Introduction

Understanding estimated tax payments can feel like a maze, especially for self-employed folks. Unlike traditional employees, you’ve got unique challenges to tackle. Getting these payments right isn’t just about staying on the right side of the law; it can save you from some pretty hefty penalties too. But here’s the kicker: many self-employed individuals still feel a bit lost when it comes to managing their tax responsibilities.

So, what’s the game plan? How can you ensure your estimated tax payments are timely and accurate? And let’s not forget about the resources out there that can help make this whole process a lot less intimidating. Let’s dive in!

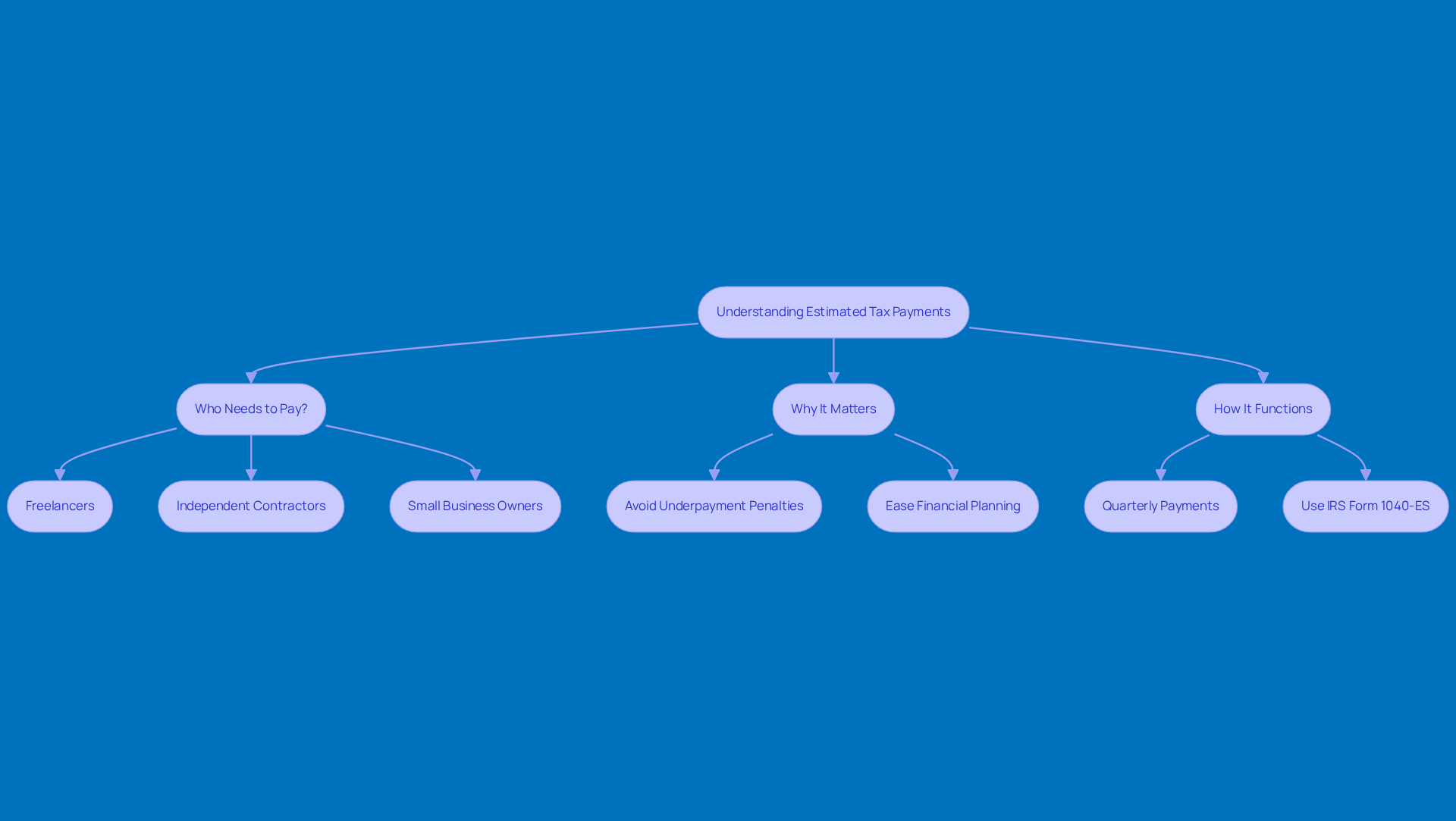

Understand Estimated Tax Payments

Understanding how to calculate estimated tax payments for self employed individuals is super important for them and certain taxpayers. They help you tackle your expected tax obligations for the year. Unlike traditional employees, who have taxes taken out of their paychecks, self-employed individuals must understand how to calculate estimated tax payments for self employed and pay their taxes directly. This includes both income tax and self-employment tax, which helps fund Social Security and Medicare. Understanding how to calculate estimated tax payments for self employed individuals is key to avoiding penalties and staying compliant with tax regulations.

Who needs to pay: If you think you’ll owe $1,000 or more in taxes when you file your return, you generally need to know how to calculate estimated tax payments for self employed individuals. This applies to freelancers, independent contractors, and small business owners alike.

-

