Introduction

Understanding the ins and outs of repairs and maintenance tax deductions can really change the game for small business owners looking to cut down on their tax bills. By figuring out what counts as a repair versus an improvement, you can snag some immediate financial perks and steer clear of potential audits.

But with tax regulations being as tricky as they are, how can you make sure you’re getting the most out of your deductions without tripping over common mistakes? This guide is here to shine a light on the key steps to navigate this important part of your tax strategy with ease.

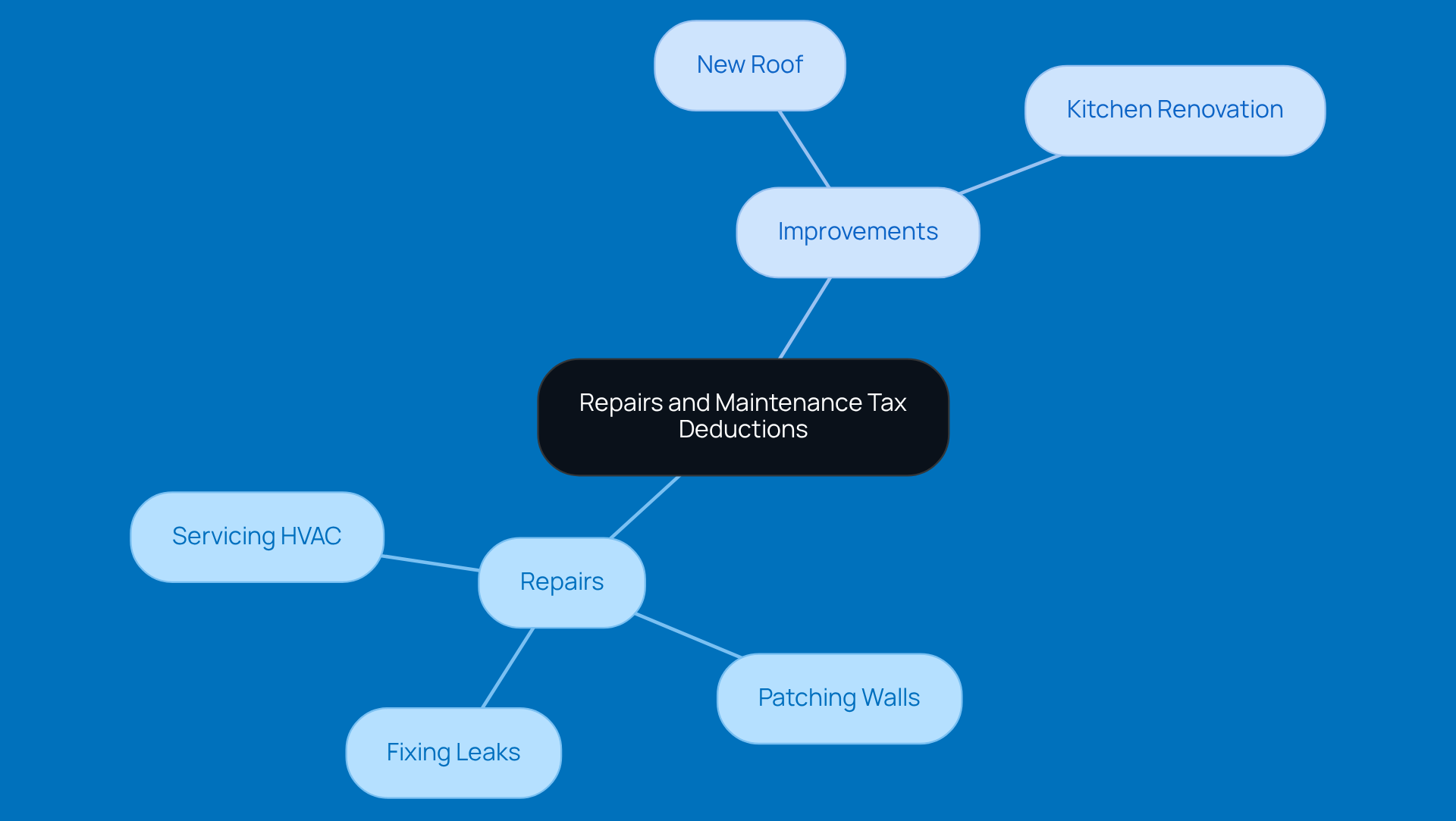

Understand Repairs and Maintenance Tax Deductions

If you're a small business owner looking to cut down on your tax bill, understanding repairs and maintenance tax deductions is key. The IRS allows you to deduct ordinary and necessary expenses that come up during your business operations. But here's the catch: knowing the difference between repairs and improvements is super important.

