Introduction

Managing the financial details of a homeowners association (HOA) can feel like a lot to handle, right? Especially for smaller agencies trying to juggle bookkeeping and compliance. But here’s the good news: getting a grip on essential HOA bookkeeping practices can really simplify things. Plus, it boosts transparency and trust within the community.

So, what challenges do small agencies face when it comes to keeping accurate records and sticking to regulations? And how can they use technology and smart practices to tackle these hurdles? Let’s dive in and explore!

Establish Accurate Financial Recordkeeping Practices

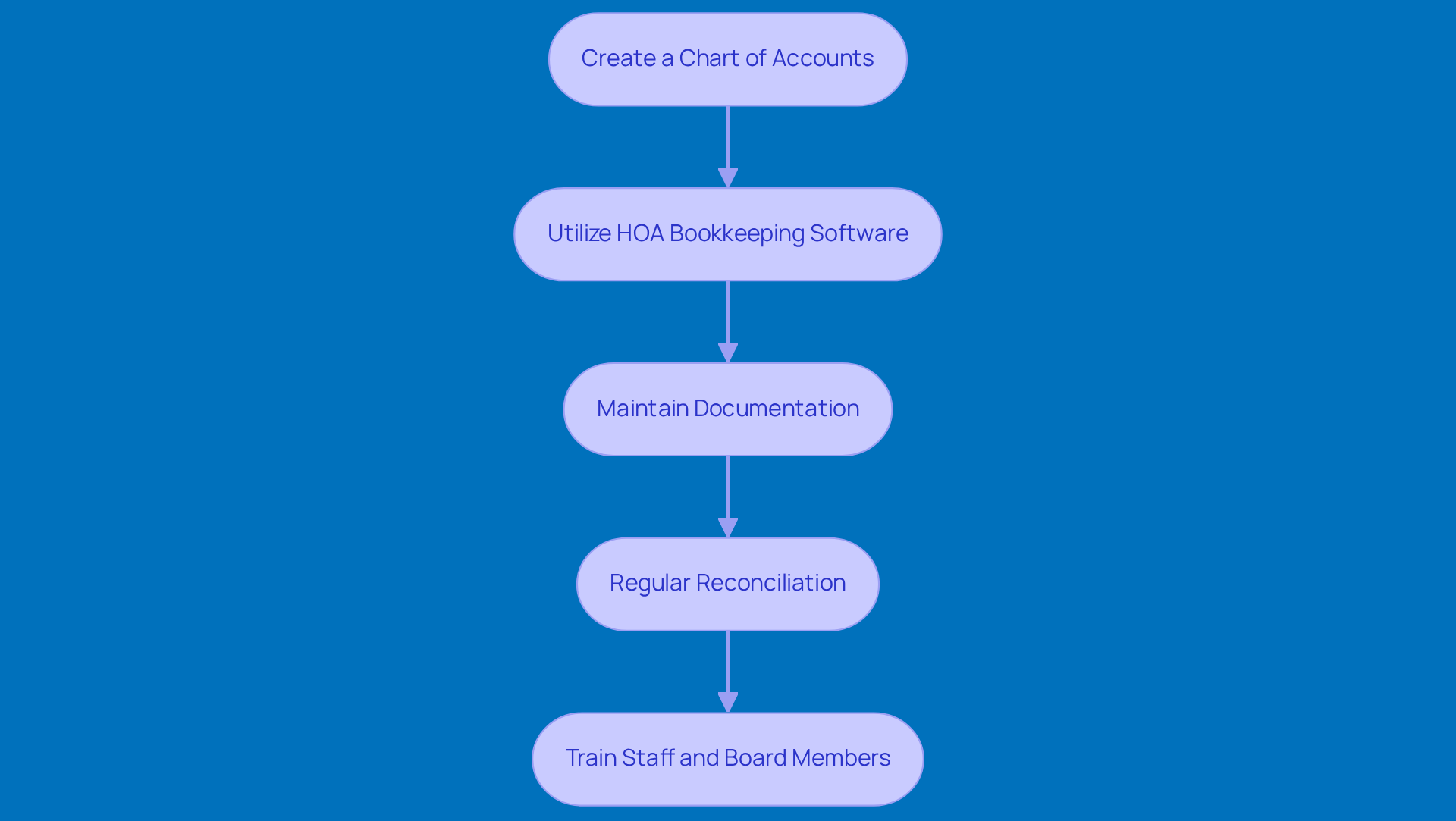

Managing HOA funds can feel like a daunting task, but with the right HOA bookkeeping practices, it doesn’t have to be! Let’s break it down into some key steps that can make a big difference:

-

Create a Chart of Accounts: Start by developing a chart of accounts that categorizes all your monetary transactions. Think of it as your financial roadmap! Include income sources like dues and fees, as well as expense categories such as maintenance and utilities. A well-organized chart is crucial for keeping your finances clear and manageable.

