Introduction

Hey there! If you’re a small business owner, understanding the ins and outs of Limited Liability Companies (LLCs) is super important as you navigate the wild world of entrepreneurship. This guide is here to break down the essentials of LLC bookkeeping for you. We’ll highlight how good financial management not only protects your personal assets but also keeps you in line with those ever-changing tax regulations. But with so much at stake, you might be wondering: what are the best strategies to keep your records straight and dodge those costly mistakes? Let’s dive in!

Understand the Basics of an LLC

A Limited Liability Company (LLC) is a pretty flexible way to organize your business, blending the perks of both corporations and partnerships. One of the biggest benefits? It protects your personal assets from liabilities. So, if your LLC gets hit with lawsuits or debts, your personal stuff - like your home and savings - usually stays safe. This legal shield is super important for small business owners, as it helps reduce the risk of losing personal assets if financial troubles pop up.

LLCs also offer a lot of flexibility when it comes to management and taxes. You can choose to be taxed as a sole proprietorship, partnership, or corporation, which means you can tailor your tax strategy to save some serious cash. For example, opting for S Corporation taxation can really cut down on the income that gets hit with payroll tax, especially if your earnings go beyond what you’d typically take as a salary.

It’s no surprise that more and more small businesses are leaning towards LLCs because of these advantages. In fact, a good chunk of new businesses set up in recent years have gone with the LLC structure, showing just how popular it’s becoming for protecting personal assets while keeping tax obligations in check.

Real-life stories really drive home how effective LLCs can be in safeguarding personal assets. Take, for instance, a small retail shop that operated as an LLC and successfully defended itself against a lawsuit. Thanks to this structure, the owner’s home and personal savings stayed untouched. This example underscores how crucial it is to pick the right organizational setup to keep your personal finances secure.

Looking ahead to 2025, there are some updates to LLC regulations and tax implications that make them even more appealing. New laws now require LLCs to file a Beneficial Ownership Information report, which boosts transparency while still keeping those protective benefits intact. Understanding these basics is key for any small business owner thinking about forming an LLC, as it directly impacts LLC bookkeeping, liability exposure, and tax responsibilities. So, if you’re considering this route, it’s definitely worth diving into the details!

