Introduction

Keeping records is super important for any small business, but let’s be honest - managing all those financial documents can feel like a daunting task. A solid system not only helps you stay on the right side of tax regulations but also makes your operations run smoother. This can lead to smarter decisions and even growth! But with so many methods and tools out there, how do you, as a small business owner, find your way through the record-keeping maze to discover what really works? Let's dive in!

Establish a Systematic Record Keeping Approach

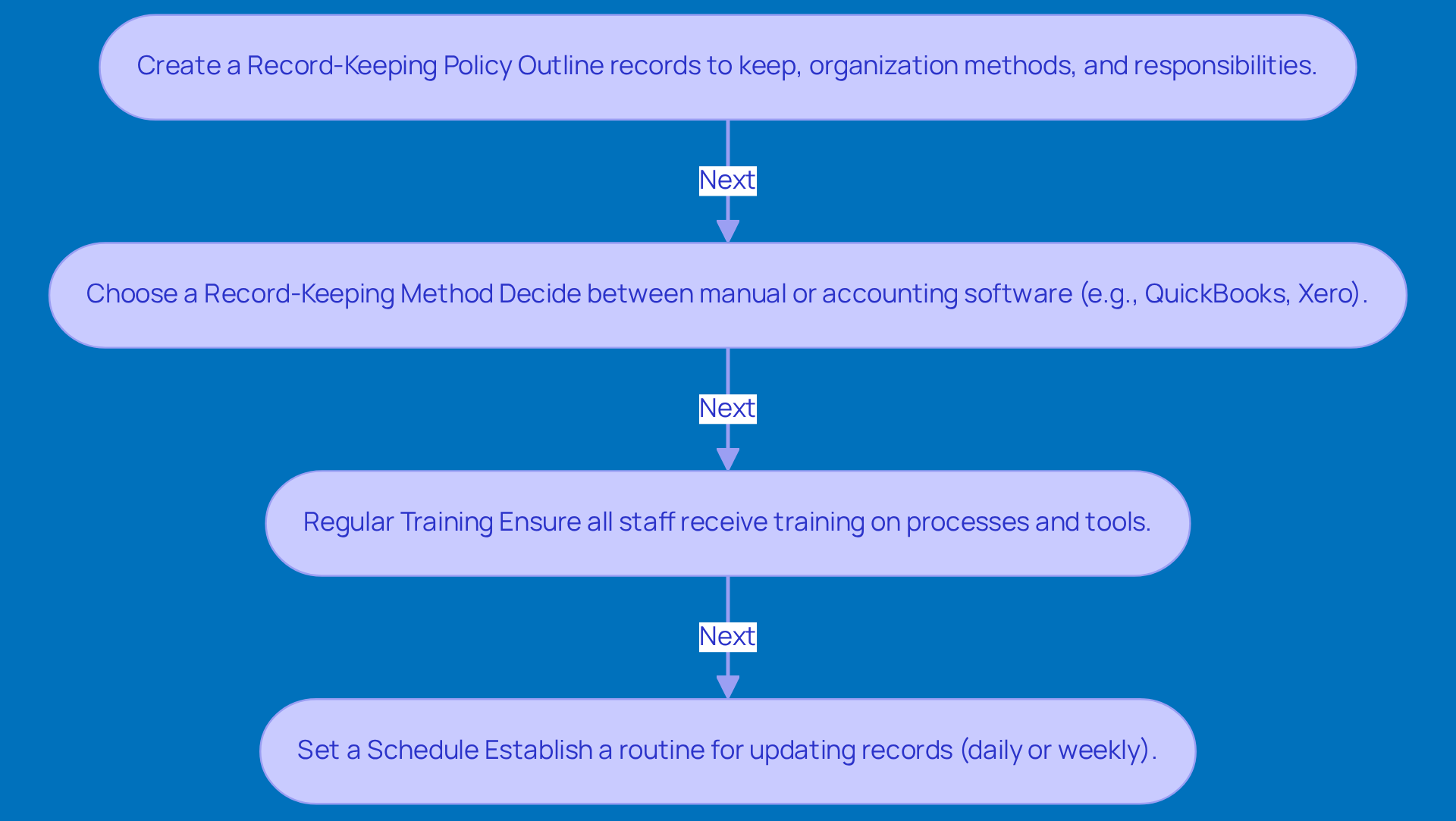

If you're a small business owner looking to establish effective record keeping for small business, starting with a clear process for documenting all your monetary transactions is key. Here’s how to kick things off:

-

Create a Record-Keeping Policy: First things first, outline what records you need to keep, how you’ll organize them, and who’s in charge of maintaining them. This policy will serve as your go-to guide for all things money-related, especially in terms of record keeping for small business, helping you stay compliant with tax regulations and avoiding any surprises come tax season. Trust me, this is a big part of what Steinke and Company focuses on.

