Introduction

Navigating the world of LLC corporate tax rates can feel like a maze, especially for small business owners. Did you know that a whopping 96% of limited liability companies are classified as small businesses? That means the choice of tax structure isn’t just a detail; it can really shape your financial future and compliance responsibilities.

But here’s the thing: many entrepreneurs hit a wall, unsure of how to fine-tune their tax strategies without stepping into common traps. So, what’s the secret sauce for aligning your tax classification with your business goals? And how can you make sure you’re squeezing every last drop out of available deductions and credits? Let’s dive in and explore!

Clarify LLC Structure and Tax Implications

Managing your LLC's tax obligations, including the LLC corporate tax rate, can feel a bit overwhelming, but it doesn’t have to be! Let’s break down the different structures you can choose from:

-

Single-Member LLC: Think of this as a solo act. It’s classified as a disregarded entity for tax purposes, meaning you’ll report profits and losses right on your personal tax return using Schedule C. This setup makes tax filing a breeze, but keep in mind that you might face self-employment taxes, which are at 15.3% as of 2025. Plus, don’t forget about underpayment penalties! The IRS wants at least 90% of your current year’s tax obligation paid throughout the year to avoid any nasty surprises.

-

Multi-Member LLC: If you’ve got a partner or two, this is likely your route. Typically treated as a partnership, you’ll need to file Form 1065. Each member reports their share of profits on their personal tax returns, which means you get those sweet pass-through taxation benefits. Fun fact: about 23% of limited liability companies have two members! This structure also gives you more flexibility in how you distribute profits. Just be aware of the IRS's safe harbor provisions - they can help you dodge underpayment penalties if you meet the required prepayment benchmarks.

-

LLC Electing S-Corp Status: Now, this option is a game changer! It lets your LLC avoid double taxation by passing income directly to shareholders, who then report it on their personal tax returns. This can really lower those self-employment taxes, making it a popular choice for many small business owners. Just remember, understanding the implications of the LLC corporate tax rate classification is key, especially when it comes to IRS audits. Keeping accurate records and staying compliant can save you a lot of stress down the line.

So, why does all this matter? Well, understanding these classifications is crucial for you as a business owner. Picking the right structure can align perfectly with your financial goals and compliance needs. With a whopping 96% of limited liability companies classified as small businesses, choosing the right tax treatment can lead to some serious advantages. As Jack Nicholaisen wisely points out, "Limited Liability Companies that have a clear business plan are more likely to succeed and grow." So, let’s get strategic about your tax management!

