Overview

This article dives into some key insights for small business owners about the difference between income and profit. So, what’s the scoop? Well, income is all about the total revenue you bring in before any expenses hit the books. On the flip side, profit is what’s left after you’ve paid all those pesky expenses.

Understanding this distinction is super important for effective budgeting and making smart financial decisions. You see, many business owners often mix up high income with being financially healthy. But here’s the kicker: if you don’t keep an eye on your expenses, that high income might not mean much when it comes to profitability.

So, next time you’re looking at your numbers, take a moment to reflect on how expenses play into your overall financial picture. It’s all about making sure you’re not just chasing income, but also keeping your profit in check!

Introduction

Getting a grip on the financial landscape of your small business is key to thriving in the long run. But let’s be real—many owners struggle to understand the difference between income and profit. So, what’s the deal? Income is all about the total cash flow coming in from your various business activities, while profit is what’s left after you’ve paid all your expenses. This isn’t just some dry academic distinction; it really matters when it comes to budgeting, forecasting, and keeping your financial health in check.

Now, how can you, as a small business owner, navigate this tricky terrain? It’s all about making sure your venture not only survives but thrives, without stumbling into those common pitfalls. Let’s dive in and explore how to make sense of it all!

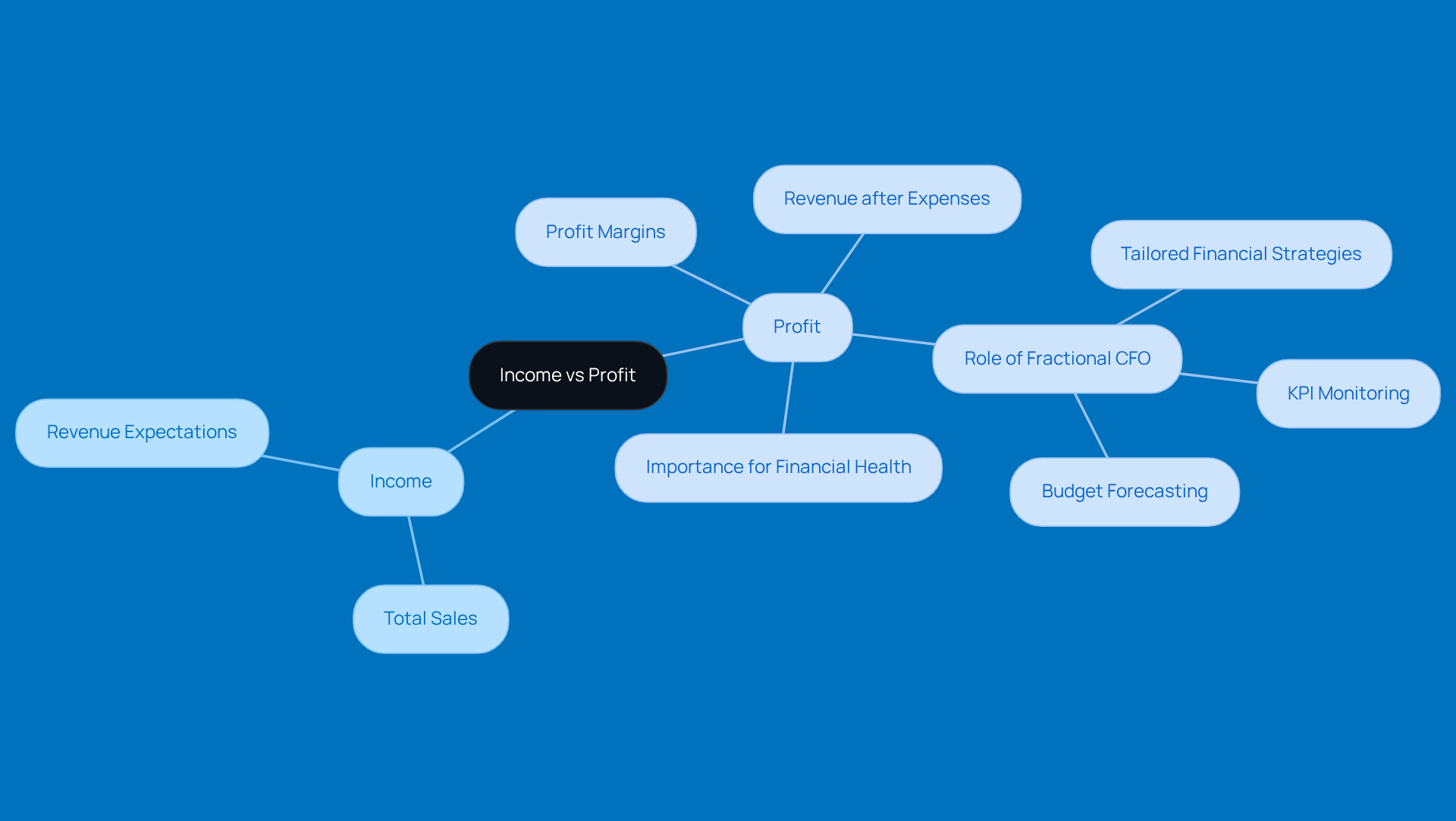

Define Income and Profit: Core Concepts for Small Businesses

Income is essentially the total cash flow from all your business activities before you start subtracting expenses, highlighting the distinction of income vs profit. This includes everything you earn from sales, services, and other sources. Now, let's discuss income vs profit? That’s what’s left after you’ve taken out all those pesky expenses like operating costs, taxes, and interest from your income vs profit.

For small business owners, getting a grip on these definitions is super important. They play a huge role in budgeting, forecasting, and your overall money strategy. Imagine this: your business might show impressive income vs profit numbers, but if your costs are sky-high, your returns could be pretty dismal. This really highlights why keeping a close eye on your expenses is key to achieving a balance between income vs profit.