-

Choose a Record-Keeping Method: Next up, decide if you want to go the manual route or use accounting software. Tools like QuickBooks or Xero can automate a lot of tasks, which means fewer chances for human error and a boost in efficiency. Did you know that companies with solid financial management practices have seen revenue growth of up to 25%? Plus, a good record keeping for small business system makes tax prep a breeze, which aligns perfectly with what Steinke and Company offers.

-

Regular Training: It’s super important to make sure everyone involved in record-keeping gets proper training on the processes and tools you’re using. Consistent training helps keep things accurate and uniform. Without it, you might run into common pitfalls, like relying too much on paper documentation-something 45% of small and midsize enterprises still do! Training also equips your staff to handle tax inquiries and compliance issues effectively, which is crucial for tapping into Steinke and Company’s expertise.

-

Set a Schedule: Finally, establish a routine for updating your records, whether that’s daily or weekly. This way, you won’t miss any transactions. Regular updates are vital for keeping your financial data accurate; in fact, better billing processes can cut payment delays by 40%! This proactive approach not only helps with budget management but also ensures you’re ready for tax season, reducing that last-minute stress.

By following these steps, you’ll lay a solid foundation for record keeping for small business, which will make it easier to stick to tax regulations and prepare for audits. For example, a small marketing agency improved its financial management through better record-keeping, leading to significant operational efficiencies and happier clients. So, why not take the plunge and start organizing your records today?