Explore LLC Corporate Tax Rates by Classification

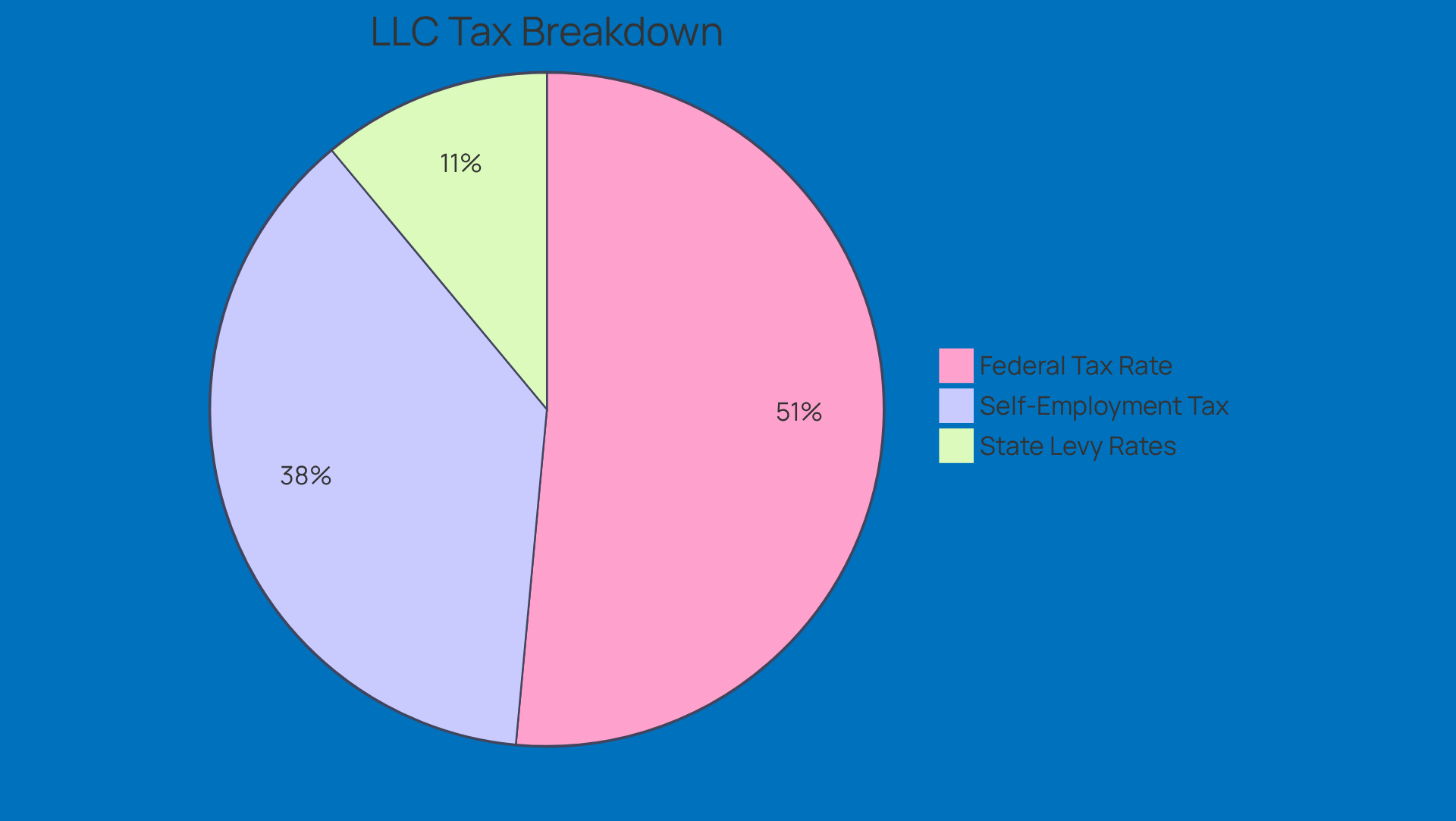

When it comes to tax rates for LLCs, things can get a bit tricky, but let’s break it down together:

-

Federal Tax Rate: Starting in 2026, the federal corporate tax rate is set at 21% for C Corporations. But here’s the good news for LLCs: they usually enjoy pass-through taxation. This means that profits are taxed at the individual member's tax rate, which can range from 10% to 37%, depending on how much you earn. This setup can help LLC owners lower their overall tax burden compared to traditional corporations. Pretty neat, right?

-

State Levy Rates: Now, let’s talk about state taxes. Many states have their own corporate income taxes, and these can vary quite a bit - from 0% to over 9%! For example, Pennsylvania has a flat rate of 7.49% for 2026. It’s super important to know your state’s specific rates and rules because they can really affect your business’s financial game plan.

-

Self-Employment Tax: Don’t forget about self-employment taxes! LLC members need to keep in mind that there’s a 15.3% tax for Social Security and Medicare on net earnings. This can add to your overall tax liability, so it’s something to consider.

By getting a solid grasp on the LLC corporate tax rate, LLC owners can better estimate their tax obligations and plan their finances wisely. This way, they can stay compliant while also optimizing their tax positions. So, what do you think? Are you ready to tackle your tax planning with confidence?

Implement Strategies for Tax Optimization and Compliance

If you want to optimize your LLC's tax situation, here are some friendly strategies to consider:

-

Choose the Right Tax Classification: Have you thought about how your LLC should be taxed? Whether it’s as a sole proprietorship, partnership, or S-Corp, each option has its own tax implications that can significantly influence your overall LLC corporate tax rate.