Repairs are all about keeping your property in good shape without boosting its value. Think fixing leaks, patching up walls, or servicing your HVAC system. The best part? You can benefit from repairs and maintenance tax deductions by deducting these expenses in the year you incur them, providing you with some immediate tax relief.

On the flip side, Improvements are capital expenses that actually increase your property's value or extend its lifespan. This could mean putting on a new roof or renovating a kitchen. Unfortunately, these costs need to be capitalized and depreciated over time-typically 27.5 years for residential properties and 39 years for commercial ones.

Getting these distinctions right is crucial for maximizing your tax benefits, including repairs and maintenance tax deductions, and steering clear of audits. If you mistakenly label repairs as improvements, you could miss out on repairs and maintenance tax deductions and draw unwanted attention from the IRS. Many small business owners have navigated these rules successfully by keeping detailed records and clearly separating repair costs from improvement expenses. For example, if you regularly maintain your HVAC system, those repair costs can be deducted right away, but a full system replacement? That’s a different story-it needs to be capitalized.

Tax pros, like those at Steinke and Company, emphasize the importance of accurate documentation and correctly categorizing your costs to maximize repairs and maintenance tax deductions. Keeping detailed invoices and clear descriptions of the work done is essential for claiming those deductions and avoiding IRS headaches. Plus, the BAR test (Betterment, Adaptation, Restoration) can help you figure out whether a cost counts as a repair or an improvement. By sticking to IRS guidelines and keeping your records straight, you can manage your tax strategies effectively, boost your cash flow, and stay compliant-no surprises here!

Identify Eligible Expenses for Deductions

To maximize your tax deductions, it’s super important to figure out which costs actually qualify. Let’s break down some common eligible expenses:

-

Routine Repairs: If you’ve got broken stuff that needs fixing-like plumbing or electrical work-those costs are fully deductible. Tax expert Elizabeth Pandolfi points out that safe harbor lets you deduct the full amount in one year instead of spreading it out over several. How great is that?

-

Maintenance Services: Regular services, like lawn care or HVAC maintenance, that keep your property in tip-top shape can also be deducted. Just remember, keeping good records of these costs is key to optimizing your repairs and maintenance tax deductions.

-

Supplies and Materials: Got items for repairs? Things like paint, tools, or replacement parts can be written off too. For example, Sarah, a small business owner, managed to cut her taxable income by over 30% after she started identifying these expenses with some tailored tax strategies. Talk about a win!

-

Labor Costs: Payments to contractors or employees for repair work may qualify for repairs and maintenance tax deductions? Yep, those qualify as repairs and maintenance tax deductions.

But here’s a little heads-up: improvements that boost your property’s value need to be capitalized and depreciated over time, rather than deducted in the year you incur them. Understanding these distinctions, along with the safe harbor rules for small invoices, can really make a difference in your overall tax strategy. So, keep these tips in mind as you navigate your deductions!

Collect and Organize Necessary Documentation

Accurate documentation is key to supporting your tax reductions. Let’s break down how to effectively collect and organize your records:

-

Keep Receipts: Make sure to save all your receipts related to repairs and maintenance. This includes invoices from contractors and purchase receipts for materials. The IRS really stresses the importance of keeping these records to help you maximize your deductions.

-

Create a filing system by organizing your documents by category, focusing on repairs and maintenance tax deductions, as well as improvements. This way, you can easily find what you need when tax season rolls around. A well-structured filing system can really cut down on the stress of preparing your taxes.

-

Utilize Digital Tools: Consider using accounting software or apps to track your costs and keep digital copies of your receipts. More and more small business owners are turning to digital tools for financial tracking, and it’s a smart move that boosts both efficiency and accuracy in recordkeeping.

-

Document Details: For each expense, jot down the date, amount, and purpose. This context is super important if tax authorities come knocking with questions. Keeping thorough records not only supports your claims but also helps you avoid costly mistakes that can happen when documentation is lacking.

By keeping detailed records, you’re not just supporting your claims - you’re also making the filing process a whole lot easier. In the end, this can lead to better financial outcomes for your organization!

