Introduction

Understanding the ins and outs of tax bill bonus depreciation can really change the game for small business owners, especially with new regulations popping up. This strategic tax perk lets businesses deduct a big chunk of asset costs right away, which can really boost cash flow and help with reinvestment.

But, let’s be real - the rules around eligibility and the long-term effects can get a bit tricky. So, how can small businesses navigate these waters to make the most of the benefits while dodging potential pitfalls?

Let’s dive into these details together, empowering you to make smart choices that can enhance your financial stability and growth potential!

Define Bonus Depreciation and Its Importance for Small Businesses

Hey there! Let’s discuss tax bill bonus depreciation in relation to write-offs. This nifty tax advantage, which is referred to as tax bill bonus depreciation, lets companies deduct a big chunk of the cost of qualifying assets - think machinery, office furniture, and vehicles - right in the year they start using them. Pretty cool, right? This immediate deduction through tax bill bonus depreciation can really help lower taxable income, which means more cash flow in your pocket.

For small businesses, especially those in rural areas, getting a grip on the tax bill bonus depreciation is super important. It can lead to some serious savings that help with reinvestment and growth. Just remember, to snag those extra write-offs, the property needs to be bought during a specific time frame and put into action when it’s ready to roll.

Now, here’s where it gets even better: the One Big Beautiful Bill (OBBB) introduces 100% tax bill bonus depreciation! This means companies can fully deduct the costs of qualifying assets purchased after January 19, 2025. This change is a game-changer for rural small businesses, which often work with tighter margins and face unique challenges.

By taking advantage of these tax incentives, these businesses can boost their financial stability and invest in the resources they need to thrive in their communities. So, if you’re a small business owner, why not explore how these write-offs can work for you?

