Introduction

Hey there! If you’re a small agency owner, you’ll want to pay attention to the recent changes in tax Section 174. These updates can really shake things up when it comes to handling research and experimental (R&E) expenditures. Imagine being able to expense certain costs right away - sounds great, right? This could really boost your cash flow and lighten your tax load.

But here’s the catch: as these new rules roll out, it can get a bit tricky. Figuring out which expenses qualify and keeping everything documented properly can feel overwhelming. So, how can you, as a small business leader, tweak your tax strategies to make the most of these changes? And how do you steer clear of the common pitfalls? Let’s dive in and explore!

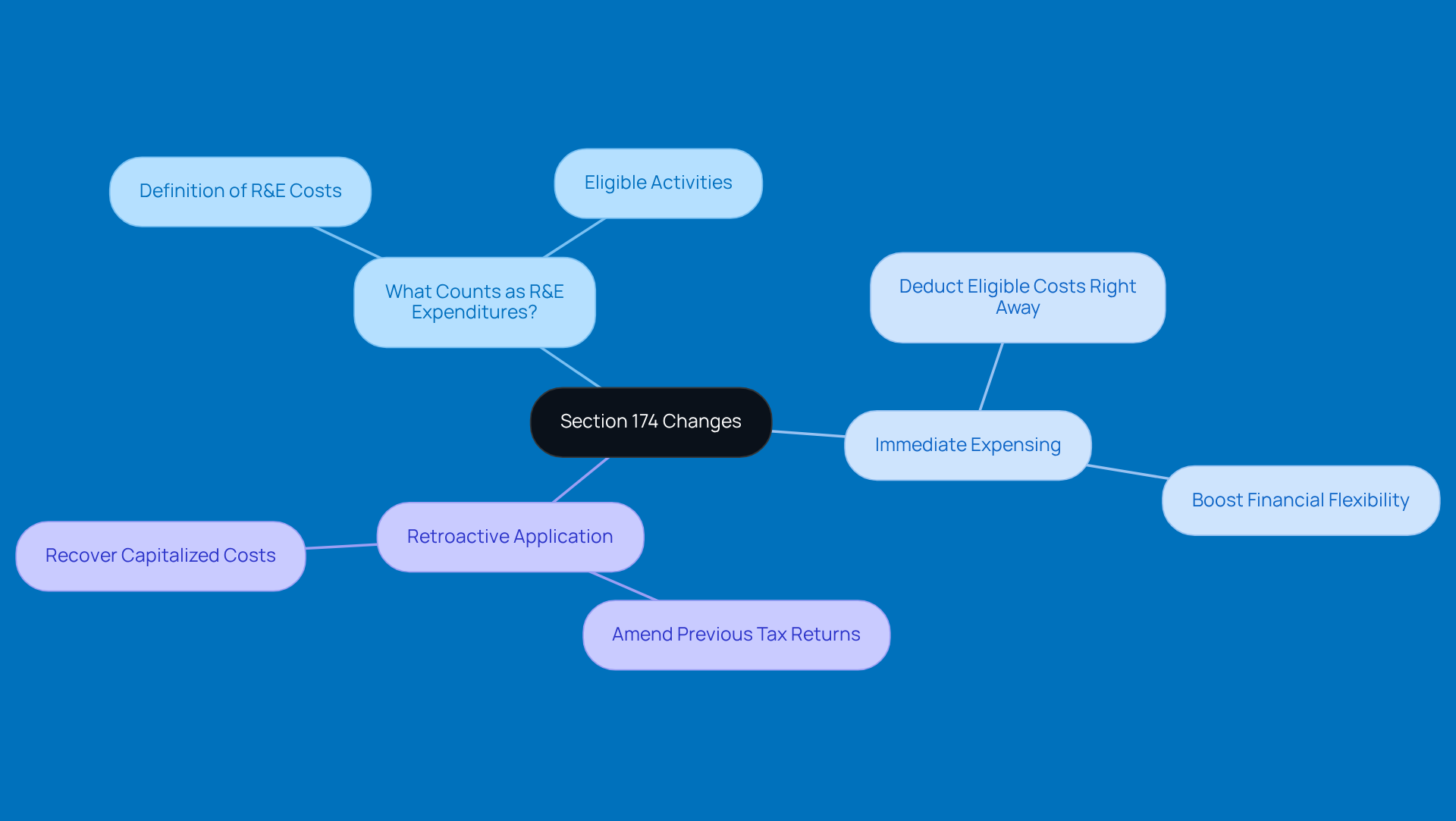

Understand the Basics of Section 174 Changes

Hey there! Let’s chat about tax section 174 of the Internal Revenue Code and how it’s shaking things up for small businesses regarding research and experimental (R&E) expenditures. In the past, businesses had to capitalize these costs and spread them out over time. But guess what? Recent updates now let you expense certain R&E costs right away! This change can really boost your cash flow and lighten your tax load.

So, what do you need to know? Here are a few key points to keep in mind:

- What Counts as R&E Expenditures?: First off, it’s important to get a grip on what qualifies as research and experimental expenditures under these new rules.

- Immediate Expensing: The new provisions allow you to deduct eligible R&E costs immediately. This can really give your financial flexibility a nice little boost!

- Retroactive Application: And here’s a bonus-businesses might be able to go back and amend previous tax returns to take advantage of these changes. That means you could recover some costs you capitalized before!

By understanding these basics, you’ll be in a much better spot to adjust your tax strategies in compliance with tax section 174 moving forward. So, what do you think? Ready to dive into these changes?

