Introduction

Navigating the ins and outs of tax deductions can feel pretty overwhelming for small agencies, right? But here’s the good news: safe harbor deductions offer a simpler way to handle those tax obligations. They let businesses claim specific expenses with less paperwork and a lower risk of penalties. Sounds great, doesn’t it?

However, figuring out the details of eligibility and documentation can be a bit tricky. So, how can small agencies make the most of these deductions to boost their tax savings while staying on the right side of IRS guidelines? Let’s dive in and explore!

Understand Safe Harbor Deductions

Safe harbor allowances are super important for taxpayers looking to dodge penalties for underpaying taxes. By sticking to specific IRS guidelines, these allowances make the tax process a whole lot easier. They let small agencies claim certain expenses without the headache of tons of paperwork. Understanding these allowances can lead to some serious tax savings and fewer compliance headaches.

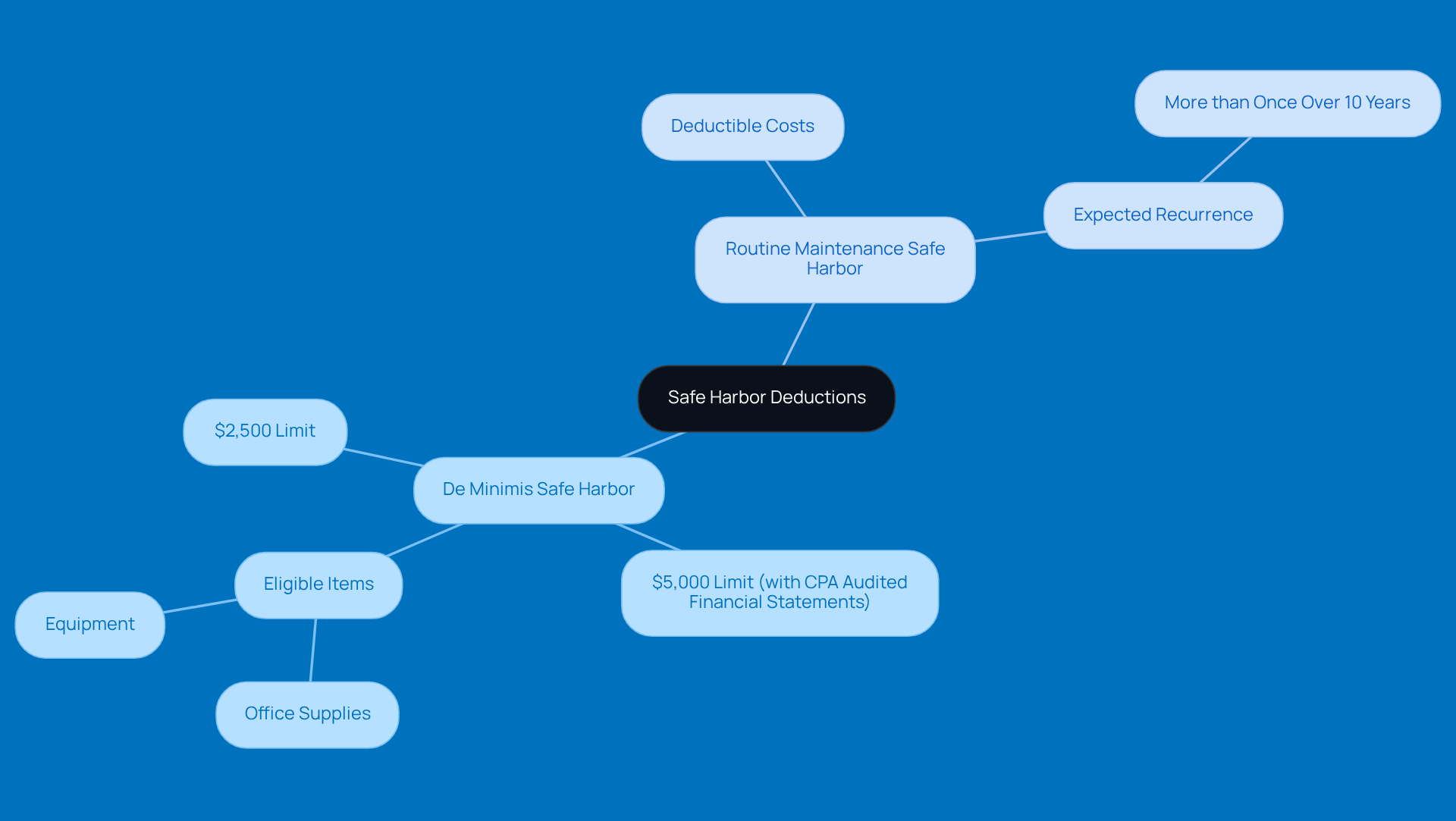

So, what are the main categories of safe harbor deduction? Let’s break it down:

- De Minimis Safe Harbor: This one lets you expense small-dollar items right away, like office supplies or equipment, up to $2,500 per invoice line item. If your business has applicable financial statements, that limit jumps to $5,000. This really simplifies things for minor expenses!

- Routine Maintenance Safe Harbor: Here, you can deduct costs for routine maintenance that you expect to do more than once over a ten-year span. This helps keep your property running smoothly without racking up huge tax bills.

The guideline for safe harbor deduction on estimated taxes shows you how much to pay to steer clear of penalties, making it easier for small agencies to handle their tax responsibilities.

Let’s look at a real-world example. Imagine a small agency buys ten appliances at $2,000 each. They can deduct that total $20,000 expense under the de minimis provision, which really boosts their cash flow. Plus, businesses with revenues under $10 million can expense up to $10,000 or 2% of their property’s value in repair and maintenance costs. That’s a smart way to optimize their tax strategy!

As we look ahead to 2026, the IRS is still emphasizing how crucial the safe harbor deduction is. They give small agencies a chance to maximize their tax benefits while easing compliance burdens. By taking advantage of these provisions, small agencies can navigate the tricky world of tax regulations with a lot more confidence and ease.

Determine Your Eligibility for Safe Harbor Deductions

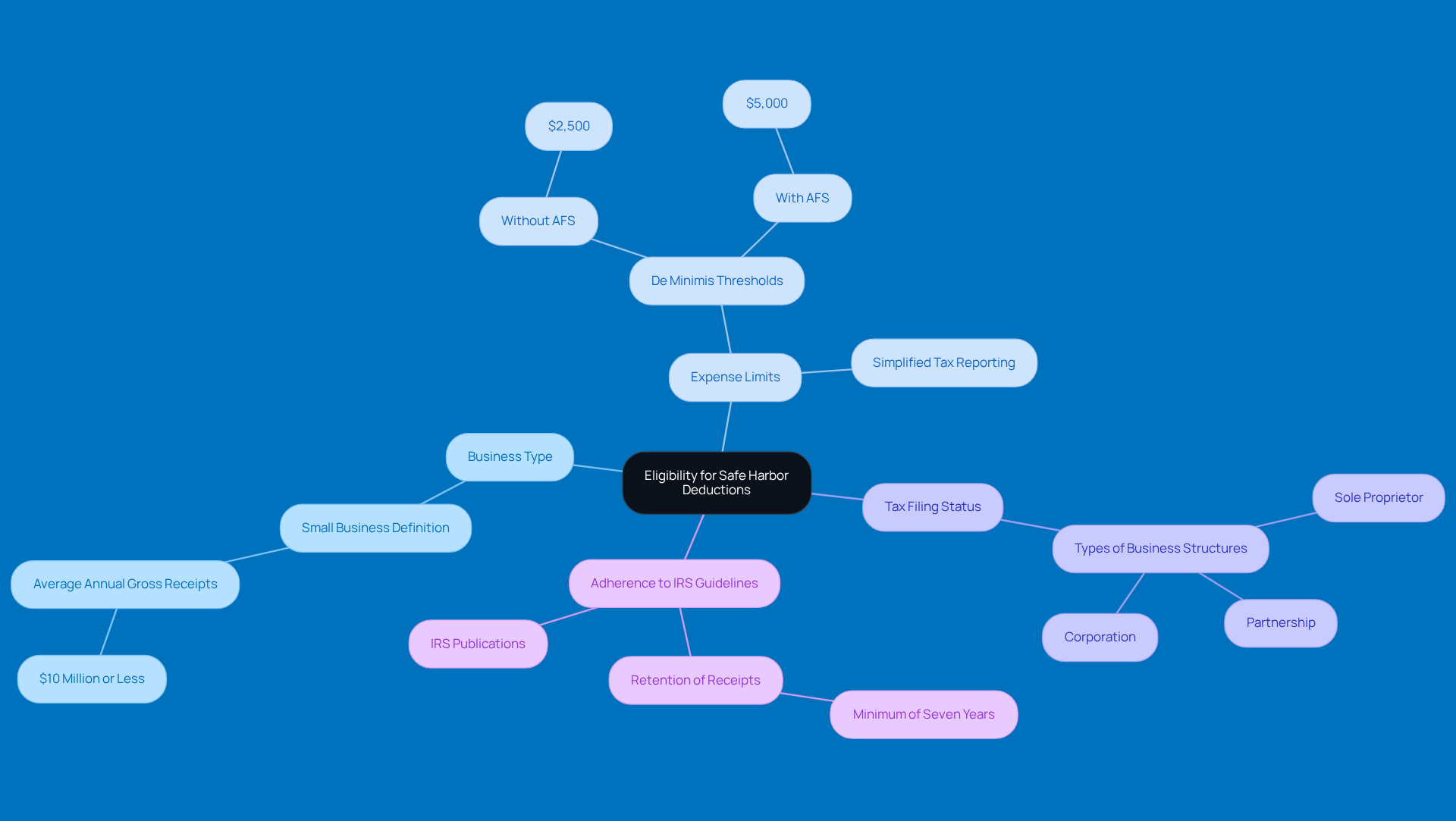

If you're looking to see if you qualify for protective reductions, let’s break down a few key criteria you should consider:

-

Business Type: First off, make sure your agency fits the bill as a small business according to IRS definitions. Generally, this means your business should have average annual gross receipts of $10 million or less.

-

Expense Limits: Next up, let’s talk about expense limits. For the de minimis threshold, your expenses shouldn’t go over $2,500 per item if you don’t have an applicable financial statement (AFS). If you do have one, that limit bumps up to $5,000. This threshold is super handy because it simplifies tax reporting, letting you deduct small expenses without jumping through hoops. Nicholas Galletta, a tax manager, points out that the safe harbor deduction can simplify the decision-making process and provides more certainty for immediately expensing certain items, subject to dollar limitations.

-

Tax Filing Status: Now, check your filing status. Are you a sole proprietor, partnership, or corporation? Your eligibility for protective reductions can vary based on your business structure, so it’s good to know where you stand.

-

Adherence to IRS Guidelines: Lastly, take a look at IRS publications about secure exemptions. You want to make sure you meet all the necessary criteria, like keeping receipts for at least seven years to back up your acquisition expenses.

By getting a handle on these criteria and seeing how Steinke and Company can help you navigate these guidelines, small agencies can really optimize their financial strategies and stay compliant. So, what do you think? Ready to dive in and make the most of these opportunities?