Why It Matters: Making these contributions helps you dodge underpayment penalties, which can pile up at a rate of 0.5% of the total amount owed for each missed installment. Plus, understanding how to calculate estimated tax payments for self employed individuals saves you from the shock of a hefty tax bill at year-end, making financial planning a whole lot easier.

-

How It Functions: Payments are usually made quarterly, based on your projected income for the year. You can use IRS Form 1040-ES to help you learn how to calculate estimated tax payments for self employed individuals in a structured way.

Real-world examples really show why these payments matter. Take a ridesharing driver earning $15,000, for instance. They might not get Form 1099-K because they didn’t hit the reporting thresholds, but they still need to keep track of their income and expenses to accurately calculate their tax obligations. This just goes to show the complexities self-employed individuals face when figuring out how to calculate estimated tax payments for self employed.

On top of that, a significant number of self-employed individuals end up facing penalties for underpaying their projected taxes, highlighting the need to understand how to calculate estimated tax payments for self employed. This highlights how crucial it is to understand and comply with these requirements. Tax specialists emphasize that understanding how to calculate estimated tax payments for self employed individuals is vital for staying compliant and improving your financial situation. By staying informed and organized, self-employed owners can navigate their tax obligations effectively, ensuring they meet their responsibilities without unnecessary stress.

