Introduction

Navigating the complexities of real estate transactions can feel a bit overwhelming, right? Especially when it comes to understanding capital gains tax. This tax, which is applied to the profits from selling properties, can really affect the financial outcomes for both homeowners and investors. But don’t worry! By exploring some effective strategies and exemptions, you can find ways to minimize or even avoid these taxes altogether, boosting your returns on investment.

Now, with regulations changing all the time and the details of qualifying for exclusions being a bit tricky, you might be wondering: what steps can you take to make sure you’re fully leveraging the opportunities out there while steering clear of costly mistakes? Let’s dive in and figure this out together!

Understand Capital Gains Tax on Real Estate

Capital profits tax is all about the money you make when you sell an asset, like real estate. If you sell a property for more than what you paid for it, that profit is considered an increase in value and, yep, it’s taxable. The tax rate you face depends on how long you’ve owned the property:

- Short-term capital gains: If you’ve held onto your property for a year or less, you’ll be taxed at ordinary income tax rates, which can be anywhere from 10% to 37%, depending on your income.

- Long-term profits: For properties you’ve owned for over a year, the tax rate usually drops to a more favorable 0%, 15%, or 20%, again depending on your income tier. And here’s a little nugget for 2026: many taxpayers with lower incomes might qualify for that sweet 0% long-term profit tax rate.

Now, to tackle those tax liabilities effectively, it’s crucial to understand how to avoid real estate capital gains tax and what exemptions might be available. For instance, if you’re a homeowner, you can exclude up to $500,000 of profits from the sale of your primary residence if you’re married and filing jointly. If you’re filing solo, that limit drops to $250,000. Just make sure you meet the two-year residency requirement within the five years leading up to the sale, and that the home was your main residence.

Let’s look at a quick example: imagine a married couple sells their home, which they bought for $200,000 and sold for $800,000. They could potentially exclude $500,000 from taxable profits, leaving just $100,000 to be taxed. Plus, if they’ve made significant improvements to their property, they can adjust their cost basis, which can further lower their taxable profits.

Getting a grip on these details and using available exemptions is key for small business owners and individuals alike, particularly in understanding how to avoid real estate capital gains tax. It helps minimize tax liabilities and maximize returns on real estate investments. So, what are your thoughts? Have you considered how these tax rules might affect your next property sale?