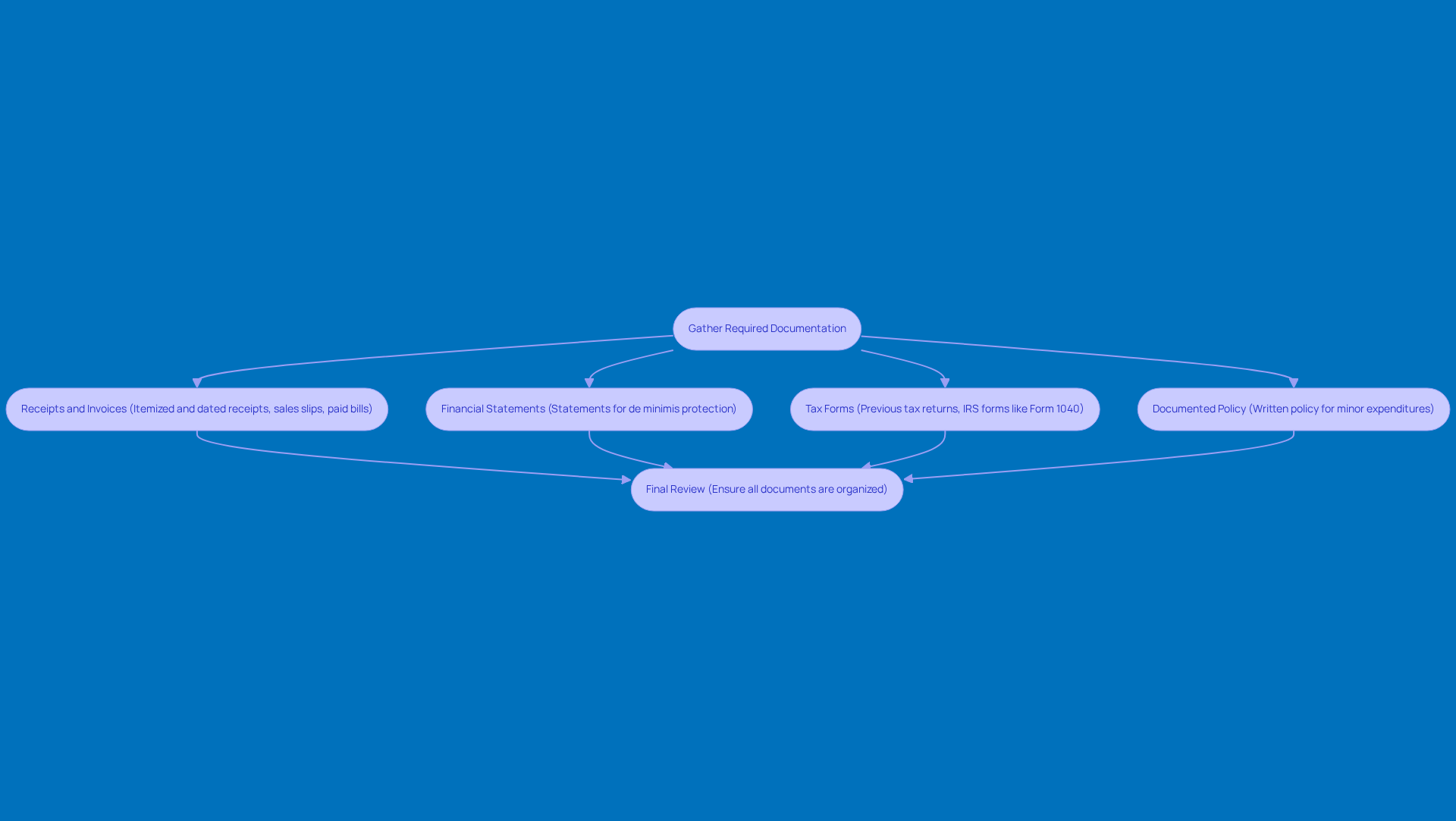

Gather Required Documentation for Your Claim

To effectively claim safe harbor deduction, it’s crucial to gather and organize a few key documents. Let’s break it down:

-

Receipts and Invoices: First things first, collect all those itemized and dated receipts for the expenses you plan to deduct. This means grabbing sales slips, paid bills, and invoices that clearly show what the expense is all about.

-

Financial Statements: If it applies to you, get your financial statements ready, especially when you’re using the de minimis protection. These statements will back up your claims and give a clear picture of your financial activities.

-

Tax Forms: Don’t forget to keep your previous tax returns and any relevant IRS forms, like Form 1040 or Schedule C, handy. These documents will help you accurately reference your income and expenses.

-

Documented Policy: If you’re claiming the de minimis exemption, it’s a good idea to create a written policy that outlines how you handle minor expenditures. This policy should detail how you categorize and manage these expenses to stay in line with IRS guidelines.

Getting these documents in order not only makes the reimbursement process smoother but also backs up your claims, reducing the chances of any disputes with tax authorities. As tax experts often say, keeping thorough records is key to validating what you’ve entered in your financial records and tax returns. So, are you ready to tackle those deductions?