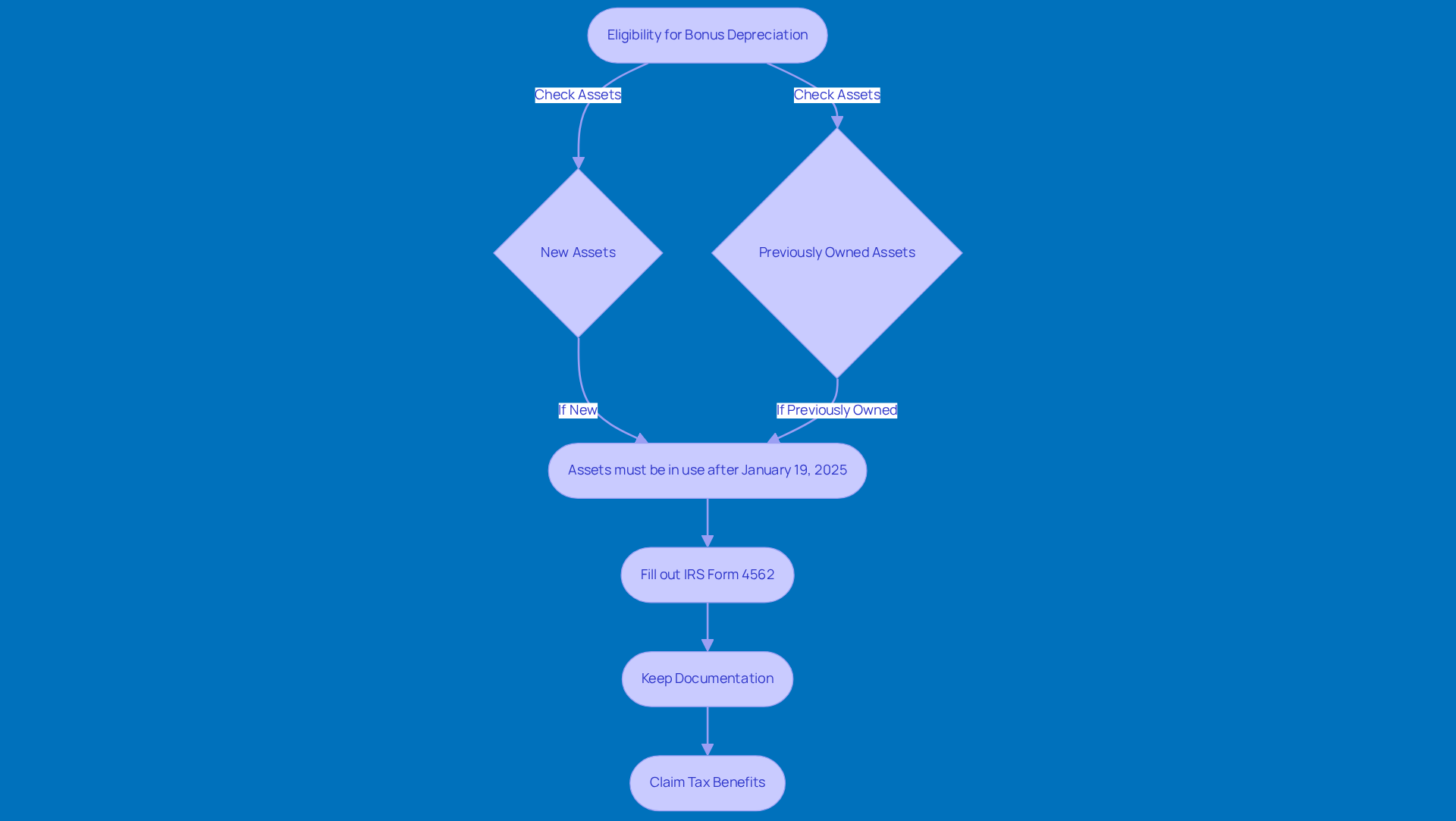

Explain How Bonus Depreciation Works: Eligibility and Claiming Process

If you’re looking to snag some extra write-offs, here’s the scoop: assets need to be either brand new or previously owned property that you’ve got up and running after January 19, 2025. What kind of assets are we talking about? Think machinery, equipment, and certain property improvements. To claim this deduction, just fill out IRS Form 4562, which is all about 'Depreciation and Amortization.'

Now, here’s a tip: keeping solid documentation is key! You’ll want to have proof of your purchase and how you’re using that asset for your business. And guess what? You can actually claim tax bill bonus depreciation as well as Section 179 deductions. This gives you a bit more wiggle room when it comes to tax planning. So, if you’re a small business owner, this strategy can really help you make the most of your tax benefits!

Discuss Strategic Benefits and Considerations of Bonus Depreciation

Hey there! Let’s discuss how the tax bill bonus depreciation and bonus write-offs can significantly boost your small business. These write-offs can lead to some pretty sweet tax savings thanks to the tax bill bonus depreciation, which means more cash flow for you. Imagine being able to deduct the full cost of qualifying assets right when you buy them thanks to the tax bill bonus depreciation! That’s money you can reinvest back into your business, helping it grow and thrive.

But hold on a second! It’s super important to think about the long-term effects of this tax strategy. Sure, the tax bill bonus depreciation can provide you with a nice short-term boost through those extra write-offs, but they might also lead to fewer deductions down the line. So, it’s a good idea to take a step back and look at your overall tax plan. Ask yourself:

- Does using these extra write-offs fit with my financial goals and cash flow needs?

By being thoughtful about how you apply these write-offs, you can make the most of their benefits while keeping any potential downsides at bay. So, what do you think? Are you ready to dive into your tax strategy and see how bonus write-offs can work for you?