Qualify for Capital Gains Tax Exclusion

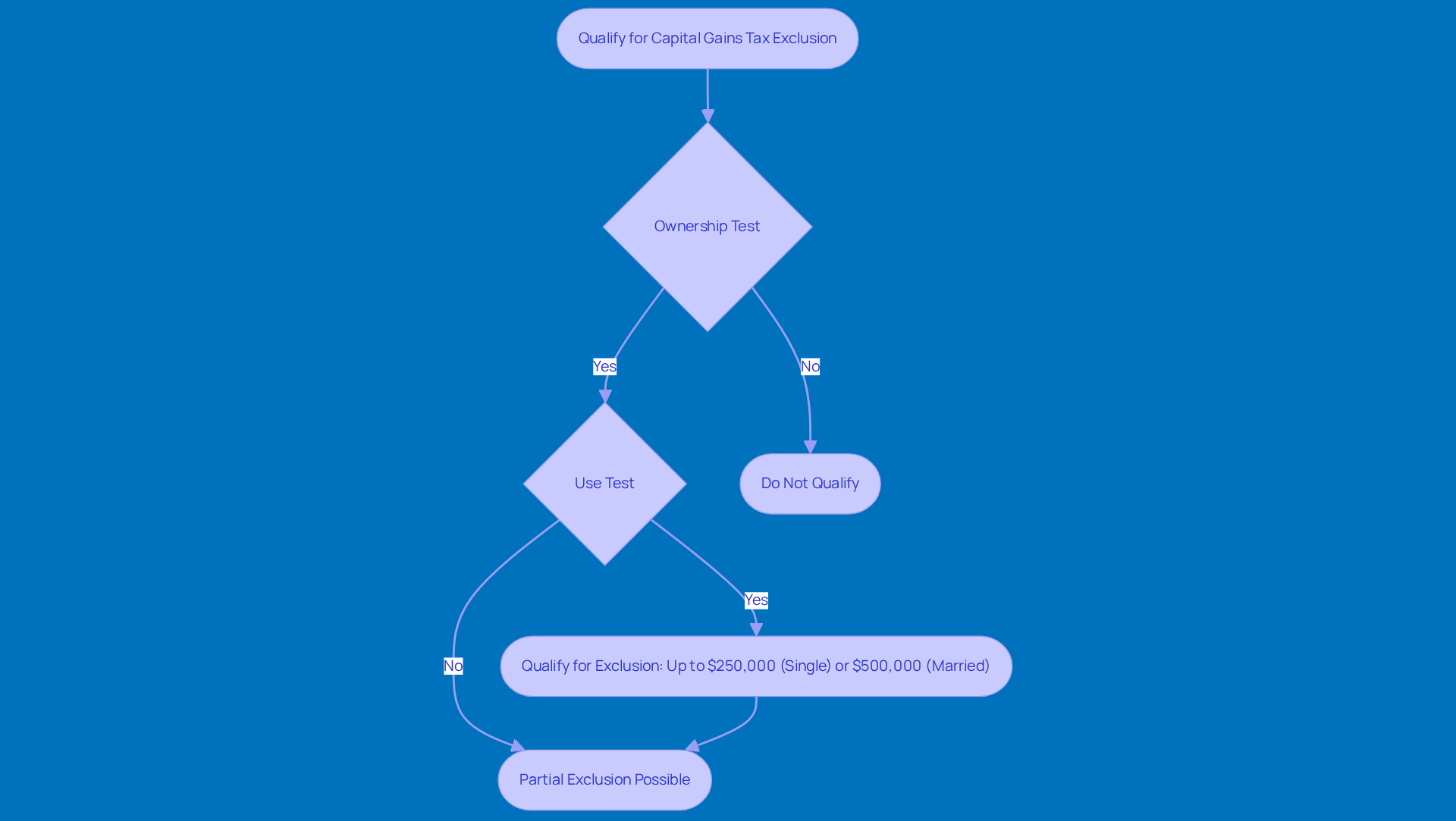

If you're looking to qualify for the capital gains tax exclusion when selling your primary residence, there are two key criteria you need to meet:

- Ownership Test: You’ve got to have owned the home for at least two years within the five years leading up to the sale.

- Use Test: The home must have been your primary residence for at least two years during that same five-year stretch.

Now, here’s a little heads-up: if you’ve sold another home and didn’t report the profit from that sale within the two years before your current transaction, you might not qualify for this exclusion. So, keep that in mind as you plan your sale!

If you check off these boxes, you could exclude up to $250,000 of capital gains if you’re filing as a single person, or up to $500,000 if you’re married and filing jointly. That’s a pretty sweet deal that can really help lower your taxable income from the sale, giving you some much-needed financial relief.

There are plenty of success stories out there where homeowners have made the most of this exclusion. For instance, imagine a married couple who sold their home for a $200,000 profit after just one year of ownership because of a job-related move. They might still qualify for a partial exclusion, which means they can protect their entire earnings from taxes. This partial exclusion can be a lifesaver when you can’t quite meet that full two-year requirement.

As of 2026, those exclusion amounts haven’t changed since 1997, which really underscores the importance of understanding and using this tax benefit, especially in today’s real estate market where home values have skyrocketed. Plus, if you’re on qualified official extended duty, you can actually pause that five-year test period for up to 10 years, which could impact your eligibility for the exclusion. By keeping an eye on those ownership and use tests, you can learn how to avoid real estate capital gains tax while navigating the complexities and boosting your financial outcomes.