Identify Essential Records for Compliance and Operations

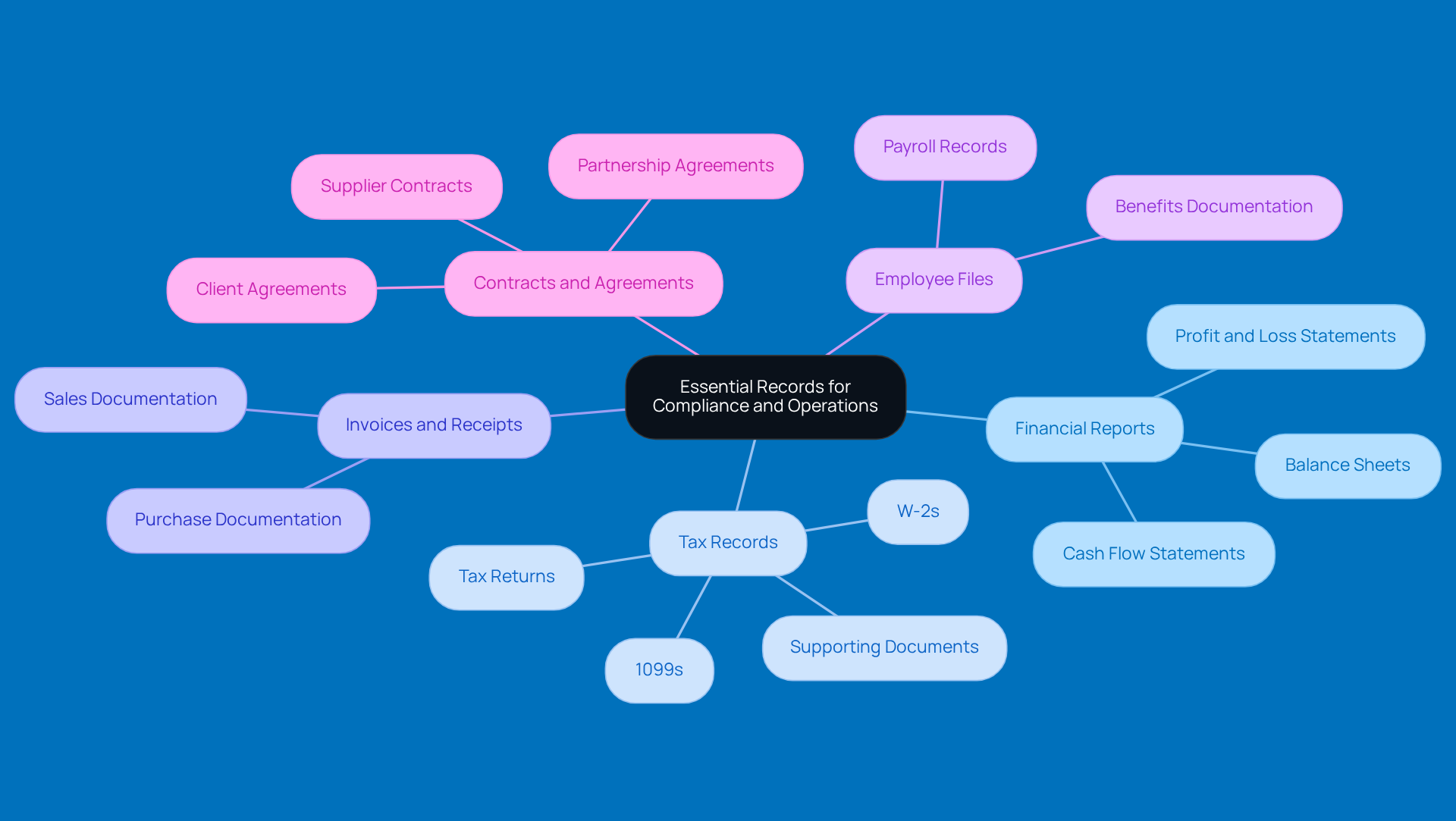

Hey there! If you’re running a small business, record keeping for small business is extremely important for keeping your documents organized. It not only helps you stay compliant but also keeps your operations running smoothly. Let’s break down some essential records you should have:

-

Financial Reports: Think of profit and loss statements, balance sheets, and cash flow statements as your business’s health check-up. They’re crucial for understanding how your organization is doing financially and for making smart decisions.

-

Tax Records: You’ll want to hang onto copies of your tax returns, W-2s, 1099s, and any supporting documents for at least three to seven years. This is a must according to IRS guidelines! Keeping these records safe helps you prepare for audits and ensures you’re reporting everything accurately.

-

Invoices and Receipts: Don’t forget to document all your sales and purchases! This is key for tracking your income and expenses. Plus, it makes tax reporting a breeze and helps you analyze your finances better.

-

Employee Files: It’s essential to keep detailed records of your employees, including payroll and benefits. This not only helps you comply with labor laws but also ensures you’re meeting your tax obligations.

-

Contracts and Agreements: Make sure to keep copies of all agreements with clients, suppliers, and partners. This protects your interests and clarifies everyone’s responsibilities.

By taking the time to organize these important documents, you’ll be setting yourself up for success in record keeping for small business. You’ll reduce risks and make informed decisions based on reliable data. So, why not start sorting through those files today? You’ve got this!

Leverage Technology for Efficient Record Management

If you're a small business owner looking to improve your record keeping for small business, technology can be a game changer! Here are some friendly suggestions to get you started:

-

Cloud-Based Accounting Software: Think about using platforms like QuickBooks Online or FreshBooks. They can help automate your bookkeeping tasks, track expenses, and whip up financial reports without breaking a sweat.

-

Document Management Systems: Ever feel overwhelmed by piles of paperwork? Implementing a document management system can help you store and organize your files digitally, making it super easy to find what you need when you need it.

-

Automated Backups: Nobody likes losing important data. Regular backups are a must! Many cloud solutions offer automatic backup features, so you can rest easy knowing your files are safe.

-

Mobile Apps: On the go? No problem! Mobile apps for expense tracking and invoicing let you manage your records anytime, anywhere. It’s like having your office in your pocket!

-

Integration with Other Tools: Look for software that plays nice with other tools you use, like CRM systems. This can streamline your workflows and cut down on the hassle of duplicate data entry.

