Introduction

Navigating the complexities of the R&D tax credit carryforward can really change the game for small agencies, especially those trying to innovate while keeping an eye on their budgets. This federal program not only encourages research and development but also lets companies carry forward any unused credits. That could mean turning future tax liabilities into some serious savings!

But let’s be honest - understanding all the rules and making the most of these benefits can feel overwhelming. How can small businesses make sure they’re not leaving money on the table while still keeping up with the ever-changing regulations? It's a lot to think about, right?

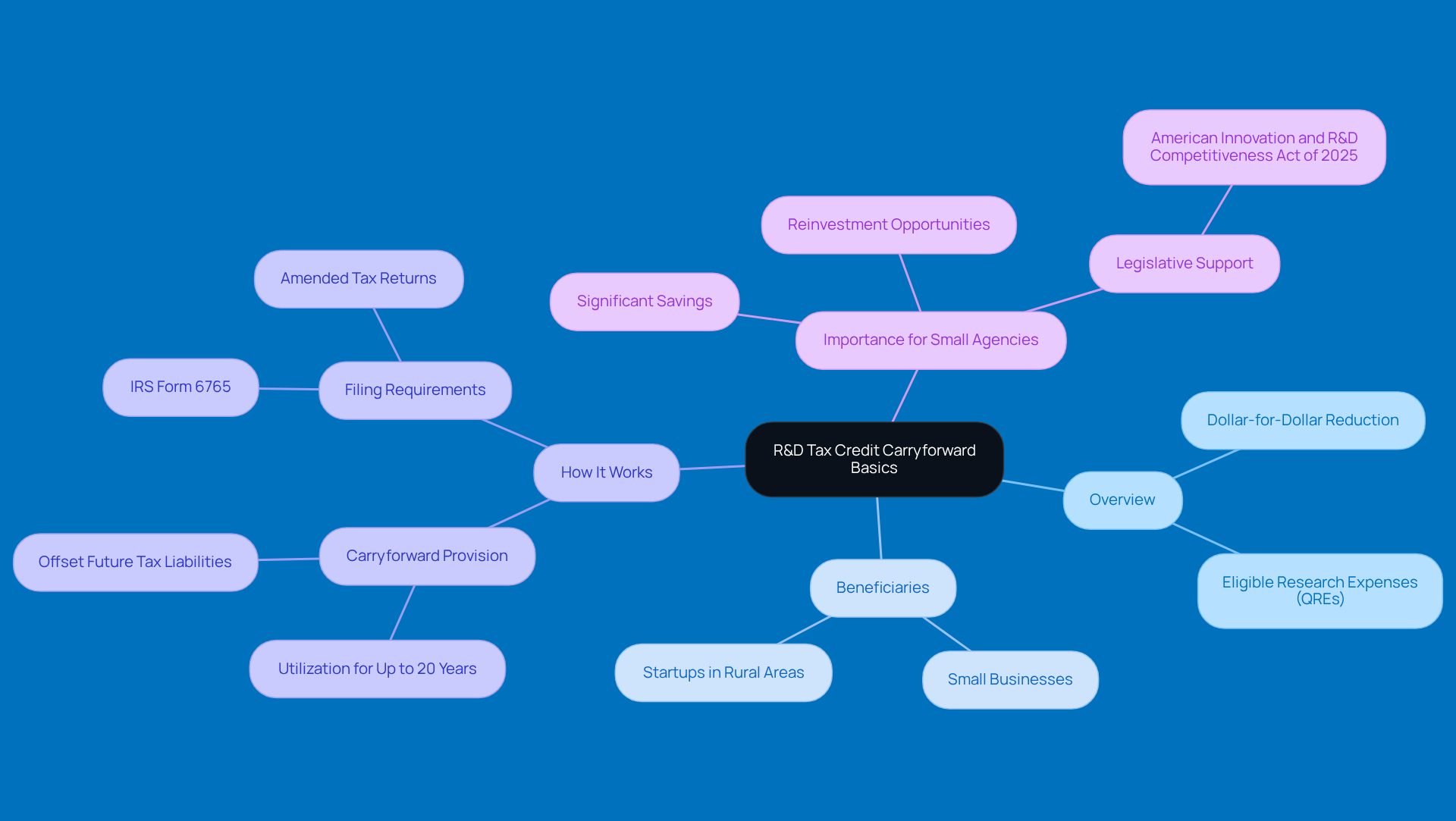

Understand R&D Tax Credit Carryforward Basics

The R&D tax incentive is a federal program designed to encourage companies to invest in research and development activities. One key feature of this program is the R&D tax credit carryforward provision, which allows companies to utilize any unused allowances from previous years to reduce their future tax bills. Let’s break it down:

- What’s it all about? The R&D tax incentive gives you a dollar-for-dollar reduction in tax obligations for eligible research expenses (QREs) you rack up during the tax year.

