Overview

This article dives into some smart strategies for small business owners looking to tackle their tax obligations, especially if you find yourself in that $100,000 tax bracket for the 2025 tax year. It’s all about understanding those progressive tax rates and getting savvy with tax-saving techniques. Think about:

- Retirement contributions

- Keeping track of your operational expenses

- Making the most of deductions and credits

These can really help cut down your taxable income and boost your financial health.

Have you ever felt overwhelmed by tax season? You’re not alone! By implementing these strategies, you can navigate the tax landscape with confidence. Imagine being able to save more money and invest it back into your business. Sounds good, right? So, let’s explore how you can make the most of your tax situation and keep more of your hard-earned cash in your pocket!

Introduction

Getting a handle on the $100,000 tax bracket is super important for small business owners who want to make the most of their finances. With the 2025 tax year just around the corner, understanding how this bracket works can really impact how much of your hard-earned cash gets taxed. So, it’s key for entrepreneurs to get the ins and outs of their taxable income. And let’s not forget about those pesky underpayment penalties that could sneak up on you!

So, how can small business owners navigate this tax maze to cut down on liabilities and boost deductions?

Understand the $100,000 Tax Bracket

The 100k tax bracket is a significant consideration for small business owners as it determines the federal tax rates applicable to their profits. For the 2025 tax year, if you're filing as single, your taxable earnings would fall within the 100k tax bracket, which covers earnings from $89,076 to $170,050. It's super important to understand the 100k tax bracket, as it directly impacts how much of your earnings get taxed. Remember, your overall taxable earnings include not just your business profits but also other income sources, like investments or side gigs. This broader view of your income can really help you plan your finances and manage your taxes better.

Tax experts point out that understanding the 100k tax bracket can significantly affect your company's financial health. It allows you to fine-tune your tax strategies effectively. And with the recent cuts in COVID-19 tax benefits, it’s crucial for small business owners to stay sharp about their tax obligations to dodge those pesky underpayment penalties. Did you know the IRS charges an interest rate of 8% per year on underpayments, compounded daily? That really drives home the need for timely tax payments!

To help with this, strategies like safe harbor payments and making estimated tax payments can be lifesavers. As tax experts say, understanding the 100k tax bracket is crucial for making informed financial decisions and maximizing your deductions. Plus, real-world examples show how small businesses can navigate this bracket successfully, ensuring they take advantage of all available tax strategies while staying compliant with IRS regulations. So, how are you planning to tackle your tax obligations this year?