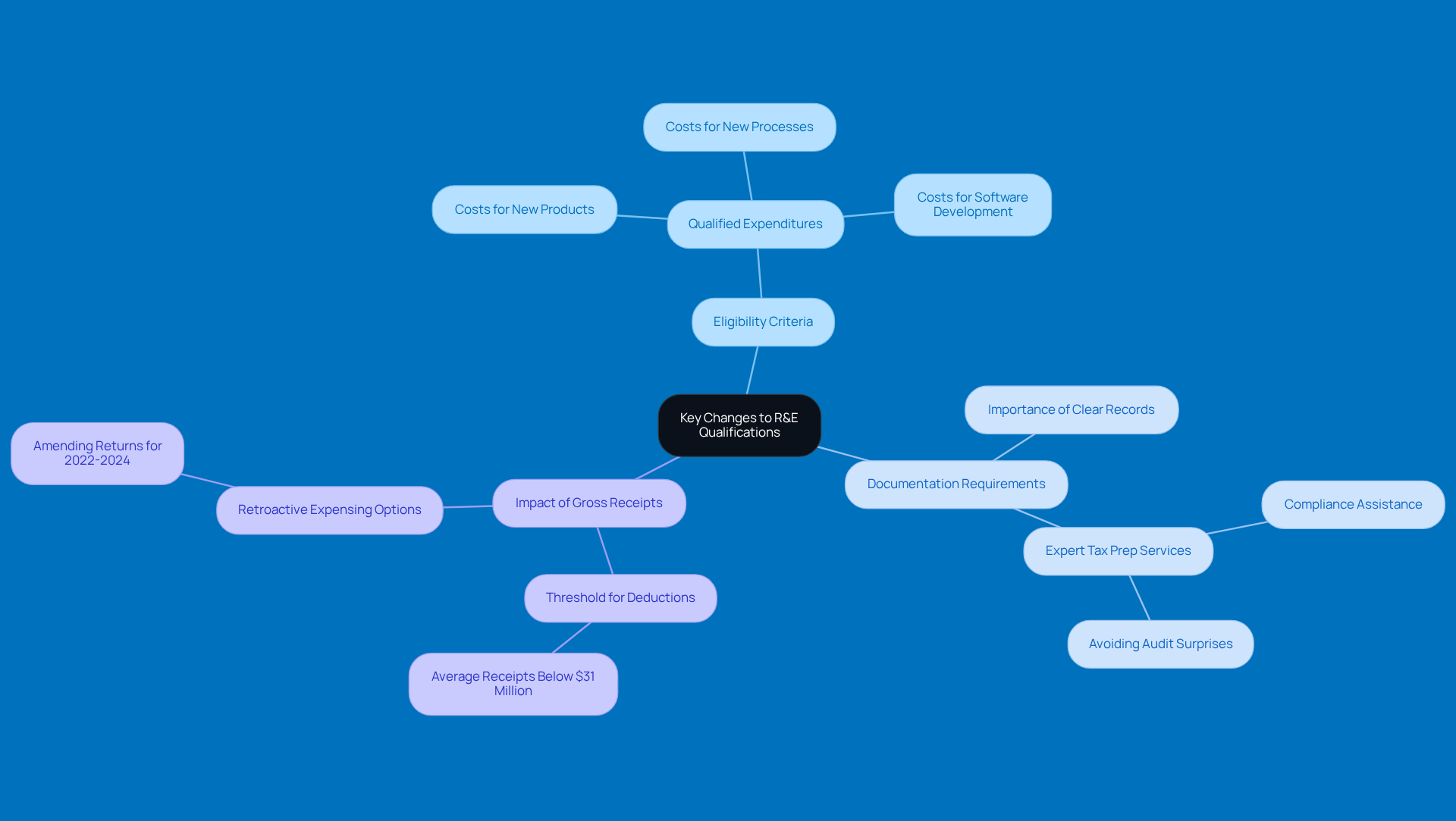

Identify Key Changes to R&E Qualifications

To really take advantage of tax section 174, small business owners need to get a handle on the recent changes in R&E qualifications. Let’s break down the key updates:

- Eligibility Criteria: First off, check out the updated criteria for what counts as qualified R&E expenditures. Now, it includes costs tied to developing new products, processes, or software. This means a wider range of activities can be considered eligible, which is great news!

- Documentation Requirements: Next, it’s important to get familiar with the new documentation requirements that come with these expensing rules. Keeping clear and thorough records is crucial to back up your claims during audits. The IRS has made it clear that precise documentation is a must. And hey, working with expert tax prep services, like those at Steinke and Company, can help you stay compliant and avoid any surprises along the way.

- Impact of Gross Receipts: If your business has average gross receipts below $31 million, you’re in luck! You can benefit from these deductions, which is a big deal for many small firms. This eligibility under tax section 174 means that smaller businesses can enjoy immediate expensing, potentially boosting cash flow and improving their financial standing. Plus, you can opt for retroactive expensing for 2022-2024 by amending previous returns, with the amendment window open until July 4, 2026.

By staying informed about these changes and using professional tax planning services, small business leaders can confidently claim all eligible deductions while sticking to IRS regulations. And don’t forget, the One Big Beautiful Bill Act is bringing back immediate deductions for R&E expenditures starting in 2025, so understanding these updates is more important than ever!