- Who can benefit? Small businesses that are working on creating or improving products, processes, or software might just qualify for this incentive.

- How does the carryforward work? If a company can’t fully use its R&D tax incentive in the year it’s earned, it can utilize the R&D tax credit carryforward for the unused portion for up to 20 years. This means you can lower your tax obligations in the future, which can really help with cash flow. In fact, research shows that for every $1 of R&D tax incentive, you could see between $1 and $4 in new R&D investment. That’s a pretty big deal for business growth!

- Why does it matter for small agencies? For small agencies, especially those in rural areas, getting a handle on this financial benefit can lead to significant savings. This allows them to reinvest in their operations and foster growth. Plus, with legislative efforts like the American Innovation and R&D Competitiveness Act of 2025 aiming to enhance these incentives, it’s super important for small agency owners to stay in the loop about these changes.

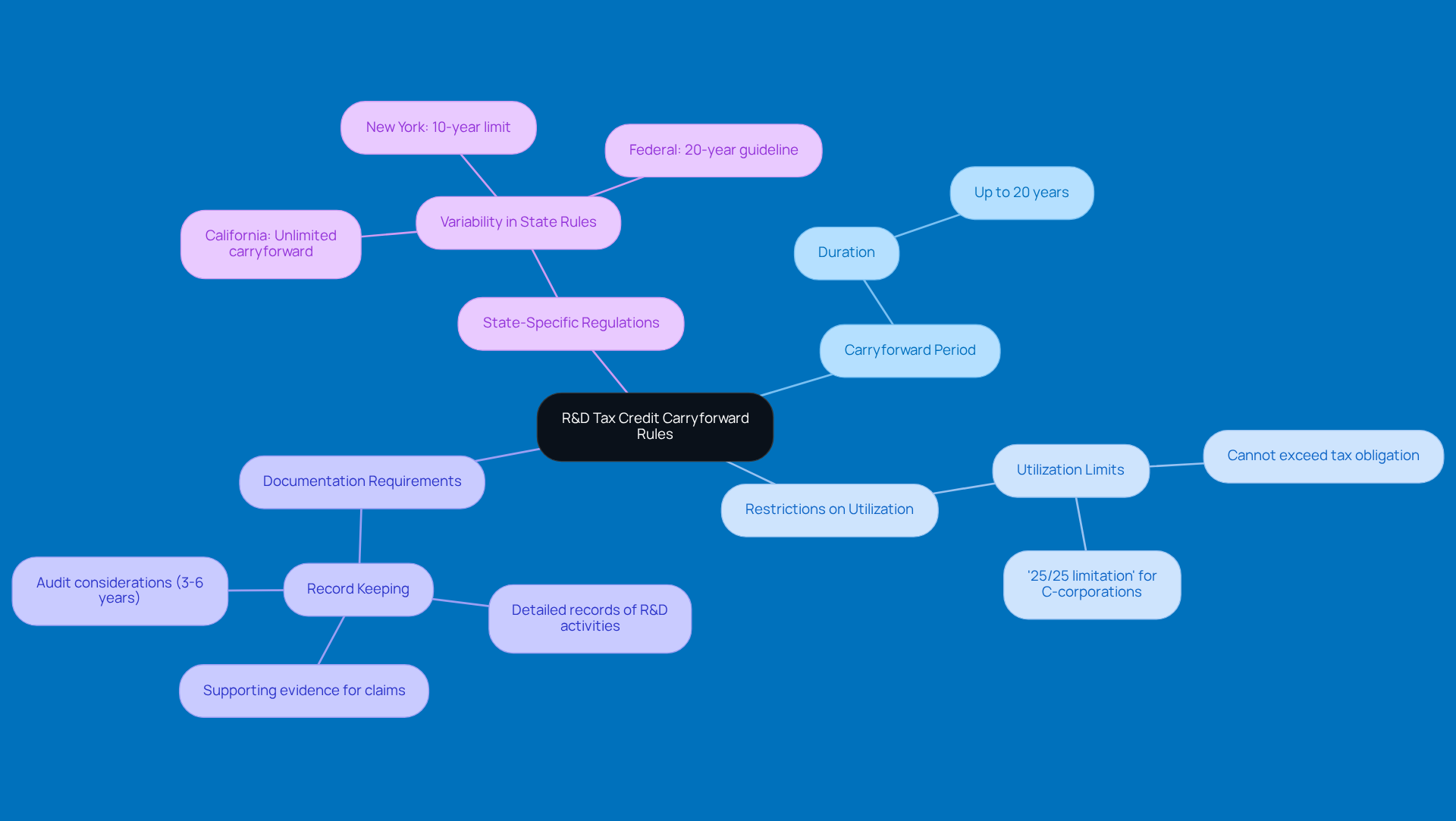

Explore R&D Tax Credit Carryforward Rules and Limitations

Navigating the rules and limitations of the R&D tax credit carryforward is super important if you want to make the most of its benefits. Let’s break down the key points:

-

Carryforward Period: You can carry forward unused R&D tax incentives for up to 20 years. That’s a long time! This gives companies a chance to use the R&D tax credit carryforward when they might be facing bigger tax bills.

-