-

Maximize Deductions: Keeping track of all your business-related expenses is key! Think about operational costs, home office deductions, and health insurance premiums. These deductions can really help lower your taxable income. Did you know that small business owners typically claim around $12,000 in deductions each year? That’s a big deal, so make sure you document everything carefully.

-

Utilize the Qualified Business Income (QBI) Deduction: If you qualify, this deduction lets you deduct up to 20% of your qualified business income. That could mean some serious tax savings! Just a heads up, starting in 2026, this deduction will start phasing out for individuals earning above certain thresholds, so it’s smart to plan ahead.

-

Plan for Self-Employment Taxes: It’s a good idea to set aside funds for self-employment taxes. Consider making estimated tax payments throughout the year to dodge any penalties. This proactive approach can really help with cash flow and keep you compliant.

-

Stay Informed on Tax Law Changes: Tax laws change all the time! Make it a habit to review updates that could impact your LLC. Chatting with a tax professional can give you valuable insights into new opportunities for tax savings, helping you stay compliant while maximizing your financial outcomes.

By putting these strategies into action, you can enhance your tax compliance and really optimize your financial results in light of the LLC corporate tax rate. So, what are you waiting for? Let’s get started!

Conclusion

Understanding LLC corporate tax rates and structures can feel a bit overwhelming, right? But for small business owners, getting a grip on this is key to optimizing financial outcomes. By choosing the right classification - whether it’s a single-member LLC, a multi-member LLC, or even electing S-Corp status - you can really make a difference in your tax obligations and overall financial health. The right choice not only simplifies tax filing but also aligns with your financial goals, paving the way for growth and success.

Throughout this article, we’ve highlighted some key strategies to help you navigate the complexities of LLC taxation. Think about:

- maximizing deductions

- utilizing the Qualified Business Income deduction

- planning for self-employment taxes

Staying updated on tax law changes and actively managing your tax obligations are crucial steps to avoid any nasty surprises come tax season. Each of these insights contributes to a comprehensive approach to tax management that can lead to some serious savings.

So, let’s wrap this up! The importance of understanding LLC corporate tax rates and implementing effective tax strategies can’t be stressed enough. Small business owners should definitely take proactive steps in their tax planning. By leveraging the benefits of your chosen LLC structure, you can minimize liabilities and boost profitability. This way, you’re not just securing your financial future; you’re also setting your business up for sustained growth in an ever-changing economic landscape. Ready to take charge of your tax strategy?

Frequently Asked Questions

What is a Single-Member LLC and how is it taxed?

A Single-Member LLC is classified as a disregarded entity for tax purposes, meaning profits and losses are reported on the owner's personal tax return using Schedule C. While tax filing is straightforward, the owner may face self-employment taxes of 15.3% as of 2025 and must ensure at least 90% of the current year’s tax obligation is paid throughout the year to avoid penalties.

How does a Multi-Member LLC operate in terms of taxation?

A Multi-Member LLC is typically treated as a partnership and must file Form 1065. Each member reports their share of profits on their personal tax returns, benefiting from pass-through taxation. This structure also allows for flexible profit distribution, but members should be aware of IRS safe harbor provisions to avoid underpayment penalties.

What are the benefits of an LLC electing S-Corp status?

An LLC electing S-Corp status can avoid double taxation by passing income directly to shareholders, who report it on their personal tax returns. This option can significantly lower self-employment taxes, making it popular among small business owners. However, it's crucial to understand the implications of the LLC corporate tax rate classification and maintain accurate records for compliance.

Why is it important for business owners to understand LLC structures and tax implications?

Understanding LLC structures and their tax implications is vital for business owners as it helps align their business structure with financial goals and compliance needs. Choosing the right tax treatment can offer significant advantages, especially since 96% of limited liability companies are classified as small businesses.