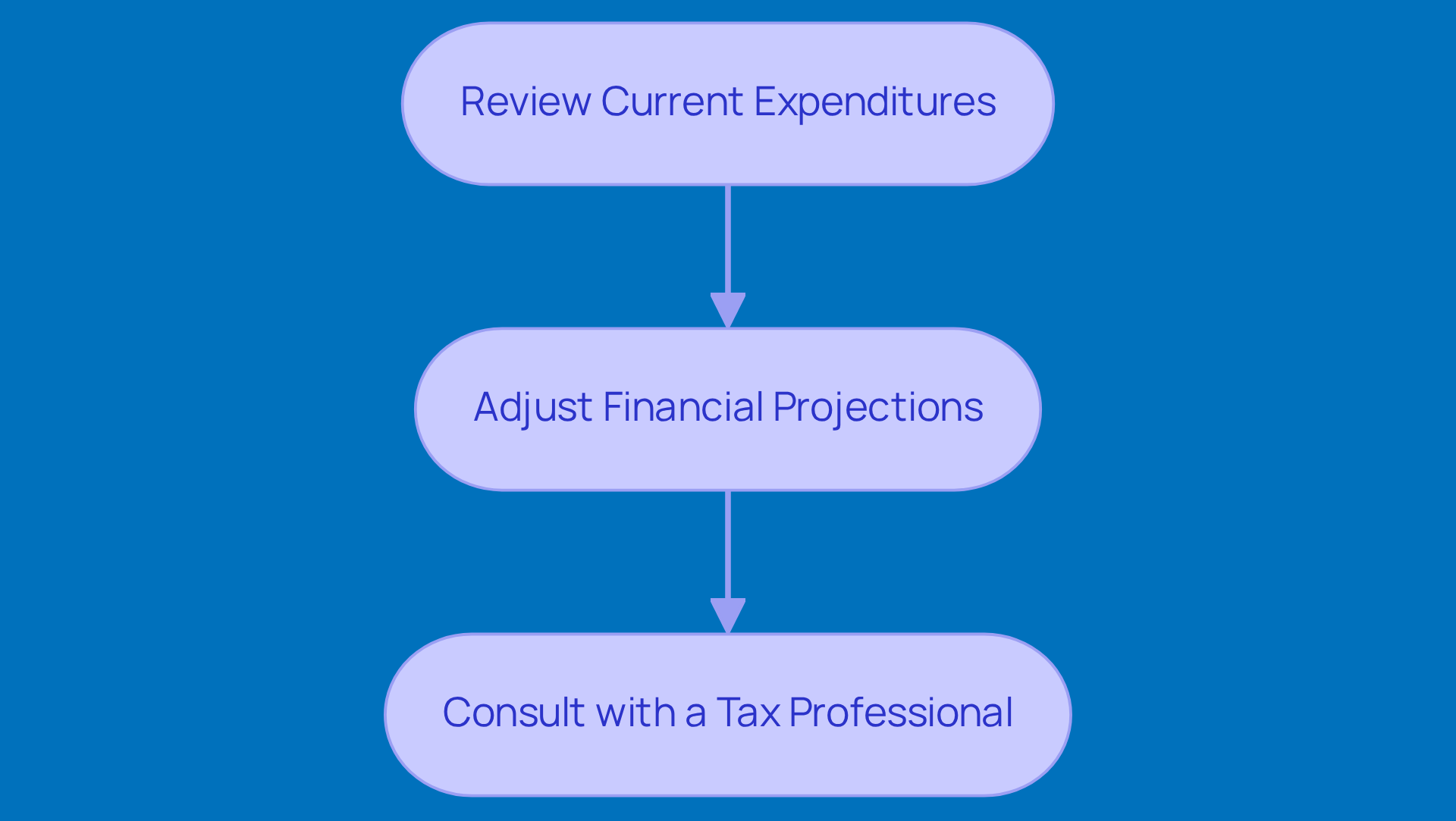

Plan Strategically for Section 174 Updates

Hey there, business owners! With the recent changes to tax section 174, it’s time to get strategic about your tax planning. Here are some steps you might want to consider:

- Review Current Expenditures: Take a good look at your current and past research and experimental (R&E) expenses. You might find some costs that can be retroactively expensed under the new rules, which could lead to some nice tax savings.

- Adjust Financial Projections: It’s a good idea to tweak your financial forecasts to include potential tax savings from immediate expensing. This little adjustment can boost your cash flow and open up opportunities for reinvestment, setting your business up for growth.

- Consult with a Tax Professional: Don’t hesitate to reach out to a tax advisor who specializes in business tax compliance. Their expertise will help ensure your strategies are in line with the latest regulations and optimize your overall tax position.

By putting these strategies into action, you can navigate the changes in tax section 174 like a pro, ultimately enhancing your financial well-being and strengthening your operations. So, what do you think? Ready to tackle your tax planning?