Restrictions on Utilization: It’s crucial to understand the limits on how much of the funding you can use in any given year. For instance, if your tax obligation is $10,000, you can’t use more than that in offsets, even if you have more available. Plus, thanks to the Tax Cuts and Jobs Act, there’s a '25/25 limitation' for C-corporations. This means if you have over $25,000 in regular tax liability, you can’t reduce more than 75% of your tax obligation through R&D incentives.

-

Documentation Requirements: To claim the tax credit, businesses need to keep detailed records of their R&D activities and expenses. This includes project descriptions, costs, and any supporting evidence that shows what the research is all about. It’s really important to hang onto this documentation, especially since the IRS can audit claims within a typical three-year statute of limitations. If they suspect fraud, that audit window could stretch to six years!

-

State-Specific Regulations: Don’t forget that some states have their own rules about R&D tax incentives, which might be different from federal regulations. For example, California allows an unlimited carryover period, while New York limits it to 10 years. States vary in their R&D tax incentive rules, with some sticking to the federal 20-year guideline and others being more or less flexible. So, it’s a good idea for businesses to check out state-specific guidelines to stay compliant and maximize their benefits.

By navigating these rules effectively, small agencies can truly optimize their R&D tax credit carryforward. This way, they can take full advantage of available tax savings while staying on the right side of regulations!