-

Utilize HOA bookkeeping: Investing in reliable HOA bookkeeping software tailored for HOAs, like QuickBooks or specialized HOA management tools, can be a game changer. These programs automate recordkeeping, making it a breeze to track transactions and generate reports. Who doesn’t love a little efficiency and accuracy?

-

Maintain Documentation: Keep all your monetary documents organized - this means invoices, receipts, and bank statements. Proper documentation not only supports accurate HOA bookkeeping but also ensures you’re covered during audits. Plus, it fosters transparency and trust among everyone involved.

-

Regular Reconciliation: Make it a habit to conduct monthly reconciliations of your bank statements with your internal records. This helps you catch discrepancies early on, which is key to maintaining precision in your fiscal documentation. And don’t forget to keep a separate account for reserve funds to avoid any accidental borrowing from your operating funds!

-

Train Staff and Board Members: It’s super important to ensure that everyone involved in managing the money is trained in your recordkeeping practices. This consistency minimizes mistakes and boosts your agency’s performance and decision-making abilities. Did you know that companies with precise fiscal disclosures are 70% more likely to make effective strategic decisions? That’s a pretty compelling reason to get this right!

So, what do you think? With these steps, you can take control of your HOA funds and make informed decisions that benefit everyone involved!

Understand and Comply with HOA Financial Regulations

When it comes to managing your HOA, sticking to monetary regulations is a must. Here are some key practices to keep everything on track:

-

Get to Know Your State Regulations: Every state has its own set of laws that govern HOAs, including rules about monetary disclosures and reserve fund management. For instance, California’s Civil Code section 5200 gives homeowners the right to request and review financial statements, reserve studies, and meeting minutes. It’s super important to regularly check these laws to stay compliant and avoid any nasty penalties.

-

Stick to GAAP Standards: Following Generally Accepted Accounting Principles (GAAP) for your financial reporting helps ensure that everything is prepared consistently and transparently. This not only boosts your credibility but also meets the expectations of homeowners and regulatory bodies. Did you know that a recent survey found 62% of HOA residents feel they’re paying 'just the right amount' or 'too little' for their fees? That really shows how crucial transparent financial practices are!

-

Schedule Regular Audits: Making time for annual audits is key to verifying that your financial records are accurate and compliant with regulations. Regular evaluations promote openness and build trust among HOA members, as they provide an unbiased look at the community’s financial health. As legal expert Luke S. Carlson, Esq. puts it, "Navigating the evolving HOA legal landscape requires experienced guidance."

-

Document Your Fiscal Policies: It’s essential to have clear policies in place regarding dues collection, expense approvals, and reserve fund usage. Writing these down helps ensure consistency and accountability, which can prevent disputes and misunderstandings in the community. One common pitfall? Not communicating these policies effectively, which can lead to confusion among residents.

-

Consult Legal Counsel: It’s a smart move to chat with legal experts who specialize in HOA regulations. They can help you stay updated on any changes in laws that might affect your financial practices. This proactive approach can really help your organization navigate the shifting legal landscape, ensuring compliance and protecting everyone’s interests. Just think about it: non-compliance can lead to local enforcement penalties and even personal liability for board members if something goes wrong!

