Overview

If you’re looking to dodge capital gains tax on your real estate, there are some handy strategies you can use! Think about the following:

- Primary residence exclusion

- 1031 exchanges

- Tax-loss harvesting

These methods can really help you keep more of your hard-earned money in your pocket.

Let’s break it down a bit. The primary residence exclusion allows you to exclude a good chunk of profit from the sale of your home, provided you meet certain criteria. Then there’s the 1031 exchange, which lets you swap one investment property for another without paying taxes right away. And don’t forget about tax-loss harvesting, where you can offset gains with losses to lower your taxable income.

Each of these strategies has its own eligibility requirements and benefits, so it’s worth diving into the details. By understanding how they work, you can significantly reduce those taxable profits from your real estate transactions. So, why not explore these options and see how they can work for you?

Introduction

Navigating the ins and outs of capital gains tax can seem pretty overwhelming for real estate investors, right? With all those different rates and exemptions, figuring out how to minimize these taxes is key to boosting your returns. In this article, we’re diving into some practical strategies that not only break down the complexities of capital gains tax but also help you make smart decisions. What if I told you there are simple yet effective ways to keep more of your hard-earned profits in your pocket?

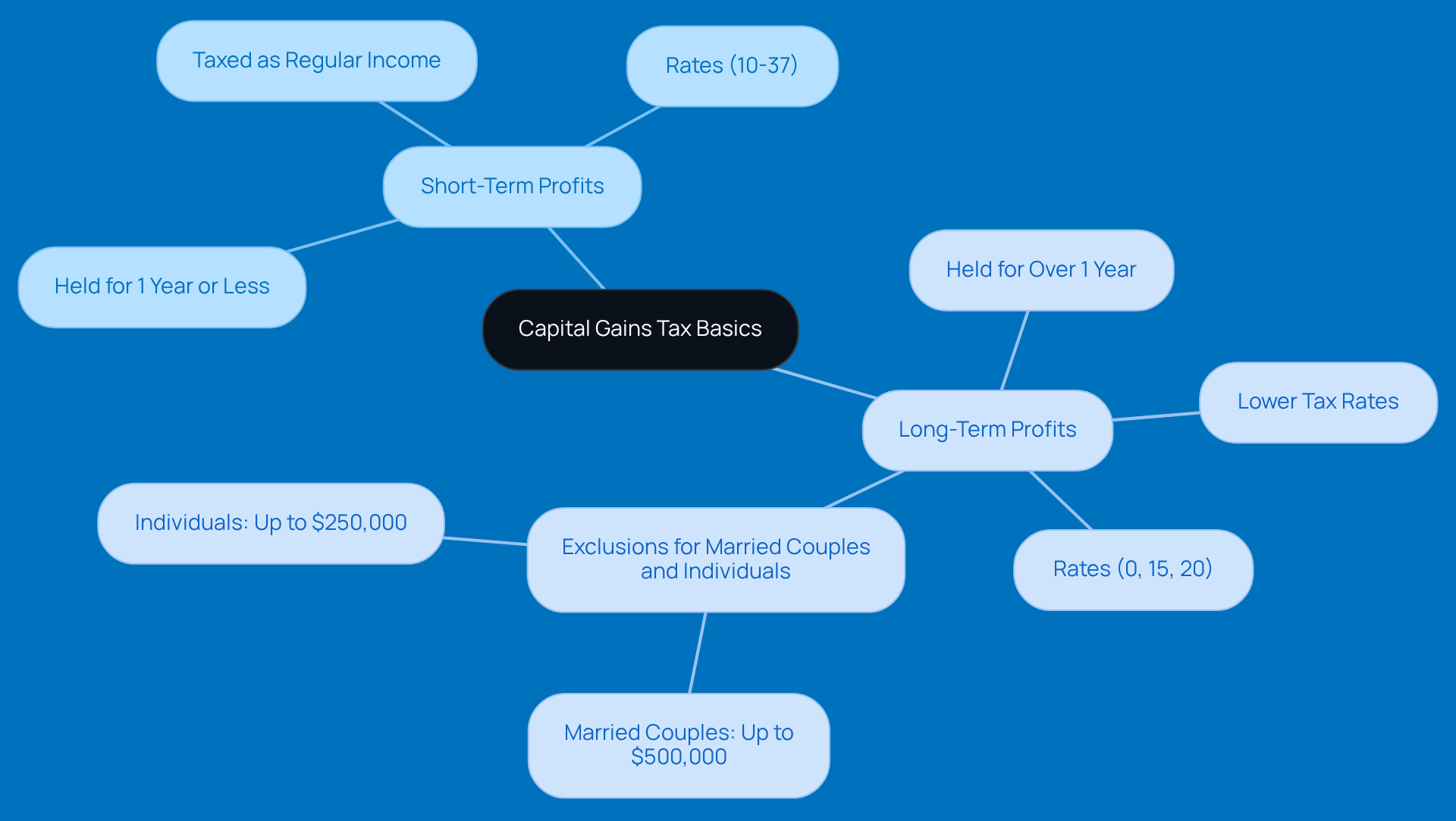

Understand Capital Gains Tax Basics