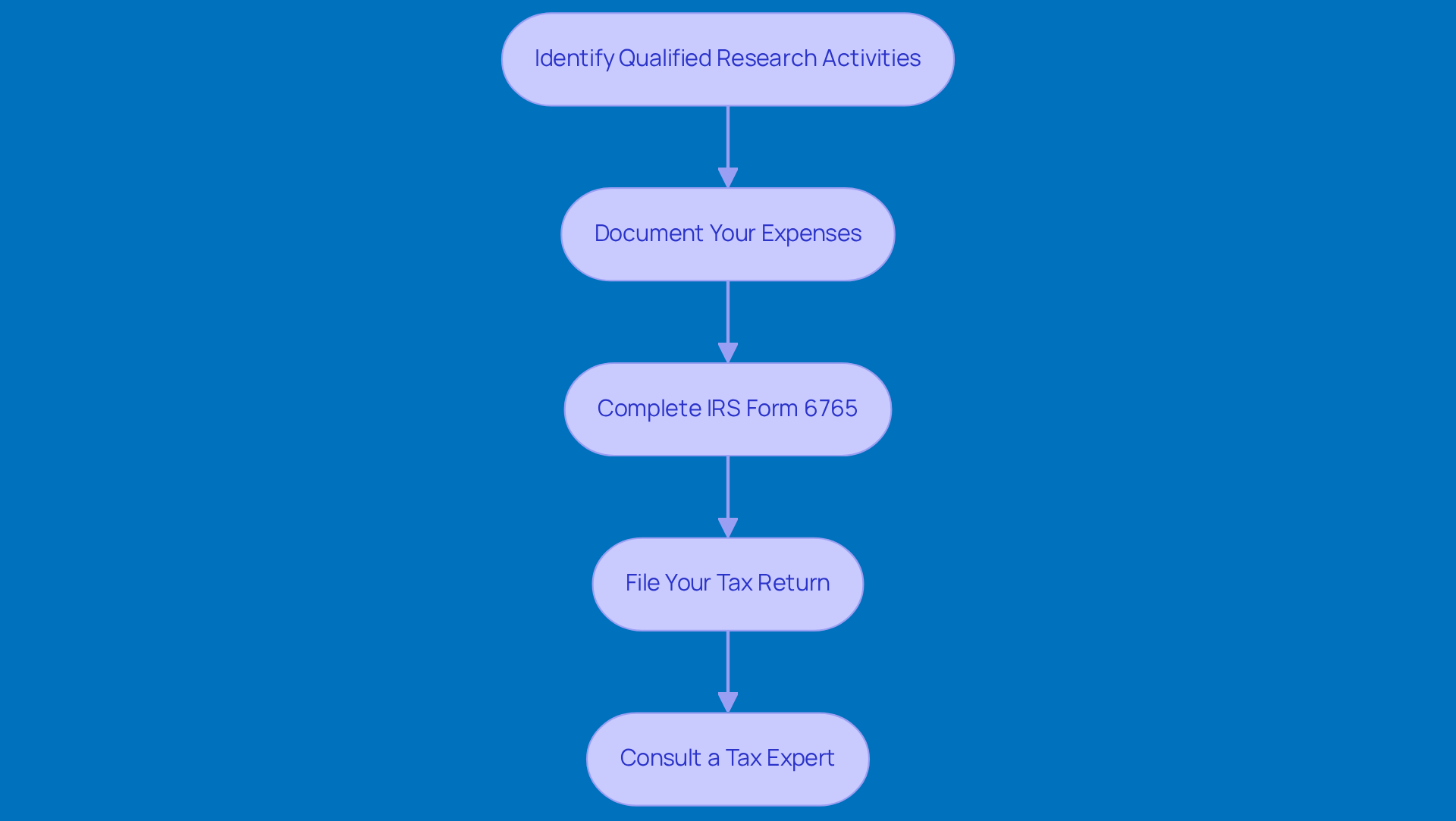

Claim and Utilize Your R&D Tax Credits Effectively

To effectively claim and make the most of your R&D tax credits, just follow these simple steps:

-

Identify Qualified Research Activities (QRAs): First things first, figure out which activities qualify for the R&D tax credit. This usually involves developing new products, processes, or software that come with some technical uncertainty. For example, companies like Computer Controlled Solutions Ltd nailed it by pinpointing qualifying activities with a little help from specialists, which really boosted their innovation recognition. Similarly, Hone-All Precision Ltd found expert guidance invaluable, leading to successful claims for R&D tax relief.

-

Document Your Expenses: Next up, keep detailed records of all expenses tied to your R&D activities. This means tracking wages for employees involved in R&D, supplies used, and any contract research expenses. On average, small businesses rack up significant costs for R&D, which are crucial for optimizing claims. Many companies often share their average costs, which can really impact their total claims.

-

Complete IRS Form 6765: Ready to claim your benefit? Fill out IRS Form 6765, which helps calculate how much you’re eligible for based on your documented expenses. Just make sure all your info is accurate and complete to dodge any delays or audits. Heads up: the IRS has updated Form 6765 for 2026, so there are new documentation requirements to follow, including more detailed breakdowns of employee time spent on qualifying versus non-qualifying work.

-

File Your Tax Return: Don’t forget to attach Form 6765 to your business tax return! If you have forward-looking benefits, make sure they’re documented and included in your filing. Understanding the ins and outs of R&D tax credit carryforward provisions can really help you maximize your borrowing potential.

-

Consult a Tax Expert: Given how tricky tax regulations can be, it’s a smart move to chat with a tax expert who specializes in R&D tax incentives. Their expertise can help ensure you’re optimizing your claim and meeting all the requirements. Just look at companies like AnyVan Ltd, which really benefited from expert advice in identifying and claiming their innovation perks.