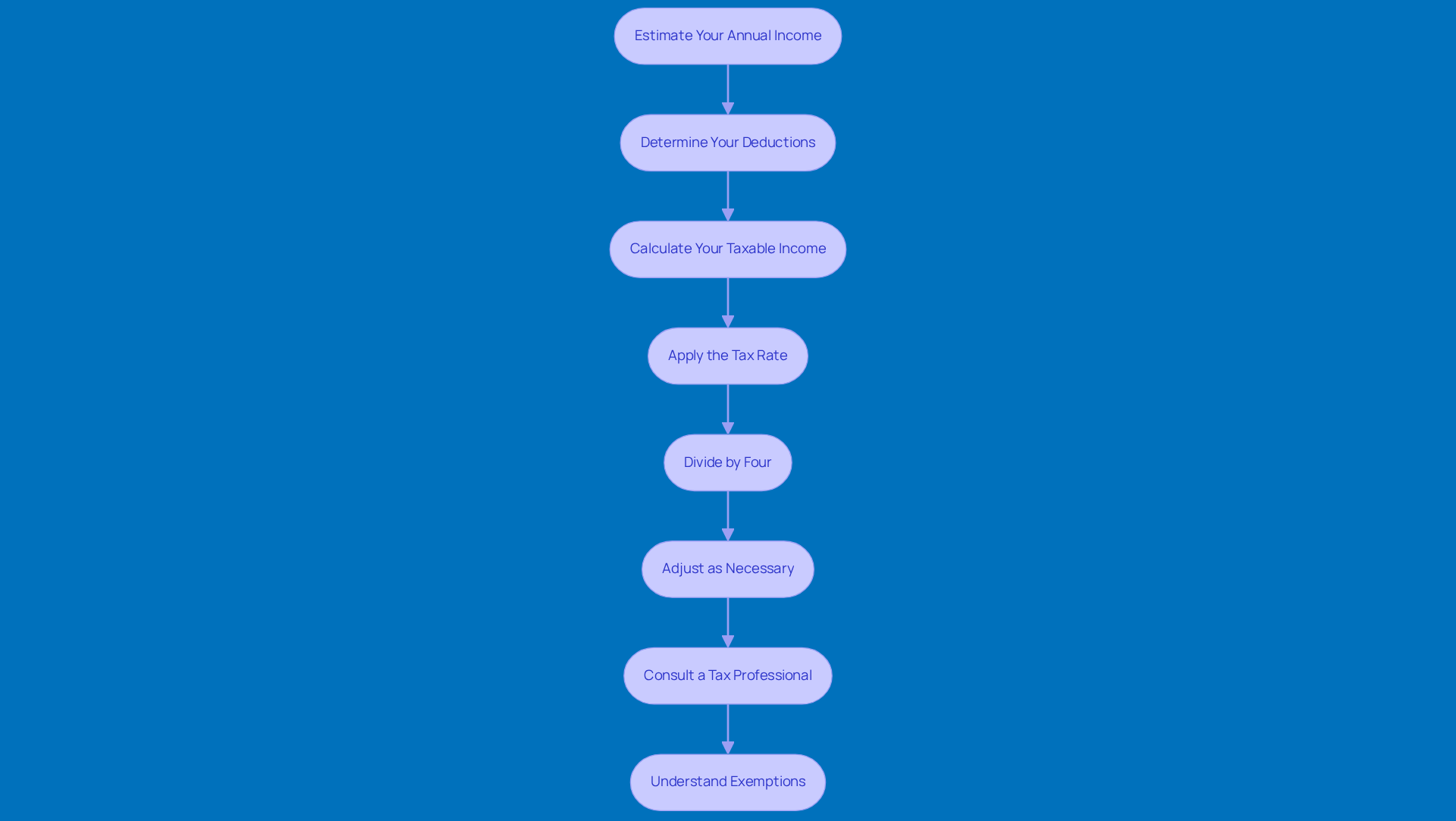

Calculate Your Estimated Tax Payments

Understanding how to calculate estimated tax payments for self-employed individuals doesn’t have to be a headache! Just follow these simple steps:

-

Estimate Your Annual Income: Start by projecting your total income for the year. This includes everything from freelance gigs to consulting fees and any extra earnings you might have.

-

Determine Your Deductions: Next up, identify those deductible business expenses that can help lower your taxable income. Think home office costs, health insurance premiums, and retirement contributions.

-

Calculate Your Taxable Income: Now, subtract your projected deductions from your total income to find out your taxable income. For 2026, the standard deduction is $16,100 for single filers and $32,200 for married couples filing jointly.

-

Apply the Tax Rate: Use the current tax rates to estimate your total tax liability. Don’t forget to include self-employment tax, which is about 15.3% on your net earnings, covering both Social Security and Medicare.

-

Divide by Four: Since estimated taxes are paid quarterly, just divide your total estimated tax liability by four to figure out your quarterly payment amount. For 2026, mark your calendar for the estimated tax payment deadlines: April 15, June 16, September 15, and January 15 of the following year.

-

Adjust as Necessary: If your income changes, it’s a good idea to revisit your calculations and adjust your payments to avoid any underpayment penalties. A handy rule of thumb for how to calculate estimated tax payments for self-employed is to set aside about 30% of your gross earnings for taxes.

-

Consult a Tax Professional: Given how tricky tax regulations can be, it’s wise to consult a tax professional. Steinke and Company is here to make tax season smooth, accurate, and stress-free, helping you stay compliant and minimizing any surprises.

-

Understand Exemptions: You might be exempt from paying estimated taxes if you had no tax obligation for the current or prior period.

-

Be Aware of Common Errors: Keep an eye out for common mistakes in your quarterly tax submissions, like underpayment, missed deadlines, and incorrect calculations. Understanding your paystub and keeping your tax records in check are key for financial stability and compliance, so take a moment to review those documents carefully.

