agencies trying to navigate the tricky world of investments with confidence. This step-by-step guide breaks down the due diligence process, giving you valuable insights into key areas like:

- Investment strategies

- Performance metrics

- Risk evaluation

But let’s be real - what happens when the stakes are high, and the info isn’t as clear-cut as it seems? Understanding the ins and outs of fund due diligence could be your ticket to making smart investment decisions and steering clear of costly mistakes.

Understand Fund Due Diligence Basics

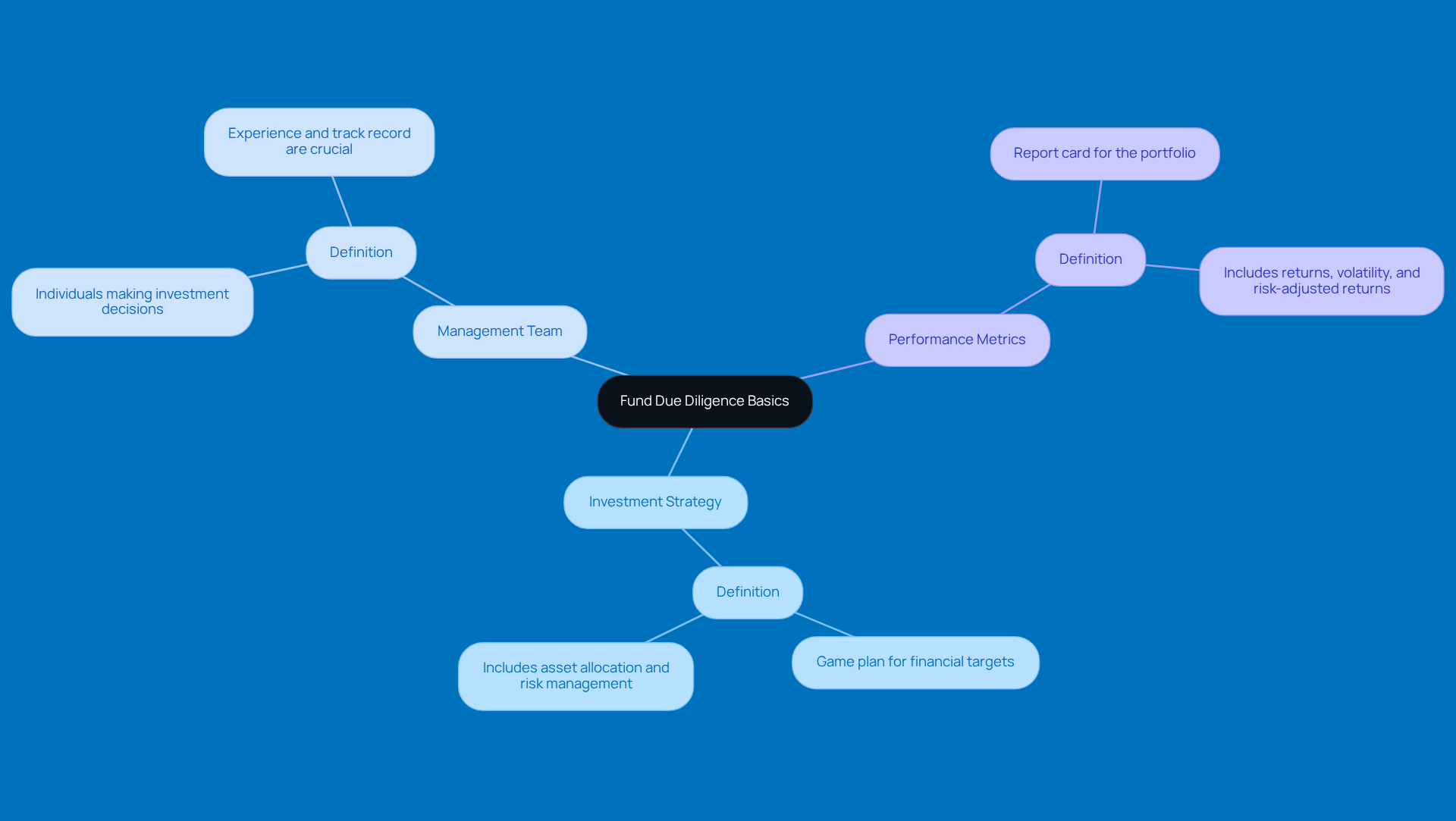

When we talk about fund due diligence in relation to a financial vehicle, we’re diving into a thorough process of checking things out before you put your money on the line. It’s all about evaluating different aspects like the portfolio's framework, the management team, the allocation strategy, and how it’s performed in the past. Let’s break down some key terms that’ll help you get a grip on this:

- Investment Strategy: This is the game plan the fund uses to hit its financial targets, covering everything from asset allocation to how they manage risk.