By embracing these tech solutions, you can enhance your record keeping for small business efficiency and focus more on what really matters-growing your business and strategizing for the future. So, what do you think? Ready to give it a try?

Implement Regular Review and Reconciliation Practices

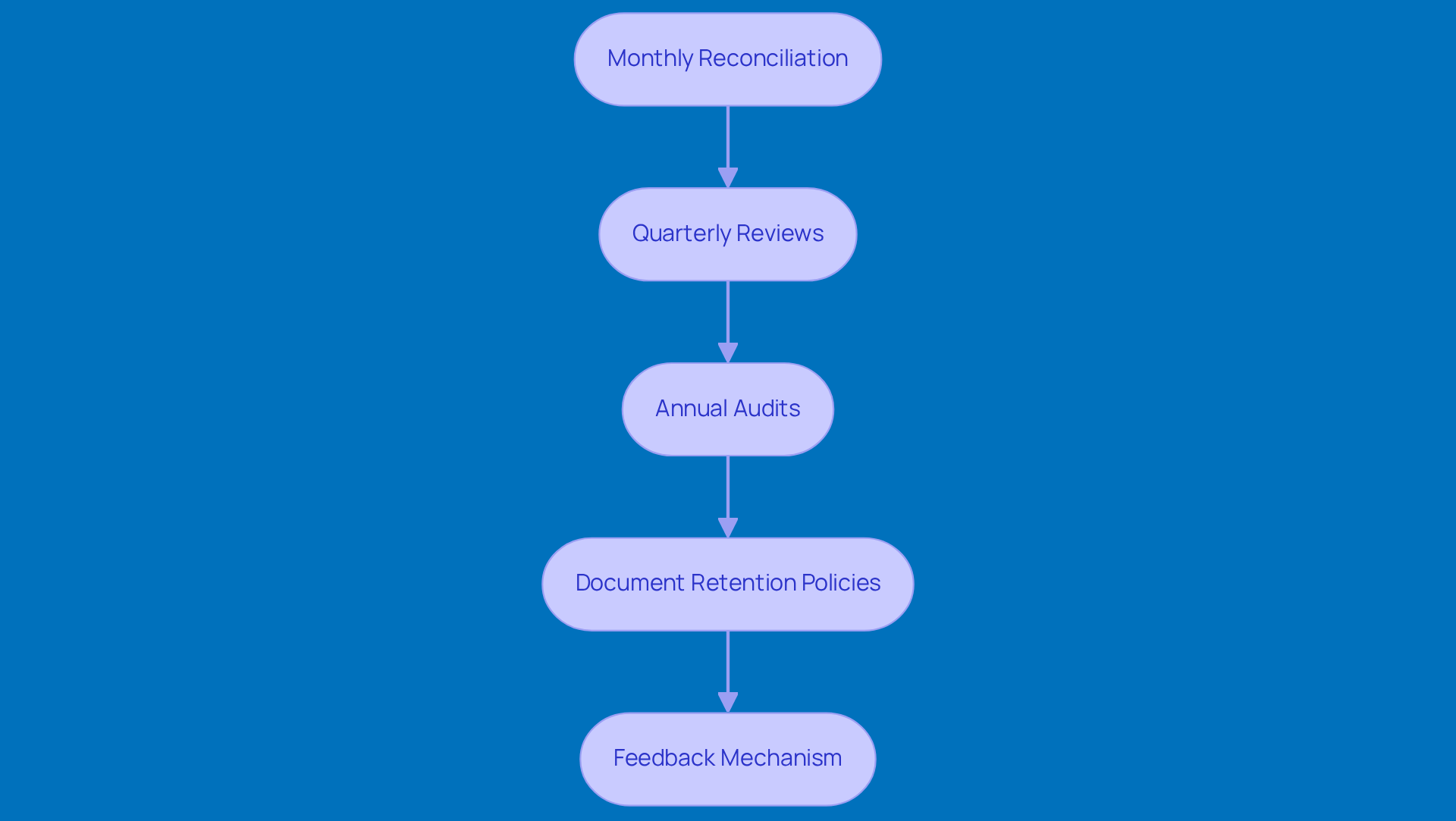

To maintain excellent record keeping for small business, small businesses should definitely get into the habit of regular reviews and reconciliations. Here’s how:

-

Monthly Reconciliation: It’s a good idea to compare your bank statements with your internal records every month. This way, you can make sure all transactions are accounted for and any discrepancies are sorted out quickly. Think of it as a way to verify that your income matches what’s on your paystubs. After all, you want to be sure you’re getting paid correctly and that the right amounts are being withheld. Plus, understanding your paystub breakdown can help clear up any confusion.