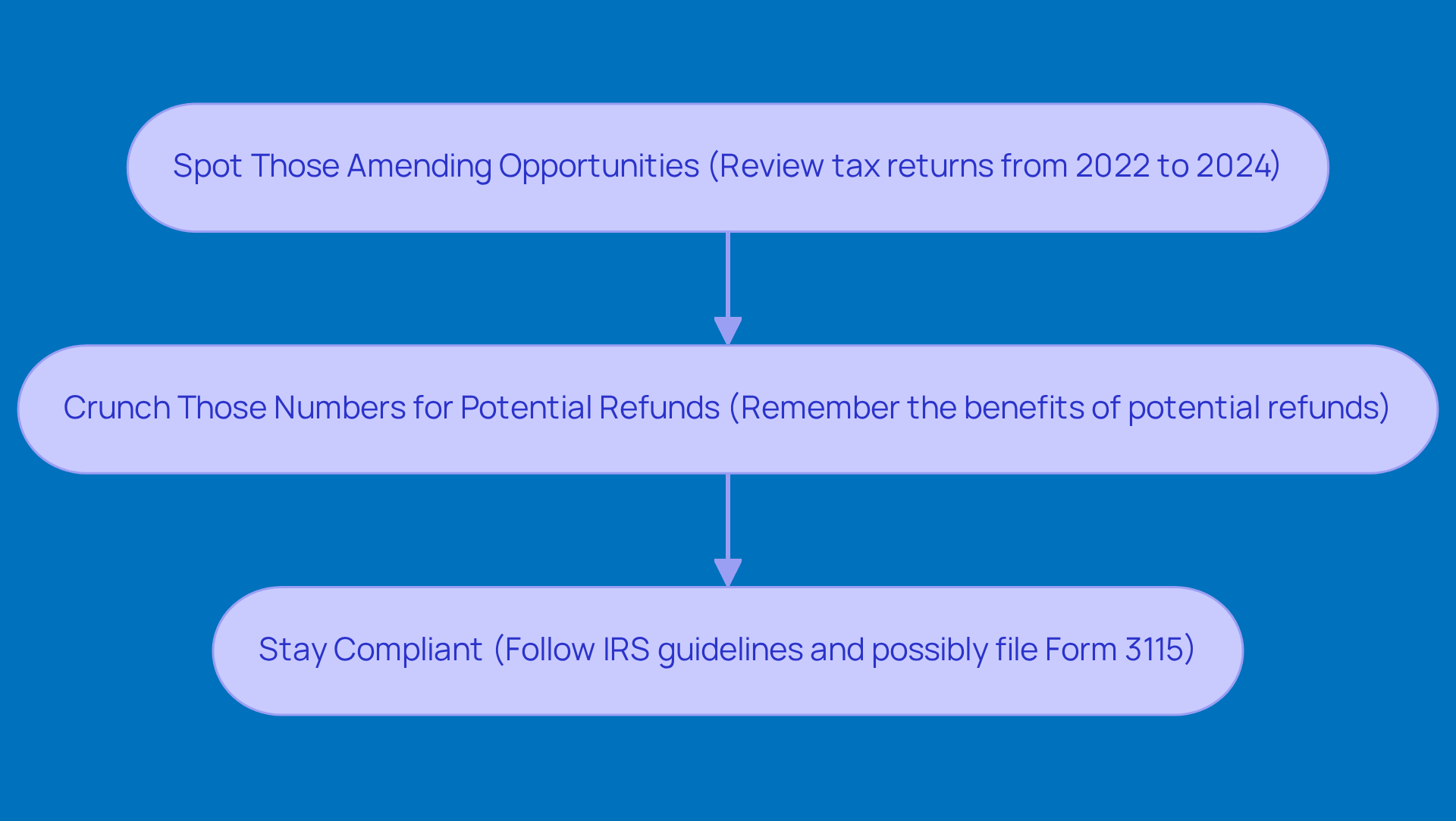

Evaluate the Impact on Prior Tax Returns

Hey there, small business leaders! It’s super important to take a moment and see how the changes to tax section 174 might affect your past tax returns. Here’s a friendly guide to help you out:

- Spot Those Amending Opportunities: Take a look at your tax returns from 2022 to 2024. Can you find any R&E expenditures that you previously capitalized but can now deduct? If so, you might need to file some amended returns.

- Crunch Those Numbers for Potential Refunds: Think about the tax refunds you could snag from these amendments. A little extra cash could really boost your business!

- Stay Compliant: It’s crucial to make sure any amendments follow IRS guidelines to dodge any penalties. You might need to file Form 3115 to change how you account for those R&E expenditures.