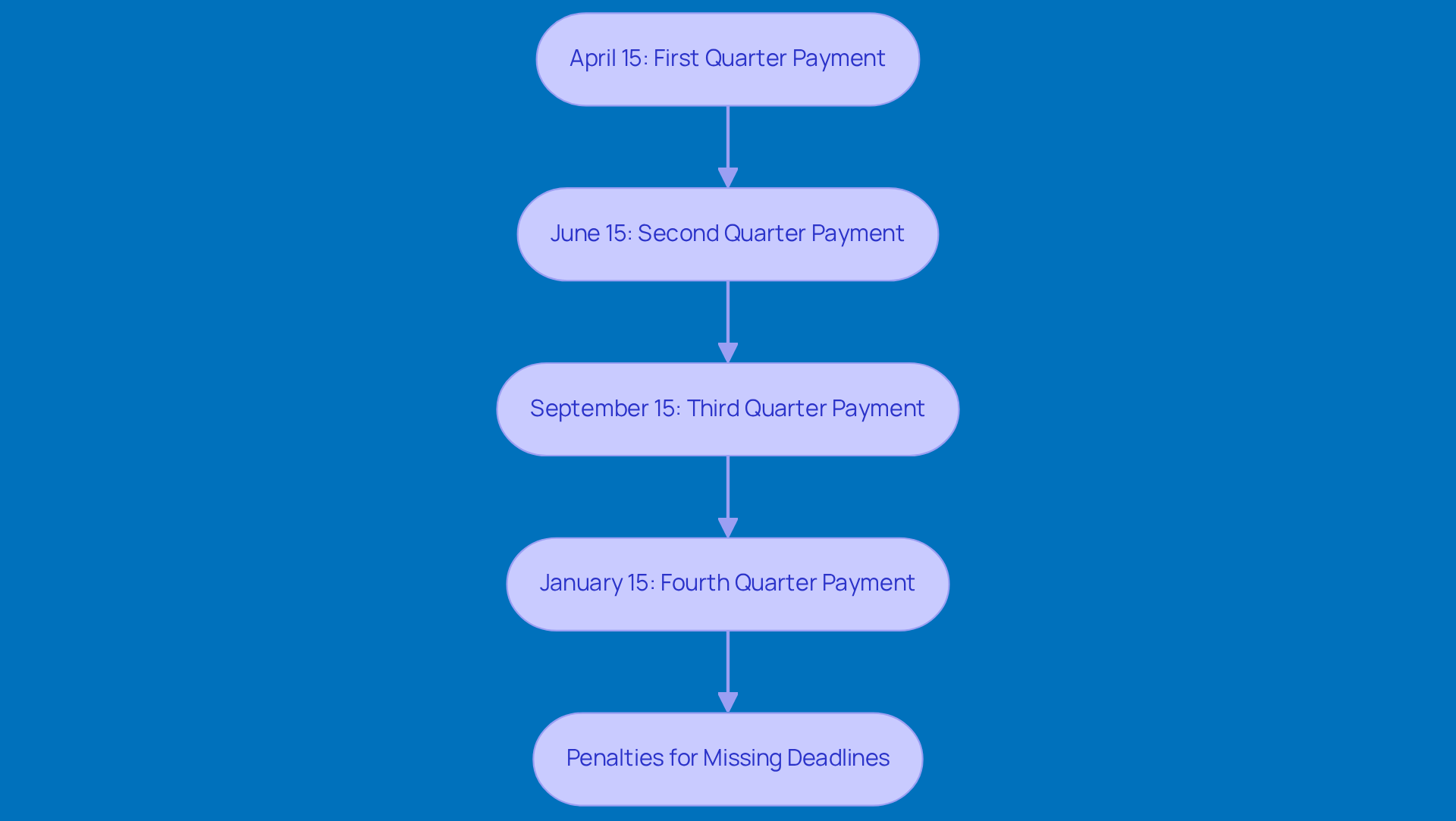

Know Your Payment Deadlines

Estimated tax payments are super important for self-employed folks, and they usually have deadlines that fall on these dates each year:

- April 15: First quarter payment

- June 15: Second quarter payment

- September 15: Third quarter payment

- January 15 of the following year: Fourth quarter payment

Now, if any of these dates happen to land on a weekend or holiday, don’t worry! The due date typically gets pushed to the next business day. It’s a good idea to mark these dates on your calendar and set some reminders to keep everything on track. Missing a deadline? That can lead to some hefty penalties and interest on what you owe. For example, if you don’t file on time, you could face a penalty of five percent of the tax owed for each month your return is late, up to a maximum of 25%. And if you let tax go unpaid for more than 10 days after getting an IRS notice of intent to levy, that late fee penalty jumps to one percent.