Utilize Technology for Efficient HOA Bookkeeping

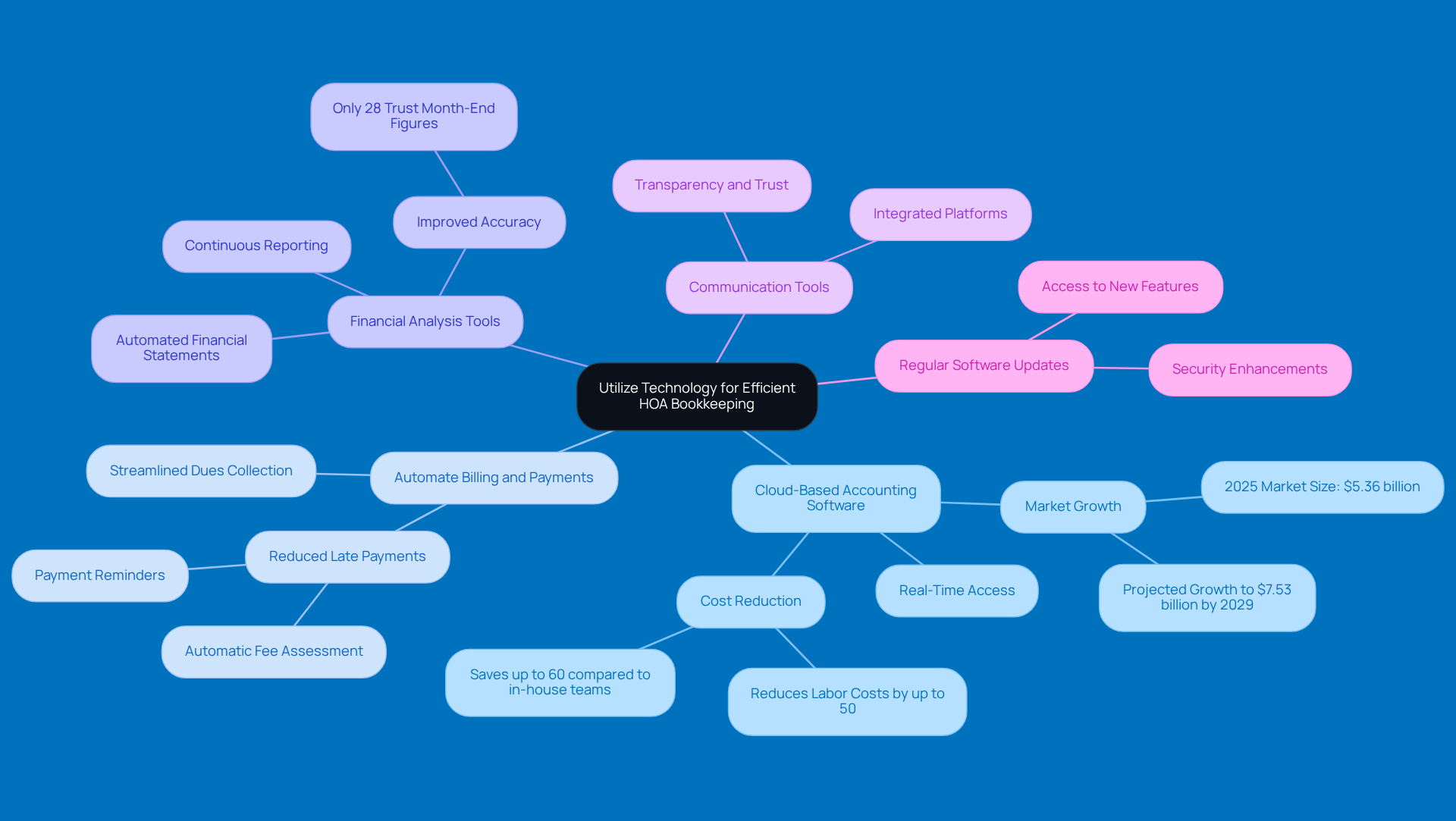

Incorporating technology into HOA bookkeeping can significantly boost efficiency and accuracy. Here are some friendly tips to consider:

-

Adopt Cloud-Based Accounting Software: Think about using cloud-based accounting solutions. They let you access financial data in real-time from anywhere! This makes it easier for board members and staff to collaborate, keeping everyone in the loop. Did you know the cloud accounting software market hit $5.36 billion in 2025? It’s expected to grow even more, reaching $7.53 billion by 2029!

-

Automate Billing and Payments: Why not streamline your dues collection with automated billing systems? They can help reduce late payments by automatically assessing fees and sending reminders. This not only makes it easier for members but also helps with cash flow since payments can be processed right away.

-

Utilize Financial Analysis Tools: Leverage software that makes generating financial statements and performance summaries a breeze. This automation saves time on manual work and boosts accuracy. After all, only 28% of folks trust the figures at their month-end closes! Plus, continuous reporting can ease that month-end pressure and cut down on errors from rushing.

-

Integrate Communication Tools: Use integrated communication platforms to keep the conversation flowing between board members and residents about financial matters. Transparency is key to building trust and keeping everyone informed about financial decisions.