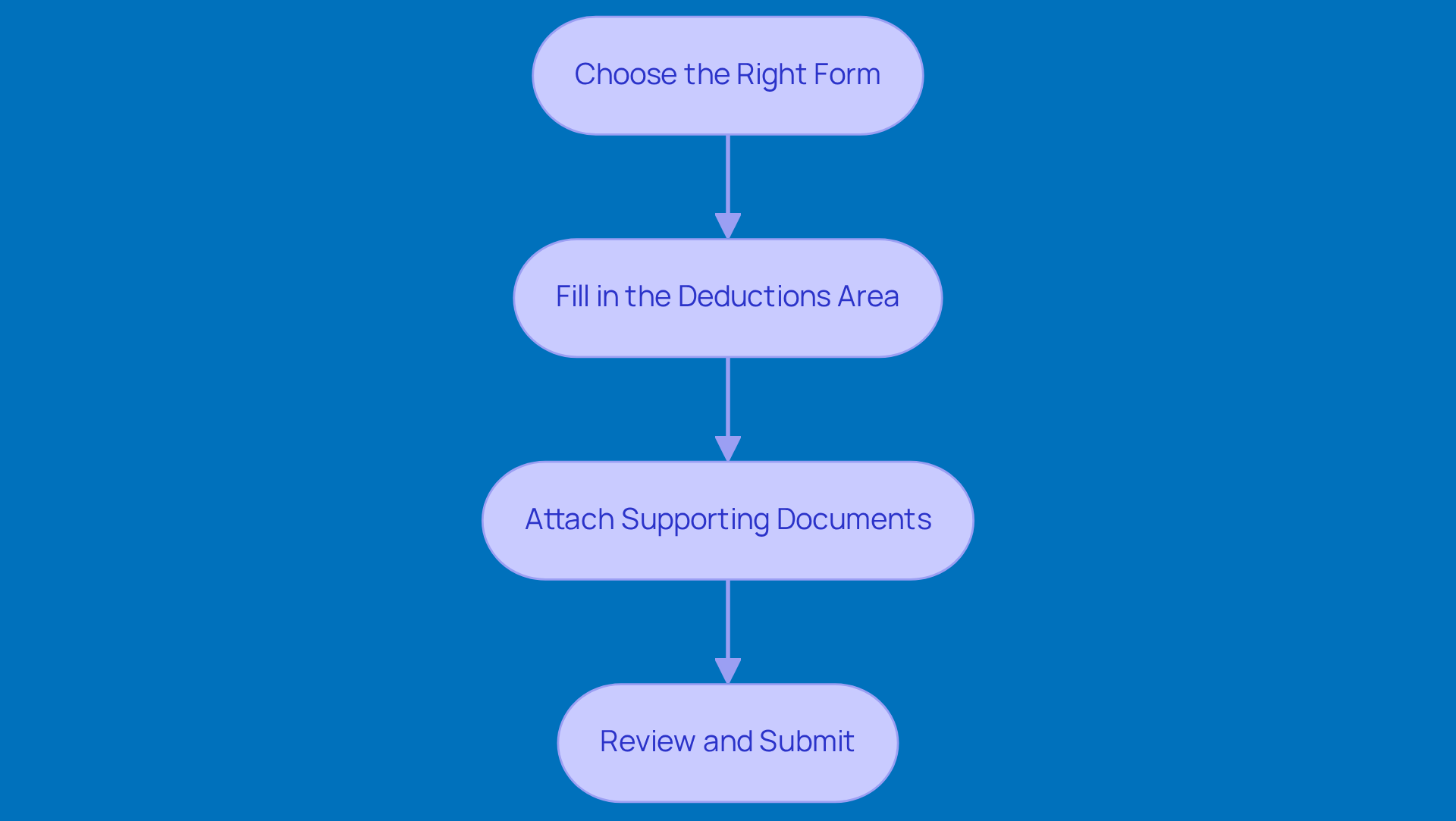

File Your Tax Return with Deductions

So, you’ve figured out your qualifying expenses and gathered all your documents - great job! Now, let’s get that tax return submitted. Here’s how to do it:

- Choose the Right Form: First things first, pick the right tax form based on your business structure. For individuals, that’s usually Form 1040, while corporations will want Form 1120.

- Fill in the Deductions Area: Next up, head to the deductions section of the form. Make sure to enter your total reductions and don’t forget to include all those qualified repairs and maintenance tax deductions.

