Overview

This article dives into some key insights for small agency owners about the difference between revenue and profit, and why it really matters in managing your business. Think of revenue as the total sales performance—it’s the big number that shows how much you’re bringing in. But profit? That’s where the magic happens. It tells you how healthy your finances are after you’ve covered all your expenses. Understanding both is super important for making smart decisions that can lead to sustainable growth and long-term success.

So, why should you care about this distinction? Well, knowing the difference can help you steer your agency in the right direction. For instance, if you’re only looking at revenue, you might feel great about those big sales numbers, but if your expenses are eating away at your profits, you could be in trouble. It’s like throwing a party and realizing you spent all your money on snacks but forgot to pay the DJ!

In short, keeping an eye on both revenue and profit is crucial. It’s not just about how much you sell; it’s about how much you keep. So, take a moment to reflect on your own business. Are you focusing on the right numbers? Remember, understanding these concepts can lead to better decisions and a healthier bottom line. Let’s keep the conversation going—what’s your take on balancing revenue and profit?

Introduction

Navigating today’s economy can be quite the challenge for small agency owners, right? Understanding the financial landscape is key. It’s not just about crunching numbers; it’s about tapping into the potential for sustainable growth and making informed decisions. But here’s the kicker: many business owners often mix up revenue and profit, which can lead to some pretty big misconceptions that might hurt their financial health.

So, what can agencies do to strike that perfect balance between generating revenue and maximizing profit? It’s all about ensuring immediate success while also keeping an eye on long-term viability. Let’s dive into some strategies that can help you navigate this tricky terrain!

Define Revenue and Profit: Core Concepts for Business Owners

Revenue is basically the total income a business makes from selling goods or services before any expenses are taken out. You might hear it called the 'top line' on an income statement. For example, if a small bakery sells $20,000 worth of pastries in a month, that’s its revenue. Now, earnings are what’s left after all expenses, taxes, and costs are deducted from that revenue—often referred to as the 'bottom line.' So, if our bakery has $15,000 in total costs, its net profit for the month would be $5,000.

Understanding these terms is super important for small agency owners as they navigate the ups and downs of the economy. Just because a business is generating a lot of revenues and profits doesn’t mean it’s actually making a profit. A company can have impressive sales but still end up in the red if its revenues and profits are insufficient due to high expenses. That’s why knowing the difference between revenue and earnings is key. It helps business owners make smart financial decisions, plan for growth, and really assess how their company is doing. This knowledge is crucial for building sustainable business practices and ensuring long-term success.

So, how does this apply to you? Think about your own experiences with revenue and expenses. Are you keeping a close eye on both? Understanding these concepts can really help you steer your business in the right direction!

Differentiate Between Revenue and Profit: Key Distinctions

Revenue and earnings might sound like they’re the same thing, but they actually tell different stories about a business's financial health. Revenue is all about the total income from sales—it’s a key indicator of how well a business is attracting customers and performing in the market. On the flip side, earnings show what’s left after all the costs are taken out. This gives us a peek into how efficiently a business operates and its overall economic health.

Let’s break it down a bit:

- Revenue: Think of it as a direct measure of sales performance. It highlights how well a business is drawing in customers and raking in income.

- Earnings: This number is crucial for figuring out how effectively a business manages its costs and resources. It ultimately determines how sustainable and poised for growth the business is.

Recognizing these differences helps business owners focus on both managing expenses and maximizing revenues and profits. This balanced approach is key to ensuring solid revenues and profits. Nowadays, companies that focus on maximizing both their revenues and profits, as well as improving their margins, are better equipped to handle market shifts and achieve lasting success. For instance, businesses that implement smart pricing strategies and keep a close eye on costs often see a nice bump in their margins, even if their income growth is a bit slow.

So, while income is what fuels business activity, earnings are what keep it going. Understanding and managing both aspects is vital for the financial well-being of any organization. What strategies are you considering to balance your income and expenses?