By taking the time to review your past returns, you can really make the most of the new regulations under tax section 174 and give your financial position a nice little lift. So, why not dive in and see what you can find?

Avoid Common Mistakes in Navigating Section 174

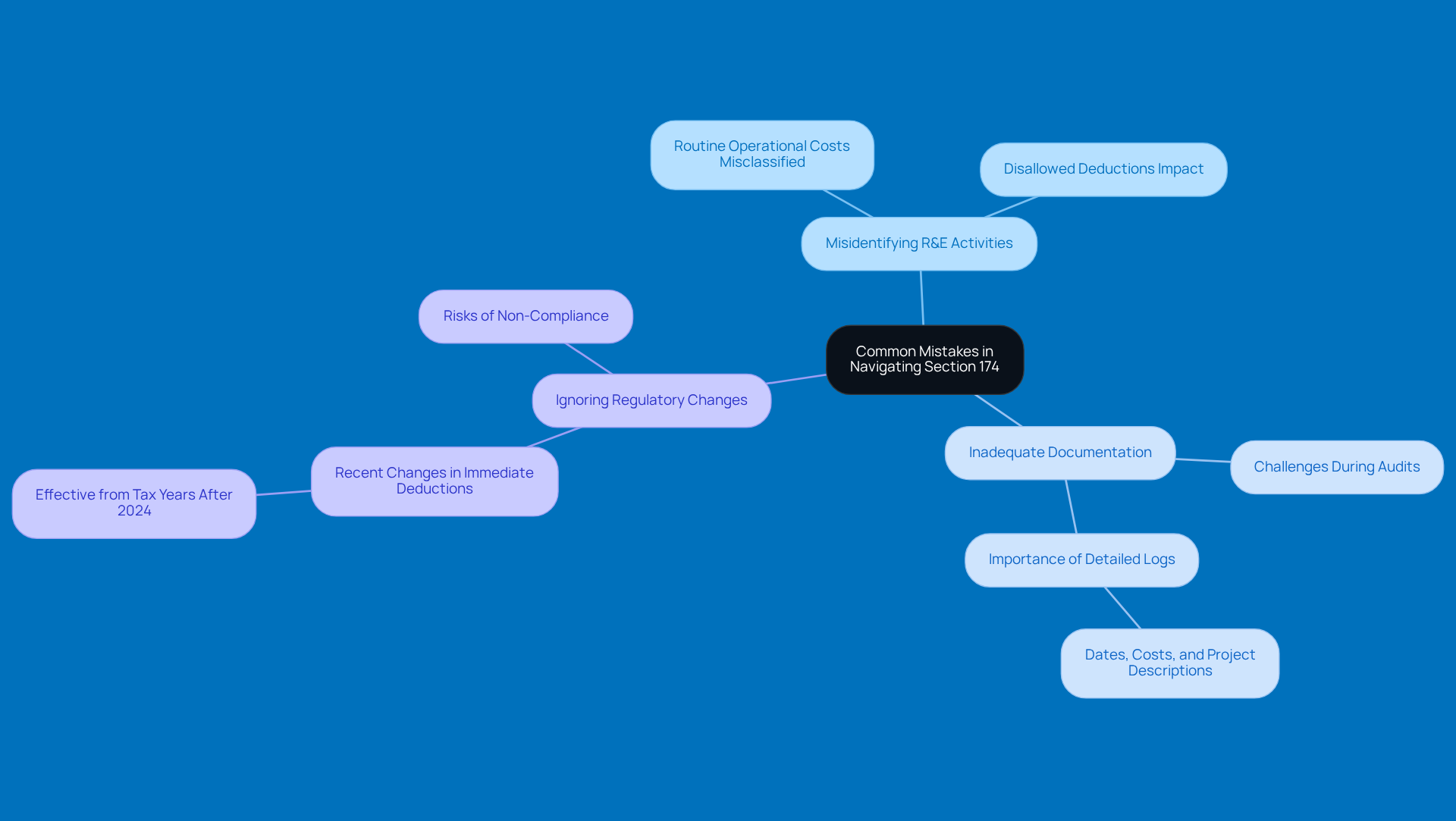

Navigating the ins and outs of tax section 174 can be a bit tricky for small business owners, but avoiding some common pitfalls can save you from compliance headaches and missed tax benefits. Let’s dive into a few critical mistakes you’ll want to steer clear of:

-

Misidentifying R&E Activities: First off, it’s super important to make sure that all your claimed research and experimental (R&E) expenses fit the IRS definition. If you misclassify, you could end up with disallowed deductions, which can really hit your tax liabilities hard. For instance, many small firms mistakenly label routine operational costs as R&E, leading to costly errors in their tax filings.

-

Inadequate Documentation: Keeping thorough records of all your R&E activities and expenses is key. If your documentation isn’t up to snuff, you might face challenges during audits, which could mean losing out on deductions. So, make it a habit to log your R&E projects in detail - think dates, costs, and what the research is all about - to back up your claims effectively.

Ignoring changes in regulations regarding tax section 174 and related tax laws is crucial to stay informed about updates. Did you know that there’s a recent change allowing immediate deductions for domestic R&E expenses starting from tax years after December 31, 2024? This could really boost cash flow for local businesses! Not keeping up with these changes could put your compliance and financial benefits at risk.

By tackling these common mistakes head-on, small agency owners can really make the most of tax section 174, maximizing their tax benefits while staying compliant. So, keep these tips in mind and take charge of your tax strategy!

Conclusion

Understanding and adapting to the changes from tax section 174 is super important for small agency owners looking to optimize their financial strategies. With the recent updates, you can now expense certain research and experimental (R&E) expenditures right away. This can really boost your cash flow and help lower your tax bills. By getting a handle on these changes, you can enhance your financial flexibility and set yourself up for future growth.

Throughout this article, we’ve highlighted some key points. First off, it’s crucial to identify which R&E expenditures are eligible. Keeping thorough documentation is a must, and don’t forget about the chance to make retroactive amendments to past tax returns. Plus, strategic planning is essential! Avoid common pitfalls like misidentifying R&E activities or not keeping adequate records. These insights can really empower you to navigate the complexities of tax compliance with confidence.

Ultimately, embracing these changes and putting together a solid tax plan can lead to some serious financial benefits for your small business. Staying in the loop about upcoming reforms - like the expected return of immediate deductions for R&E expenses in 2025 - will only help you capitalize on available tax advantages. So, take some proactive steps! Review your R&E activities and chat with tax professionals to ensure you’re compliant and maximizing your deductions under section 174.

Frequently Asked Questions

What is Section 174 of the Internal Revenue Code?

Section 174 pertains to the treatment of research and experimental (R&E) expenditures for tax purposes, allowing certain costs to be expensed immediately rather than capitalized over time.

What are R&E expenditures?

R&E expenditures include costs related to developing new products, processes, or software that qualify under the updated rules of Section 174.

What is the benefit of the recent changes to Section 174?

The changes allow businesses to deduct eligible R&E costs immediately, which can enhance cash flow and reduce tax burdens.

Can businesses amend previous tax returns under the new Section 174 rules?

Yes, businesses may be able to amend previous tax returns to take advantage of the new provisions, potentially recovering costs that were previously capitalized.

What are the updated eligibility criteria for R&E expenditures?

The updated criteria now include a broader range of activities, specifically costs tied to developing new products, processes, or software.

What are the documentation requirements for claiming R&E deductions?

Businesses must maintain clear and thorough records to support their claims for R&E expenditures, as precise documentation is essential during audits.

How does the average gross receipts threshold impact small businesses?

Businesses with average gross receipts below $31 million can benefit from immediate expensing under Section 174, which can significantly improve their financial situation.

What is the amendment window for retroactive expensing for 2022-2024?

The amendment window for retroactive expensing is open until July 4, 2026, allowing businesses to amend their previous returns to claim eligible deductions.

What future changes are anticipated for R&E expenditures?

The One Big Beautiful Bill Act is expected to reinstate immediate deductions for R&E expenditures starting in 2025, making it essential for businesses to stay informed about these updates.