- Attach Supporting Documents: If it’s needed, attach copies of your receipts and any documentation that backs up your claims. It’s always good to have proof!

- Review and Submit: Before you hit send, double-check everything for accuracy. You can submit your return electronically or by mail - whatever works best for you.

Filing accurately is key to making sure you snag all the tax benefits you’re entitled to. Happy filing!

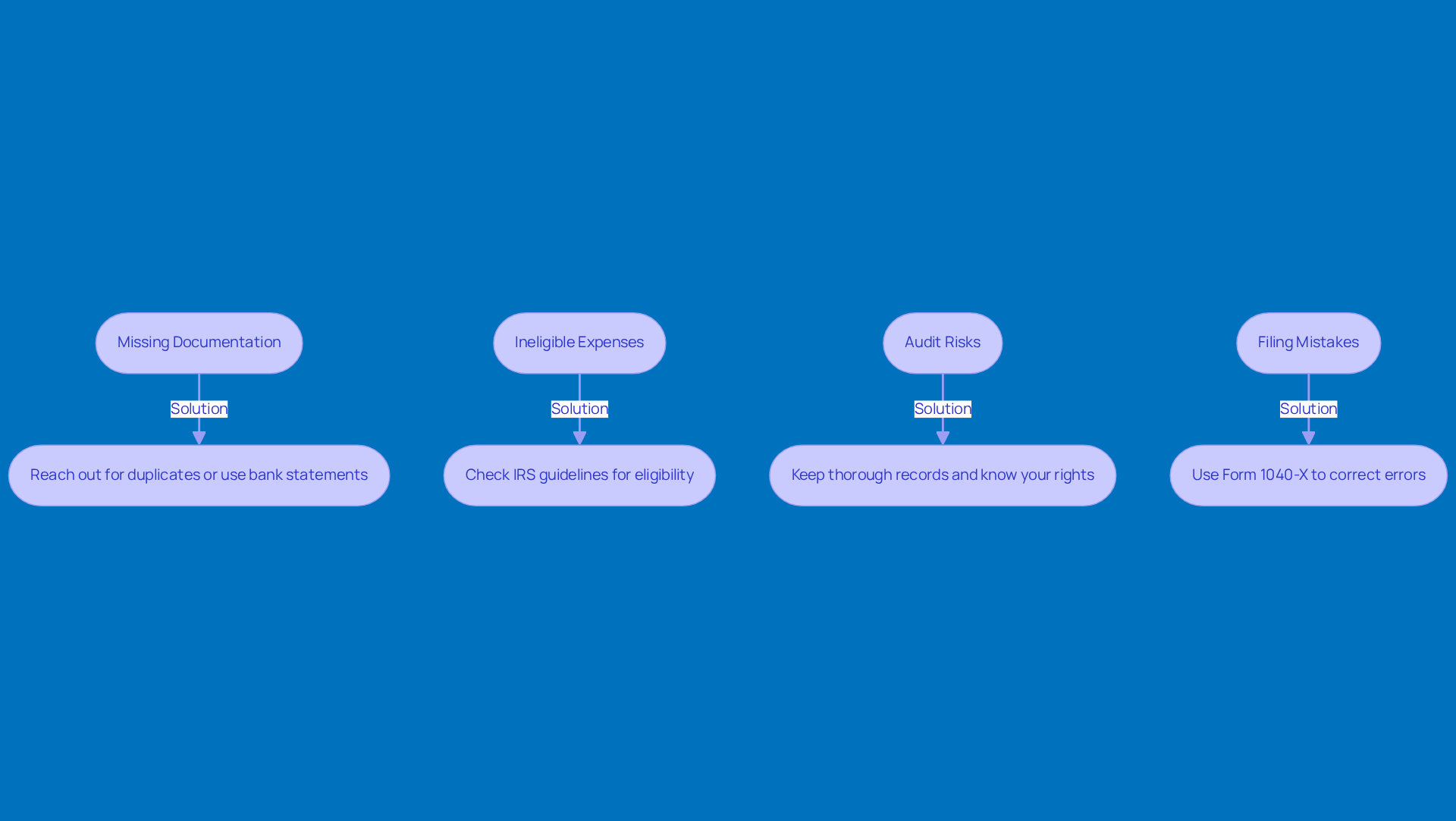

Troubleshoot Common Claiming Issues

Even with all the planning in the world, dealing with repairs and maintenance tax deductions can throw some curveballs your way. Let’s dive into some common hiccups and how to tackle them:

- Missing Documentation: Lost receipts? No worries! Just reach out to your vendors for duplicates or use your bank statements as backup proof of payment. This can really help when you’re trying to back up your claims during an audit. And remember, if the IRS decides to audit you, they’ll let you know by mail. Keeping good records is key to making that process smooth sailing.