Explore Applicable Tax Rates and Brackets

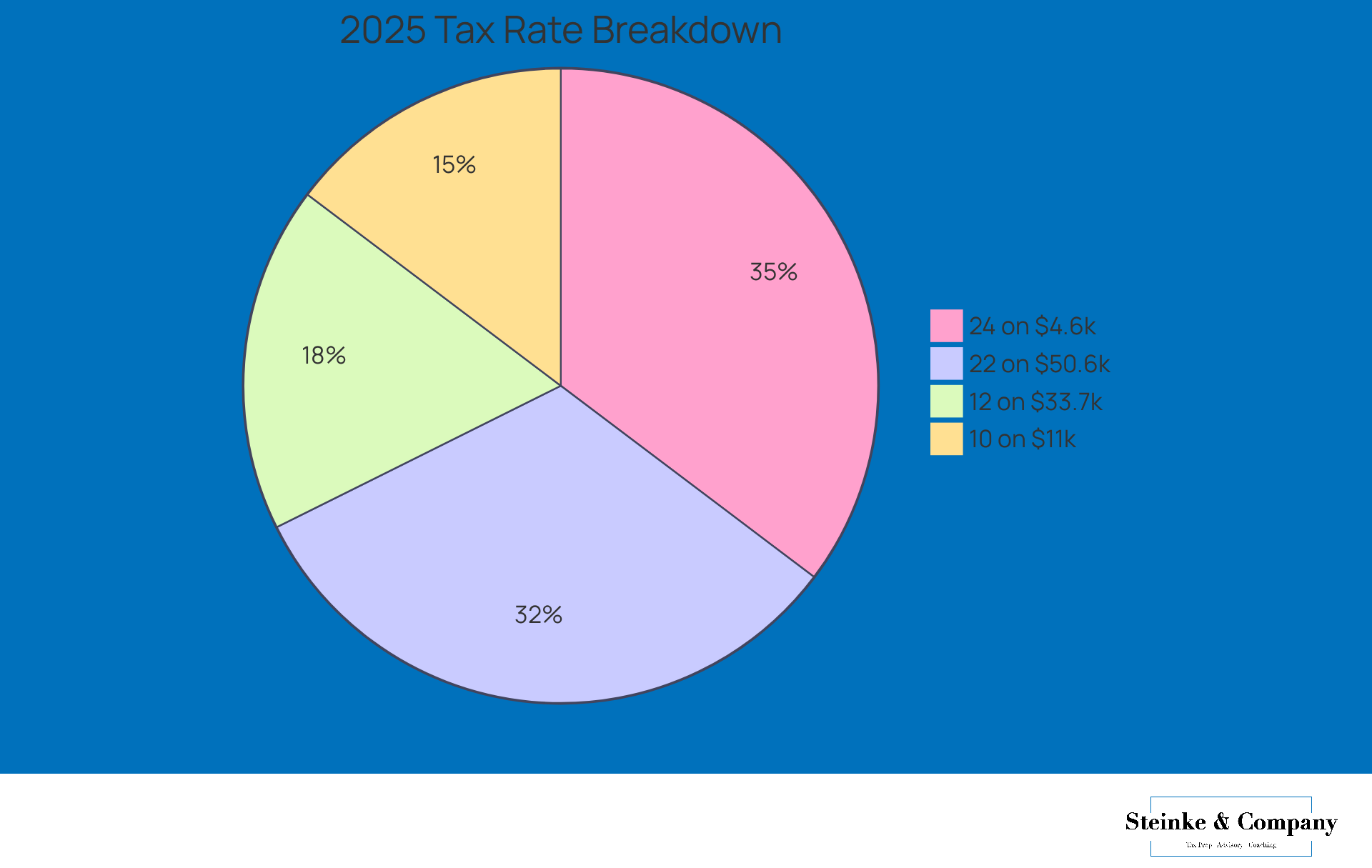

Hey there! Let’s discuss the federal revenue tax rates for individuals, especially focusing on those in the 100k tax bracket for the 2025 tax year. They’re set up in a progressive way, which can really impact small business owners. So, if you’re earning around $100,000 and fall into the 100k tax bracket, here’s how it breaks down:

- 10% on the first $11,000

- 12% on the next chunk from $11,000 to $44,725

- 22% from $44,725 to $95,375

- 24% on the income that goes over $95,375 up to $182,100

For our small business operator making $100,000, their income falls within the 100k tax bracket, which means taxes will look like this:

- 10% on the first $11,000

- 12% on the next $33,725

- 22% on another $50,650

- 24% on the last $4,625

It’s a lot to keep track of, right? This whole progressive tax system really shows why it’s so important for entrepreneurs to get a grip on their tax responsibilities and come up with smart strategies to manage their liabilities.

By being aware of these rates, small business operators can make savvy financial decisions that might even improve their tax outcomes. And don’t forget—expenses that count as operational costs can help lower your taxable income before those income taxes kick in. That’s a handy tip for managing your taxes!

Also, keep in mind the risk of underpayment penalties if you don’t hit your estimated tax payment goals. The IRS wants taxpayers to pay at least 90% of their current year’s tax liability or 100% of last year’s tax to dodge those pesky penalties. Using strategies like safe harbor payments or the de minimis exception can really help you steer clear of trouble.

So, by understanding these factors and getting proactive with your tax planning, you can navigate your tax responsibilities much more smoothly. Sound good? Let’s tackle those taxes together!