Capital profits tax hits you right in the pocket when you sell an asset, like real estate. Now, there are two main types of profits from investments: short-term and long-term. Short-term profits come from assets held for a year or less, and guess what? They’re taxed as regular income, which can range from 10% to 37%, depending on your income bracket. On the flip side, long-term profits apply to assets held for over a year and enjoy lower tax rates—usually 0%, 15%, or 20%, based on your taxable income.

Understanding these differences is super important for planning your real estate transactions. For instance, if you sell a property you’ve held for more than a year, you could qualify for that sweet long-term tax rate, leading to some serious tax savings. In 2025, most folks will likely pay no more than 15% in long-term investment tax, so holding onto your assets a bit longer could really pay off.

Plus, knowing the current profit tax rates and limits can really sharpen your financial strategy. Take married couples, for example—they can exclude up to $500,000 in profits from selling their main home if they’ve lived there for two of the last five years. Individual filers? They can exclude up to $250,000. This kind of knowledge helps you manage your real estate ventures better and understand how to avoid capital gains tax on real estate.

To further trim those taxes on profits, think about strategies like using tax-advantaged accounts such as IRAs and 401(k)s, and learn how to avoid capital gains tax on real estate, as these accounts let your assets grow without immediate taxation or with delayed taxation. Also, keeping an eye on your paystub and maintaining accurate tax records can keep you in the loop about your income and deductions, which can affect your overall tax situation. Regularly checking your paystub ensures you’re aware of any changes that might impact your tax strategy. Staying updated on annual changes in tax rates and thresholds is key for effective financial planning, empowering you to navigate your real estate investments more smoothly and minimize tax liabilities.