- Ineligible Expenses: If you find that an expense isn’t allowed, take a moment to check the IRS guidelines. You want to make sure it qualifies for repairs and maintenance tax deductions instead of being classified as a capital improvement. Knowing the difference is super important for staying compliant and avoiding any nasty penalties.

- Audit Risks: Did you know the IRS looks at about 1% to 2% of small businesses each year? That’s why it’s so important to keep thorough records for all your claims. Make sure your expenses are reasonable and directly tied to your business activities to help lower those audit risks. And hey, don’t forget your rights as a taxpayer! You can have representation during an audit and enjoy the protections laid out in the taxpayer bill of rights.

- Filing Mistakes: Oops! If you spot an error after filing, you can fix it using Form 1040-X for individuals or the right form for organizations. Making timely corrections can save you from complications and penalties down the line. And if you disagree with an audit decision, you can ask for an informal chat with the examiner’s manager or even file a petition with the tax court.

By tackling these challenges head-on, you can navigate the tricky waters of tax deductions with confidence and keep your business’s finances in tip-top shape!

Conclusion

Understanding repairs and maintenance tax deductions is super important for small business owners looking to cut down on their tax bills. By knowing the difference between repairs - those can be deducted in the year they happen - and improvements, which need to be capitalized, you can manage your expenses smartly and make the most of your tax benefits. This knowledge not only helps you maximize deductions but also keeps you clear of any potential IRS audits.

In this article, we’ve shared some key insights on:

- Spotting eligible expenses

- The importance of keeping good records

- The steps to file your tax returns accurately

Having a well-organized filing system and using digital tools can really make claiming those deductions a breeze. Plus, tackling common issues like missing documents or ineligible expenses gives you the confidence to handle the complexities of tax deductions like a pro.

Ultimately, getting a grip on repairs and maintenance tax deductions can lead to some serious financial perks for your small business. By staying informed and proactive about managing your records and claims, you can boost your cash flow and stay compliant with IRS rules. So, why not embrace these strategies? They’ll help you take charge of your tax game and enjoy the benefits of smart financial management!

Frequently Asked Questions

What are repairs and maintenance tax deductions?

Repairs and maintenance tax deductions allow small business owners to deduct ordinary and necessary expenses incurred during business operations. These deductions can provide immediate tax relief.

What is the difference between repairs and improvements?

Repairs maintain property in good condition without increasing its value, such as fixing leaks or servicing HVAC systems. Improvements, on the other hand, are capital expenses that enhance property value or extend its lifespan, like a new roof, and must be capitalized and depreciated over time.

How can I benefit from repairs and maintenance tax deductions?

You can deduct repair expenses in the year they are incurred, which offers immediate tax relief. However, improvements must be capitalized and depreciated over 27.5 years for residential properties and 39 years for commercial properties.

What are some common eligible expenses for repairs and maintenance tax deductions?

Common eligible expenses include routine repairs (like plumbing or electrical work), maintenance services (such as lawn care or HVAC maintenance), supplies and materials (like paint and tools), and labor costs for contractors or employees performing repair work.

What is the safe harbor rule in relation to tax deductions?

The safe harbor rule allows you to deduct the full amount of certain small expenses, such as routine repairs, in one year rather than spreading the deduction over multiple years.

Why is accurate documentation important for claiming deductions?

Keeping detailed invoices and clear descriptions of work done is essential for claiming repairs and maintenance tax deductions and avoiding issues with the IRS, including audits.

What is the BAR test and how does it help with tax deductions?

The BAR test (Betterment, Adaptation, Restoration) helps determine whether a cost is classified as a repair or an improvement, which is crucial for maximizing tax benefits and ensuring compliance with IRS guidelines.

How can small business owners maximize their repairs and maintenance tax deductions?

Small business owners can maximize deductions by accurately categorizing costs, keeping thorough records, and understanding the distinctions between repairs and improvements.