By understanding the difference between income vs profit, you can make smarter choices that help your business grow sustainably and keep your finances healthy. So, how are you managing your expenses? It’s worth a thought!

Differentiate Between Income and Profit: Key Distinctions

Understanding the difference between income v profit is super important for small business owners. So, let’s break it down: income v profit indicates that income is all the money you make from sales, while profit is what’s left after you’ve paid all your expenses. For instance, if your small business rakes in $100,000 in sales but has expenses of $80,000, your earnings are just $20,000. This distinction is key! Many owners mistakenly think that having high income v profit means they’re financially healthy. Without a solid grasp of profit margins, they might overlook necessary cost cuts or miss out on reinvesting in their business effectively.

Recognizing this difference helps entrepreneurs make smarter choices that focus on income v profit rather than just chasing revenue. Misunderstanding these concepts can lead to financial pitfalls, as having substantial income v profit doesn’t guarantee sustainability or growth. As one advisor pointed out, "Many small business owners focus solely on revenue, ignoring the importance of earnings, which is crucial for long-term success." This insight underscores the need for a strategic approach to managing finances that balances both revenue and earnings for the overall health of the organization.

Plus, bringing in a fractional CFO can provide tailored financial strategies and insights that help small business owners navigate these complexities. A fractional CFO can whip up detailed reports that highlight revenue margins, keep an eye on cash flow, and develop strategies that align with your business goals. They also offer valuable services like KPI monitoring and budget forecasting, which are essential for making informed decisions. This kind of support is especially important in today’s economic climate, where inflation worries are on everyone’s mind, making the understanding of profit more crucial than ever.

Did you know that small businesses account for about 51 percent of all private employment? That really shows how vital it is to understand financial health within the broader economy!