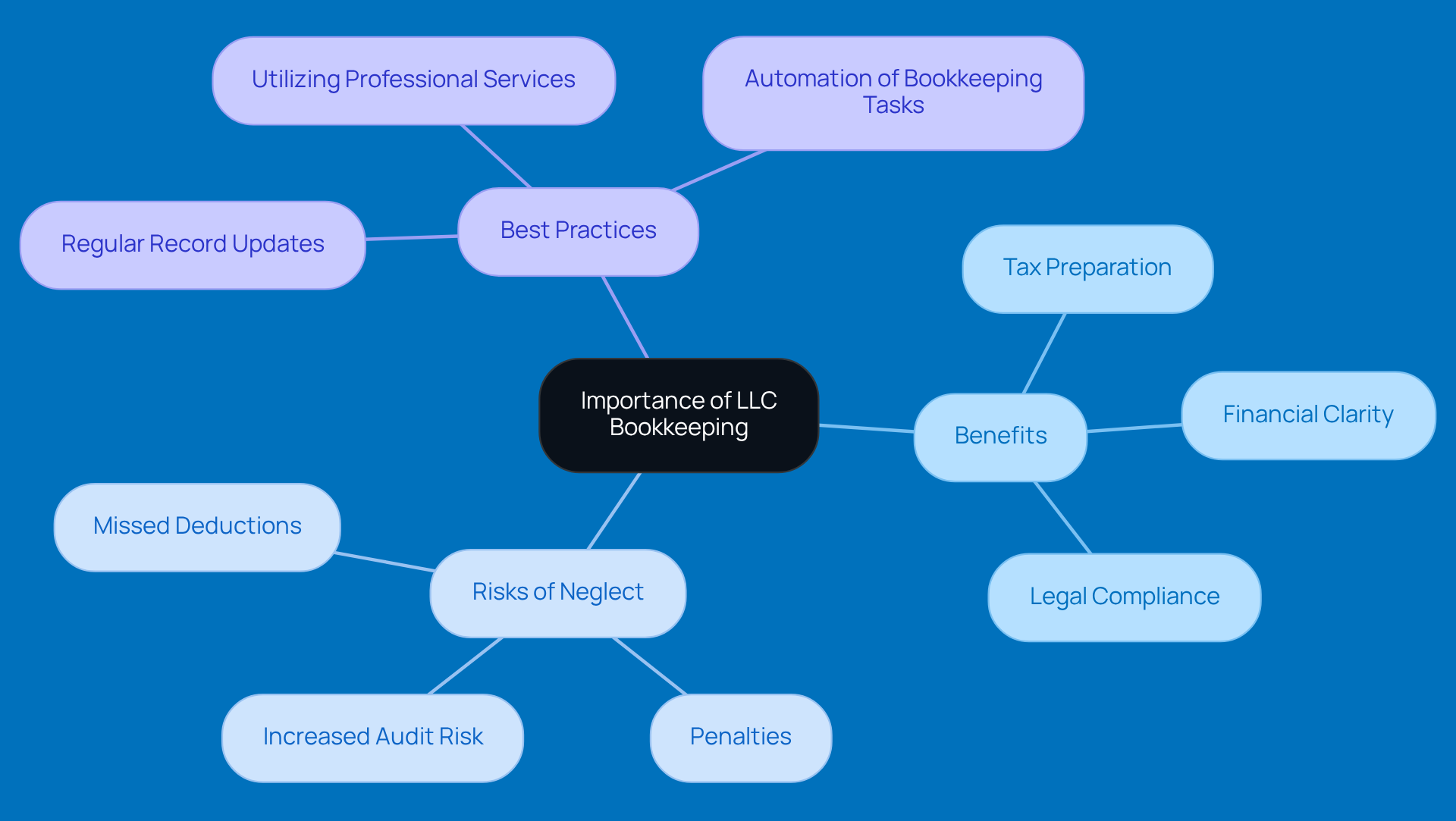

Recognize the Importance of LLC Bookkeeping

LLC bookkeeping is essential for keeping track of your money, especially due to the unique tax rules and legal considerations involved. When you keep your books in order, you can easily see how much you’re making and spending, get ready for tax season, and make smart choices for your business. Plus, it’s crucial for following state and federal laws, which can be pretty different for LLCs.

If you don’t keep up with your bookkeeping, you might miss out on deductions, face penalties for not following the rules, and lose sight of your financial health. Did you know that many entrepreneurs in California lose thousands every year just because they don’t claim accelerated depreciation or keep track of payroll credits properly? This often happens due to not having solid bookkeeping practices in place.

By regularly updating your records, you not only save yourself time and stress when tax season rolls around, but you also lower the chances of getting audited by the IRS. In fact, noncompliant recordkeeping can increase your audit risk by four times! Therefore, establishing a robust llc bookkeeping system is essential for any LLC owner aiming for long-term success.

What steps are you taking to keep your financial records in check?