-

Regularly Update Software: Don’t forget to keep your accounting software up to date! Regular updates help you take advantage of new features and security enhancements. This is super important as the cloud accounting software market keeps expanding, ensuring your sensitive financial info stays safe and compliant with changing regulations.

By adopting these practices, small agencies can not only improve their HOA bookkeeping processes but also enhance overall operational efficiency. So, what do you think? Ready to give these tips a try?

Implement Regular Financial Reporting and Analysis

Regular monetary assessments and analysis are super important for effective HOA bookkeeping management. Let’s dive into some key practices you can implement:

-

Establish a Reporting Schedule: It’s a good idea to create a consistent timetable for reporting on finances - think monthly or quarterly. This keeps board members in the loop about the HOA's financial health. And hey, community managers should send budget reports to board members at least five days before meetings. This way, everyone has time to prepare for some meaningful discussions.

-

Prepare Comprehensive Reports: Make sure to include key fiscal statements in your reports, like balance sheets, income statements, and cash flow statements. This provides everyone with a clear picture of the HOA's economic health as reflected in the HOA bookkeeping.

-

Examine Discrepancies: Regularly check for discrepancies between budgeted and actual figures. This helps you spot any areas of concern and adjust your financial strategies as needed. With 91% of community associations facing unexpected expense increases, having proactive economic strategies is key to navigating these challenges.

-

Share reports with members: Don’t forget to distribute monetary reports to HOA members as part of your HOA bookkeeping! This promotes transparency and builds trust. You might even want to organize meetings to discuss economic performance and answer any questions. Engaging with members fosters a sense of community and accountability.

-

Utilize Ratios: Implementing ratios can help you assess the HOA's performance over time. Ratios like the current ratio and debt-to-equity ratio offer insights into economic stability. As Warren Buffett wisely said, "Don’t depend on a single income. Make an investment to create a second source." This really highlights the importance of diverse monetary strategies.

-

Avoid Common Pitfalls: Be on the lookout for common traps in financial documentation, like not updating records regularly or forgetting to communicate changes to members. Keeping clarity and consistency in your reporting can prevent misunderstandings and build trust.

Conclusion

Mastering HOA bookkeeping is super important for small agencies that want to keep their finances in check and transparent. By following the practices we’ve talked about, organizations can really get a handle on their financial operations, making sure every transaction is recorded accurately and meets all the necessary regulations.

So, what are some key strategies? Well, it starts with having a well-organized chart of accounts and using specialized bookkeeping software. Don’t forget about keeping thorough documentation and doing regular reconciliations! Plus, understanding state regulations and sticking to GAAP standards is vital for building trust and accountability in the community. And let’s not overlook technology - cloud-based accounting solutions and automated billing systems can really boost efficiency and accuracy, giving you real-time financial management.

Now, let’s talk about the importance of regular financial reporting and analysis. Seriously, you can’t underestimate this! By setting up a consistent reporting schedule and sharing detailed financial statements with members, HOAs can foster transparency and get the community engaged. Embracing these best practices not only protects the financial health of the organization but also empowers board members and residents to make informed decisions that benefit everyone. Taking these steps means small agencies are ready to tackle the complexities of HOA financial management and lay a solid foundation for future success.

Frequently Asked Questions

What is the first step in managing HOA funds effectively?

The first step is to create a chart of accounts that categorizes all monetary transactions, including income sources like dues and fees, and expense categories such as maintenance and utilities.

How can HOA bookkeeping software assist in financial management?

Reliable HOA bookkeeping software, like QuickBooks or specialized HOA management tools, automates recordkeeping, making it easier to track transactions and generate reports, enhancing efficiency and accuracy.

Why is maintaining documentation important for HOAs?

Keeping all monetary documents organized, such as invoices, receipts, and bank statements, supports accurate bookkeeping, ensures compliance during audits, and fosters transparency and trust among stakeholders.

How often should bank statements be reconciled with internal records?

Bank statements should be reconciled monthly to catch discrepancies early and maintain precision in fiscal documentation.

What is the significance of having a separate account for reserve funds?

Maintaining a separate account for reserve funds helps avoid accidental borrowing from operating funds, ensuring better financial management.

Why is training staff and board members important in HOA financial management?

Training ensures consistency in recordkeeping practices, minimizes mistakes, and enhances the agency’s performance and decision-making abilities. Accurate fiscal disclosures significantly improve strategic decision-making.