- Management Team: These are the folks making the investment calls and running the portfolio. Their experience and track record can really give you a sense of how likely the investment is to succeed.

- Performance Metrics: Think of these as the report card for the portfolio. They include returns, volatility, and risk-adjusted returns, helping you see how well the portfolio stacks up against its benchmarks.

By getting familiar with these concepts, you’ll be in a much better spot to tackle fund due diligence like a pro!

Gather Essential Fund Information

To really nail your due diligence, you’ve got to gather a complete set of documents and data points tied to the investment. Here’s a handy checklist of what you’ll need:

-

Private Placement Memorandum (PPM): This is your go-to document that lays out the investment strategy, the risks involved, and the terms of the investment. Think of it as a roadmap for potential investors, detailing the goals and the management team behind the scenes.

-

Historical Performance Data: It’s crucial to look at how the portfolio has performed in the past. This includes gains over various time frames and comparisons to relevant benchmarks, giving you a peek into the fund's reliability. For example, the S&P 500 has averaged an annual gain of about 10.12% since 1928, showcasing the potential for long-term growth. Plus, the average annual return over the last 20 years is 8.87%, highlighting why historical performance matters when evaluating investment opportunities.

-

Management Team Bios: Don’t skip over the backgrounds of the managers! Understanding their experience, track record, and past successes can really help you gauge the entity's potential for effective management and smart decision-making.

-

Fee Structure: You’ll want to get a clear picture of the fund's fee structure. This includes management fees, performance fees, and any other costs that could affect your overall returns. Even small differences in fees can have a big impact over time, as experts often point out. Jess Catorc puts it well: "small differences in fees may seem insignificant at first, but they can make a big impact in the long run."

-

Legal Documents: Make sure to collect all relevant legal agreements, like the investment's operating agreement and subscription agreements. These documents shed light on the legal framework governing the financial engagement and help ensure compliance with regulations. And don’t forget about state filings under Blue Sky Laws, which require you to follow each state’s unique securities regulations.

By gathering all this info, you’ll build a solid foundation for fund due diligence, making sure you’re equipped to make informed choices about the investment's potential.