Establish Your LLC Bookkeeping System

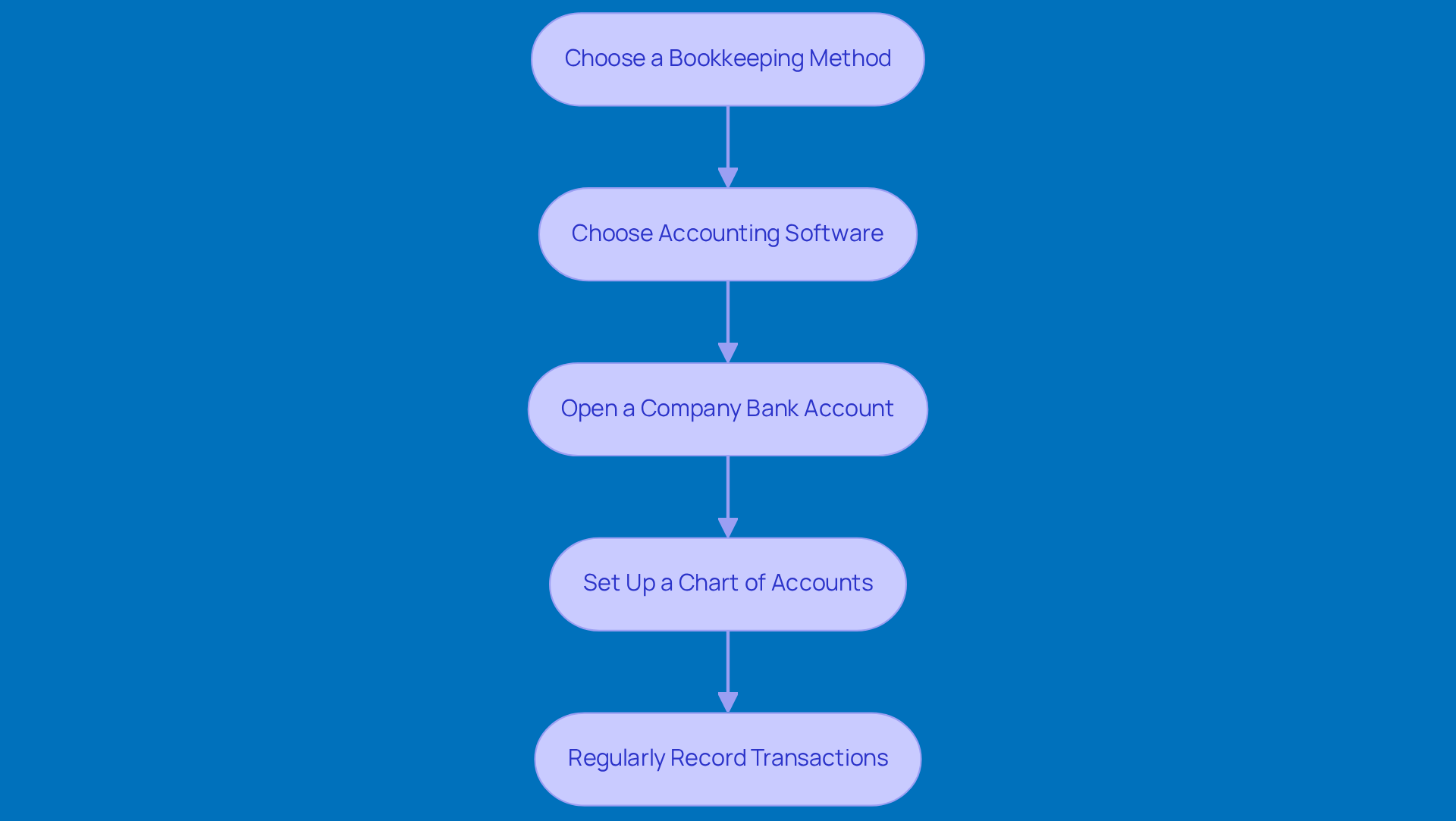

To set up your LLC bookkeeping system, just follow these simple steps:

-

Choose a Bookkeeping Method: First off, you’ll want to decide between cash basis and accrual basis accounting. The cash basis method records income and expenses when they’re actually received or paid, which is pretty straightforward for many small businesses. On the flip side, the accrual basis method logs transactions when they happen, no matter when cash changes hands. This can give you a clearer picture of your financial health, especially if your projects take a while to wrap up.

-

Choose Accounting Software: Next, think about investing in reliable accounting software that fits your business needs. Popular choices like QuickBooks, FreshBooks, and Xero can automate a lot of your bookkeeping tasks and improve your financial reporting. By 2025, cloud-based solutions are especially recommended for their real-time updates and easy access, making it easier to collaborate with your accountant.

-

Open a Company Bank Account: It’s super important to keep your personal and business finances separate, so open a dedicated company bank account. This not only simplifies tracking your income and expenses but also helps protect your LLC’s liability. Keeping your finances distinct and organized is key!

-

Set Up a Chart of Accounts: Now, let’s create a chart of accounts to categorize your income and expenses. This organization will help you generate financial reports and give you a clearer view of your financial activities, which is essential for making informed decisions.