Outline Practical Steps for Implementing Bonus Depreciation in Tax Strategy

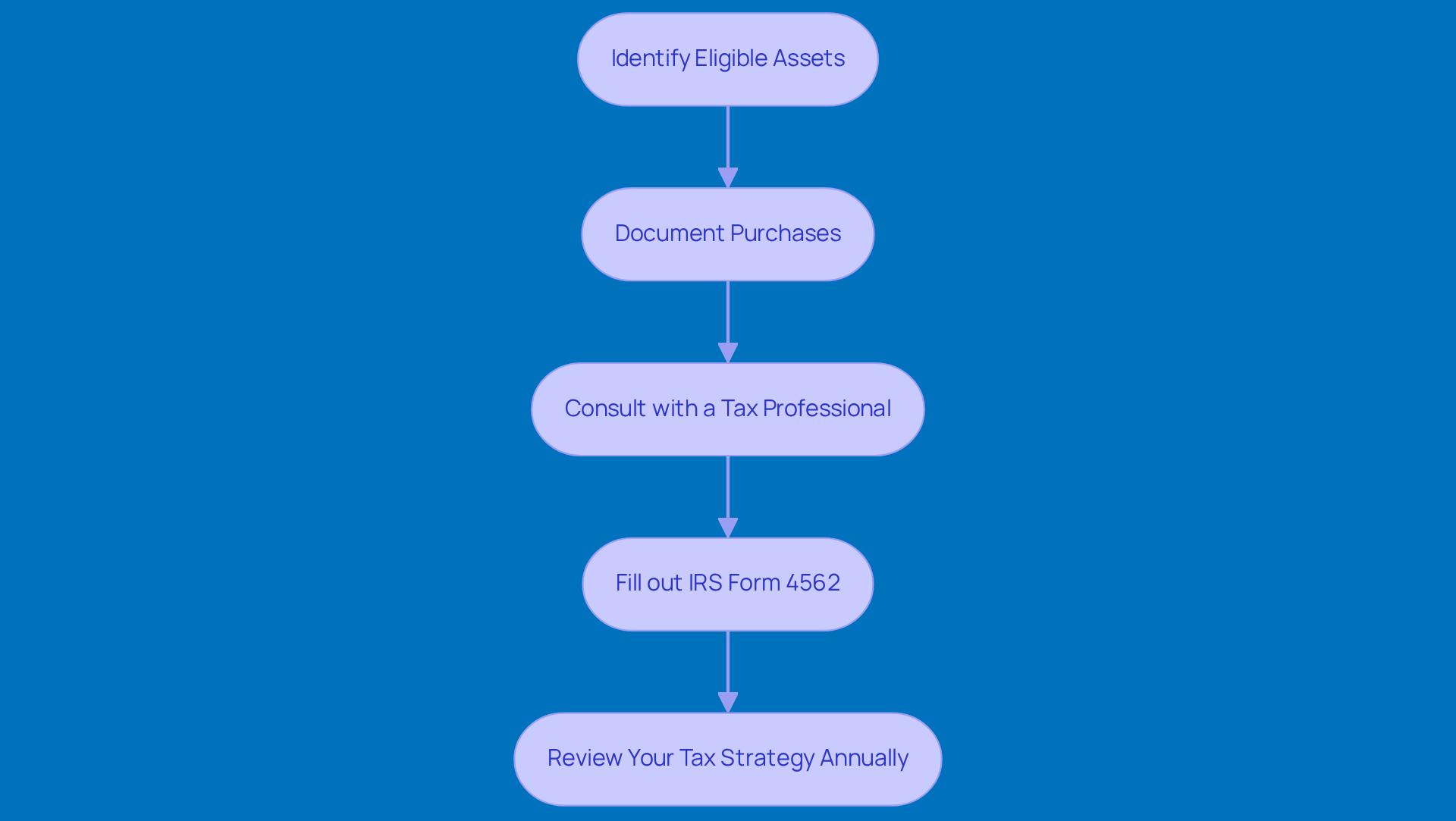

If you're a small business owner looking to make the most of additional write-offs, here are some practical steps to follow:

-

Identify Eligible Assets: First things first, figure out which assets qualify for bonus depreciation according to IRS guidelines. You’re looking at new and used tangible property related to your business that has a MACRS recovery period of 20 years or less, which may qualify for tax bill bonus depreciation. Think machinery, equipment, and certain enhancements.

-

Document Purchases: Keep track of your asset acquisitions with solid records - this means invoices and proof of commercial use. Good documentation is key to backing up your claims. It’s a bit like checking your paystub to make sure your withholdings and deductions are spot on; both need that careful attention to detail for compliance.

-

Consult with a Tax Professional: Don’t go it alone! Chat with a tax advisor to ensure you’re in line with current regulations and to fine-tune your tax strategy, especially with the recent updates from the One Big Beautiful Bill Act.

-

Fill out IRS Form 4562: When tax time rolls around, make sure to indicate your additional deduction on this form. It’s crucial to get all qualifying assets recorded correctly.

-

Review Your Tax Strategy Annually: Finally, take a moment each year to reassess your tax strategy. This way, you can maximize the benefits from the tax bill bonus depreciation and other deductions, adjusting as needed for any changes in tax law or your business situation.

So, what do you think? Ready to dive into those write-offs and make the most of your assets?

Conclusion

Understanding and leveraging tax bill bonus depreciation is super important for small business owners who want to optimize their financial strategies. This tax incentive can really pack a punch, allowing for significant immediate deductions on qualifying assets. That means better cash flow and more room for growth! By getting a handle on eligibility and the claiming process, small businesses can really make the most of these benefits to strengthen their financial footing.

Throughout this article, we’ve shared some key insights, like the importance of:

- Identifying eligible assets

- Keeping thorough documentation

- Chatting with tax professionals

And let’s not forget about the One Big Beautiful Bill - it really amps up the advantages of bonus depreciation. It’s crucial for small businesses to stay in the loop about these changes and what they mean for tax planning.

So, what’s the takeaway? The strategic use of bonus depreciation can truly change the game for small businesses. By taking proactive steps to implement this tax strategy, owners can snag immediate financial benefits and set their businesses up for long-term success. Embracing these opportunities isn’t just about saving on taxes; it’s about investing in the future and building resilience within the community. So, why not dive in and explore how bonus depreciation can work for you?

Frequently Asked Questions

What is bonus depreciation?

Bonus depreciation is a tax advantage that allows companies to deduct a significant portion of the cost of qualifying assets, such as machinery, office furniture, and vehicles, in the year they start using them.

Why is bonus depreciation important for small businesses?

Bonus depreciation is important for small businesses because it can significantly lower taxable income, leading to increased cash flow and allowing for reinvestment and growth.

What types of property qualify for bonus depreciation?

Qualifying assets for bonus depreciation include machinery, office furniture, and vehicles.

What are the requirements to benefit from bonus depreciation?

To benefit from bonus depreciation, the property must be purchased during a specific time frame and put into use when it is ready.

What is the One Big Beautiful Bill (OBBB) and how does it relate to bonus depreciation?

The One Big Beautiful Bill (OBBB) introduces 100% bonus depreciation, allowing companies to fully deduct the costs of qualifying assets purchased after January 19, 2025.

How does 100% bonus depreciation impact rural small businesses?

The 100% bonus depreciation is a game-changer for rural small businesses, which often operate on tighter margins and face unique challenges, as it enhances their financial stability and investment capabilities.

How can small business owners take advantage of bonus depreciation?

Small business owners can explore how bonus depreciation write-offs can work for them to boost their financial position and invest in necessary resources for their businesses.