Calculate Revenue and Profit: Step-by-Step Methods

Understanding your revenues and profits is super important for getting a handle on your company’s financial health. Let’s break it down with a simple guide to help you through these calculations:

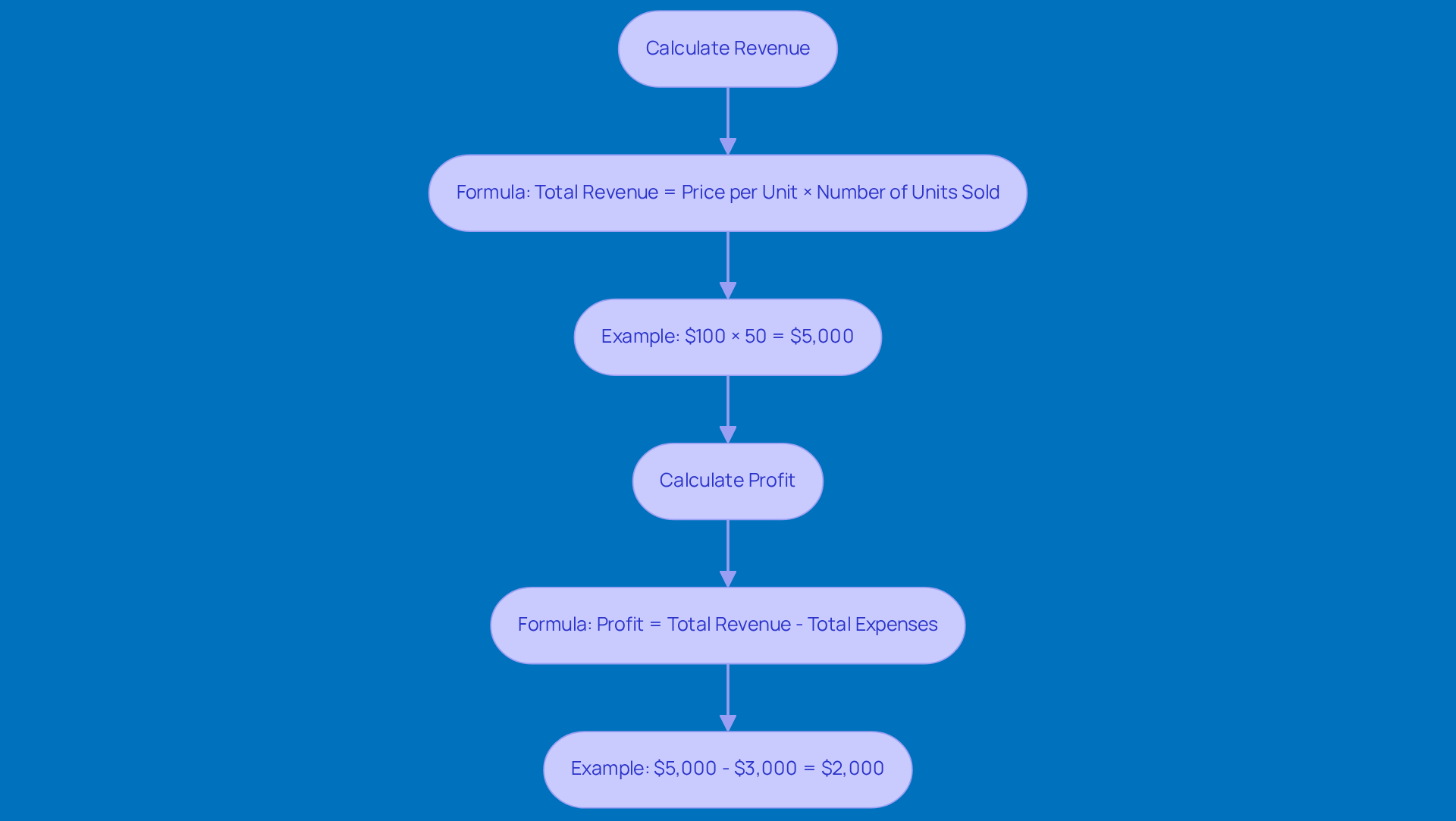

Step-by-Step Calculation:

-

Calculate Revenue:

- Formula: Total Revenue = Price per Unit × Number of Units Sold

- Example: Say you offer a service that costs $100 and you serve 50 clients. Your total revenue would be $100 × 50 = $5,000. Easy, right?