Explore Strategies to Minimize Capital Gains Tax

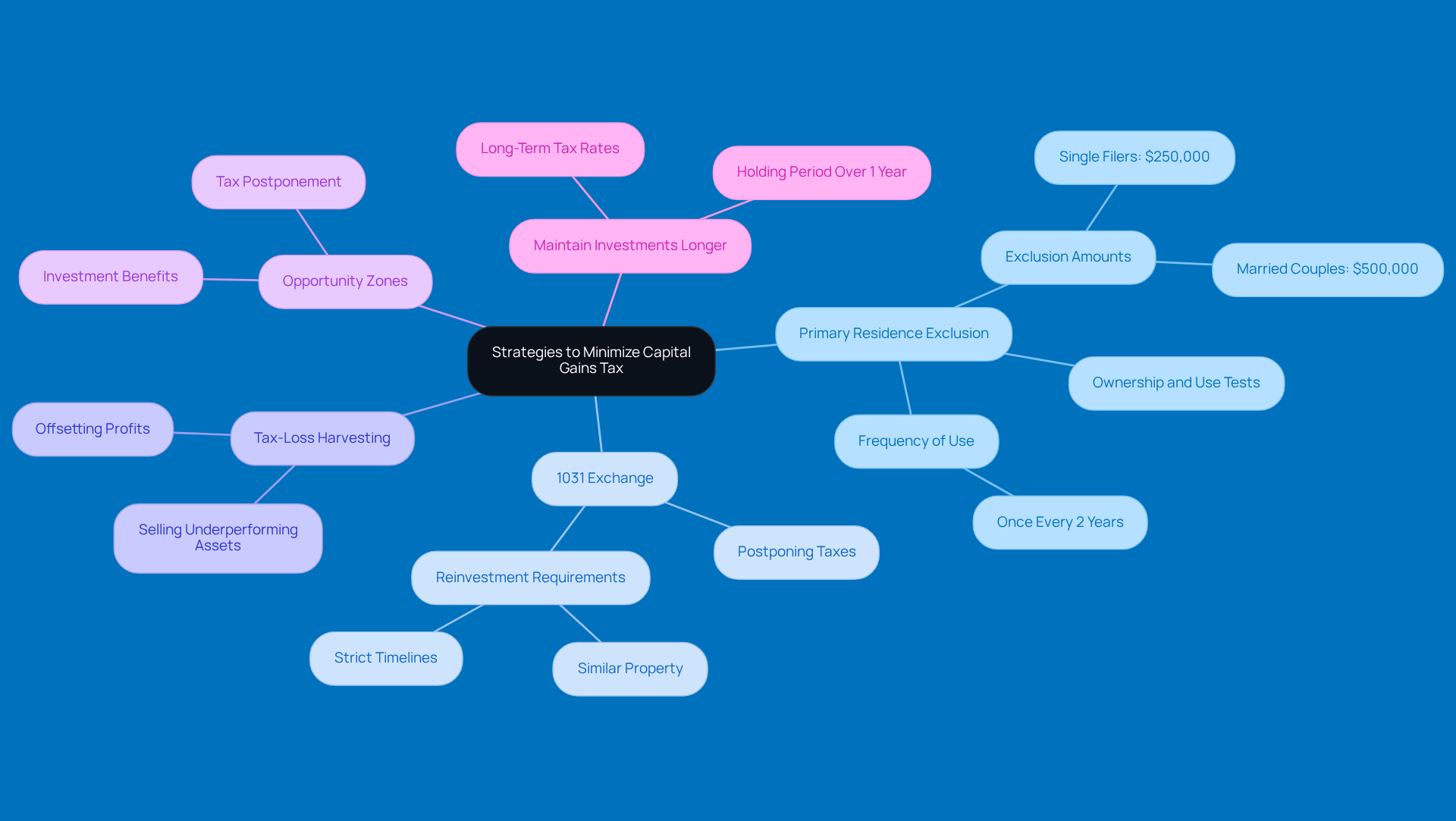

Looking to learn how to avoid capital gains tax on real estate? Here are some friendly strategies to consider:

-

Utilize the Primary Residence Exclusion: If you’re selling your primary home, you might be able to exclude up to $250,000 of profit from your taxable income—$500,000 if you’re married! Just make sure you know how to avoid capital gains tax on real estate by meeting the ownership and use tests.

-

Consider a 1031 Exchange: This nifty option lets you postpone paying taxes on your profits by reinvesting the sale proceeds into another similar property. Just remember to adhere to the strict timelines and requirements set by the IRS, especially when learning how to avoid capital gains tax on real estate.

-

Tax-Loss Harvesting: Got other assets that have lost value? Selling them can help offset your profits, which might lower your overall tax bill. It’s a smart way to learn how to avoid capital gains tax on real estate!

-

Invest in Opportunity Zones: By putting your money into designated Opportunity Zones, you can postpone and potentially reduce taxes on your profits. Understanding how to avoid capital gains tax on real estate can create a win-win situation!

-

Maintain Investments Longer: If you hold onto your investments for over a year, you can benefit from those lower long-term tax rates. Patience is essential when learning how to avoid capital gains tax on real estate, as it ultimately pays off!

So, which strategy resonates with you? Consider how these options might fit into your real estate plans, especially in terms of how to avoid capital gains tax on real estate!