-

Regularly Record Transactions: Finally, establish a routine for entering transactions into your bookkeeping system. Whether you do this daily, weekly, or monthly, consistency is crucial for keeping accurate records. Regularly reviewing financial statements, like profit and loss reports, is vital for tracking your business’s financial health and catching any potential issues early.

By following these steps, you’ll lay a solid foundation for your LLC bookkeeping system, setting yourself up for long-term success and financial clarity. And remember, Steinke and Company is here to help you choose the right entity and set up efficient financial systems tailored just for you!

Maintain and Update Your Bookkeeping Records

To keep your bookkeeping records in tip-top shape, here are some friendly tips to consider:

-

Schedule Regular Reviews: Set aside some time each month to go over your statements and reconcile your accounts. This little habit helps you catch any discrepancies early on and keeps your records accurate.

-

Keep Digital Copies of Receipts: Why not use a scanning app to store digital copies of your receipts and invoices? It saves you physical space and makes it a breeze to organize and find documents when you need them.

-

Stay Informed on Tax Changes: Tax laws can change faster than you can say "deduction!" So, it’s super important to stay updated on anything that might affect your LLC bookkeeping practices. Regularly check out resources like the IRS website or chat with a tax pro. Understanding your paystub and ensuring correct withholding can save you from headaches come tax time.

-

Backup Your Data: Don’t forget to back up your financial info regularly! This way, you won’t lose anything important due to technical hiccups. Cloud storage solutions are great for secure and easy access to your backups.

-

If LLC bookkeeping feels like a mountain to climb, consider hiring a professional bookkeeper or accountant. They bring expertise to the table and can help you navigate financial regulations, IRS audits, and your rights as a taxpayer. Plus, they can help you dodge underpayment penalties on estimated taxes, keeping your business financially healthy.

So, what do you think? Have you tried any of these tips before? Let’s keep the conversation going!

Conclusion

Understanding LLCs and their bookkeeping practices is super important for small business owners who want to protect their personal assets and make the most of their financial strategies. The perks of an LLC, like liability protection and flexible tax options, really make it a great choice. But to truly take advantage of these benefits, keeping your bookkeeping accurate and up-to-date is key.

In this article, we’ve highlighted some essential insights, from the basics of LLCs to practical steps for setting up a solid bookkeeping system. Regular financial reviews, using accounting software, and staying on top of tax changes are all crucial. These practices not only help you stay compliant but also boost your business's overall financial health.

At the end of the day, mastering LLC bookkeeping isn’t just about ticking boxes; it’s about empowering you, the small business owner, to make smart decisions and achieve lasting success. By putting the strategies we discussed into action and focusing on diligent financial management, you can tackle the complexities of business finances with confidence. So why wait? Start investing your time and resources into building a strong bookkeeping system today, and set yourself up for a bright and prosperous future!

Frequently Asked Questions

What is an LLC?

A Limited Liability Company (LLC) is a flexible business structure that combines the benefits of both corporations and partnerships, providing personal asset protection from liabilities.

What are the benefits of forming an LLC?

The main benefits of an LLC include protection of personal assets from lawsuits and debts, management and tax flexibility, and the ability to tailor tax strategies for potential savings.

How does an LLC protect personal assets?

If an LLC faces lawsuits or debts, the owner's personal assets, such as their home and savings, are typically shielded from being used to satisfy those liabilities.

What tax options are available for LLCs?

LLCs can choose to be taxed as a sole proprietorship, partnership, or corporation, allowing owners to customize their tax strategy based on their financial situation.

Why are LLCs becoming more popular among small businesses?

LLCs are increasingly favored by small businesses due to their advantages in protecting personal assets and managing tax obligations effectively.

Can you provide an example of how an LLC can safeguard personal assets?

An example is a small retail shop operating as an LLC that successfully defended itself against a lawsuit. As a result, the owner's home and personal savings remained untouched.

What upcoming changes to LLC regulations should business owners be aware of?

Starting in 2025, new laws will require LLCs to file a Beneficial Ownership Information report, enhancing transparency while maintaining the protective benefits of the LLC structure.

Why is it important for small business owners to understand LLC basics?

Understanding the basics of LLCs is crucial for small business owners as it affects bookkeeping, liability exposure, and tax responsibilities associated with their business structure.