-

Calculate Profit:

- Formula: Profit = Total Revenue - Total Expenses

- Example: If your total expenses, which include costs of goods sold and operating expenses, come to $3,000, then your profit would be $5,000 - $3,000 = $2,000. Simple math!

By regularly crunching these numbers, you’ll keep a close eye on your revenues and profits to monitor your financial performance. This awareness helps you make informed decisions and plan strategically. For instance, it’s crucial to realize that a business might generate a lot of revenues and profits but still operate at a loss if expenses are too high. Keeping tabs on these metrics lets you spot trends, tweak your strategies, and ultimately boost your revenues and profits.

So, how often do you check in on your numbers? It’s a good habit to get into!

Prioritize Revenue or Profit: Strategic Considerations for Growth

Deciding whether to focus on revenues and profits really hinges on what your organization aims to achieve and the situation at hand. Let’s break it down:

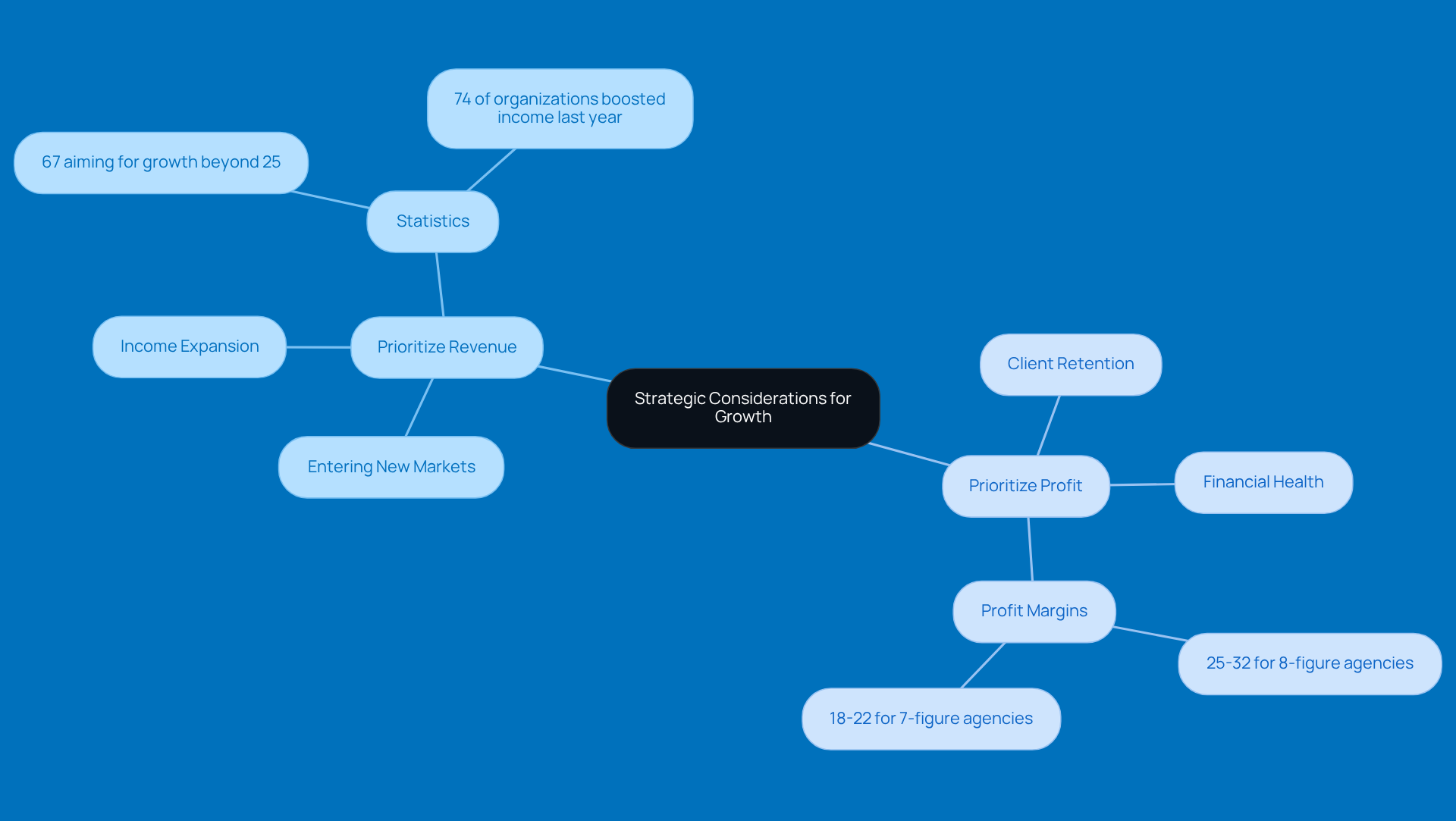

Prioritize Revenue:

- If you’re stepping into new markets or rolling out fresh services, you’ll want to zero in on revenue growth. It’s all about making your mark and drawing in clients. Did you know that 67% of organizations are shooting for growth beyond 25% by 2025? That’s a clear sign that income expansion is the name of the game! Plus, with 74% of organizations boosting their income last year, it’s clear there’s some serious momentum here.

- High revenue can really boost your cash flow, giving you the chance to reinvest in your business. This is key for scaling up and enhancing your revenues and profits.

Prioritize Profit:

- Now, if you’re running an established agency, focusing on profit is crucial for keeping your financial health in check and weathering any economic storms. Organizations with profit margins between 25-32% are in a much better position to handle financial hiccups, especially compared to those seven-figure firms that usually see margins of 18-22%.

- Plus, being profitable can really up your firm’s valuation, which is super important if you’re thinking about selling or bringing in investors. With 8-figure firms retaining 92% of their clients each year, prioritizing profitability can lead to stronger client relationships and long-term success.

As Charles Gaudet, CEO of Predictable Profits, puts it, "The future looks bright - 84% of leaders in the field are optimistic about what’s ahead." This kind of optimism really highlights the importance of balancing both income and profit strategies.

In the end, finding that sweet spot between revenues and profits will help your agency grow sustainably, allowing you to thrive in a competitive landscape. And don’t forget, understanding your customers’ needs is key to tailoring your strategies effectively. So, what’s your take on this balance?