Explore Strategies to Reduce Capital Gains Tax

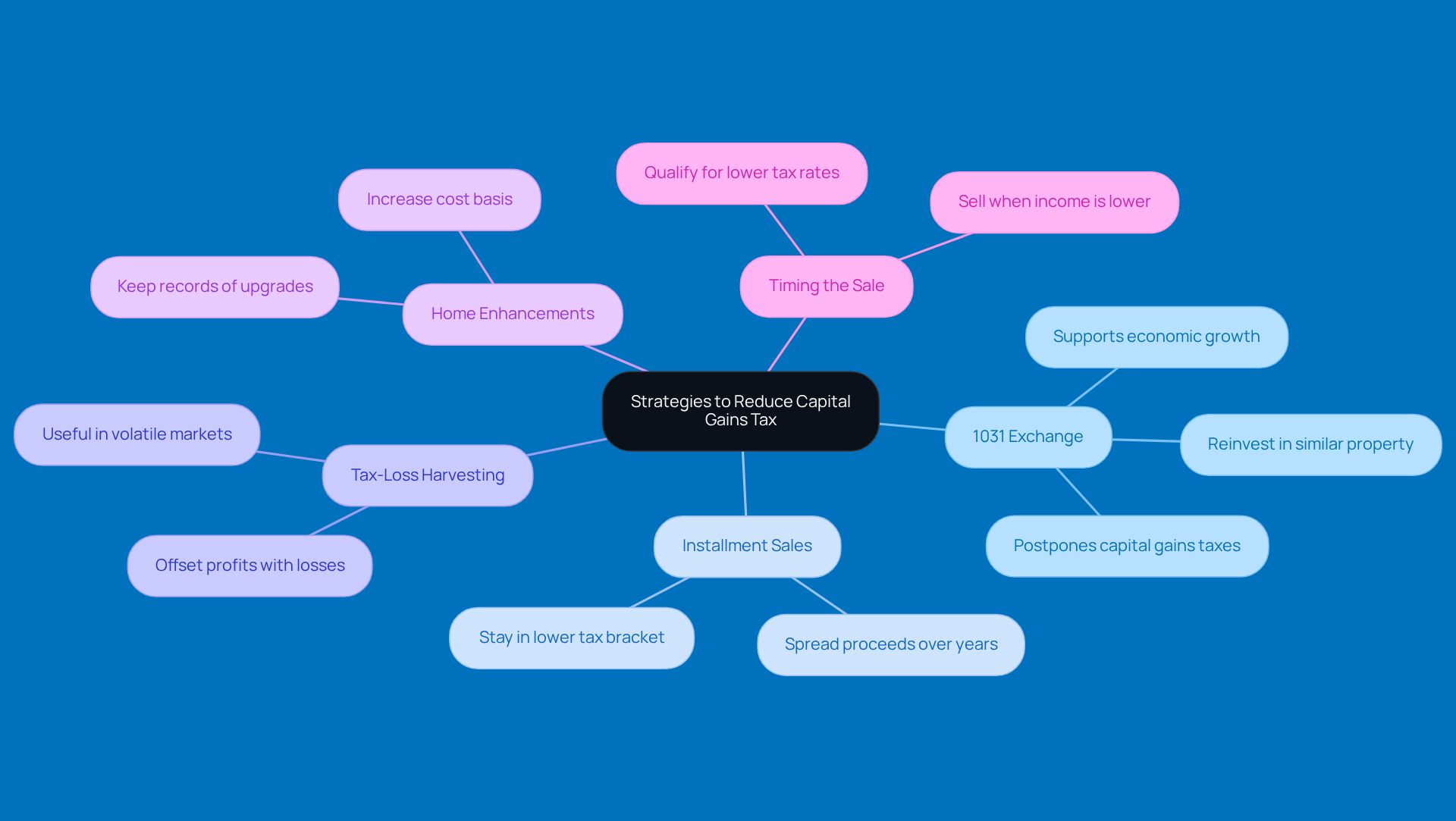

If you're looking to cut down on your capital gains tax when selling real estate, here are some friendly strategies to consider:

-

1031 Exchange: Think of this as a handy tool that lets you postpone those pesky capital gains taxes. By reinvesting the money from your sale into a similar property, you can keep your profits intact for a bit longer. Even in 2026, 1031 exchanges are still a go-to option, helping to boost the economy and create jobs, all while generating billions in tax revenue each year.

-

Installment Sales: Ever thought about spreading your sale proceeds over a few years? This can help you stay in a lower tax bracket, which might just mean less tax to pay overall. It’s a smart move, especially if you’re dealing with larger transactions.