Calculate Your Safe Harbor Deduction Amount

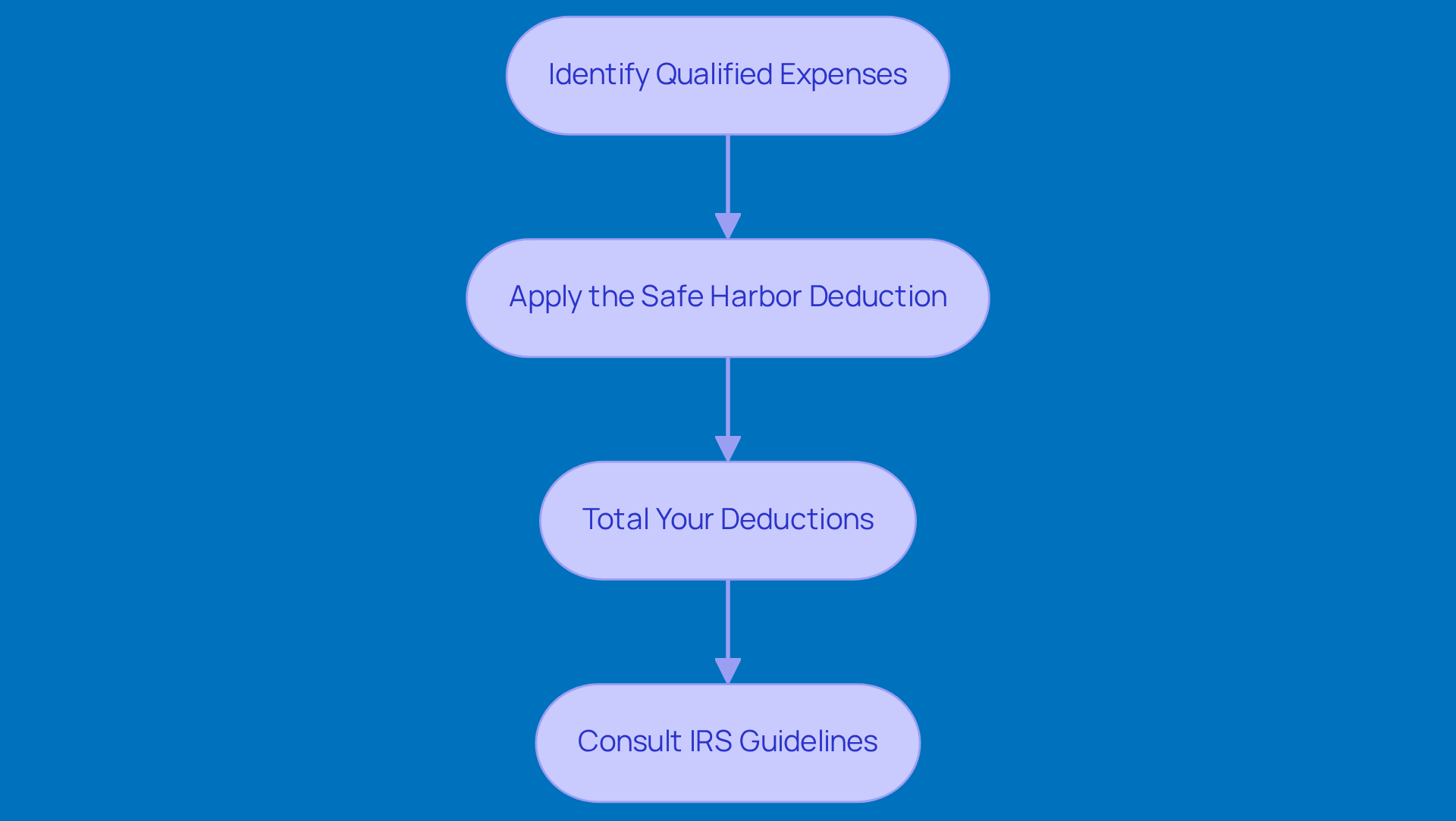

Want to figure out your secure deduction amount? It’s easier than you think! Just follow these simple steps:

-

Identify Qualified Expenses: Start by making a list of costs that qualify for protection, like repairs and maintenance. For example, if you buy a ladder for $450, you can fully deduct that under the de minimis guidelines. Pretty neat, right?

-

Apply the safe harbor deduction: If you have items that cost less than $2,500, you can deduct the whole expense. And if you have an applicable financial statement, that limit jumps to $5,000 per item. Talk about a win!

-

Total Your Deductions: Now, add up all those qualifying expenses to see your total permissible amount. It’s like a little victory dance for your finances!

-

Consult IRS Guidelines: Don’t forget to check IRS publications regularly for any updates or changes to limit allowances that might affect your calculations. In 2026, small businesses can really take advantage of these provisions, making tax reporting a breeze and possibly lowering their tax bills.