Implement Strategies to Minimize Tax Liability

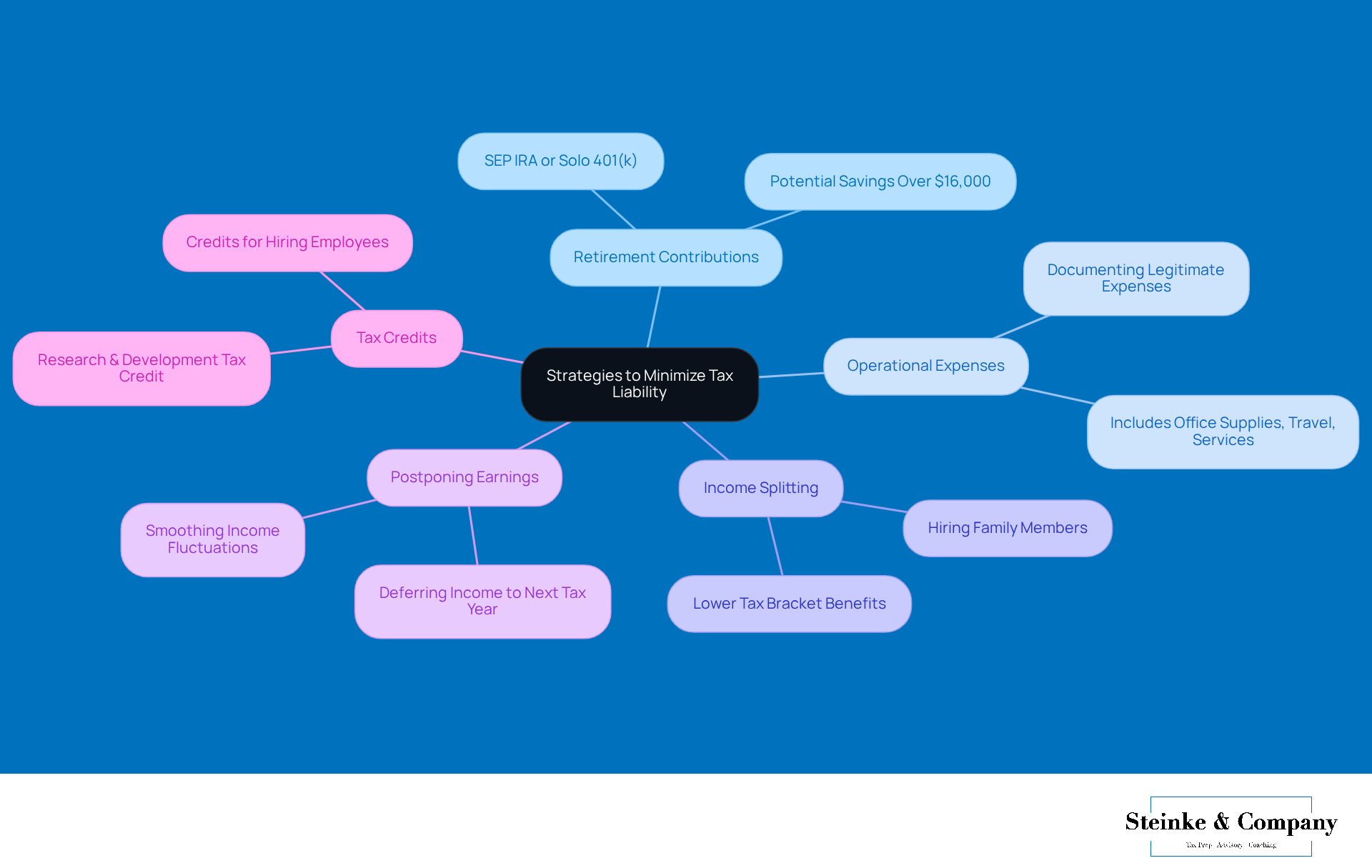

If you're a small business owner looking to minimize your tax liability, there are some smart strategies you can put into action:

-

Retirement Contributions: Have you thought about contributing to retirement accounts like a SEP IRA or Solo 401(k)? Not only do these help secure your future savings, but they can also significantly lower your taxable earnings. For instance, if an entrepreneur maxes out their contributions, they could slash their taxable income by thousands—potentially saving over $16,000 in federal taxes each year!

-

Operational Expenses: It's super important to keep track of all your legitimate operational expenses. This includes everything from office supplies to travel costs and professional services. By diligently documenting and deducting these expenses, you could see some pretty significant tax savings, allowing you to hang onto more of your hard-earned money.