-

Tax-Loss Harvesting: Here’s a little trick: if you sell other investments at a loss, you can offset your profits. This strategy can help balance out your tax exposure, and it’s especially useful when the market’s a bit shaky.

-

Home Enhancements: Did you make any upgrades to your property? Keep track of those! They can boost your cost basis, which means you’ll pay less in taxes when you sell. Good record-keeping is key to maximizing this benefit.

-

Timing the Sale: Consider selling when your income is lower. This little timing trick can help you snag a lower tax rate, which is always a win.

By using these strategies, you can discover how to avoid real estate capital gains tax while navigating the complexities of profit tax and improving your financial outcomes when selling your property. So, which of these tips are you thinking about trying out?

Plan and Document Your Real Estate Transactions

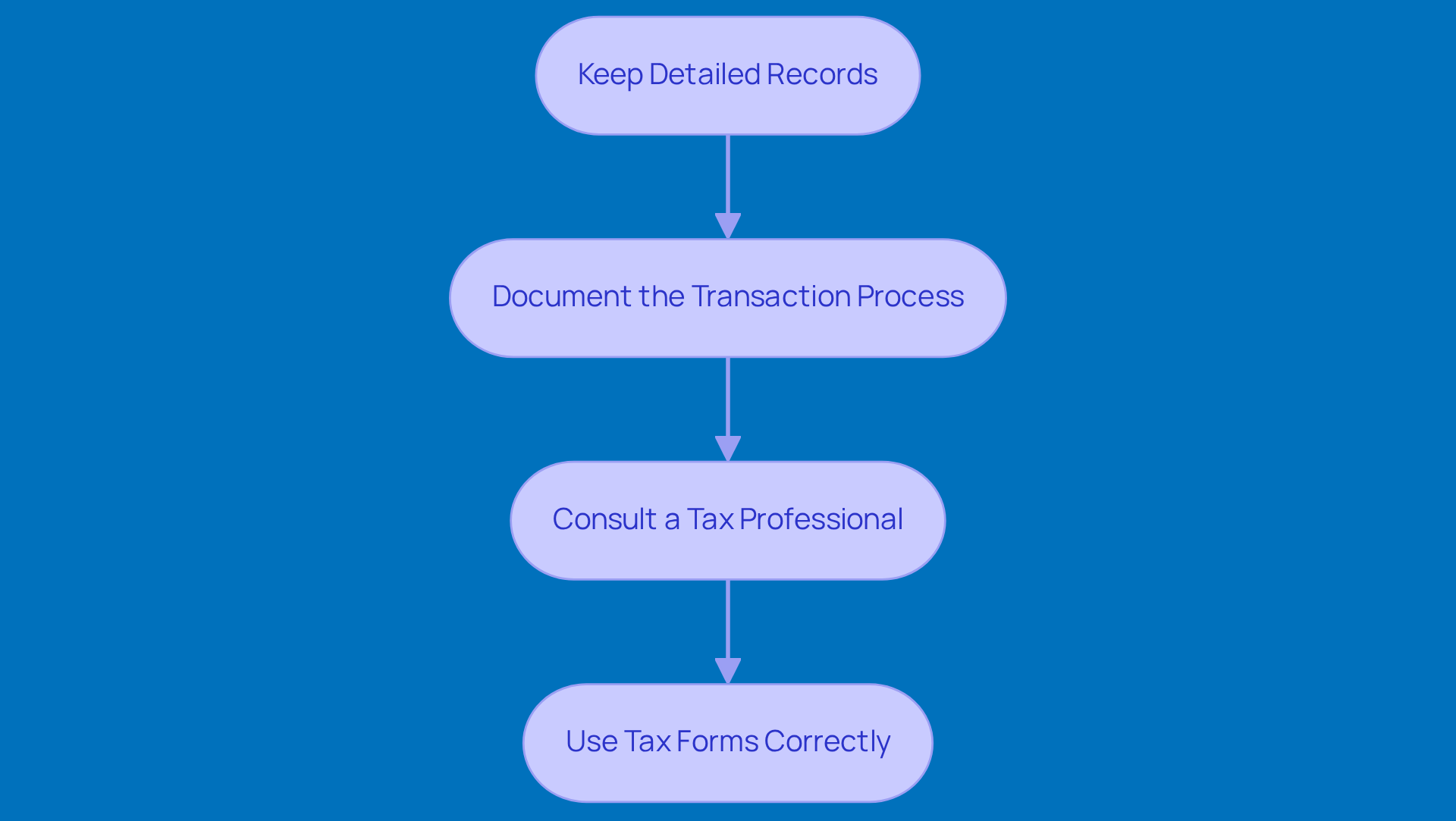

When it comes to selling real estate, effective planning and documentation are key. Let’s break down some essential steps to help you get ready:

-

Keep Detailed Records: It’s super important to maintain thorough records of your purchase price, closing costs, and any improvements you’ve made to the property. This info is crucial for figuring out your cost basis, which is important for understanding how to avoid real estate capital gains tax liability. For example, one seller in Bonsall managed to cut their tax bill by $12,000 just by keeping track of renovation costs and holding onto their Closing Statement during an audit. Pretty impressive, right?

-

Document the Transaction Process: Make sure to keep copies of all contracts, disclosures, and communications related to the sale. This documentation not only backs up your claims but also clears things up in case any disputes pop up. Holding onto documents like the Title Report and Purchase Agreement is essential for your legal protection and future transactions.

-

Before you wrap up the transaction, it’s a good idea to consult a tax professional to learn how to avoid real estate capital gains tax and fully understand the tax implications. They can help you strategize on how to minimize your tax burden and ensure you’re in line with current regulations, especially with new reporting requirements rolling out in 2026.

-

Use Tax Forms Correctly: Be aware of the necessary tax forms, like Form 1099-S, which reports the sale of real estate. Filling these out accurately is crucial to avoid any headaches with the IRS. Remember, if you’ve had any forgiven or canceled mortgage debt, you need to report that as income. Understanding these details can save you from unexpected tax surprises down the line.

By following these steps and keeping your records organized, you’ll be better equipped to navigate the complexities of real estate transactions. This way, you can ensure compliance and optimize your financial outcomes. So, are you ready to tackle your real estate journey?

Conclusion

Navigating the ins and outs of real estate capital gains tax can feel like a maze, right? But don’t worry! If you’re looking to make the most of your property transactions, understanding this tax is key. With the right strategies and a bit of know-how about available exclusions, you can really cut down on those tax bills and keep more of your hard-earned profits.

So, what are some of these strategies? Well, the article shares some great tips! You can qualify for exclusions based on how long you’ve owned the property and how you’ve used it. Plus, there’s the option of 1031 exchanges, which can be a game-changer. And let’s not forget about keeping detailed records of your transactions and any improvements you’ve made. Each of these methods can help lighten your tax load while keeping you on the right side of the law, especially with some changes coming in 2026.

In the end, being proactive and making informed choices is super important when dealing with real estate. By putting these strategies into action and maybe even getting some professional advice, you can manage your capital gains tax exposure like a pro and boost your financial returns. Embracing these practices not only helps grow your wealth but also gives you a better grasp of the real estate market and its tax implications. So, why not start planning today?

Frequently Asked Questions

What is capital gains tax on real estate?

Capital gains tax is the tax on the profit made when selling an asset, such as real estate. If you sell a property for more than what you paid for it, the profit is considered taxable.

How does the duration of property ownership affect capital gains tax rates?

The tax rate on capital gains depends on how long you’ve owned the property. Short-term capital gains (for properties held for a year or less) are taxed at ordinary income tax rates, ranging from 10% to 37%. Long-term capital gains (for properties owned for over a year) are usually taxed at lower rates of 0%, 15%, or 20%, based on income tier.

What exemptions are available to reduce capital gains tax for homeowners?

Homeowners can exclude up to $500,000 of profits from the sale of their primary residence if married and filing jointly, or $250,000 if filing solo, provided they meet the two-year residency requirement within the five years leading up to the sale.

Can improvements to a property affect capital gains tax?

Yes, if you make significant improvements to your property, you can adjust your cost basis, which can lower your taxable profits when you sell.

Why is it important to understand capital gains tax and available exemptions?

Understanding capital gains tax and available exemptions is crucial for minimizing tax liabilities and maximizing returns on real estate investments, especially for small business owners and individuals.