At Steinke and Company, we’re here to make tax season smooth, accurate, and stress-free. We handle your business and personal returns, ensuring compliance and minimizing surprises. Plus, keeping your tax records organized is key to financial stability. By staying on top of your tax returns and supporting documents, you’ll avoid budgeting pitfalls and stay compliant with IRS regulations. So, let’s tackle this together!

File Your Safe Harbor Deduction on Tax Forms

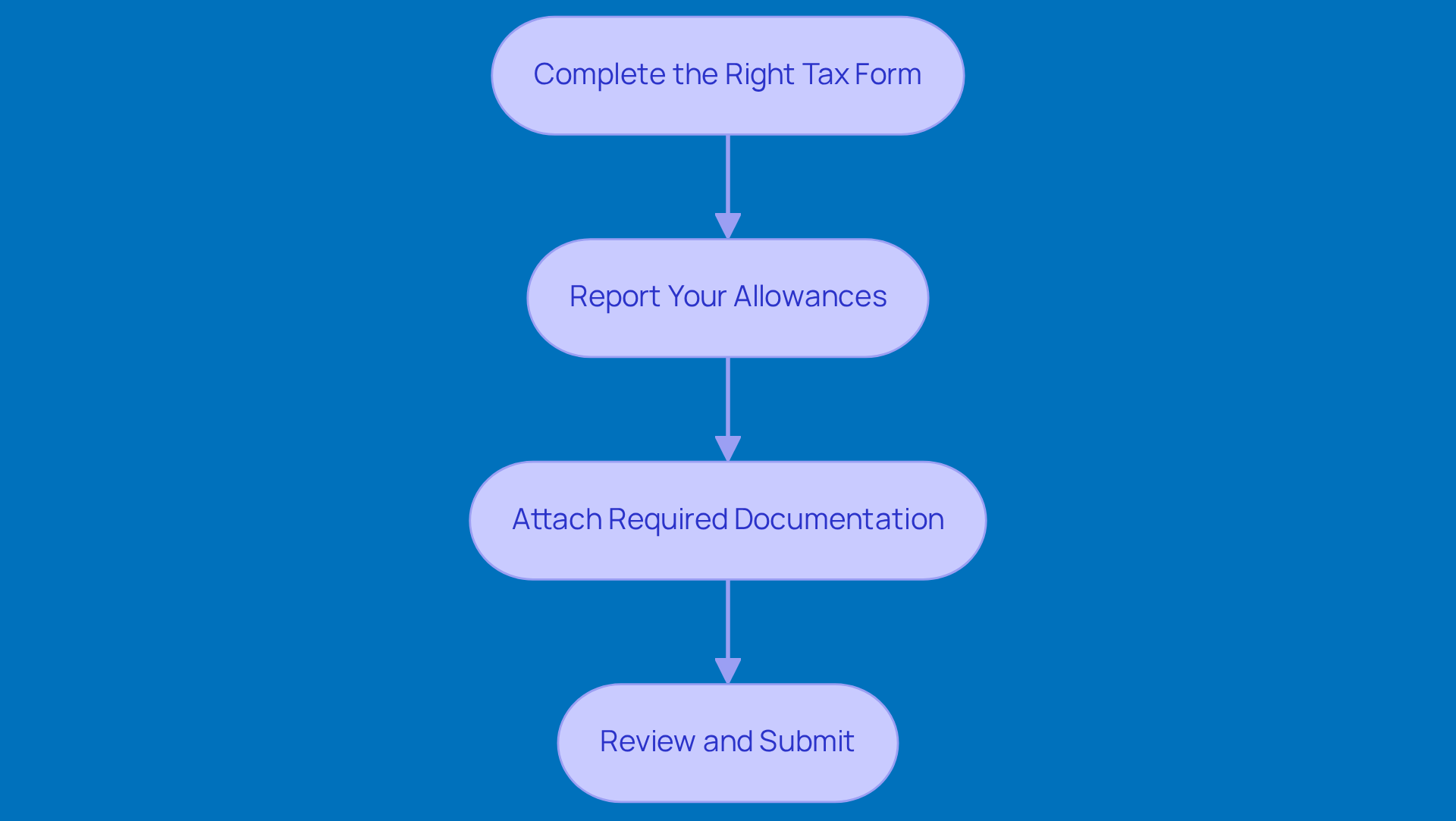

Submitting your secure exemption on tax forms? It’s not as daunting as it sounds! Let’s break it down into a few simple steps:

-

Complete the Right Tax Form: If you’re filing as an individual, grab Form 1040. For corporations, you’ll need Form 1120. Easy peasy!