-

Quarterly Reviews: Every three months, take a moment to evaluate your statements. This helps you get a grip on your business’s financial health and make any necessary adjustments. It’s kind of like checking where your money is going, similar to looking at deductions on your paystub. This insight can really help you make smarter financial decisions.

-

Annual Audits: Have you thought about bringing in an external auditor each year? They can take a look at your financial documents and give you an unbiased evaluation of your compliance and accuracy. This step can be a lifesaver when preparing for potential IRS audits, ensuring your files are organized and you’ve kept copies of all important documents. Getting familiar with the IRS audit process can also help ease any worries you might have.

-

Document Retention Policies: It’s crucial to set up policies for how long you should keep files and when to toss them. This ensures you’re following legal requirements. For instance, keeping tax documentation for at least three years after the due date is a must, as it aligns with IRS guidelines for retention.

-

Feedback Mechanism: Create a way for your employees to report any discrepancies or issues they notice in the record-keeping process. This fosters a culture of accountability and can really help reduce stress during evaluations. Plus, it ensures that all statements are accurate and truly reflect the company’s condition.

By implementing these practices, small businesses can ensure that record keeping for small business is not only accurate but also compliant and a true reflection of their financial status.

Conclusion

Setting up a solid record-keeping system is crucial for small businesses that want to thrive in the long run. By putting systematic practices in place - like crafting a clear record-keeping policy and using technology - business owners can simplify their financial management and stay compliant with regulations. This strong foundation not only reduces the chance of mistakes but also boosts operational efficiency, which is key to the growth and stability of any business.

Throughout this article, we’ve highlighted the importance of keeping essential records, such as:

- Financial reports

- Tax documents

- Employee files

Regular training, scheduled updates, and tools like cloud-based accounting software are vital for effective record management. Plus, practices like monthly reconciliations and annual audits help ensure accuracy and compliance, protecting businesses from potential pitfalls.

So, what’s the takeaway? Embracing smart record-keeping practices isn’t just about ticking boxes for regulations; it’s about empowering small businesses to make informed decisions and succeed in a competitive world. By focusing on systematic approaches and harnessing modern technology, entrepreneurs can turn their record-keeping into a strategic advantage. Now’s the time to get organized - sort those records, invest in the right tools, and set your business up for success in the years ahead!

Frequently Asked Questions

What is the first step in establishing a systematic record-keeping approach for small businesses?

The first step is to create a record-keeping policy that outlines what records need to be kept, how they will be organized, and who is responsible for maintaining them.

Why is having a record-keeping policy important?

A record-keeping policy serves as a guide for managing financial records, helping businesses stay compliant with tax regulations and avoiding surprises during tax season.

What are the options for record-keeping methods?

Business owners can choose to keep records manually or use accounting software like QuickBooks or Xero, which can automate tasks and reduce human error.

How can effective record-keeping impact a business's revenue?

Companies with solid financial management practices can see revenue growth of up to 25%, as effective record-keeping makes tax preparation easier and enhances overall efficiency.

Why is regular training important for staff involved in record-keeping?

Regular training ensures that everyone understands the processes and tools used, maintaining accuracy and uniformity in record-keeping, and equipping staff to handle tax inquiries and compliance issues.

What is a common pitfall that small and midsize enterprises face in record-keeping?

A common pitfall is relying too much on paper documentation, which 45% of small and midsize enterprises still do.

How often should records be updated for effective management?

Records should be updated regularly, whether daily or weekly, to ensure that no transactions are missed and to maintain accurate financial data.

What benefits come from having a routine for updating records?

Establishing a routine for updating records helps with budget management, reduces payment delays by 40%, and prepares businesses for tax season, minimizing last-minute stress.

Can you provide an example of how improved record-keeping has benefited a business?

A small marketing agency improved its financial management through better record-keeping, leading to significant operational efficiencies and increased client satisfaction.