Conclusion

Understanding the nuances of revenue and profit is super important for small agency owners trying to navigate today’s competitive landscape. Revenue shows the total income from sales, while profit reveals how efficiently a business operates after expenses. Knowing the difference between these two can help agency owners make smart decisions that lead to sustainable growth and long-term success.

This article highlights some key insights, like why it’s crucial to keep an eye on both revenue and profit, and the strategic choices that come with prioritizing one over the other. It’s all about balance! Focusing just on revenue might boost cash flow, but keeping an eye on profit is what really ensures financial stability and resilience against those pesky economic ups and downs. Plus, the step-by-step calculations provided will help agency owners assess their financial health effectively.

Ultimately, mastering revenues and profits isn’t just about crunching numbers; it’s about crafting a business strategy that can weather market challenges. By prioritizing the right metrics and understanding how revenue and profit interact, small agency owners can set themselves up for growth and success in an ever-changing economic environment. So, here’s the takeaway: take some time to regularly analyze your financial performance and adapt your strategies accordingly. That’s how you thrive in the competitive landscape of 2025 and beyond!

Frequently Asked Questions

What is revenue in a business context?

Revenue is the total income a business makes from selling goods or services before any expenses are deducted. It is often referred to as the 'top line' on an income statement.

How is profit defined in a business?

Profit, often called net profit, is what remains after all expenses, taxes, and costs are deducted from revenue. It is commonly referred to as the 'bottom line.'

Can a business have high revenue but still not be profitable?

Yes, a business can generate a lot of revenue but still end up in the red if its expenses are too high. High revenues do not guarantee profitability.

Why is it important for business owners to understand the difference between revenue and profit?

Understanding the difference helps business owners make informed financial decisions, plan for growth, and assess their company's financial health, which is crucial for building sustainable business practices and ensuring long-term success.

How can understanding revenue and expenses impact a business owner's decision-making?

By keeping a close eye on both revenue and expenses, business owners can steer their business in the right direction and make smarter financial choices.