-

Report Your Allowances: Make sure to input your calculated secure allowance on the right line of your tax form. For example, if you’re using Schedule C, you’ll want to report it under 'Expenses.'

-

Attach Required Documentation: Don’t forget to include any necessary documents, like receipts or your written policy for the de minimis protection, with your tax return. It’s all about keeping things in order!

-

Review and Submit: Before you hit that submit button, take a moment to double-check your entries for accuracy. And remember, keep copies of all your documents for your records!

Now, let’s talk about some common slip-ups to avoid. Typical errors include forgetting to attach important documentation, misreporting amount reductions, and missing the submission deadline. Yikes! But don’t worry-successful small businesses have tackled these challenges by sticking to some solid best practices. Think organized records and regular reviews of their tax strategies.

By following these steps and avoiding common pitfalls, you can maximize your safe harbor deduction and simplify your tax filing process. So, are you ready to tackle your taxes with confidence?

Conclusion

Mastering safe harbor deductions can really lighten the tax load for small agencies. It’s all about taking advantage of specific IRS provisions without getting bogged down by a mountain of paperwork. When small businesses understand and apply these deductions, they can fine-tune their tax strategy, which might lead to some nice savings and less stress when it comes to compliance.

In this guide, we’ve explored key categories of safe harbor deductions, like the de minimis safe harbor for small expenses and the routine maintenance safe harbor for keeping up with property upkeep. We’ve also laid out the eligibility criteria, stressing how important it is to know your business type, expense limits, and the IRS guidelines. Plus, we highlighted the need for thorough documentation - it’s crucial for backing up your claims and staying compliant. And let’s not forget the practical steps for calculating and filing those deductions, giving small agencies the confidence to tackle the tax process.

So, here’s the deal: leveraging safe harbor deductions isn’t just a smart financial move; it’s a must for small agencies looking to thrive in a competitive world. By getting a handle on these deductions, businesses can simplify their tax processes, save some cash, and focus more on growth and innovation. I encourage small agencies to take those proactive steps in understanding and implementing these deductions. Trust me, maximizing your benefits while keeping in line with IRS regulations is totally worth it!

Frequently Asked Questions

What are safe harbor deductions?

Safe harbor deductions are allowances provided by the IRS that help taxpayers avoid penalties for underpaying taxes. They simplify the tax process by allowing small agencies to claim certain expenses without extensive paperwork.

What are the main categories of safe harbor deductions?

The main categories of safe harbor deductions include: - De Minimis Safe Harbor: Allows expensing small-dollar items up to $2,500 per invoice line item, or $5,000 if the business has applicable financial statements. - Routine Maintenance Safe Harbor: Enables the deduction of costs for routine maintenance expected to occur more than once over a ten-year period.

How does the de minimis safe harbor work?

The de minimis safe harbor allows businesses to expense small items immediately, simplifying tax reporting. For businesses without applicable financial statements, the limit is $2,500 per item; with applicable financial statements, it increases to $5,000.

What are the eligibility criteria for safe harbor deductions?

Eligibility criteria include: - Business Type: Must be classified as a small business by the IRS, generally with average annual gross receipts of $10 million or less. - Expense Limits: Expenses should not exceed $2,500 per item (or $5,000 with an applicable financial statement). - Tax Filing Status: Eligibility may vary based on whether the business is a sole proprietor, partnership, or corporation. - Adherence to IRS Guidelines: Must meet criteria outlined in IRS publications, including keeping receipts for at least seven years.

How can small agencies benefit from safe harbor deductions?

Small agencies can optimize their tax strategies, maximize tax benefits, and ease compliance burdens by taking advantage of safe harbor deductions, which help navigate tax regulations more confidently.

What is a real-world example of utilizing safe harbor deductions?

If a small agency buys ten appliances at $2,000 each, they can deduct the total $20,000 expense under the de minimis provision, significantly boosting their cash flow. Additionally, businesses with revenues under $10 million can expense up to $10,000 or 2% of their property’s value in repair and maintenance costs.