Access Tools and Resources for R&D Tax Credit Management

Managing your r&d tax credit carryforward doesn’t have to be a headache! Here are some handy tools and resources to help you navigate the process:

-

Tax Incentive Software: Think about investing in tax incentive management software. Tools like KBKG and Gusto make it super easy to track your R&D expenses and generate the reports you need. They streamline everything from data gathering to documentation, helping you stay compliant and maximize the benefits of your r&d tax credit carryforward.

-

IRS Resources: Don’t forget to check out the IRS website for the latest info on R&D tax incentives. You’ll find instructions for Form 6765 and guidelines on eligibility and documentation. With the IRS ramping up scrutiny by 1% more in 2026, linked to a 0.4% drop in R&D incentives, staying informed about the R&D tax credit carryforward is essential!

-

Professional Services: Consider teaming up with tax experts or consultants who know the ins and outs of R&D tax incentives. Steinke and Company, for instance, offers top-notch tax compliance and preparation services. They can help you prepare and file your corporate and personal returns, ensuring you’re compliant and minimizing any surprises. As KBKG puts it, 'Determining eligibility, aligning Section 174 treatment, and defending claims require technical, tax, and documentation expertise, which should be handled by a qualified R&D tax credit carryforward provider.'

-

Online Communities and Forums: Why not join some online forums or communities focused on small business tax strategies? These platforms can be goldmines for insights, tips, and shared experiences from fellow small business owners navigating the R&D tax landscape. Engaging with others can really boost your understanding and approach to snagging those benefits efficiently.

-

Important Deadlines: Just a heads-up-small businesses need to make retroactive elections for the r&d tax credit carryforward by July 6, 2026. Mark that date on your calendar! It’s crucial for capturing potential refunds and maximizing your benefits.

Conclusion

Mastering the R&D tax credit carryforward is super important for small agencies that want to boost their financial health and grow. By getting a handle on this federal program, businesses can turn those unused tax credits into valuable resources that fuel innovation and reinvestment. This guide has shed light on how to navigate the ins and outs of R&D tax credit carryforward, helping small agencies make the most of their benefits and secure their financial future.

So, what are the key takeaways? First off, it’s all about:

- Identifying qualified research activities

- Keeping solid documentation

- Staying on top of both federal and state regulations

The carryforward provision lets you apply unused credits for up to 20 years, which is a fantastic chance for small businesses to improve their cash flow. And hey, using tools, software, and expert resources can really simplify the claims process, making it easier to tap into these financial incentives.

In the end, the R&D tax credit carryforward isn’t just a tax perk; it’s a strategic chance for small agencies to invest in their future. By staying updated on current regulations and following best practices for claiming these credits, businesses can unlock some serious savings and reinvest in innovation. So, why not seize this opportunity to strengthen your agency’s financial resilience and drive growth through smart use of R&D tax credits?

Frequently Asked Questions

What is the R&D tax credit carryforward?

The R&D tax credit carryforward is a provision that allows companies to use any unused R&D tax incentives from previous years to reduce their future tax bills.

What is the purpose of the R&D tax incentive?

The R&D tax incentive is a federal program designed to encourage companies to invest in research and development activities by providing a dollar-for-dollar reduction in tax obligations for eligible research expenses.

Who can benefit from the R&D tax incentive?

Small businesses that are working on creating or improving products, processes, or software may qualify for the R&D tax incentive.

How long can companies utilize the R&D tax credit carryforward?

Companies can utilize the R&D tax credit carryforward for up to 20 years for any unused portion of their R&D tax incentive.

What impact can the R&D tax incentive have on business growth?

Research indicates that for every $1 of R&D tax incentive, businesses could see between $1 and $4 in new R&D investment, which can significantly contribute to business growth.

Why is the R&D tax credit carryforward important for small agencies?

For small agencies, particularly in rural areas, understanding and utilizing the R&D tax credit carryforward can lead to significant savings, allowing them to reinvest in their operations and promote growth.

What legislative efforts are aimed at enhancing R&D tax incentives?

The American Innovation and R&D Competitiveness Act of 2025 is an example of legislative efforts aimed at enhancing R&D tax incentives, making it important for small agency owners to stay informed about these changes.