Evaluate Risks and Returns

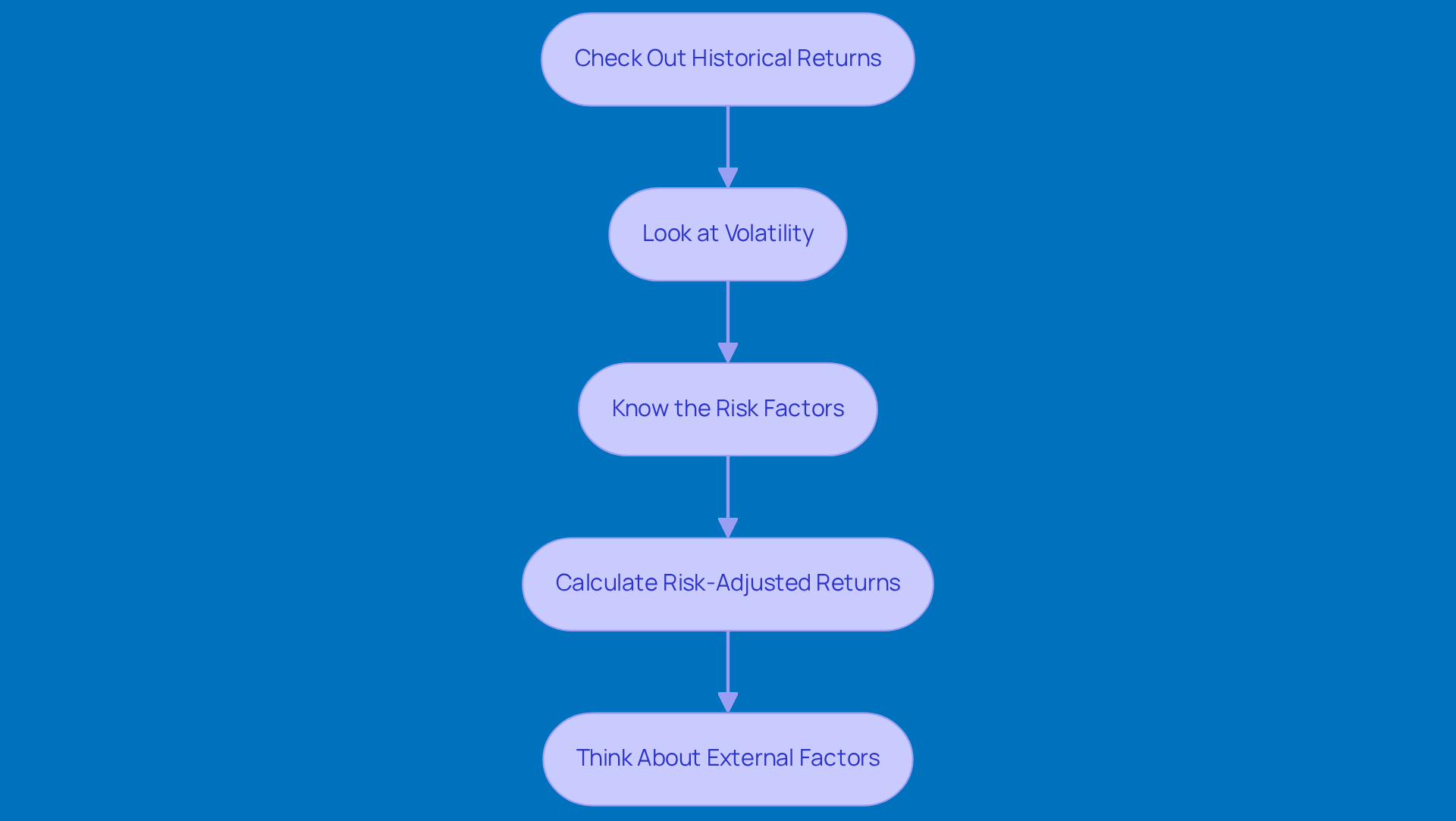

When you're looking at a fund, there are a few steps you can take to really get a handle on its risks and returns:

-

Check Out Historical Returns: Take a look at how the investment has performed over different time frames. It’s helpful to compare these results to relevant benchmarks to see how it stacks up.

-

Look at Volatility: This is all about how much the investment's returns bounce around. Generally, higher volatility means higher risk, so keep that in mind.

-

Know the Risk Factors: Every investment comes with its own set of risks - think market risk, credit risk, and liquidity risk. Understanding these can really help you gauge how the investment might perform.

-

Calculate Risk-Adjusted Returns: Metrics like the Sharpe ratio can show you how much return you’re getting for the risk you’re taking. This is super useful when comparing different investments with varying risk levels.

-

Think About External Factors: Don’t forget to consider how things like economic conditions, regulatory changes, and market trends might impact the investment's future performance.

By taking the time to perform fund due diligence on these factors, you’ll be in a much better position to decide whether or not to invest. So, what do you think? Ready to dive in?