Implement Effective Tax Strategies for Real Estate

If you're looking to minimize capital gains tax on your real estate, here are some friendly strategies to consider:

-

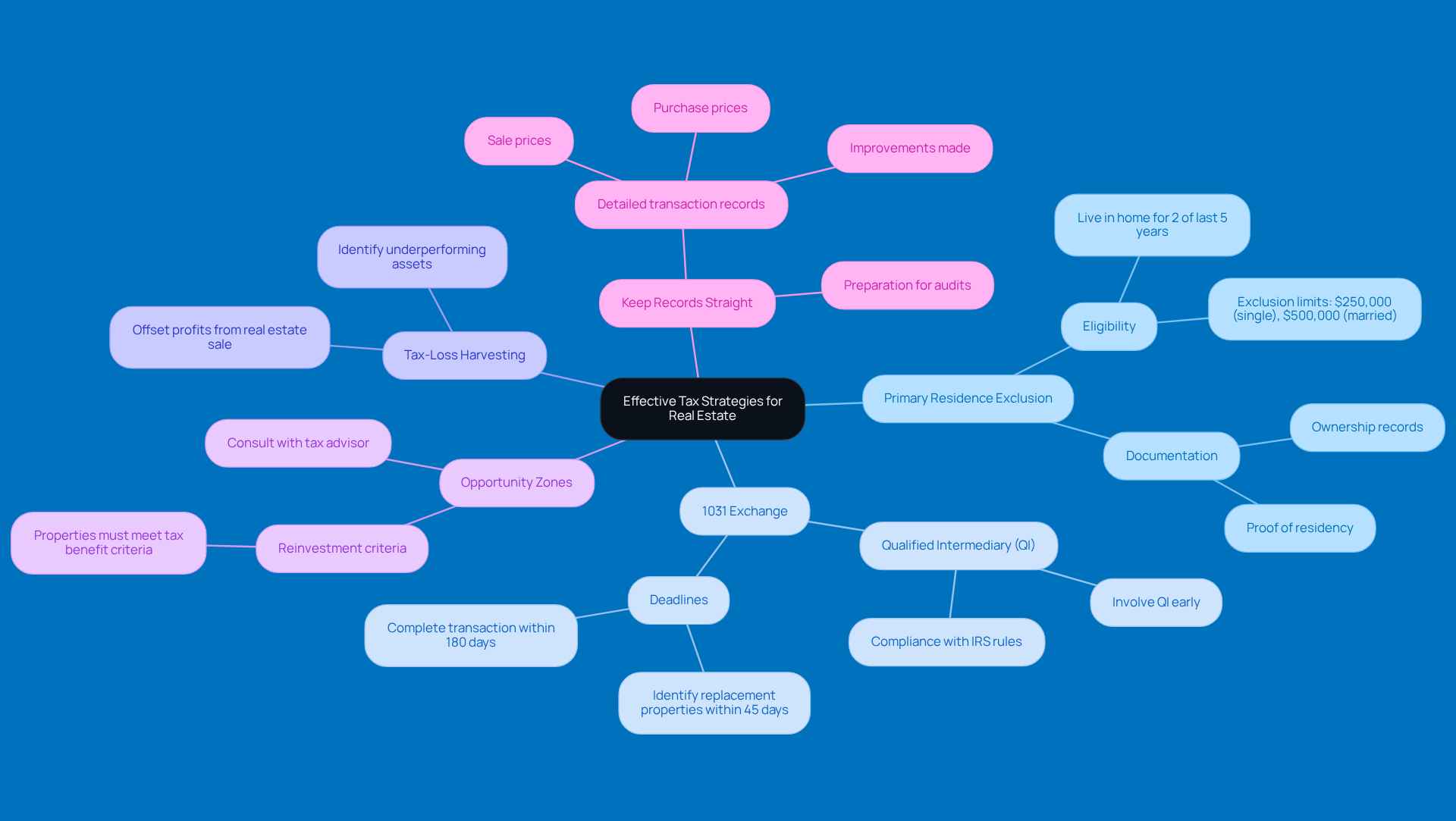

Check Your Property's Status: First things first, see if your property qualifies for the primary residence exclusion. If you’ve lived in your home for at least two of the last five years, you might be able to exclude up to $250,000 in capital gains if you’re single, or $500,000 if you’re married. Just make sure you have the right documentation to back up your residency and ownership.