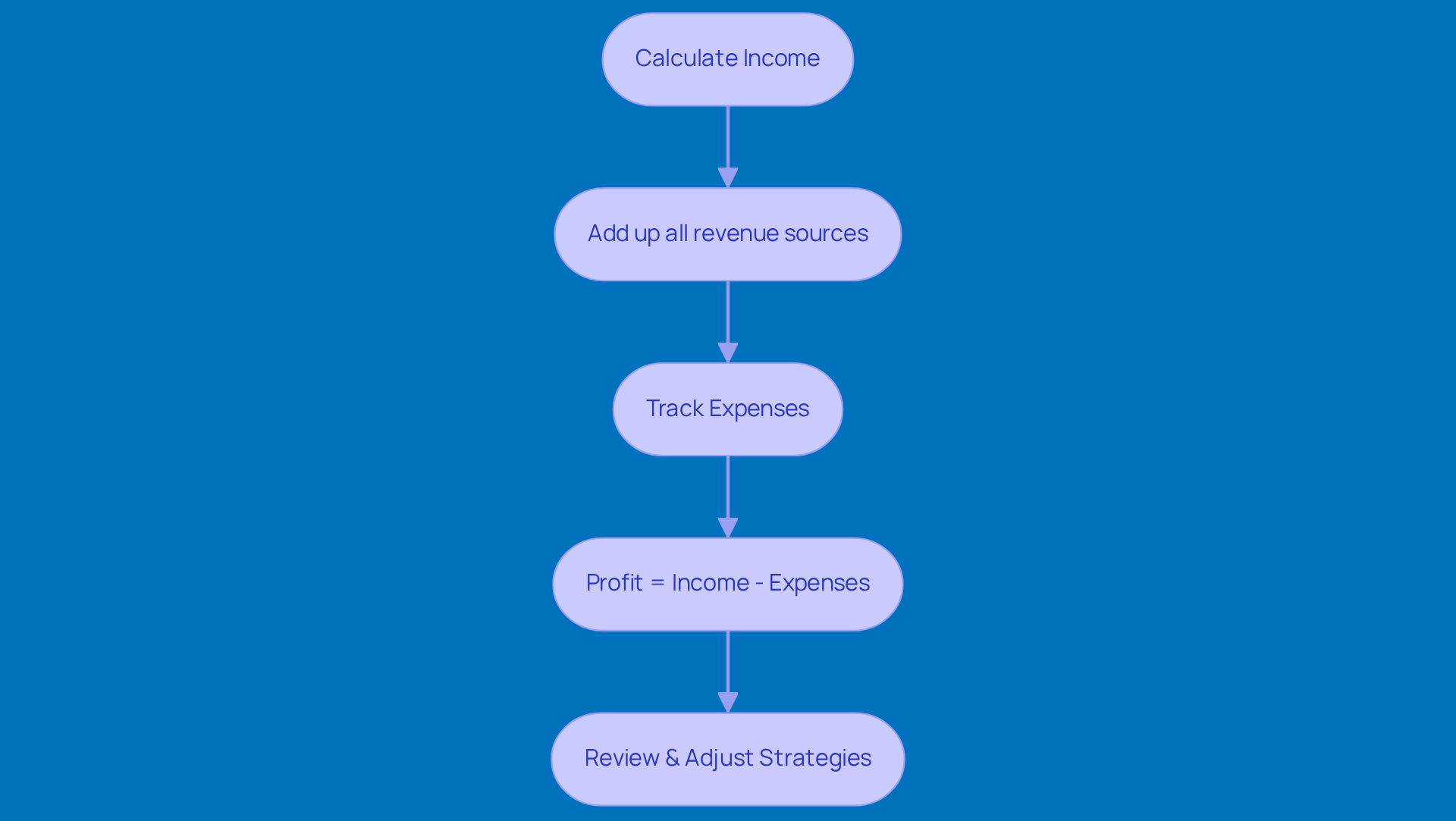

Calculate Income and Profit: Practical Methods for Small Business Owners

If you're a small business owner looking to nail down your earnings, here's a simple way to do it: just add up all your revenue sources over a specific timeframe—like monthly or yearly. This includes everything from sales revenue and service fees to any extra income you might have.