Make Informed Investment Decisions

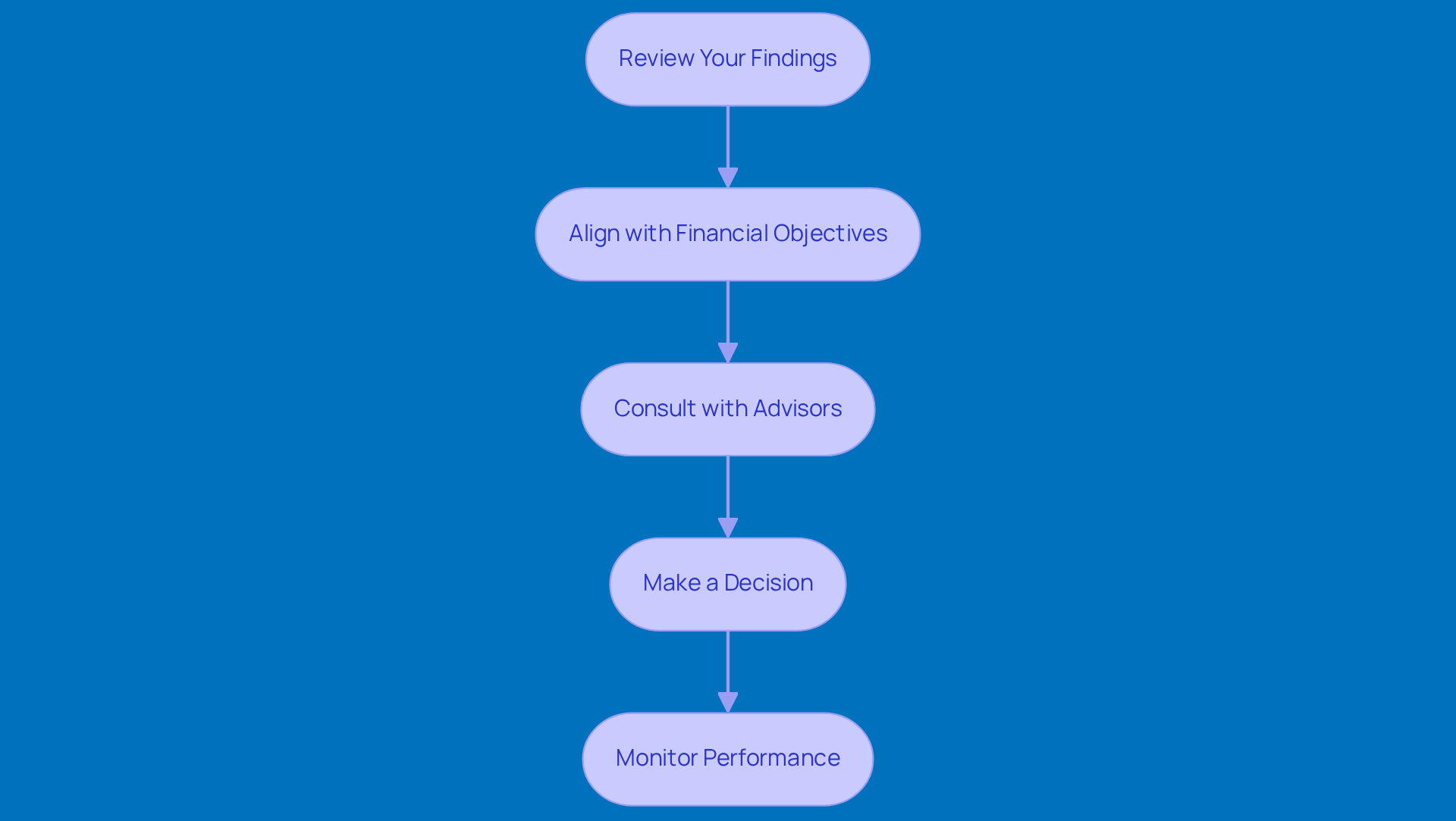

Once you’ve wrapped up your due diligence, it’s time to make some smart financial choices. Here’s how to go about it:

-

Review Your Findings: Take a good look at the info and insights you’ve gathered. Make sure you really understand the strengths and weaknesses of the investment. It’s all about knowing what you’re getting into!

-

Align with Financial Objectives: Think about how this fund fits into your overall financial game plan. Does it vibe with your risk tolerance and expected returns? A well-aligned asset can really boost your portfolio’s performance and stability. Remember what Warren Buffett said: "Risk comes from not knowing what you’re doing."

-

Consult with Advisors: Chat with financial advisors or trusted friends about your findings. Their insights can be super helpful and might just refine your investment approach. As Benjamin Graham wisely pointed out, "The investor’s chief problem - and even his worst enemy - is likely to be himself."

-

Make a Decision: After your analysis and discussions, decide whether to invest, hold off, or check out other opportunities. You know what they say: the best time to plant a tree was 20 years ago; the second-best time is now.

-

Monitor Performance: Once you’ve invested, keep an eye on how the fund is doing. Stay updated on any changes in management or strategy that could impact your financial interests. Regular check-ins help ensure your assets stay in line with your financial goals. Using metrics like the Sharpe ratio and total return can give you a clearer picture of your portfolio’s performance.

By following these steps, you can confidently navigate your investment decisions, making sure they’re informed and aligned with your financial objectives.

Conclusion

Mastering the art of fund due diligence is crucial for small agencies looking to make smart investment choices. By really getting to grips with the basics, gathering key info, weighing risks and returns, and making informed decisions, investors can confidently navigate the tricky waters of investment funds. This structured approach not only boosts the chances of hitting financial goals but also helps dodge potential pitfalls.

Throughout this article, we’ve highlighted some key components:

- The investment strategy

- The management team

- Historical performance data

- The importance of understanding fee structures

These elements form the backbone of a solid due diligence process, giving investors the tools they need to assess potential investments effectively. Plus, by evaluating risks and returns through various metrics, you can ensure your decisions are data-driven and in line with your financial objectives.

In the end, the importance of diligent research and informed decision-making can’t be stressed enough. As the investment landscape keeps changing, small agencies need to stay alert and proactive in their due diligence efforts. By embracing these strategies, you can not only safeguard your assets but also set yourself up for long-term success in a constantly evolving market. So, what are you waiting for? Dive into your due diligence and watch your investment journey flourish!

Frequently Asked Questions

What is fund due diligence?

Fund due diligence is a thorough process of evaluating various aspects of a financial vehicle before investing, including the portfolio's framework, management team, allocation strategy, and past performance.

What does investment strategy refer to in fund due diligence?

Investment strategy refers to the plan the fund uses to achieve its financial targets, which includes asset allocation and risk management.

Why is the management team important in fund due diligence?

The management team is crucial because they make investment decisions and manage the portfolio. Their experience and track record can indicate the likelihood of the investment's success.

What are performance metrics in the context of fund due diligence?

Performance metrics are indicators that evaluate the portfolio's performance, including returns, volatility, and risk-adjusted returns, allowing investors to assess how well the portfolio performs compared to its benchmarks.

How can understanding these concepts help in fund due diligence?

Familiarity with key concepts like investment strategy, management team, and performance metrics equips investors to conduct fund due diligence more effectively and make informed investment decisions.