-

Income Splitting: Here’s a thought: if it makes sense for your business, consider hiring family members. This can help you split profits, letting your family member benefit from lower tax brackets. Plus, the wages you pay them are deductible business expenses, which can further lower your overall tax liability.

-

Postponing Earnings: Another strategy is to think about postponing your earnings until the next tax year. This can be especially beneficial if you expect to be in the 100k tax bracket. It’s a smart way to smooth out income fluctuations and optimize your tax situation over time.

-

Tax Credits: Don’t forget to research and claim any tax credits available to you! Credits for hiring employees or investing in renewable energy can directly reduce your tax bills, giving you some immediate financial relief.

By embracing these strategies, you can not only boost your financial well-being but also create a more resilient business model that thrives in today’s competitive landscape. So, what are you waiting for? Start exploring these options today!

Utilize Deductions and Credits Effectively

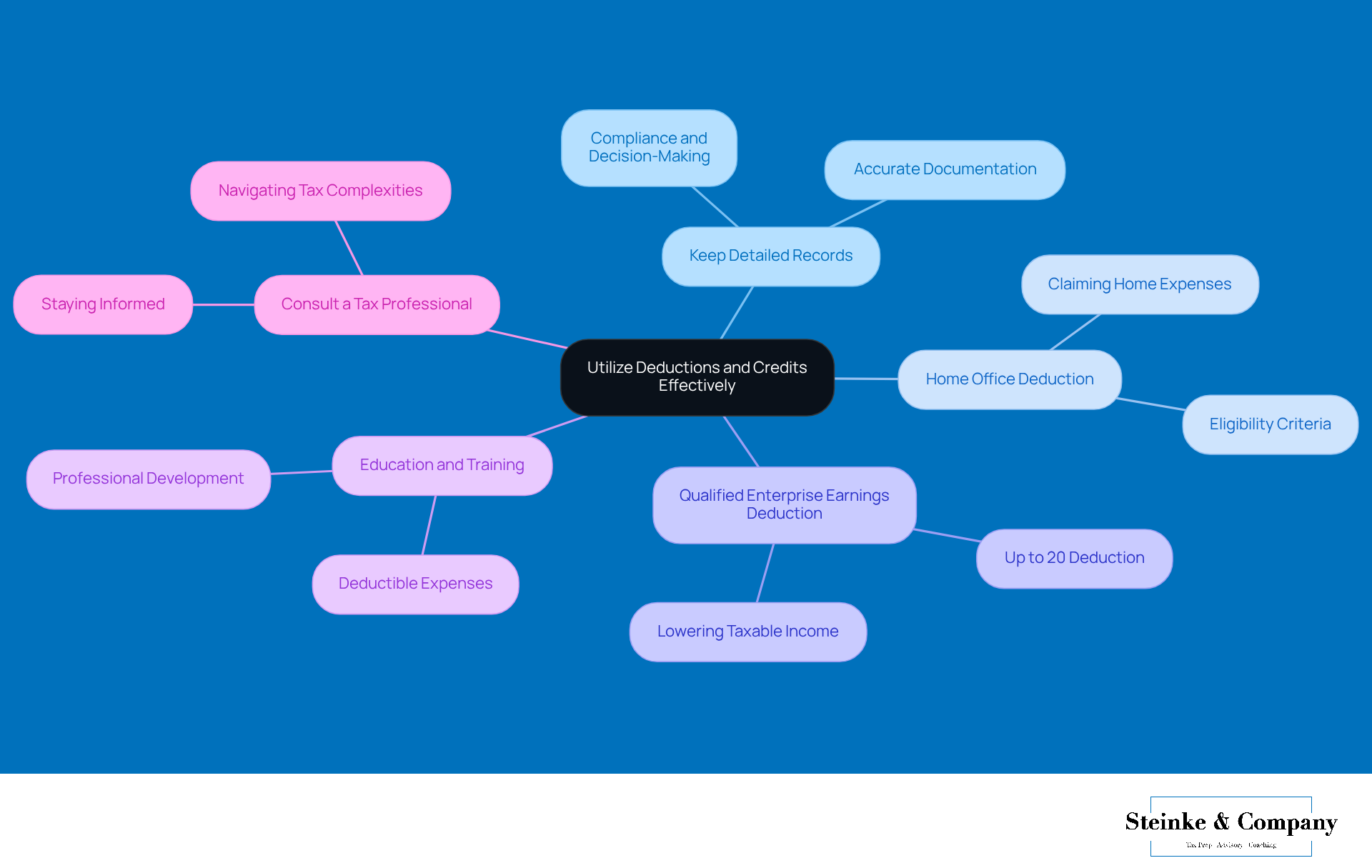

To maximize your deductions and credits, small business owners like you should consider these helpful strategies:

-

Keep Detailed Records: It’s super important to have accurate documentation of all your expenses and income. This way, you won’t miss out on any deductions. Plus, it helps you stay compliant and makes financial decision-making a whole lot easier.

-

Home Office Deduction: If it applies to you, don’t forget to claim the home office deduction! This lets you deduct a portion of your home expenses based on the space you use for work. You’d be surprised how many small business owners overlook this opportunity, which could lead to significant tax overpayments.

-

Qualified Enterprise Earnings Deduction: Have you looked into the Qualified Enterprise Earnings (QBE) deduction? It allows eligible business owners to deduct up to 20% of their qualified enterprise earnings. This can really lower your taxable income and give you a nice financial boost.

-

Education and Training: Don’t forget about deducting expenses for education and training that improve your skills related to your business. Investing in your professional development not only enhances your operations but also offers some tax perks.

-

Consult a Tax Professional: Regular chats with a tax expert are crucial for staying in the loop about new deductions and credits that might apply to your business. Experts stress that understanding the ins and outs of tax regulations can lead to better financial outcomes and keep you compliant.

By putting these strategies into action, you can navigate the complexities of tax deductions and credits more effectively, ultimately boosting your financial health!

Conclusion

Understanding the ins and outs of the $100,000 tax bracket is super important for small business owners who want to optimize their financial strategies. This bracket can really affect tax liabilities, so it’s crucial to get a handle on how different income sources and deductions play together. By mastering the details of this tax bracket, small business owners can make savvy decisions that boost their financial health and keep them in line with IRS regulations.

Throughout this article, we’ve highlighted some key strategies to help you navigate the complexities of the $100,000 tax bracket. From taking advantage of retirement contributions and operational expenses to leveraging deductions like the home office deduction and the Qualified Enterprise Earnings deduction, these insights offer practical ways to reduce tax liabilities. Plus, understanding the progressive tax structure can help small business owners make smart financial choices that could lead to some serious savings.

Ultimately, we can’t stress enough how important proactive tax planning is. By putting these strategies into action and staying informed about available deductions and credits, small business owners can not only lighten their tax burdens but also build a more resilient and successful business. Embracing these practices will empower you to tackle your tax responsibilities with confidence, ensuring your hard-earned income works even harder for you.

Frequently Asked Questions

What is the $100,000 tax bracket?

The $100,000 tax bracket refers to the federal tax rates applicable to taxable earnings between $89,076 and $170,050 for the 2025 tax year, particularly for individuals filing as single.

Why is understanding the $100,000 tax bracket important for small business owners?

Understanding the $100,000 tax bracket is crucial for small business owners as it directly impacts how much of their earnings are taxed, allowing them to fine-tune their tax strategies and manage their finances more effectively.

What types of income are included in overall taxable earnings?

Overall taxable earnings include not just business profits but also other income sources such as investments and side gigs.

What are the consequences of underpaying taxes?

The IRS charges an interest rate of 8% per year on underpayments, compounded daily, which highlights the importance of timely tax payments to avoid penalties.

What strategies can help small business owners manage their tax obligations?

Strategies such as safe harbor payments and making estimated tax payments can help small business owners manage their tax obligations effectively.

How can understanding the $100,000 tax bracket help in maximizing deductions?

By understanding the $100,000 tax bracket, small business owners can make informed financial decisions and take advantage of all available tax strategies to maximize their deductions while remaining compliant with IRS regulations.

What recent changes have affected small business tax benefits?

Recent cuts in COVID-19 tax benefits have made it more crucial for small business owners to be aware of their tax obligations to avoid underpayment penalties.