Now, when it comes to understanding the concept of income vs profit, it’s pretty straightforward:

- Profit = Income - Expenses

But here’s the kicker—keeping track of your expenses is super important! You’ll want to jot down all those costs, which can be fixed ones like rent or variable ones like materials. A basic spreadsheet can help you keep an eye on these numbers, and if you want to take it up a notch, accounting software can automate those calculations for you, giving you real-time insights into how your money’s doing.

Regularly checking these figures can help you spot trends and tweak your strategies as needed. Plus, staying organized with your records not only makes tax time a breeze but also boosts your overall financial health. This way, you can plan strategically for growth.

So, how do you keep track of your earnings and expenses? Let’s chat about it!

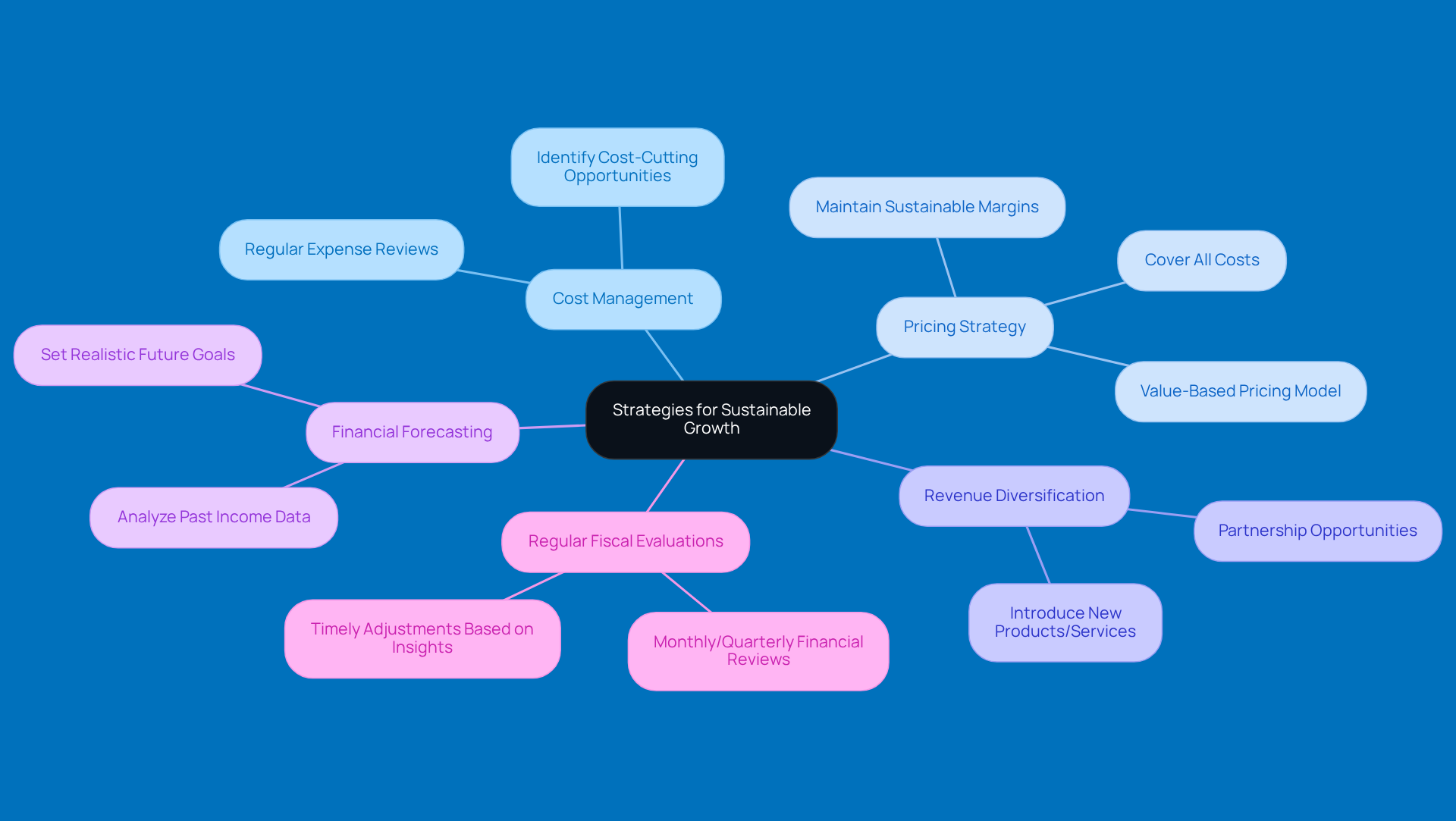

Leverage Income and Profit Insights: Strategies for Sustainable Growth

If you want to make the most of your income and profit insights, here are some key strategies that can really help small business owners like you:

-

Cost Management: Regularly check your expenses to find areas where you can cut back without sacrificing quality. This proactive approach can lead to some nice savings and better margins.

-

Pricing Strategy: Develop a pricing model that accurately reflects the value you provide to your customers. Make sure it covers all your costs and leaves you with a decent margin. Finding this balance is super important for keeping your business sustainable in the long run.

-

Revenue Diversification: Think about adding new revenue streams to boost your overall earnings. This might mean introducing new products or services or teaming up with partners to enhance what you offer.

-

Financial Forecasting: Use your past income v profit data to predict how you’ll perform in the future. Setting realistic goals based on these insights can really help with your strategic planning and resource allocation.

-

Regular Fiscal Evaluations: Make it a habit to review your financial statements monthly or quarterly. Staying on top of your financial health lets you make timely adjustments and informed decisions.

By putting these strategies into action, you can build a resilient business model that adapts to changing market conditions while keeping profitability in check. So, what do you think? Ready to give these a try?

Conclusion