-

Think About a 1031 Exchange: Planning on a 1031 exchange? It’s a good idea to get a qualified intermediary involved early on. Remember, the properties need to be 'like-kind' and used for business or commercial purposes. You’ll need to identify potential replacement properties within 45 days and wrap up the transaction within 180 days to keep those tax benefits. Having a Qualified Intermediary (QI) on board before closing is key to staying compliant with the rules.

-

Consider Tax-Loss Harvesting: Take a look at your portfolio for any underperforming assets. Selling these off can help offset profits from your real estate sale, which can lower your taxable income. It’s a smart move!

-

Explore Opportunity Zones: Have you heard about Opportunity Zones? They allow you to postpone profit taxes when you reinvest in certain areas. Just make sure the properties meet the criteria for tax benefits, and it’s always wise to chat with a tax advisor to understand what that means for you.

-

Keep Your Records Straight: Last but not least, keep detailed records of all your transactions. This includes purchase prices, any improvements you’ve made, and sale prices. Having this documentation handy is crucial for figuring out your profits and for any potential audits, ensuring you’re in line with IRS regulations.

By implementing these strategies, you can really boost your ability to understand how to avoid capital gains tax on real estate effectively. So, why not give them a try?

Conclusion

Understanding how to dodge capital gains tax on real estate is super important for anyone wanting to get the most out of their investments. By getting a handle on the differences between short-term and long-term capital gains, you can plan your real estate moves in a way that keeps those pesky tax bills down. Plus, holding onto properties a bit longer, using exclusions, and tapping into tax-deferral strategies can really boost your financial game.

Let’s talk about some key strategies! The following are great ways to cut down on your capital gains tax exposure:

- Primary residence exclusion

- 1031 exchanges

- Tax-loss harvesting

- Investing in Opportunity Zones

Sure, each of these approaches needs some careful thought and a good understanding of IRS rules, but the potential savings? They can be huge! And don’t forget, keeping your records straight and staying updated on tax rates and regulations is key to smart tax planning.

At the end of the day, the tips and tricks we’ve covered here can really empower you as a real estate investor. By taking charge of your tax implications, you can sharpen your investment strategies and pave the way for greater financial success. And hey, chatting with a tax pro can help fine-tune these strategies and keep you compliant, which is a smart move if you’re serious about maximizing your real estate investments. So, what are you waiting for? Dive in and start planning!

Frequently Asked Questions

What is capital gains tax?

Capital gains tax is a tax on the profit you make when you sell an asset, such as real estate.

What are the two main types of capital gains?

The two main types of capital gains are short-term and long-term. Short-term gains come from assets held for a year or less and are taxed as regular income, while long-term gains apply to assets held for over a year and are taxed at lower rates.

How are short-term capital gains taxed?

Short-term capital gains are taxed as regular income, with rates ranging from 10% to 37%, depending on your income bracket.

What are the tax rates for long-term capital gains?

Long-term capital gains enjoy lower tax rates, typically 0%, 15%, or 20%, based on your taxable income.

What are the benefits of holding onto assets longer?

Holding onto assets for more than a year can qualify you for lower long-term capital gains tax rates, potentially leading to significant tax savings.

What exclusions are available for selling a primary residence?

Married couples can exclude up to $500,000 in profits from selling their main home if they’ve lived there for two of the last five years. Individual filers can exclude up to $250,000.

How can tax-advantaged accounts help with capital gains tax?

Using tax-advantaged accounts like IRAs and 401(k)s allows your assets to grow without immediate taxation or with delayed taxation, which can help minimize capital gains tax.

Why is it important to keep track of your paystub and tax records?

Maintaining accurate tax records and regularly checking your paystub helps you stay informed about your income and deductions, which can impact your overall tax situation.

How can staying updated on tax rates and thresholds benefit me?

Staying updated on annual changes in tax rates and thresholds is crucial for effective financial planning, enabling you to navigate your real estate investments more smoothly and minimize tax liabilities.