Small business owners often find managing deadlines tricky, but understanding how to calculate estimated tax payments for self-employed can help you dodge those risks with proactive planning. Take, for instance, a rural contractor who keeps a close eye on these deadlines and sets aside funds for tax obligations. By doing so, they can sidestep the stress of penalties, which can average around 25% of the unpaid tax amount. Staying informed and organized is really the name of the game when it comes to keeping compliant and ensuring your financial stability.

Utilize Tools and Resources for Tax Management

Managing your estimated tax payments doesn’t have to be a headache! Here are some handy tools and resources to help you stay on track:

-

Tax Software: Have you tried programs like TurboTax or H&R Block? They’re super helpful for understanding how to calculate estimated tax payments for self employed and keeping tabs on your payments. Designed with self-employed folks in mind, these platforms make the process smoother and cut down on mistakes. Fun fact: last tax year, the IRS issued over 90% of refunds in less than 21 days, thanks to the efficiency of tax software!

-

Spreadsheets: If you’re more of a hands-on person, creating a simple spreadsheet can work wonders. It’s a great way to keep an eye on your income, expenses, and estimated tax payments. Plus, it lets you tweak your financial strategies as needed, so you’re always in control. Many small business owners swear by spreadsheets for clarifying their financial situation and making better decisions.

-

Professional Help: Sometimes, it pays to bring in the pros! Hiring a tax professional or accountant who knows the ins and outs of small business tax compliance can be a game changer. Steinke and Company emphasizes that using professional tax preparation services can really simplify the process of managing your projected contributions, letting you focus on growing your business instead of drowning in paperwork.

-

IRS Resources: Don’t forget about the IRS website! It’s packed with valuable info, including forms, instructions, and tips for estimating your tax contributions. The IRS encourages everyone to use their online tools for accurate calculations, which can really lighten the load come filing time. Familiarizing yourself with these resources can keep you informed and compliant, helping you avoid those pesky penalties. Just a heads up: quarterly projected taxes are due four times a year - mark your calendars for April 15, June 15, September 15, and January 15.

By utilizing these tools and resources, self-employed individuals can understand how to calculate estimated tax payments for self employed like pros, ensuring they remain compliant and financially healthy. So, what are you waiting for? Get started today!

Conclusion

Understanding how to calculate estimated tax payments for self-employed folks is super important for keeping your finances in check and staying on the right side of tax regulations. Unlike traditional employees, self-employed individuals have to handle these payments themselves, which means covering both income tax and self-employment tax. By getting a grip on this process, you can dodge penalties and be ready for your tax obligations all year long.

So, what should you keep in mind? First off, estimating your annual income is key, along with figuring out your deductions and sticking to those payment deadlines. Tools like tax software, spreadsheets, or even a professional can make this whole process a lot easier. Plus, being aware of common mistakes and adjusting your payments as your income changes are crucial steps in navigating the tricky waters of self-employment taxes.

At the end of the day, staying informed and organized is vital for managing your estimated tax payments effectively. By taking proactive steps - like marking deadlines on your calendar and using the resources available - you can take the stress out of tax season and focus on what really matters: growing your business. Embracing these practices not only helps you stay compliant but also boosts your overall financial stability and success.

Frequently Asked Questions

What are estimated tax payments?

Estimated tax payments are advance payments made by self-employed individuals to cover their expected tax obligations for the year, including both income tax and self-employment tax.

Who needs to pay estimated taxes?

Individuals who expect to owe $1,000 or more in taxes when filing their return generally need to pay estimated taxes. This includes freelancers, independent contractors, and small business owners.

Why are estimated tax payments important?

They help avoid underpayment penalties, which can accumulate at a rate of 0.5% of the total amount owed for each missed installment. They also prevent the shock of a large tax bill at year-end and facilitate better financial planning.

How often are estimated tax payments made?

Estimated tax payments are typically made quarterly based on the individual's projected income for the year.

What form is used to calculate estimated tax payments?

IRS Form 1040-ES is used to help individuals calculate their estimated tax payments in a structured way.

Can you provide an example of why estimated tax payments matter?

For instance, a ridesharing driver earning $15,000 may not receive Form 1099-K if they don't meet reporting thresholds, but they still need to track their income and expenses to accurately calculate their tax obligations.

What are the consequences of not understanding estimated tax payments?

Many self-employed individuals face penalties for underpaying their projected taxes, underscoring the importance of understanding how to calculate estimated tax payments to ensure compliance and avoid unnecessary stress.