Understanding the difference between income and profit is super important for small business owners aiming for financial success. Think of income as the total revenue you bring in from all your activities, while profit is what’s left after you’ve paid all your expenses. This distinction matters a lot because it shapes your budgeting, forecasting, and overall financial strategy. When you really get these concepts, you’re better equipped to make smart decisions that help your business grow sustainably and keep your finances in good shape.

Throughout this article, we’ve highlighted some key insights about:

- Keeping an eye on expenses

- Understanding profit margins

- Using financial tools like a fractional CFO for strategic advice

We’ve also talked about practical ways to calculate income and profit, stressing the importance of keeping meticulous records and regularly checking in on your financial health. Plus, we’ve outlined strategies for:

- Managing costs

- Setting prices

- Diversifying revenue

- Forecasting

At the end of the day, managing income and profit isn’t just about crunching numbers; it’s about building a resilient business that can tackle economic challenges and grab growth opportunities. So, I encourage you to embrace these strategies and insights to strengthen your financial foundation. By doing so, you’ll be setting yourself up to thrive in a competitive landscape. Remember, mastering the principles of income and profit management will lead to smarter decision-making and long-term success!

Frequently Asked Questions

What is the definition of income for small businesses?

Income is the total cash flow from all business activities before subtracting expenses, including earnings from sales, services, and other sources.

How is profit defined in relation to income?

Profit is what remains after all expenses, such as operating costs, taxes, and interest, have been deducted from income.

Why is it important for small business owners to understand the difference between income and profit?

Understanding the difference is crucial for budgeting, forecasting, and developing an overall money strategy, as high income with high expenses can lead to poor financial returns.

What role do expenses play in the relationship between income and profit?

Keeping a close eye on expenses is essential for achieving a balance between income and profit, as high costs can diminish overall returns despite impressive income figures.

How can understanding income and profit help a business grow?

By grasping the difference between income and profit, business owners can make smarter financial choices that promote sustainable growth and maintain healthy finances.